New Hampshire Department of Revenue Administration Forms

Documents:

499

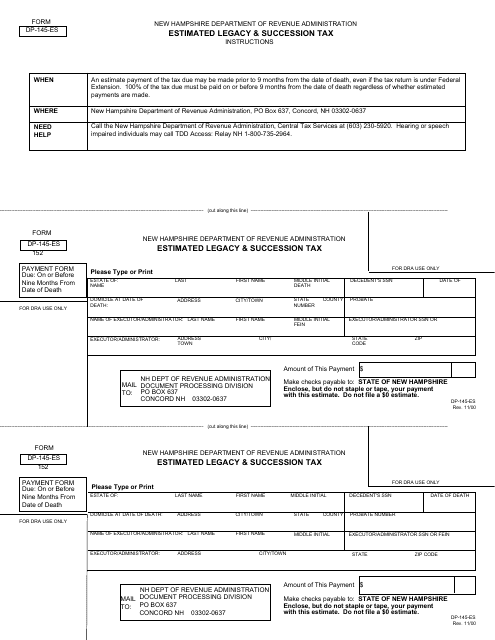

This Form is used for estimating and paying legacy and succession taxes in the state of New Hampshire. It is relevant for individuals who are handling the estate planning and transfer of wealth.

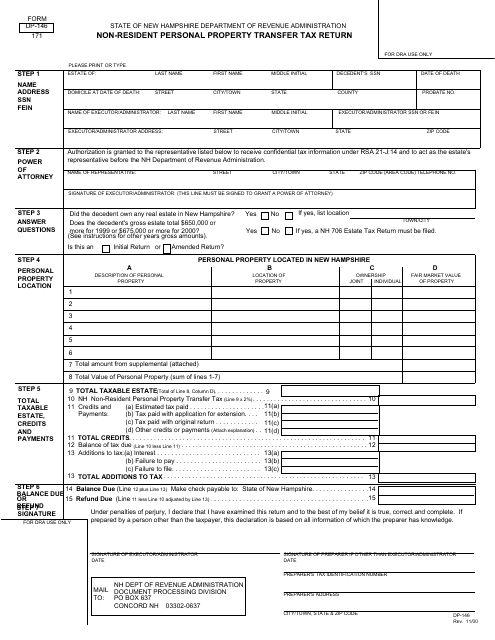

This Form is used for reporting and paying transfer tax on personal property for non-residents in New Hampshire.

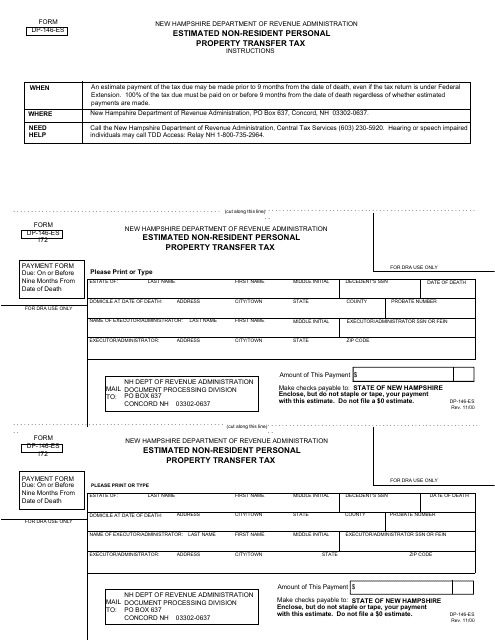

This document is used for estimating the non-resident personal property transfer tax in New Hampshire.

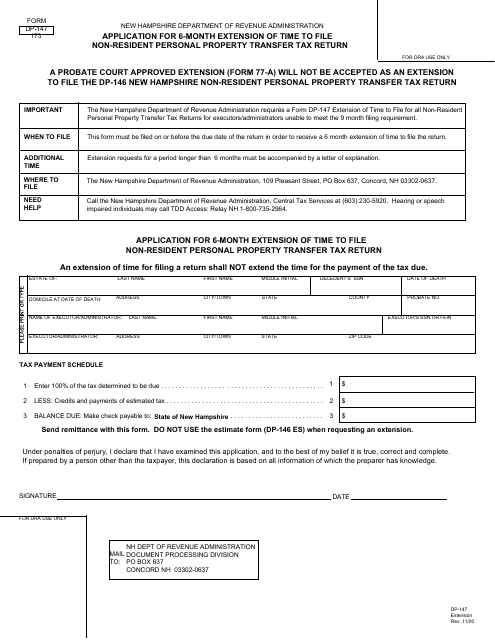

This form is used for applying for a 6-month extension of time to file your non-resident personal property transfer tax return in the state of New Hampshire.

