New Jersey Department of the Treasury Forms

Documents:

1110

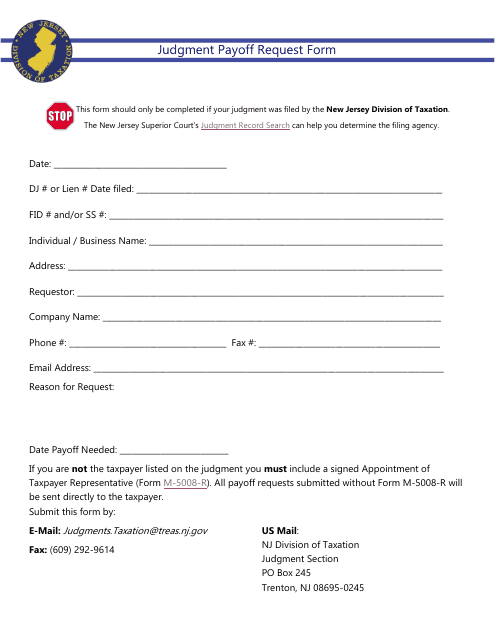

This Form is used for requesting information about paying off a judgment in New Jersey.

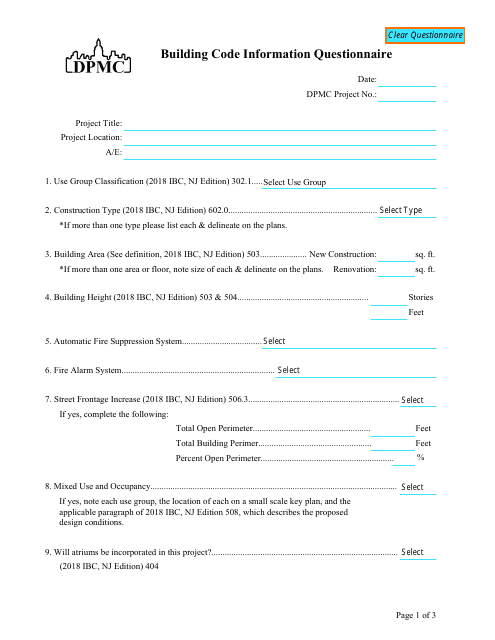

This document is a questionnaire that collects information about building codes in New Jersey. It helps gather information for construction or renovation projects in the state.

