Kentucky Department of Revenue Forms

The Kentucky Department of Revenue is responsible for administering and enforcing various tax laws and regulations in the state of Kentucky. This department collects and manages taxes, such as income tax, sales tax, property tax, and motor fuel tax, among others. Its main objective is to ensure compliance with tax laws and to provide support and assistance to taxpayers in understanding and fulfilling their tax obligations.

Documents:

318

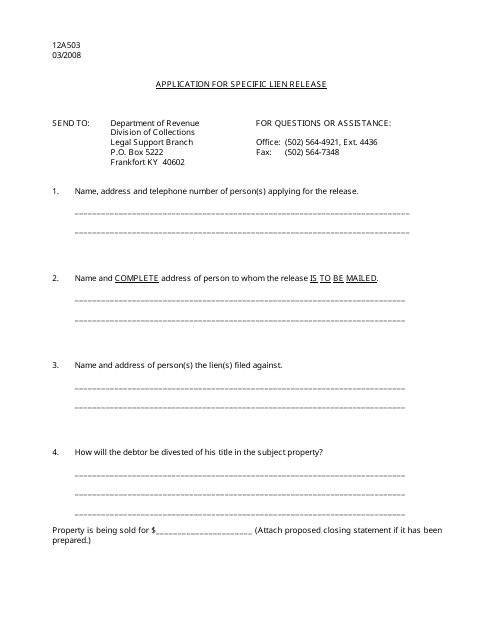

This form is used for applying for a specific lien release in the state of Kentucky.

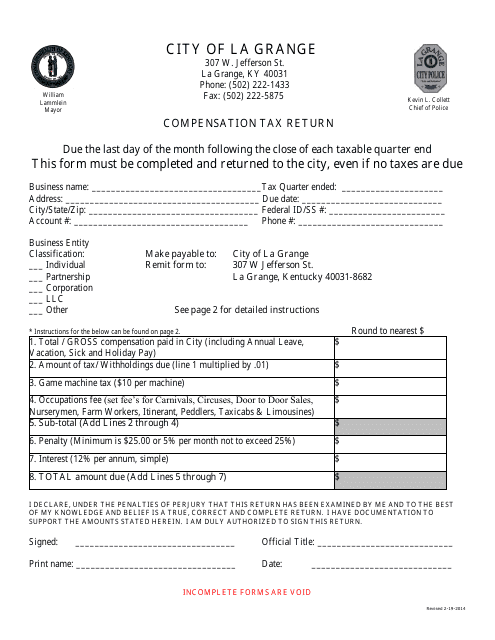

This document is used for reporting compensation tax returns to the City of La Grange, Kentucky.

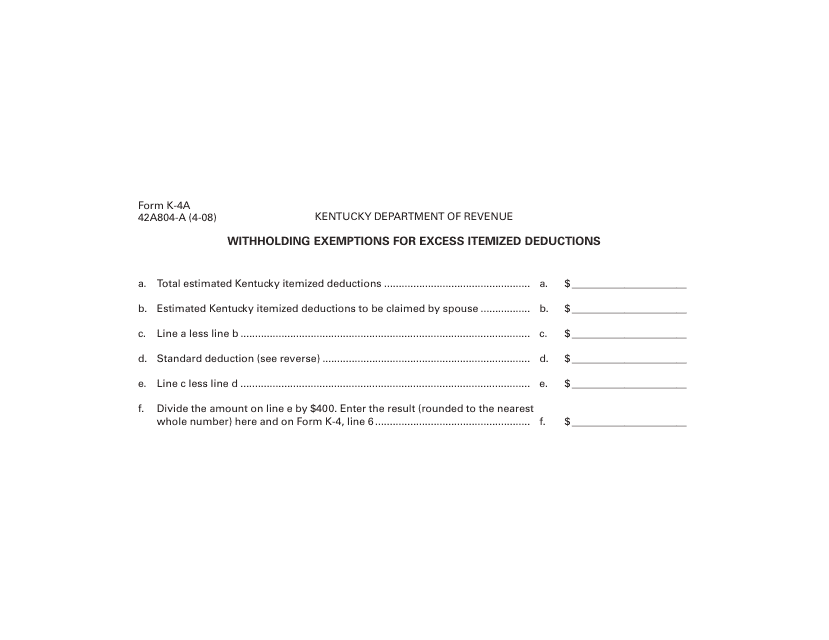

This form is used for claiming withholding exemptions for excess itemized deductions in the state of Kentucky.

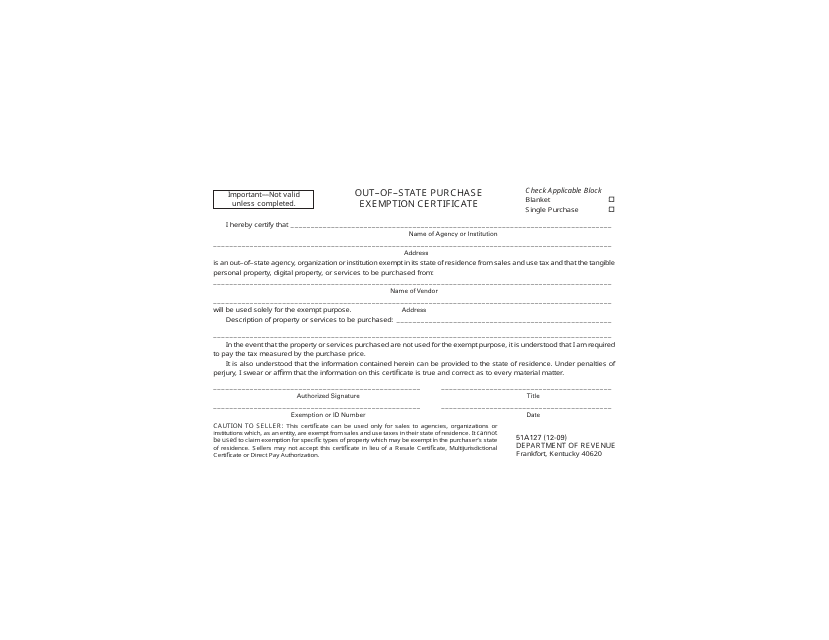

This form is used for claiming an exemption from paying sales tax on out-of-state purchases in Kentucky.

