Minnesota Department of Revenue Forms

The Minnesota Department of Revenue is responsible for administering and enforcing the tax laws and regulations in the state of Minnesota. They collect various types of taxes, including income tax, sales tax, property tax, and tobacco tax, among others. The department also provides taxpayer assistance, processes tax returns, and conducts audits to ensure compliance with tax laws. Additionally, they administer various tax credits and exemptions and offer resources and services to help individuals and businesses understand and meet their tax obligations.

Documents:

545

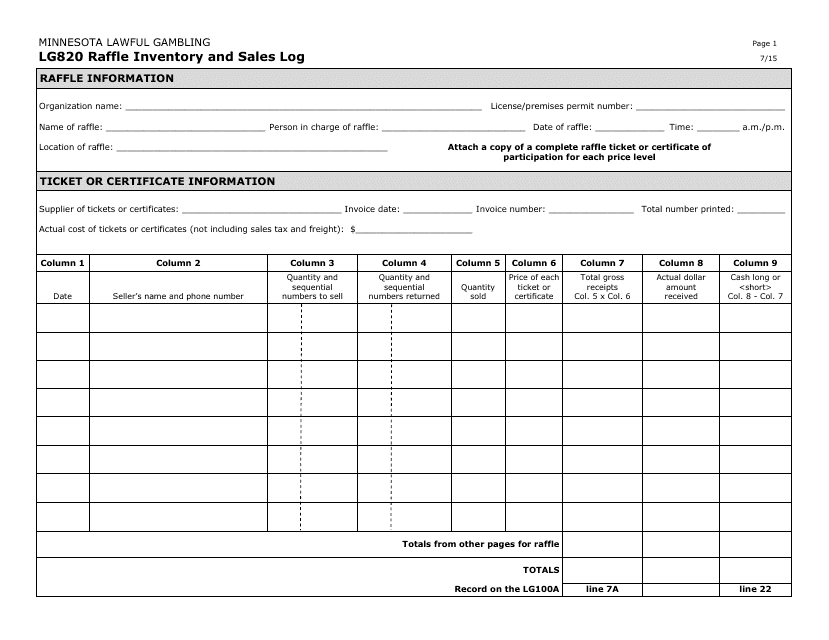

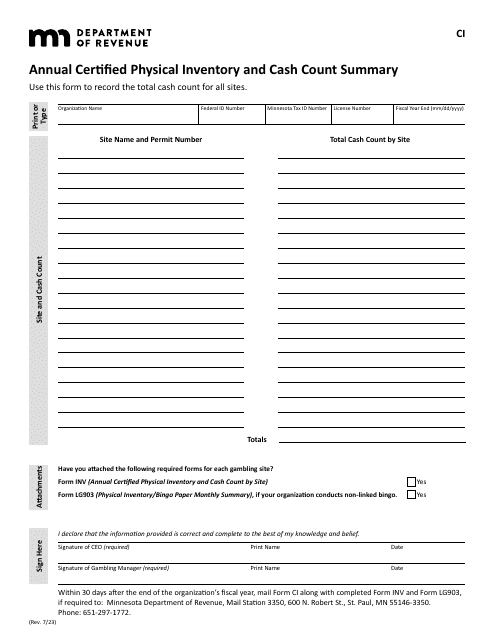

This Form is used for keeping track of inventory and sales at raffle events in Minnesota.

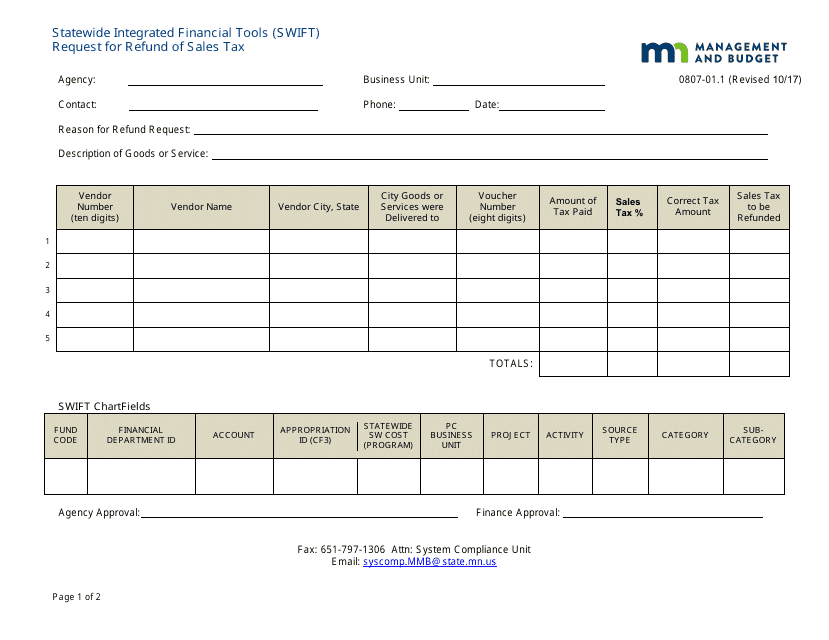

This form is used for Minnesota residents to request a refund of sales tax through the Statewide Integrated Financial Tools (Swift) system.

