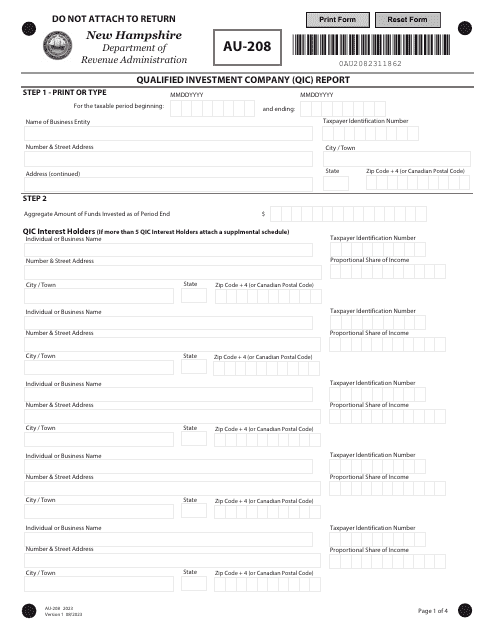

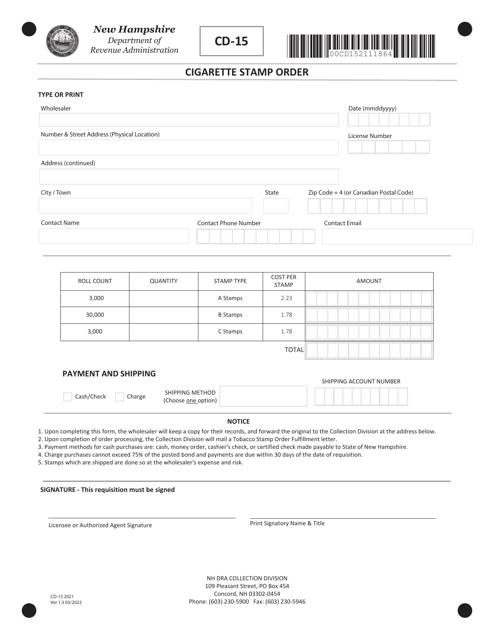

New Hampshire Department of Revenue Administration Forms

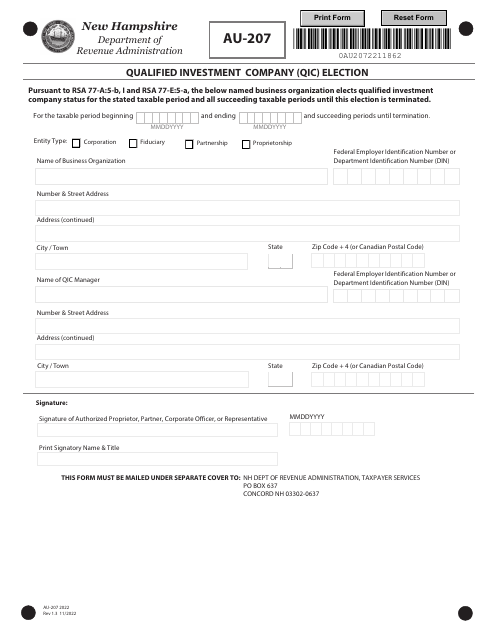

The New Hampshire Department of Revenue Administration is responsible for administering and enforcing various tax laws and regulations in the state of New Hampshire. They oversee the collection of taxes, including income taxes, property taxes, business taxes, and other taxes imposed by the state. Additionally, they provide guidance and assistance to taxpayers, process tax returns, conduct audits, and handle disputes related to tax matters. In summary, the Department of Revenue Administration plays a crucial role in ensuring compliance with tax laws and ensuring the collection of revenues to support the functioning of the state government.

