California Department of Tax and Fee Administration Forms

Documents:

417

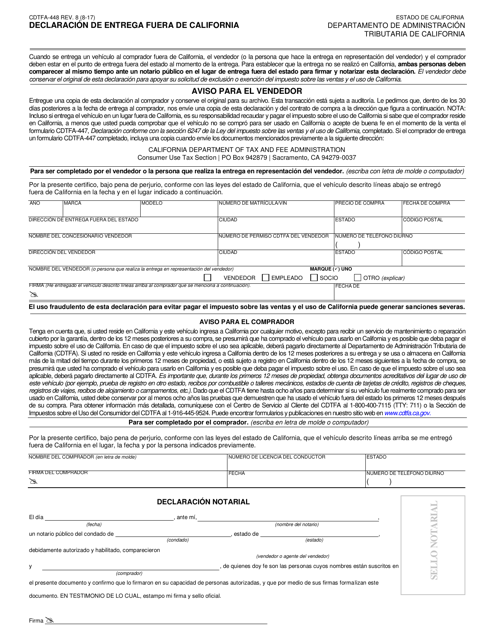

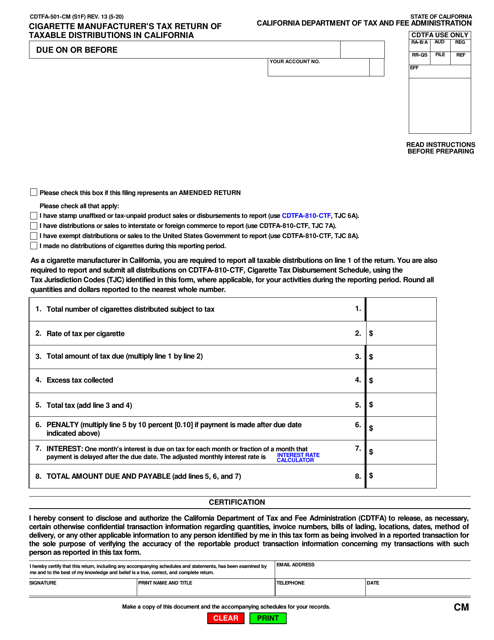

This form is used for declaring delivery outside of California for businesses in California.

