Kentucky Department of Revenue Forms

Documents:

318

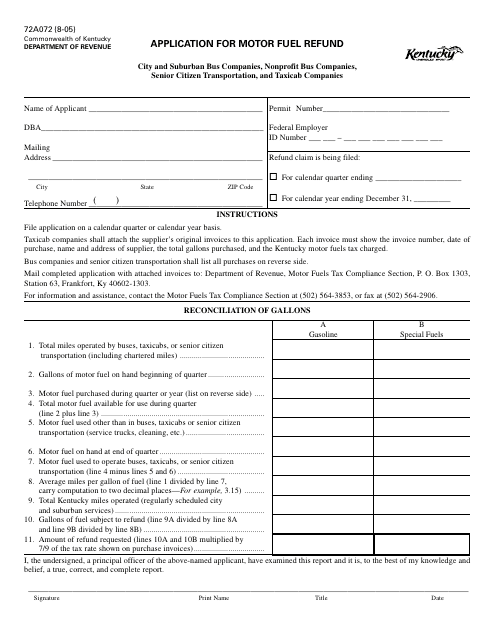

This form is used for applying for a motor fuel refund in Kentucky.

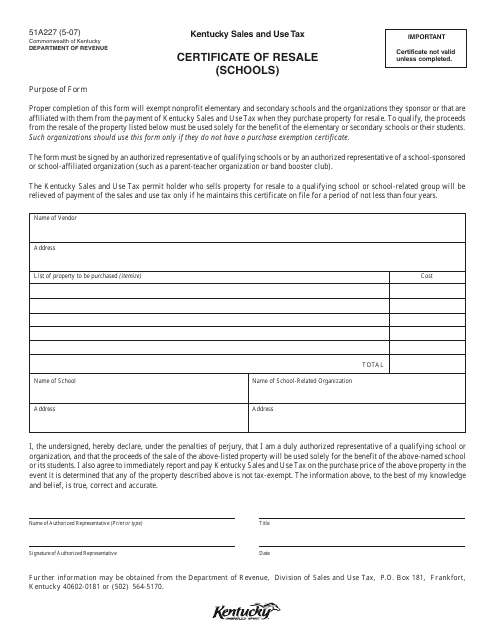

This document is used for schools in Kentucky to certify their resale status for tax purposes.

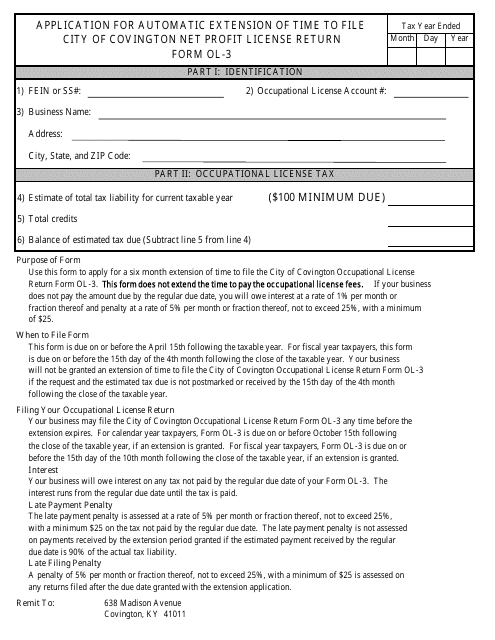

This form is used for requesting an automatic extension of time to file the Net Profit License Return form in the City of Covington, Kentucky.

