Arkansas Department of Finance & Administration Forms

Documents:

426

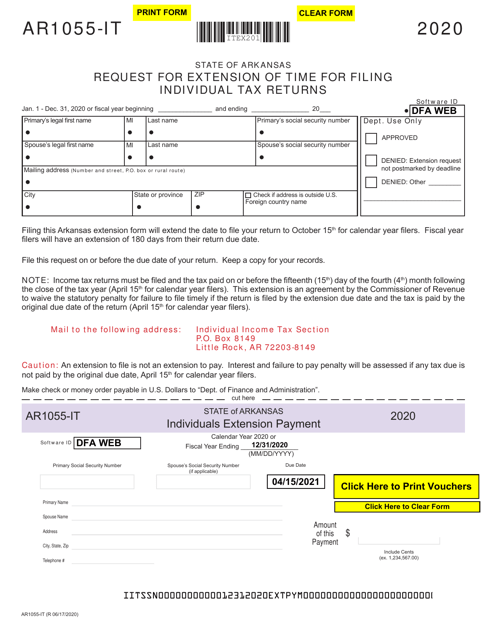

This form is used for requesting an extension of time to file your individual tax returns in Arkansas.

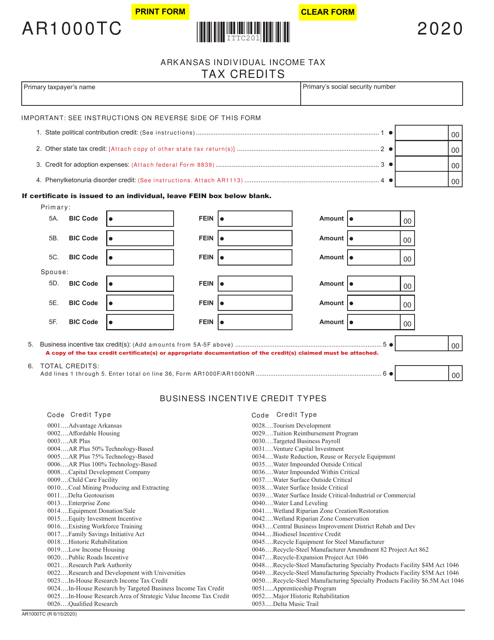

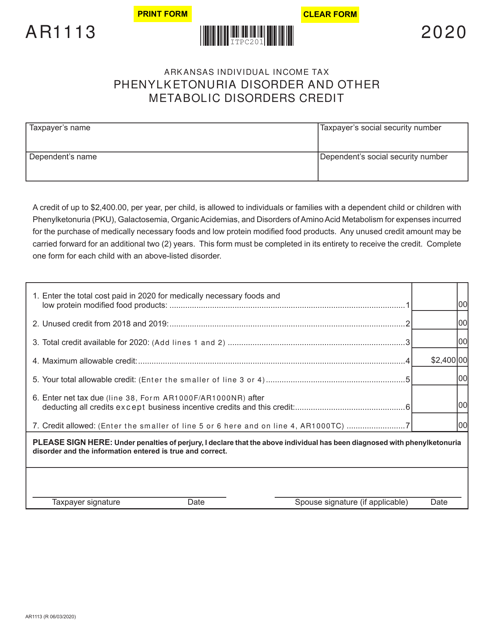

This Form is used for claiming tax credits on your Arkansas state taxes. It allows you to reduce the amount of tax you owe or increase your tax refund.

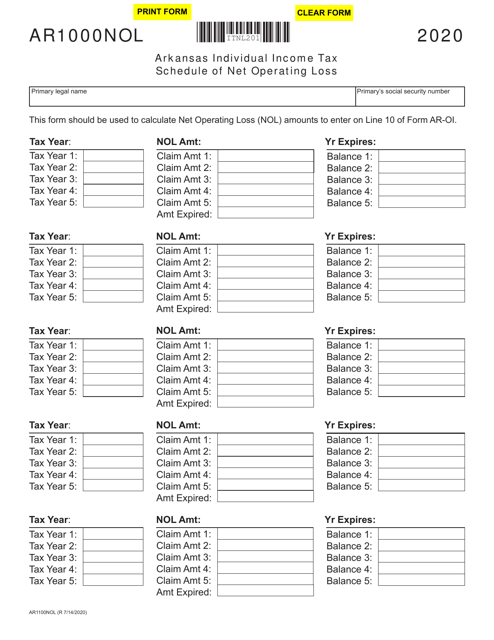

This form is used for reporting net operating losses in the state of Arkansas.

