New Jersey Department of the Treasury Forms

Documents:

1110

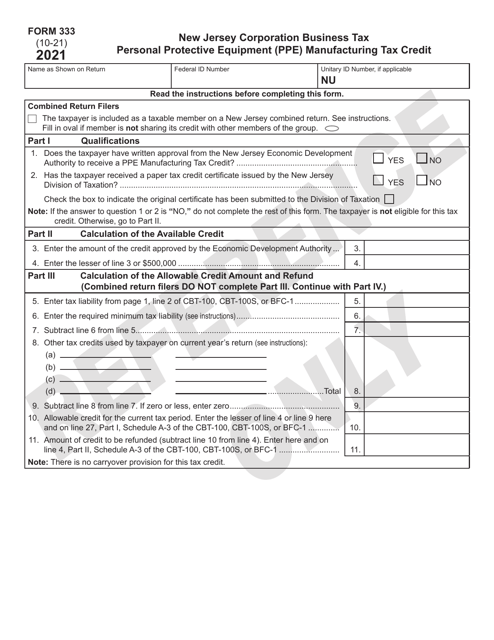

This form is used for claiming the Personal Protective Equipment (PPE) Manufacturing Tax Credit in New Jersey.

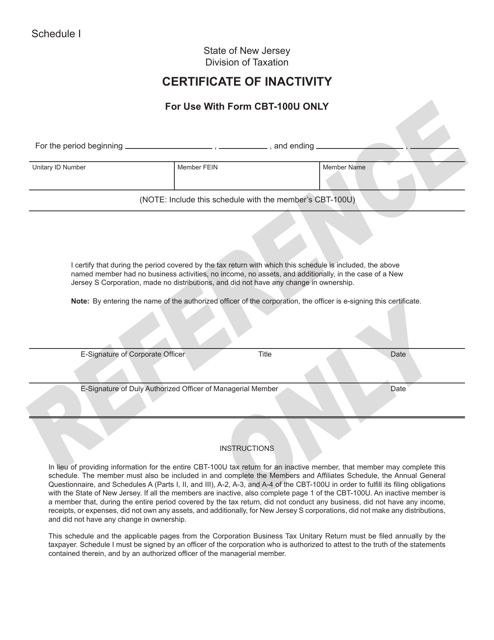

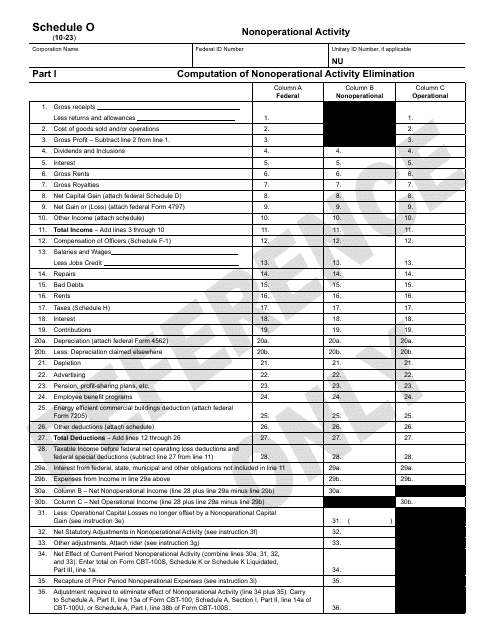

This document certifies inactivity of a certain schedule I entity for tax purposes. It is used in conjunction with Form CBT-100U in the state of New Jersey.

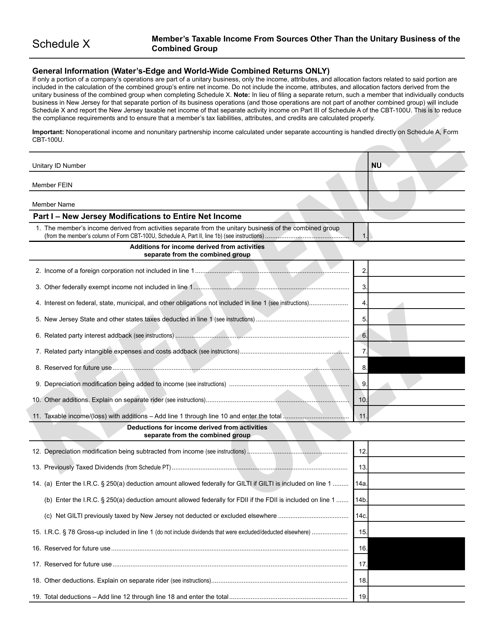

This form is used for reporting an individual or member's taxable income from sources other than the unitary business of the combined group in New Jersey. It is specifically for taxpayers filing Form CBT-100U.