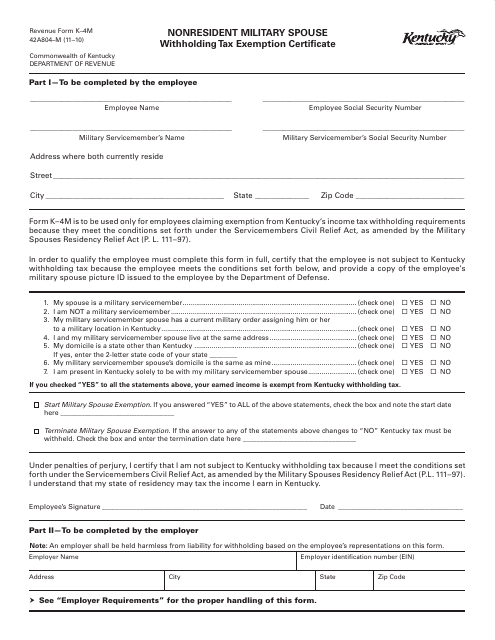

This form is used for nonresident military spouses to claim a withholding tax exemption in Kentucky.

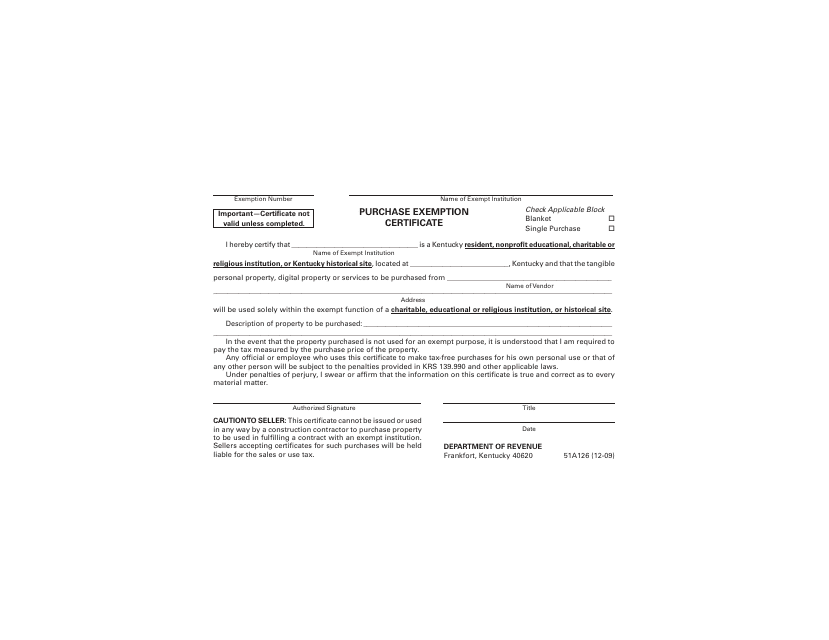

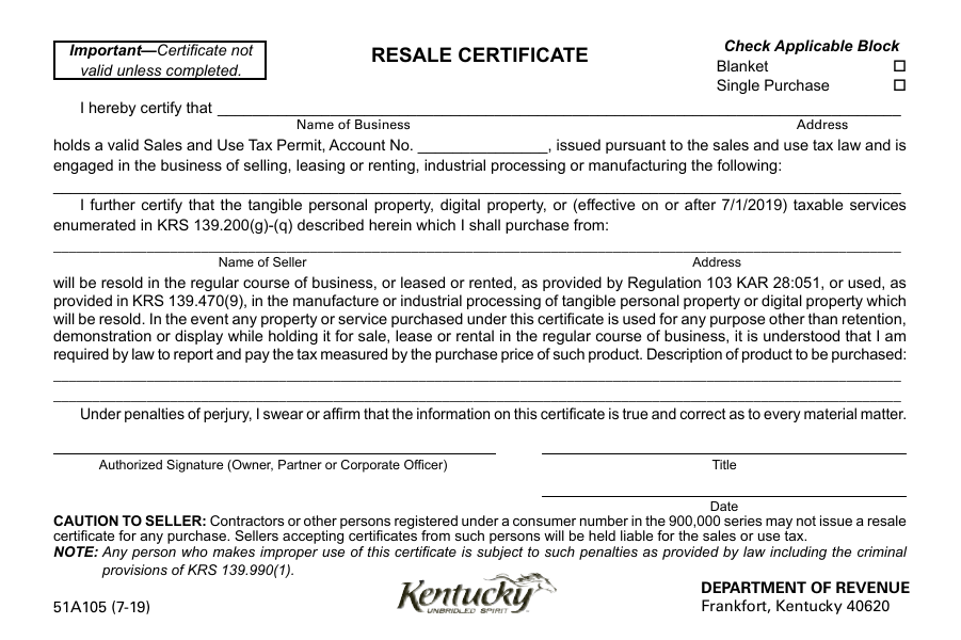

This form is used for requesting a purchase exemption certificate in the state of Kentucky. It allows individuals or businesses to claim an exemption from paying sales tax on specified purchases.

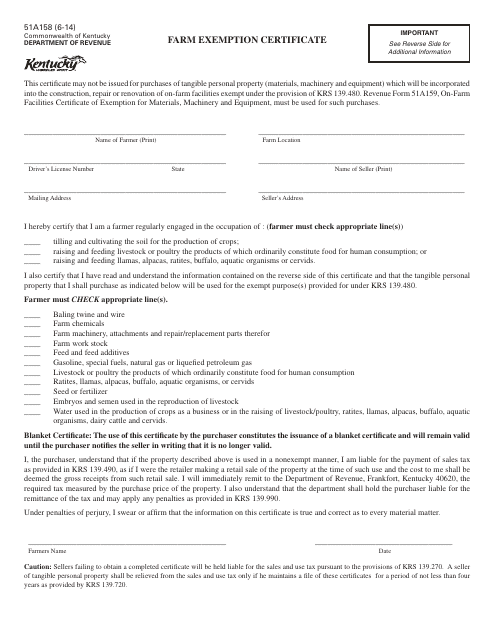

This form is used for claiming a farm exemption in the state of Kentucky. It allows residents to exempt their agricultural properties from certain taxes or fees.

