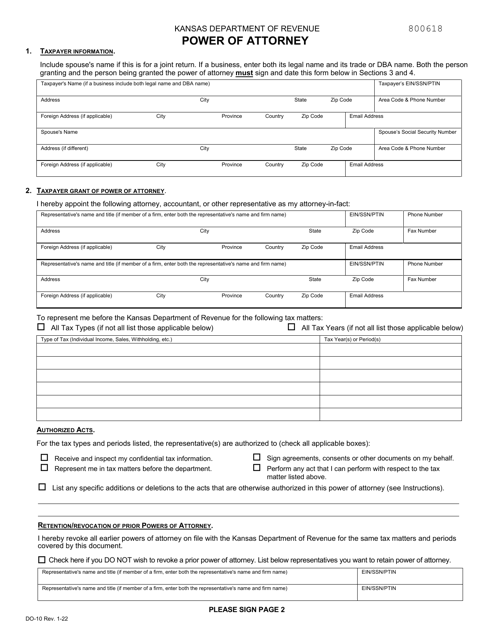

Kansas Department of Revenue Forms

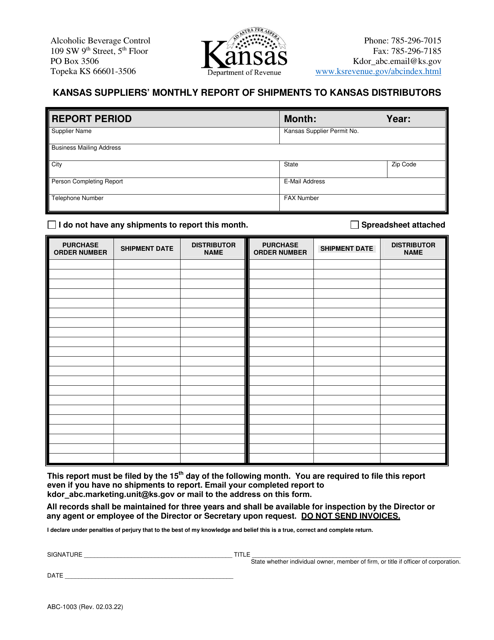

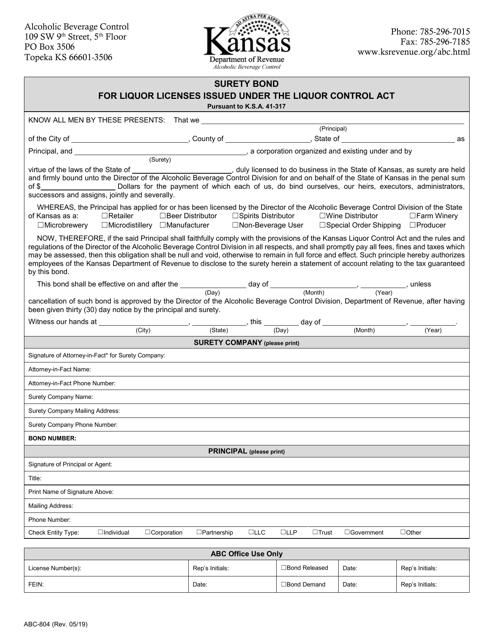

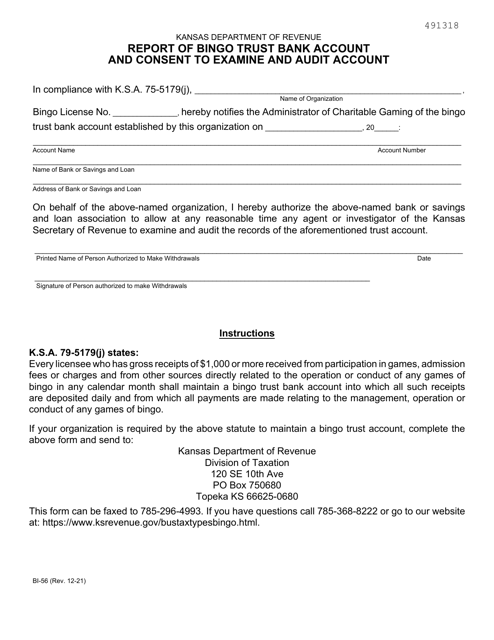

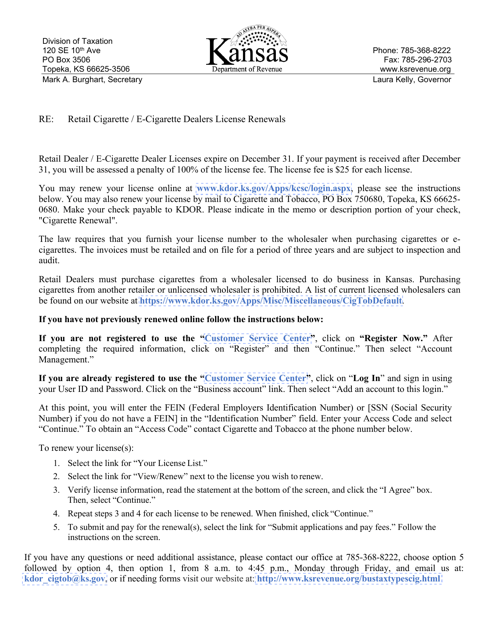

The Kansas Department of Revenue is responsible for administering and enforcing tax laws and regulations in the state of Kansas. Its main purpose is to collect taxes, including income tax, sales tax, property tax, and other taxes imposed by the