Documents:

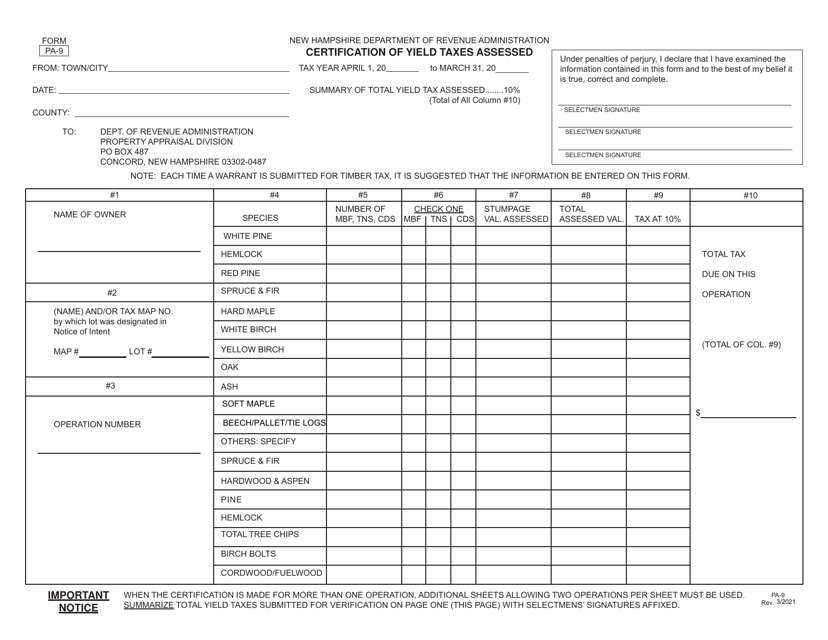

499

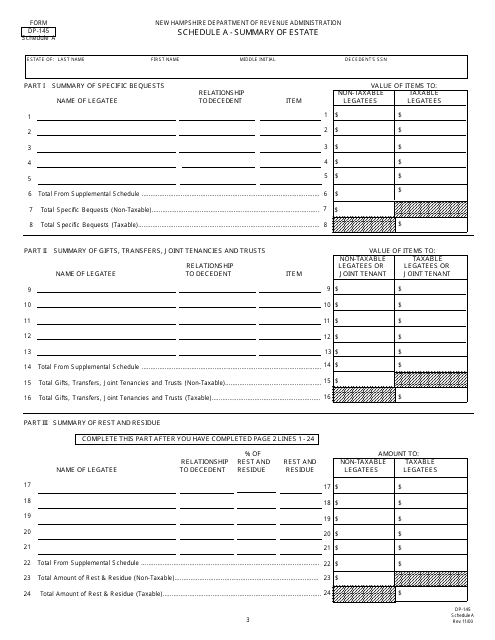

This form is used to provide a summary of an estate in the state of New Hampshire. It is typically used to report important information about the assets and liabilities of the estate for tax or legal purposes.

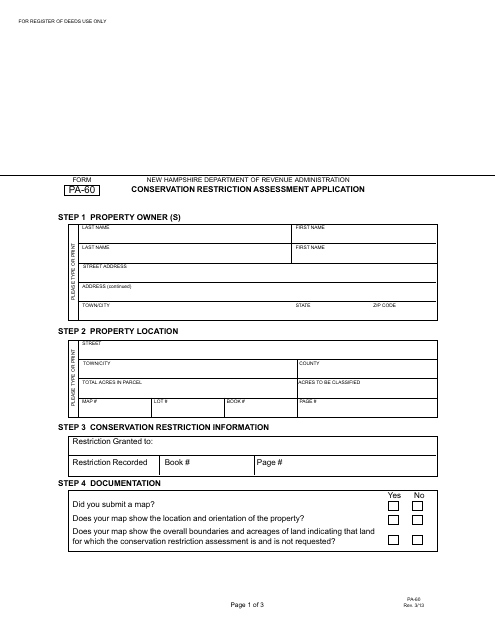

This Form is used for applying for a conservation restriction assessment in New Hampshire. It is a way to request the assessment of a property's conservation restriction eligibility.

