Kentucky Department of Revenue Forms

Documents:

318

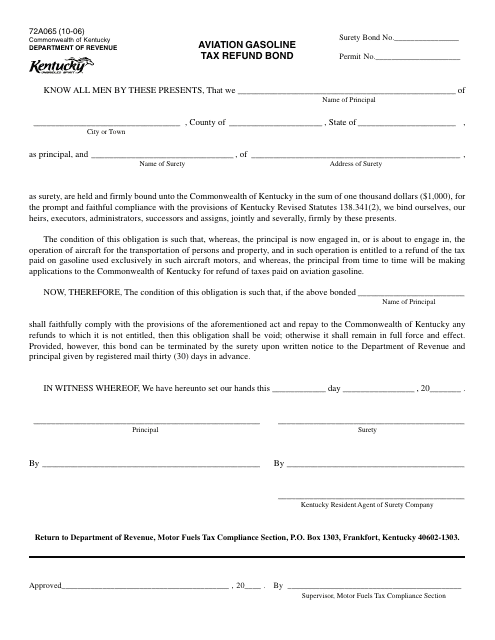

This form is used for obtaining a refund of aviation gasoline taxes paid in the state of Kentucky.

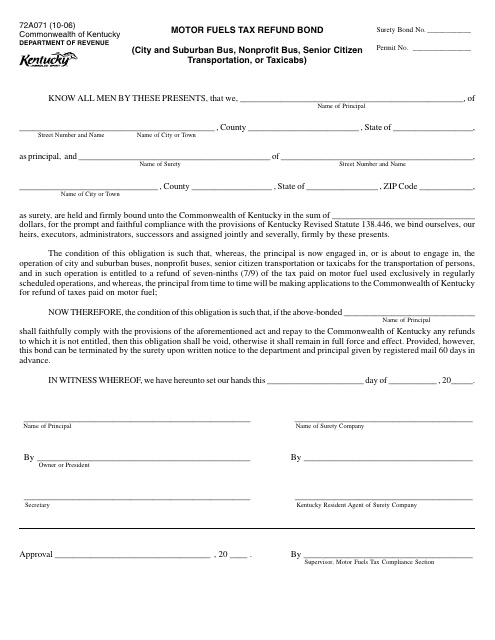

This form is used for obtaining a motor fuels tax refund bond for city and suburban buses, nonprofit buses, senior citizen transportation, or taxicabs in Kentucky.

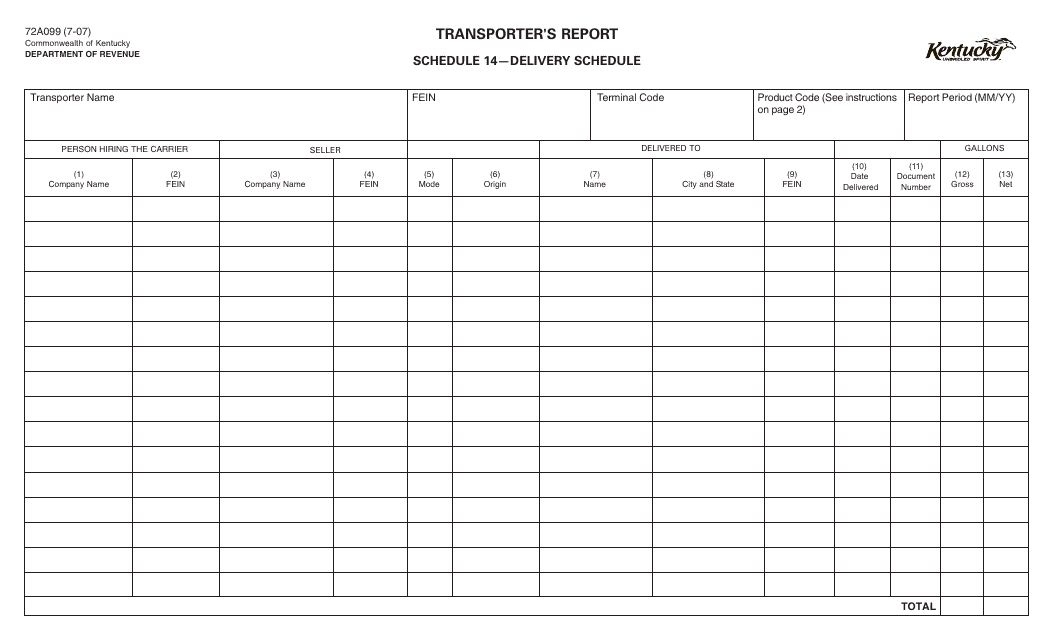

This Form is used for providing a delivery schedule in the state of Kentucky.

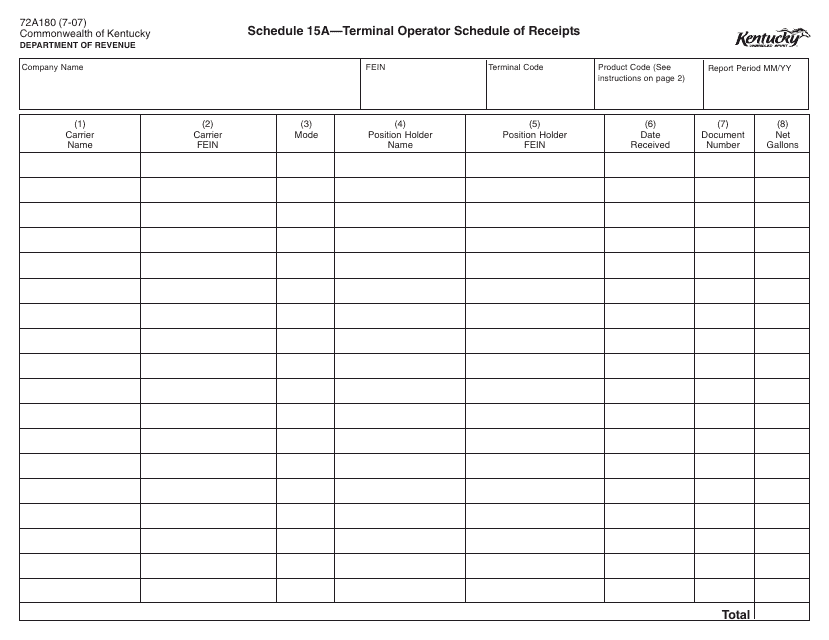

This form is used for reporting the receipts of terminal operators in Kentucky.

