Nebraska Department of Revenue Forms

Documents:

626

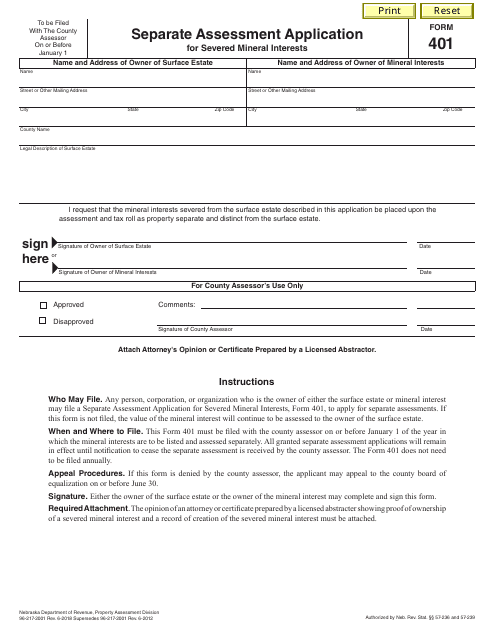

This form is used for submitting an application to the state of Nebraska for a separate assessment of severed mineral interests.

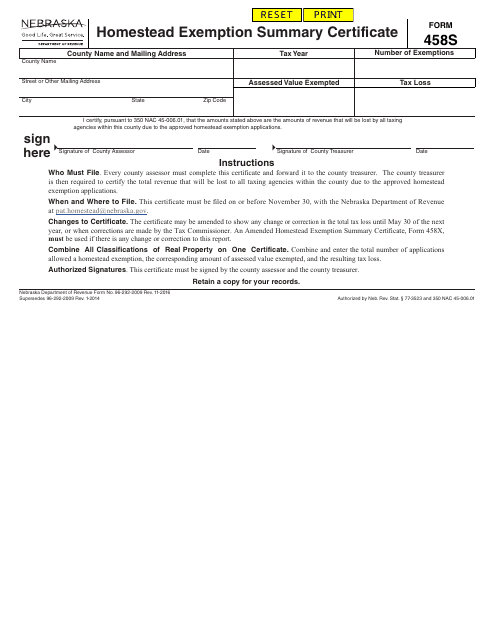

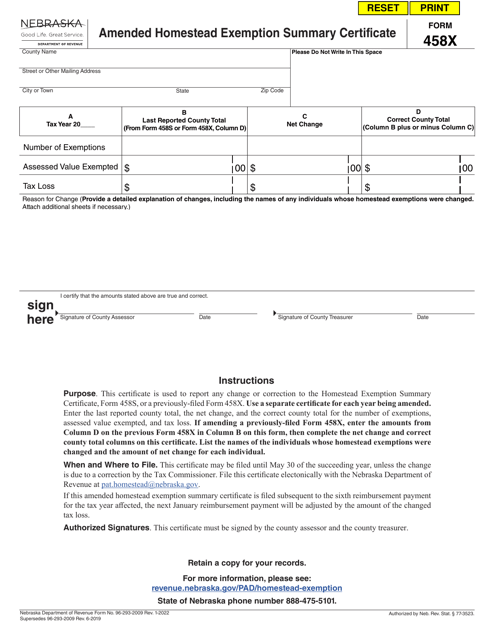

This Form is used for claiming a homestead tax exemption in Nebraska. It provides a summary certificate for the exemption application.

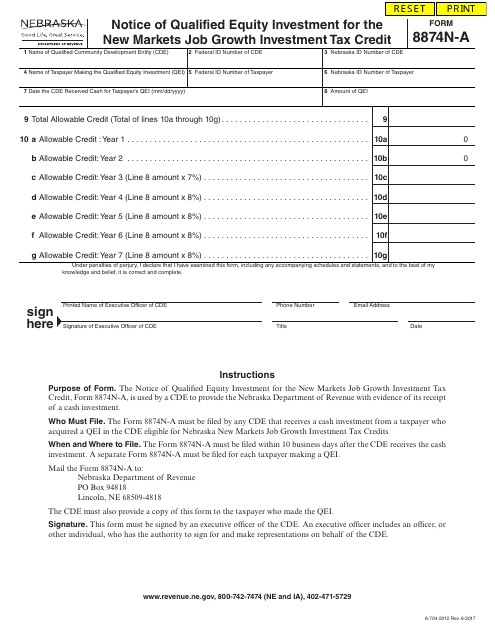

This form is used for reporting qualified equity investments for the New Markets Job Growth Investment Tax Credit in Nebraska.