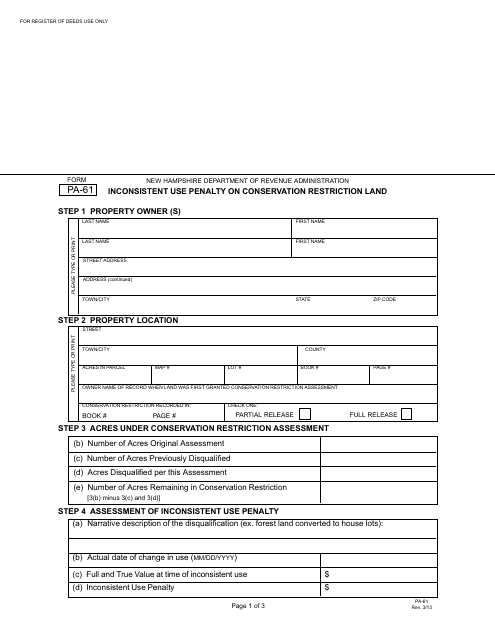

This form is used for assessing a penalty on the inconsistent use of land under a conservation restriction in New Hampshire.

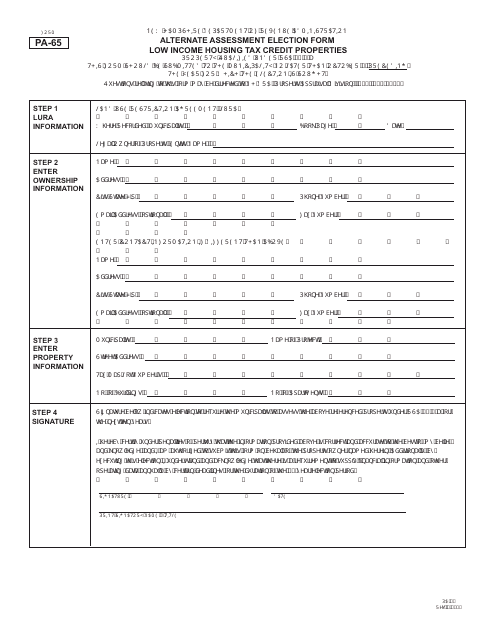

This form is used for low-income housing tax credit properties in New Hampshire to make an alternate assessment election.

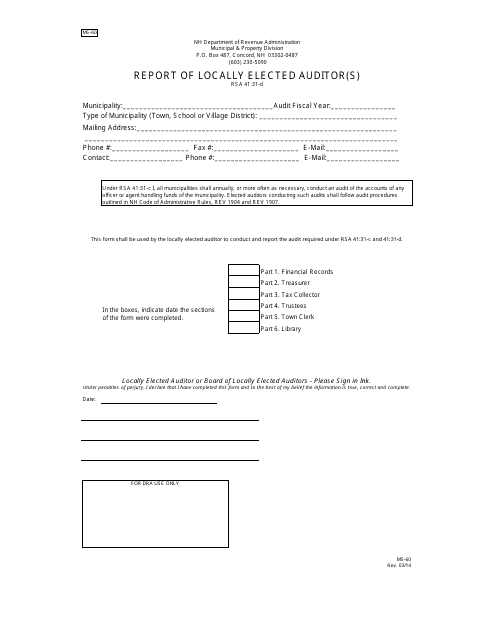

This form is used for reporting the locally elected auditors in New Hampshire. It provides information about the auditors and their activities.

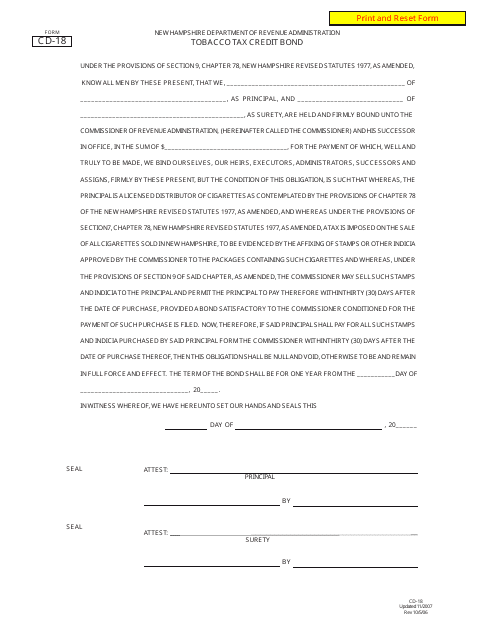

This form is used for obtaining a tobacco tax credit bond in the state of New Hampshire. It allows individuals or businesses to claim a tax credit on tobacco taxes paid.