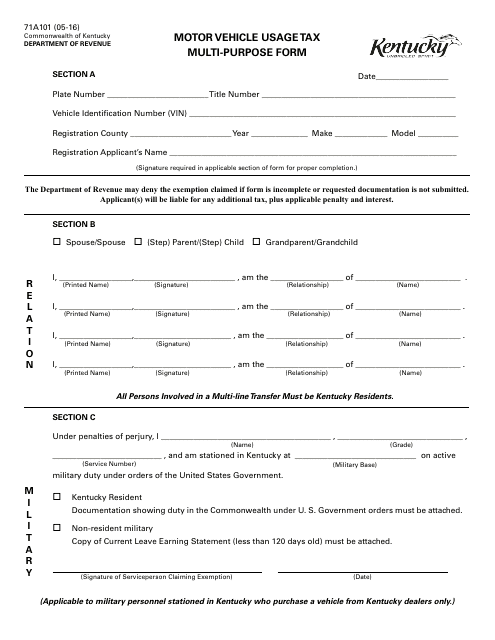

This form is used for reporting and paying motor vehicle usage tax in Kentucky. It is a multipurpose form that can be used for various purposes related to motor vehicle taxation.

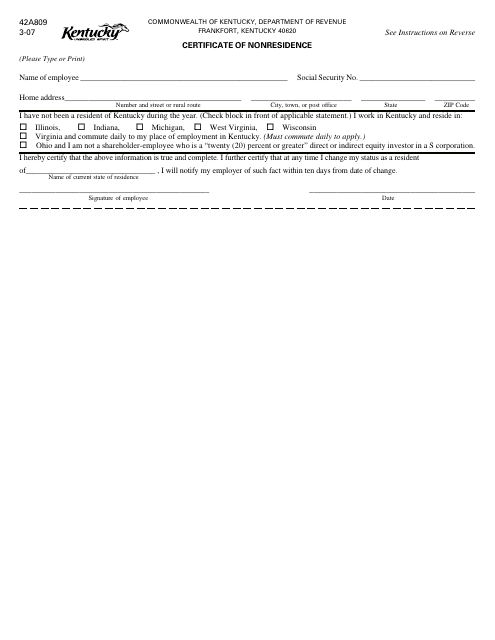

This document is used for obtaining a Certificate of Nonresidence in the state of Kentucky. It is typically required for individuals who are claiming nonresident status for tax or other purposes.

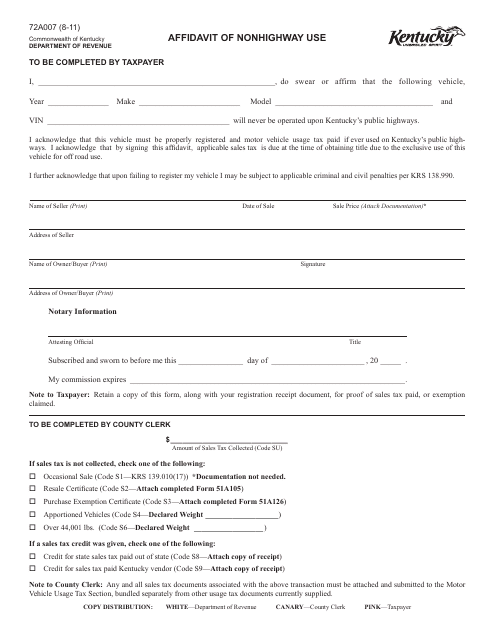

This form is used for declaring that a vehicle in Kentucky will not be used on public roadways.

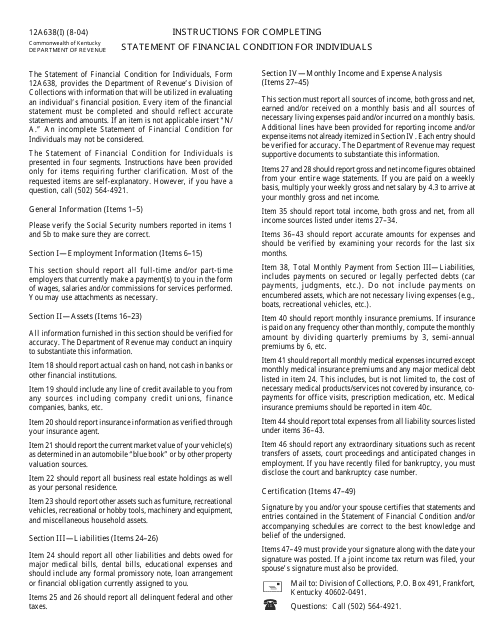

This Form is used for individuals in Kentucky to provide a statement of their financial condition.

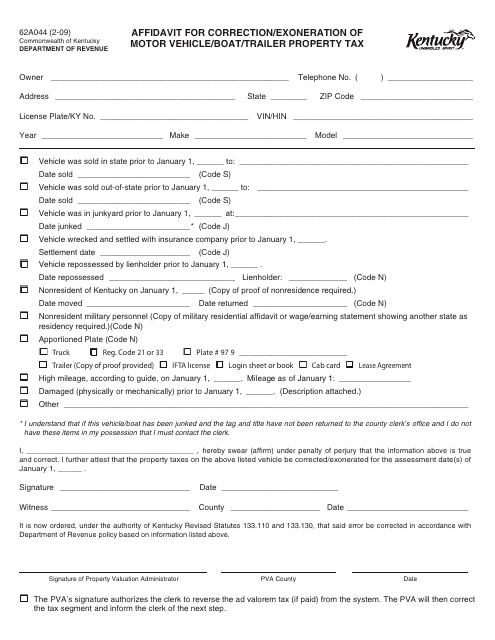

This form is used for correcting or requesting exemption from property tax for motor vehicles, boats, or trailers in Kentucky.

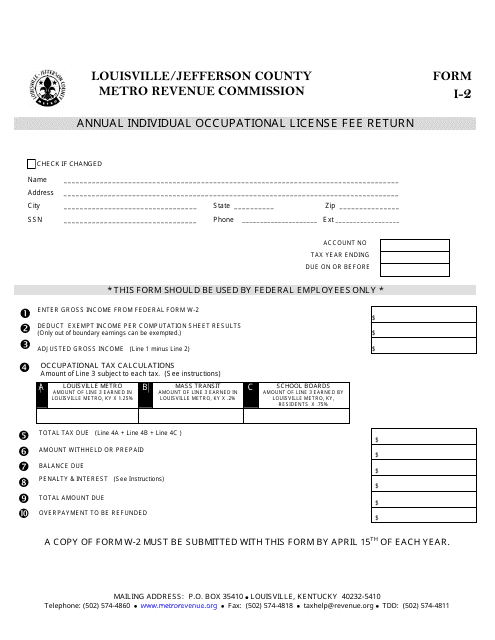

This form is used for reporting and paying the annual individual occupational license fee in Louisville/Jefferson County, Kentucky.

