Michigan Department of Treasury Forms

Documents:

739

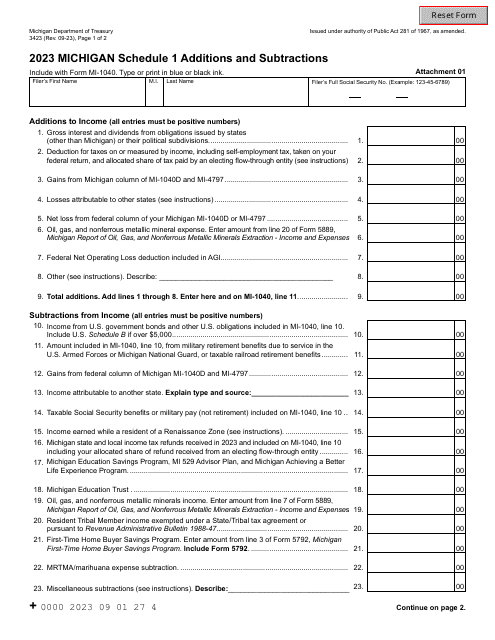

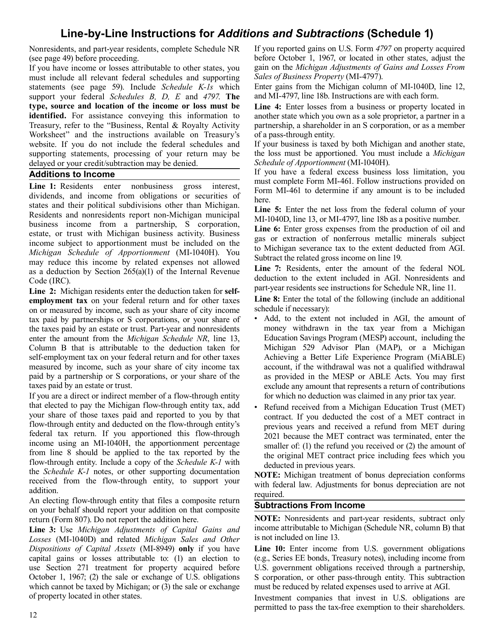

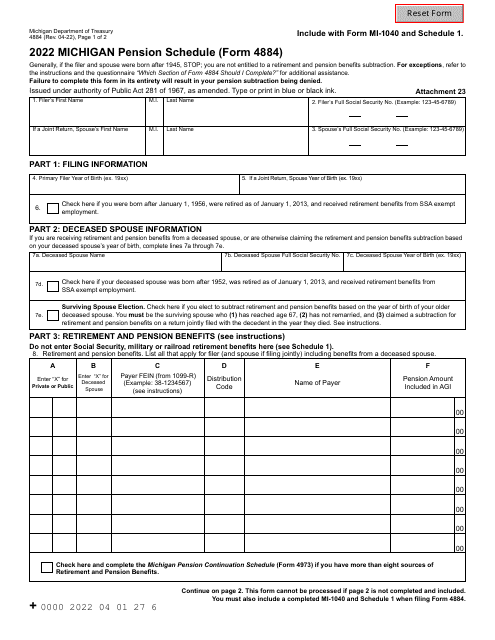

This document provides instructions for completing Schedule 1, which is used to report any additions or subtractions to your Michigan income tax return. It guides you through the process of determining what types of income or deductions should be included, and how to fill out the necessary forms.

