Nebraska Department of Revenue Forms

The Nebraska Department of Revenue is responsible for administering and enforcing the tax laws and regulations in the state of Nebraska. They collect taxes, handle tax compliance, and provide taxpayer assistance and education. The department ensures that individuals and businesses meet their tax obligations and use the collected revenue to fund government services and programs in Nebraska.

Documents:

626

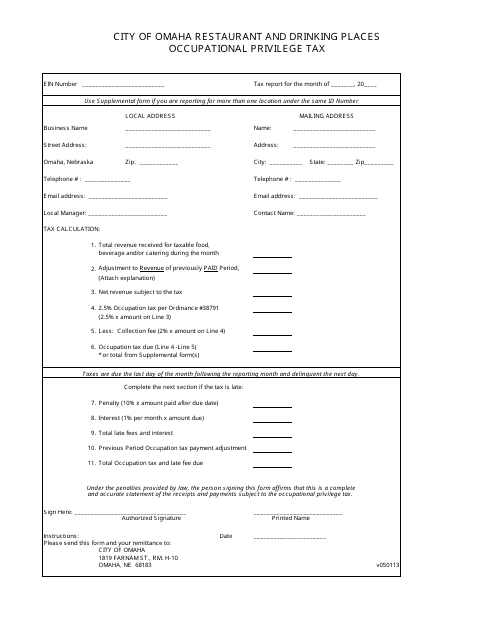

This form is used for filing the Occupational Privilege Tax for restaurants and drinking places located in Omaha, Nebraska.

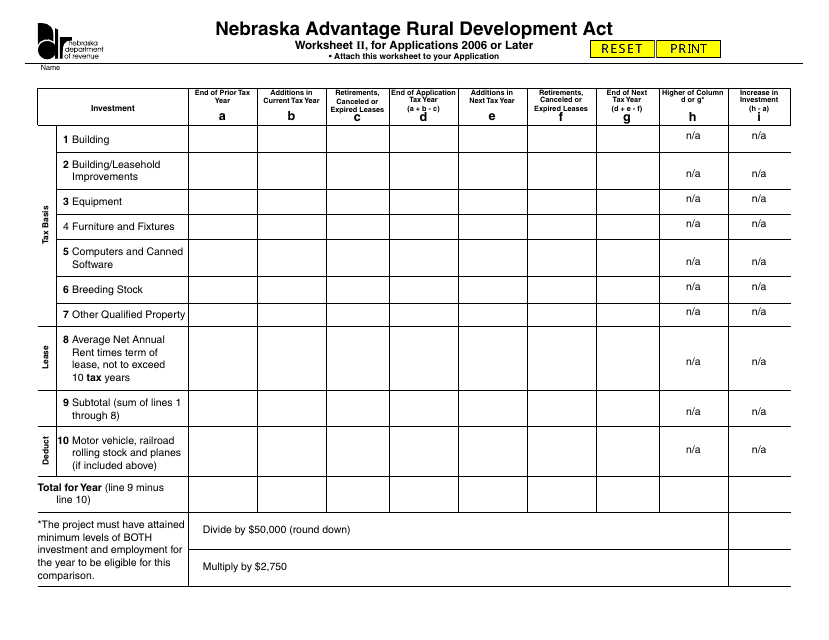

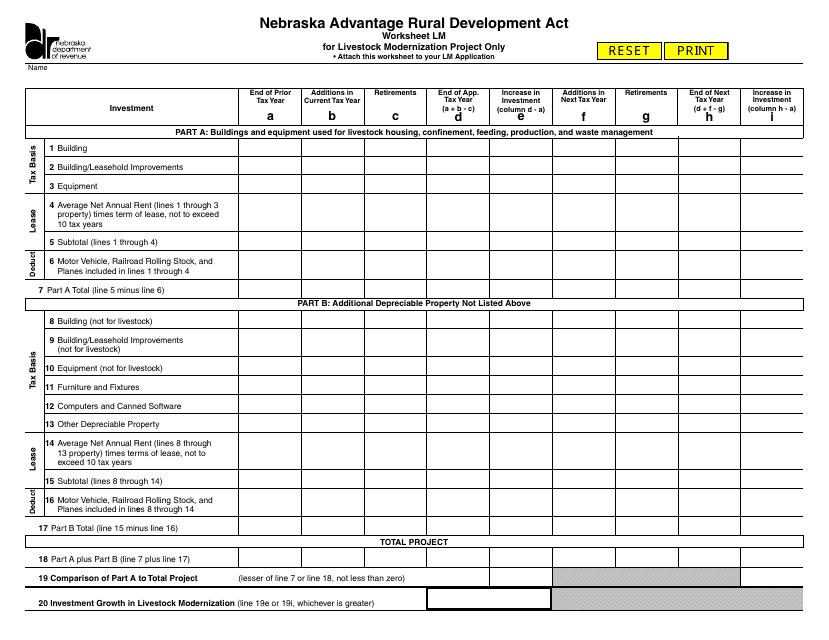

This document is for the Nebraska Advantage Rural Development Act application for the years 2006 and onwards.