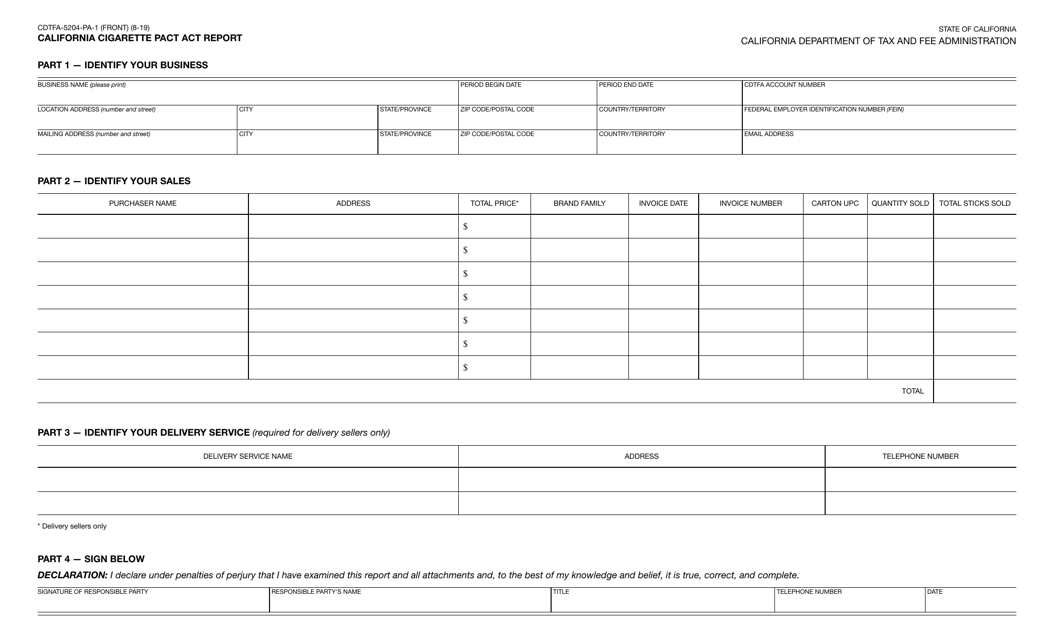

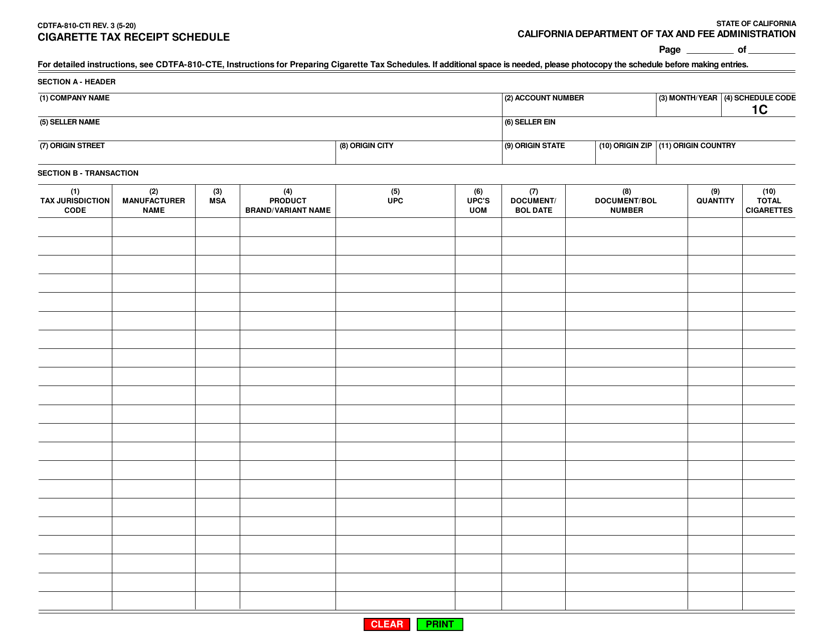

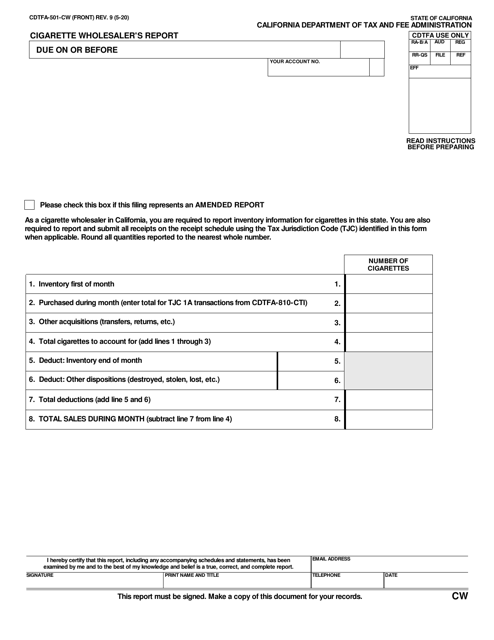

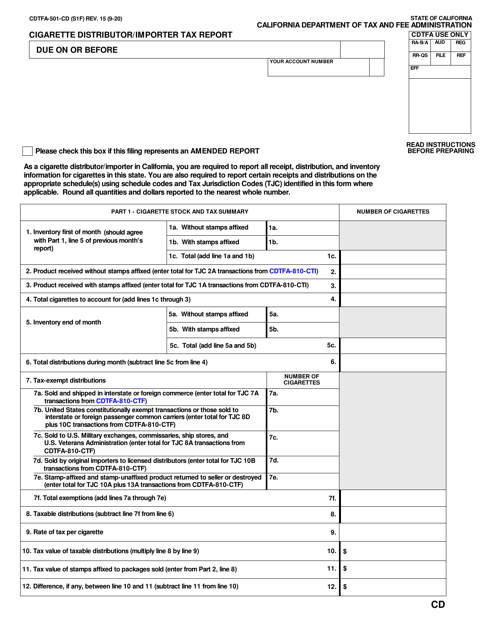

This form is used for filing the California Cigarette Pact Act Report in California.