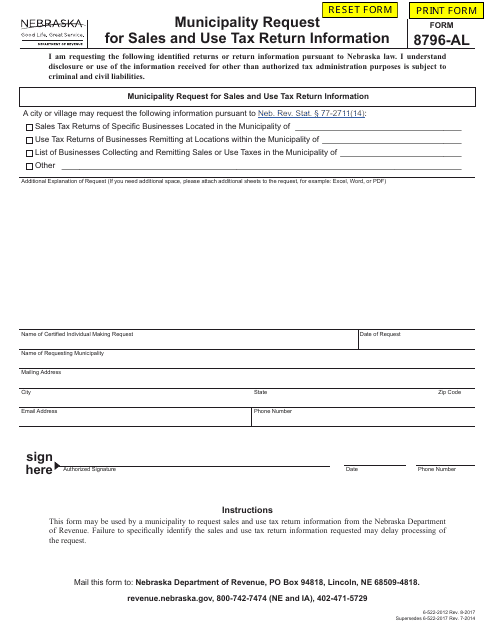

This type of document is used by municipalities in Nebraska to request sales and use tax return information.

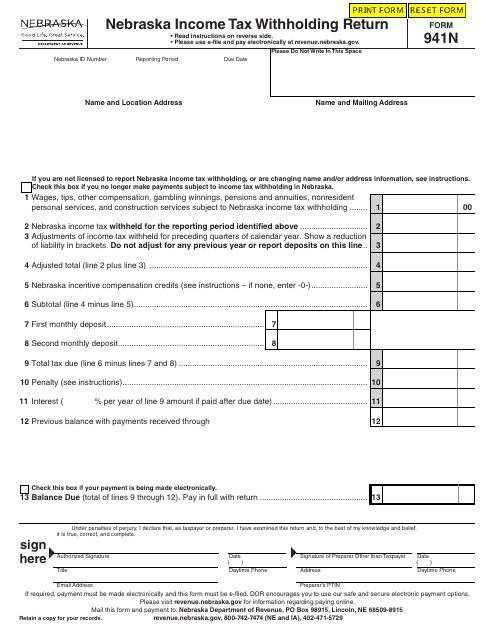

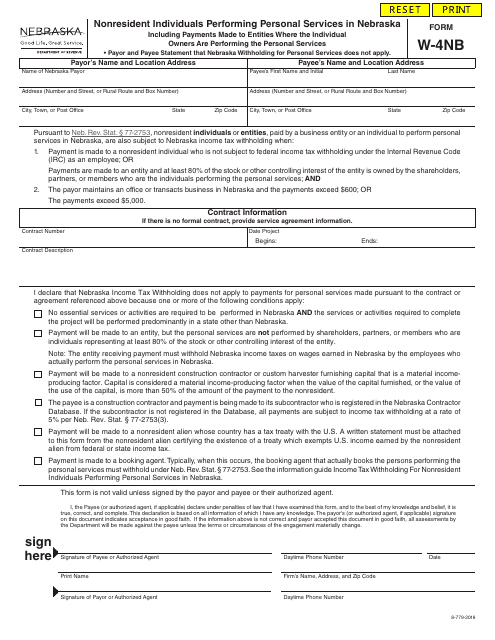

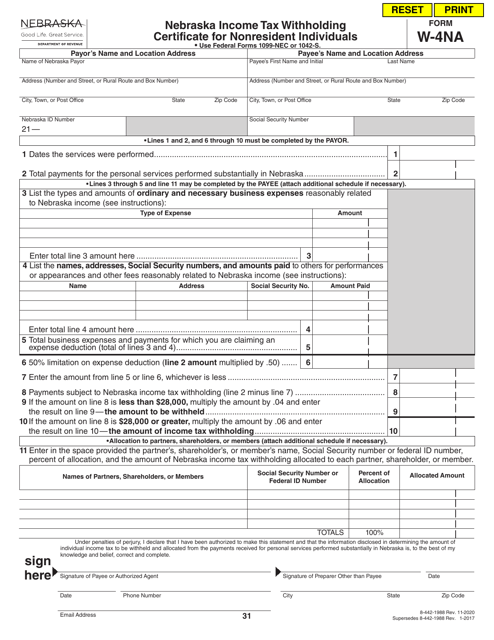

This form is used by nonresident individuals who are performing personal services in Nebraska. It is specifically for reporting and withholding state income taxes in Nebraska.