state. The department also provides various services related to tax registration, licensing, and compliance for individuals and businesses in Kansas. Additionally, it plays a role in motor vehicle registration and titling, as well as overseeing the state's lottery and alcoholic beverage control.

Documents:

645

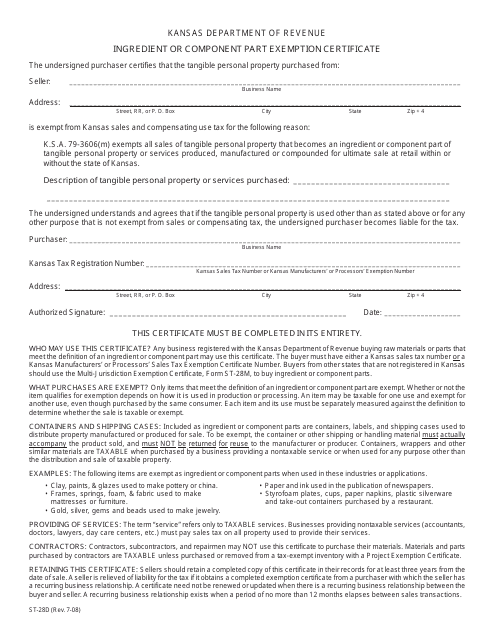

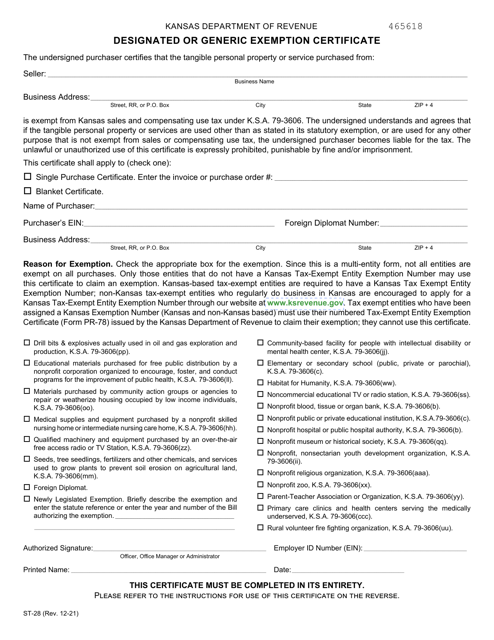

This document is used for claiming an exemption on certain ingredients or component parts in Kansas.

