Nebraska Department of Revenue Forms

Documents:

626

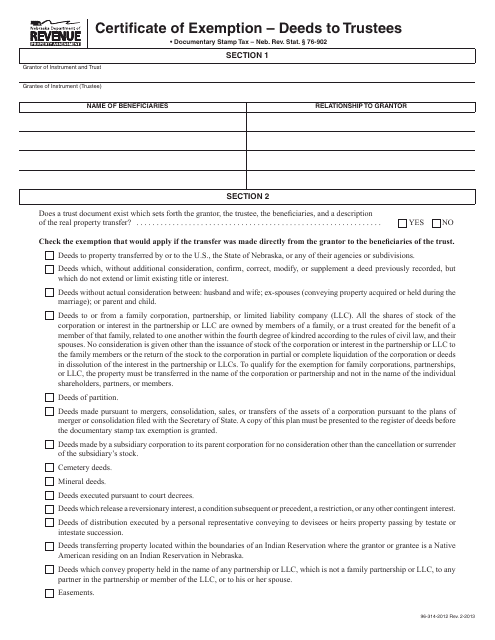

This type of document, called Certificate of Exemption - Deeds to Trustees, is used in Nebraska. It exempts certain transfers of property from fees and taxes when the property is transferred to a trustee.

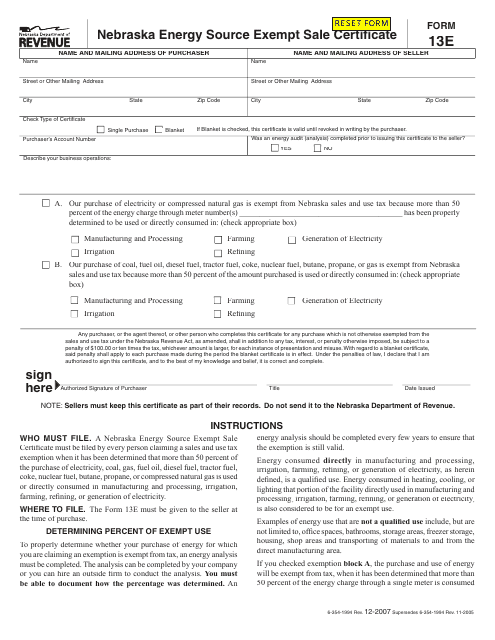

This form is used for declaring the exemption of energy source sales in Nebraska. It is required for businesses and individuals selling energy sources in the state.

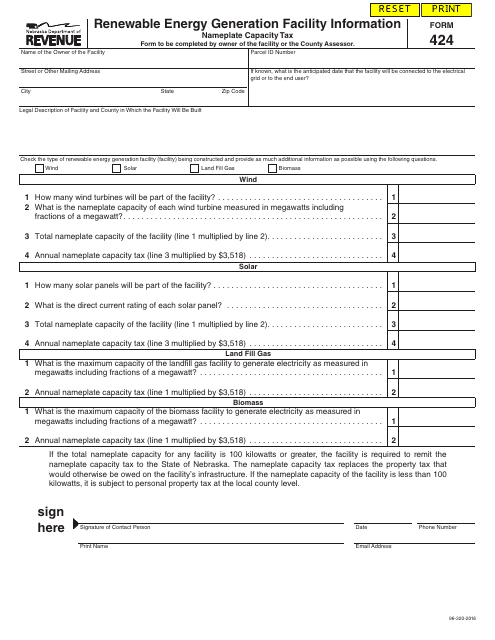

This form is used for reporting the nameplate capacity of renewable energy generation facilities for tax purposes in Nebraska.

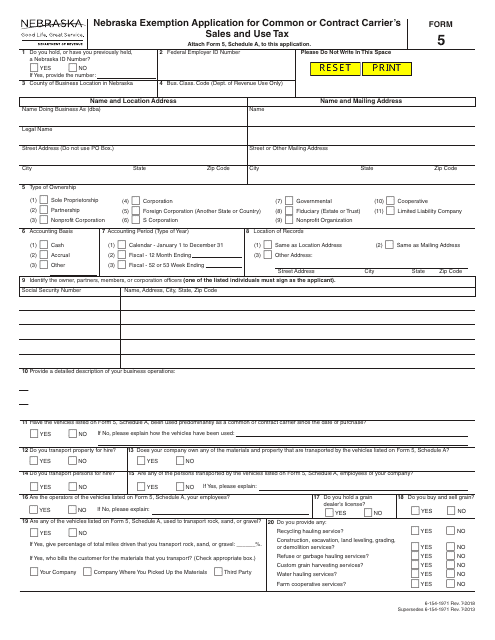

This form is used for exemption application for common or contract carrier's sales and use tax in Nebraska.