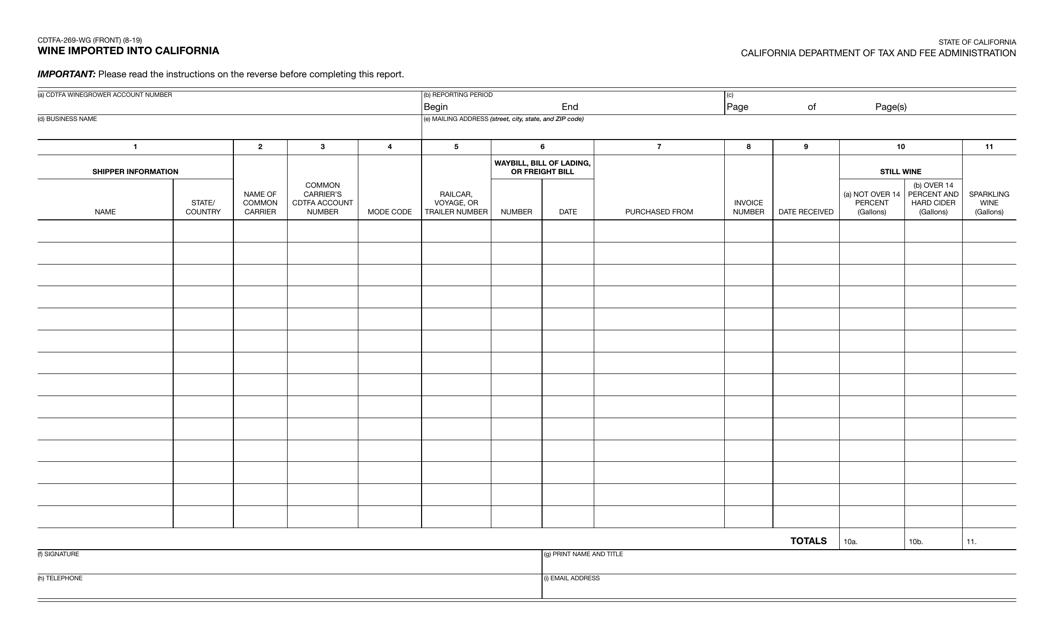

This form is used for reporting the importation of wine into California. It is specifically for wine that is imported from outside of California.