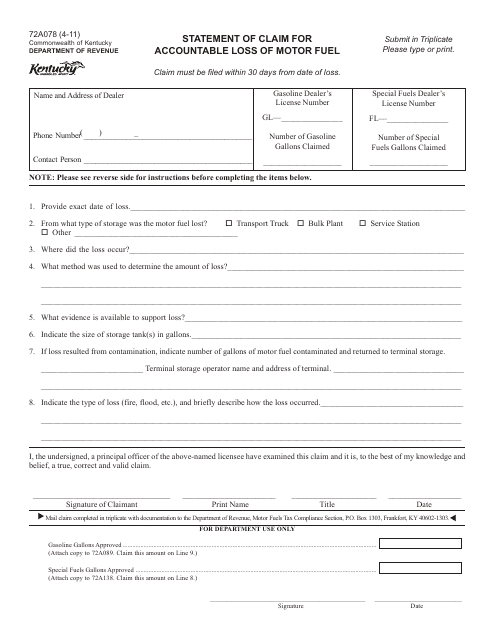

This Form is used for filing a statement of claim for accountable loss of motor fuel in the state of Kentucky.

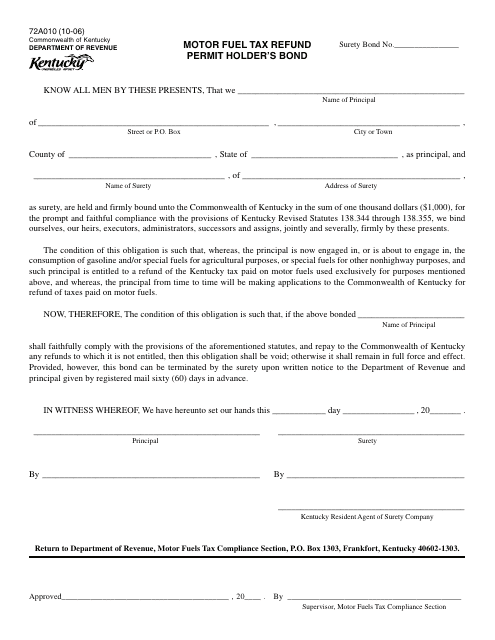

This Form is used for obtaining a refund of motor fuel taxes in Kentucky. It requires the holder of a Motor Fuel Tax Refund Permit to provide a bond.

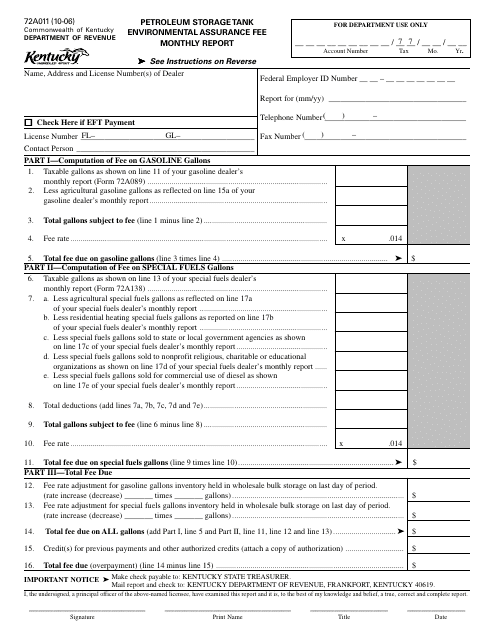

This Form is used for reporting the monthly fees related to petroleum storage tanks in Kentucky.

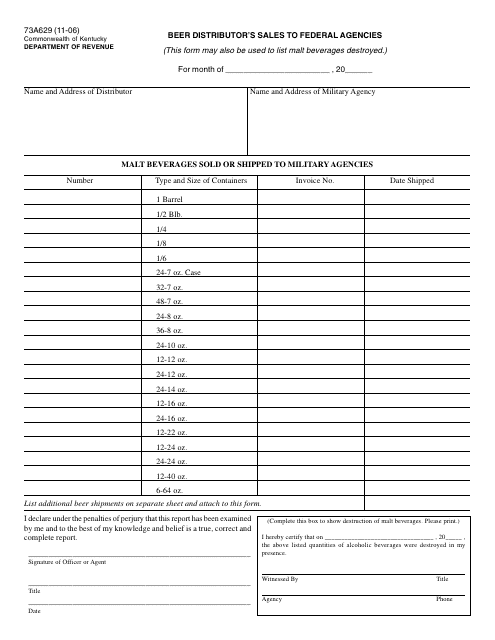

This form is used for beer distributors in Kentucky to report their sales to federal agencies.

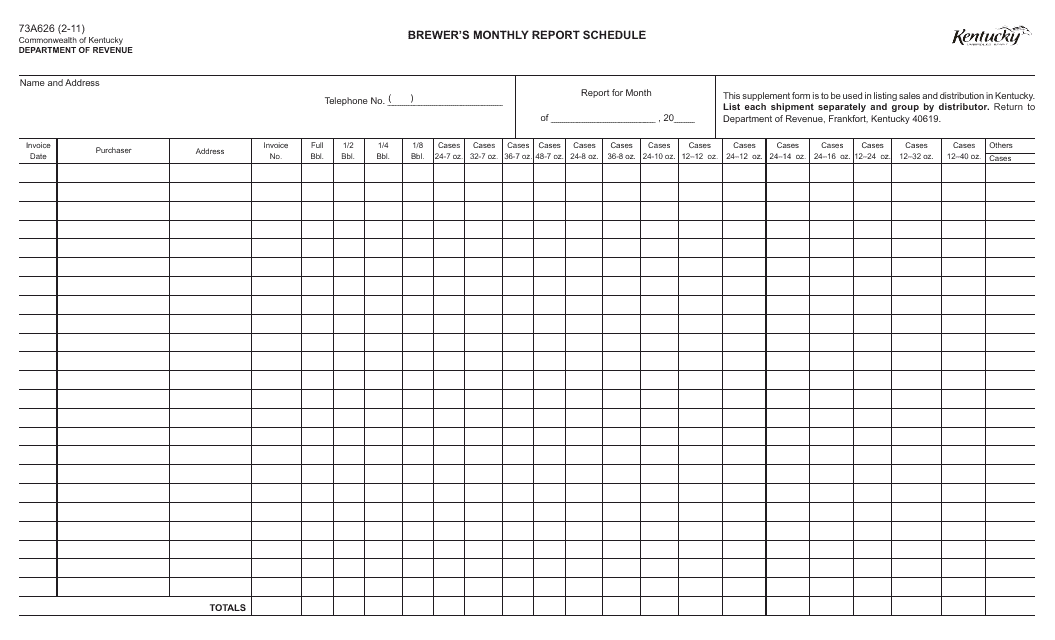

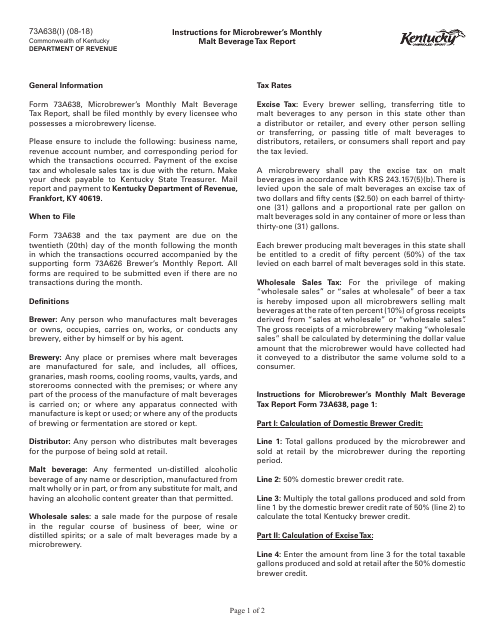

This form is used for reporting monthly sales and production data by brewers in Kentucky.