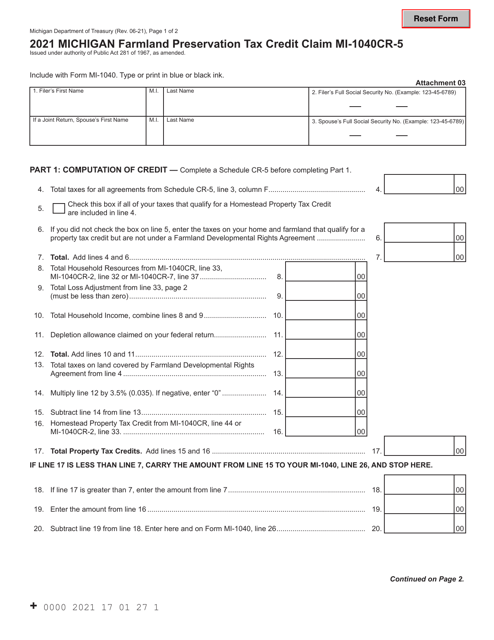

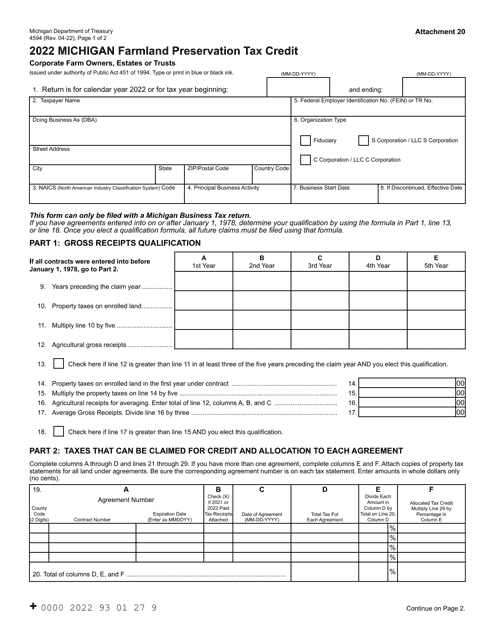

This document is for claiming the Michigan Farmland Preservation Tax Credit in Michigan. It is used to apply for tax credits for preserving farmland in the state.

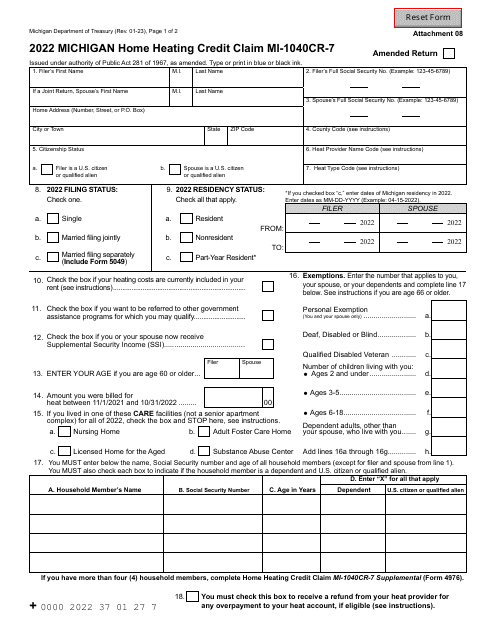

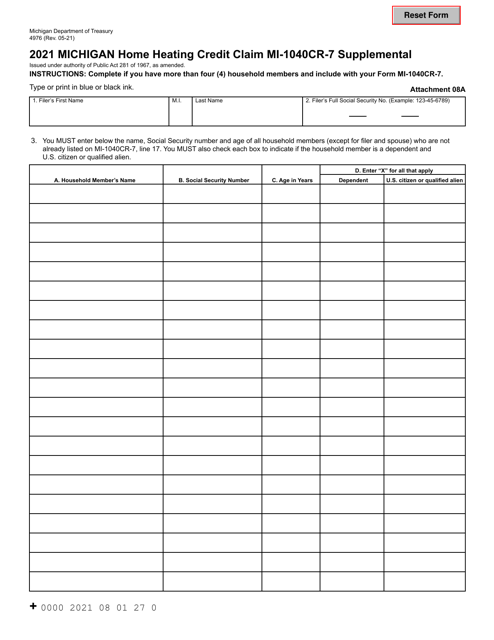

This document is used for claiming a supplemental home heating credit in the state of Michigan.