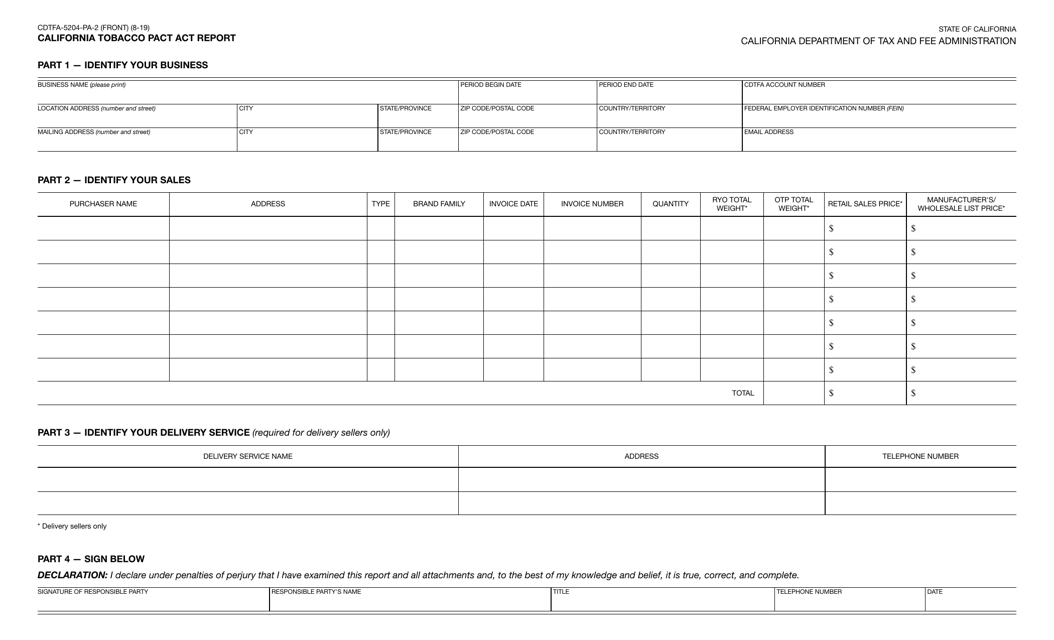

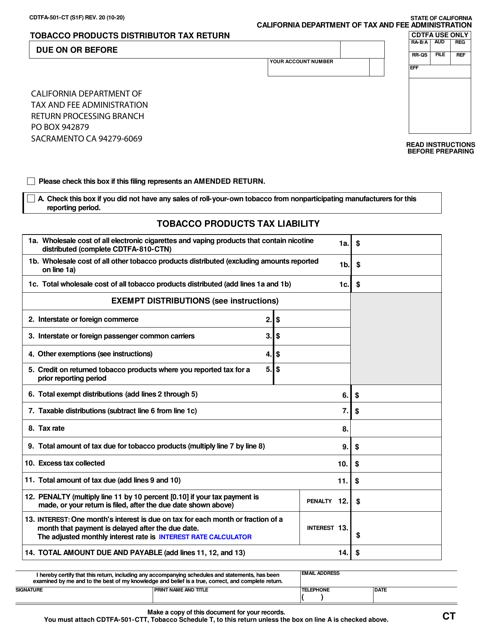

This form is used for submitting the California Tobacco Pact Act Report in the state of California. It is required for businesses engaged in the distribution and sale of tobacco products to report their sales and other related information to the California Department of Tax and Fee Administration.