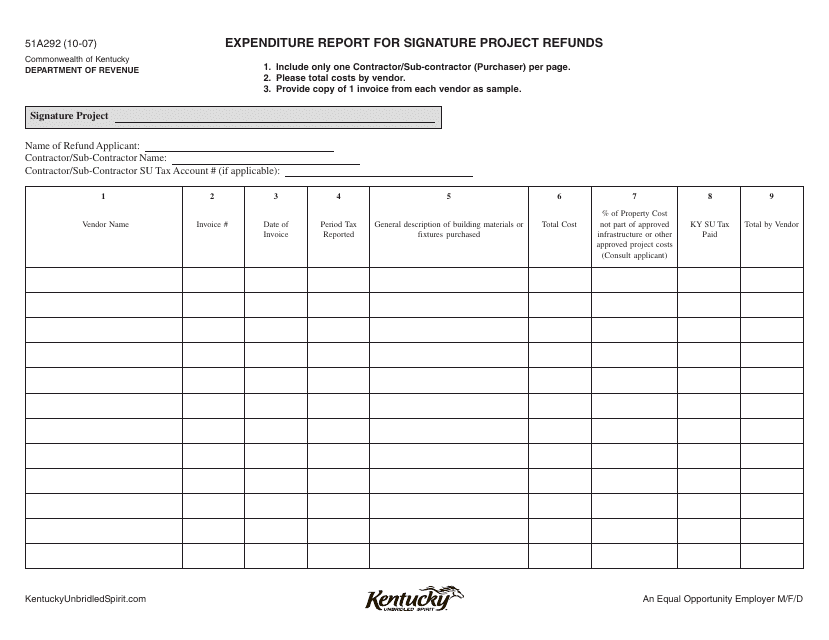

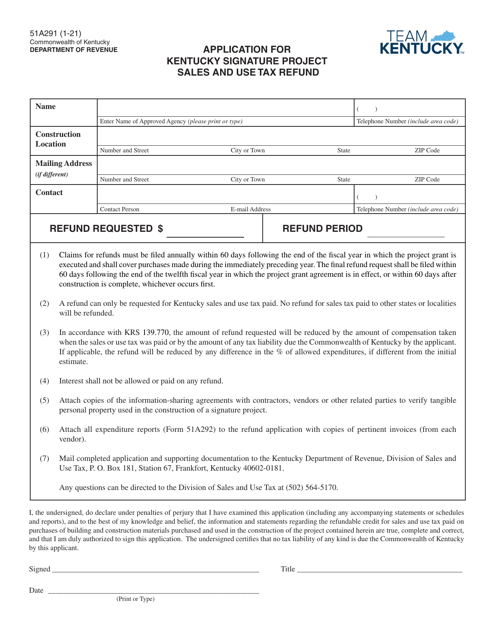

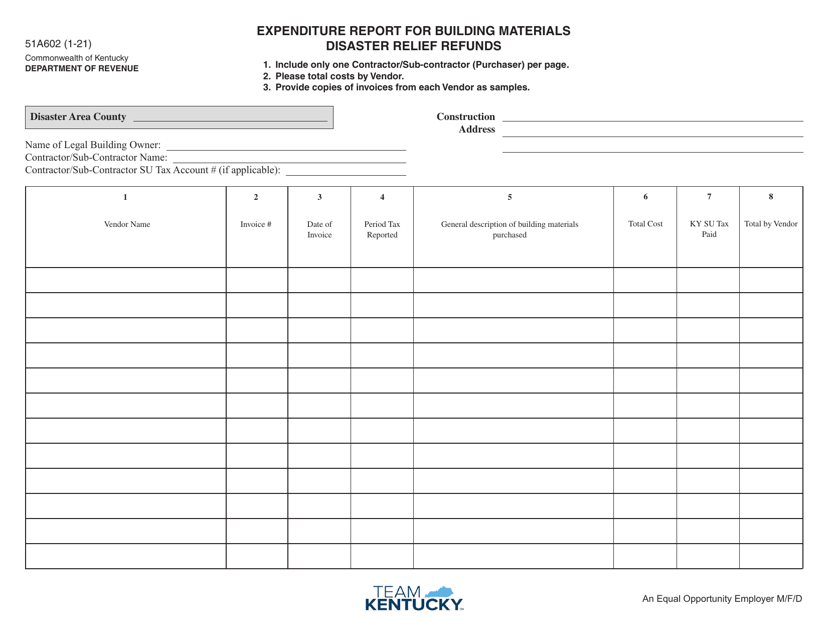

This form is used for reporting expenditures related to signature project refunds in the state of Kentucky.

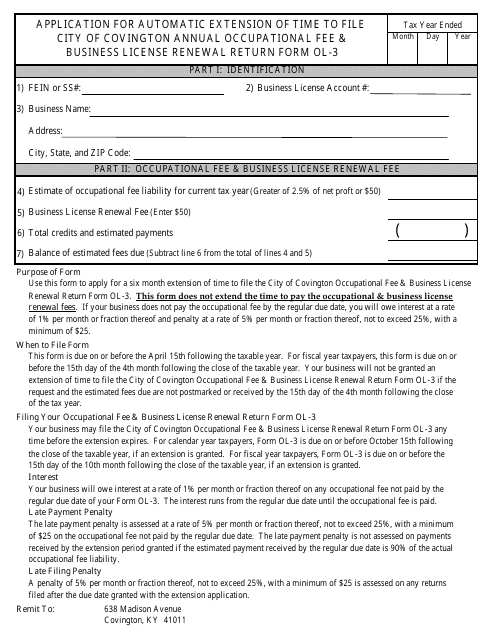

This form is used for requesting an automatic extension of time to file the City of Covington Annual Occupational Fee & Business License Renewal Return (Form Ol-3) in Covington, Kentucky.

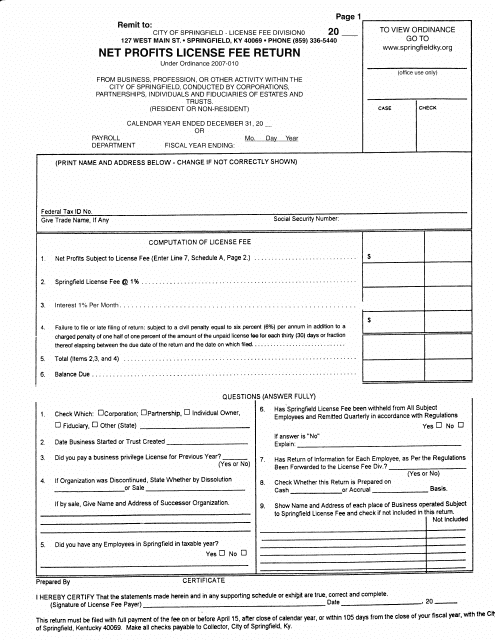

This form is used for reporting and paying the license fee on net profits in the City of Springfield, Kentucky.

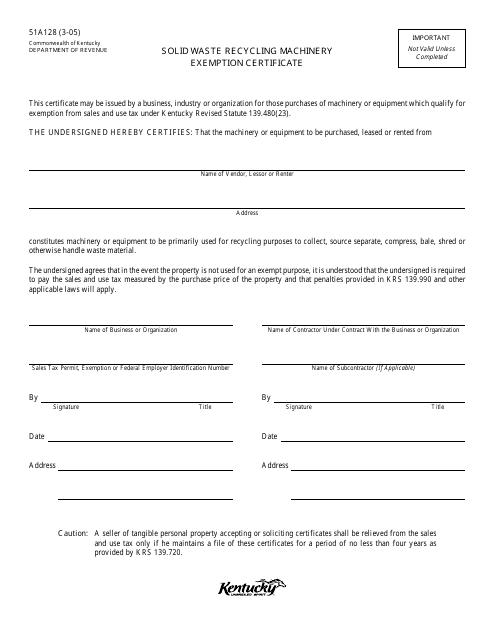

This document provides an exemption certificate for solid waste recycling machinery in the state of Kentucky. It confirms that the machinery is exempt from certain taxes or fees.