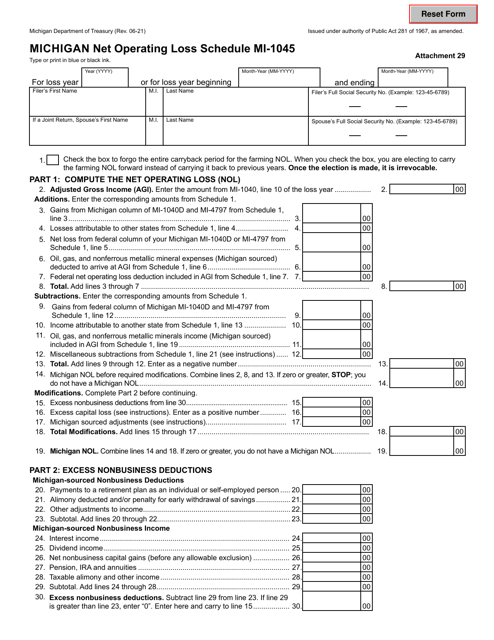

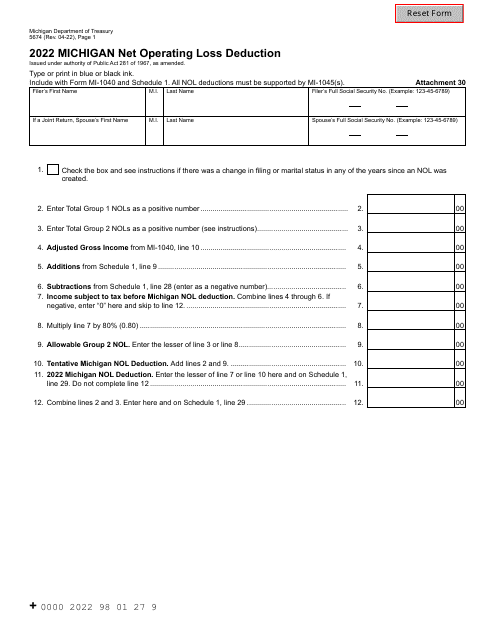

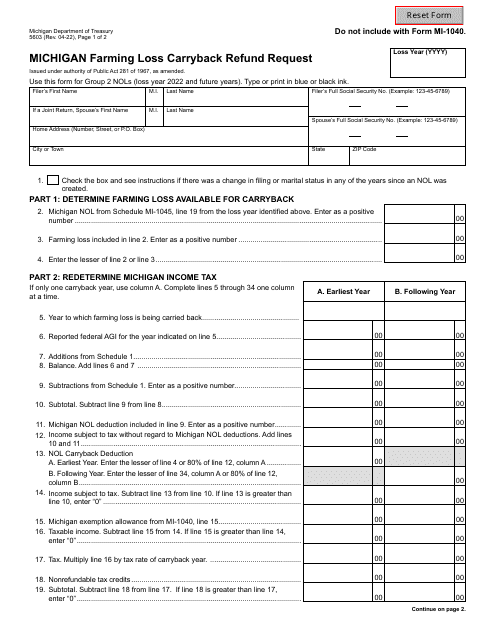

This document is used for reporting net operating losses in the state of Michigan. It is a schedule that taxpayers must complete and submit along with their Michigan income tax return.

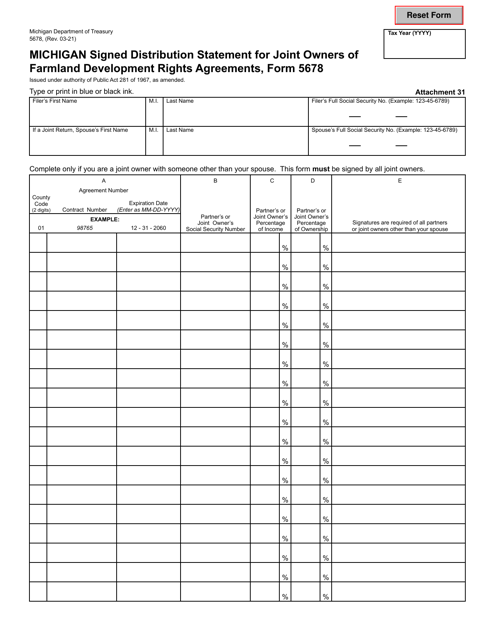

This document is used for joint owners of farmland in Michigan to sign a distribution statement for development rights agreements.