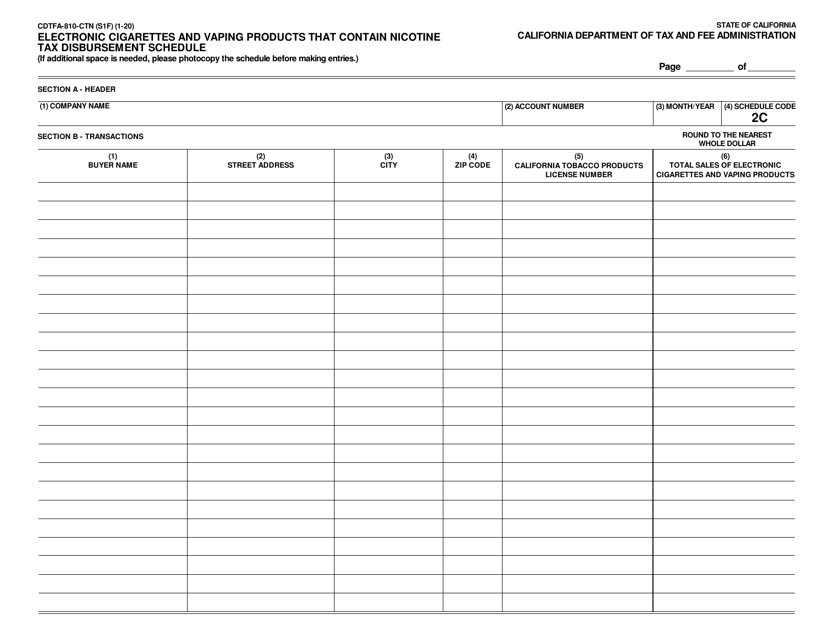

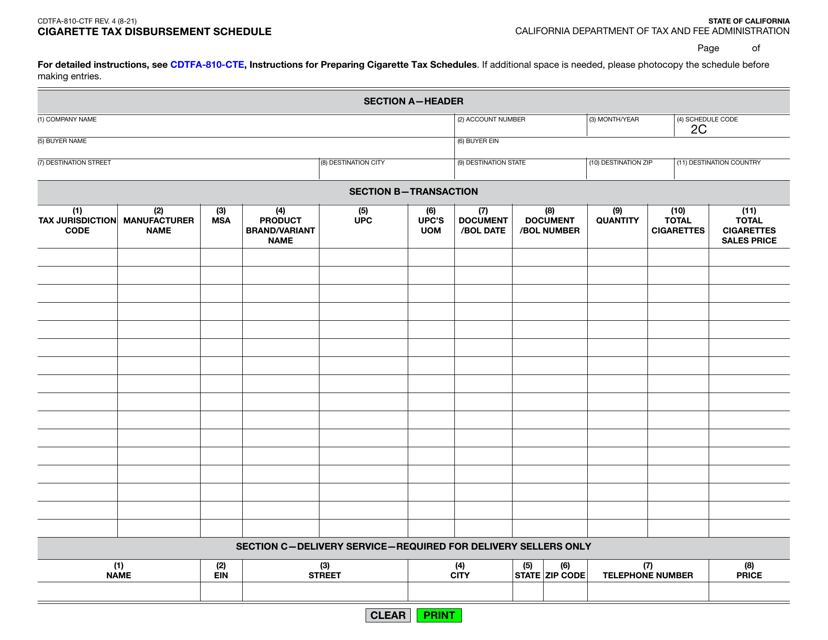

This form is used for the tax disbursement schedule for electronic cigarettes and vaping products containing nicotine in California.

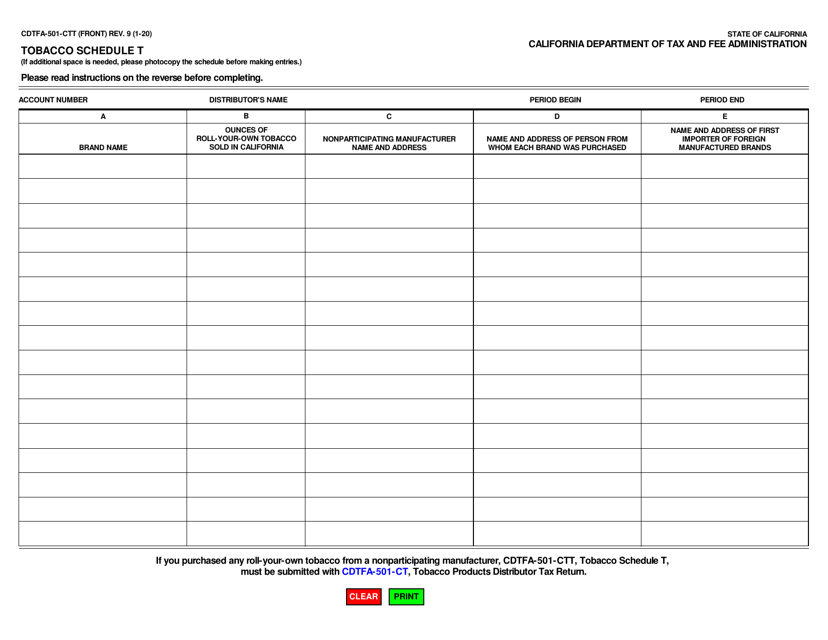

This form is used for reporting tobacco sales in California. It is specifically for Schedule T related to tobacco products.

This document provides tax tips and guidance specifically tailored for photographers, photo finishers, and film processing laboratories in California. It covers various aspects of tax planning and compliance unique to this industry to help businesses stay organized and maximize their tax benefits.

