New York State Department of Financial Services Forms

Documents:

122

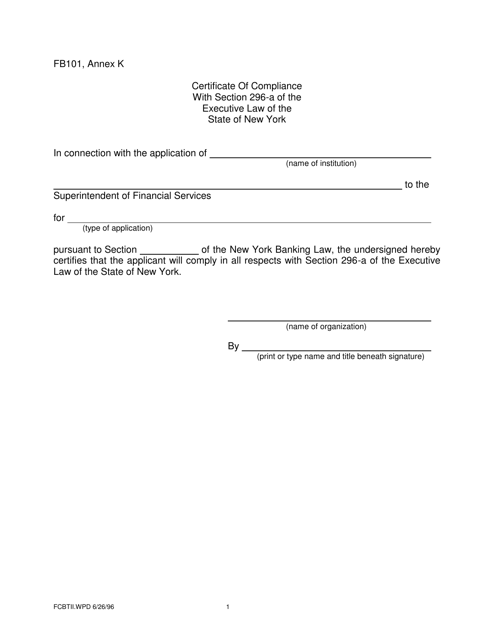

This Form is used for certificate of compliance with Section 296-a of the Executive Law of the State of New York. It is specifically for banking organizations and other applicants in formation in New York.

This document is a checklist for individuals surrendering their New York Mortgage Loan Originator License. It includes the necessary steps and requirements for surrendering the license.

This document provides instructions for applying to become a mortgage loan servicer in New York. It guides you through the application process and helps you understand the requirements.

This form is used for filing a complaint under the Americans with Disabilities Act (ADA) in the state of New York.

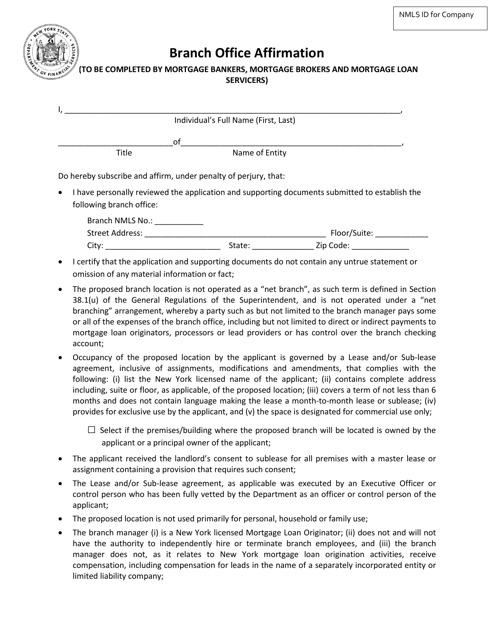

This Form is used for affirming the establishment of a branch office in the state of New York.

This document provides instructions for completing the Mortgage Loan Servicer Volume of Servicing Report for mortgage loans in the state of New York. It outlines the necessary information and procedures for reporting and submitting the report.

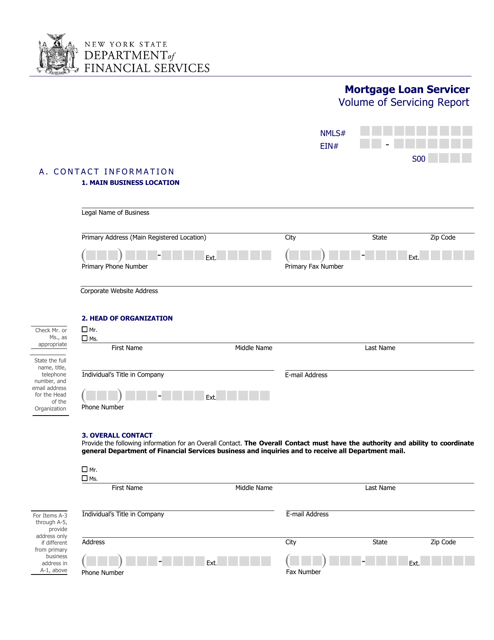

This document provides a report on the volume of mortgage loans serviced by a loan servicer in New York.

