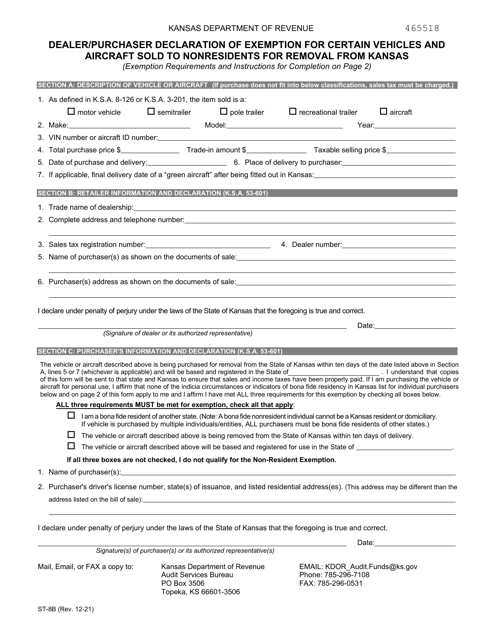

Kansas Department of Revenue Forms

Documents:

645

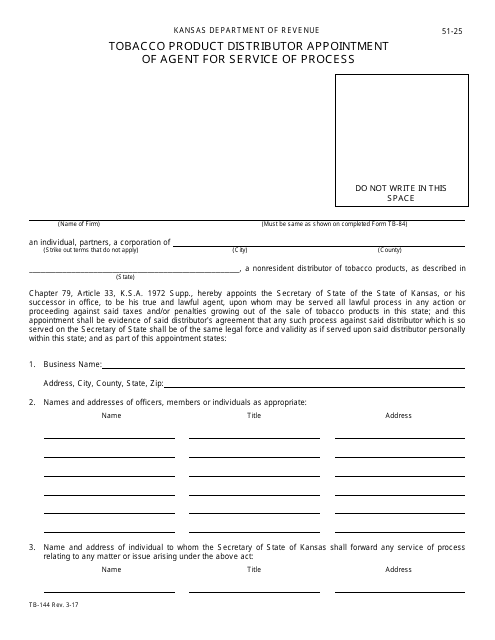

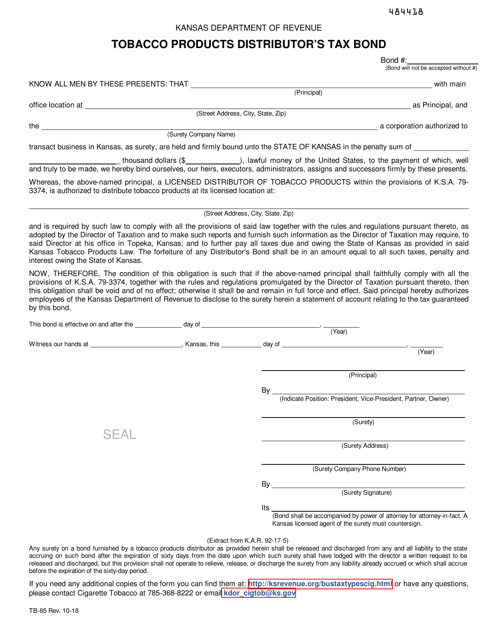

This Form is used for tobacco product distributors in Kansas to appoint an agent for service of process.