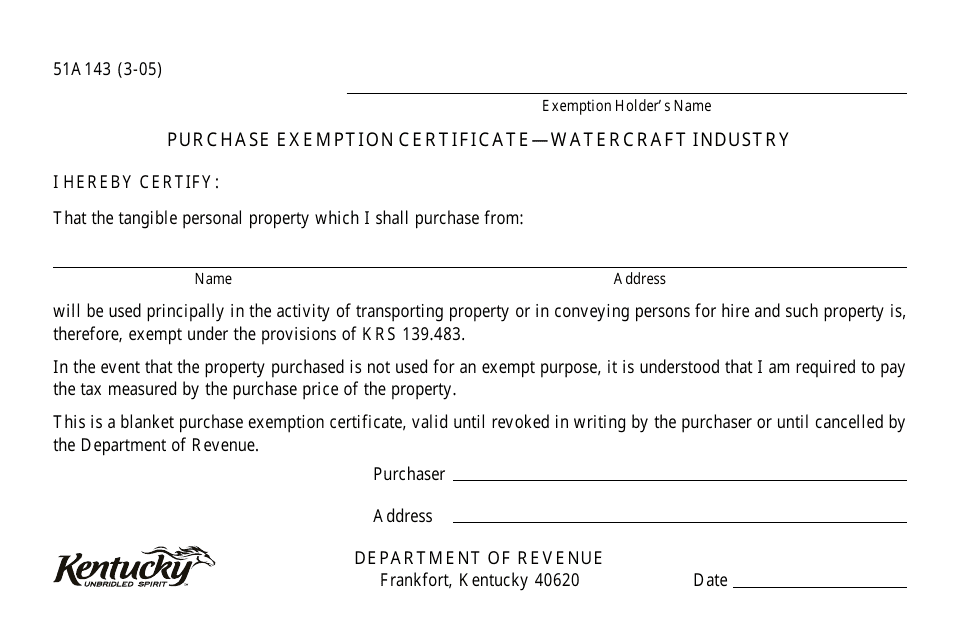

This Form is used for applying for a purchase exemption certificate in Kentucky for the watercraft industry.

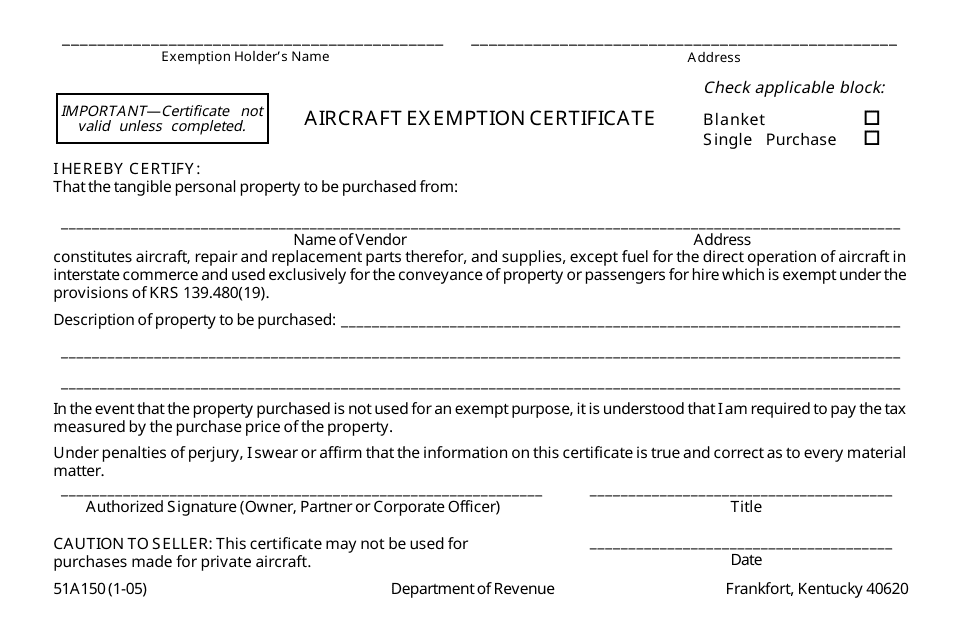

This document is used to apply for an exemption certificate for aircraft in the state of Kentucky.

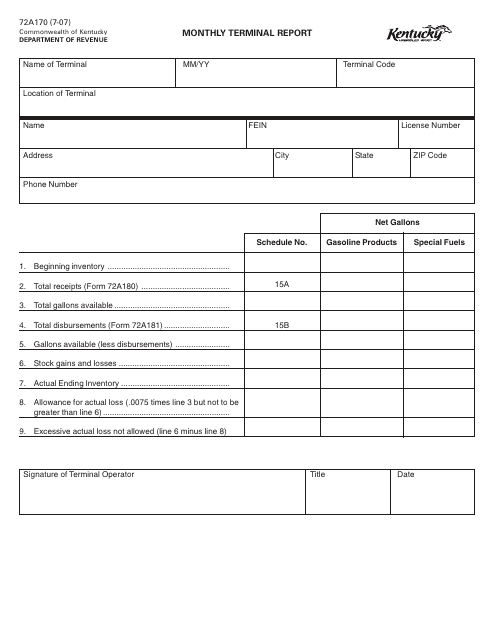

This form is used for submitting a monthly terminal report in Kentucky. It contains information about the terminal's operations and transactions for that month.