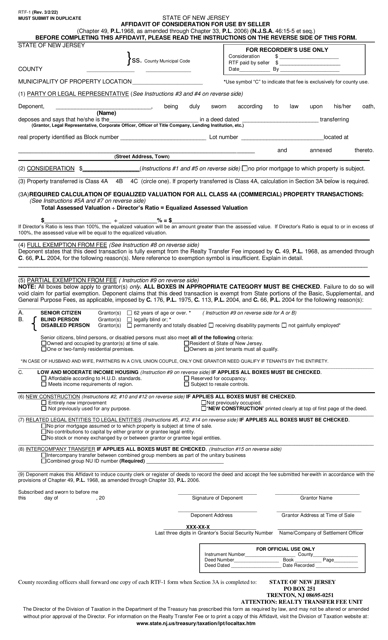

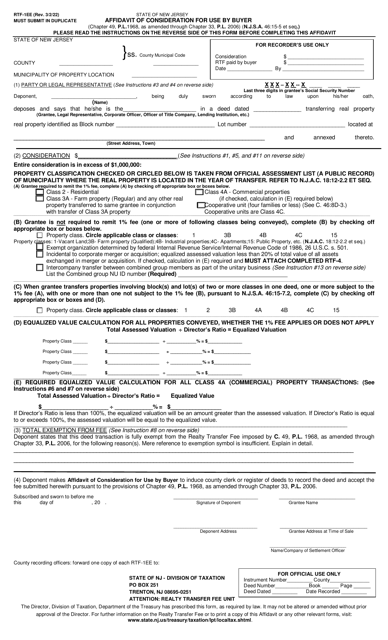

This Form is used for buyers in New Jersey to provide an affidavit of consideration for real estate transactions.

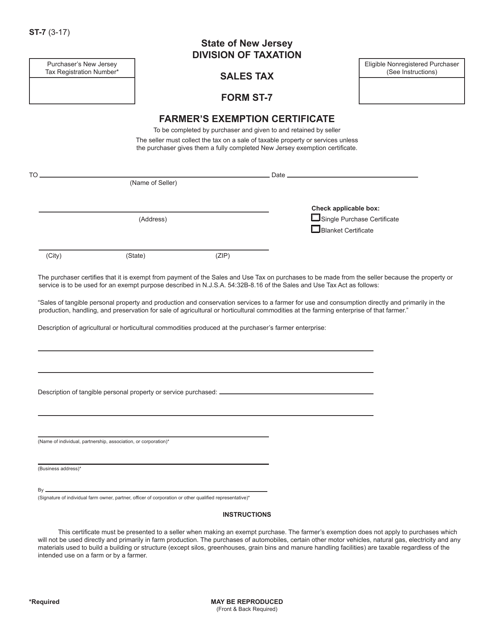

This Form is used for farmers in New Jersey to claim an exemption from certain state taxes.

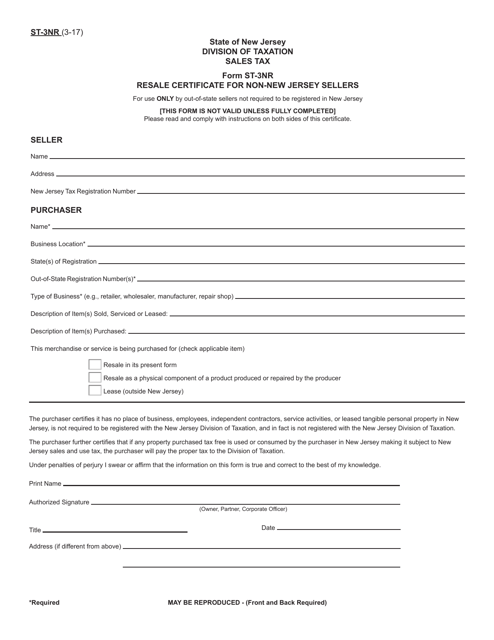

This form is used for non-New Jersey sellers to obtain a resale certificate for sales in New Jersey. It is required for sellers who are not based in New Jersey but make taxable sales in the state.

