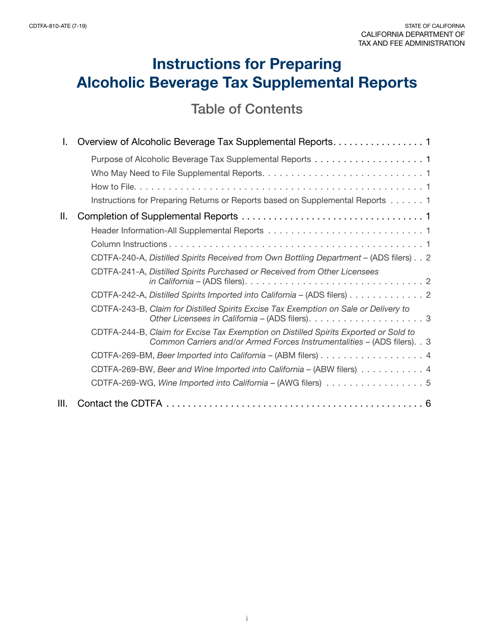

California Department of Tax and Fee Administration Forms

Documents:

417

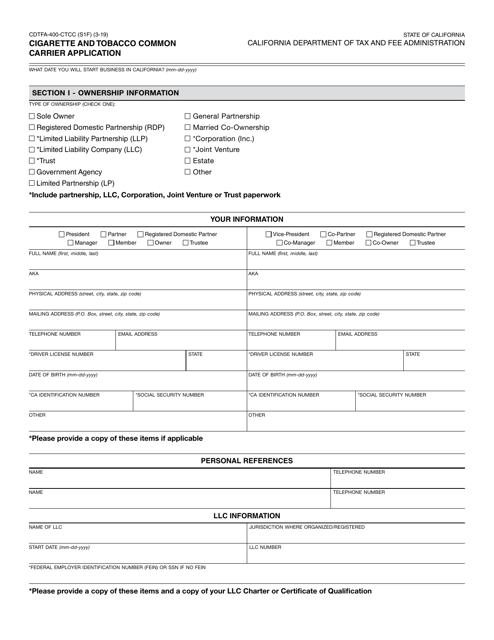

This Form is used for applying to become a common carrier for the transportation of cigarettes and tobacco products in the state of California.

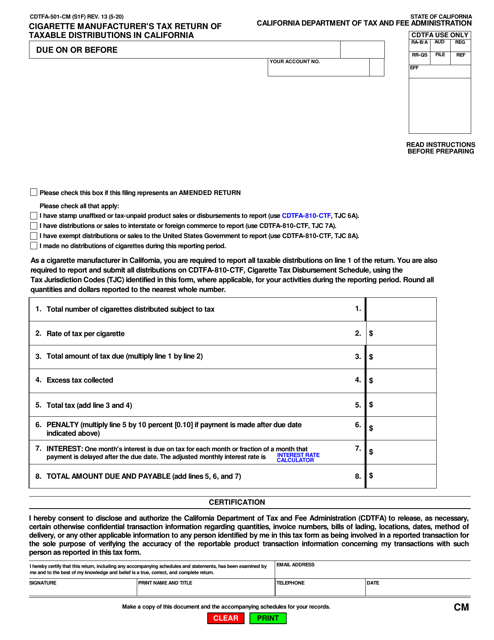

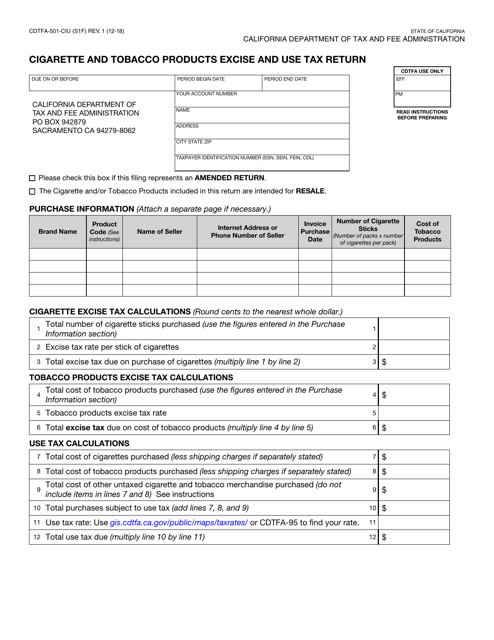

This form is used for reporting and paying excise and use tax on cigarette and tobacco products in the state of California.