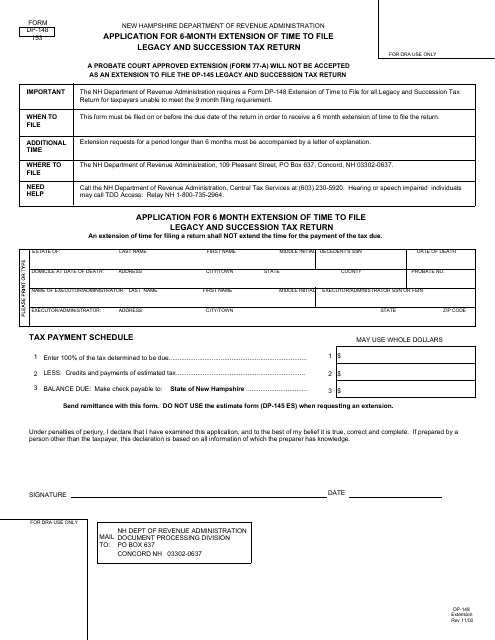

This Form is used for requesting a 6-month extension to file the Legacy and Succession Tax Return in the state of New Hampshire.

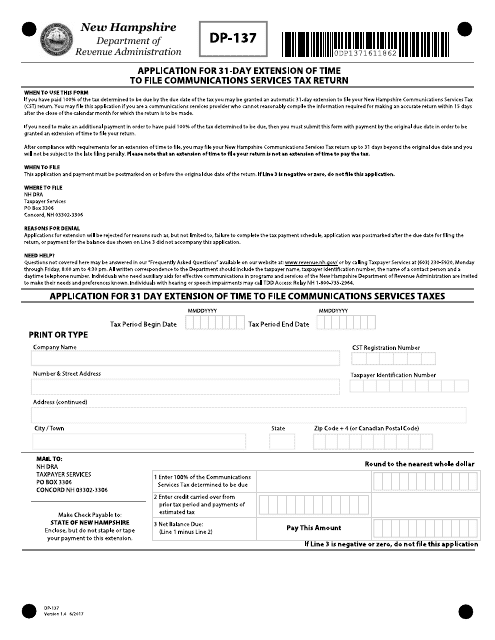

This Form is used for applying for a 31-day extension of time to file the Communications Services Tax Return in the state of New Hampshire.

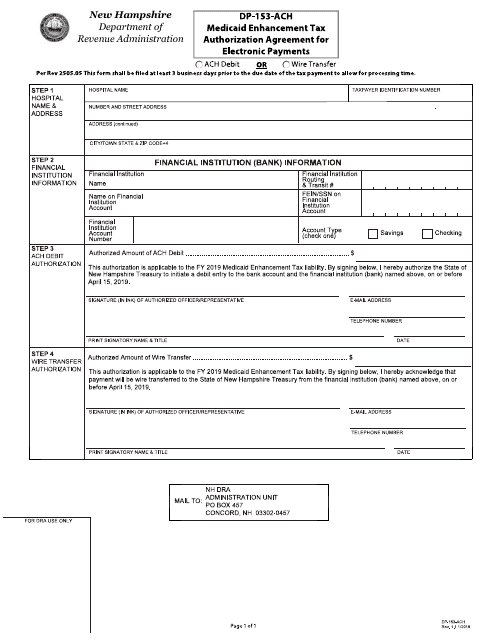

This Form is used for authorizing electronic payments for Medicaid Enhancement Tax in New Hampshire.