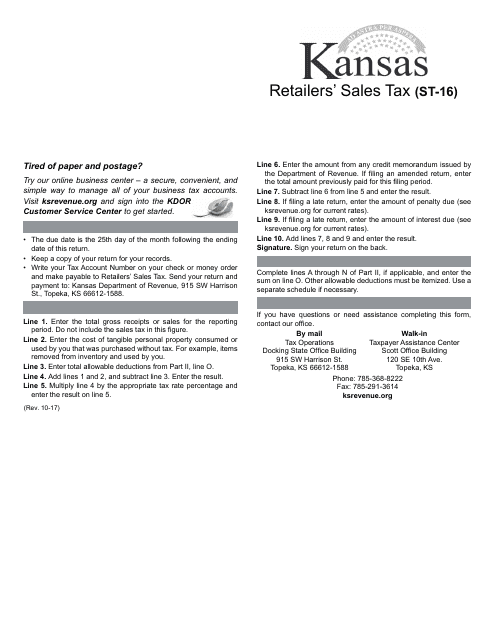

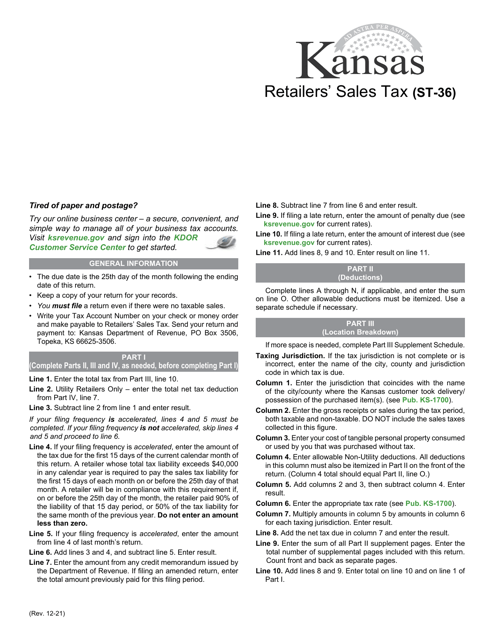

This Form is used for retailers in Kansas to file their sales tax return.

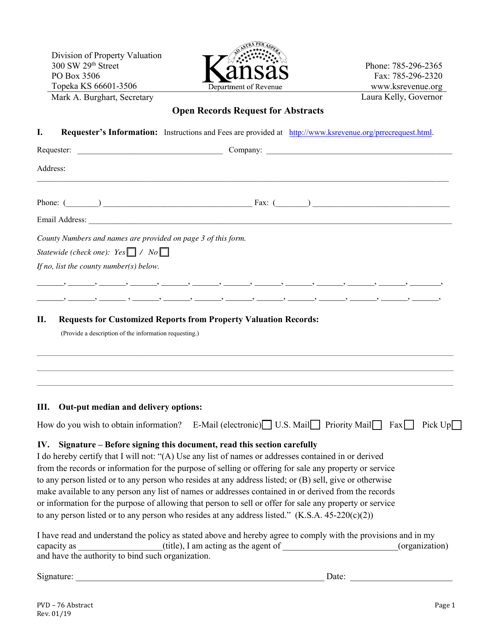

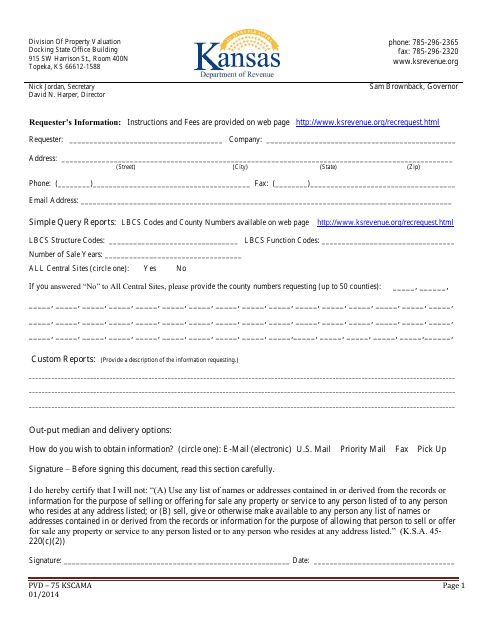

This form is used for submitting an open records request to access the CAMA (Computer Assisted Mass Appraisal) records in the state of Kansas.