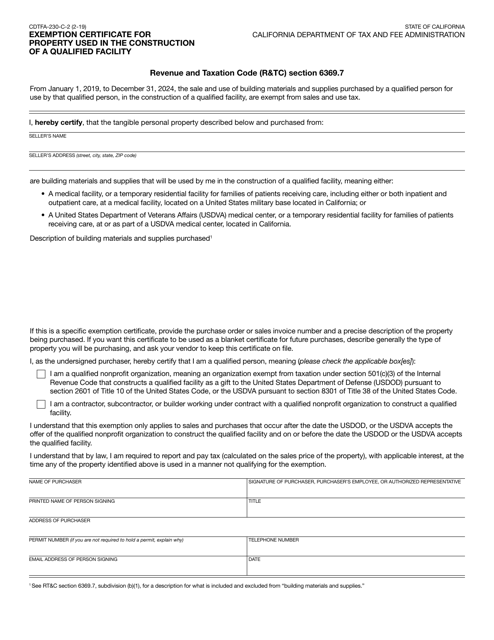

This form is used for requesting an exemption certificate for property that will be used in the construction of a qualified facility in California.

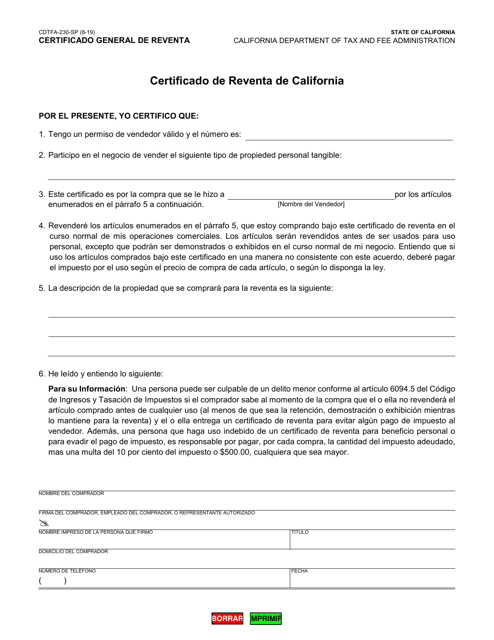

This type of document is a Spanish version of the General Resale Certificate used in California. It is used by businesses to certify that they are purchasing goods for resale and not for personal use, allowing them to avoid paying sales tax on those items.

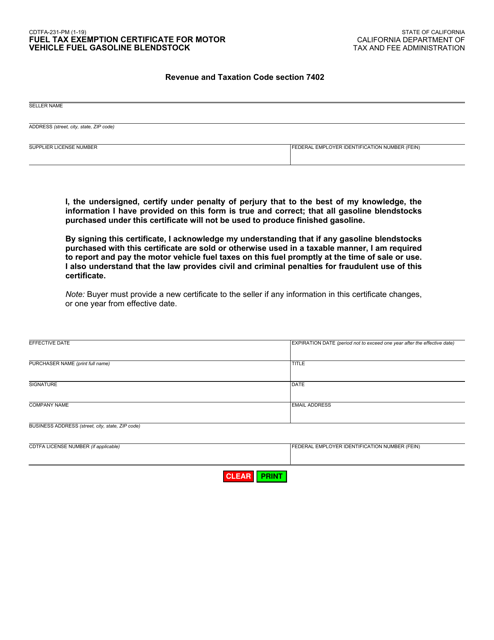

This form is used for claiming a fuel tax exemption for motor vehicle fuel gasoline blendstock in the state of California.