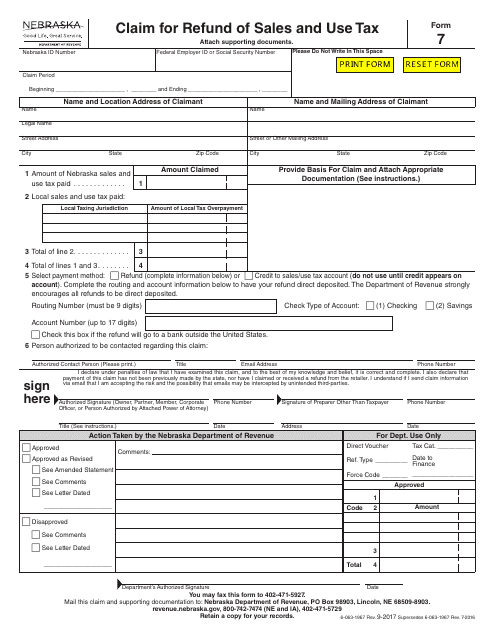

This Form is used for individuals and businesses in Nebraska to claim a refund of sales and use tax that was incorrectly paid or overpaid.

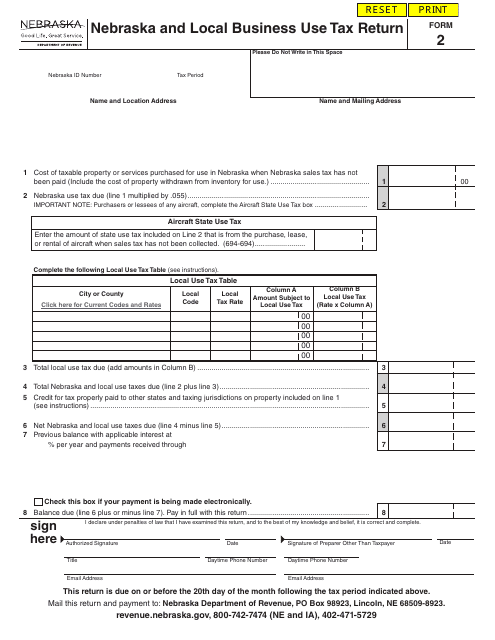

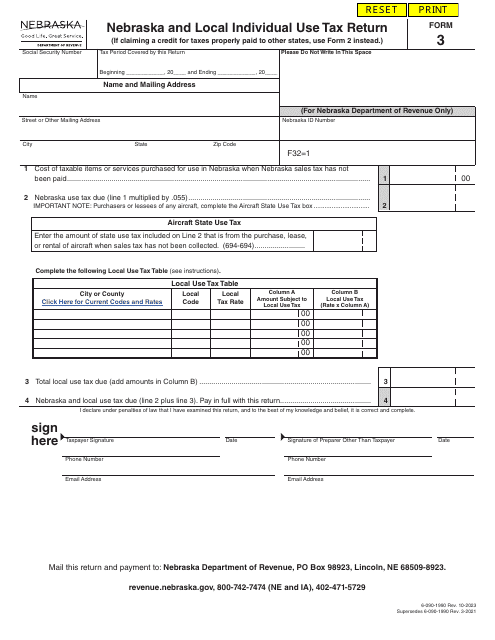

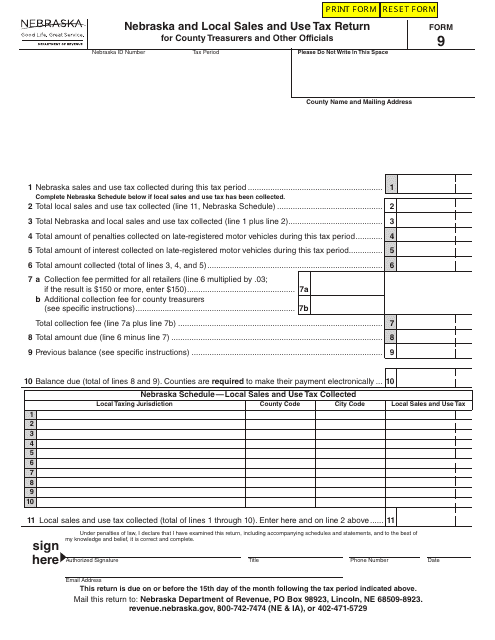