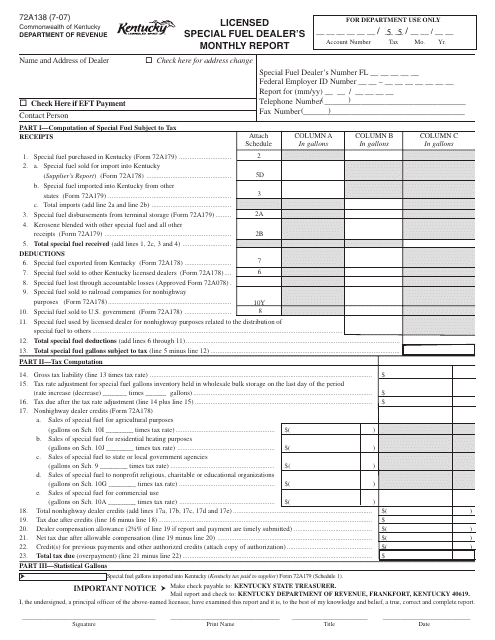

This document is used for licensed special fuel dealers in Kentucky to report on their monthly activities. It helps monitor and regulate the sale and use of special fuels in the state.

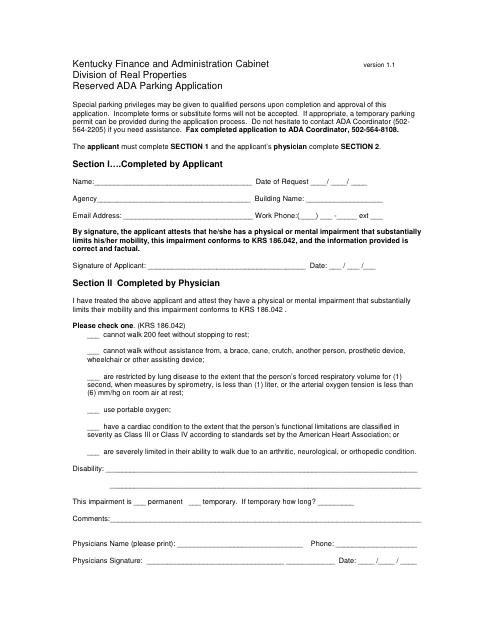

This form is used for applying for a reserved parking spot for individuals with disabilities in the state of Kentucky.

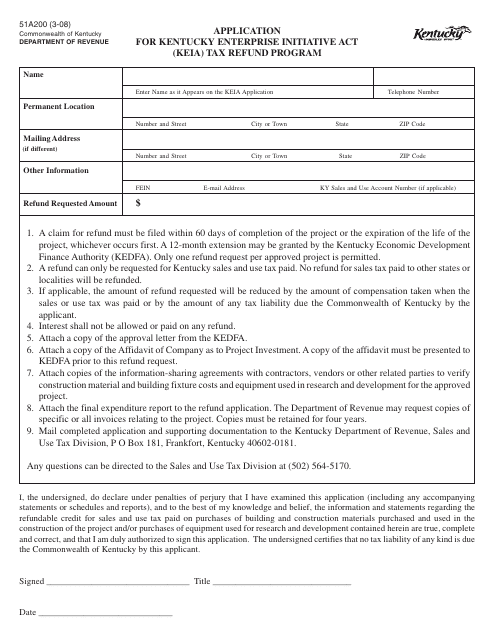

This form is used for applying for the Kentucky Enterprise Initiative Act (Keia) Tax Refund Program in Kentucky.

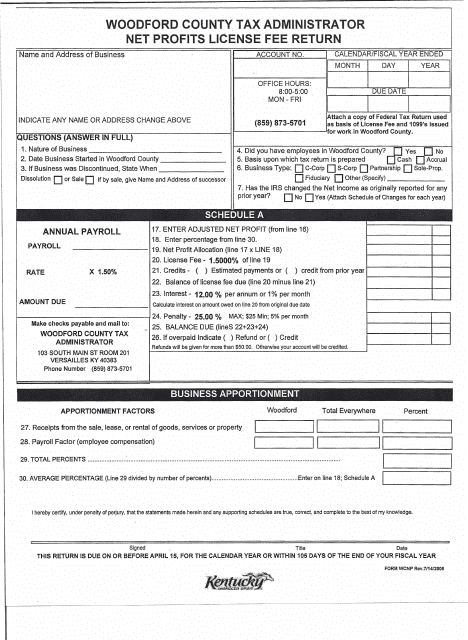

This form is used for reporting and paying the net profits license fee in Woodford County, Kentucky.