This form is used for claiming a refund or credit in the state of California.

This Form is used for claiming a refund or credit in the state of California.

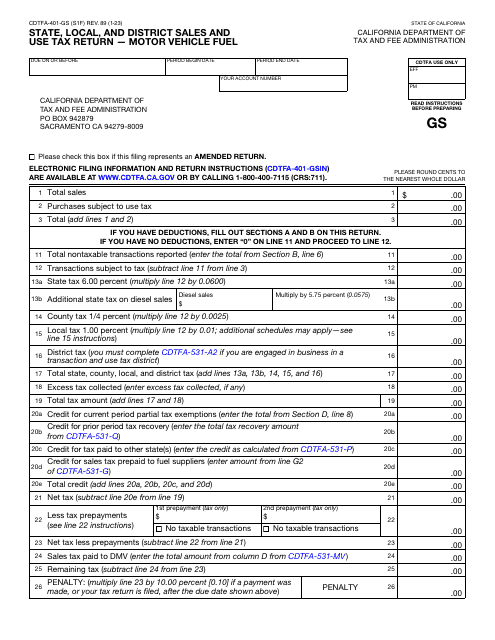

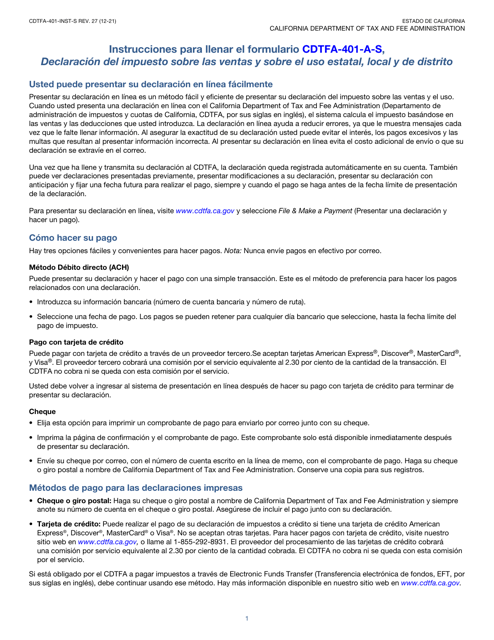

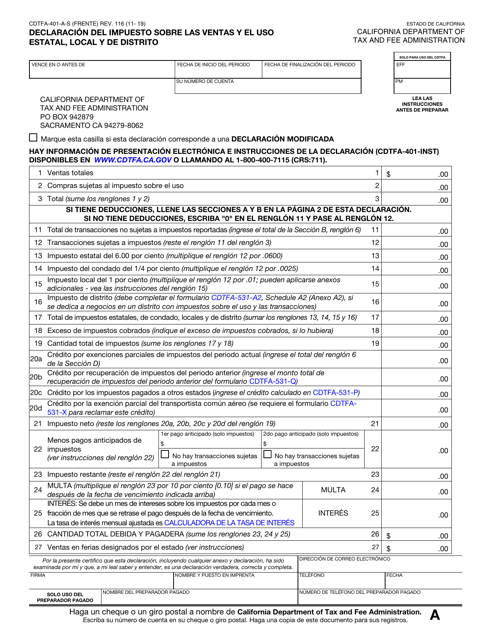

This form is used for individuals and businesses in California to report and pay state, local, and district sales and use taxes.