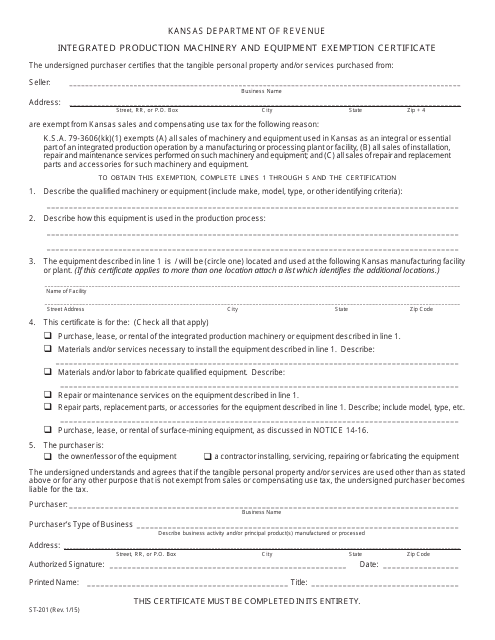

This form is used for claiming exemption from sales tax on machinery and equipment used in the production process in Kansas. It is specifically for businesses that are engaged in manufacturing, processing, or fabricating products.

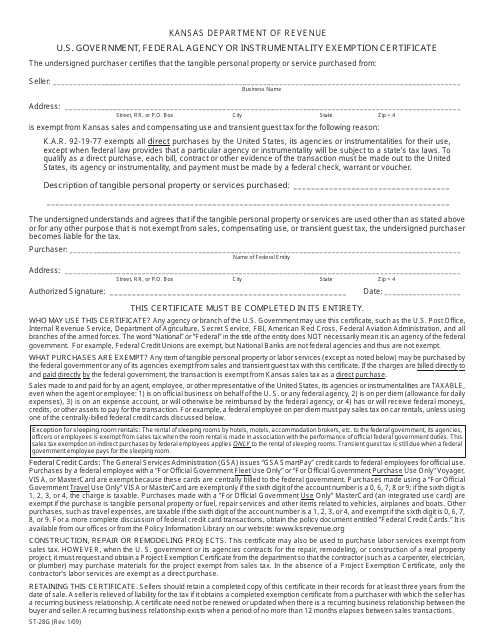

This Form is used for claiming exemption from sales tax for U.S. Government, Federal Agencies or Instrumentalities in the state of Kansas.

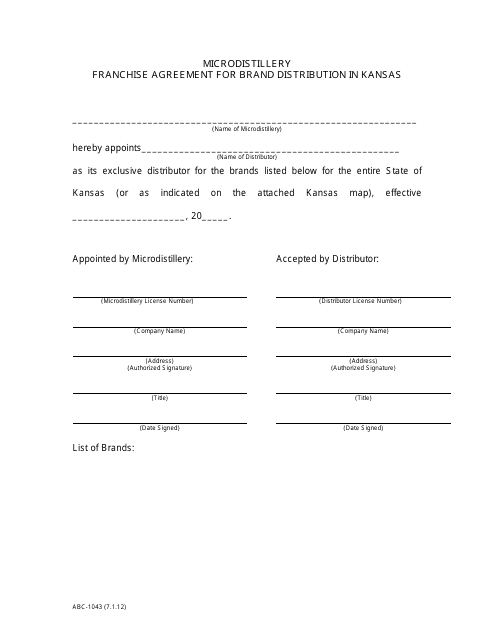

This Form is used for a microdistillery franchise agreement to distribute a brand in Kansas.

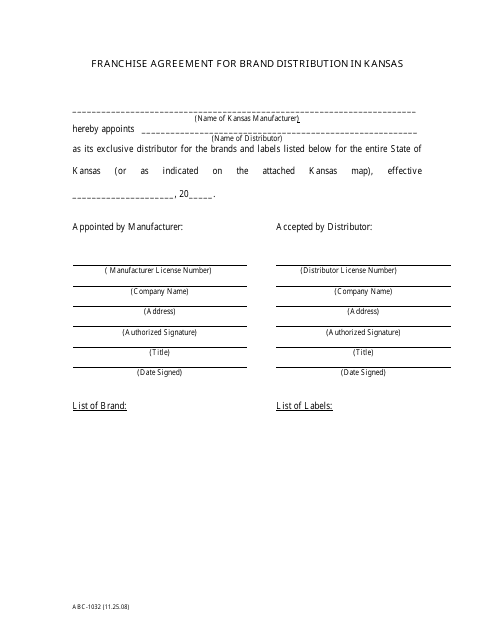

This document is used for entering into a franchise agreement to distribute a specific brand in the state of Kansas. It details the terms and conditions of the agreement between the franchisor and the franchisee.