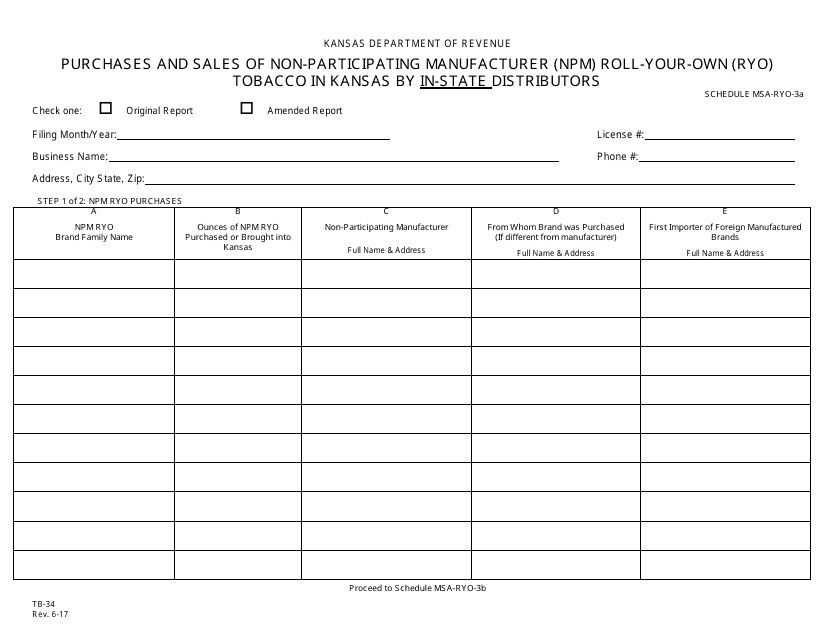

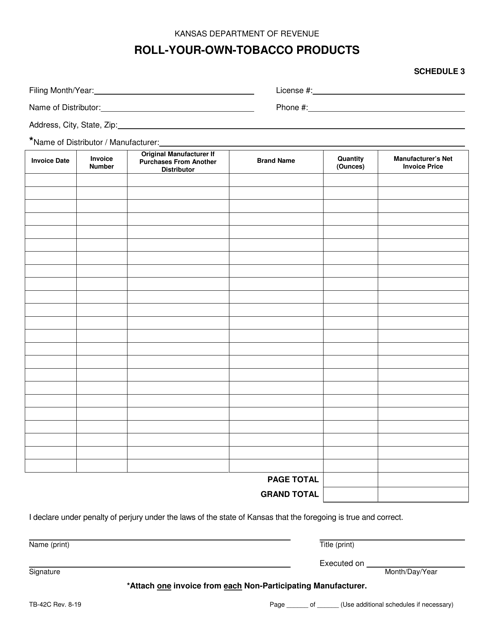

This document is used for reporting purchases and sales of Non-participating Manufacturer (Npm) Roll-Your-Own (Ryo) Tobacco by in-state distributors in the state of Kansas.

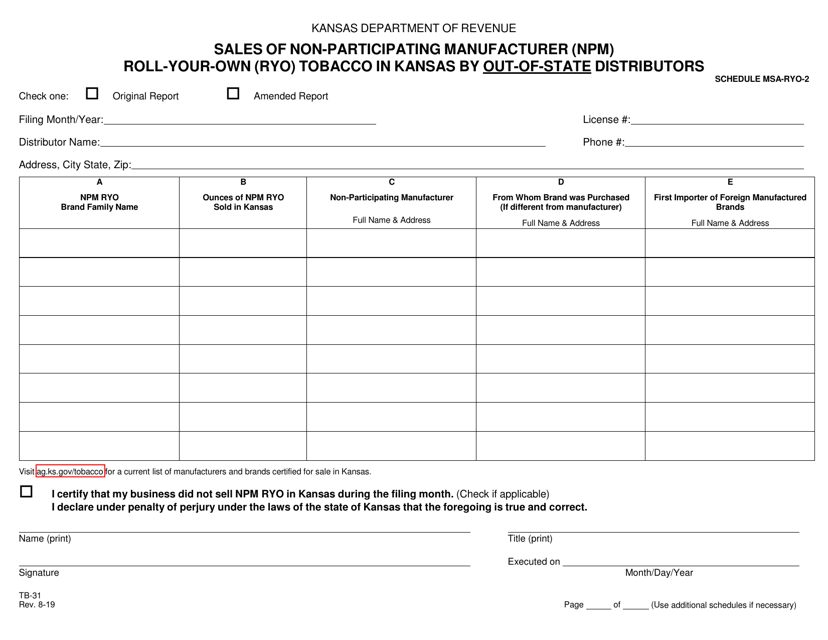

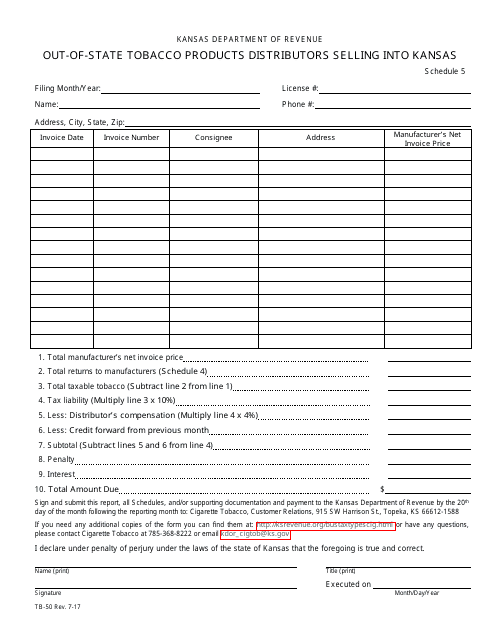

This Form is used for out-of-state tobacco product distributors who sell into Kansas to comply with Kansas regulations.