This document certifies compliance with Section 296-a of the Executive Law of the State of New York. It is used in New York to ensure compliance with this specific law.

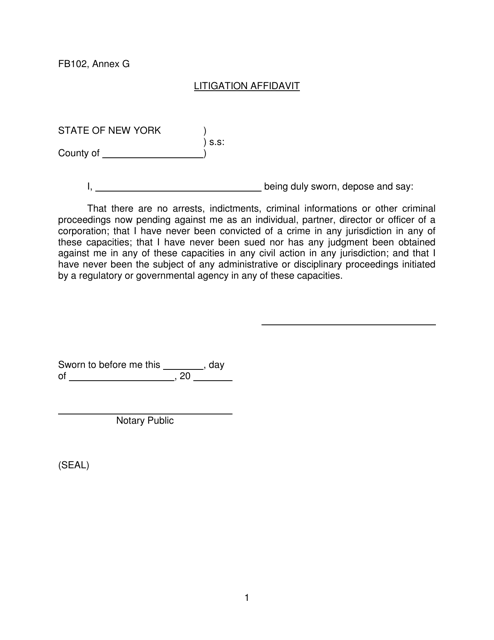

This document is used in legal proceedings in New York to provide sworn testimony or evidence related to a litigation case.

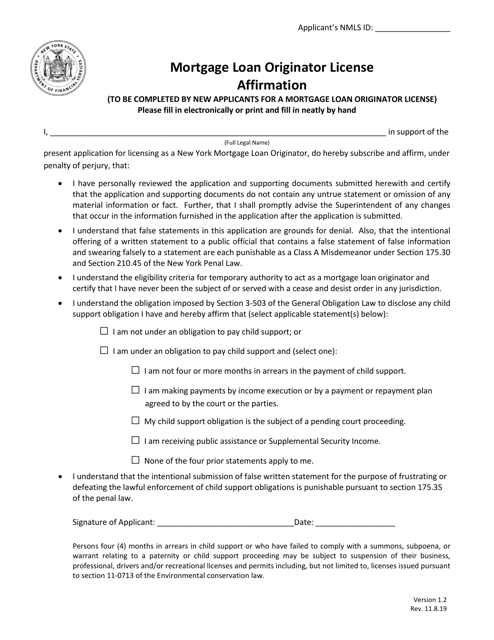

This document is used for affirming the Mortgage Loan Originator License in the state of New York.

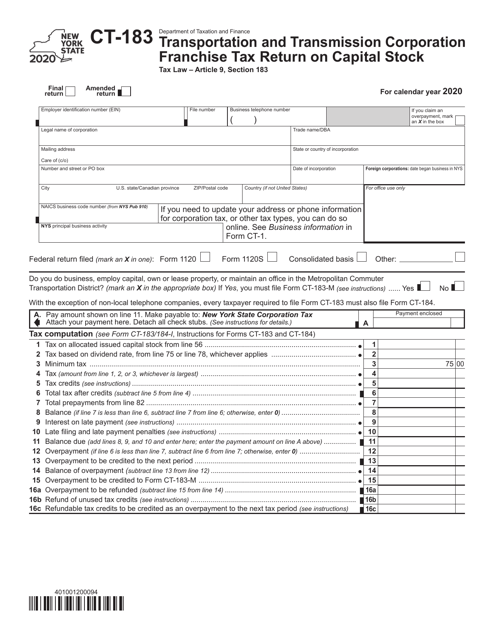

This form is used for filing the Franchise Tax Return on Capital Stock for the Transportation and Transmission Corporations in New York.