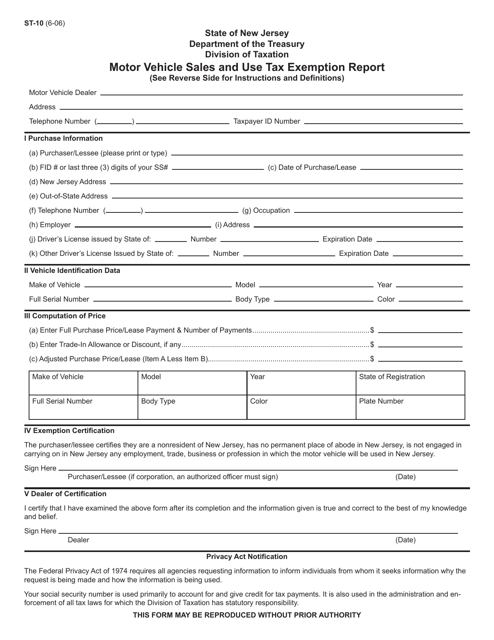

This form is used to report sales and use tax exemptions for motor vehicle purchases in New Jersey.

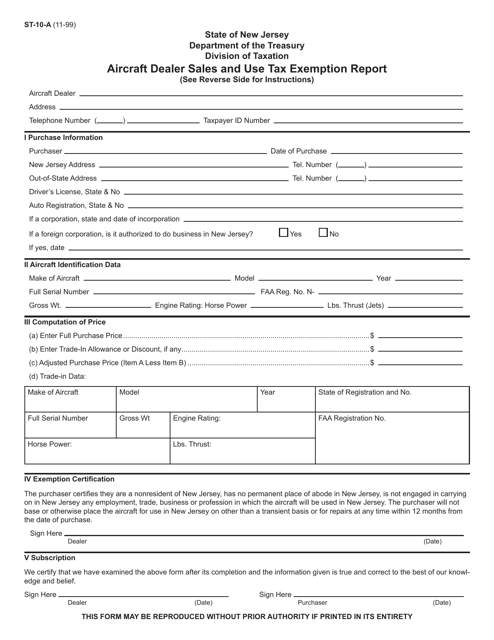

This form is used for reporting sales and use tax exemptions for aircraft dealers in New Jersey.