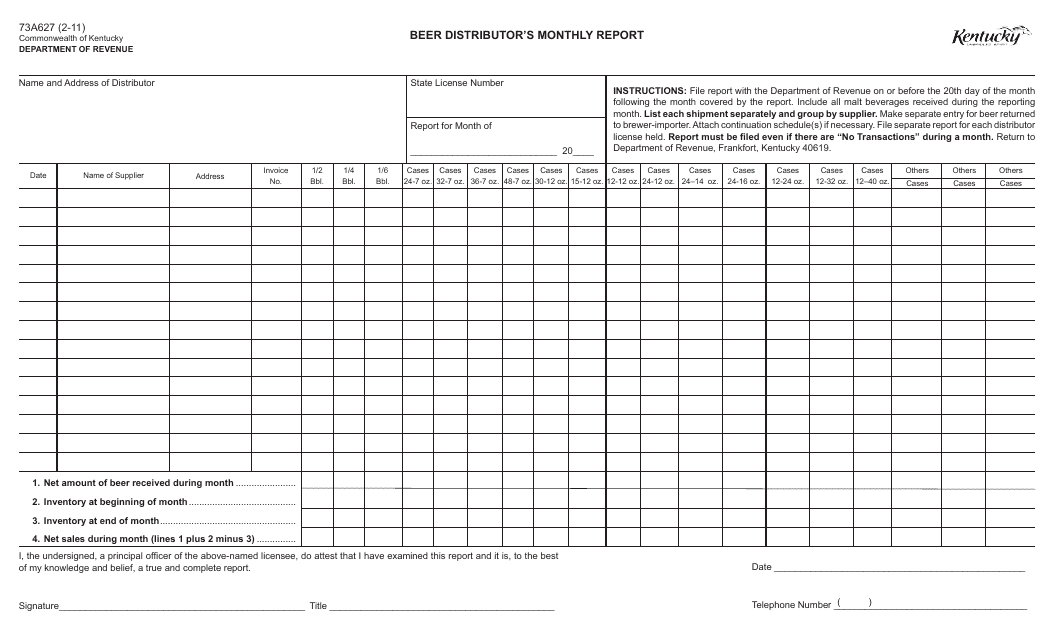

This Form is used for beer distributors in Kentucky to submit their monthly report.

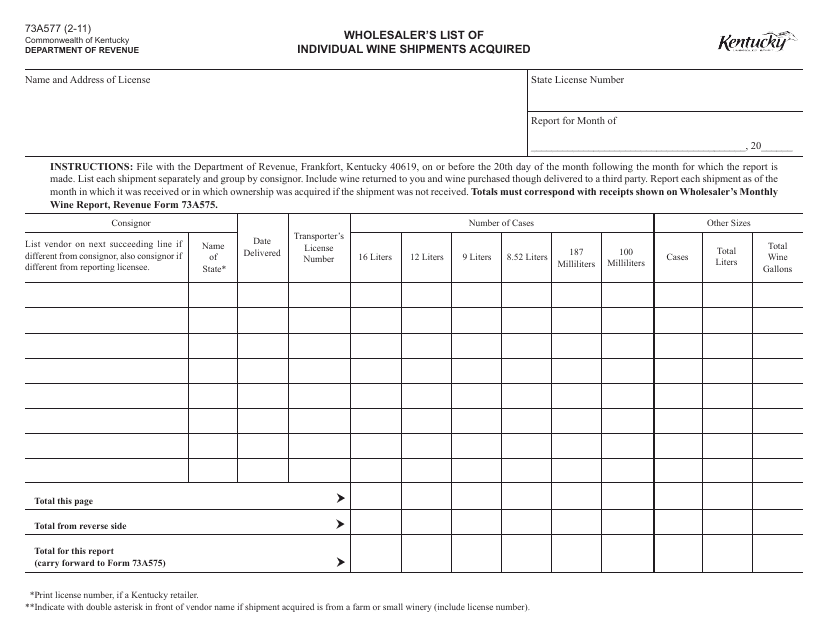

This document is used by wholesalers in Kentucky to report the individual wine shipments they have acquired.

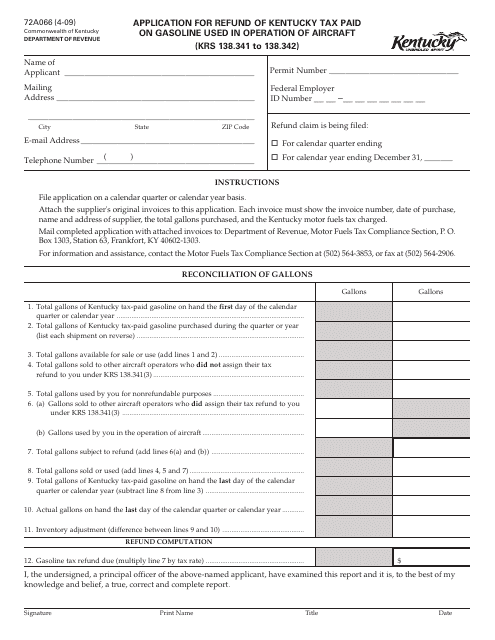

This form is used for applying for a refund of Kentucky tax paid on gasoline used in the operation of aircraft in Kentucky.

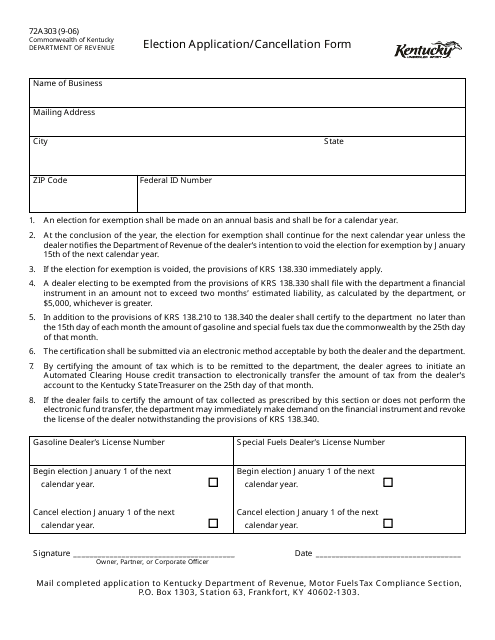

This form is used for applying or canceling an election application in the state of Kentucky.