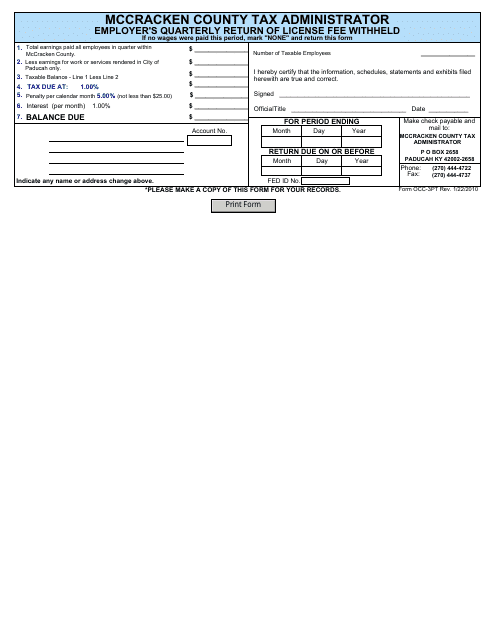

This form is used for employers in McCracken County, Kentucky to report and remit license fee withheld on a quarterly basis.

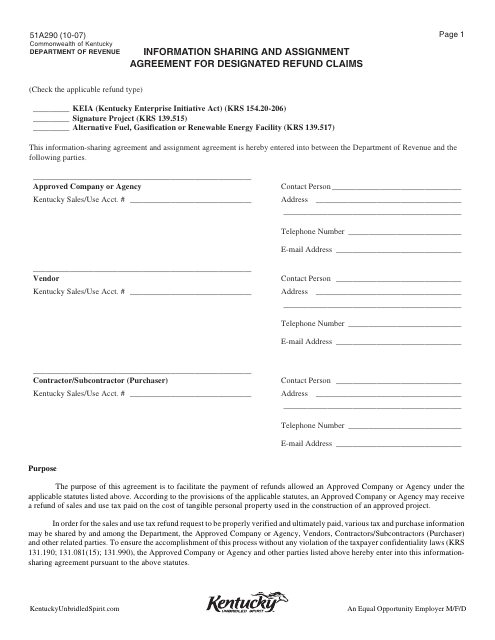

This form is used for sharing information and assigning refund claims in the state of Kentucky.

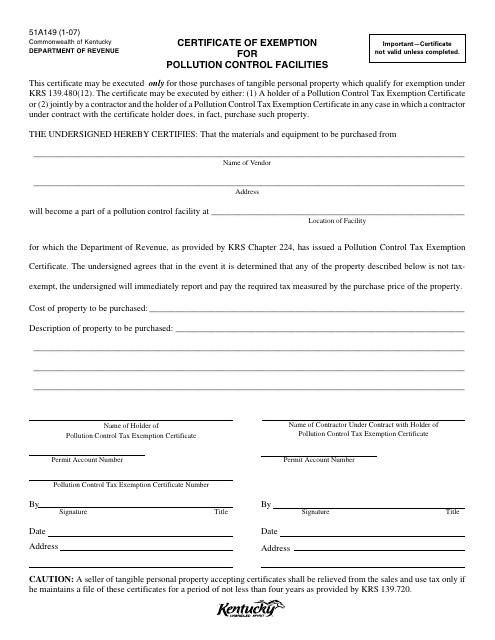

This document is a form used in Kentucky to apply for a certificate of exemption for pollution control facilities. It allows for an exemption from property tax for facilities that are used for pollution control purposes.

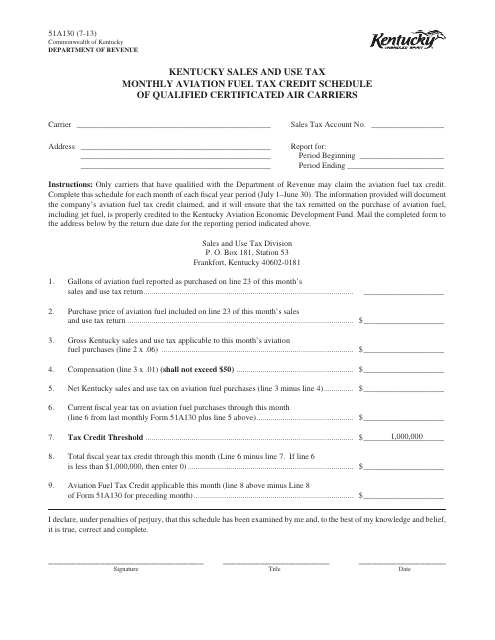

This Form is used for reporting monthly aviation fuel tax credits by qualified certificated air carriers in Kentucky.

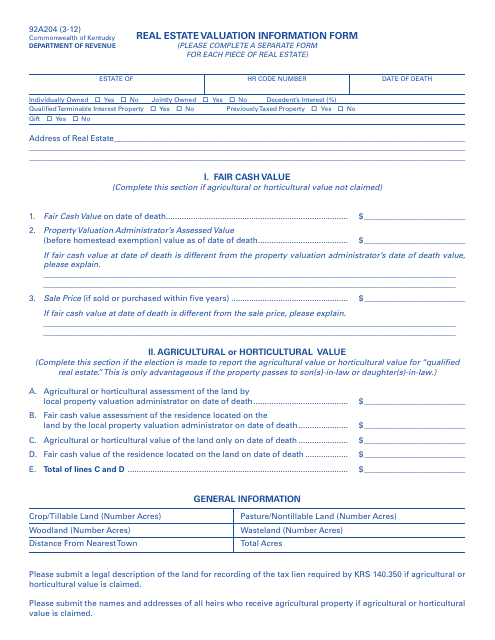

This form is used for providing real estate valuation information in the state of Kentucky.