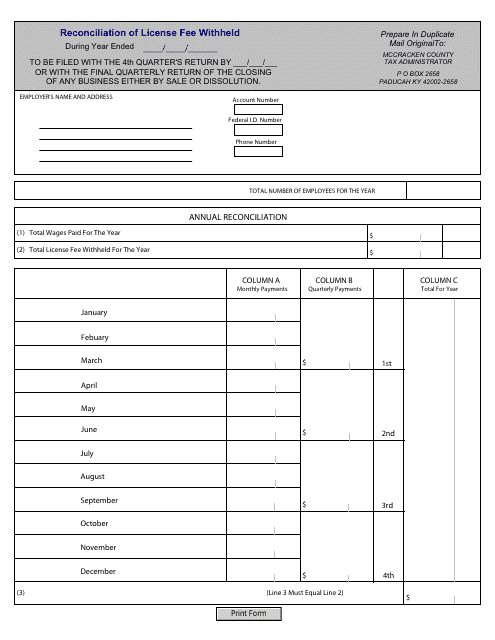

This type of document is used for reconciling license fees withheld in McCracken County, Kentucky.

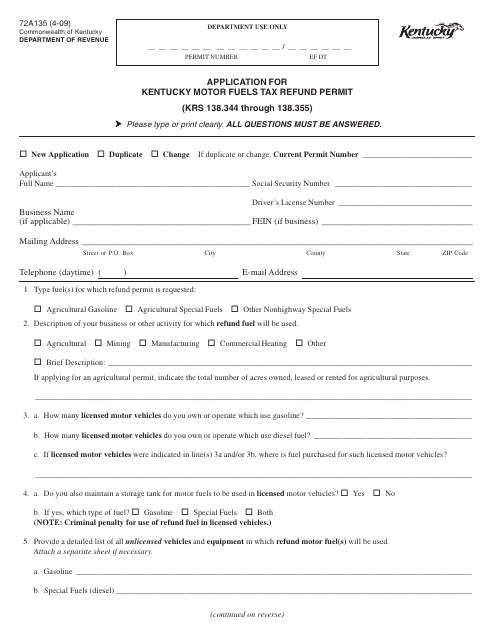

This form is used for applying for a Kentucky Motor Fuels Tax Refund Permit, which allows individuals or businesses to request a refund for taxes paid on motor fuels in Kentucky.

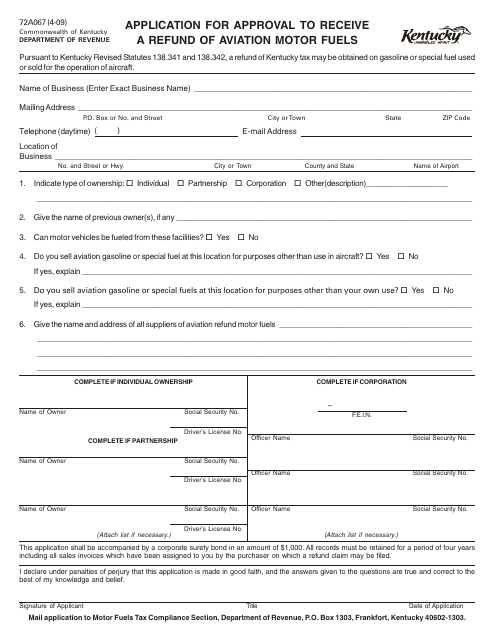

This form is used for applying to receive a refund of aviation motor fuels in the state of Kentucky.

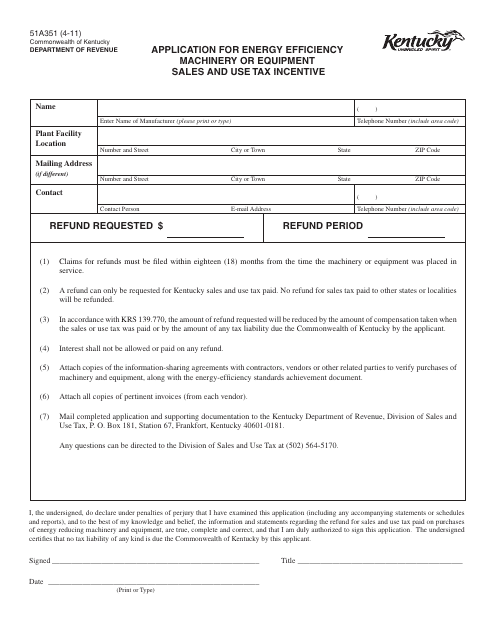

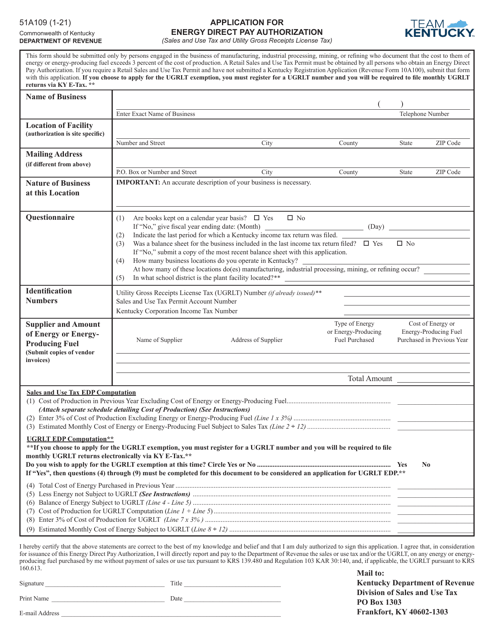

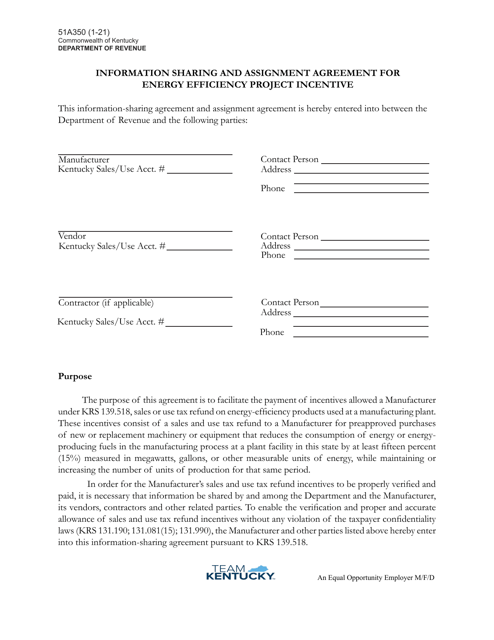

This form is used for applying for the Energy Efficiency Machinery or Equipment Sales and Use Tax Incentive in the state of Kentucky.