This document provides instructions for organizing and maintaining property records related to railroads in Minnesota. It covers the proper procedures and guidelines for managing these records.

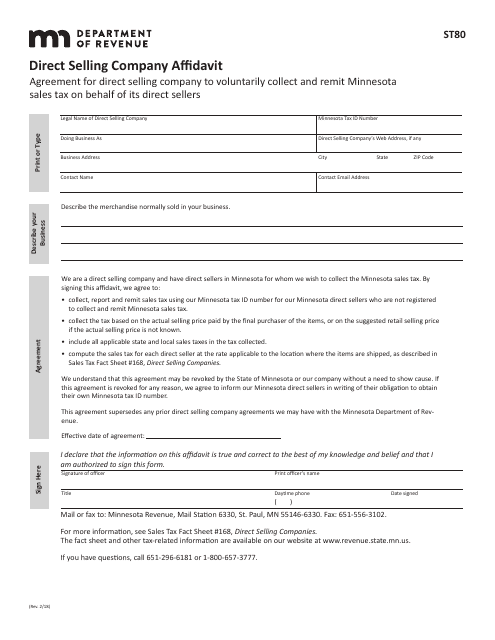

This form is used for submitting an affidavit by a direct selling company in the state of Minnesota. It may be required for registration or other purposes related to the direct selling business.

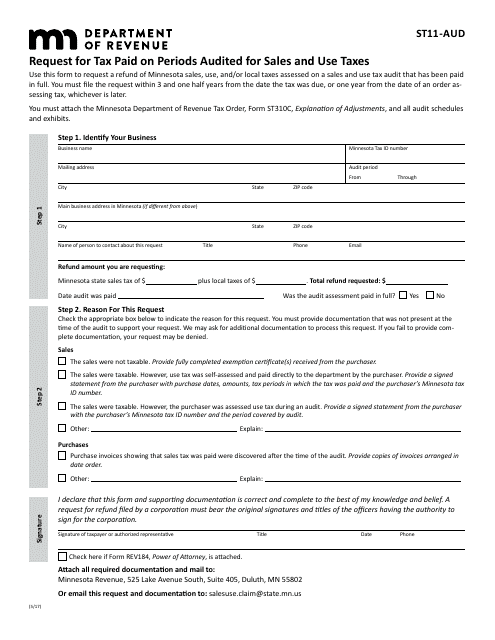

This form is used for requesting tax paid on periods that were audited for sales and use taxes in the state of Minnesota.

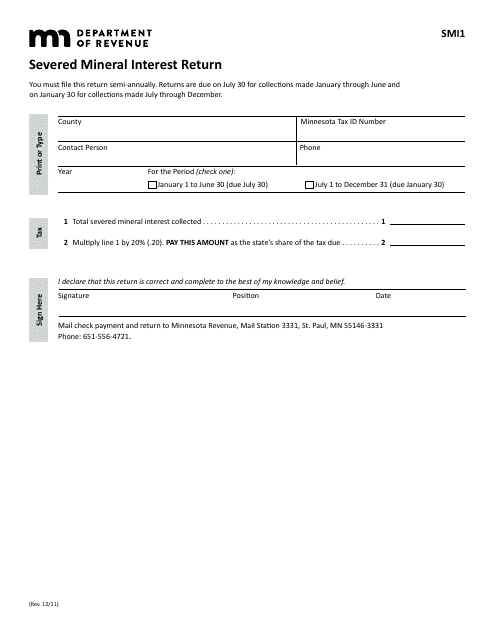

This Form is used for reporting severed mineral interests in Minnesota. It is used to provide information on these interests for assessment and taxation purposes.

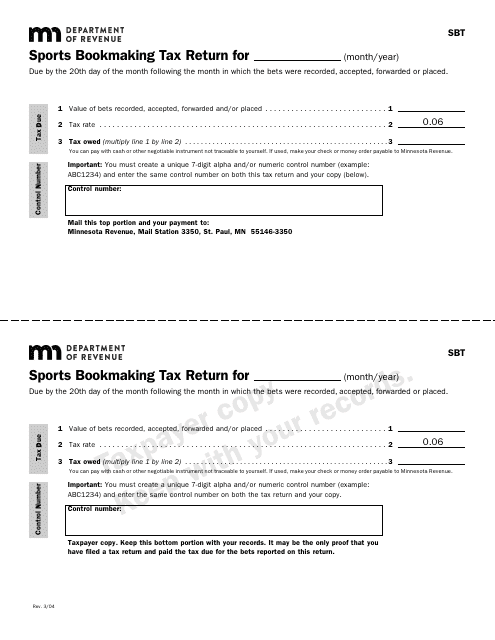

This form is used for reporting sports bookmaking taxes in the state of Minnesota. It is used by businesses or individuals involved in sports bookmaking activities to report their earnings and calculate the amount of tax owed.