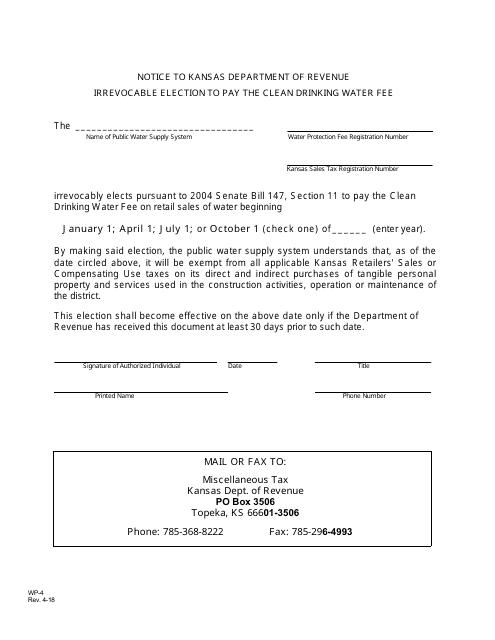

This form is used for making an irrevocable election to pay the clean drinking water fee in the state of Kansas.

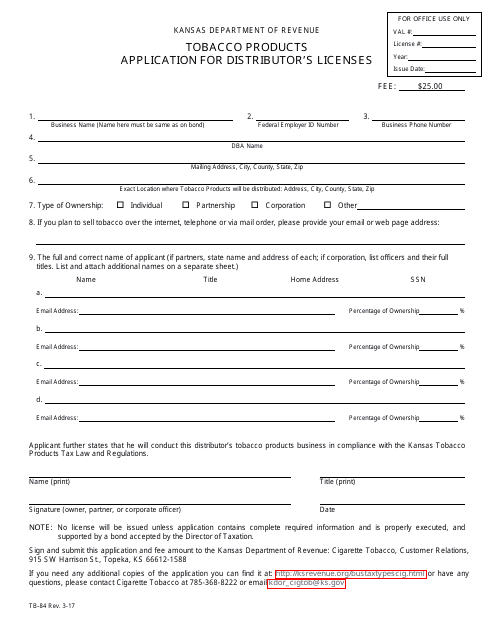

This document is used for applying for a distributor's license for tobacco products in the state of Kansas.

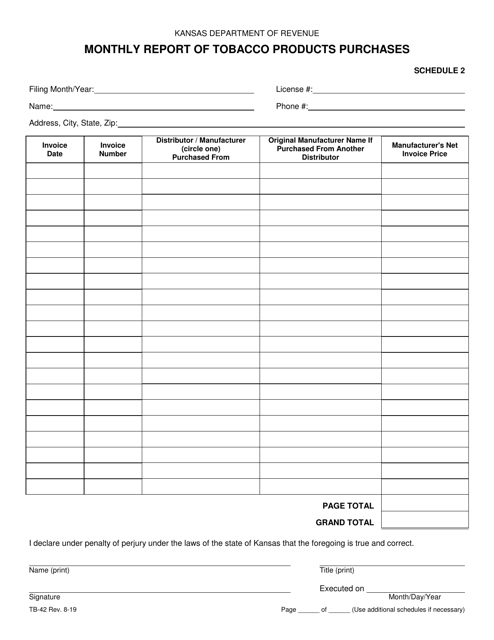

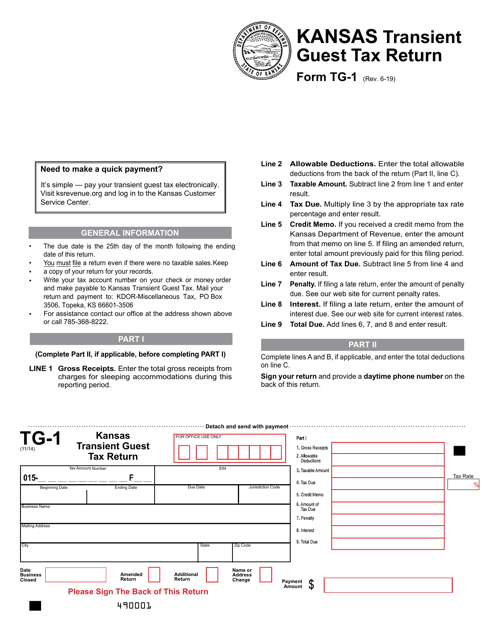

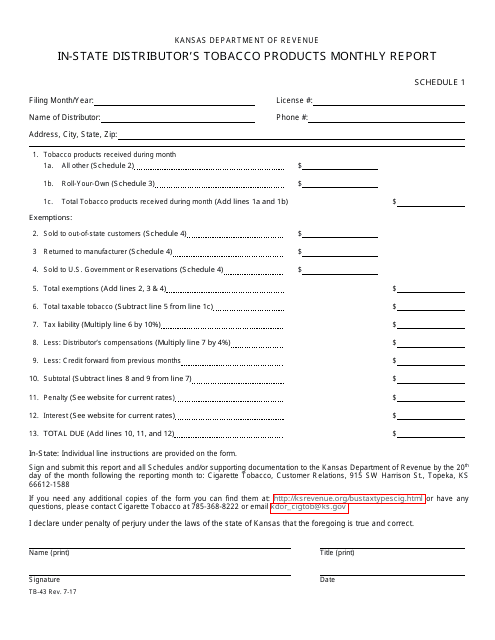

This form is used for in-state distributors of tobacco products in Kansas to report their monthly sales.