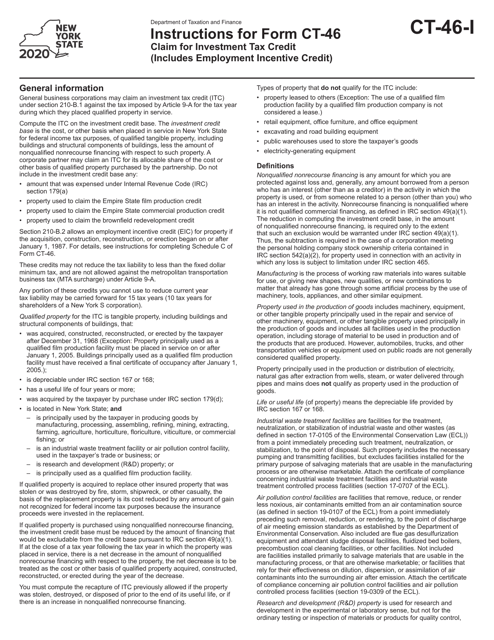

This form is used for claiming the investment tax credit, including the employment incentive credit, in New York. The instructions provide guidance on how to properly fill out the form and claim the credits.

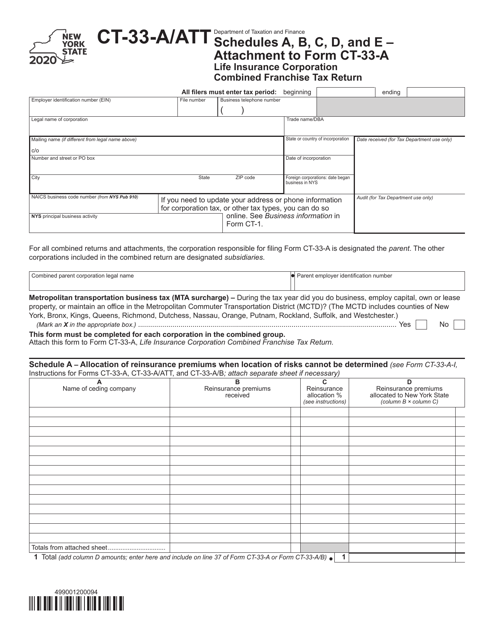

This Form is used for filing the Life Insurance Corporation Combined Franchise Tax Return in New York. It includes Schedule A, B, C, D, and E.

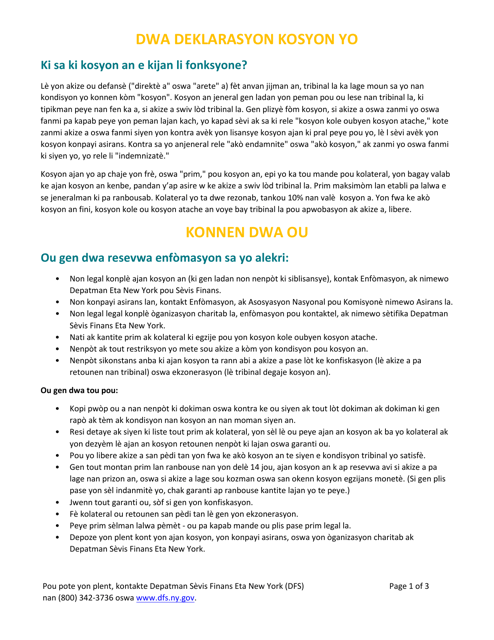

This document provides a statement of rights for individuals posting a bail bond in New York in Creole language.

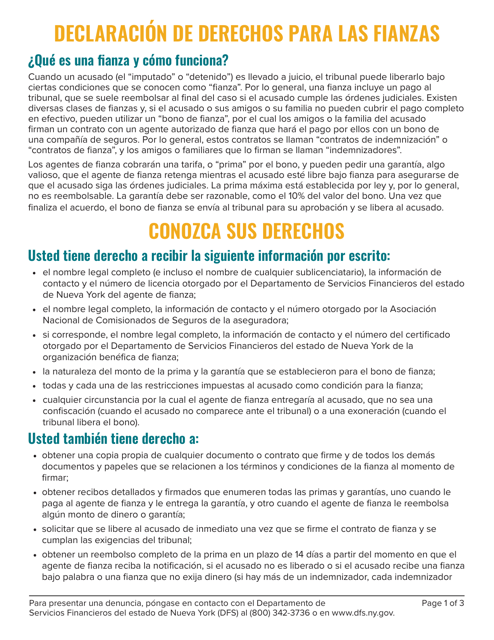

This document outlines the rights for bail in New York. It provides important information for individuals involved in the bail process in order to protect their rights.