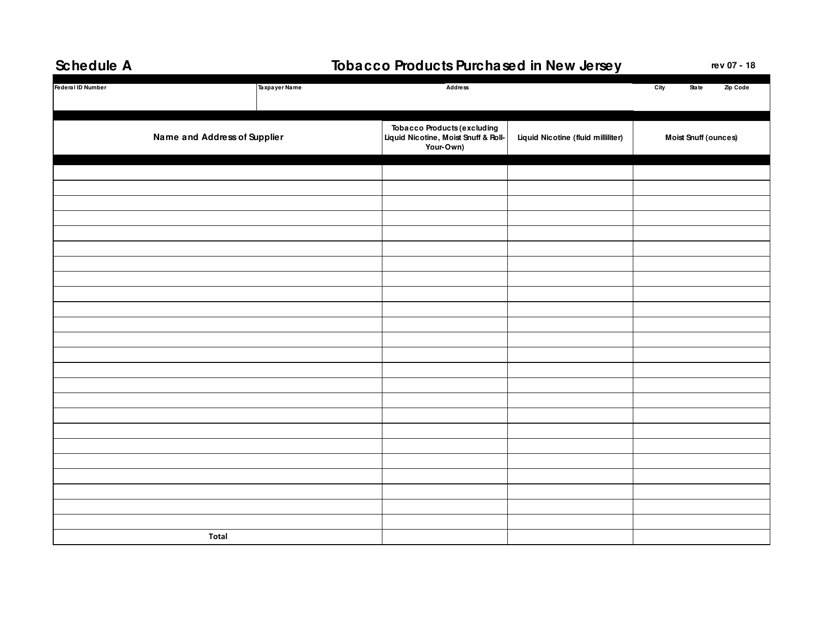

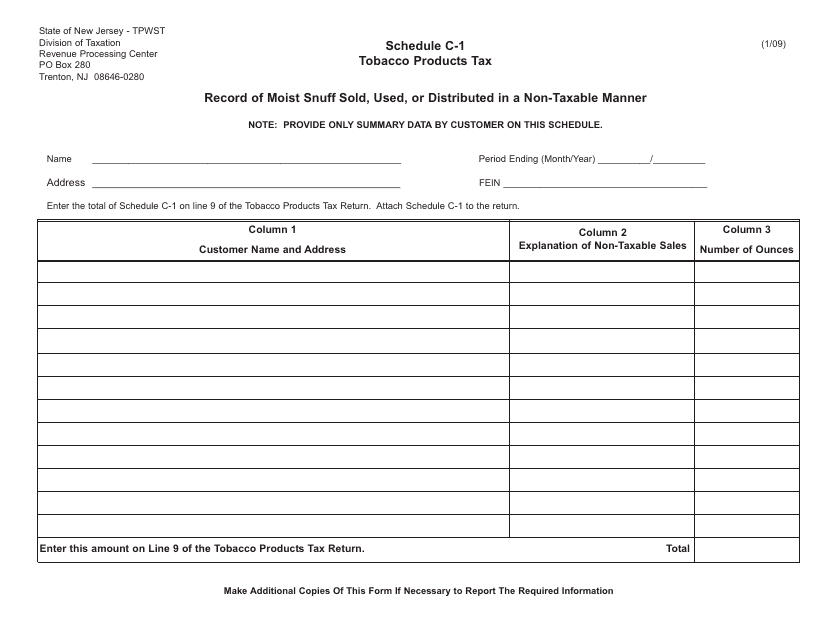

This document is used to keep a record of the sales, usage, or distribution of moist snuff in a non-taxable manner in the state of New Jersey.

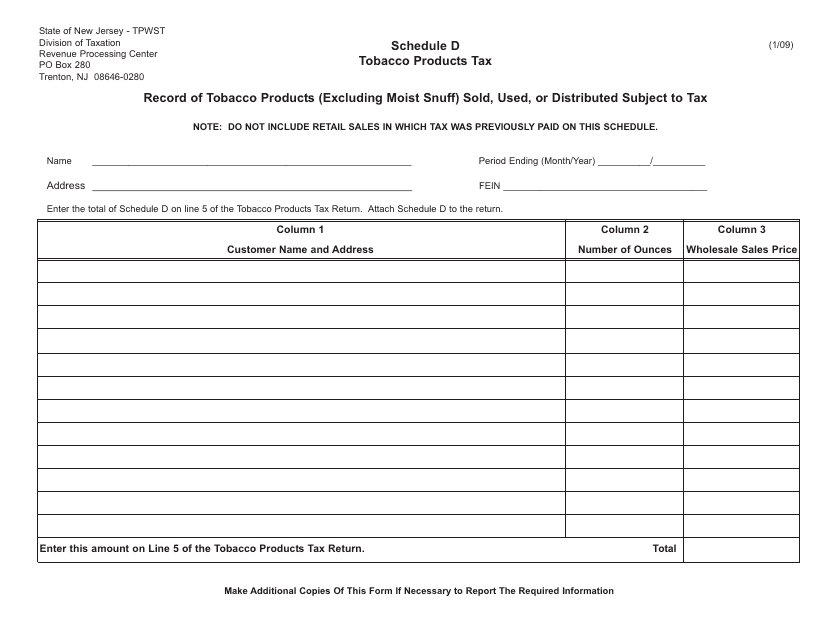

This document is used for keeping a record of tobacco products (excluding moist snuff) that have been sold, used, or distributed in New Jersey and are subject to tax.