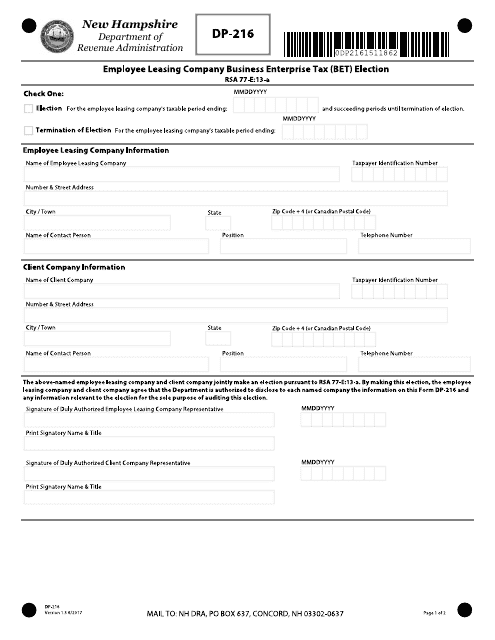

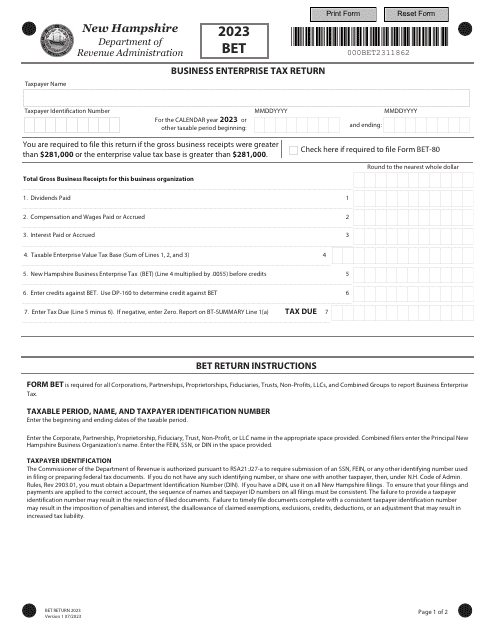

This Form is used for making a Business Enterprise Tax (Bet) election for Employee Leasing Companies in New Hampshire.

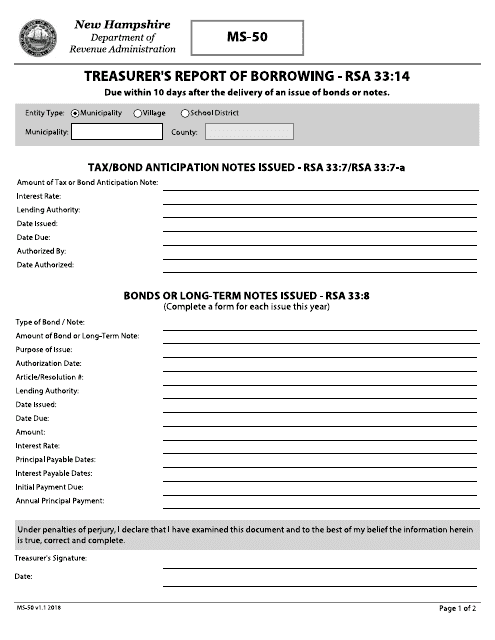

This form is used for reporting borrowing activities of a treasurer in the state of New Hampshire.

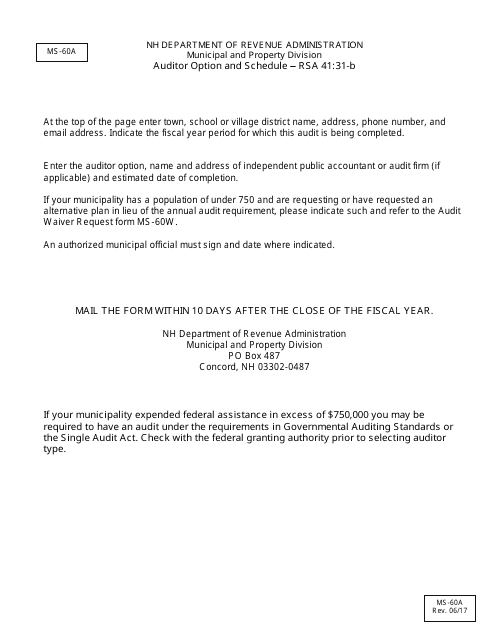

This form is used for the Auditor Option and Schedule in the state of New Hampshire.