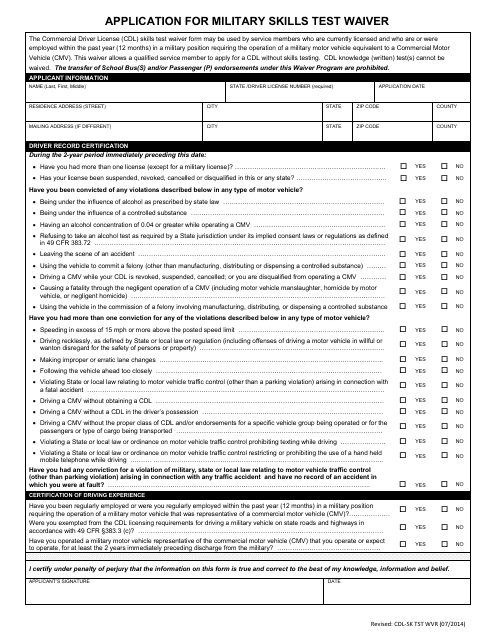

This document is for applying for a waiver for the Military Skills Test in Delaware.

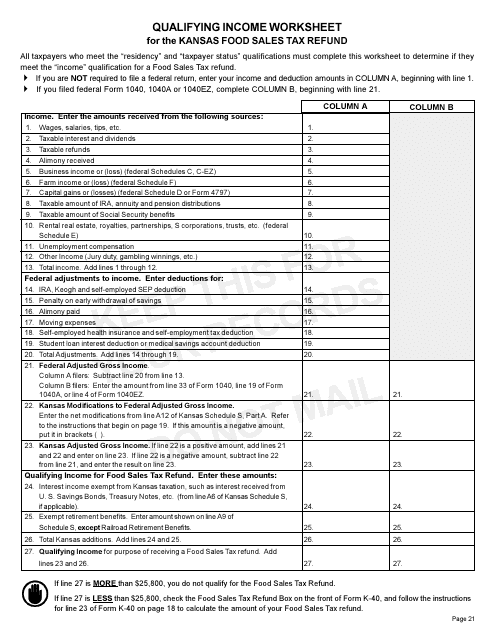

This Form is used to determine if your income qualifies for the Kansas Food Sales Tax Refund. It helps you calculate your eligible income for the refund.

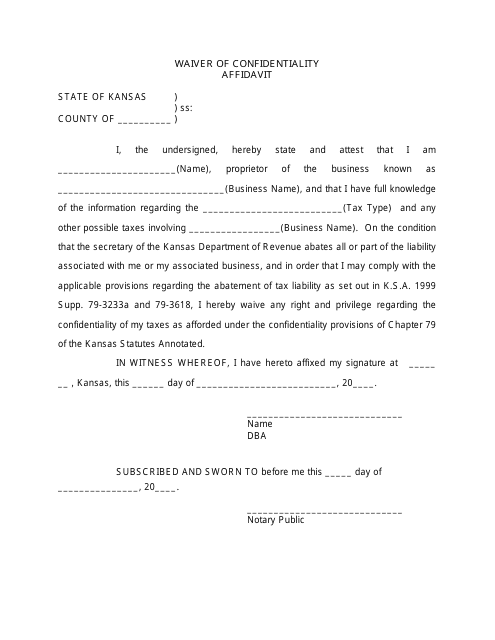

This document allows individuals in Kansas to waive their right to keep certain information confidential.

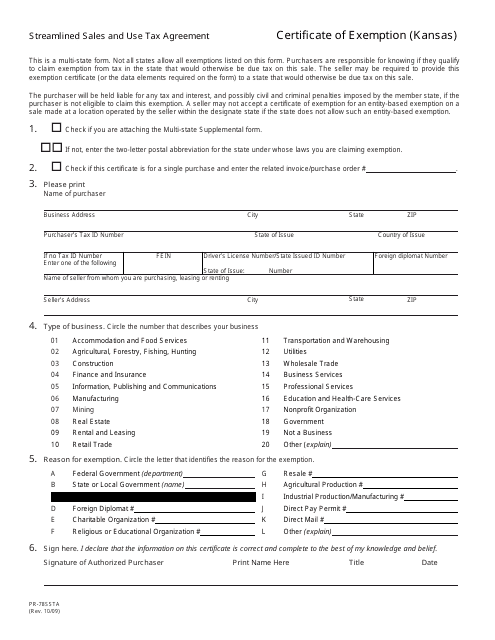

This form is used for obtaining a certificate of exemption from sales and use taxes in Kansas under the Streamlined Sales and Use Tax Agreement.