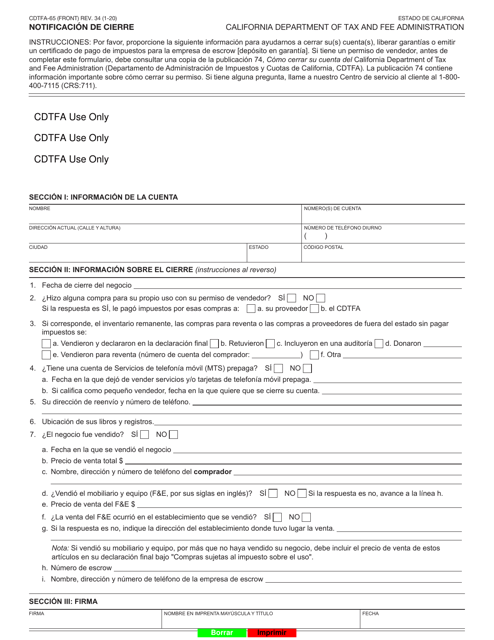

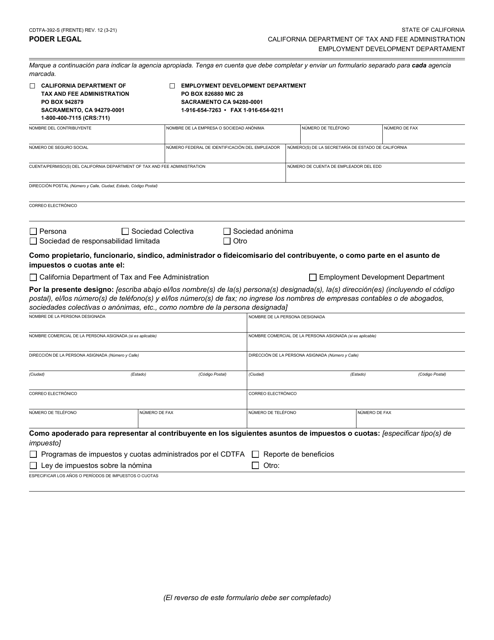

This type of document is a Form CDTFA-65-S used for notifying the closure of a business in California. It is available in Spanish.

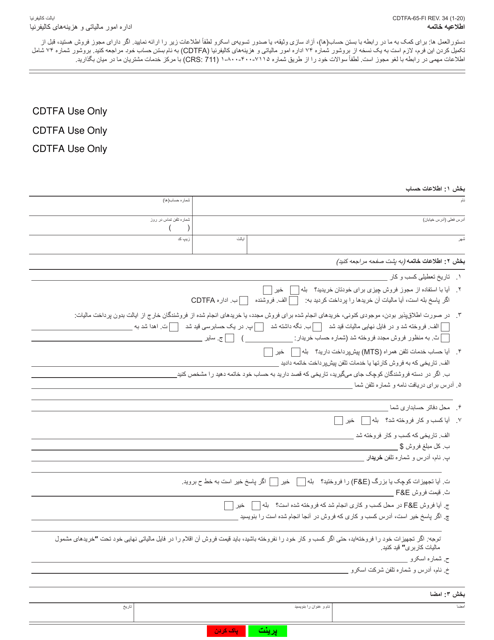

This form is used for providing a notice of closeout for businesses in California who speak Farsi.

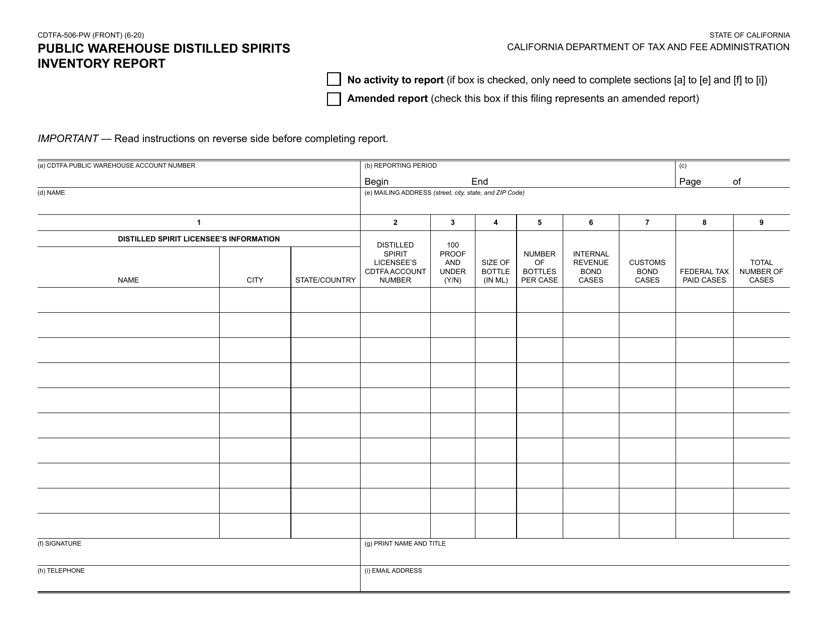

This form is used for reporting the inventory of distilled spirits in public warehouses in California.