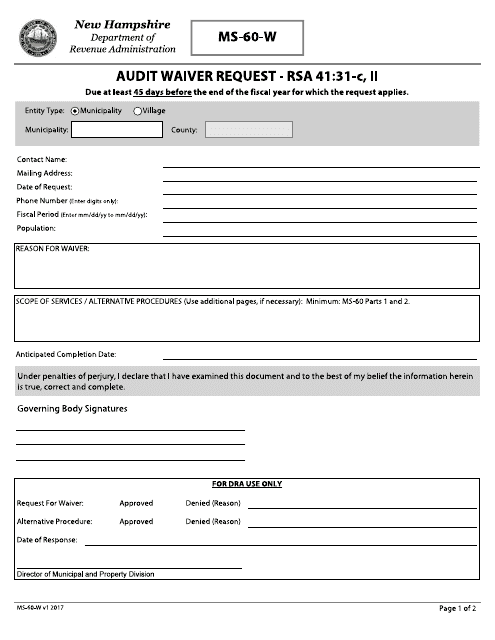

This form is used for requesting an audit waiver in the state of New Hampshire.

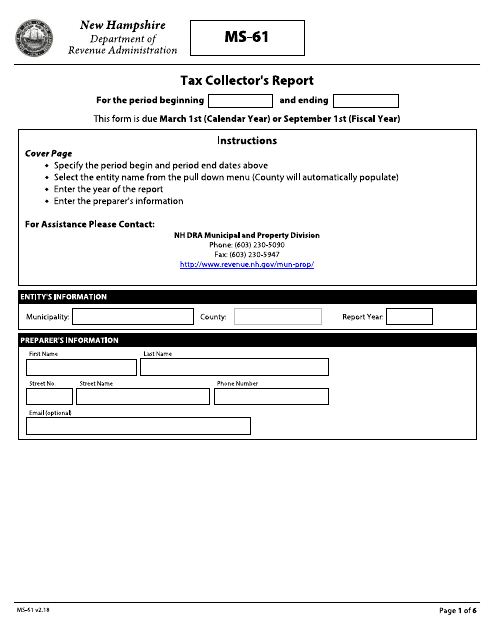

This Form is used for reporting taxes collected by the tax collector in the state of New Hampshire.

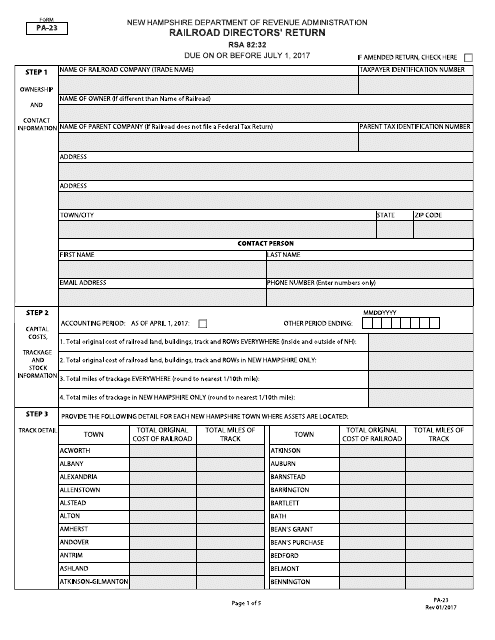

This form is used for filing the Railroad Directors' Return in the state of New Hampshire.

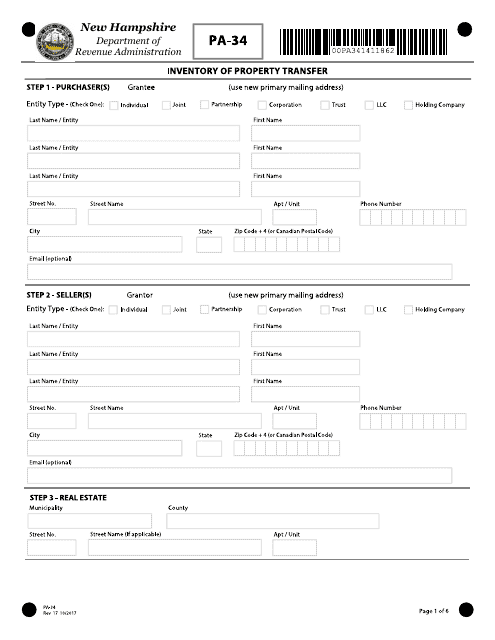

This form is used for documenting and reporting the transfer of property in the state of New Hampshire. It helps to maintain an inventory of property transfers and ensures compliance with state regulations.