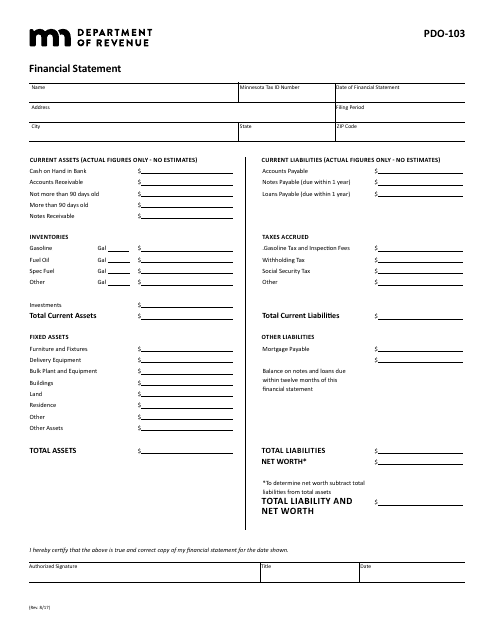

This form is used for submitting a financial statement in the state of Minnesota. It is typically used in legal proceedings or for tax purposes.

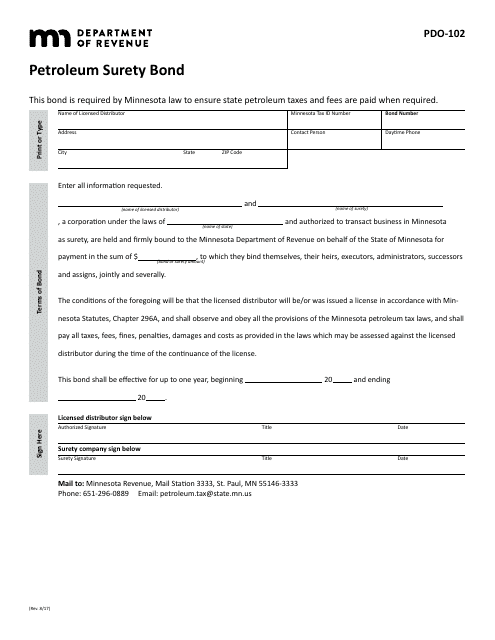

This Form is used for obtaining a surety bond for petroleum related activities in the state of Minnesota.

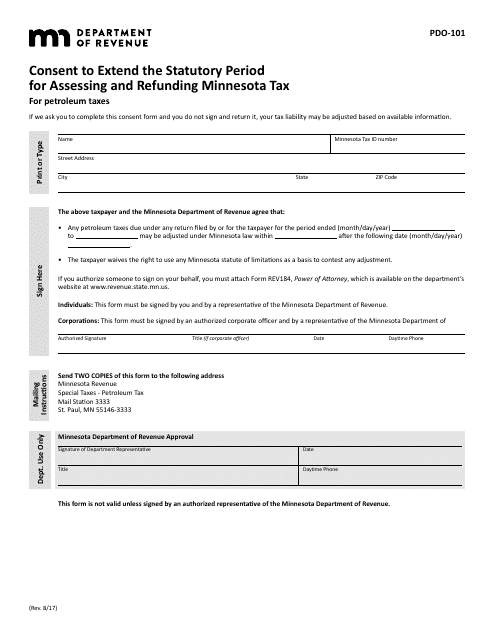

This form is used for requesting to extend the statutory period for assessing and refunding Minnesota tax for petroleum taxes in the state of Minnesota.