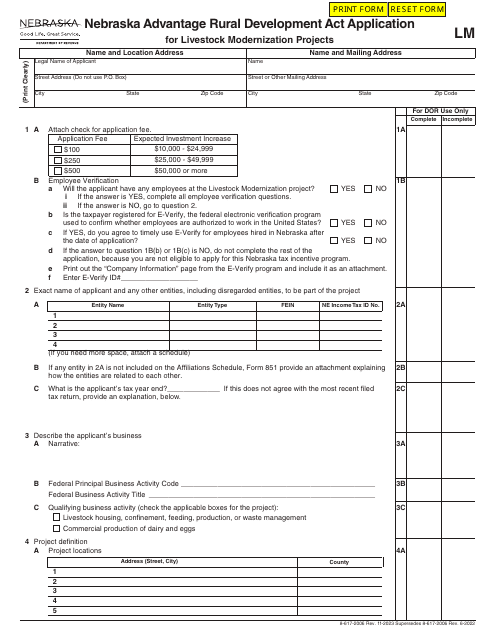

This document is for the Livestock Modernization Project in Nebraska. It is a worksheet specifically for this project.

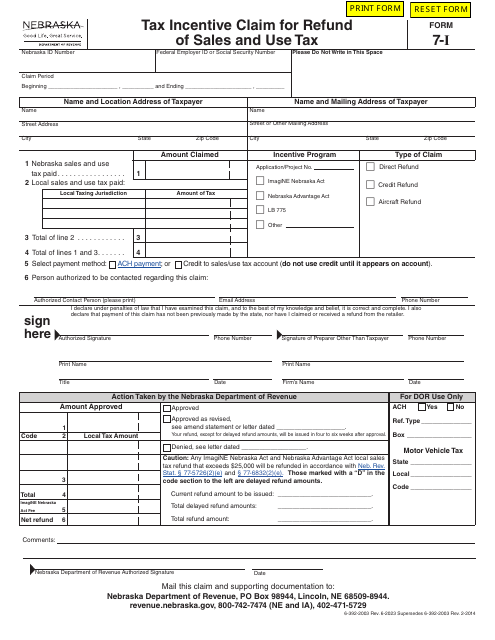

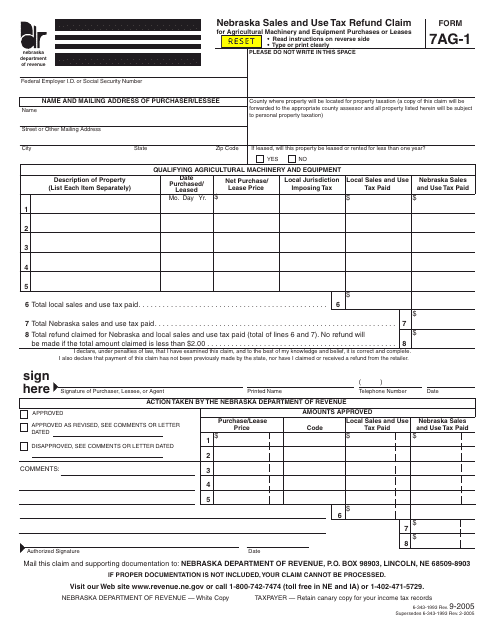

This form is used for claiming a refund for sales and use tax paid on purchases or lease of agricultural machinery and equipment in Nebraska.

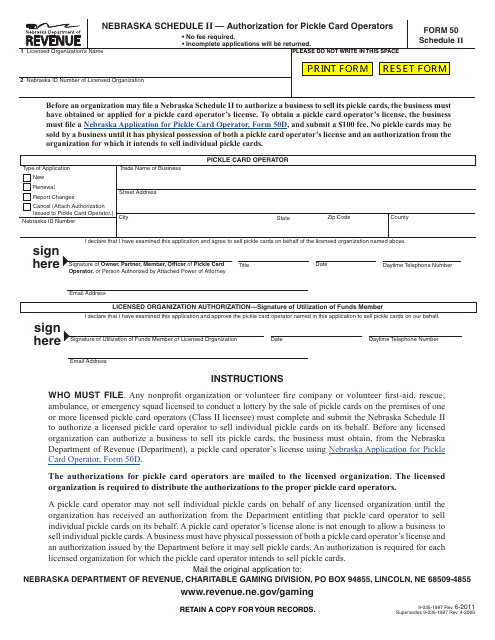

This Form is used for authorizing Pickle Card Operators in the state of Nebraska.