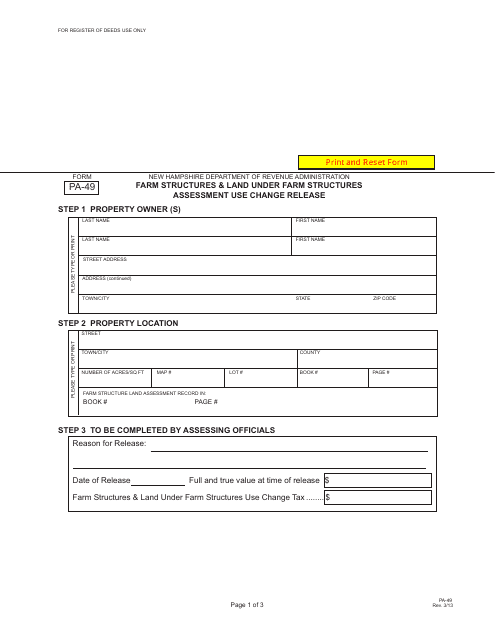

This form is used for releasing the use change of farm structures and land under farm structures assessment in the state of New Hampshire.

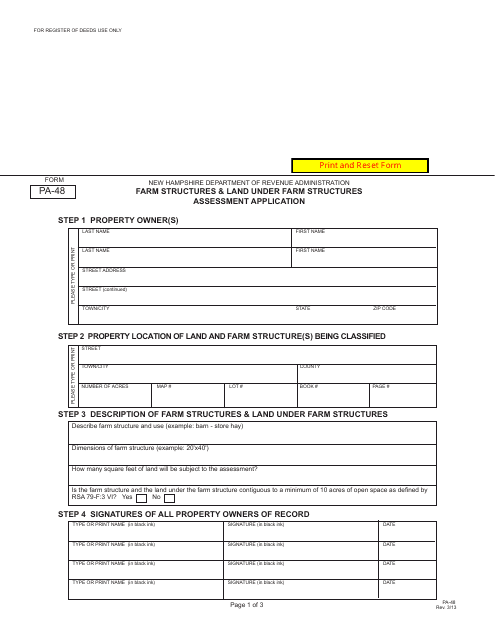

This form is used for applying for the assessment of farm structures and land under farm structures in New Hampshire. It allows farmers to receive tax benefits for their agricultural property.

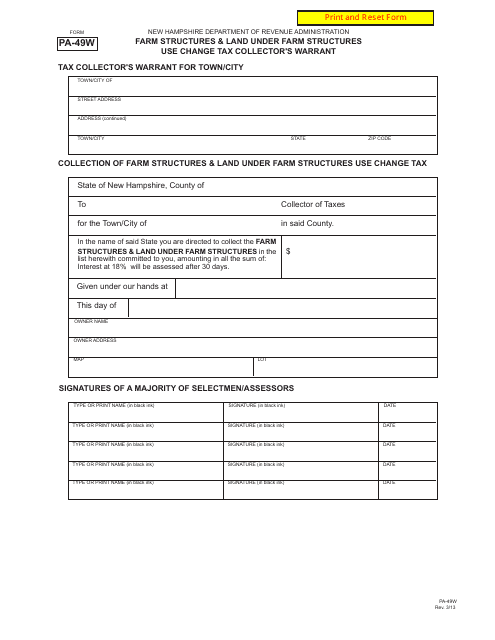

This form is used to report changes in the use of farm structures and land under farm structures for tax purposes in New Hampshire.

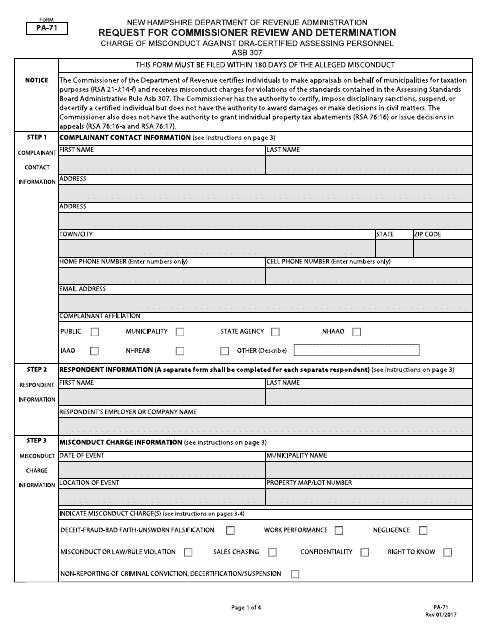

This Form is used for requesting a review and determination by the Commissioner in the state of New Hampshire.