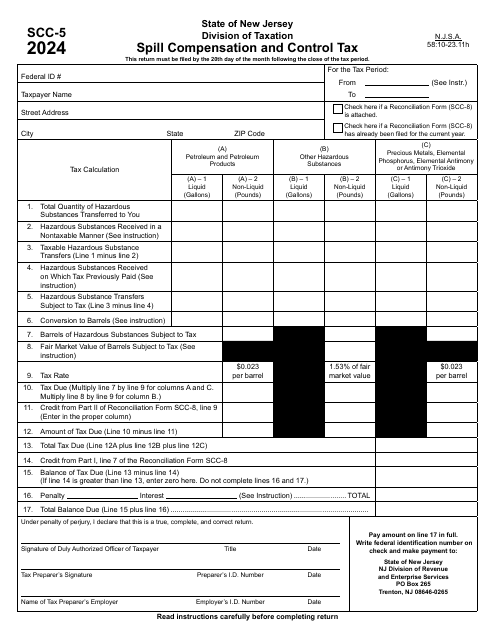

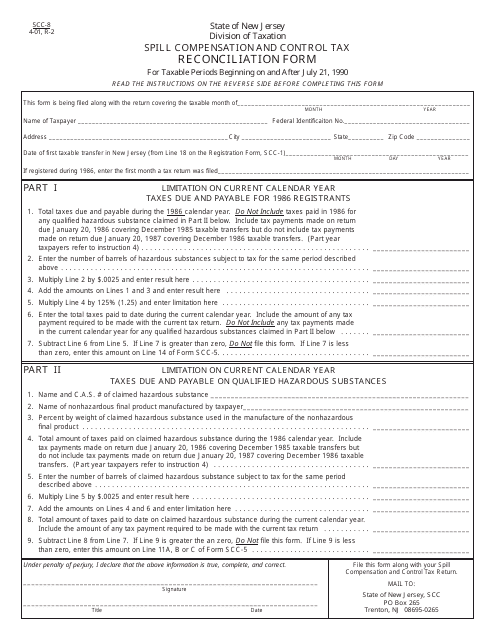

This Form is used for reconciling spill compensation and control tax in the state of New Jersey.

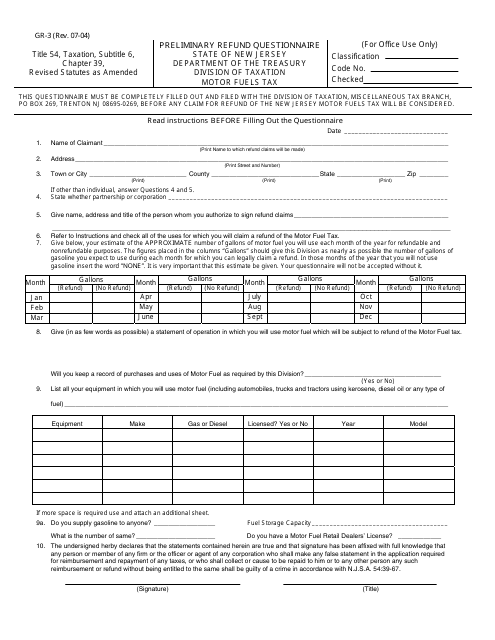

This form is used for individuals in New Jersey to complete a preliminary refund questionnaire in order to potentially claim a refund.