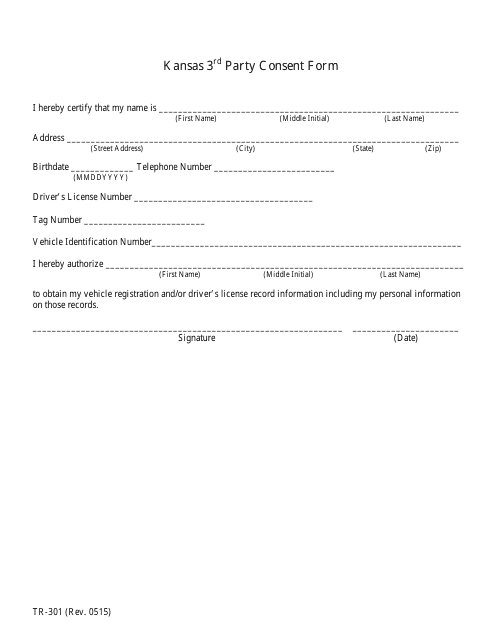

This form is used for obtaining third-party consent in the state of Kansas. It allows individuals to legally grant permission to a third party to access their personal information or make decisions on their behalf.

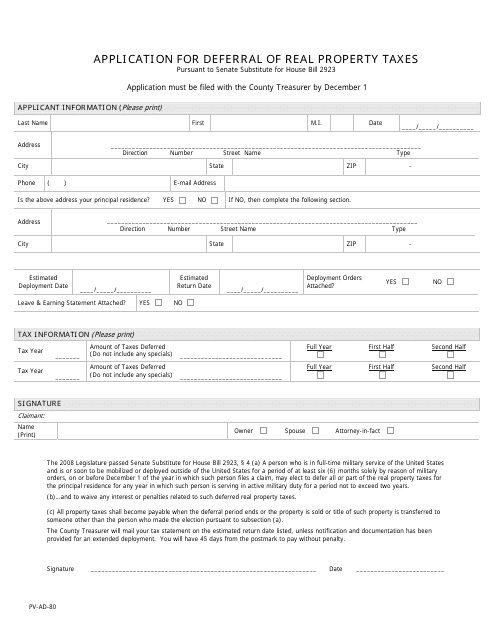

This form is used for applying to defer real property taxes in the state of Kansas. It allows eligible individuals to request a deferral of their taxes, providing financial relief for those who qualify.

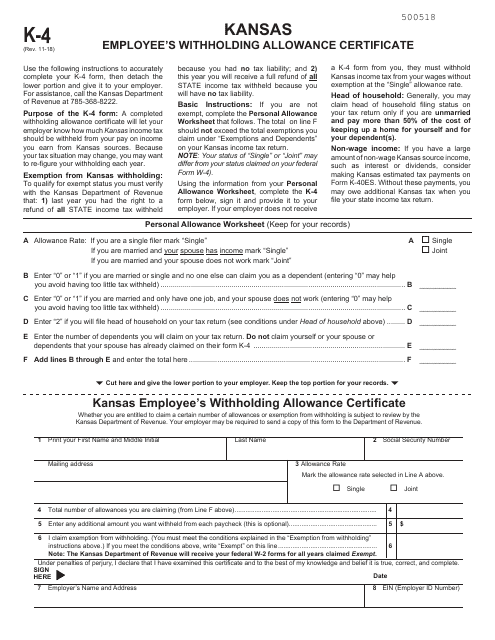

This form is used for employees in Kansas to declare their withholding allowances for state income tax purposes.