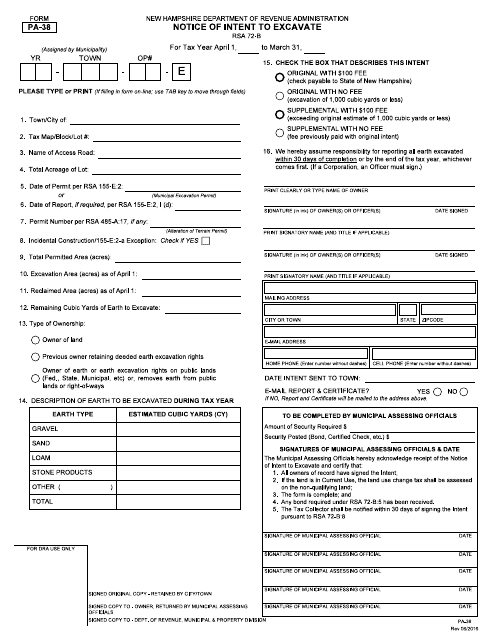

This form is used for notifying the relevant authorities in New Hampshire of the intent to excavate.

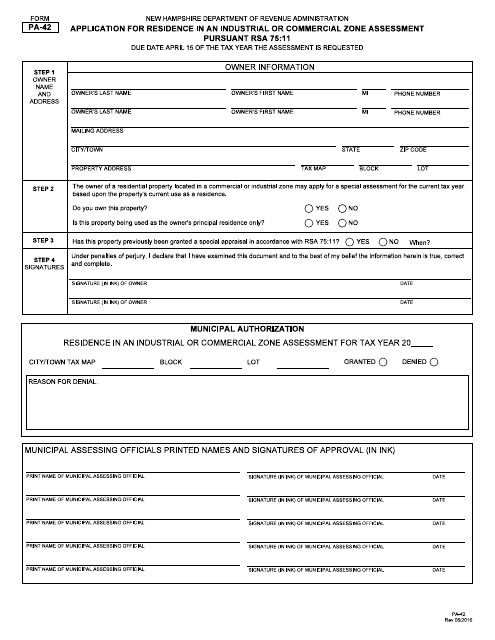

This form is used for applying for residence in an industrial or commercial zone assessment in New Hampshire.

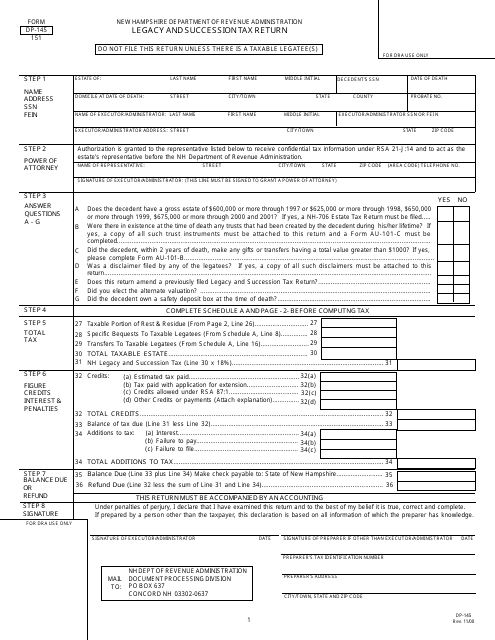

This Form is used for filing the Legacy and Succession Tax Return in the state of New Hampshire.