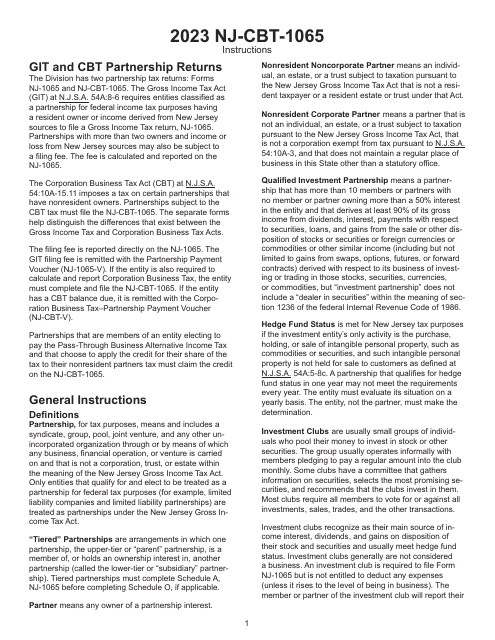

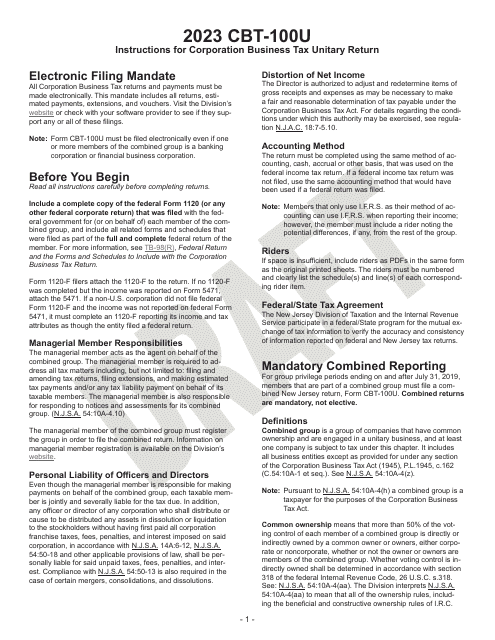

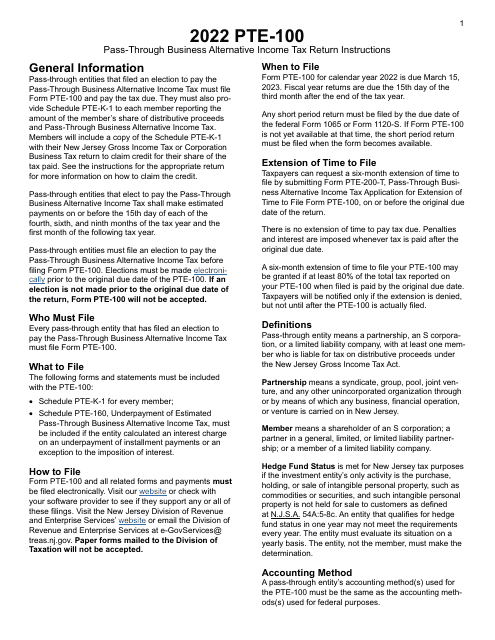

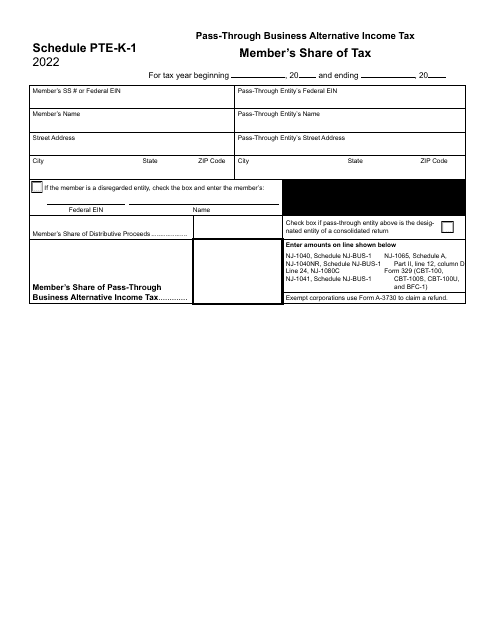

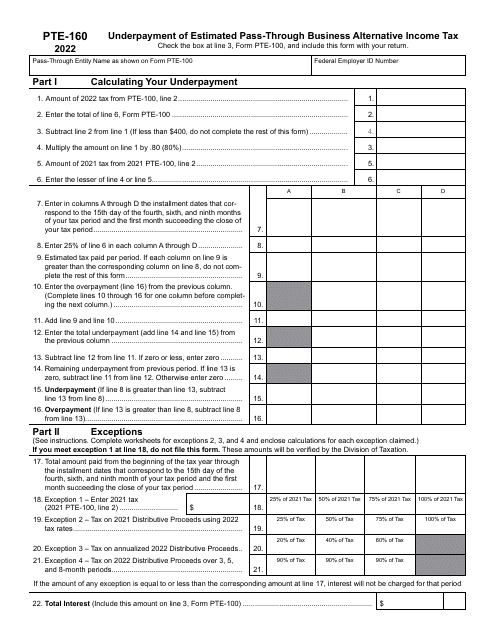

This Form is used for filing the Pass-Through Business Alternative Income Tax Return in the state of New Jersey. It is specifically for businesses classified as pass-through entities.

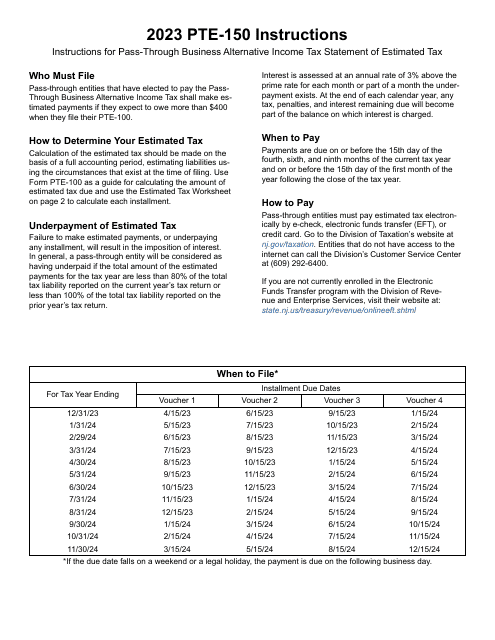

This document provides instructions for filing the Pass-Through Business Alternative Income Tax Statement of Estimated Tax in New Jersey. It outlines the necessary steps and guidelines for completing the form accurately.