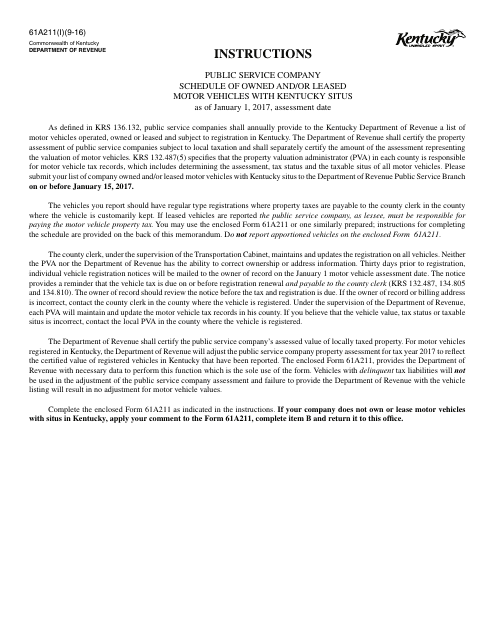

This document is used for reporting owned and/or leased motor vehicles by public service companies with Kentucky situs. It provides instructions on how to complete Form 61A211.

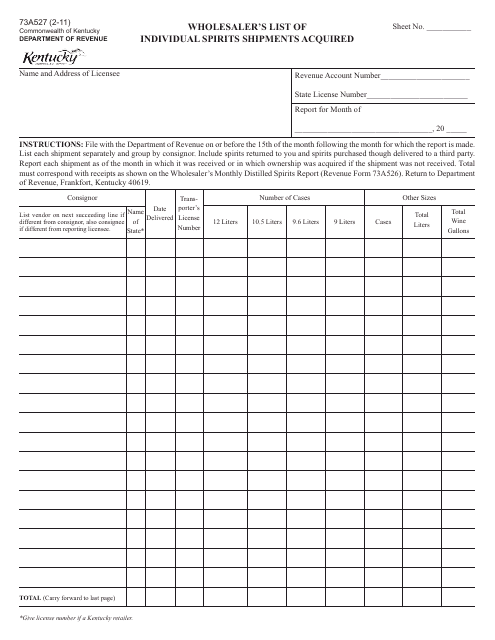

This form is used for wholesalers in Kentucky to report the individual spirits shipments they have acquired.

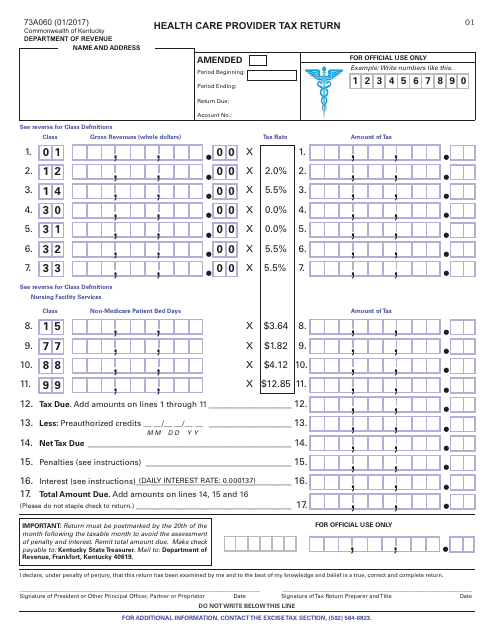

This form is used for filing the Health Care Provider Tax Return in the state of Kentucky.

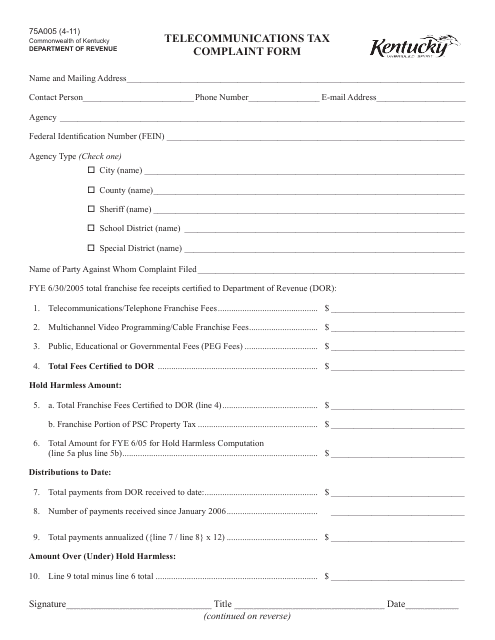

This Form is used for filing a complaint regarding telecommunications tax in the state of Kentucky.

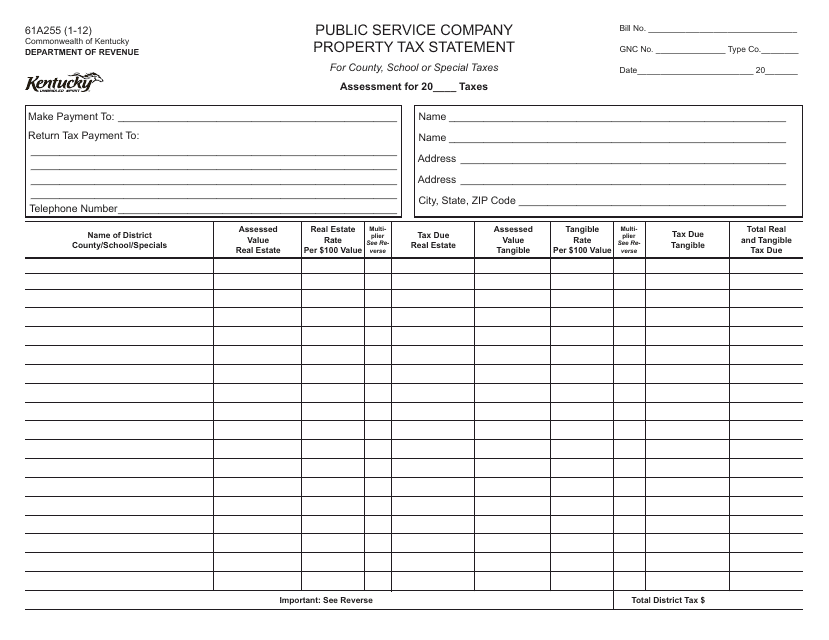

This form is used for filing the Public Service Company Property Tax Statement in Kentucky. It provides information related to the property owned by public service companies for tax purposes.

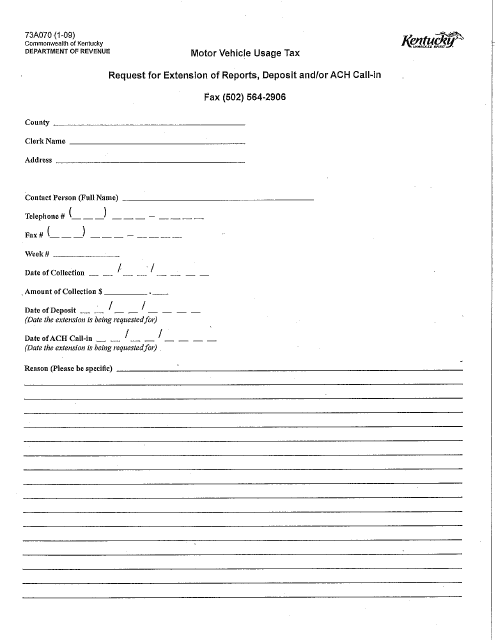

This form is used for requesting an extension for reports, deposits, and ACH call-ins in the state of Kentucky.

