Michigan Department of Treasury Forms

Documents:

739

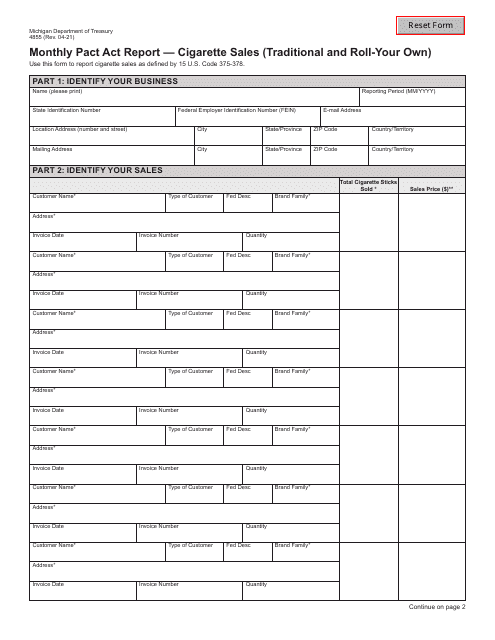

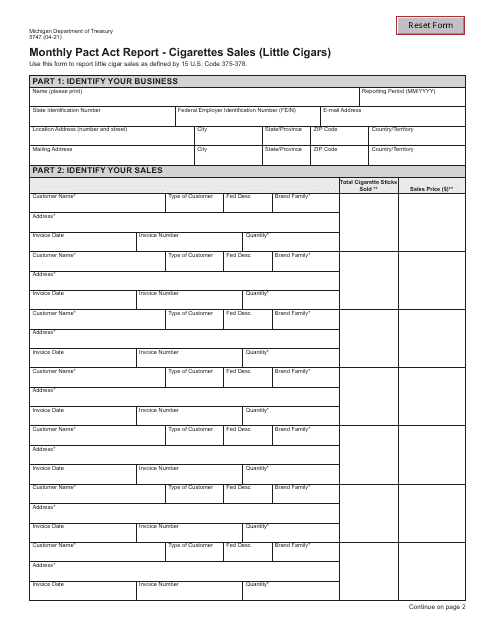

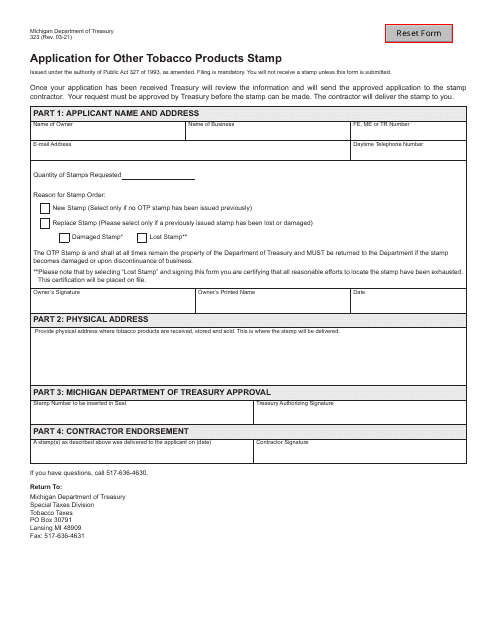

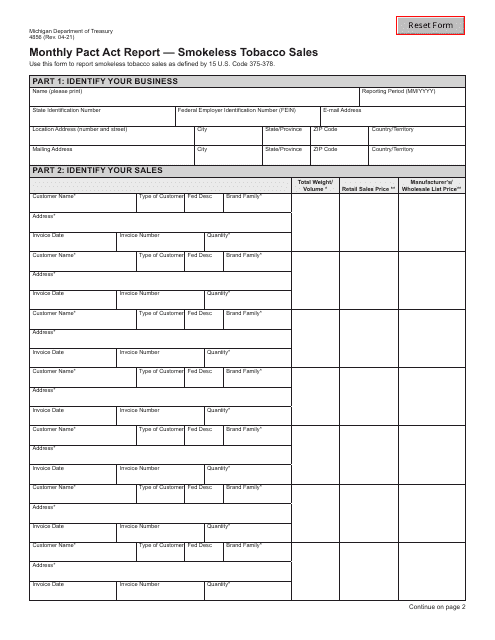

This form is used for reporting monthly sales of cigarettes and little cigars in the state of Michigan in accordance with the Pact Act.