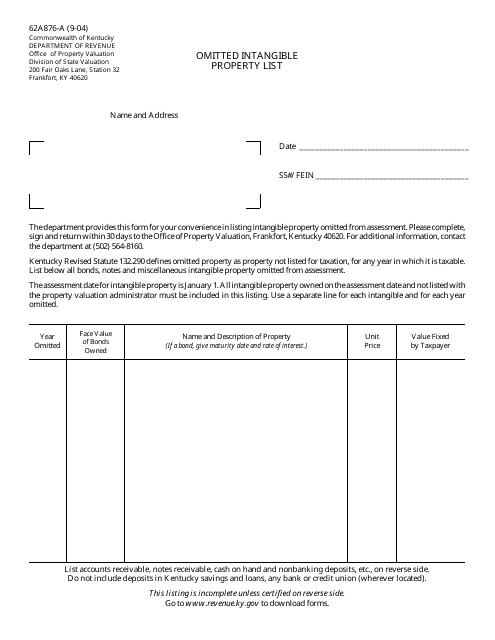

This Form is used for reporting omitted intangible property in the state of Kentucky.

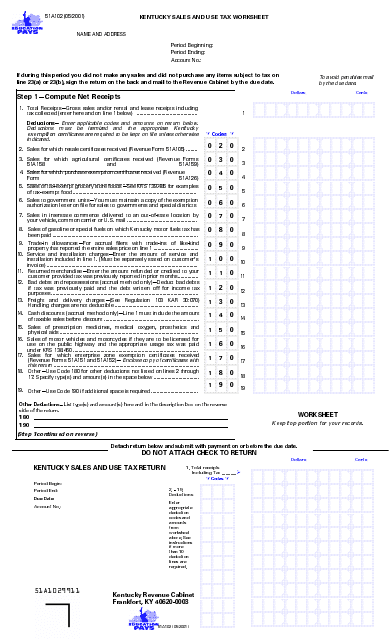

This Form is used for calculating sales and use tax in the state of Kentucky. It helps individuals and businesses determine the amount of tax owed based on their sales and use of taxable items.

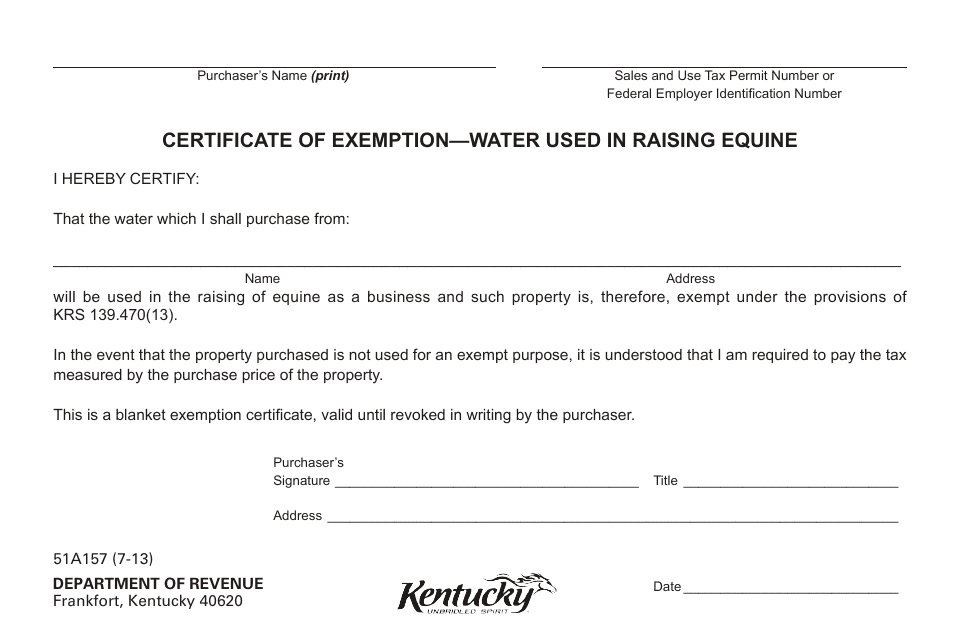

This form is used for applying for a Certificate of Exemption to exempt the water used in raising equine from the water withdrawal reporting requirements in Kentucky.