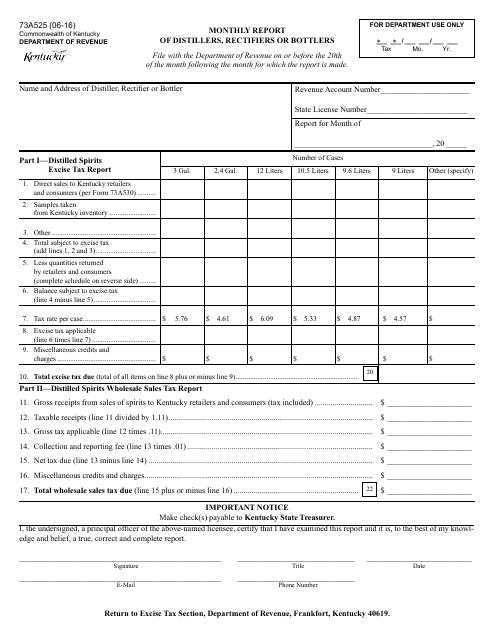

This Form is used for submitting monthly reports by distillers, rectifiers, or bottlers in Kentucky. It helps track and monitor their operations and compliance with regulations.

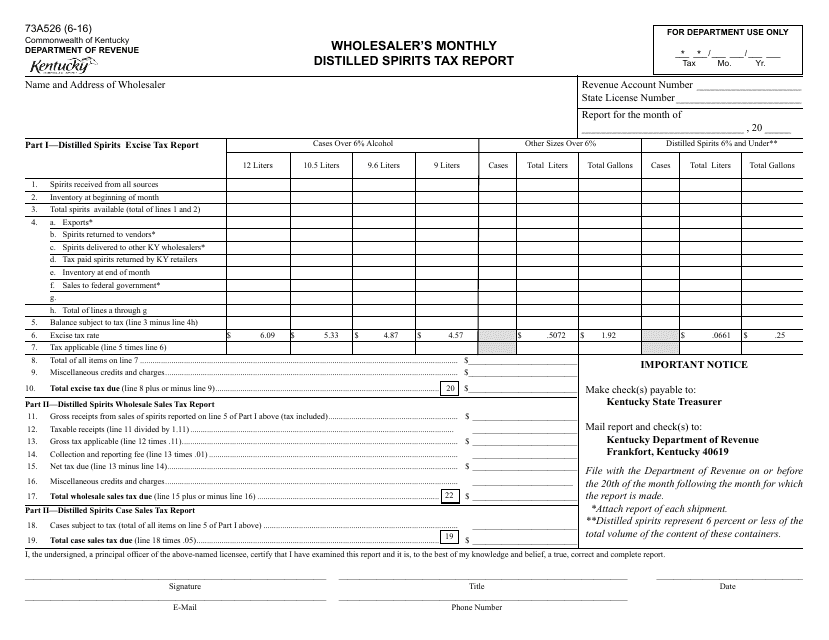

This Form is used for wholesalers in Kentucky to report their monthly distilled spirits tax.

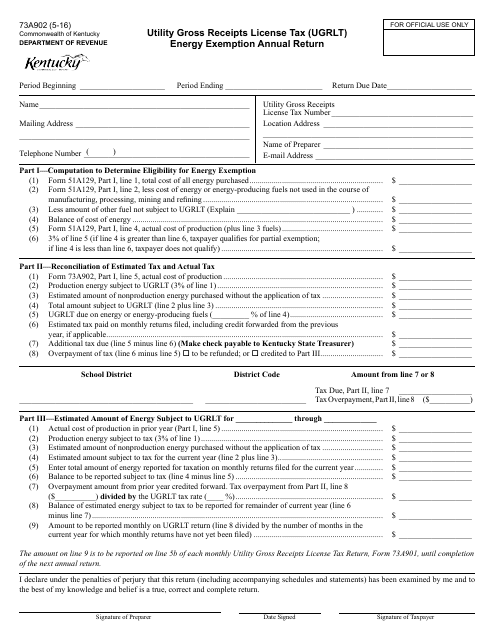

This document is used for filing an annual return to claim exemption from the Utility Gross Receipts License Tax (UGRLT) Energy Exemption in Kentucky.

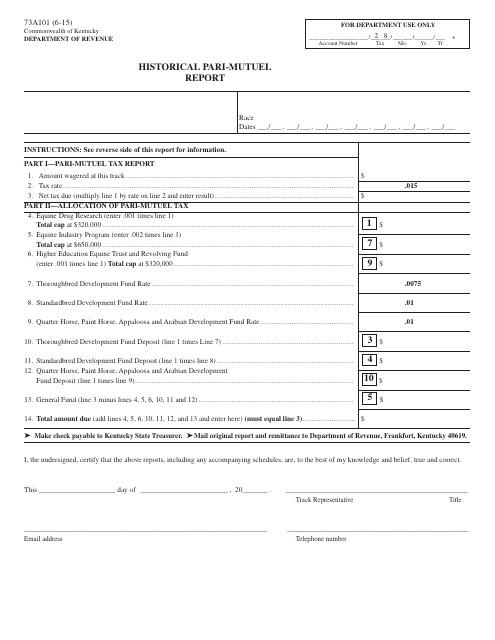

This form is used for reporting historical pari-mutuel data in the state of Kentucky.

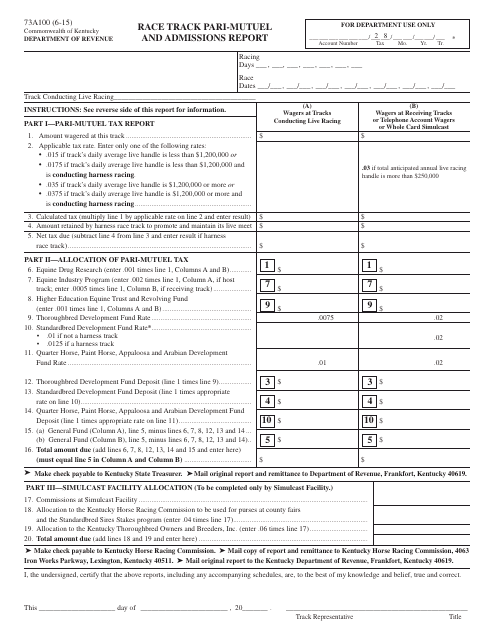

This Form is used for reporting race track pari-mutuel and admissions data in Kentucky.