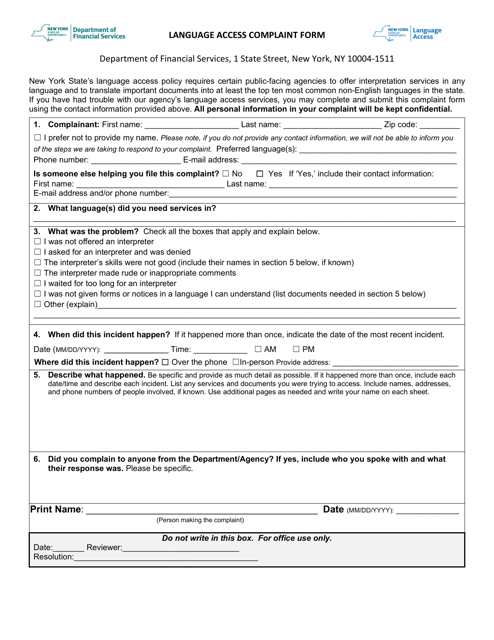

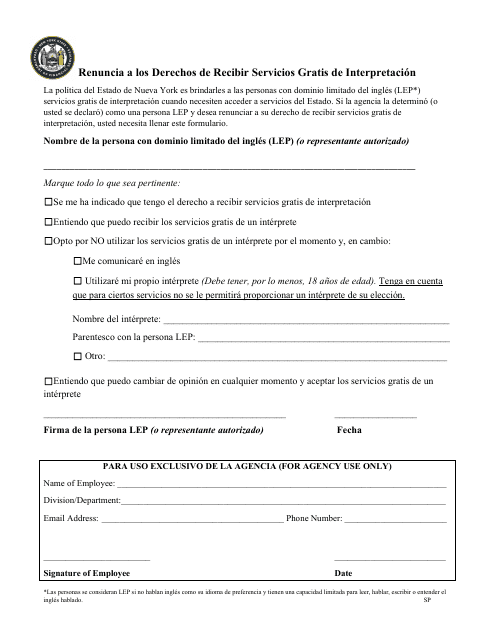

This form is used for filing a complaint regarding language access services in New York.

