New York State Department of Taxation and Finance Forms

Documents:

2566

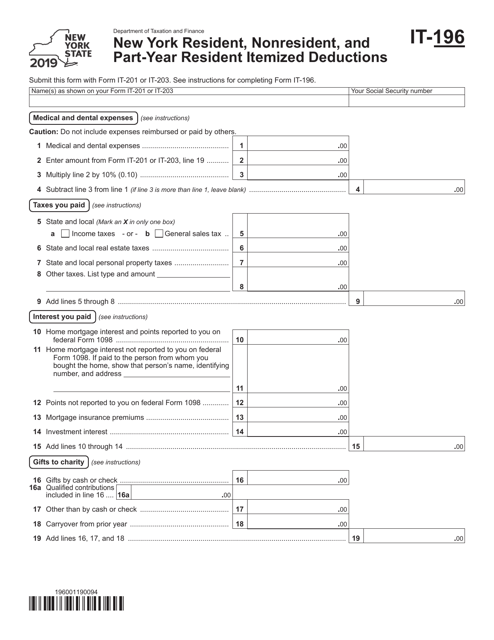

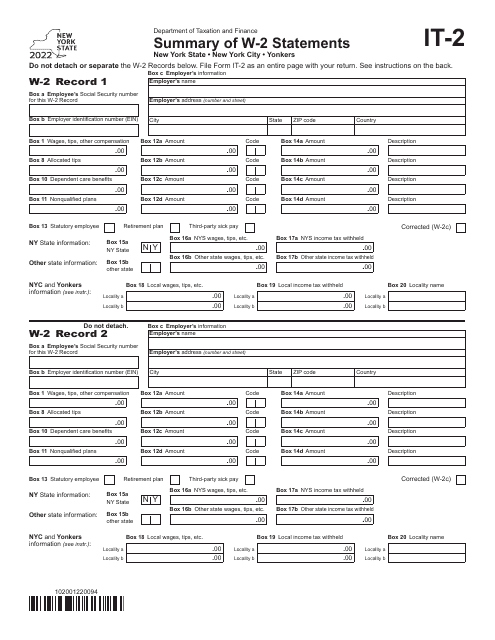

This Form is used for reporting itemized deductions for New York state residents, nonresidents, and part-year residents on their tax return.

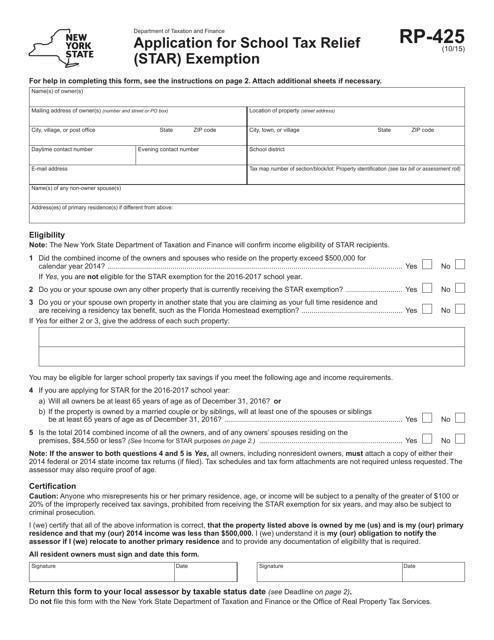

This form is used for applying for the School Tax Relief (STAR) exemption in New York.

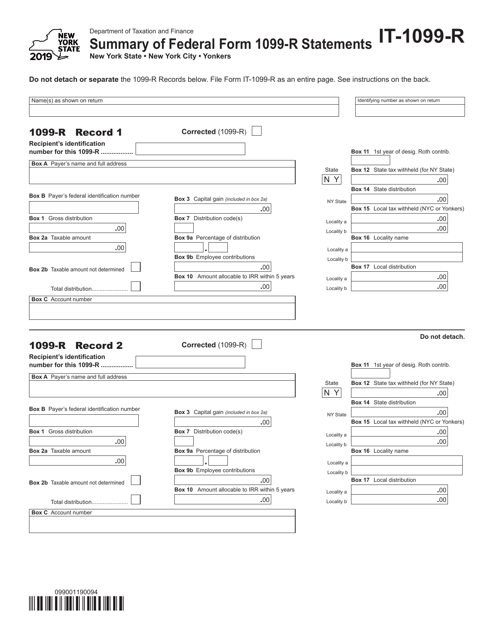

This document provides a summary of the Form 1099-R statements that were filed with the federal government for residents of New York. It is used to report distributions from pensions, annuities, and other retirement accounts.