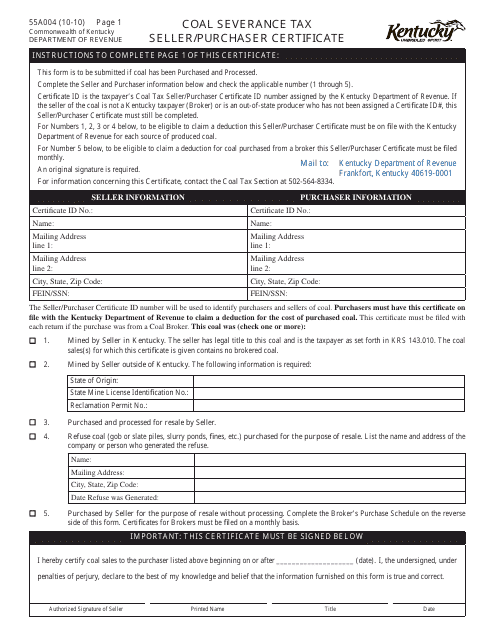

This Form is used for reporting and certifying coal severance tax transactions between sellers and purchasers in Kentucky.

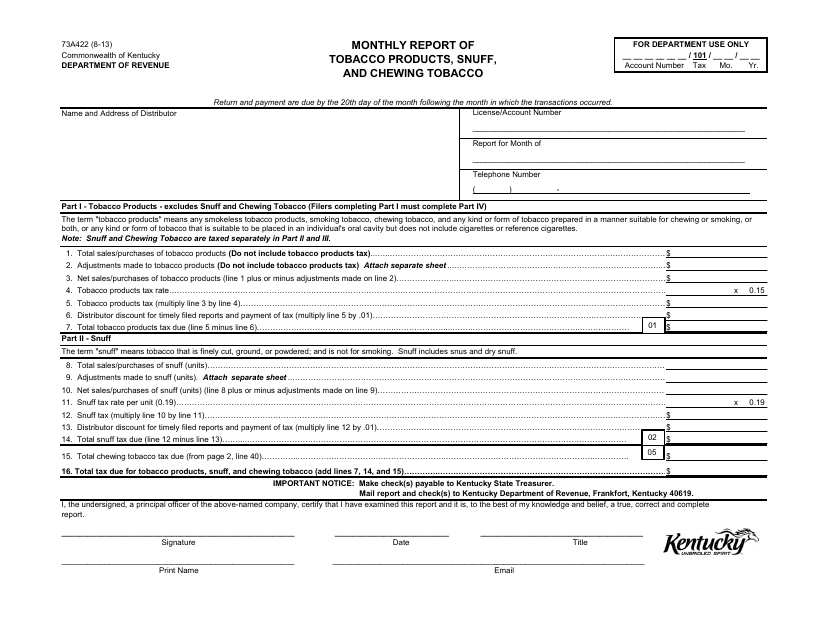

This form is used for monthly reporting of tobacco products, snuff, and chewing tobacco in the state of Kentucky.

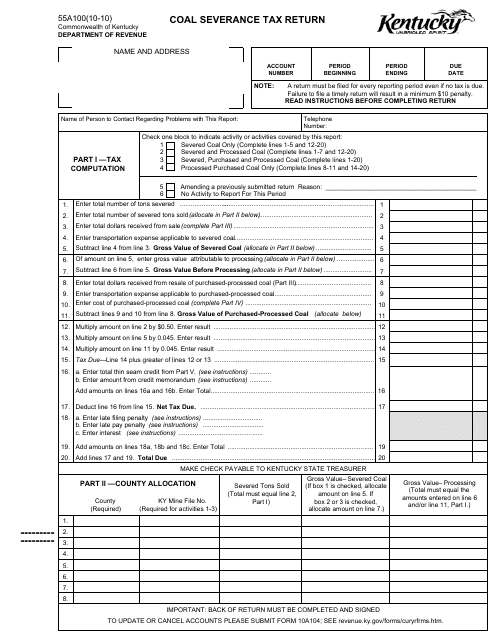

This form is used for filing the Coal Severance Tax Return in the state of Kentucky. It is required for individuals or businesses that generate income from coal severance activities.

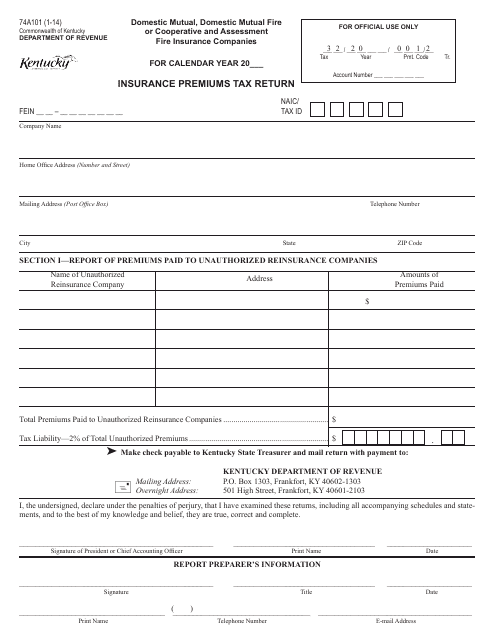

This Form is used for reporting insurance premiums tax return for domestic mutual, domestic mutual fire or cooperative and assessment fire insurance companies in the state of Kentucky.

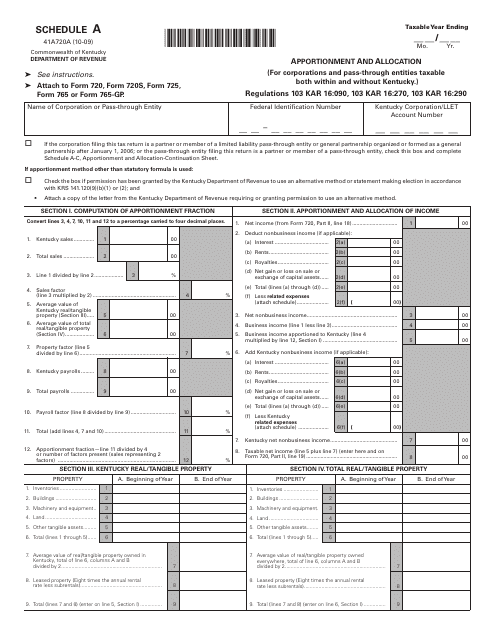

This form is used for apportionment and allocation in Kentucky. It helps determine the percentage of income and expenses that are allocated to the state for tax purposes.