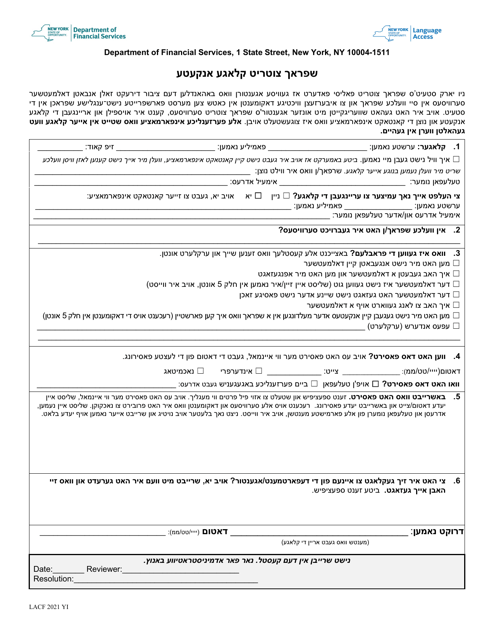

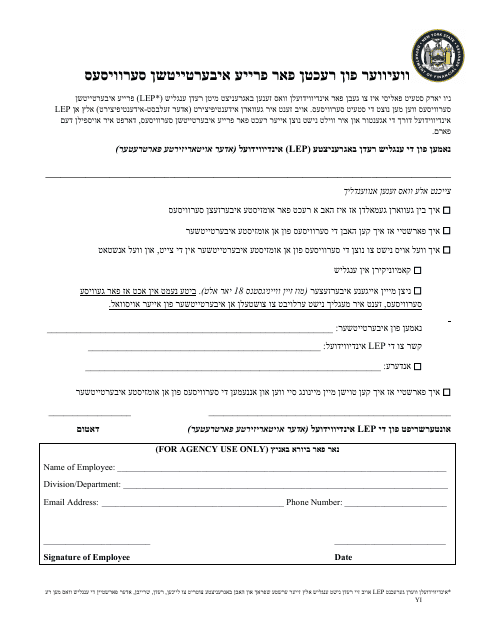

This Form is used for filing a language access complaint in New York, specifically for those who speak Yiddish.

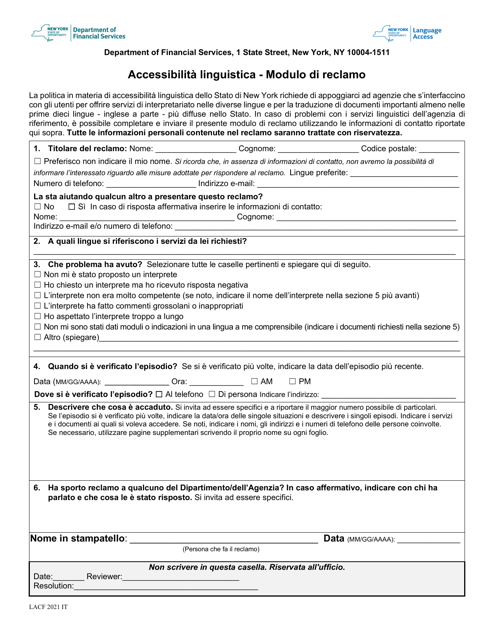

This form is used for filing a complaint about language access in New York, specifically for Italian speakers. It allows individuals to report instances where they were denied necessary language assistance services.

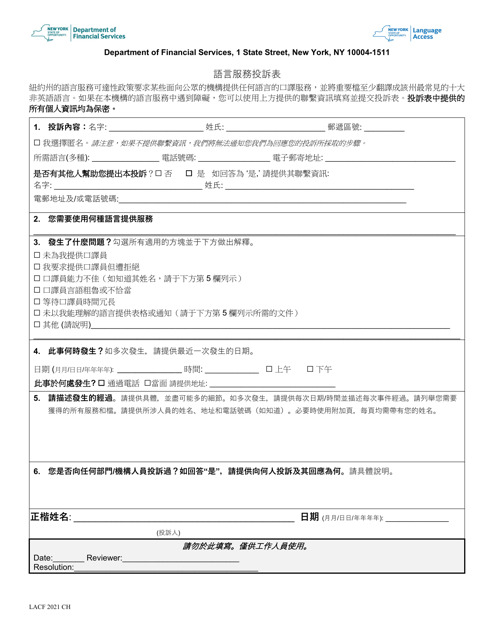

This Form is used to file a language access complaint in New York, specifically for cases involving the Chinese language.

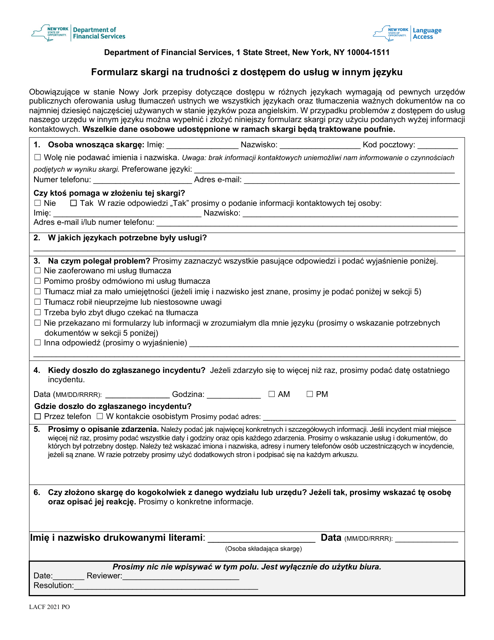

This form is used for filing a complaint related to language access issues in New York, specifically for Polish-speaking individuals.