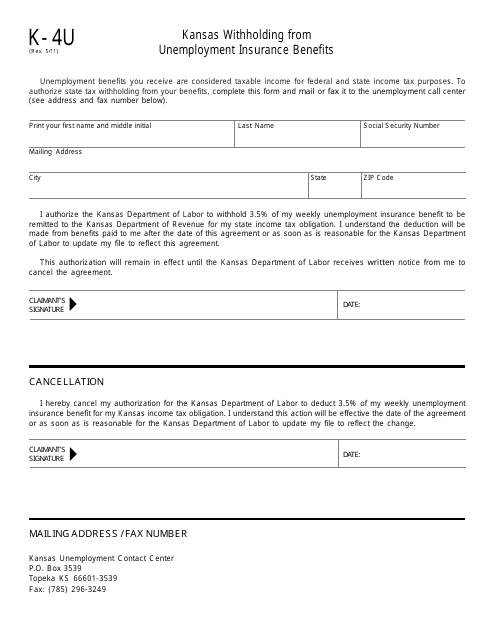

This form is used for reporting Kansas withholding allowance from unemployment benefits.

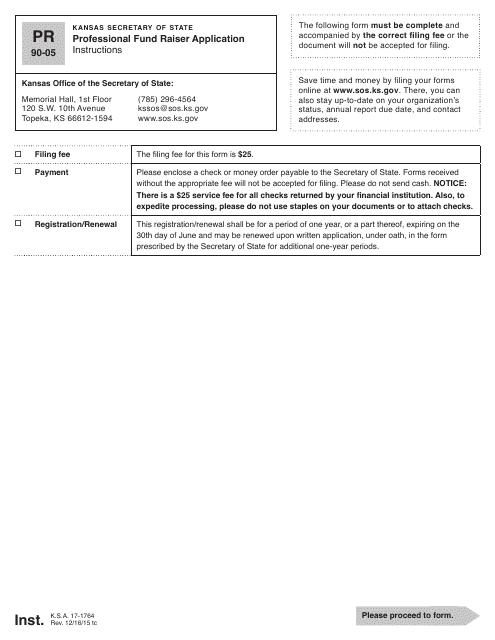

This form is used for professionals who want to apply for a fund raiser license in the state of Kansas. The form is specifically designed for individuals who plan to solicit contributions for charitable organizations in Kansas.

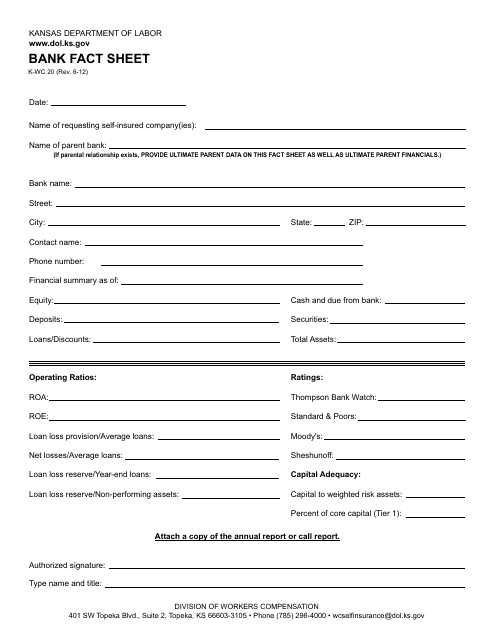

This Form is used for providing a fact sheet for a bank in the state of Kansas.