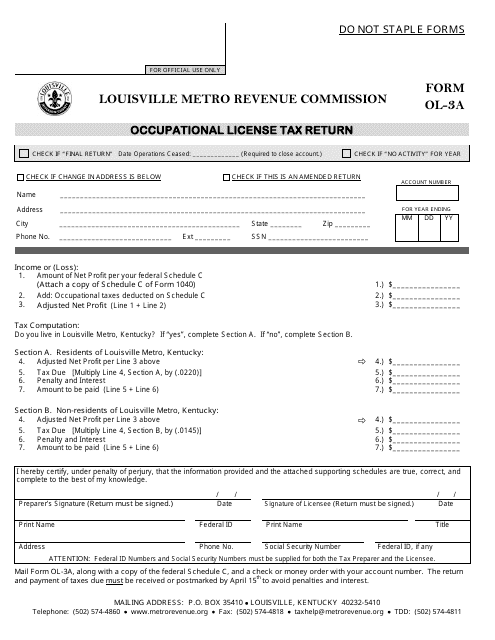

This form is used for filing the Occupational License Tax Return in Louisville, Kentucky.

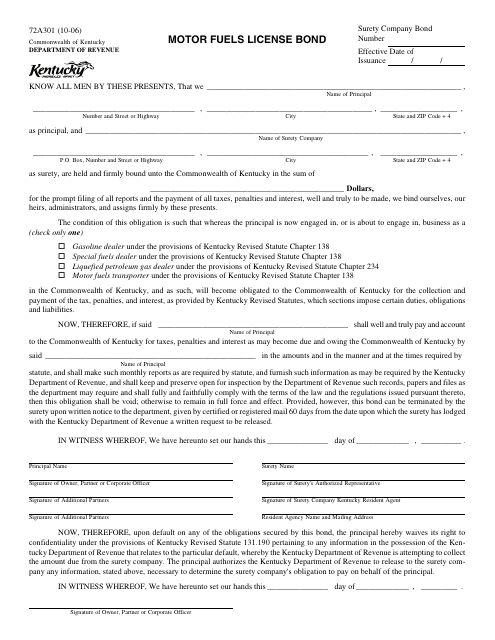

This Form is used for obtaining a motor fuels license bond in the state of Kentucky.

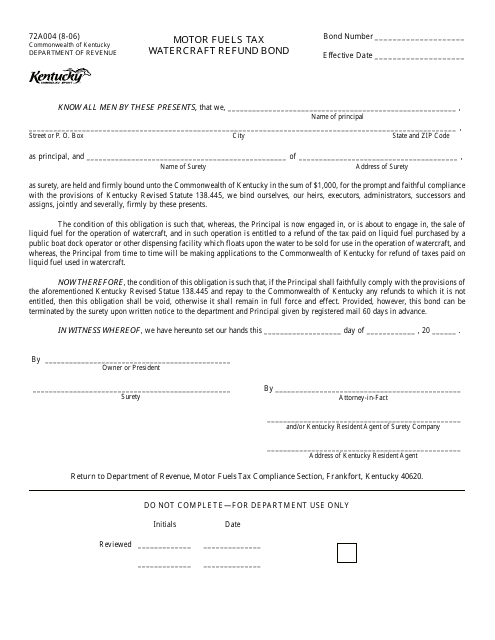

This Form is used for obtaining a refund bond for motor fuels tax paid on watercraft in Kentucky.

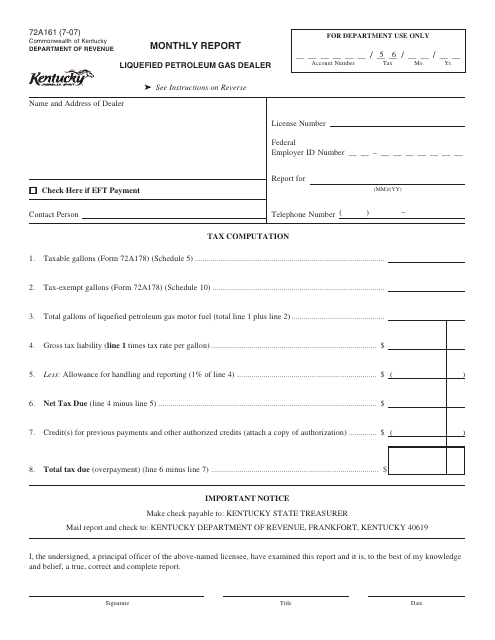

This form is used for monthly reporting by Liquefied Petroleum Gas Dealers in Kentucky.

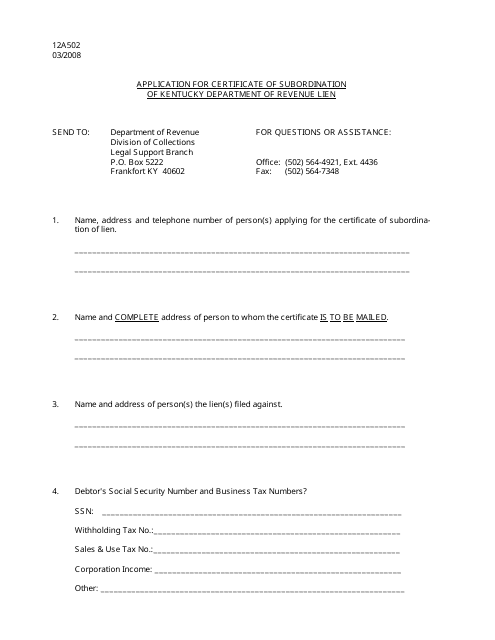

This form is used to apply for a Certificate of Subordination of a Kentucky Department of Revenue Lien in Kentucky.

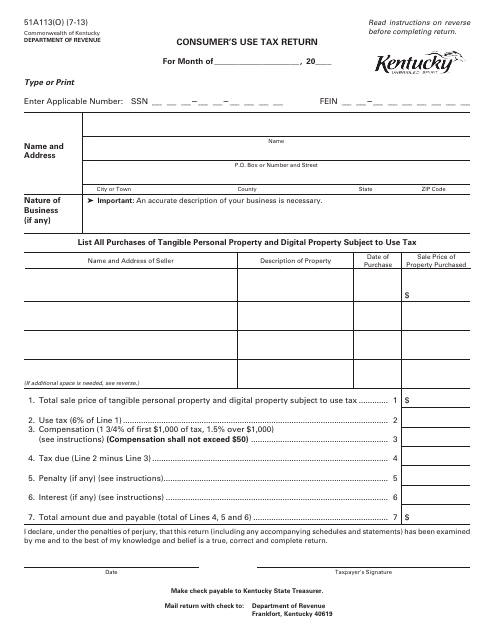

This Form is used for reporting and paying consumer's use tax in the state of Kentucky.