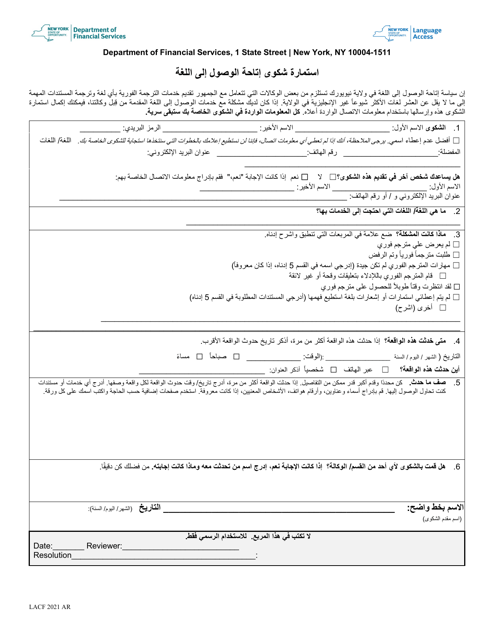

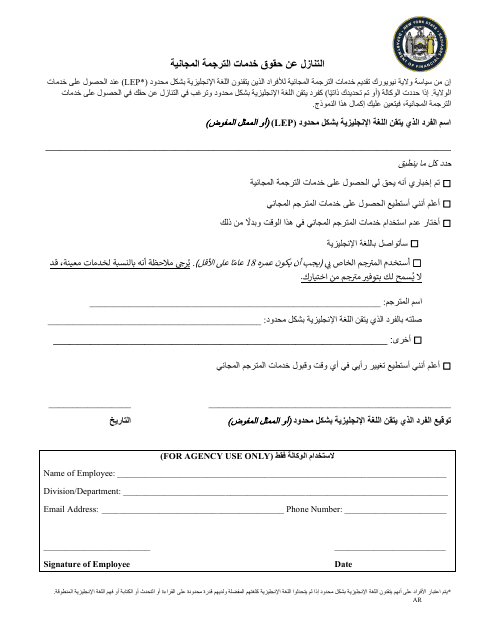

This Form is used for submitting a complaint about language access issues in New York. It specifically caters to Arabic speakers.

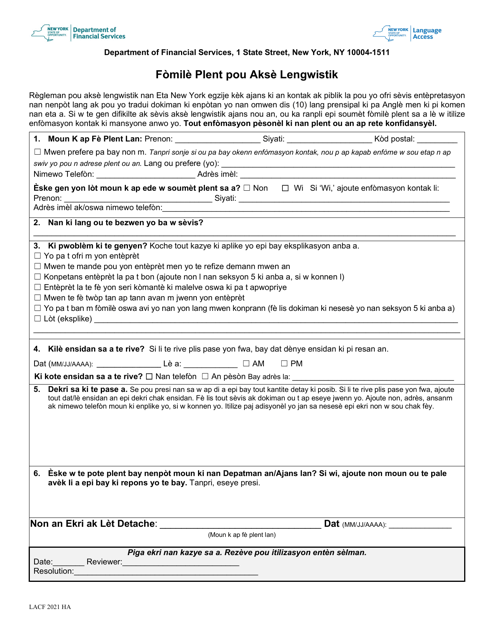

This document is a Language Access Complaint Form for residents of New York who speak Haitian Creole. It allows individuals to file a complaint if they have experienced language access issues with a government agency or organization.