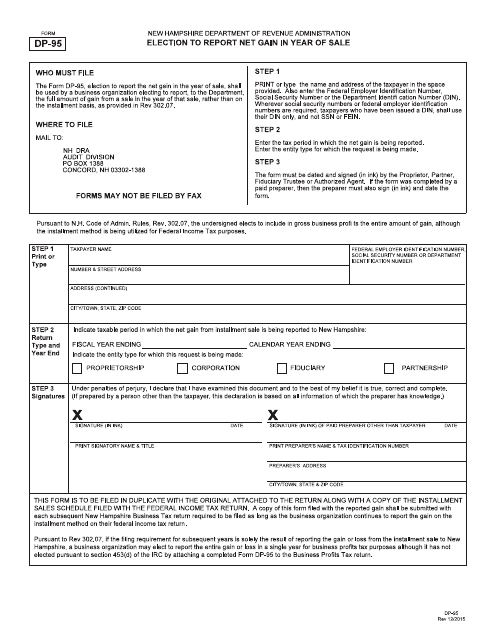

This form is used for electing to report net gain in the year of sale in New Hampshire.

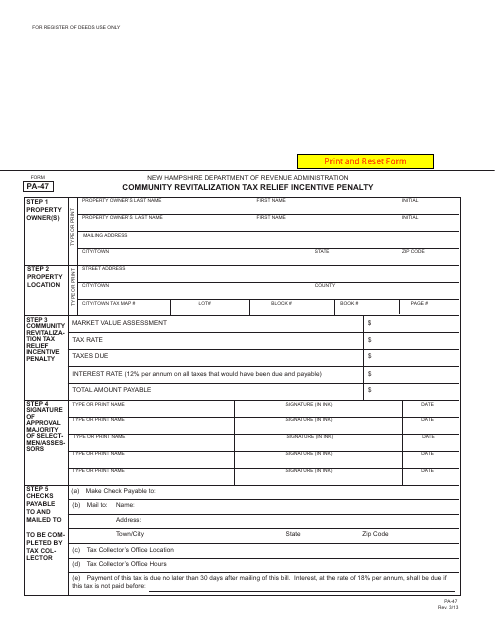

This form is used for applying for a penalty for the Community Revitalization Tax Relief Incentive in New Hampshire.

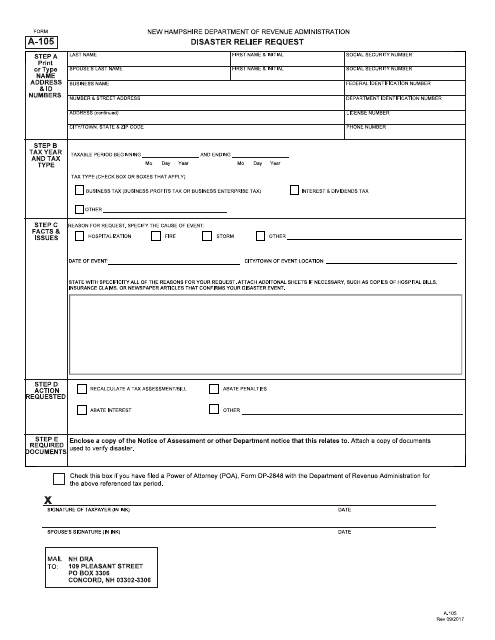

This form is used for requesting disaster relief assistance in the state of New Hampshire.

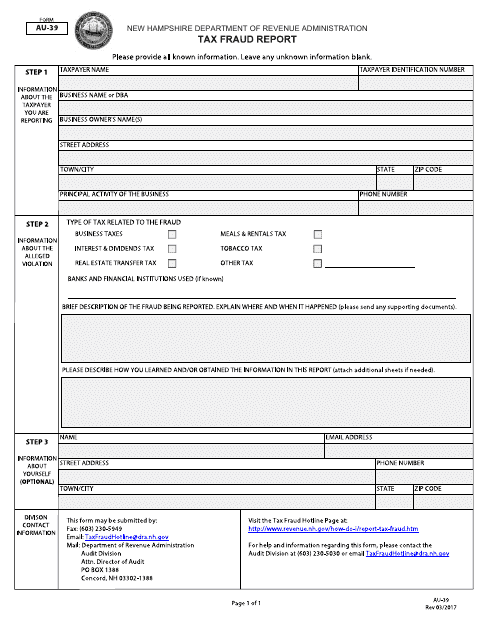

This form is used for reporting tax fraud in the state of New Hampshire.