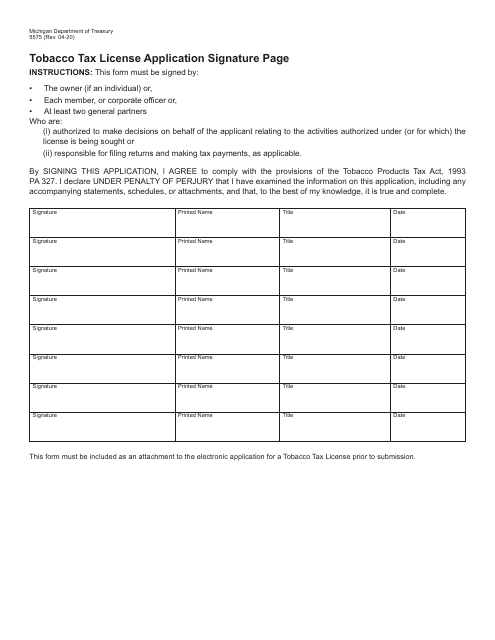

This form is used for the signature page of the Tobacco Tax License Application in Michigan.

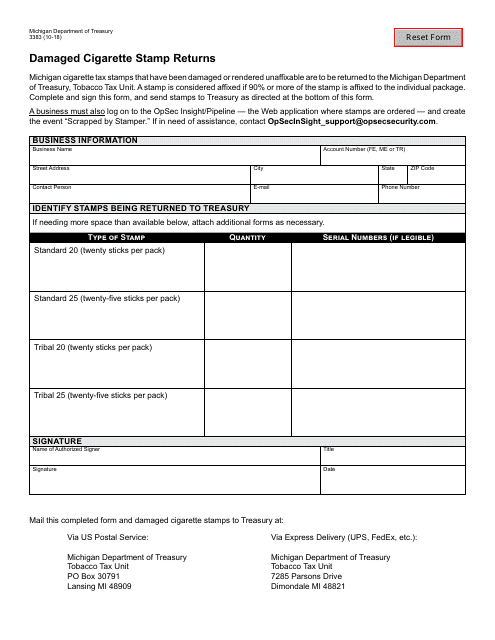

This form is used for returning damaged cigarette stamps in the state of Michigan.

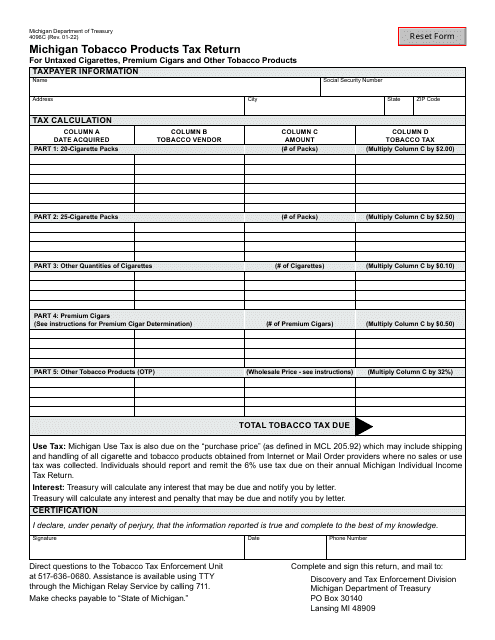

This form is used for reporting and paying taxes on untaxed cigarettes, premium cigars, and other tobacco products in the state of Michigan.