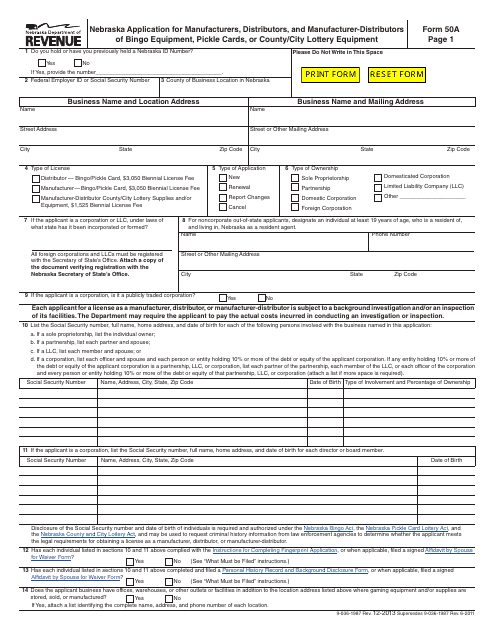

This form is used for applying to become a manufacturer, distributor, or manufacturer-distributor of bingo equipment, pickle cards, or county/city lottery equipment in Nebraska.

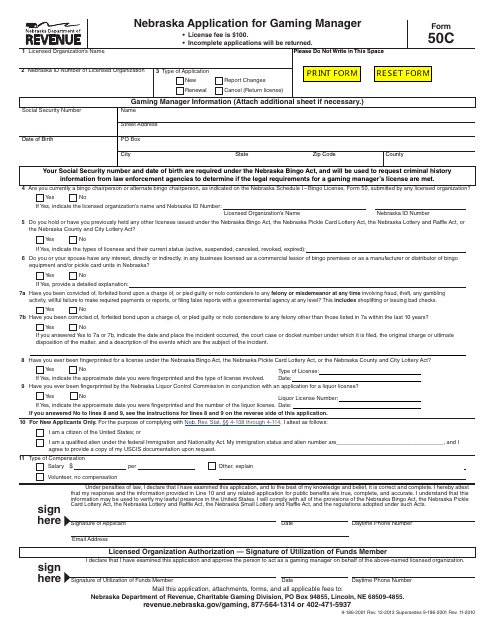

This form is used for applying to become a gaming manager in Nebraska.

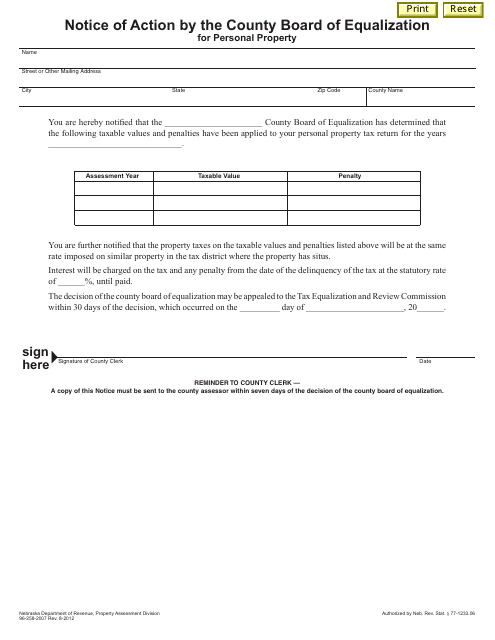

This notice is issued by the County Board of Equalization in Nebraska to inform individuals about actions taken regarding personal property. It provides important information regarding changes or decisions made by the board in relation to personal property taxes.