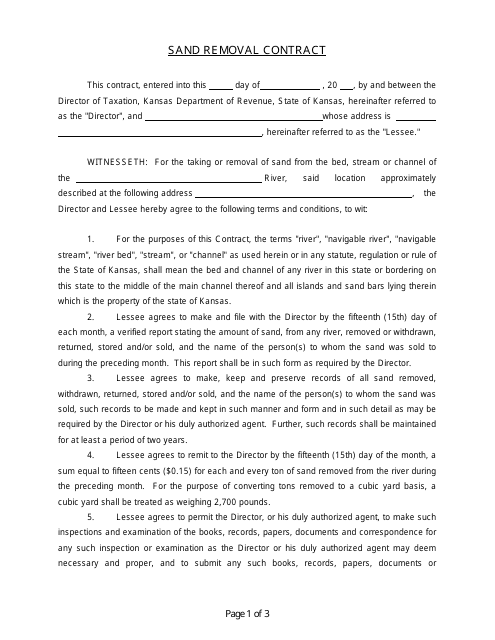

This Form is used for creating a contract for the removal of sand in Kansas.

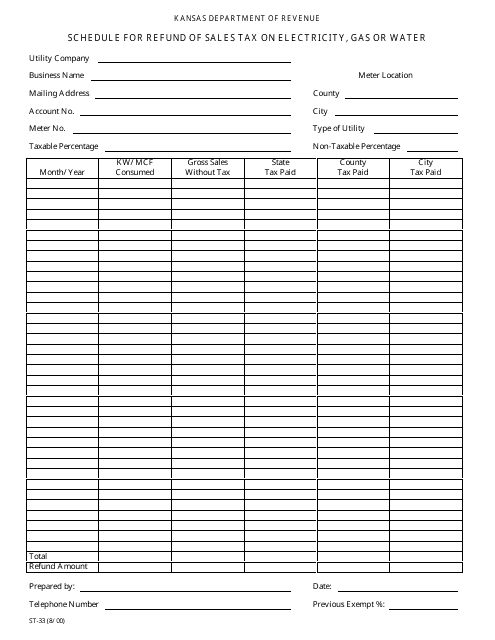

This Form is used for applying for a refund of sales tax paid on electricity, gas, or water in the state of Kansas.

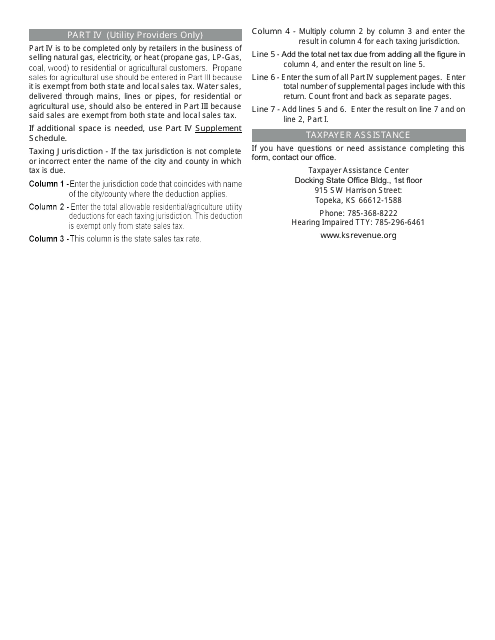

This Form is used for Kansas utility companies to report their sales tax information.