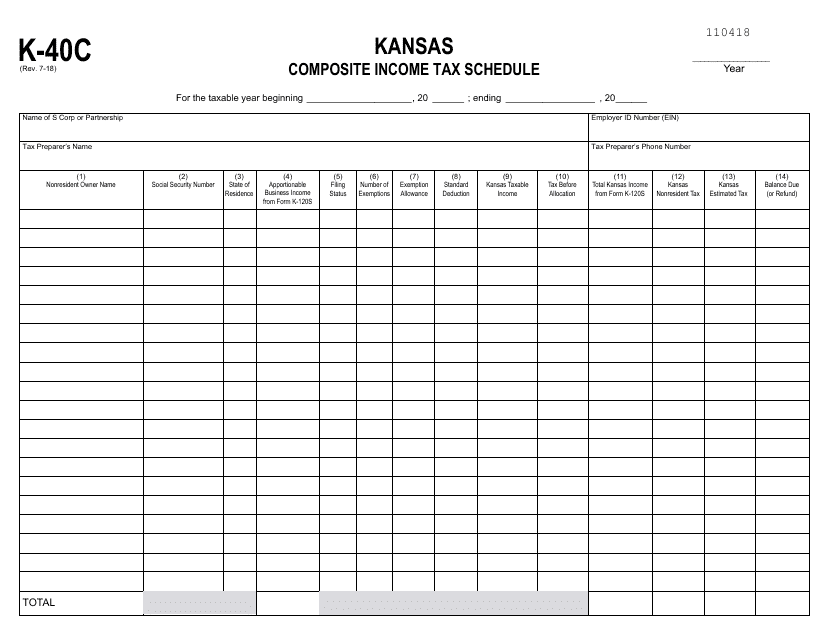

This form is used for reporting composite income tax for individuals in the state of Kansas.

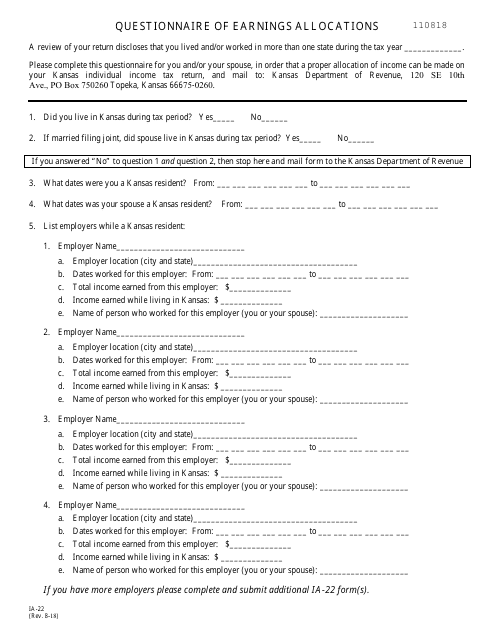

This form is used for allocating earnings in the state of Kansas. It is a questionnaire that helps identify how income should be allocated for tax purposes.

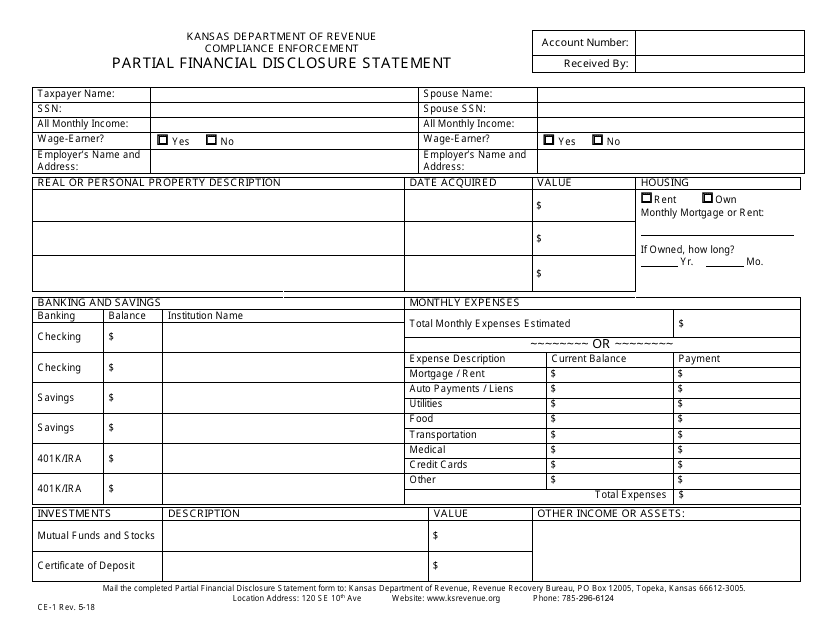

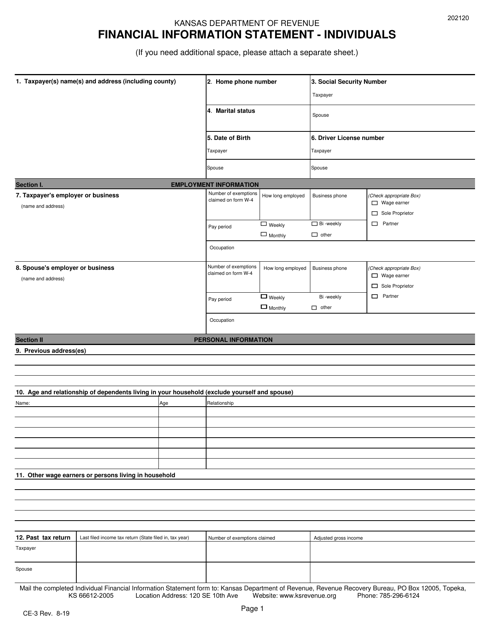

This form is used for filing a partial financial disclosure statement in the state of Kansas.