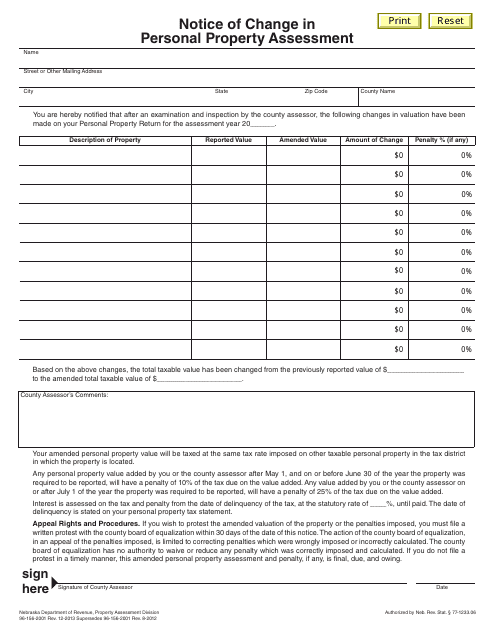

This form is used for notifying individuals in Nebraska about changes in their personal property assessment.

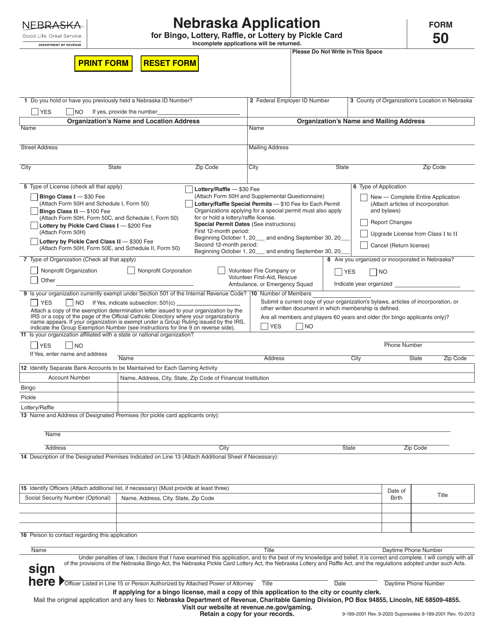

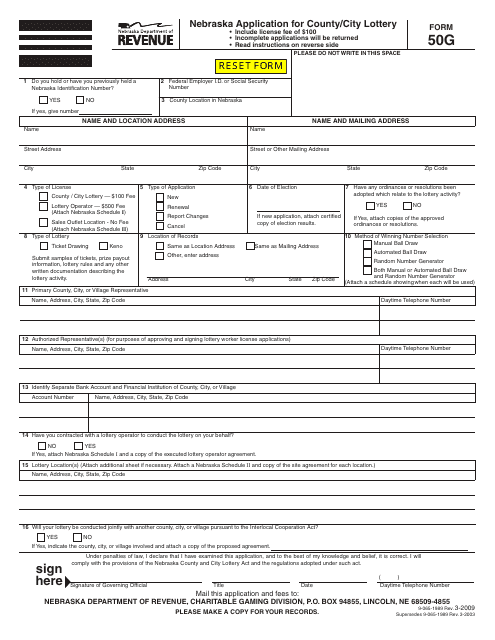

This form is used for applying for the County/City Lottery in Nebraska.

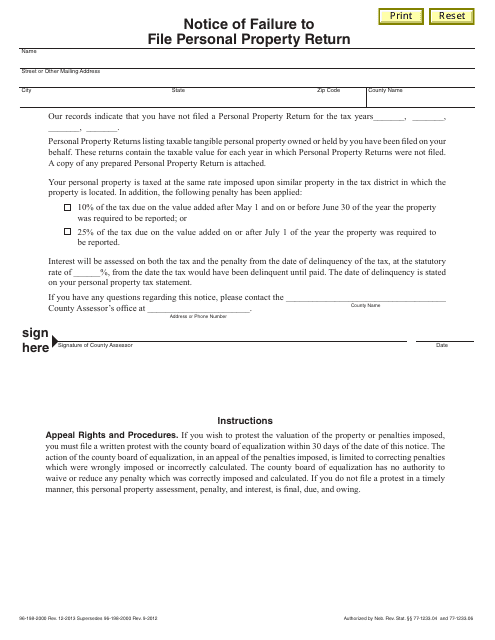

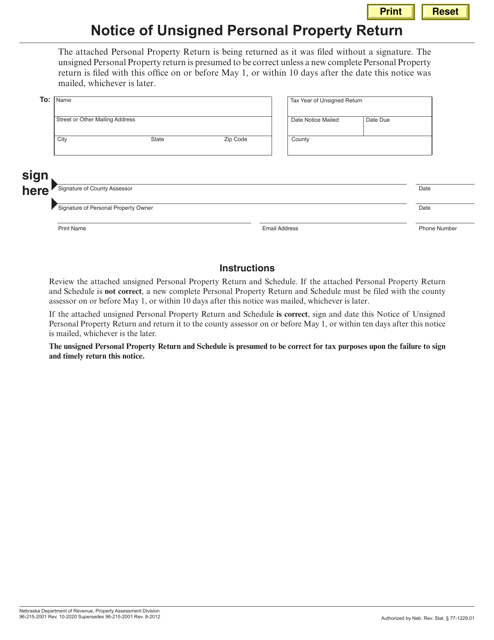

This document is a notice informing individuals in Nebraska that they have failed to file a personal property return.