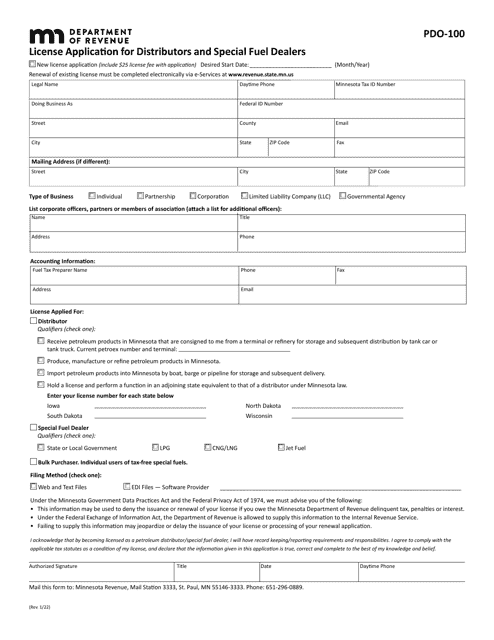

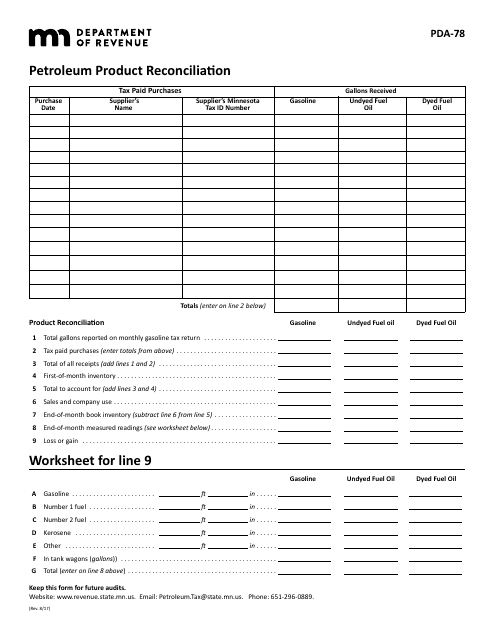

This Form is used for reconciling petroleum product information in Minnesota.

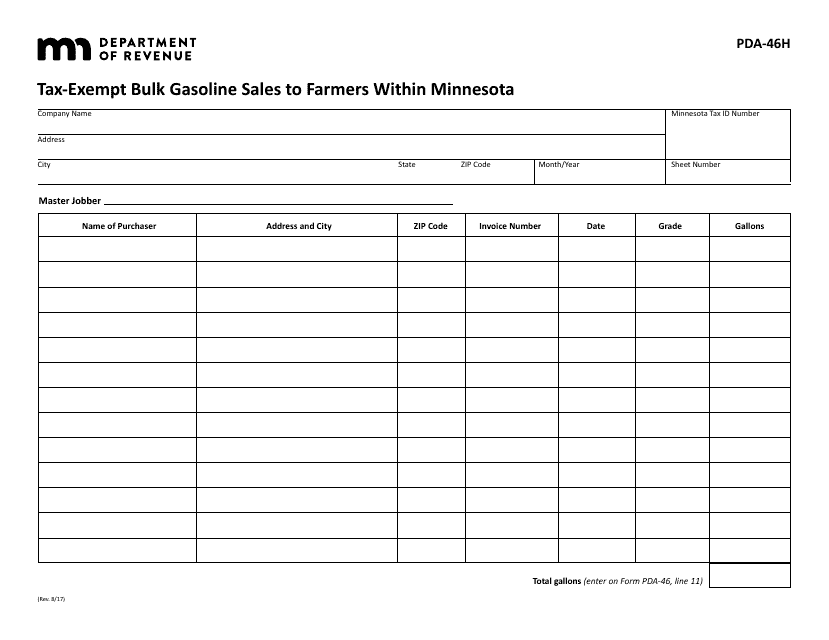

This Form is used for tax-exempt bulk gasoline sales to farmers within Minnesota.

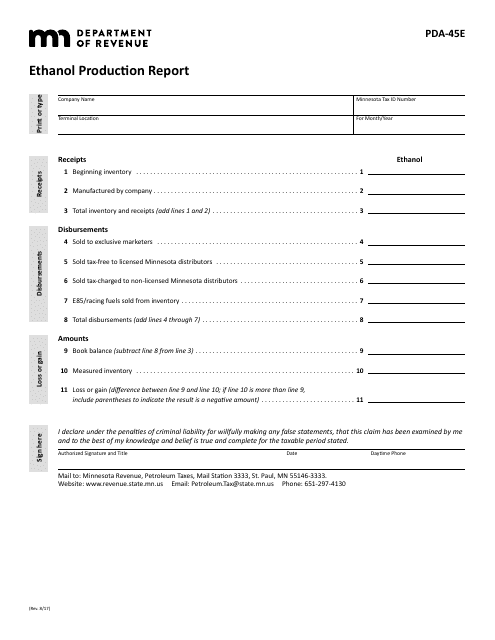

This form is used for reporting ethanol production in Minnesota.

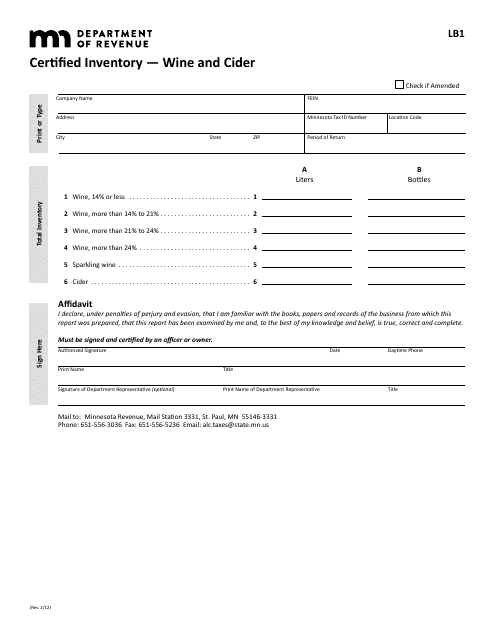

This form is used for certifying the inventory of wine and cider in the state of Minnesota.