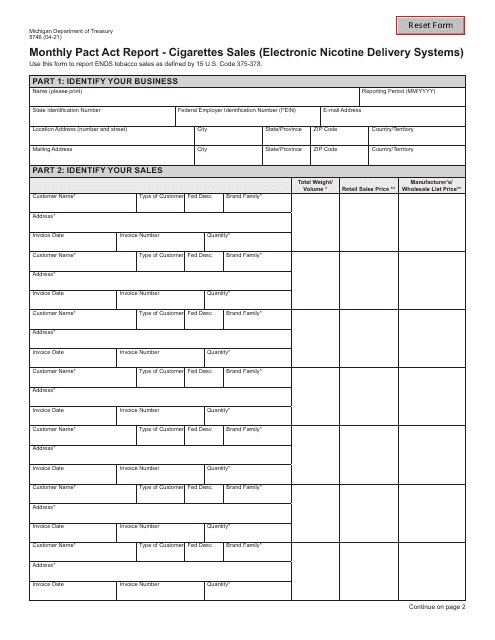

This form is used for reporting monthly sales of cigarettes and electronic nicotine delivery systems (e-cigarettes) in the state of Michigan in compliance with the Pact Act.

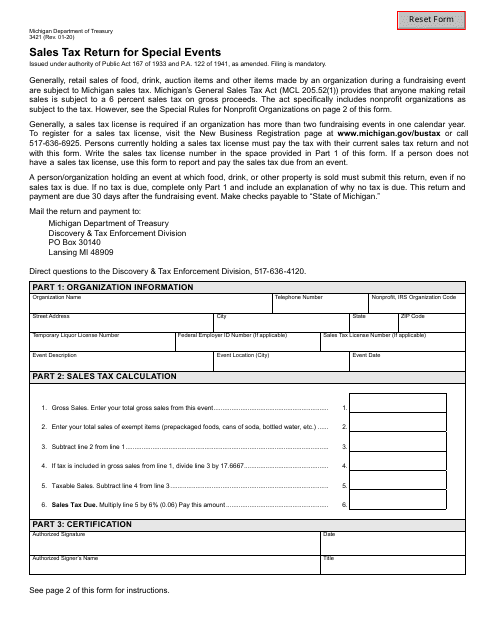

This form is used for reporting qualified data center exemptions in the state of Michigan.

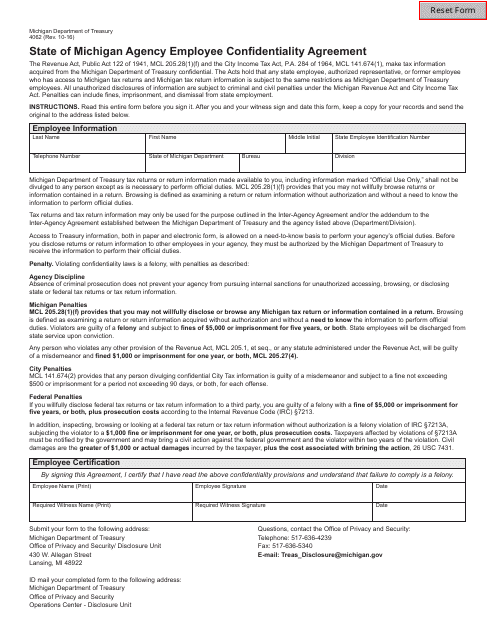

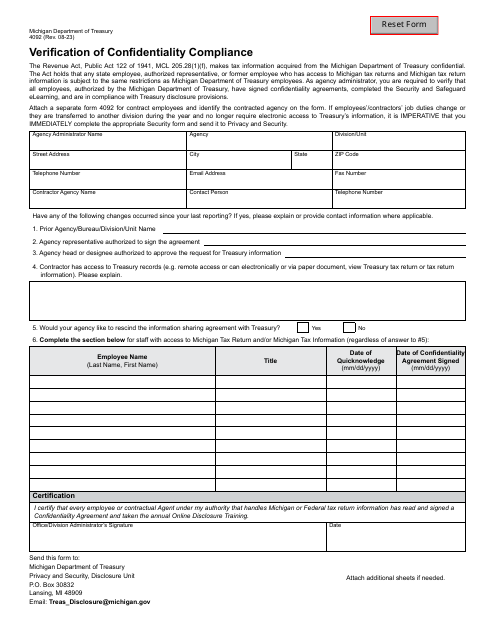

This Form is used for state of Michigan agency employees to sign a confidentiality agreement.