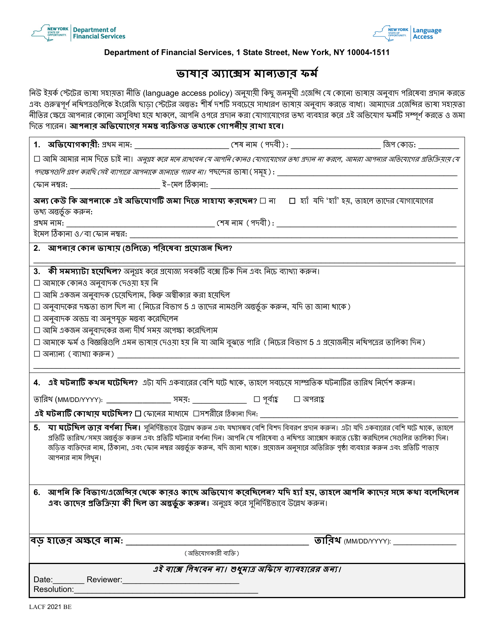

This Form is used for filing language access complaints in New York, specifically for Bengali speakers. It allows individuals to report instances where they were unable to access services or information in their preferred language.

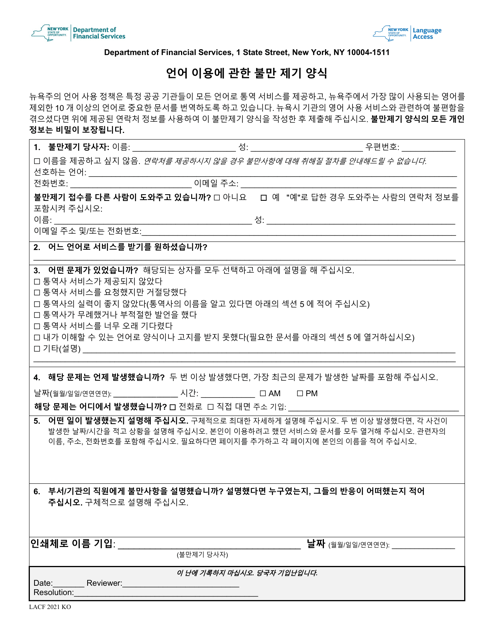

This form is used for filing a complaint regarding language access services in New York, specifically for Korean speakers.

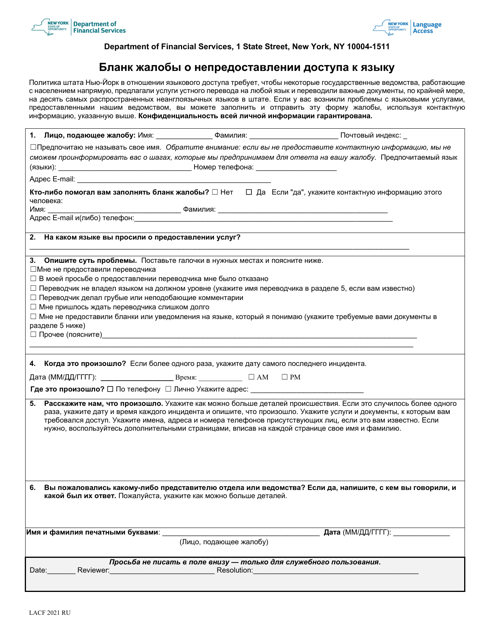

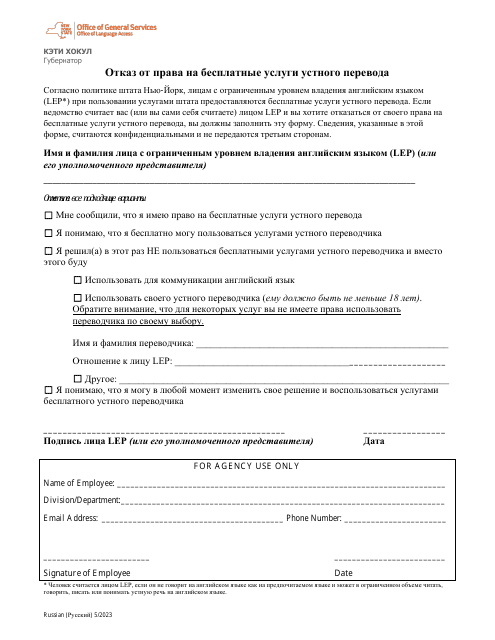

This Form is used for filing a language access complaint in New York for Russian speakers.