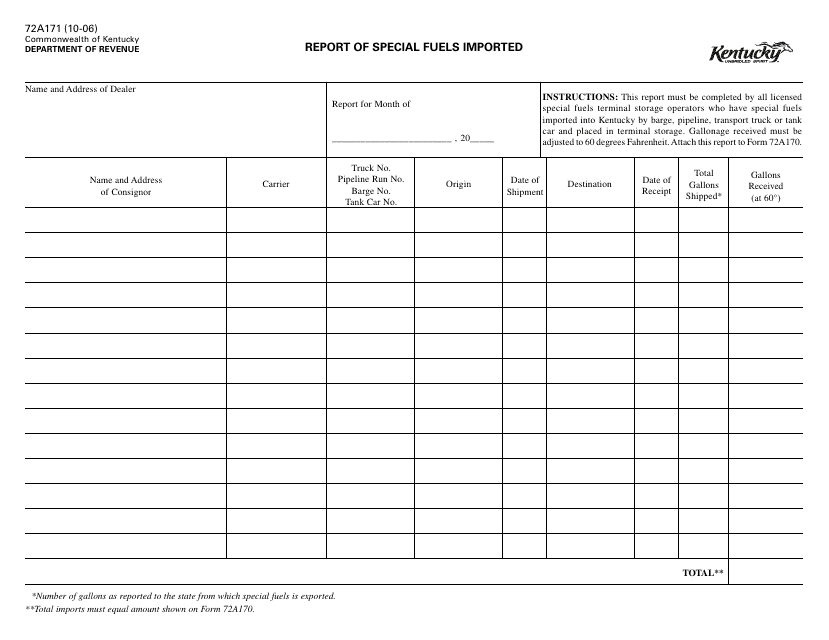

This form is used for reporting the import of special fuels in Kentucky. It provides information about the quantity and type of special fuels imported.

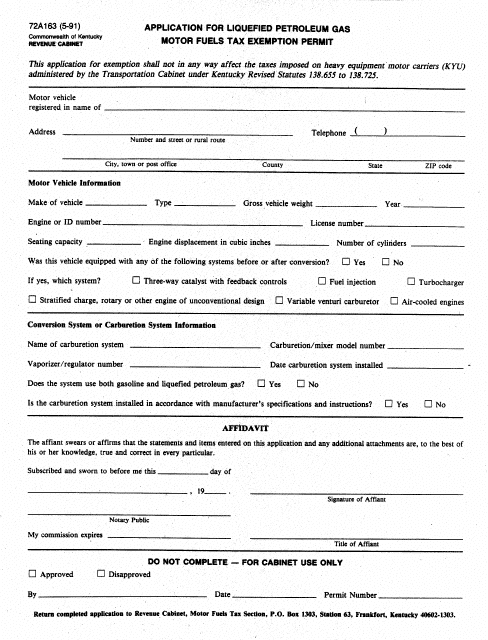

This form is used for applying for an exemption permit for the motor fuels tax on liquefied petroleum gas in the state of Kentucky.

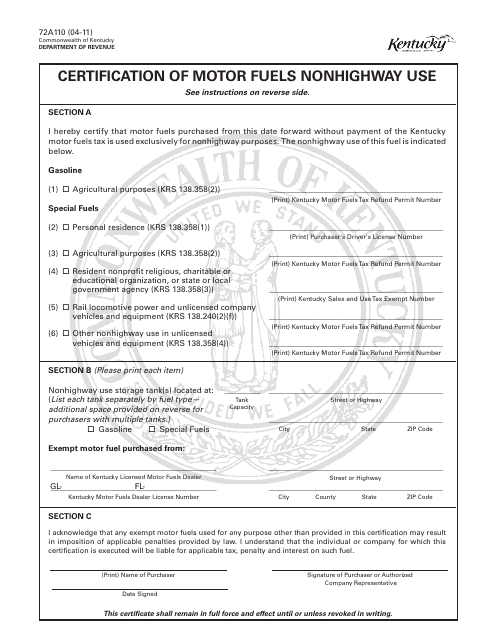

This Form is used for certifying nonhighway use of motor fuels in the state of Kentucky.

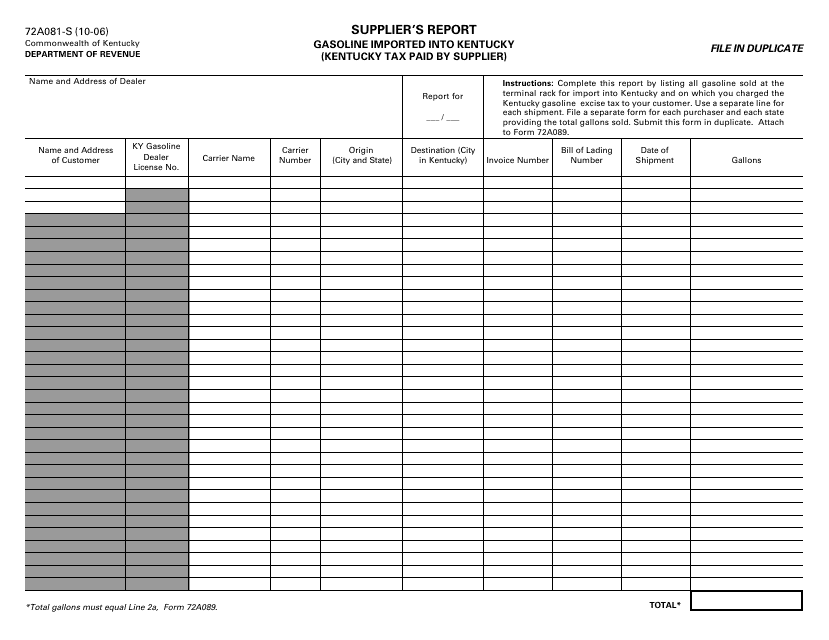

This document is used for reporting the importation of gasoline into Kentucky and the payment of Kentucky taxes by the supplier.

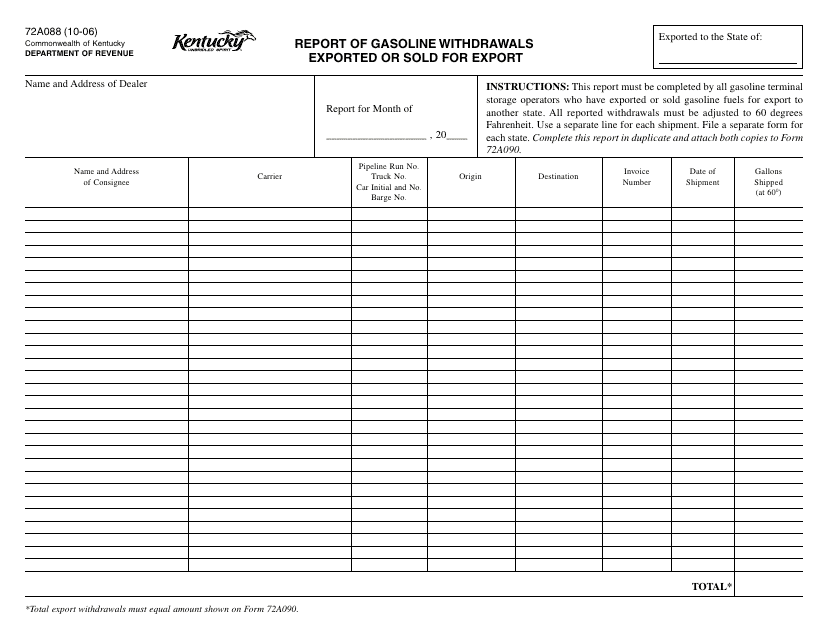

This Form is used for reporting gasoline withdrawals that are exported or sold for export in the state of Kentucky.