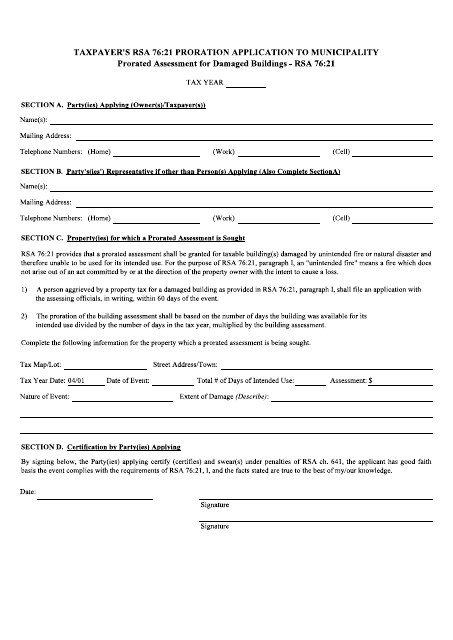

This document is used for proration application to a municipality in New Hampshire. It covers prorated assessment for damaged buildings.

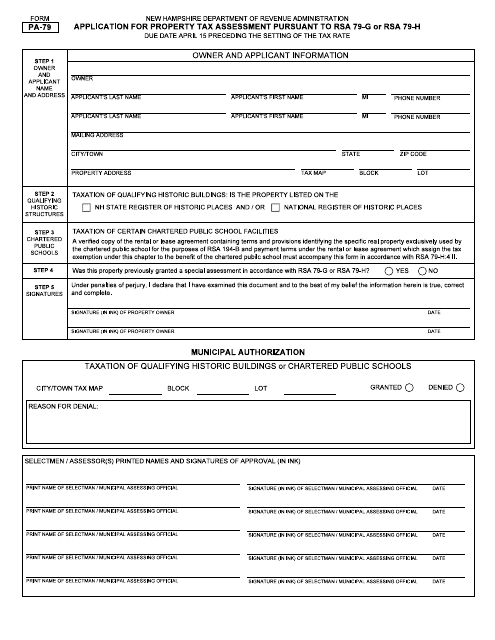

This form is used for applying for a property tax assessment in New Hampshire under RSA 79-G or RSA 79-H.

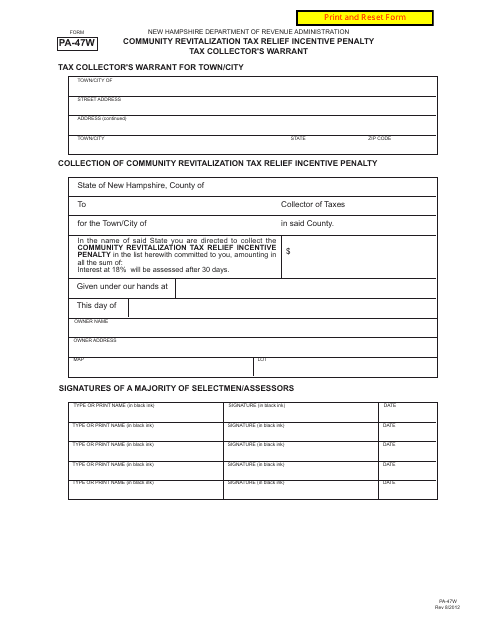

This document is used for the Community Revitalization Tax Relief Incentive Penalty in New Hampshire. It includes the Tax Collector's Warrant.

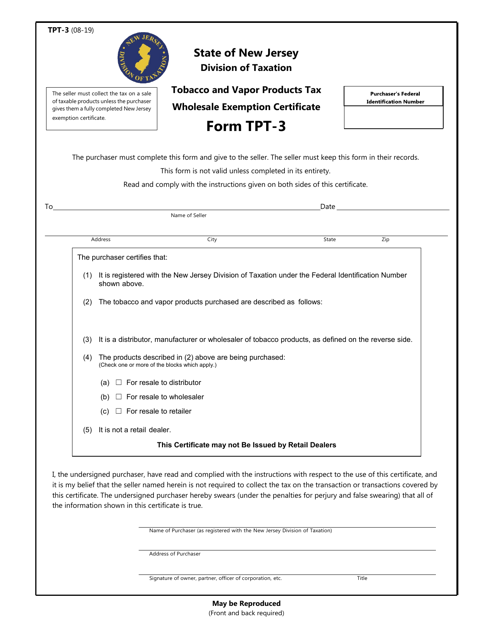

This form is used for applying for a tax exemption on wholesale purchases of tobacco and vapor products in the state of New Hampshire.