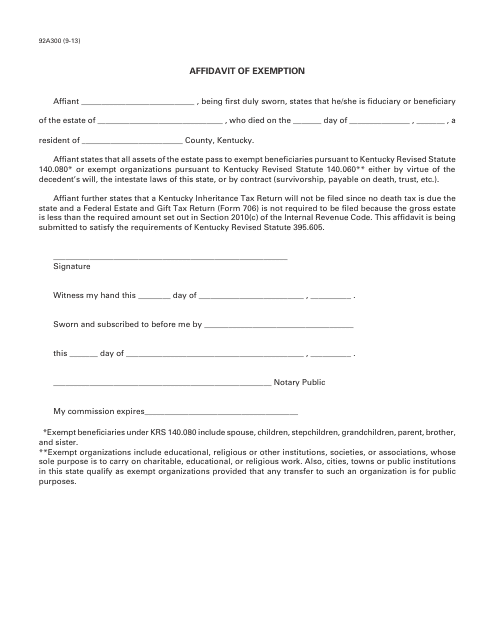

This form is used for claiming an exemption from certain fees or requirements in the state of Kentucky. It is an affidavit that must be completed and submitted to the appropriate authorities.

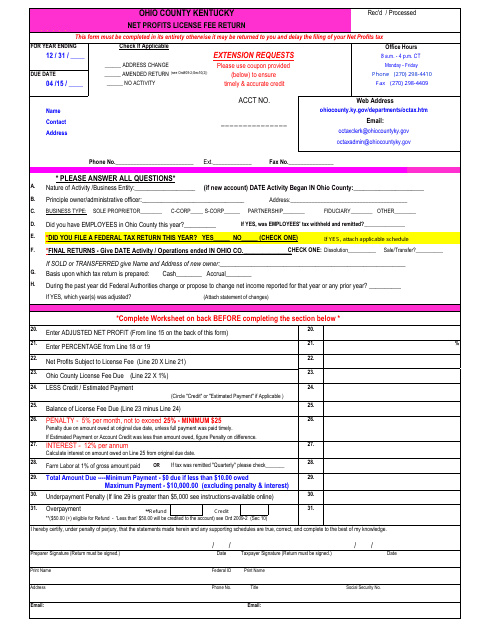

This Form is used for reporting and returning the license fee on net profits in Ohio County, Kentucky.

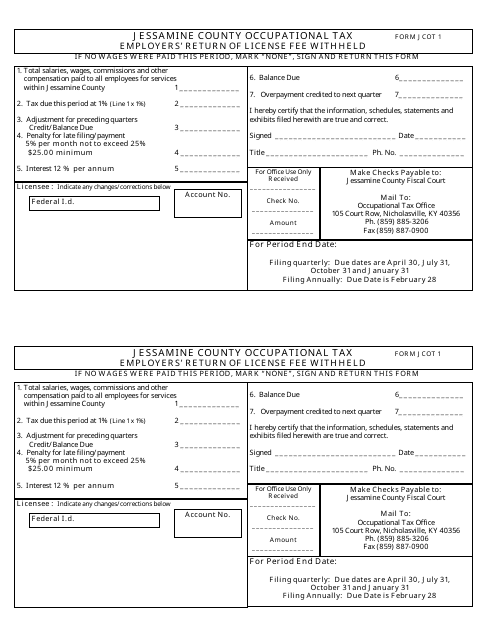

This form is used for employers in Jessamine County, Kentucky to report and remit the occupational tax withheld from their employees' license fees.

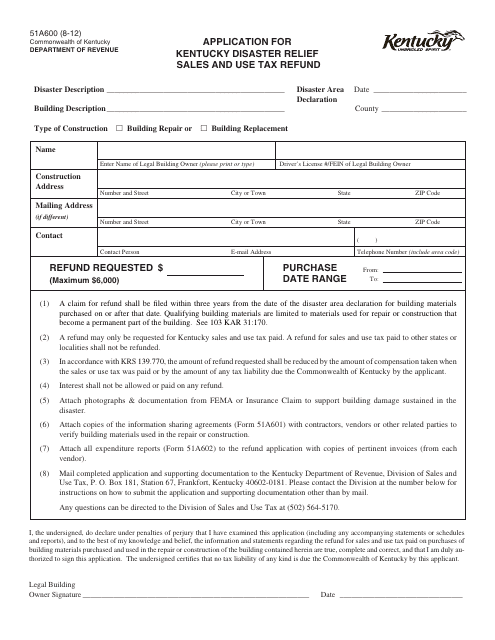

This Form is used for applying for Kentucky Disaster Relief Sales and Use Tax Refund in the state of Kentucky.

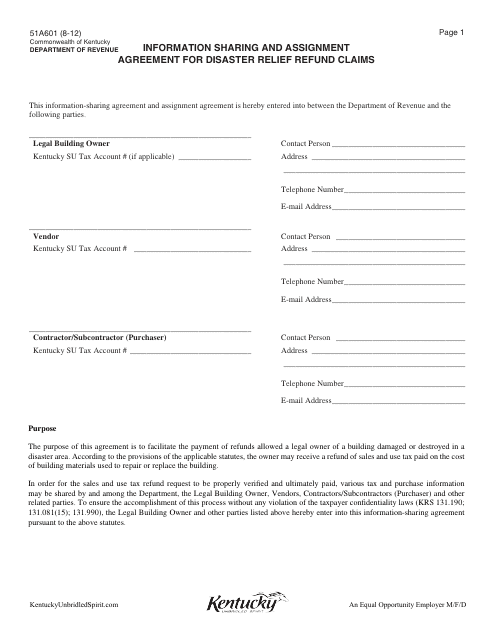

This form is used for sharing information and assigning responsibilities related to disaster relief refund claims in Kentucky.