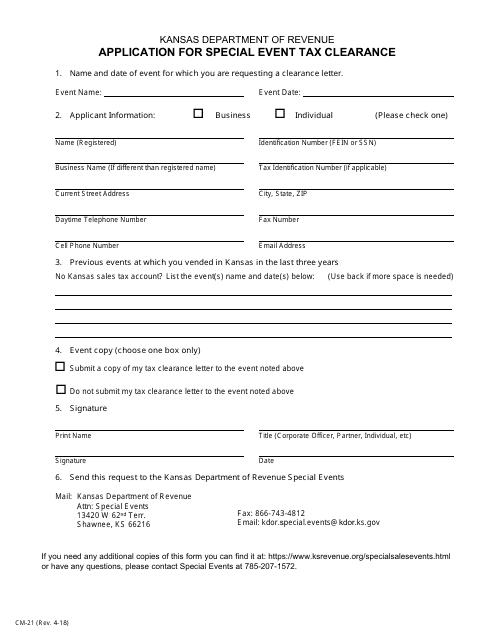

This form is used for applying for a special event tax clearance in the state of Kansas. It is required for organizers planning to hold a special event that may be subject to taxes.

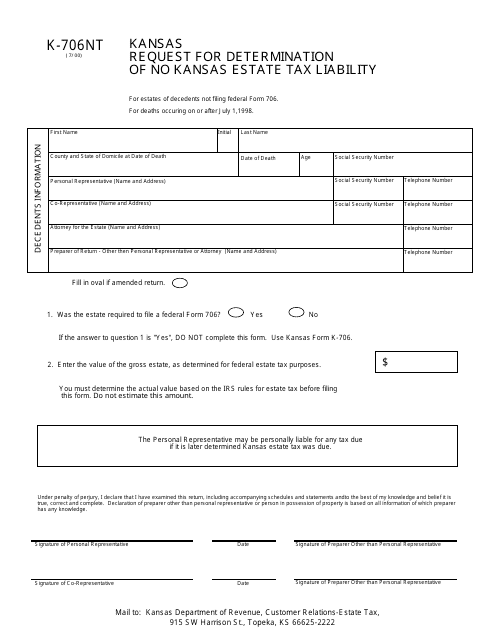

This form is used for requesting a determination of no Kansas estate tax liability in the state of Kansas.

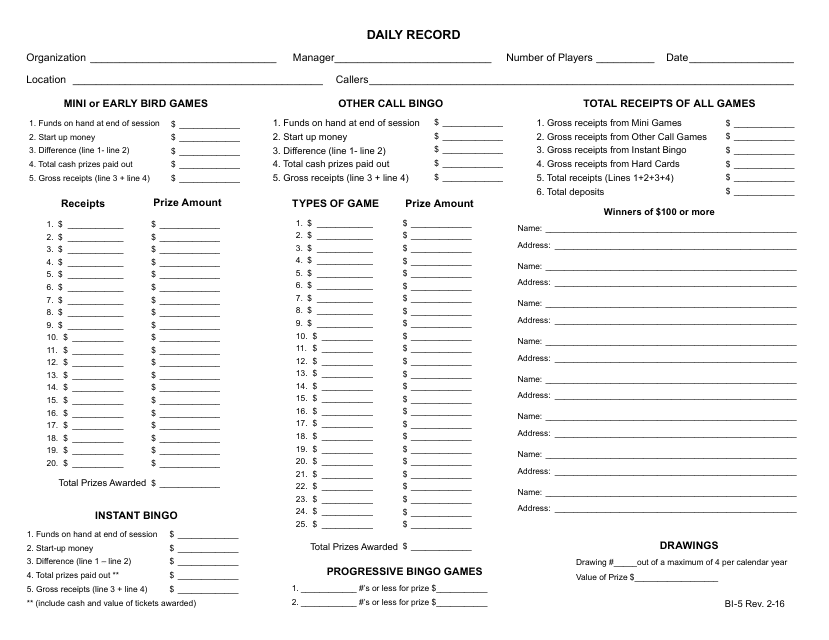

This form is used for maintaining a daily record in the state of Kansas. It is used to document and keep track of activities, events, and important information on a daily basis.