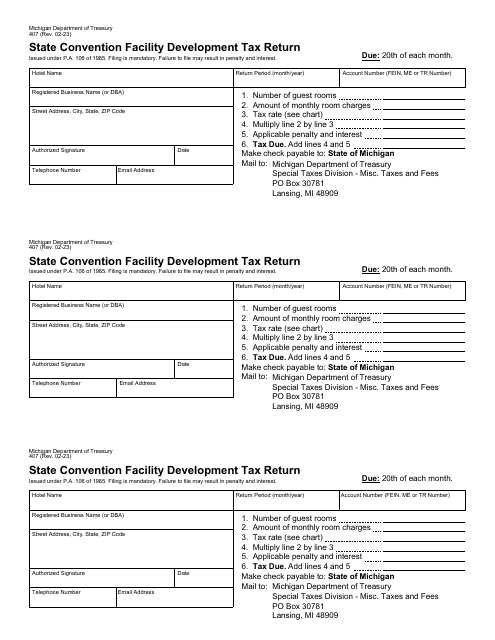

This form is used for reporting and paying the State Convention Facility Development Tax in Michigan. The form provides instructions on how to calculate the tax and where to submit the payment.

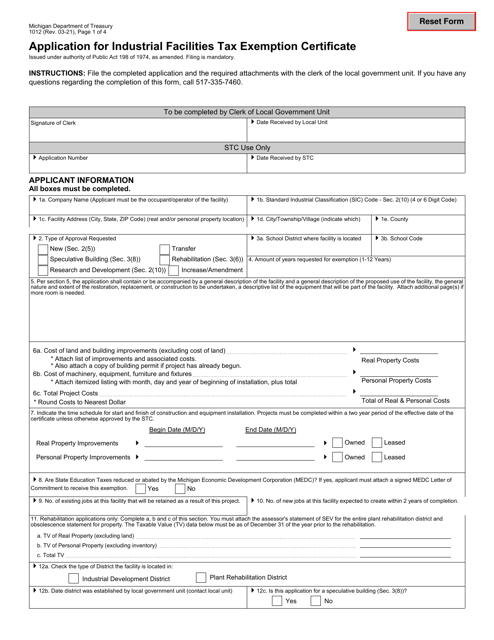

This Form is used for applying for an Industrial Facilities Tax Exemption Certificate in Michigan.

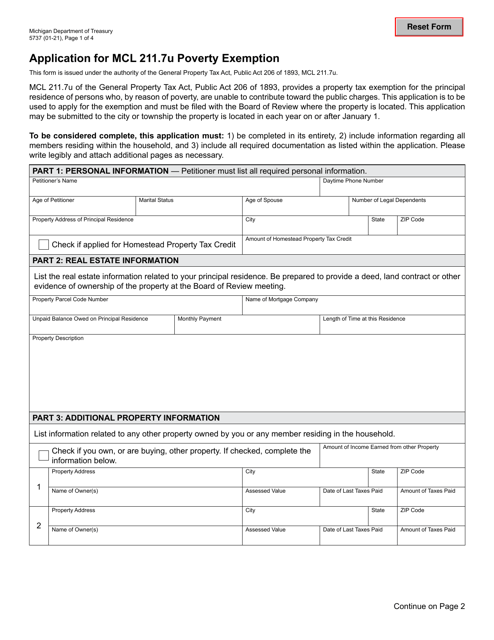

This form is used for applying for MCL 211.7u Poverty Exemption in the state of Michigan.

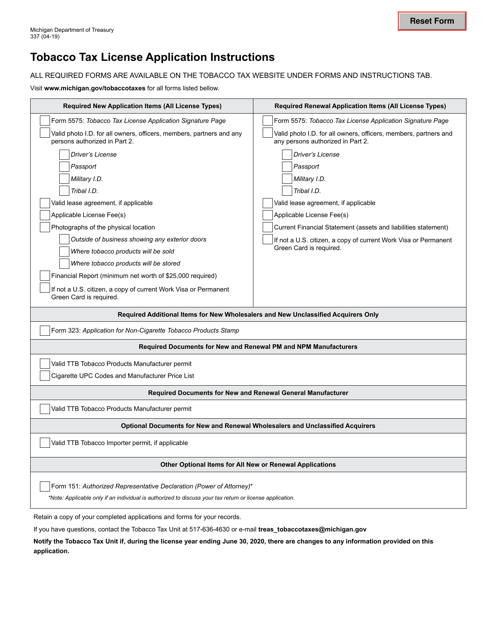

This document provides instructions for applying for a tobacco tax license in Michigan. It guides individuals or businesses on how to complete the necessary forms and submit the required information to obtain a license for selling tobacco products in the state.