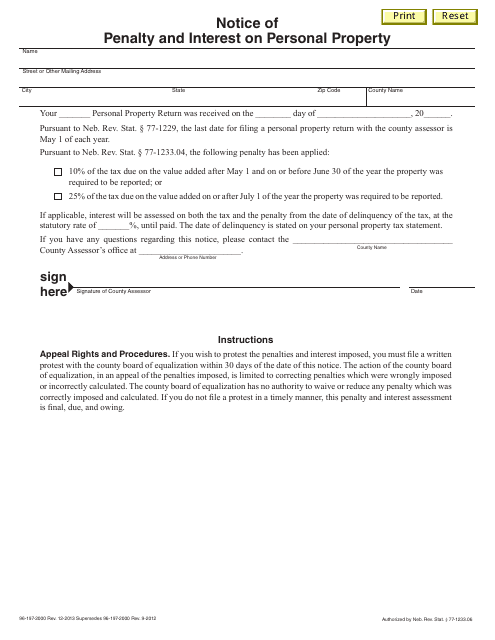

This document is a Notice of Penalty and Interest on Personal Property in the state of Nebraska. It is used to inform individuals about any penalties or interest charges imposed on their personal property.

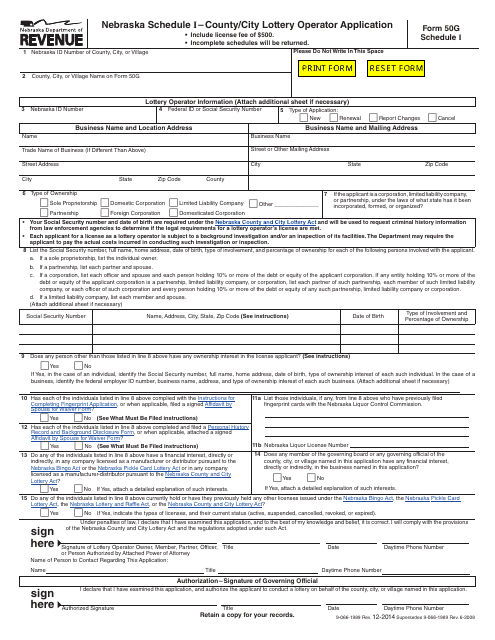

This form is used for applying to become a county/city lottery operator in Nebraska.

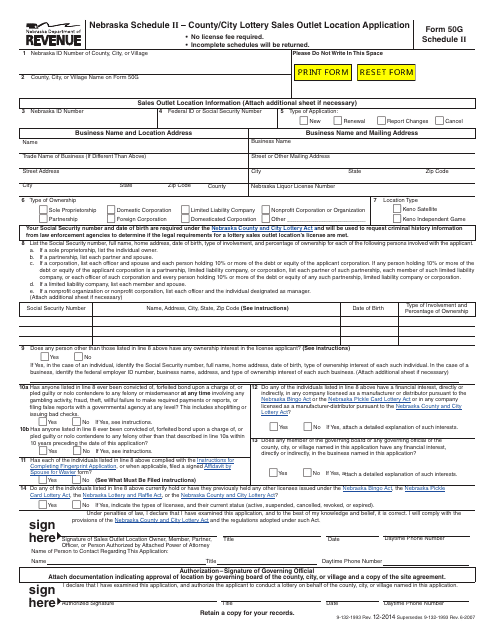

This Form is used for applying for a lottery sales outlet location in a county or city in Nebraska.

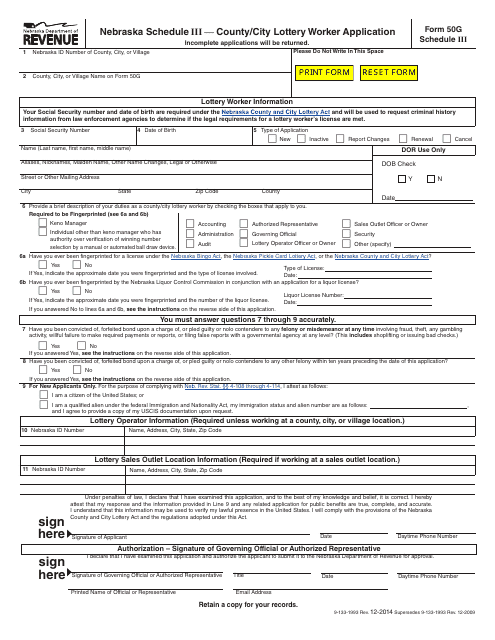

This Form is used for applying to become a county or city lottery worker in Nebraska.