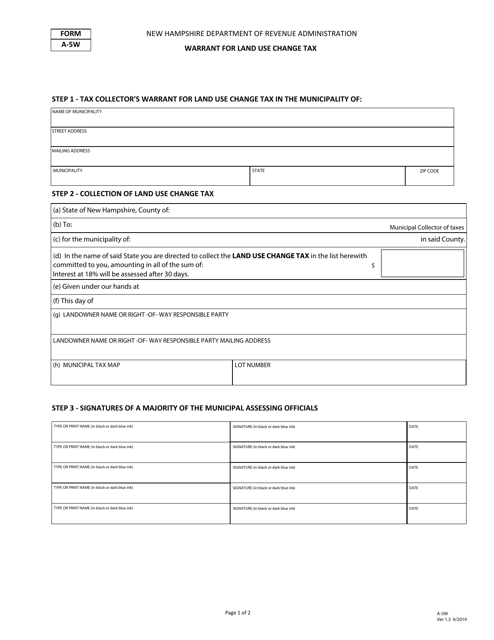

This form is used for requesting a warrant for land use change tax in the state of New Hampshire.

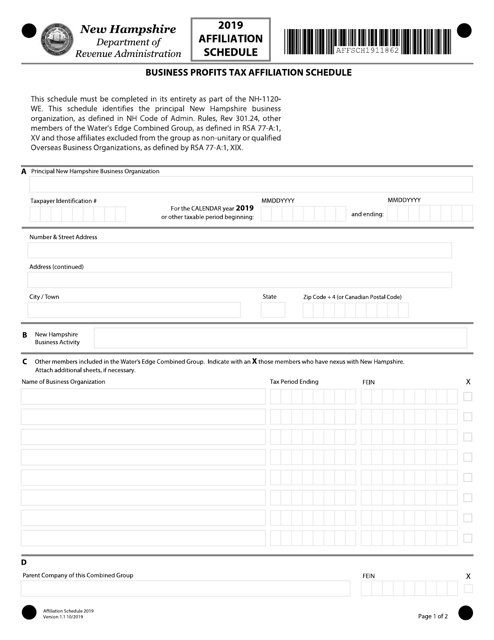

This document provides a schedule of affiliations in the state of New Hampshire. It outlines the dates and locations of upcoming affiliation events and provides information on how to join or participate in these organizations.

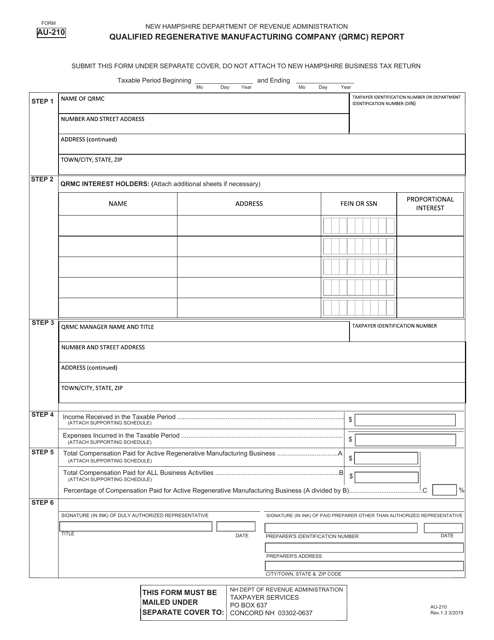

This Form is used for submitting a Qualified Regenerative Manufacturing Company (QRMC) Report in the state of New Hampshire.