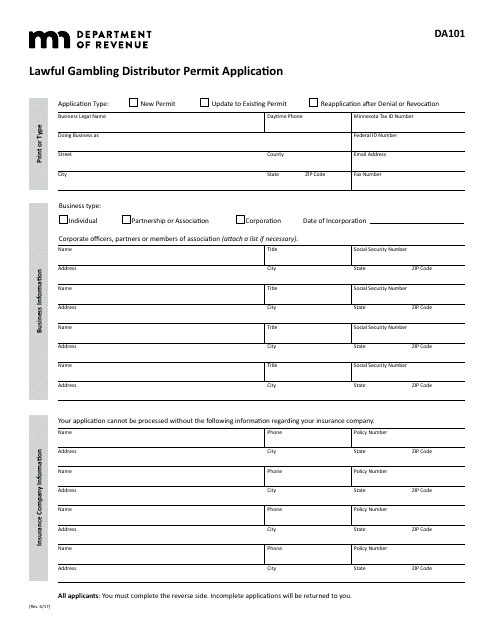

This form is used for applying for a Lawful Gambling Distributor Permit in Minnesota.

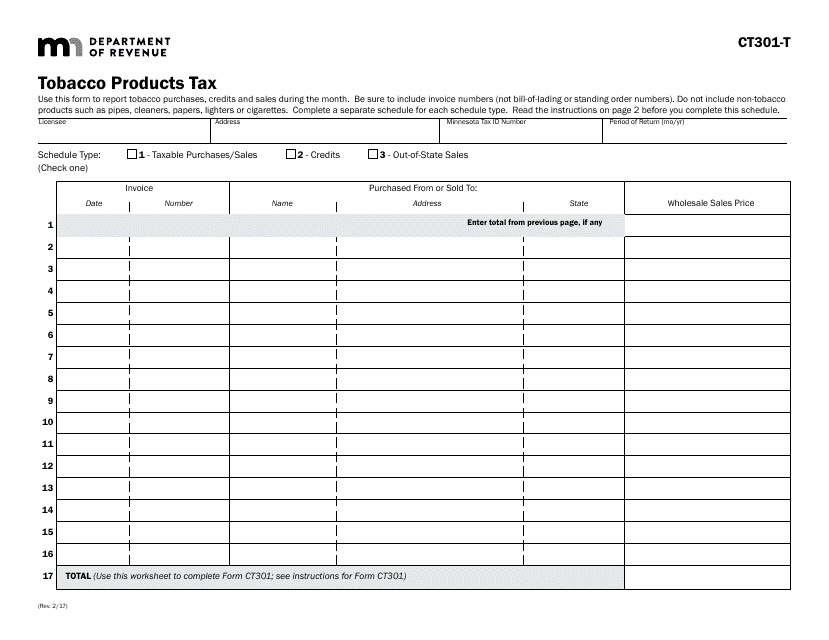

This document is used for reporting and paying tobacco products tax in the state of Minnesota.

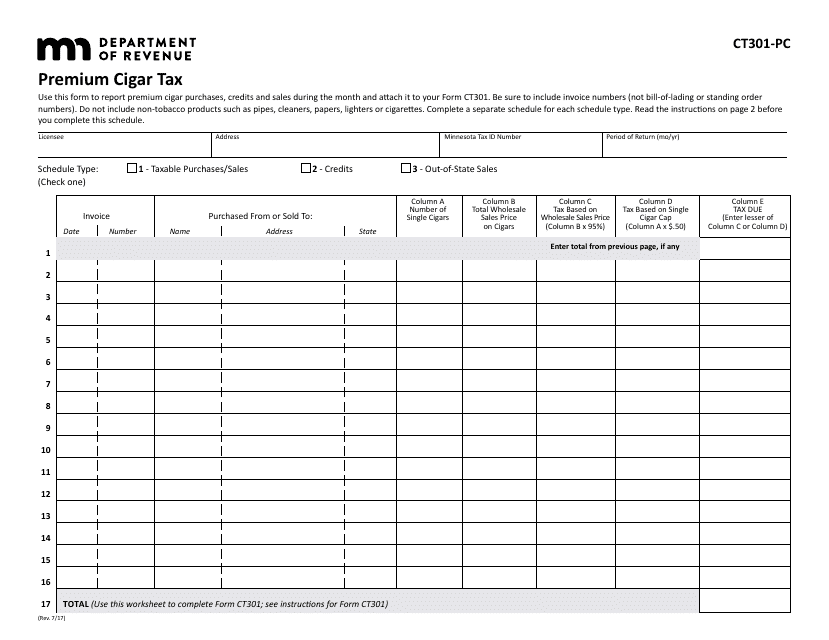

This document provides information and guidelines for paying premium cigar tax in Minnesota. It outlines the schedule and details of CT301-PC.