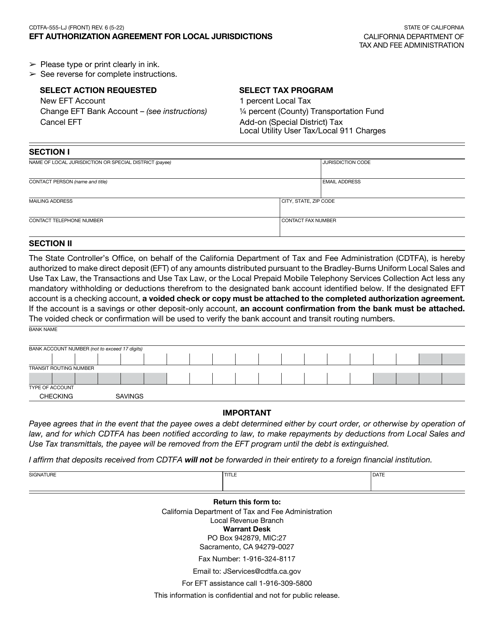

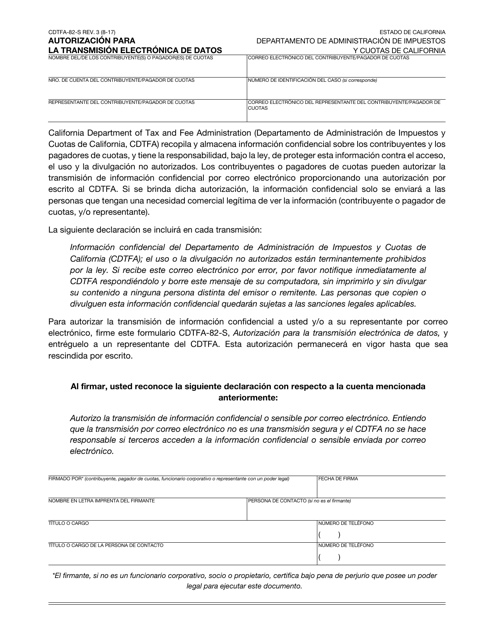

This form is used for obtaining authorization to electronically transmit data in California.

This Form is used for requesting relief from fines, cost recovery fees, and/or interest in California.

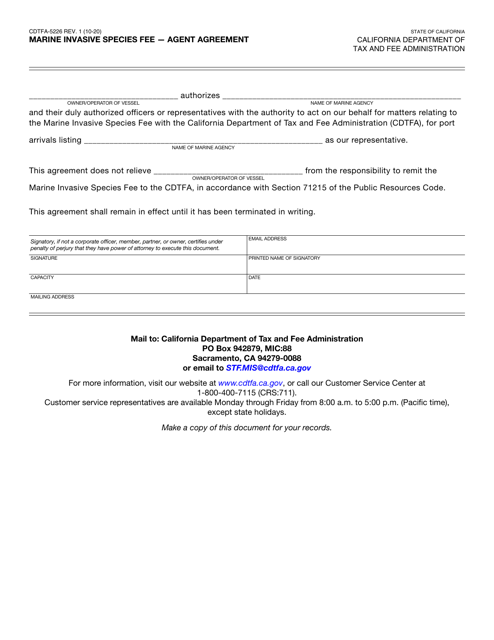

This document is used for an agent to agree to collect and remit the marine invasive species fee on behalf of the state of California.