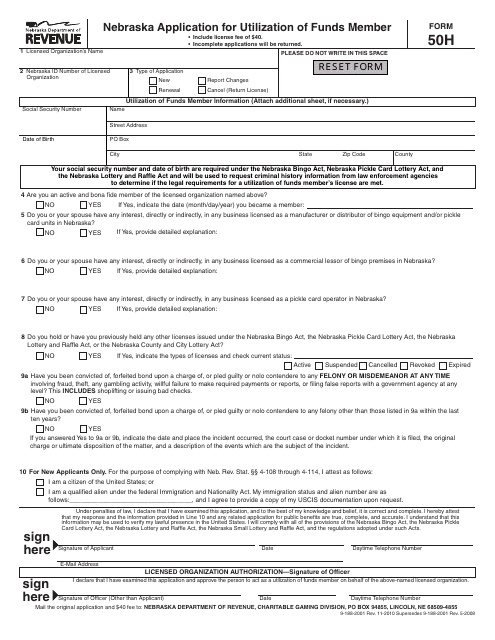

This Form is used for Nebraska residents to apply for the utilization of funds as a member in the state of Nebraska.

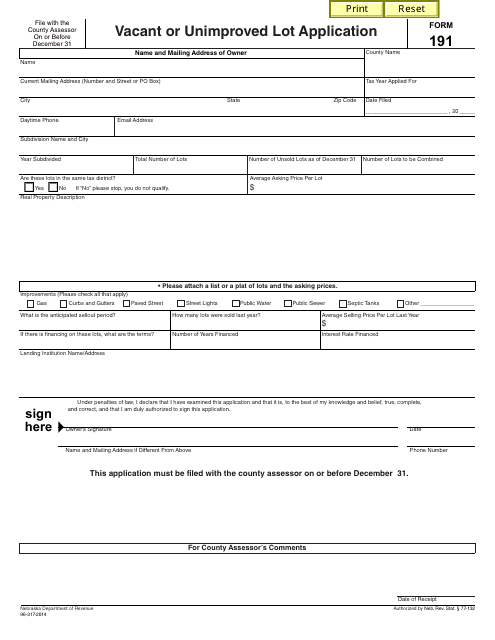

This form is used for applying for a vacant or unimproved lot in Nebraska.

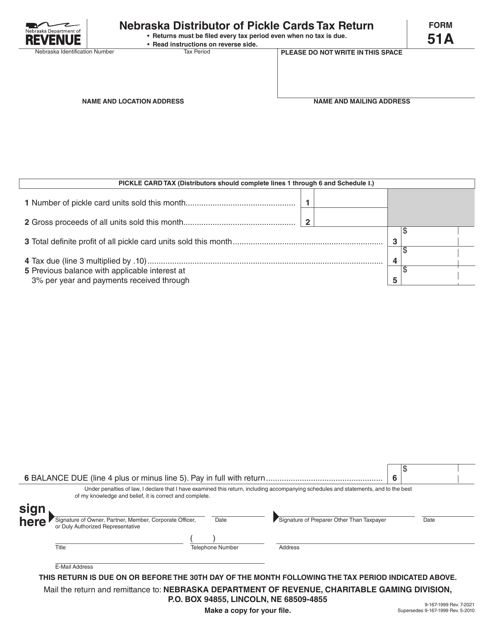

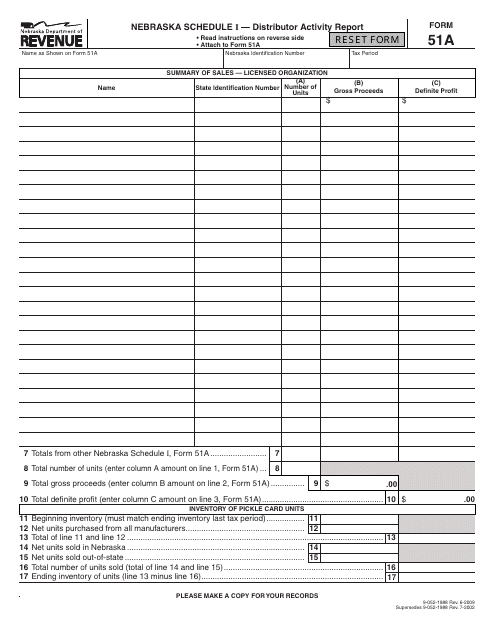

This Form is used for reporting distributor activity in Nebraska. It provides information about the distribution of goods or services within the state.