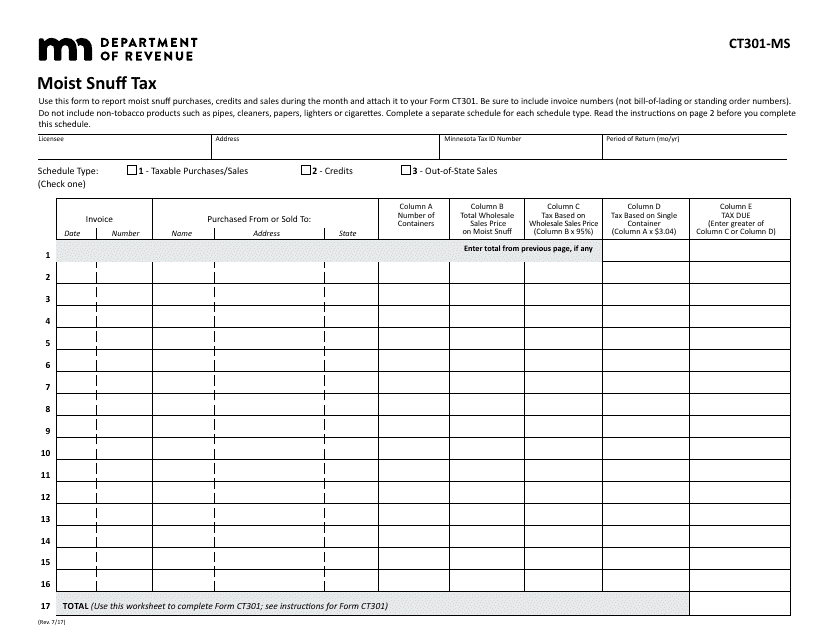

This form is used for reporting and paying the moist snuff tax in the state of Minnesota. It is required for businesses that sell moist snuff products to accurately calculate and remit the appropriate tax amount.

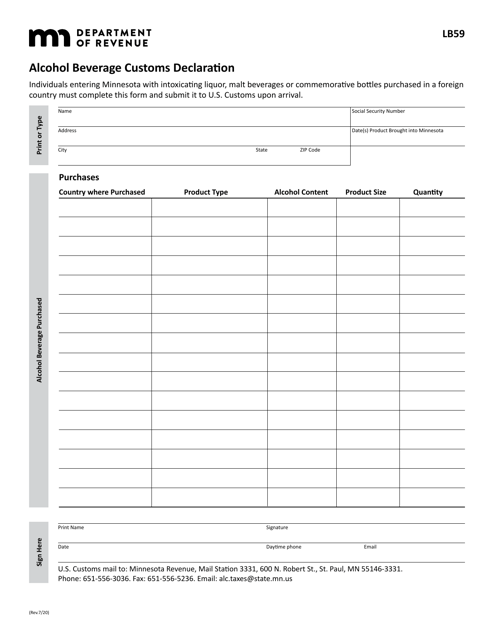

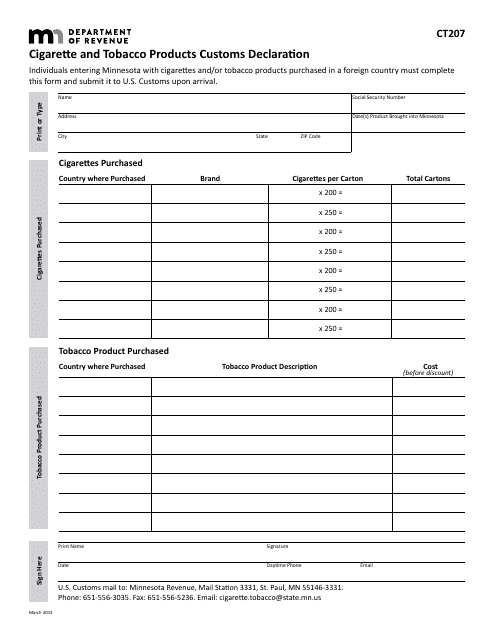

This document is used for declaring cigarette and tobacco products when entering Minnesota from another country.