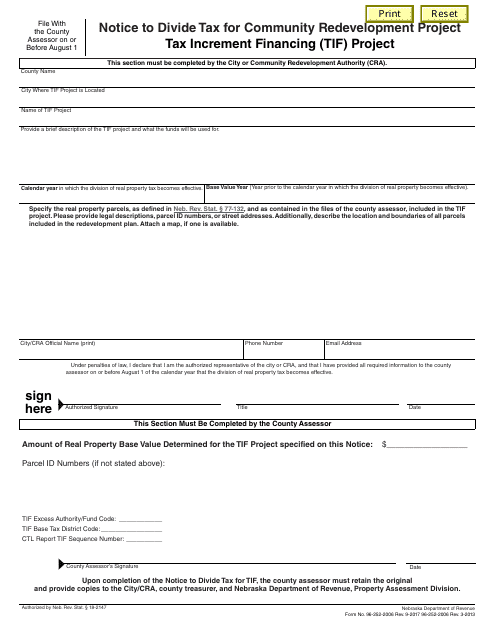

This Form is used for notifying taxpayers about the division of taxes for a Community Redevelopment Project Tax Increment Financing (TIF) Project in Nebraska.

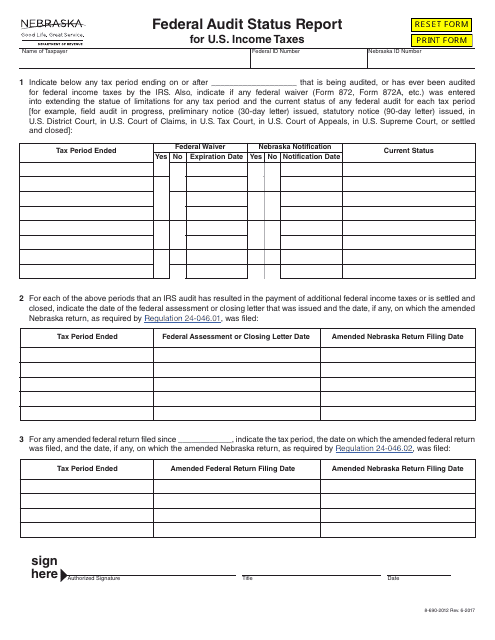

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.

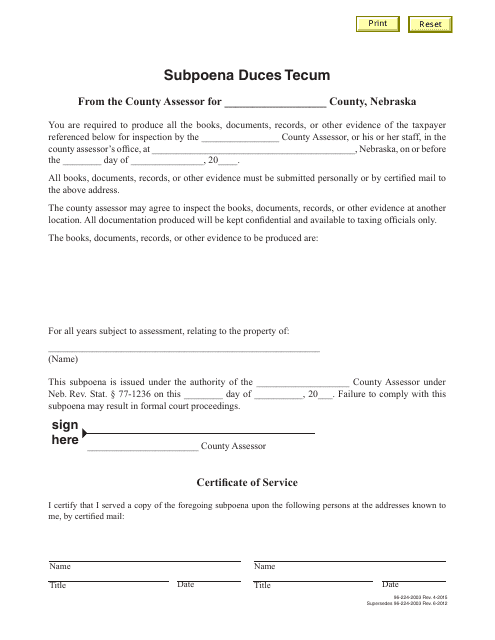

This document is used in the state of Nebraska to compel a person or organization to produce specific documents or evidence for a court case.