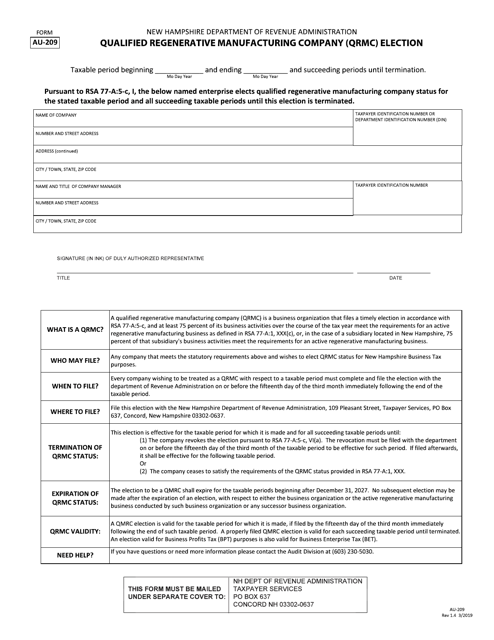

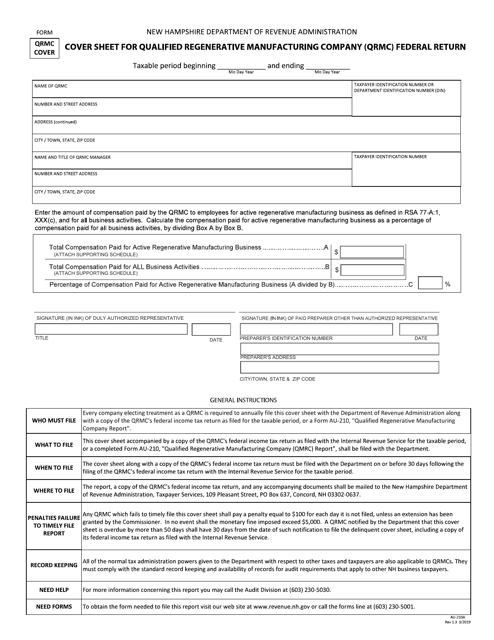

This Form is used for the Qualified Regenerative Manufacturing Company (QRMC) election in the state of New Hampshire.

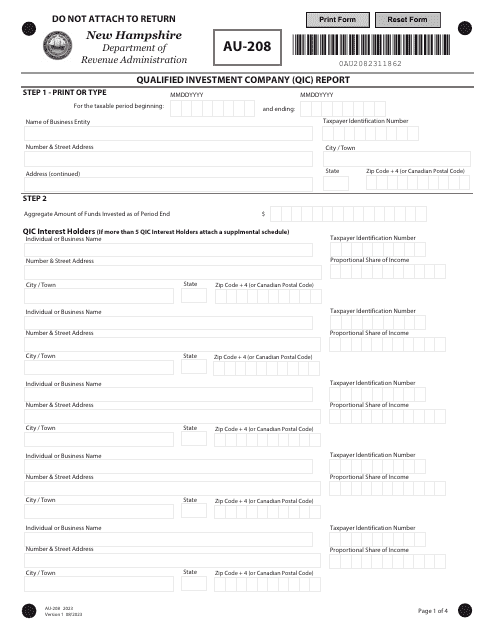

This form is used as a cover sheet for the Qualified Regenerative Manufacturing Company (QRMC) Federal Return in the state of New Hampshire. It is designed for companies that are eligible for certain tax benefits related to regenerative manufacturing.

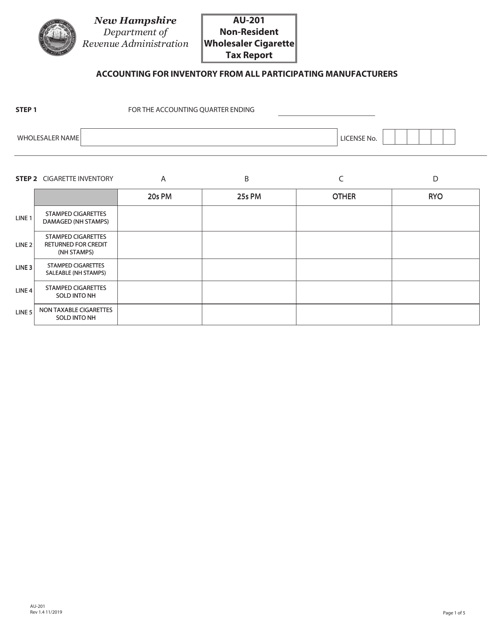

This Form is used for non-resident wholesalers to report cigarette tax in New Hampshire.