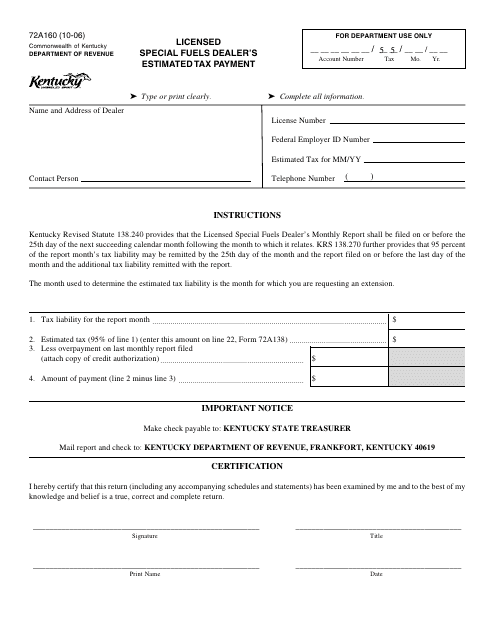

This form is used for licensed special fuels dealers in Kentucky to make estimated tax payments.

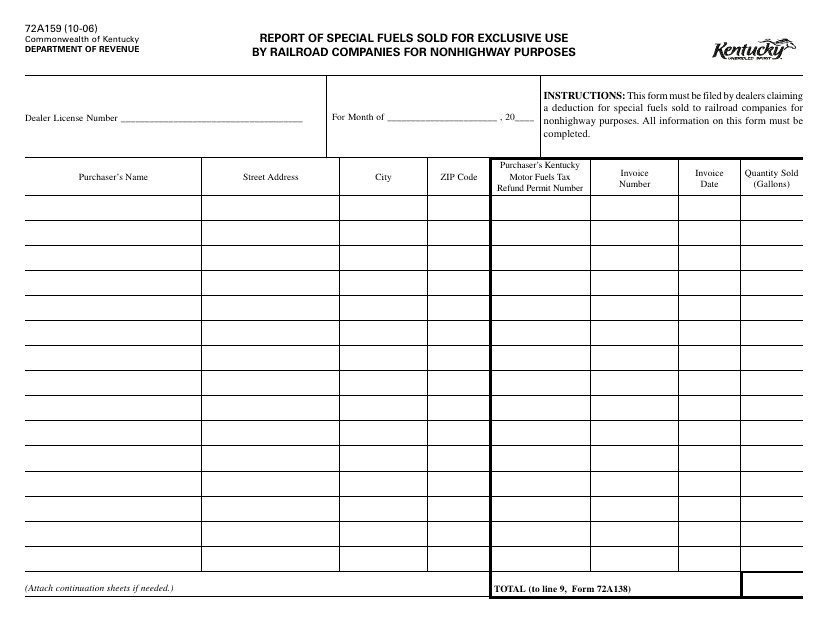

This form is used for reporting special fuels sold specifically for nonhighway purposes to railroad companies in Kentucky.

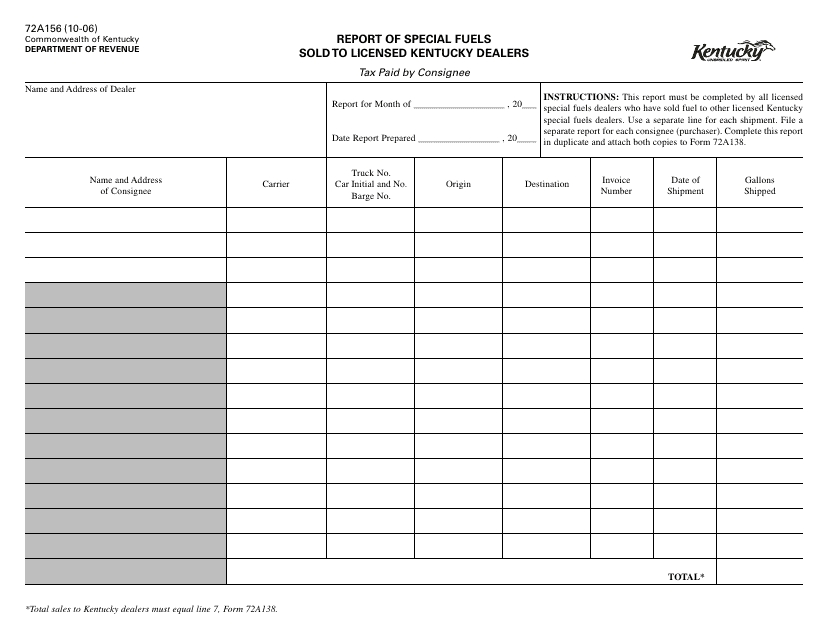

This form is used for reporting the sales of special fuels to licensed dealers in Kentucky.

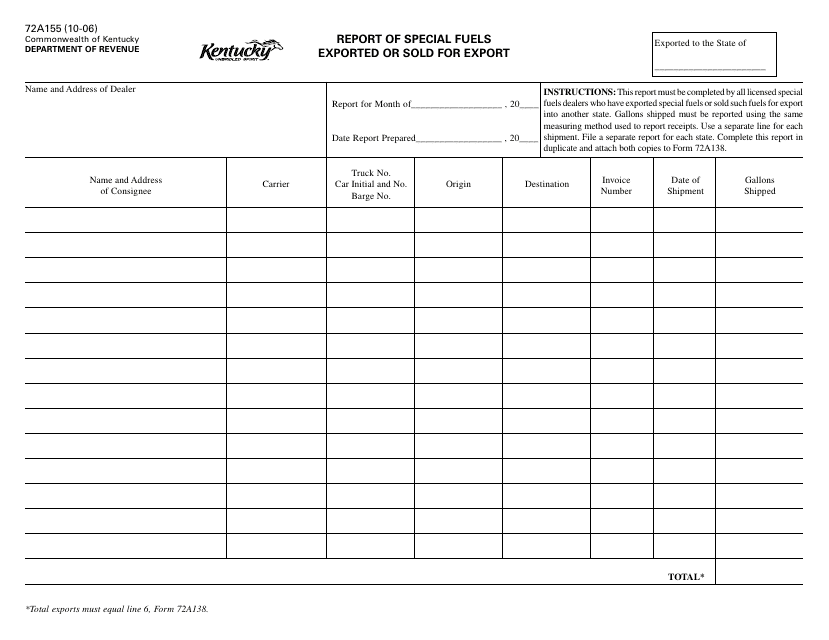

This form is used for reporting the export or sale for export of special fuels in the state of Kentucky.