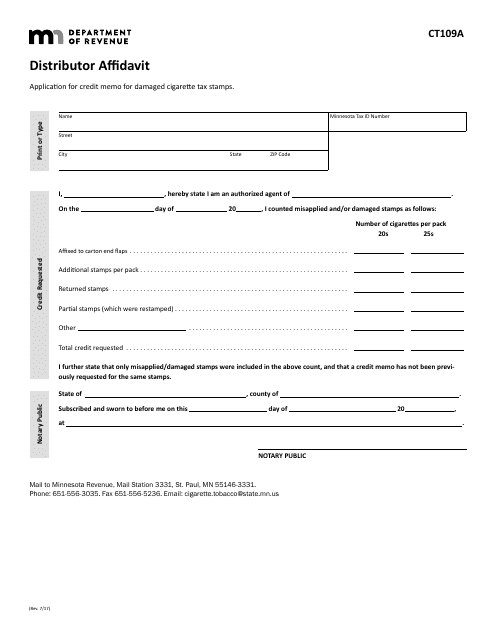

This Form is used for distributors in Minnesota to provide an affidavit.

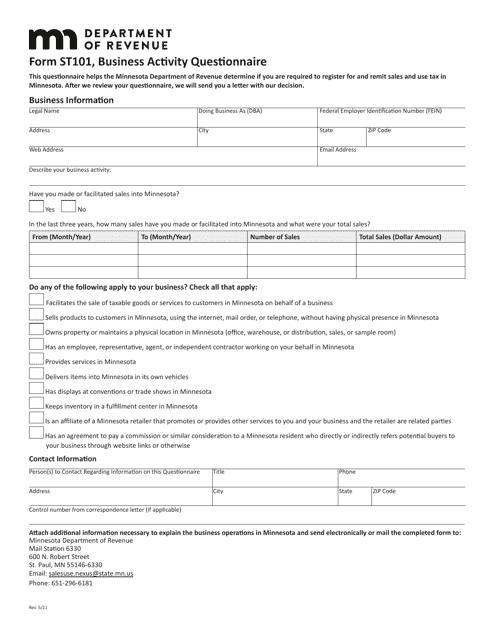

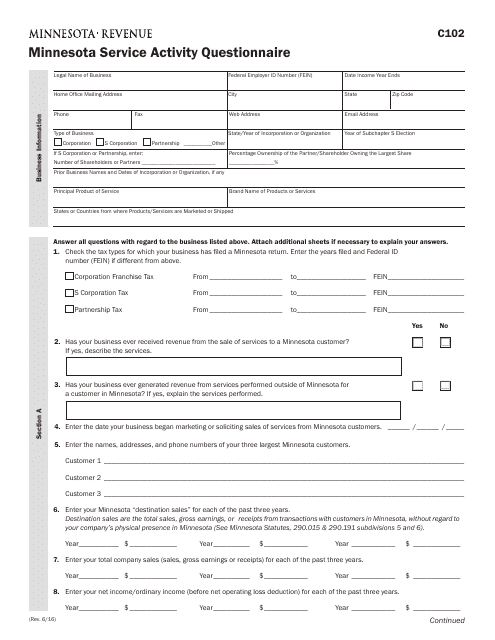

This form is used for collecting information about service activities in Minnesota.

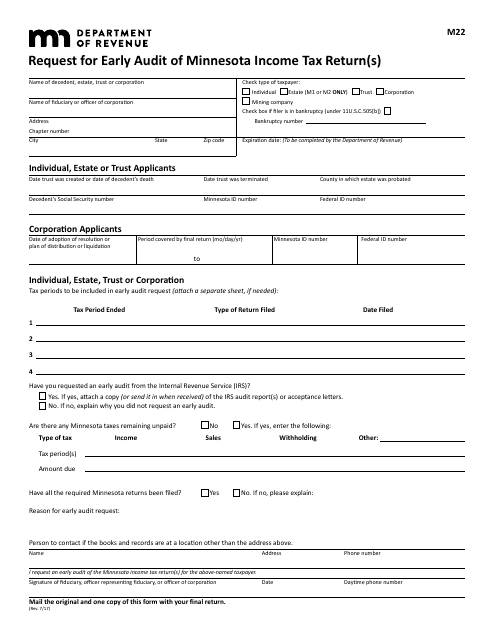

This form is used for requesting an early audit of Minnesota income tax returns in Minnesota.

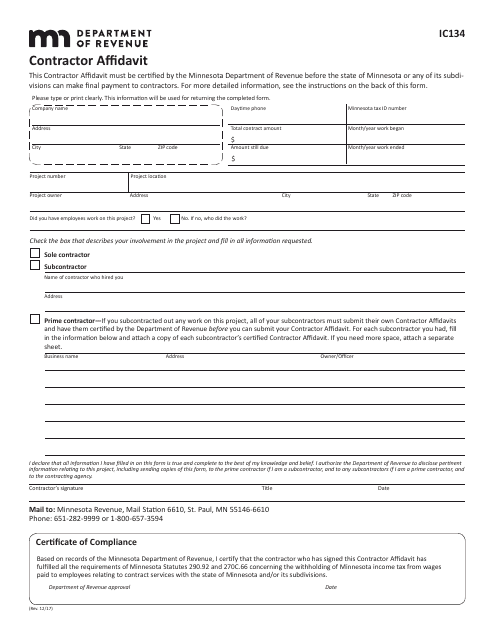

This Form is used for contractors in Minnesota to submit an affidavit confirming their compliance with certain legal requirements.