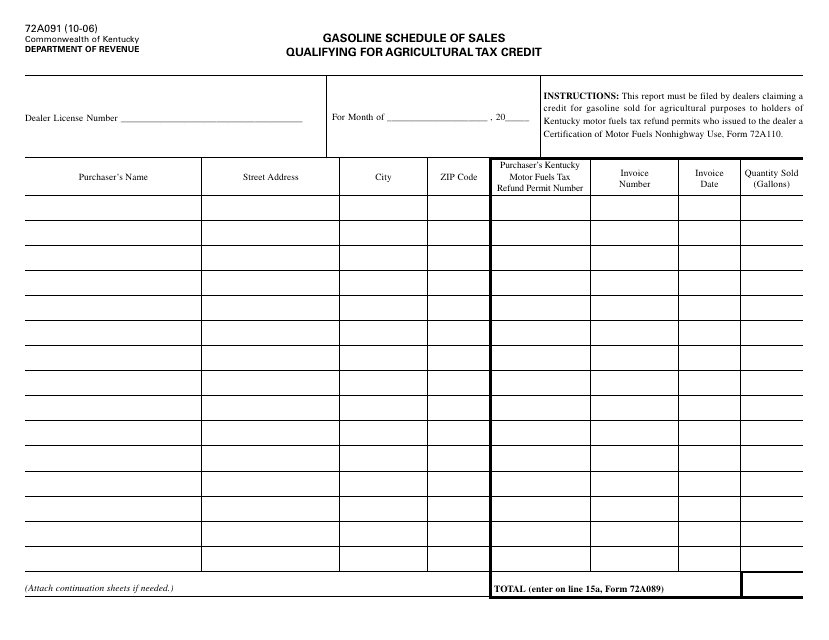

This form is used for reporting sales of gasoline that qualify for the agricultural tax credit in Kentucky.

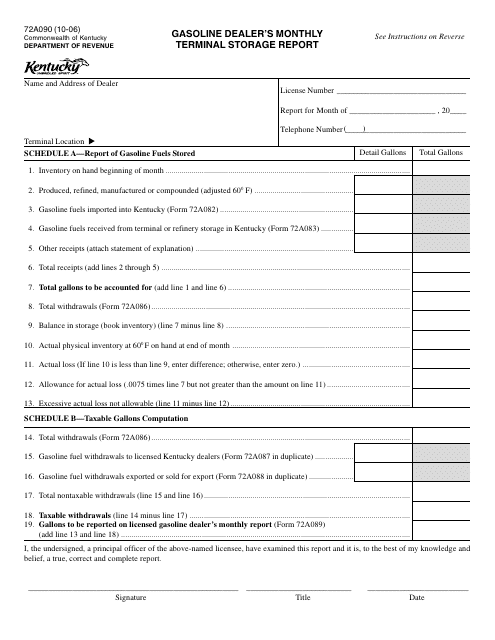

This Form is used for gasoline dealers in Kentucky to report their monthly terminal storage.

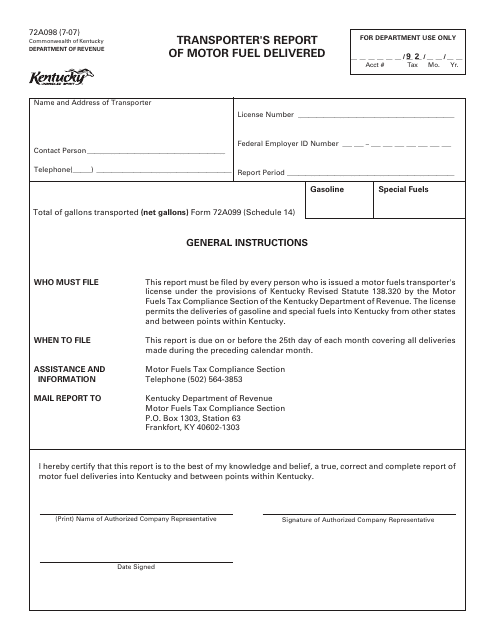

This Form is used for reporting the delivery of motor fuel by transporters in the state of Kentucky.

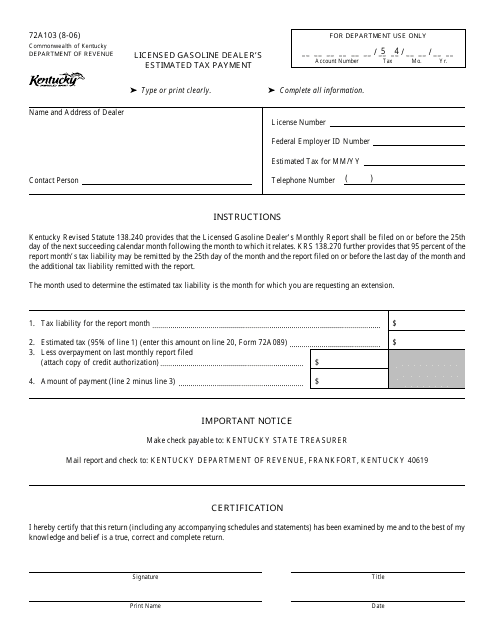

This form is used for licensed gasoline dealers in Kentucky to make estimated tax payments.

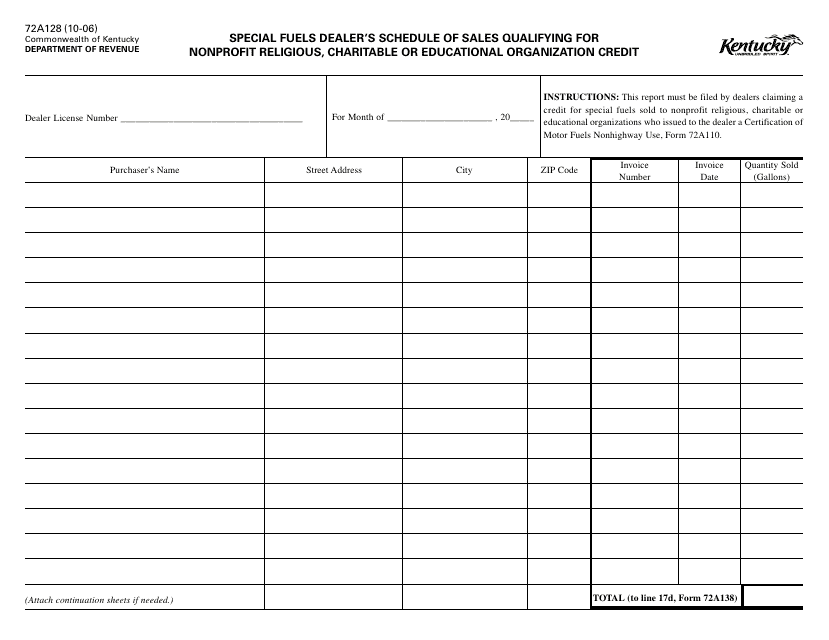

This form is used by special fuels dealers in Kentucky to report their sales that qualify for the nonprofit religious, charitable, or educational organization credit.