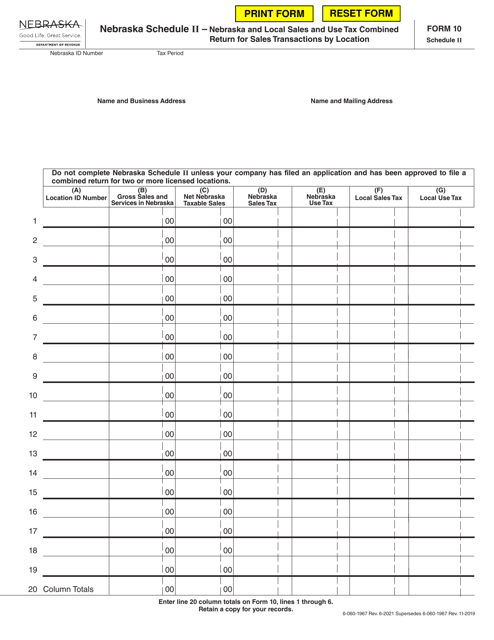

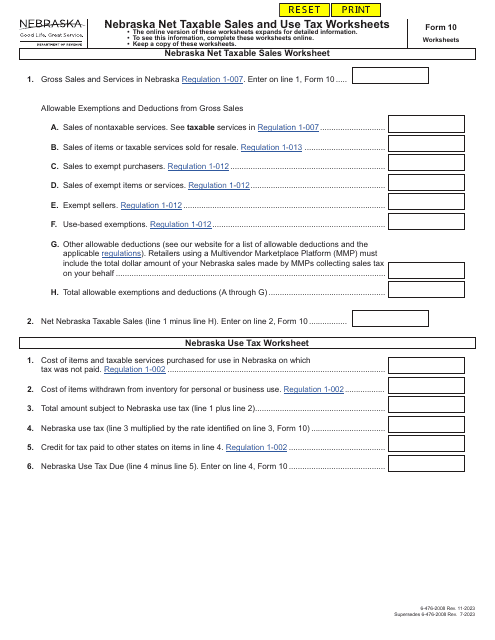

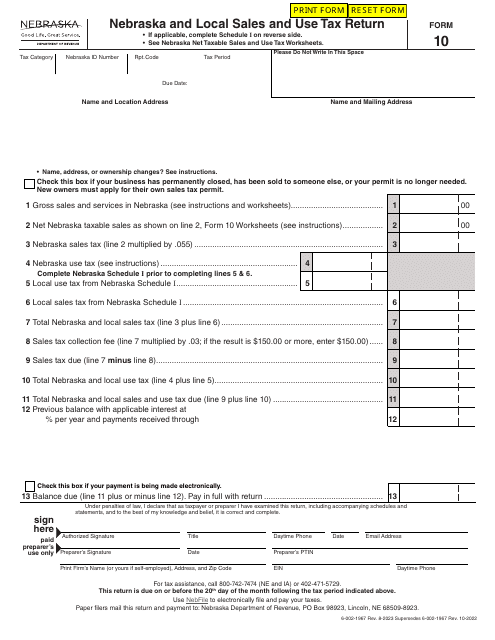

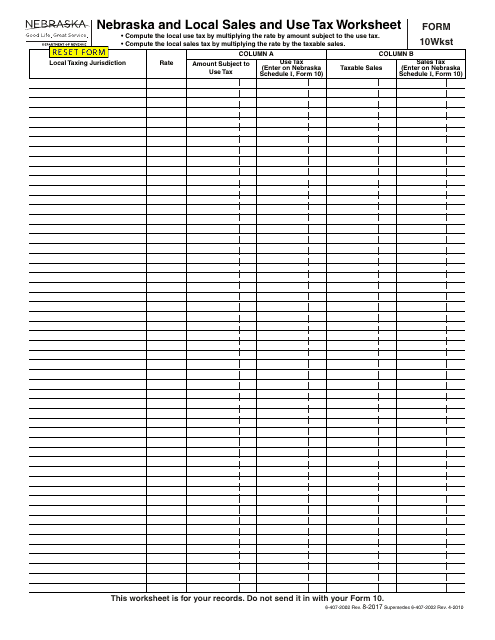

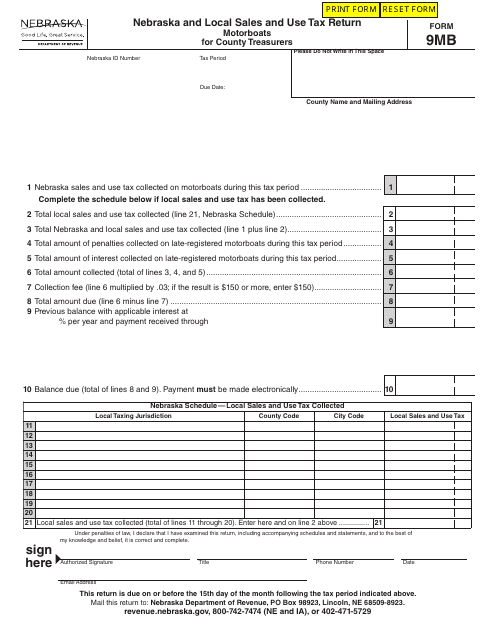

This form is used for calculating and reporting Nebraska and Local Sales and Use Tax in Nebraska.