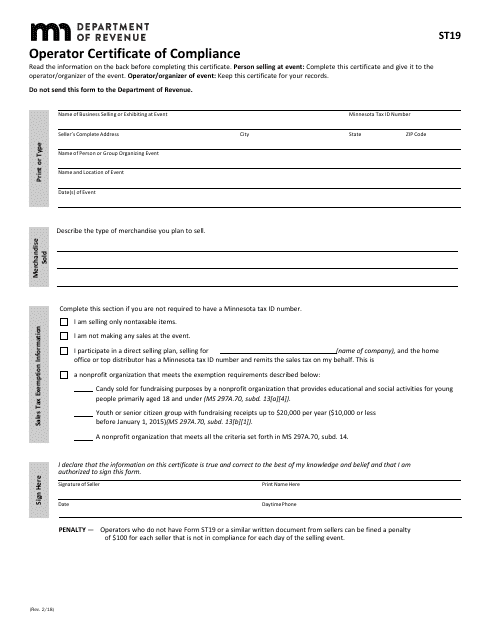

This form is used for operators in Minnesota to certify compliance with state regulations. It is required for certain professions such as plumbing and electrical work.

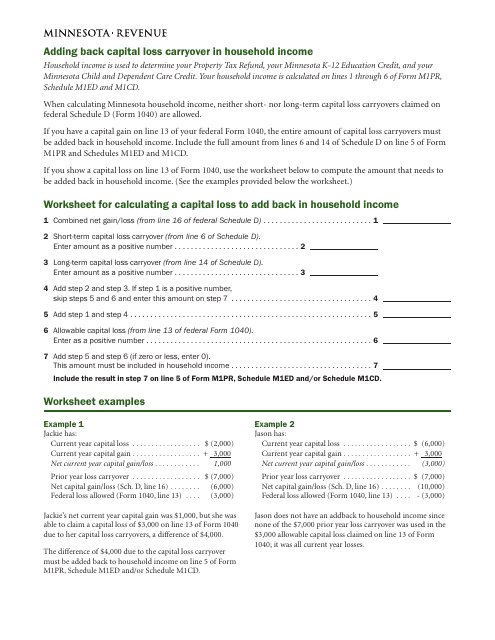

This worksheet is used in Minnesota to calculate a capital loss that needs to be added back to your household income for tax purposes. It helps in determining the amount of capital loss that can be deducted from your income tax return.

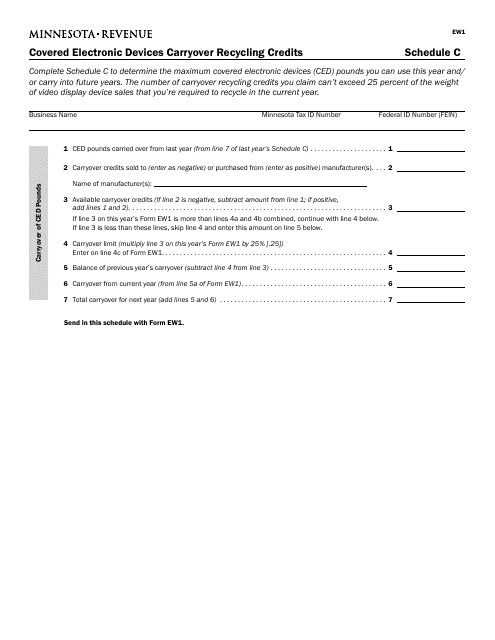

This form is used for reporting and claiming carryover recycling credits for covered electronic devices in Minnesota.

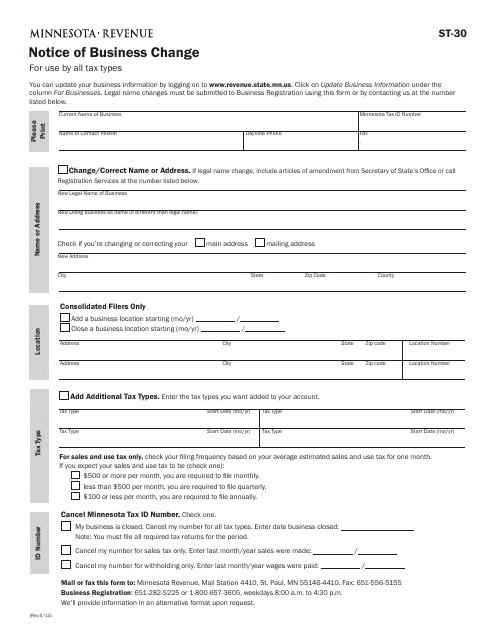

This Form is used for notifying the state of Minnesota about changes in business information. It helps businesses update their records with the state.