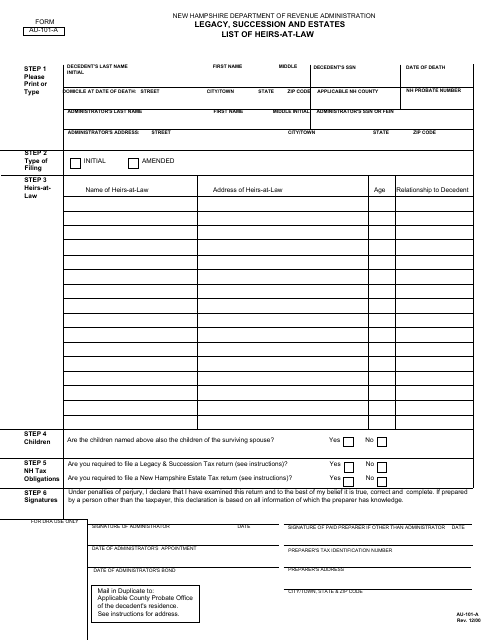

This form is used for creating a list of heirs-at-law in cases of legacy, succession, and estates in the state of New Hampshire.

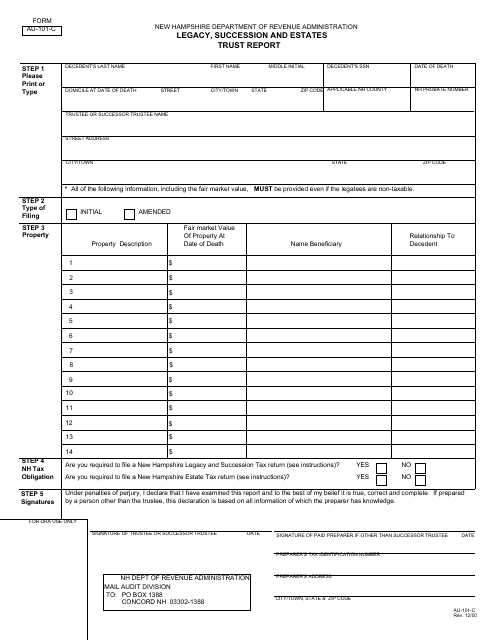

This form is used for reporting legacy, succession, and estate trusts in the state of New Hampshire.

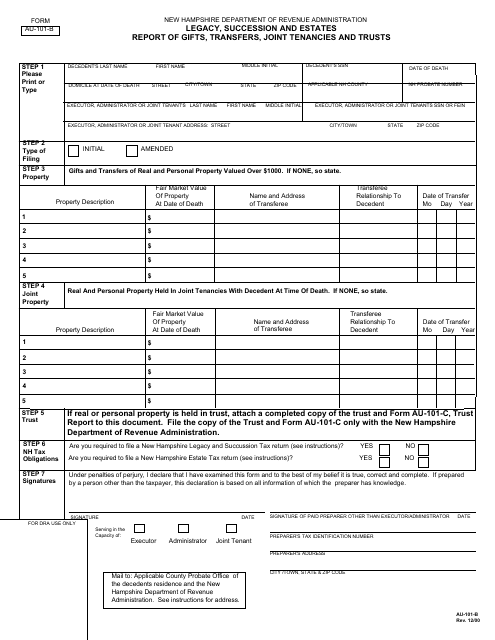

This form is used for reporting gifts, transfers, joint tenancies, and trusts related to legacy, succession, and estates in New Hampshire.

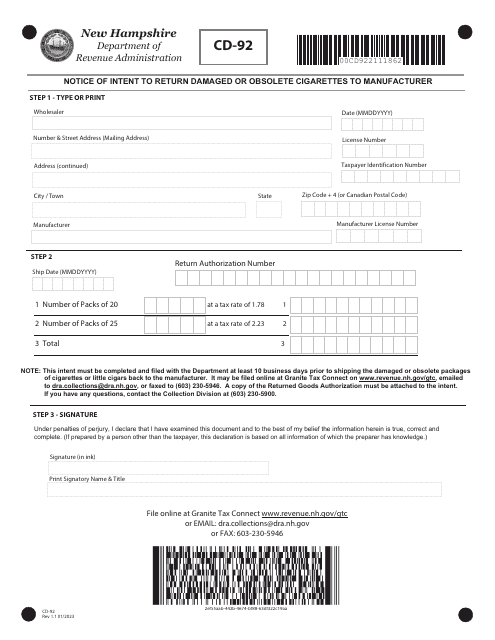

Form CD-92 Notice of Intent to Return Damaged or Obsolete Cigarettes to Manufacturer - New Hampshire