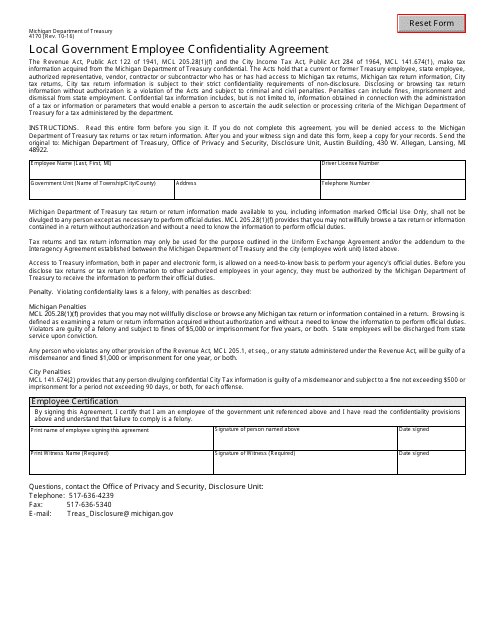

This form is used for local government employees in Michigan to sign a confidentiality agreement to protect sensitive information.

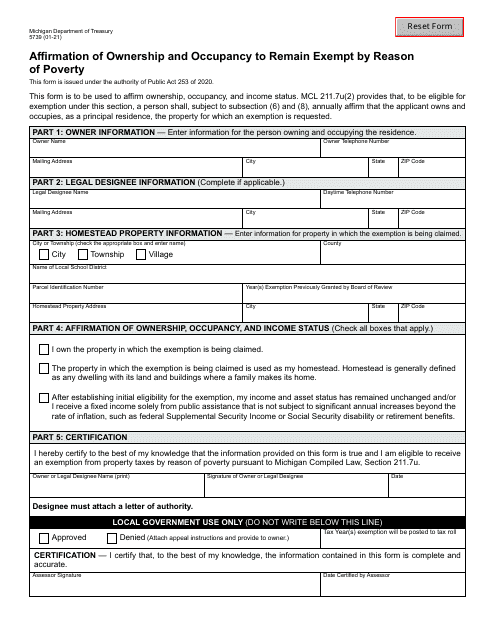

This form is used in Michigan to affirm ownership and occupancy as a reason to remain exempt from certain expenses based on poverty.

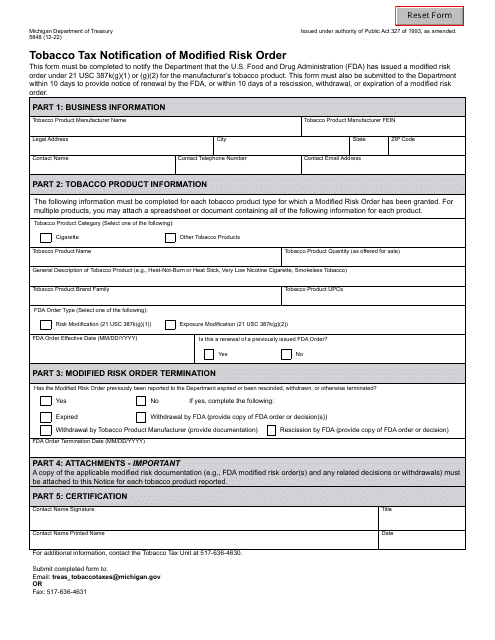

This form is used for notifying the Michigan Department of Treasury about any modified risk orders relating to tobacco tax.