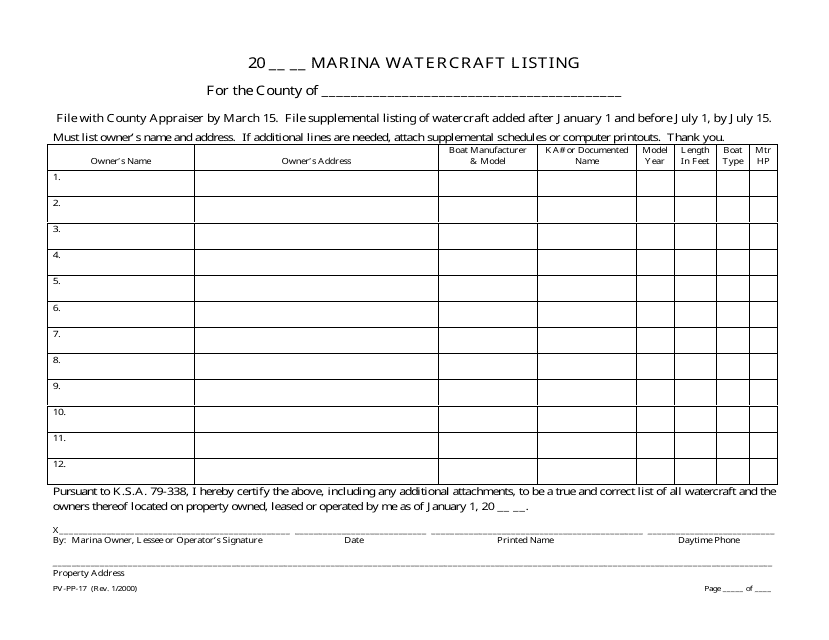

This form is used for listing marina watercraft in the state of Kansas.

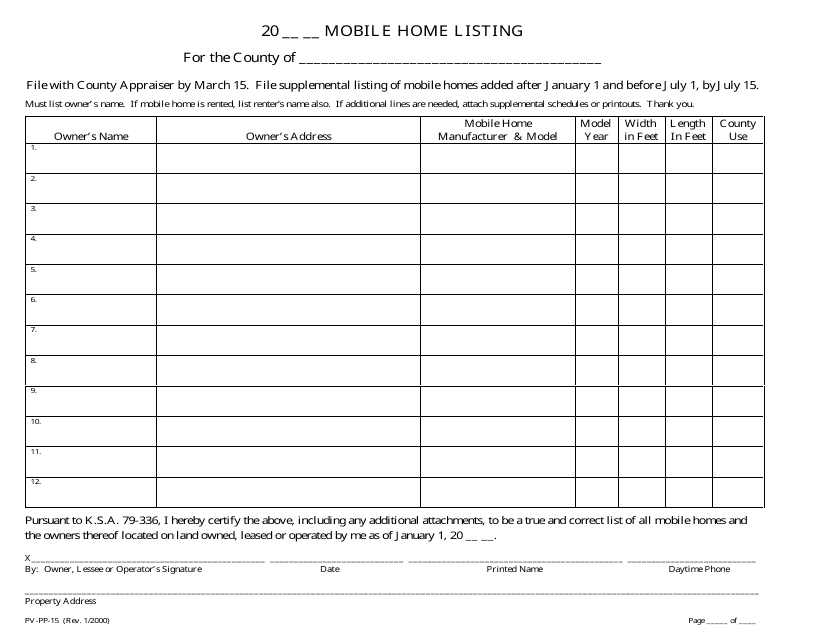

This form is used for listing mobile homes in Kansas.