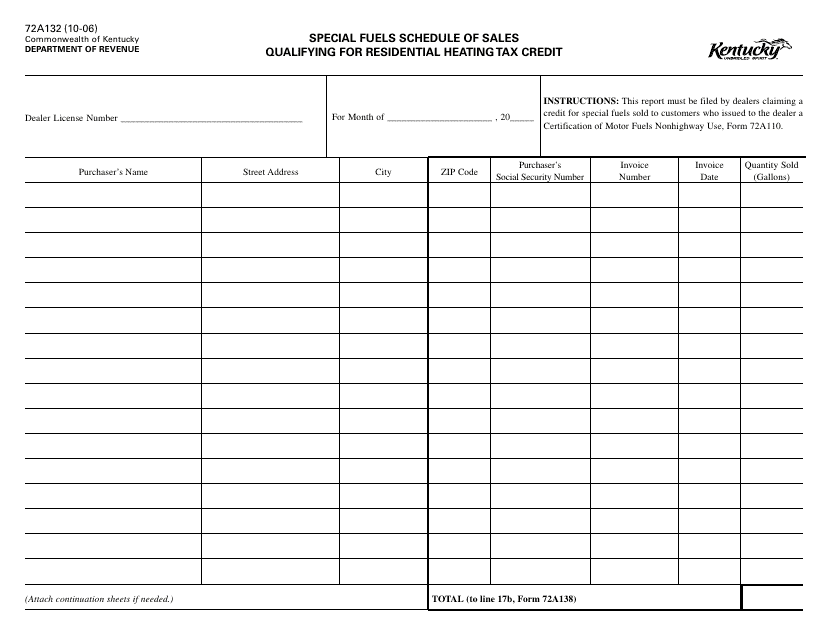

Form 72A132 Special Fuels Schedule of Sales Qualifying for Residential Heating Tax Credit - Kentucky

This form is used for reporting sales of special fuels that qualify for the residential heating tax credit in Kentucky.

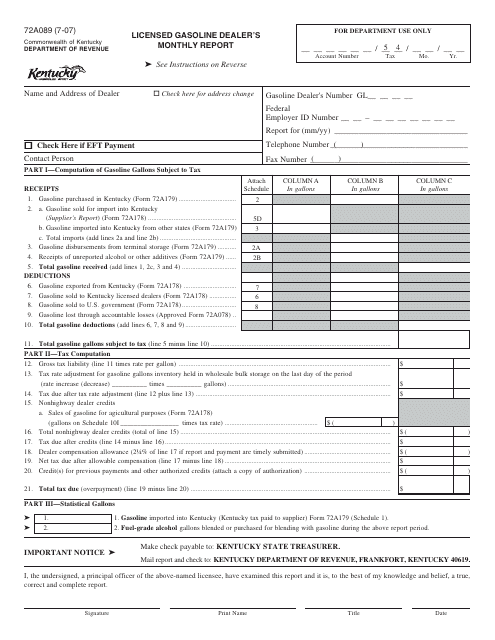

This Form is used for licensed gasoline dealers in Kentucky to report their monthly sales and inventory of gasoline.

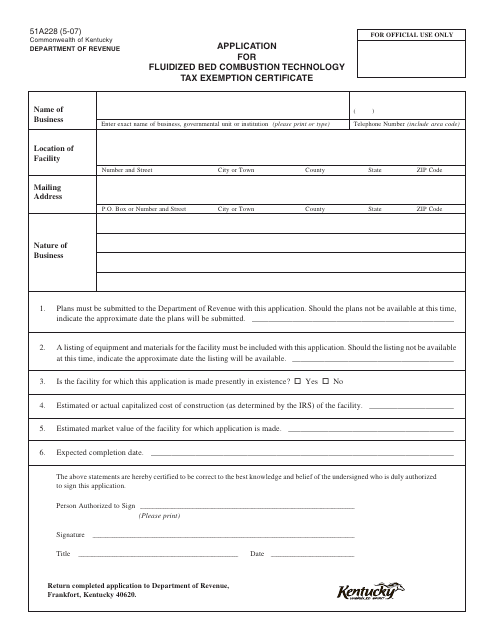

Form 51A228 Application for Fluidized Bed Combustion Technology Tax Exemption Certificate - Kentucky

This document is used for applying for a tax exemption certificate for Fluidized Bed Combustion Technology in Kentucky.

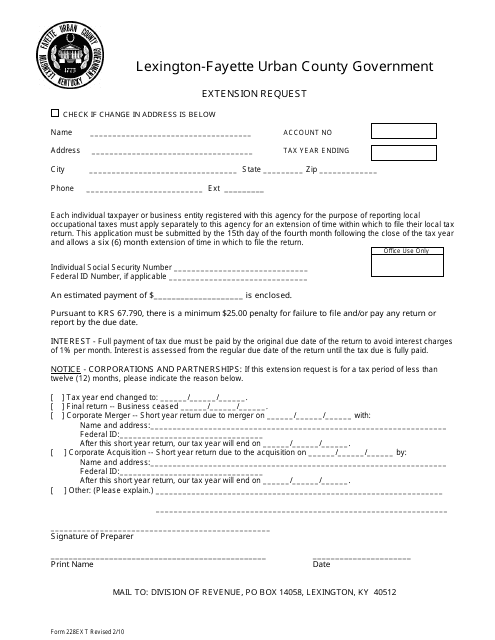

This Form is used for requesting an extension from the City of Lexington, Kentucky.

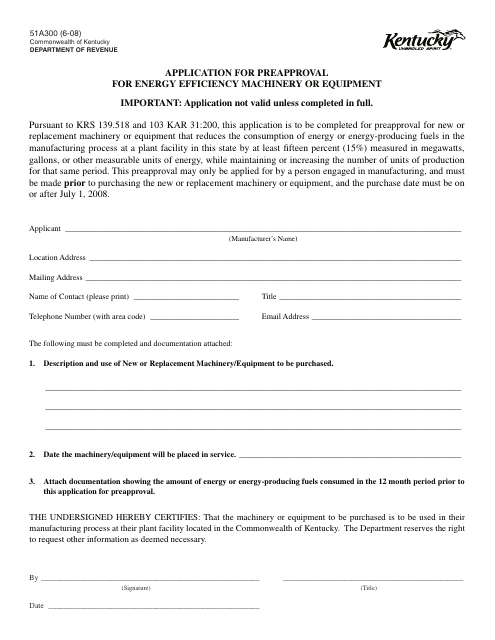

This form is used for applying for preapproval for energy efficiency machinery or equipment in the state of Kentucky.