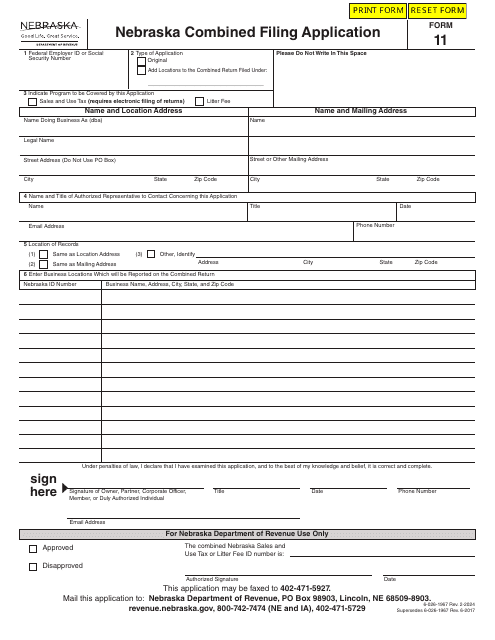

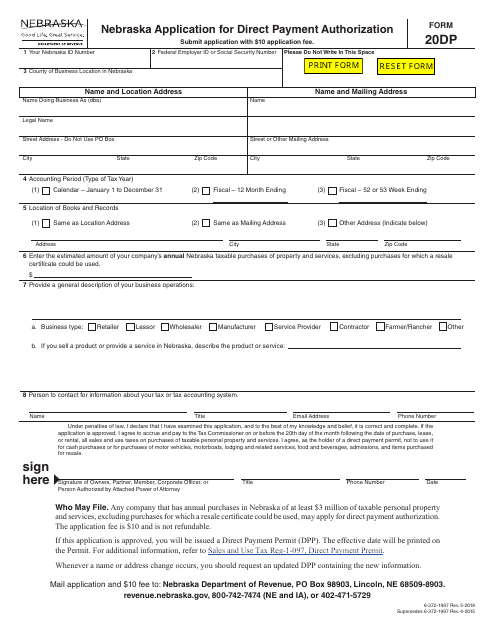

This form is used for Nebraska residents to apply for authorization to make direct payments for certain taxes and fees.

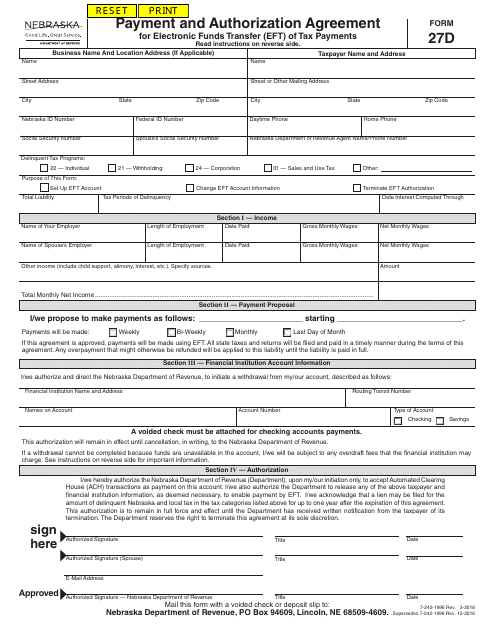

This form is used for authorizing electronic funds transfer for tax payments in Nebraska.