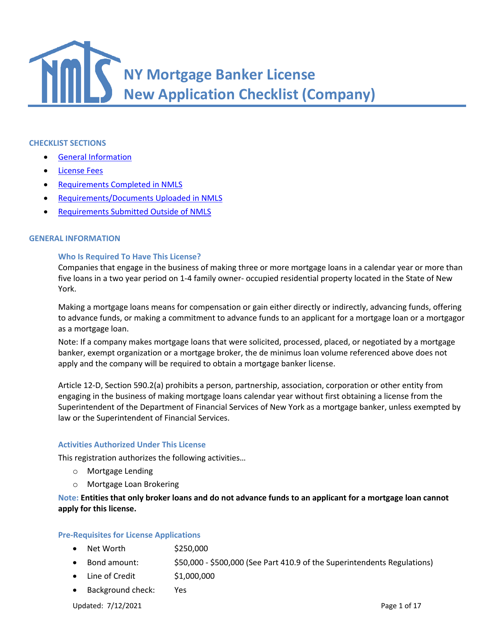

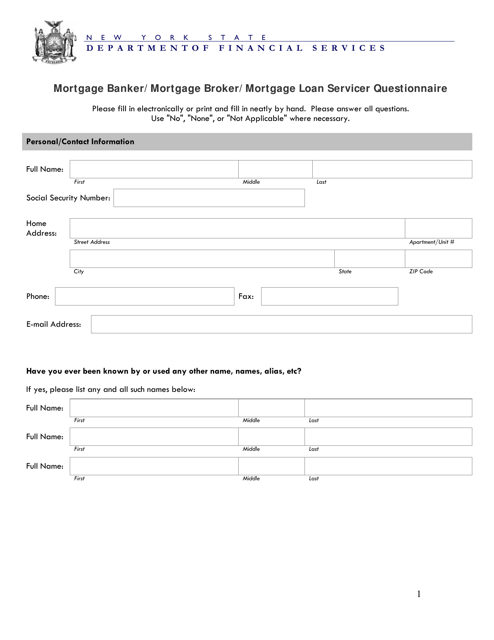

This Form is used for a questionnaire related to mortgage banking, brokering, and loan servicing in New York.

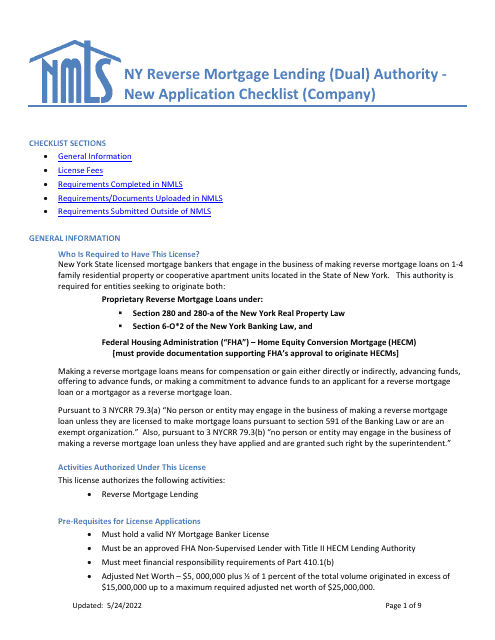

This document is a checklist for a new application for a company operating in the reverse mortgage lending industry in New York. It ensures that all required documents and information are gathered and submitted accurately.

This document is a checklist for a new application process for a company that has HECM (Home Equity Conversion Mortgage) lending authority in New York for reverse mortgages.