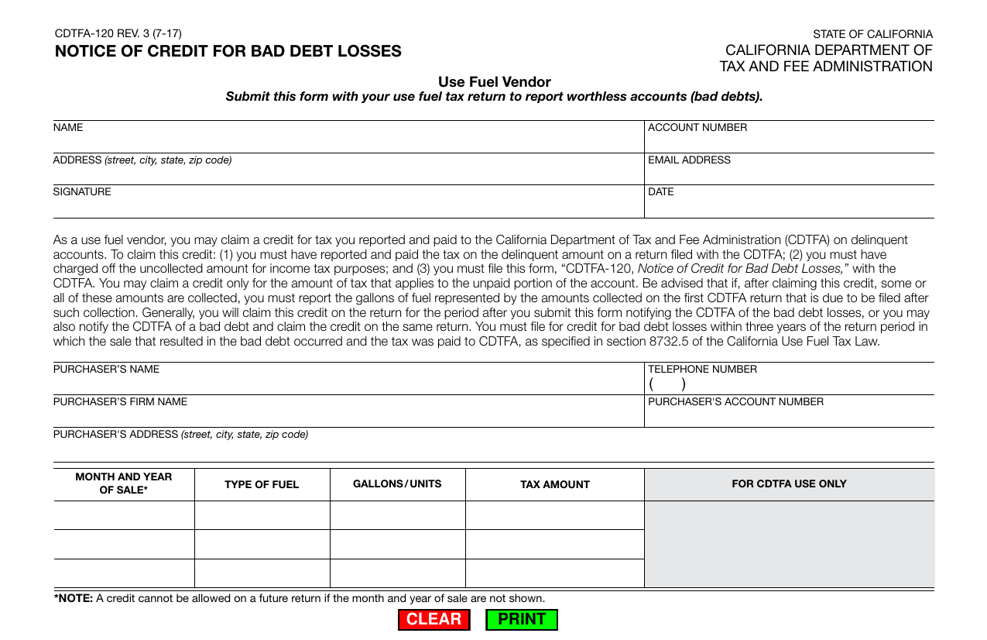

This form is used for reporting and claiming a credit for bad debt losses in California.

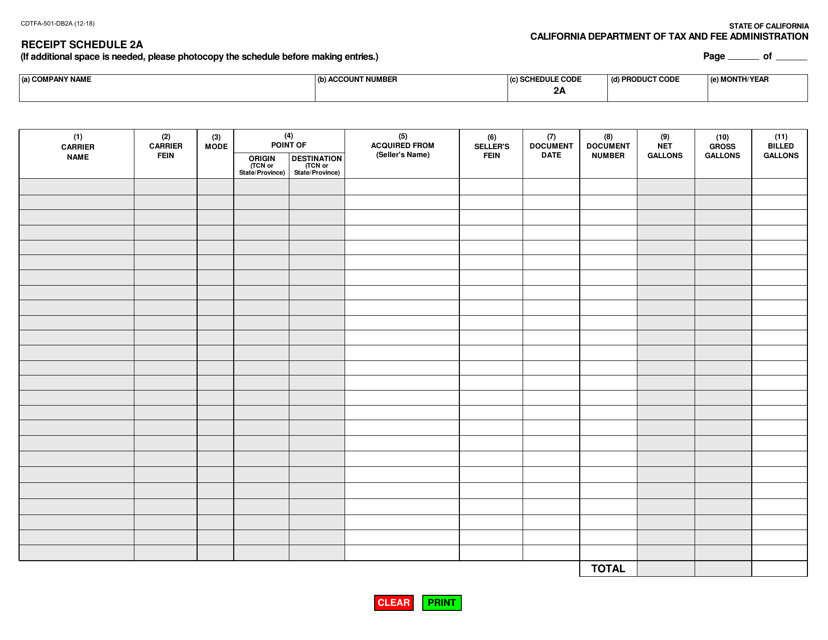

This form is used for reporting receipts on Schedule 2A in California.

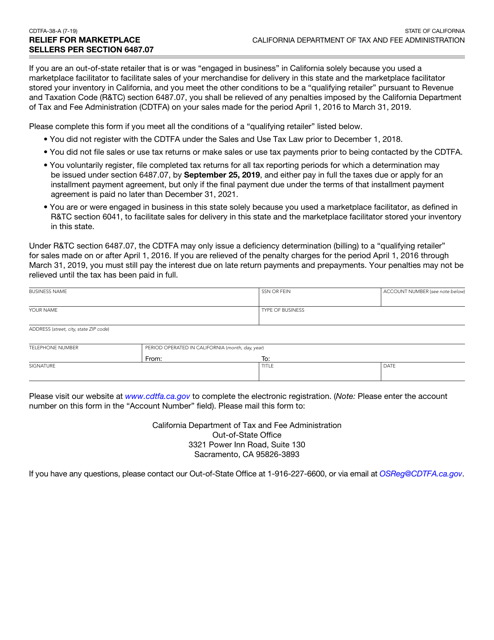

This Form is used for applying for relief for marketplace sellers in California as per Section 6487.07.