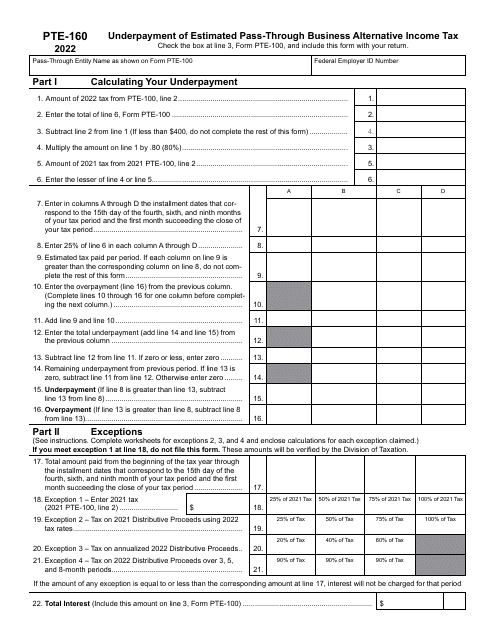

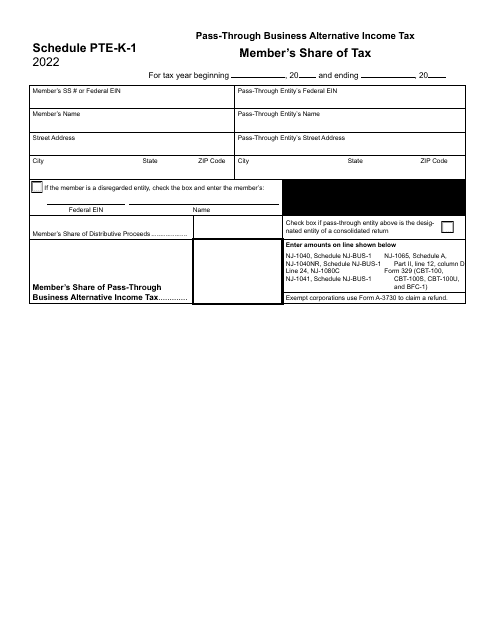

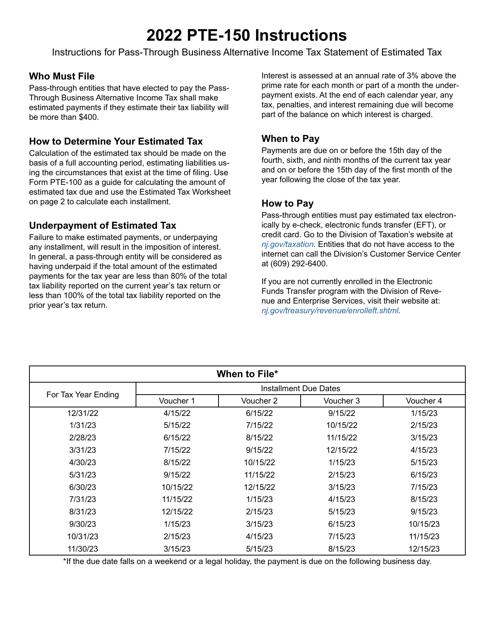

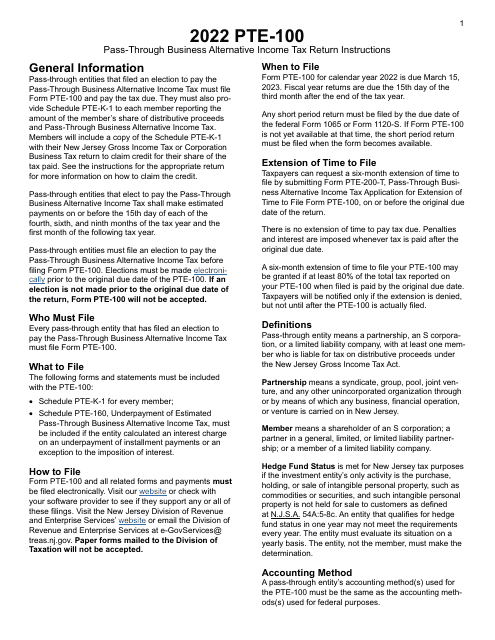

Instructions for Form PTE-100 Pass-Through Business Alternative Income Tax Return - New Jersey, 2022

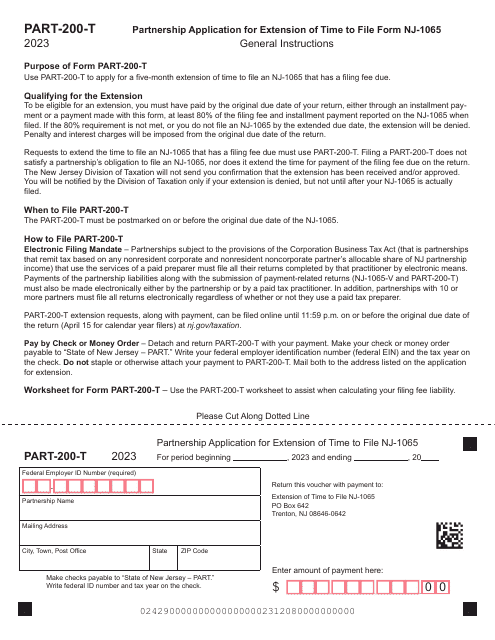

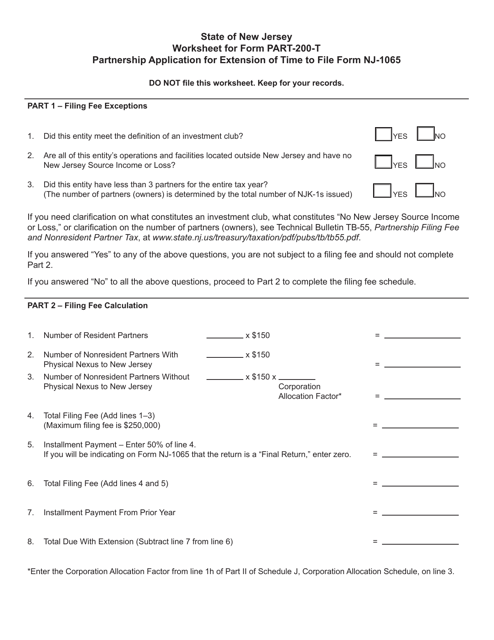

This form is used for partnership application for an extension of time to file Form NJ-1065 in New Jersey. It includes a fee worksheet for calculating the required fee.