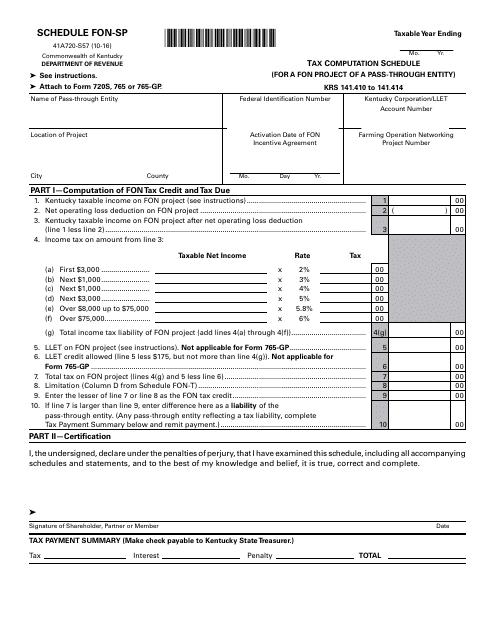

This Form is used for calculating tax for a Fon project of a pass-through entity in Kentucky.

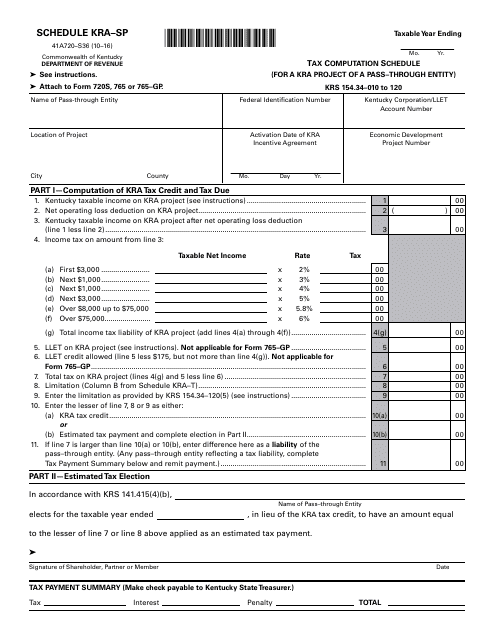

This Form is used for tax computation for a Kra project of a pass-through entity in Kentucky.

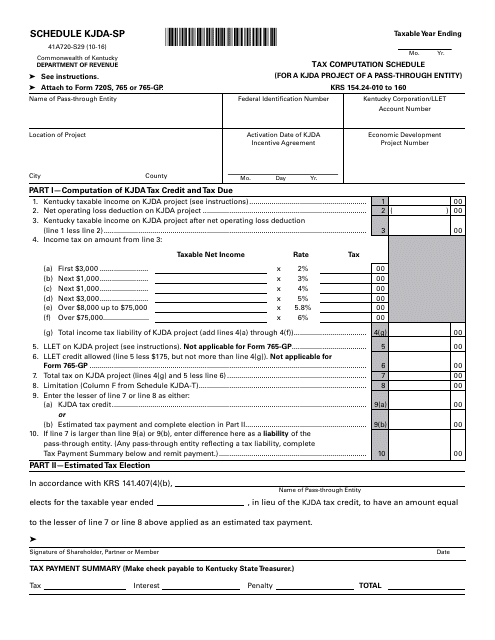

This Form is used for calculating the tax for a specific type of project in Kentucky that is owned by a pass-through entity.

This document is used for tracking schedules for a Kjda Project in Kentucky.

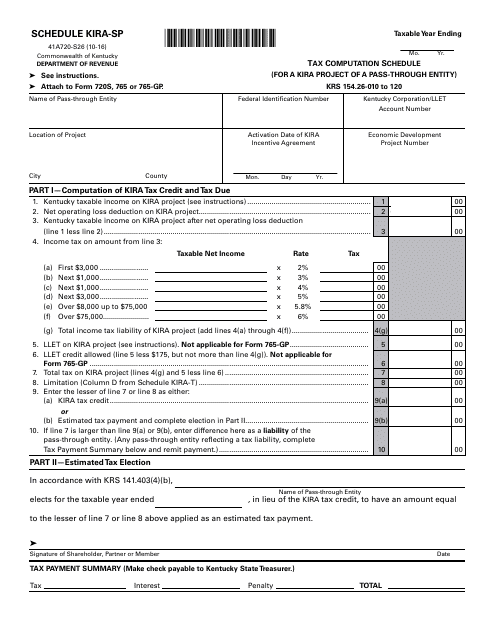

This form is used for calculating and reporting taxes for a Kira Project of a pass-through entity in Kentucky.

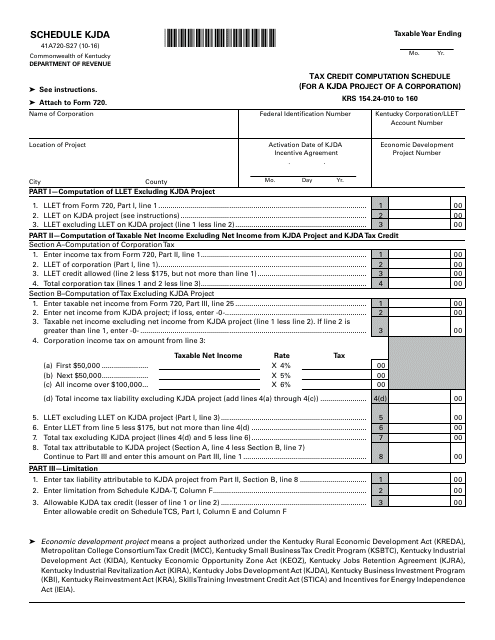

This form is used for calculating tax credits for a KJDA project of a corporation in Kentucky.

This form is used for tracking schedules related to a Kira project in the state of Kentucky.