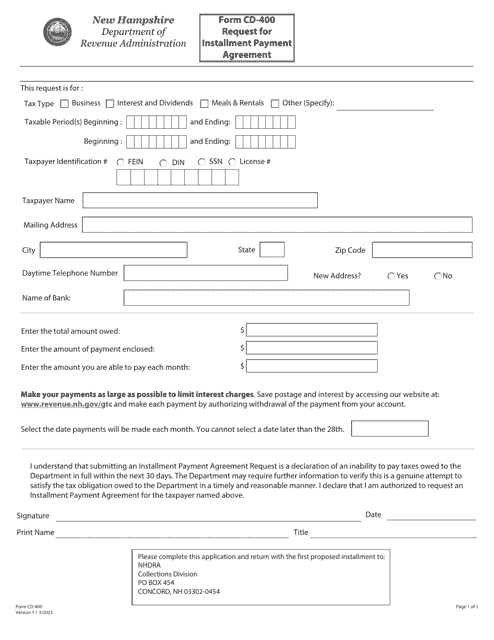

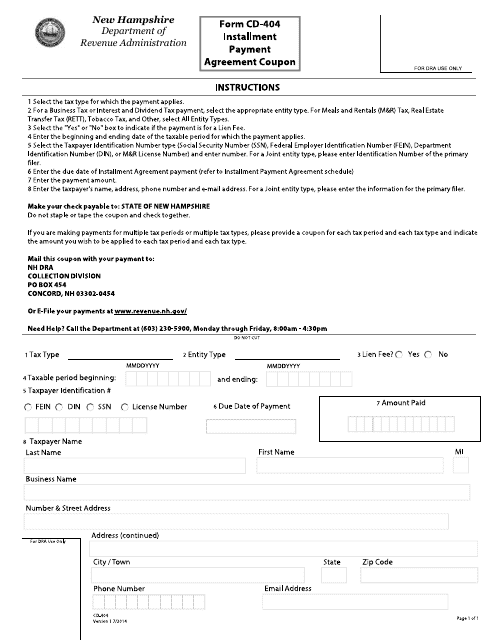

This form is used for submitting an installment payment agreement coupon in the state of New Hampshire.

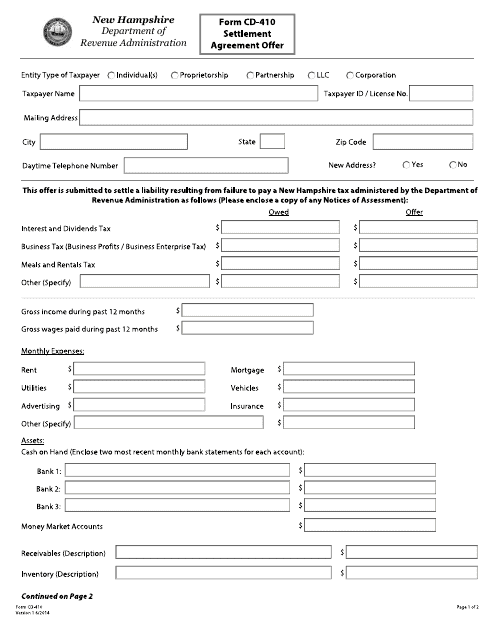

This form is used for making a settlement agreement offer in the state of New Hampshire.