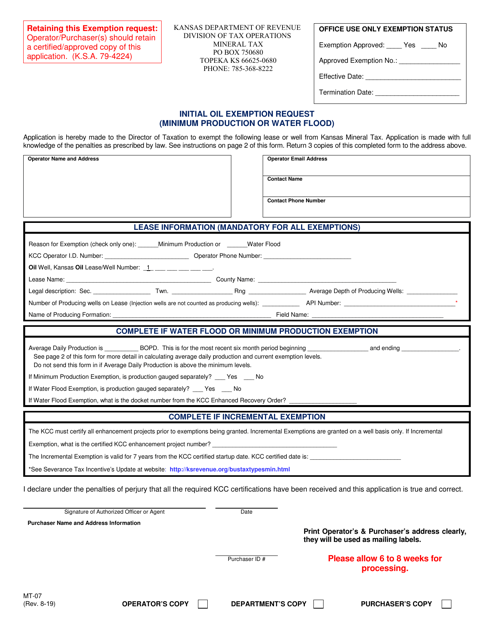

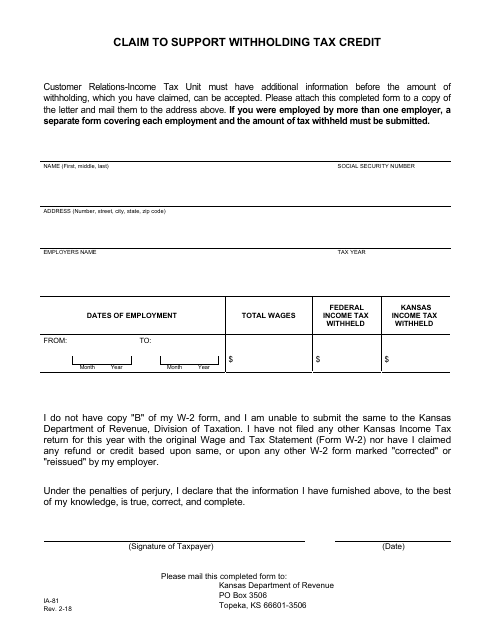

This Form is used for residents of Kansas to claim a withholding tax credit.

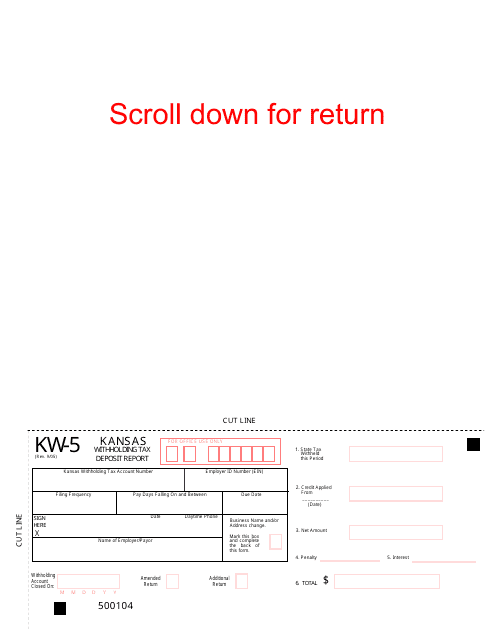

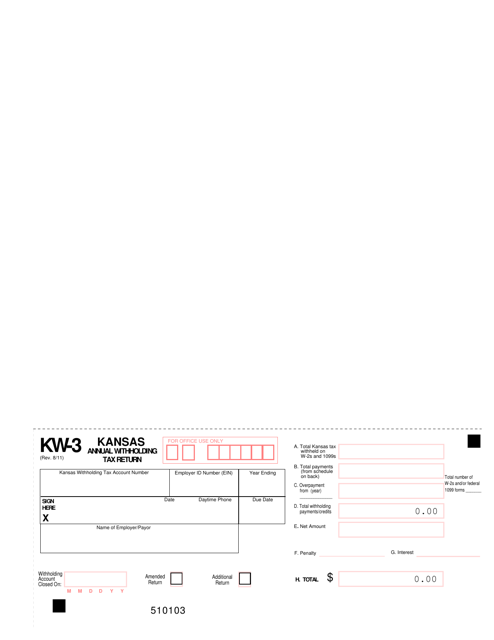

This Form is used for reporting and submitting withholding tax deposits in the state of Kansas.

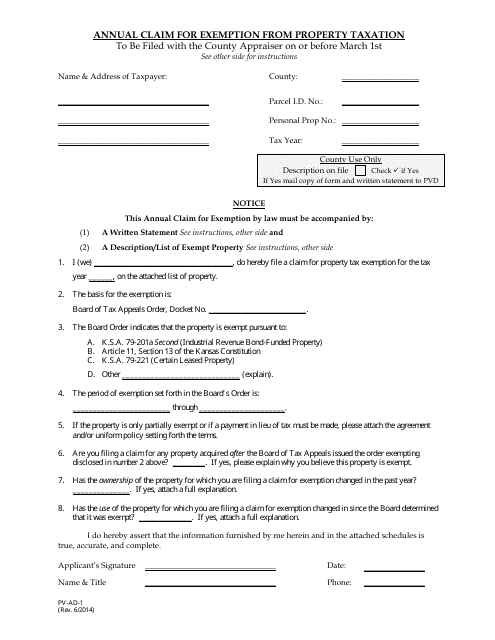

This Form is used for filing an annual claim for exemption from property taxation in the state of Kansas. It allows qualifying individuals or organizations to request an exemption from property taxes on their eligible property.