Instructions for Form PTE-100 Pass-Through Business Alternative Income Tax Return - New Jersey, 2022

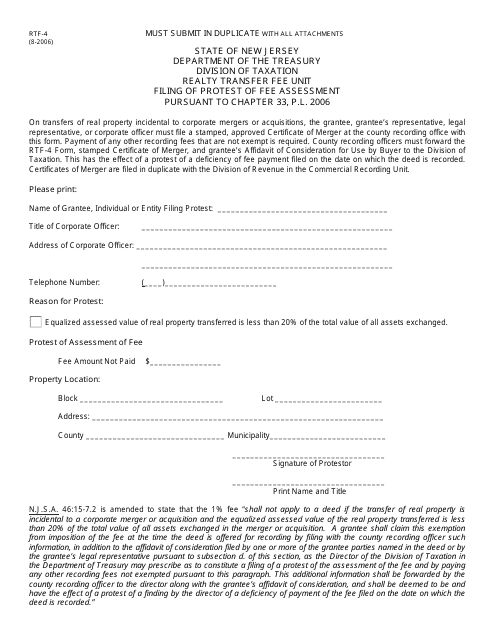

This Form is used for filing a protest of fee assessment in the state of New Jersey.

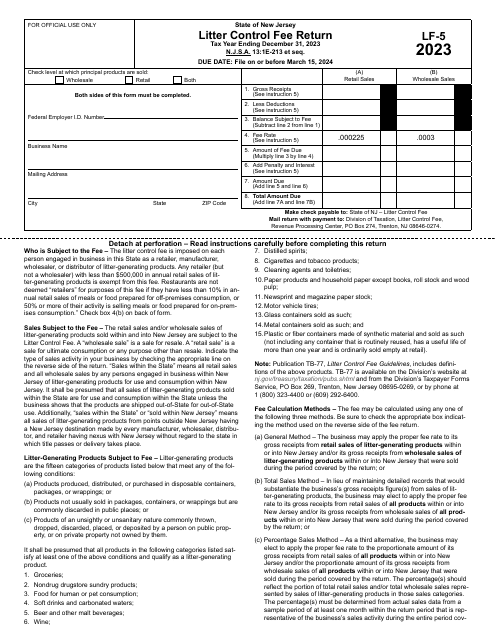

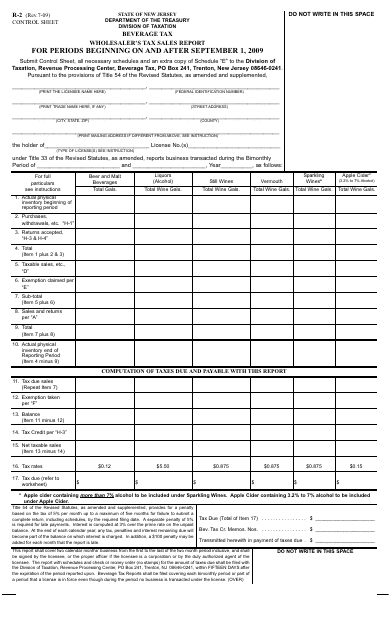

This form is used for wholesalers in New Jersey to report their tax sales.

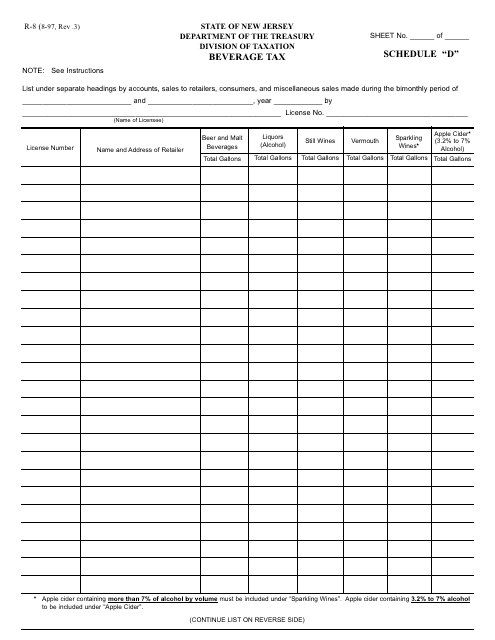

This form is used for reporting and paying beverage tax in the state of New Jersey. It is a schedule D form that is part of the R-8 form series.