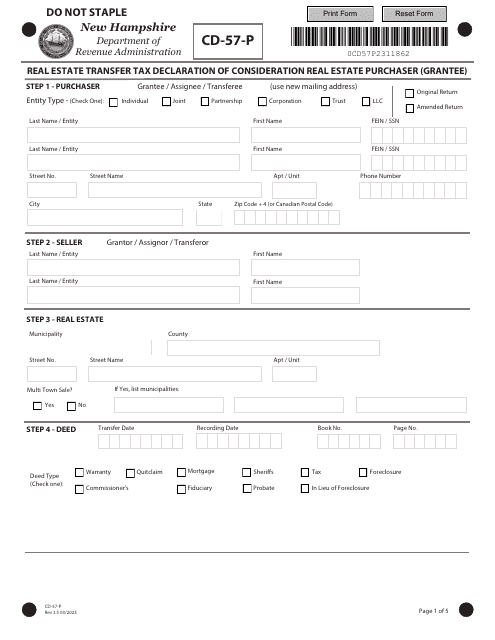

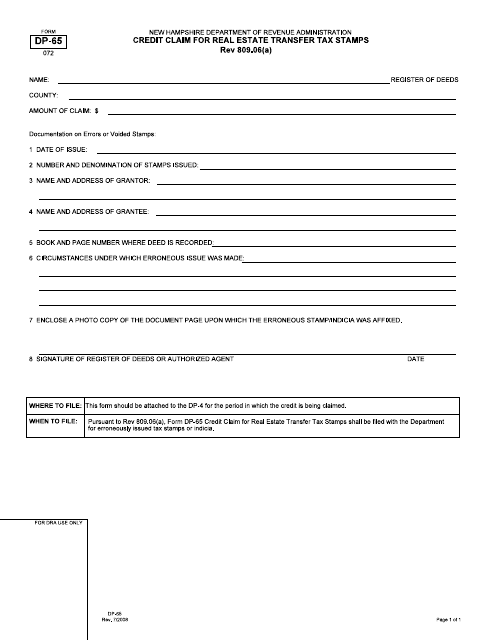

This form is used for claiming credit for real estate transfer tax stamps in New Hampshire.

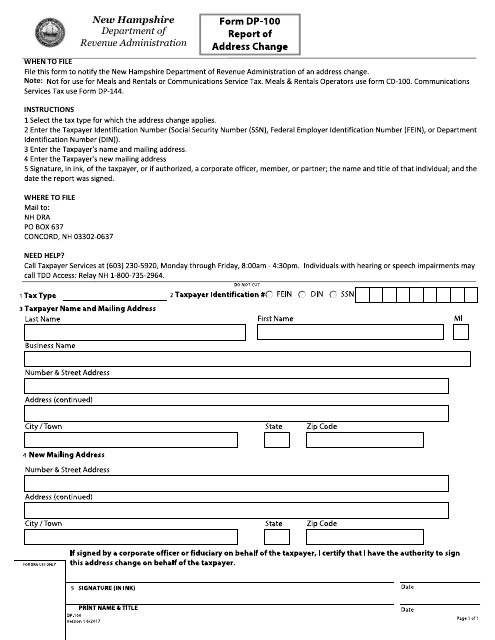

This Form is used for reporting a change of address in New Hampshire.

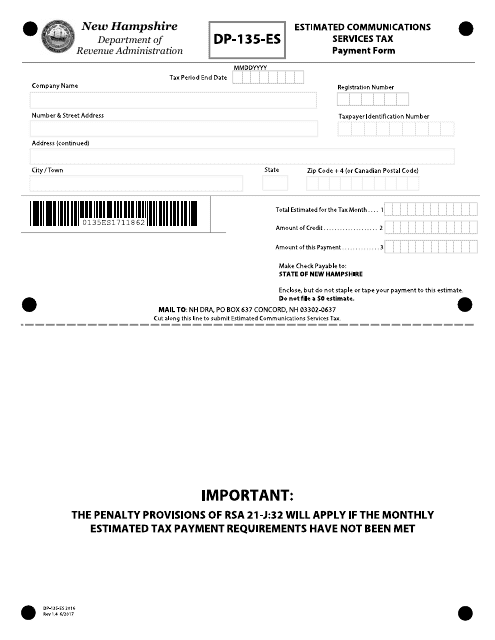

This Form is used for making estimated communications services tax payments in the state of New Hampshire.