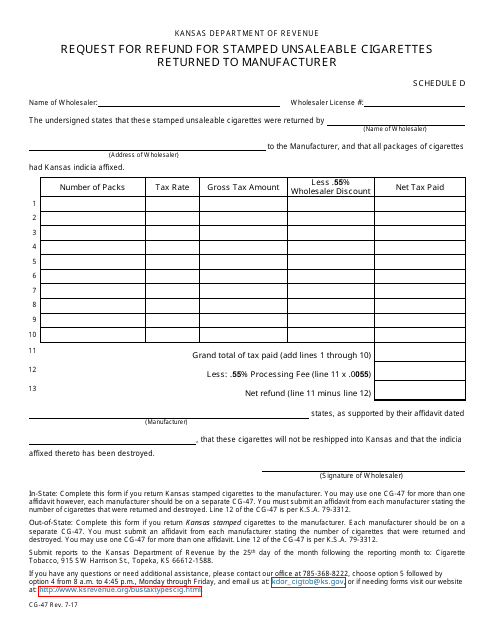

This form is used for requesting a refund for unsaleable stamped cigarettes in Kansas that have been returned to the manufacturer.

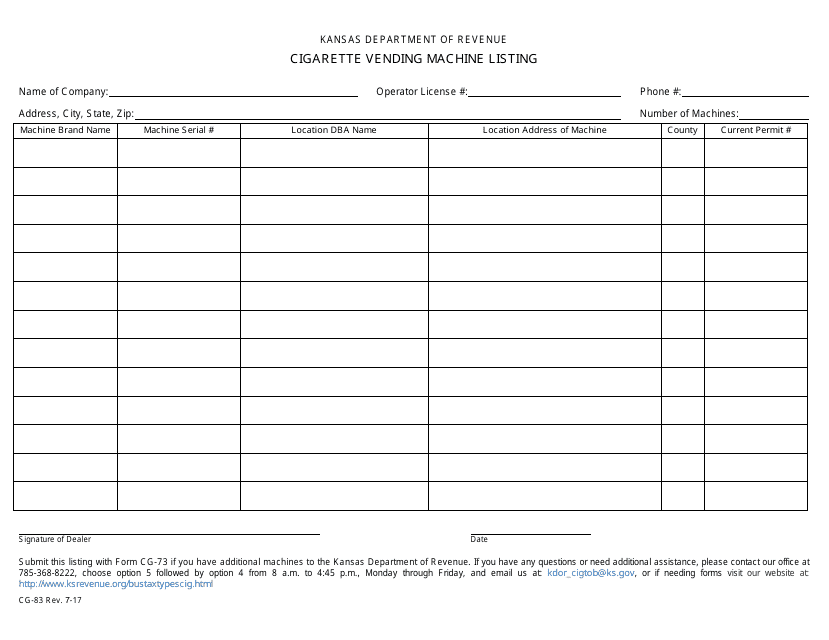

This form is used for listing cigarette vending machines in Kansas.

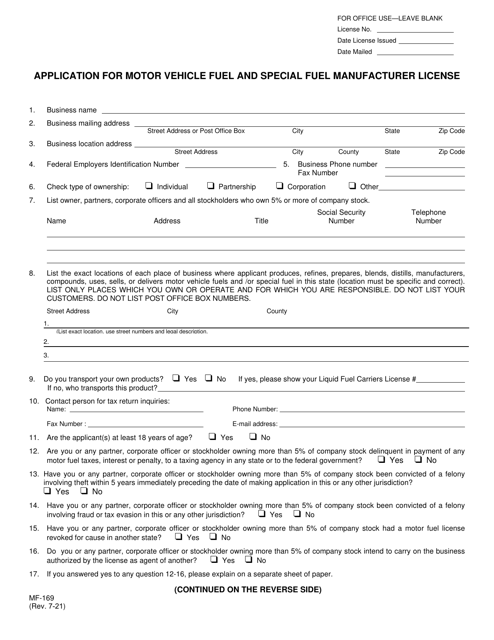

This Form is used for applying for business tax in the state of Kansas.