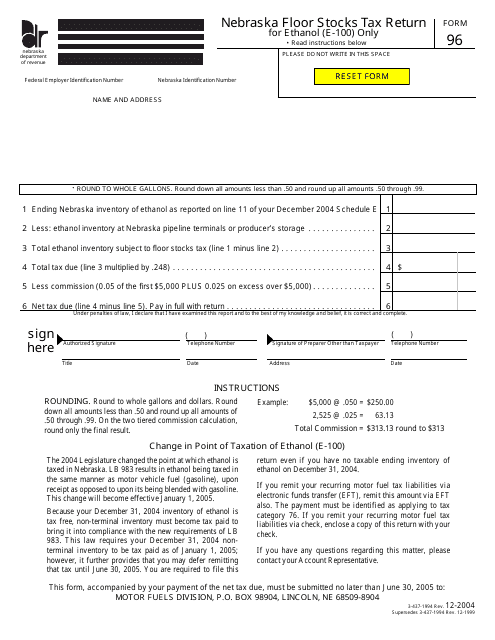

This Form is used for reporting and paying the floor stocks tax on ethanol fuel in the state of Nebraska.

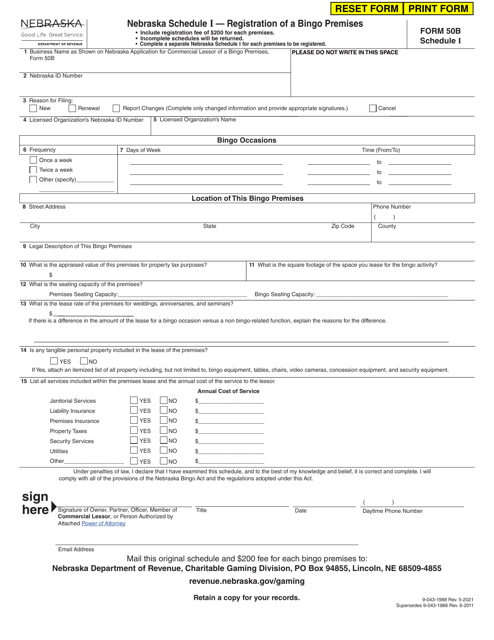

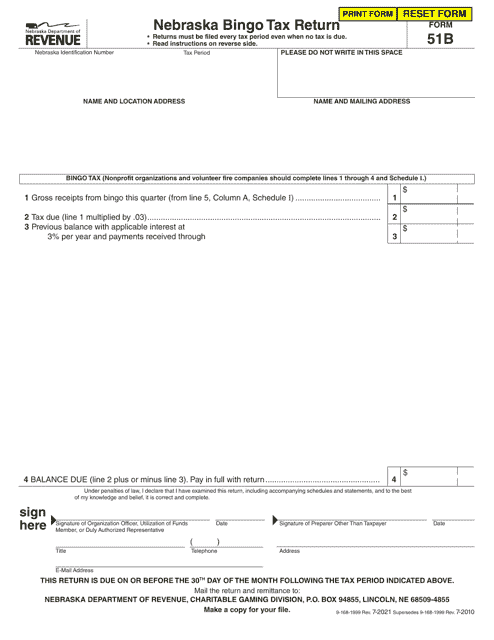

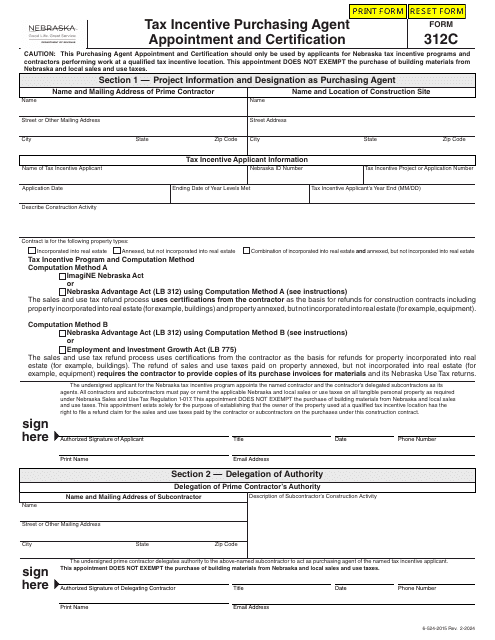

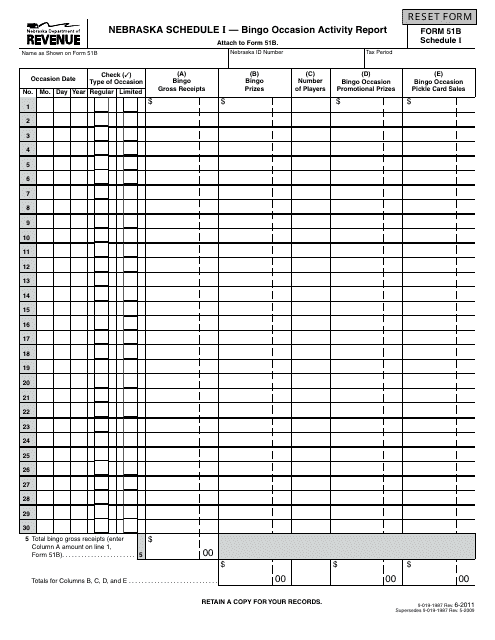