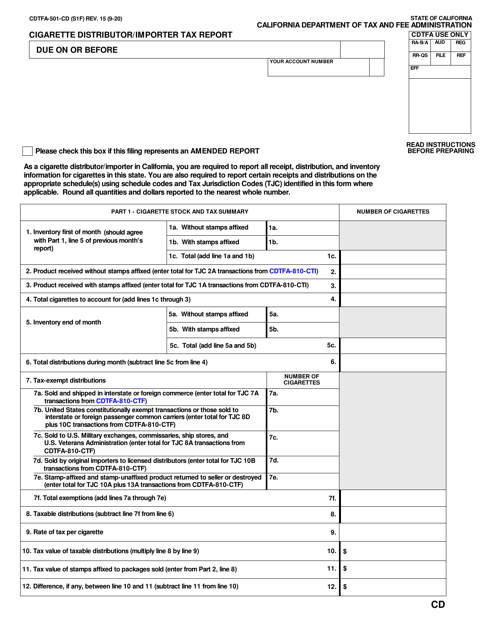

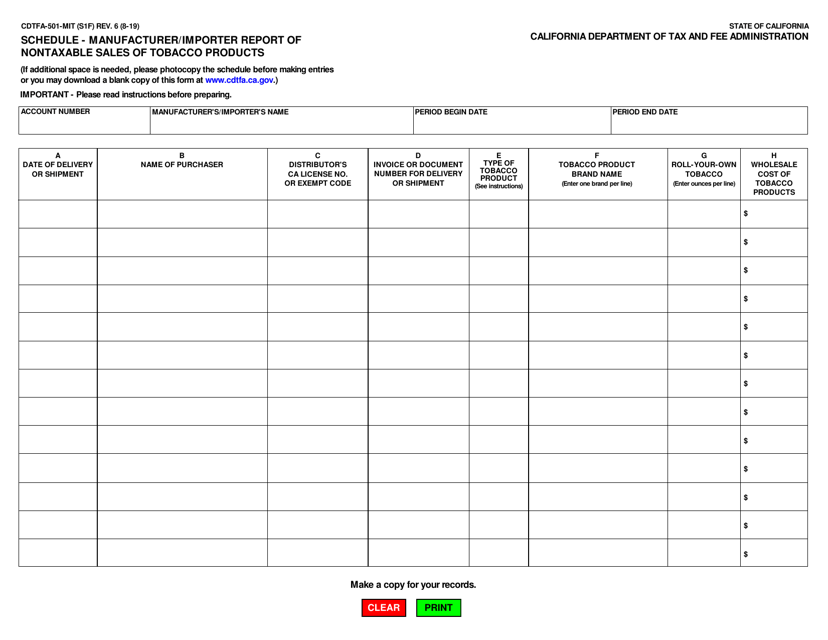

Form CDTFA-501-MIT Manufacturer/Importer Report of Nontaxable Sales of Tobacco Products - California

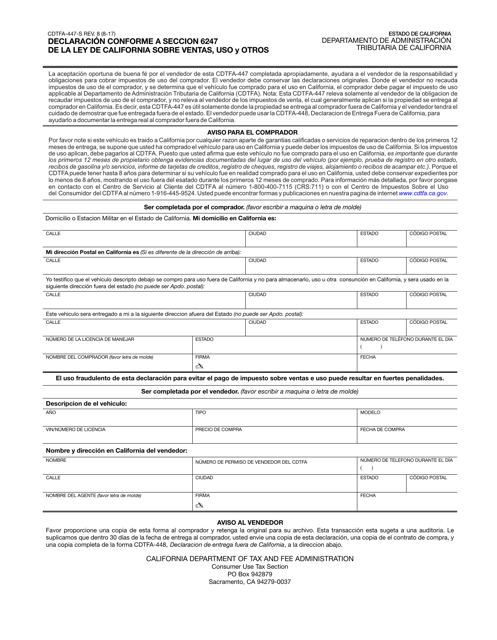

This form is used for making a declaration in accordance with Section 6247 of the California Sales and Use Tax Law.

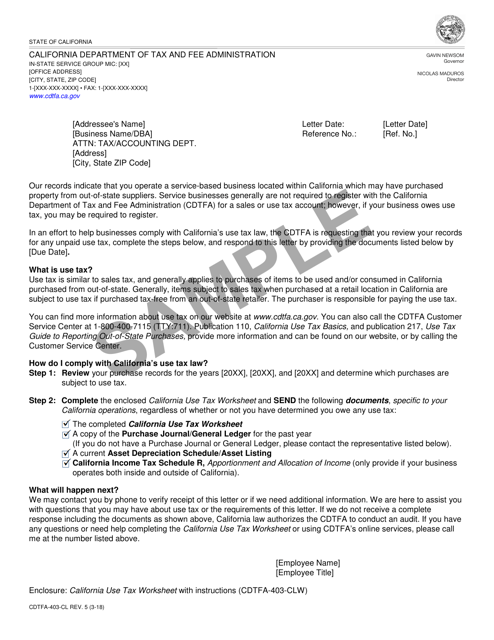

This document is a contact letter used by the California Department of Tax and Fee Administration (CDTFA) to communicate with businesses regarding tax discrepancies within the state.