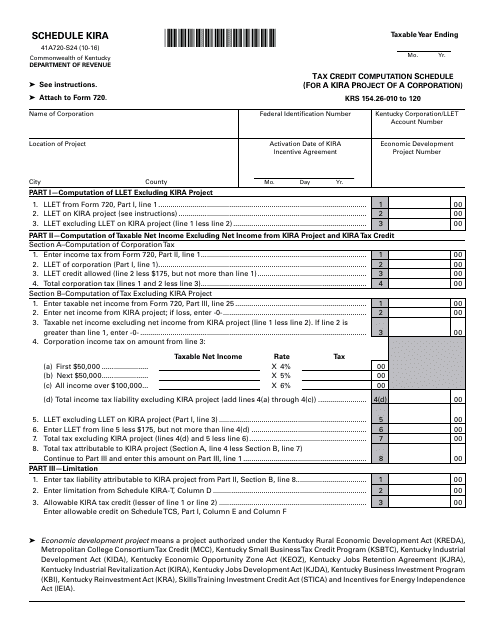

This form is used for calculating tax credits for a Kira project of a corporation in Kentucky.

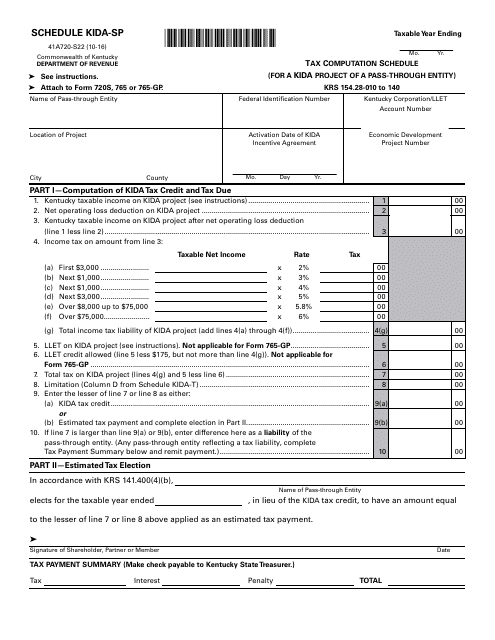

This Form is used for calculating tax for a Kida project of a pass-through entity in Kentucky.

This Form is used for tracking a Kida Project in Kentucky.

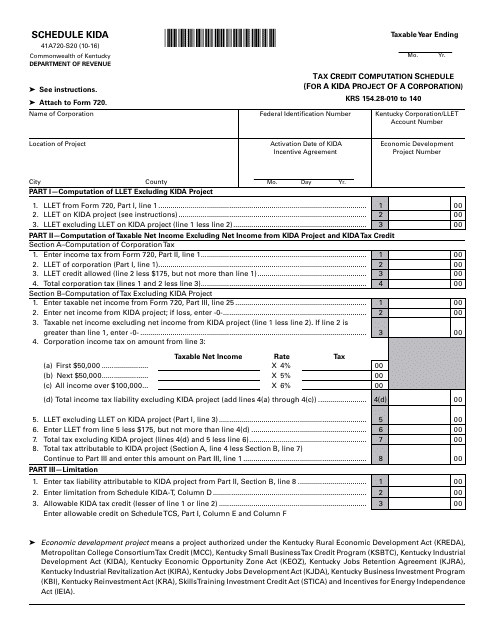

This form is used for calculating tax credits for a KIDA project of a corporation in Kentucky.

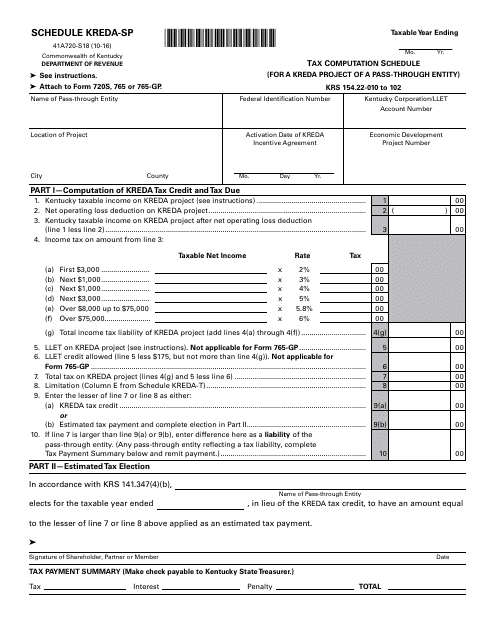

This form is used for calculating tax for a Kreda project of a pass-through entity in Kentucky.

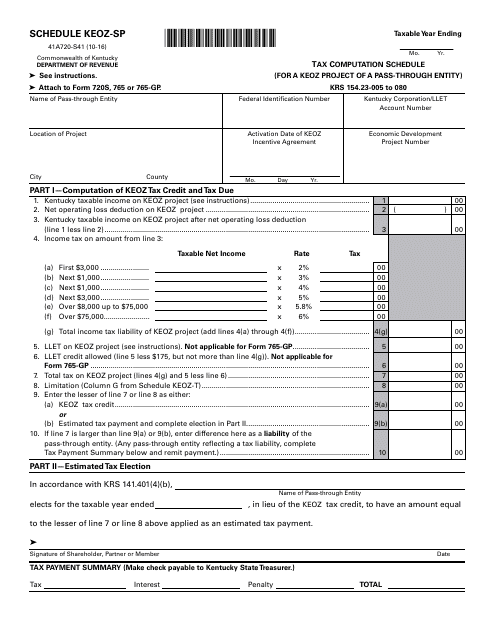

This document is used for calculating the tax for a Keoz project of a pass-through entity in the state of Kentucky.