This document is used for reporting bingo occasion activities in Nebraska.

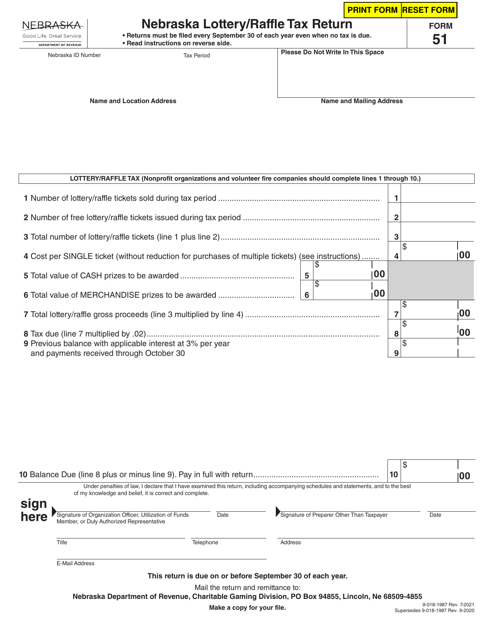

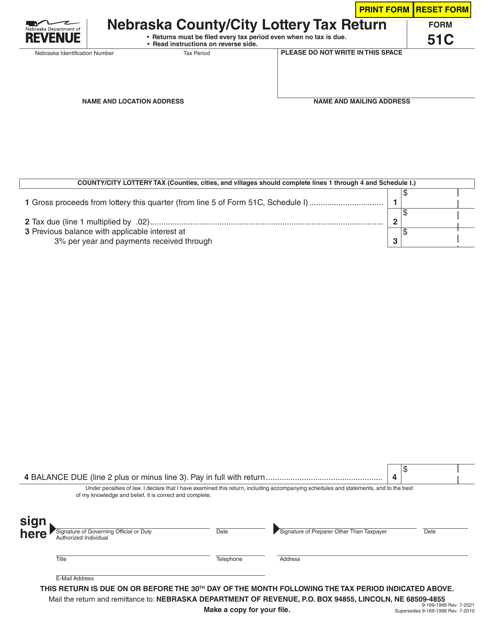

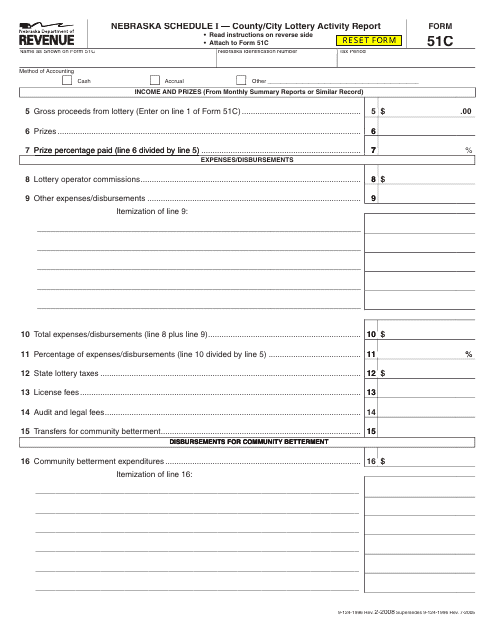

This document is used for reporting county and city lottery activities in Nebraska.