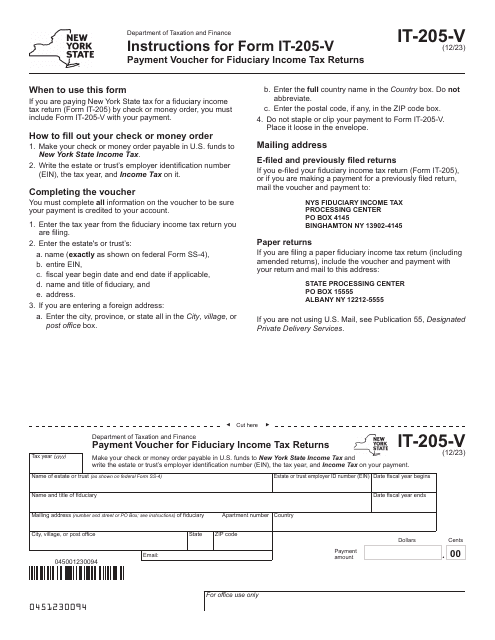

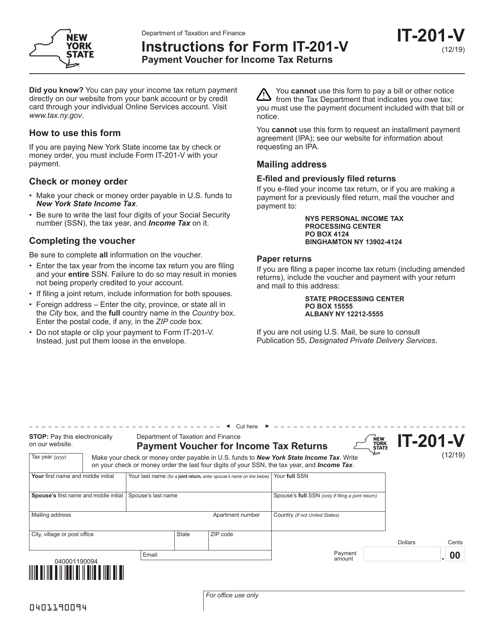

This form is used for making payments for income tax returns in the state of New York.

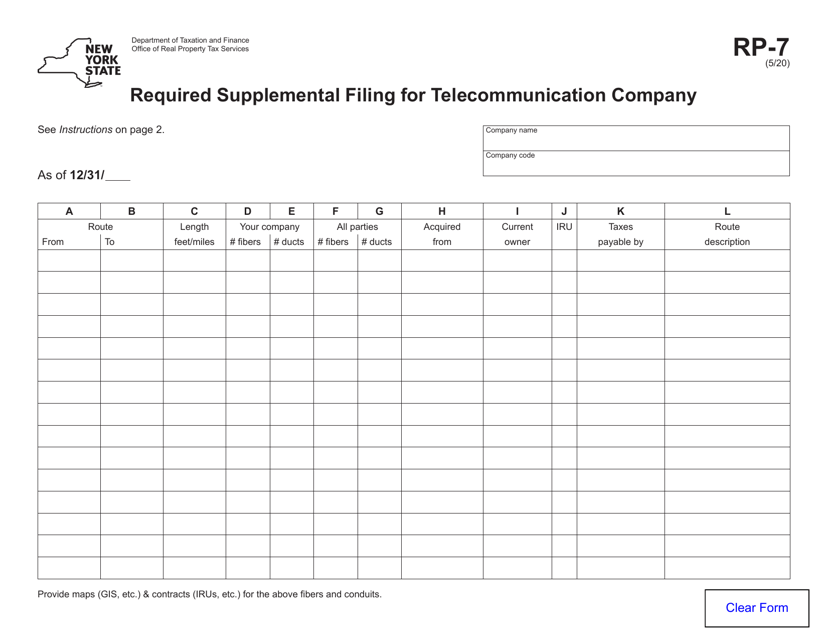

This Form is used for the required supplemental filing for telecommunication companies in New York.

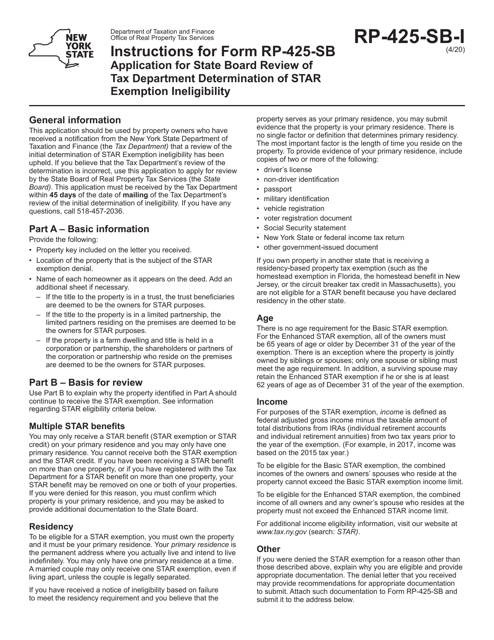

This form is used for applying to the State Board for a review of the New York Tax Department's determination of ineligibility for the Star Exemption. It provides instructions on how to complete the application process.

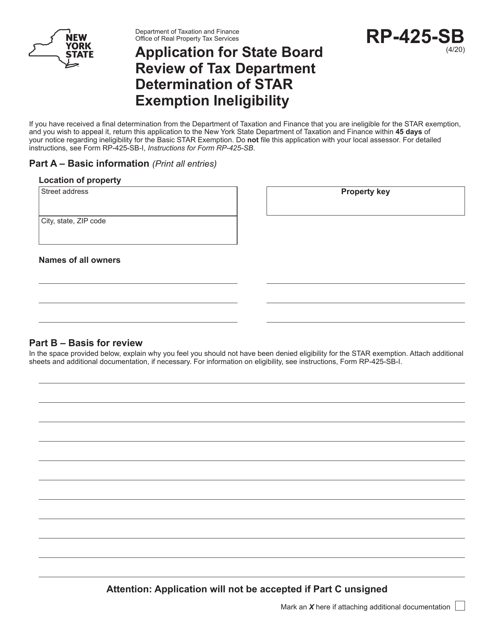

This form is used for applying to the State Board for review when the Tax Department determines that you are ineligible for the Star Exemption in New York.