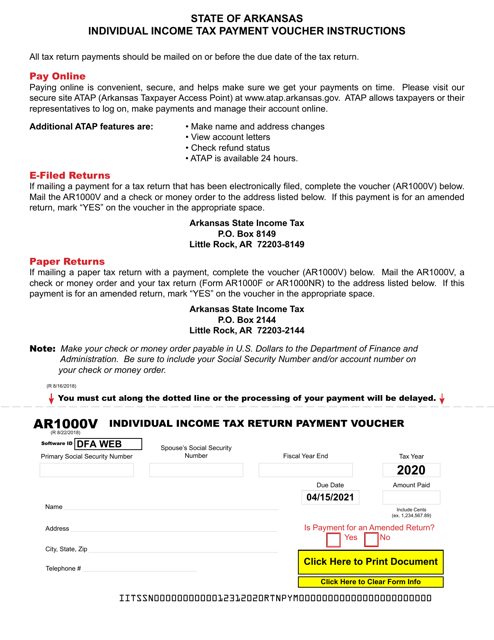

This form is used for making a payment towards your individual income tax return in the state of Arkansas. It serves as a payment voucher accompanying your tax return.

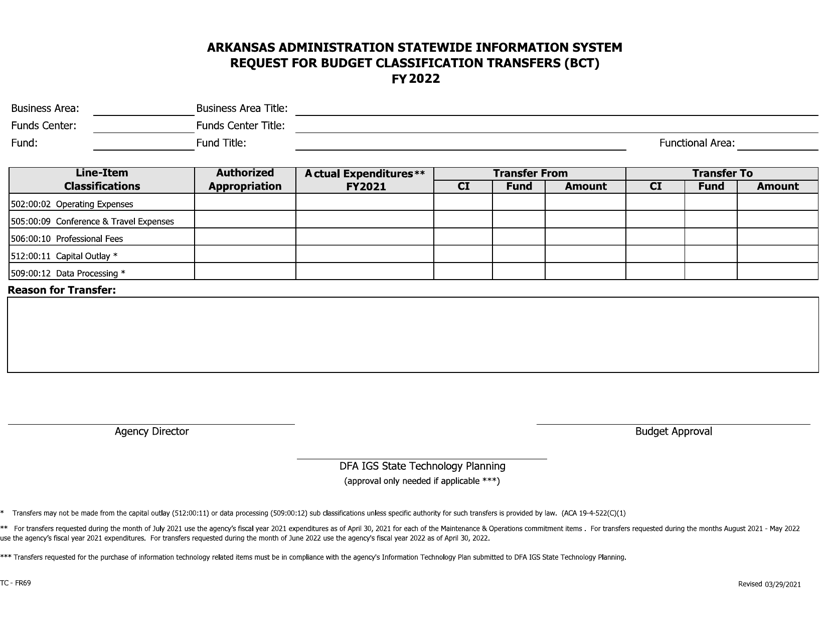

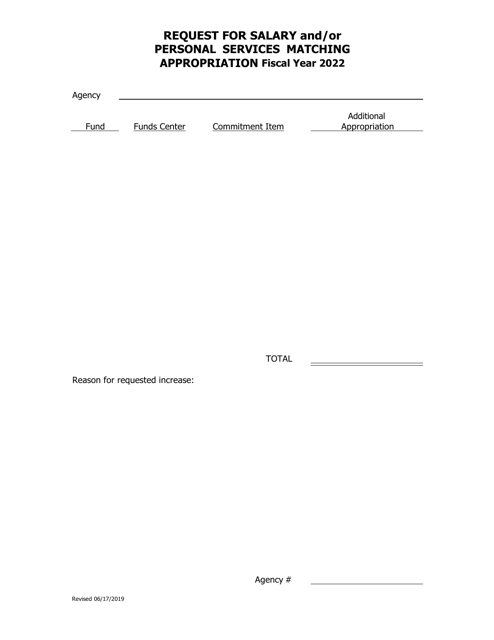

This document is a request form for making budget classification transfers in the state of Arkansas. It allows for the movement of funds between different budget categories.

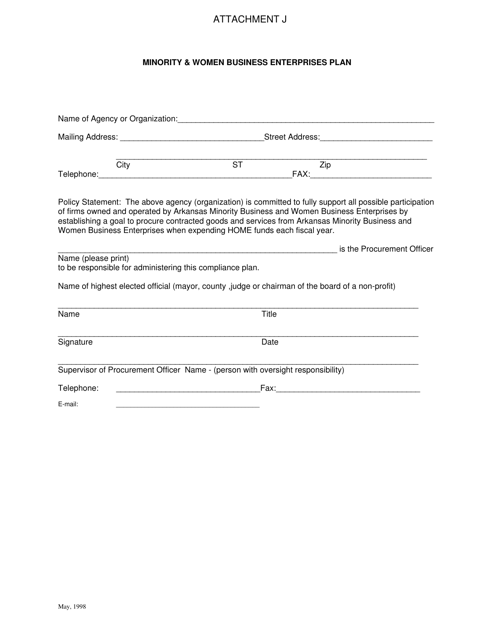

This document outlines the plan for promoting and supporting minority and women-owned businesses in Arkansas.

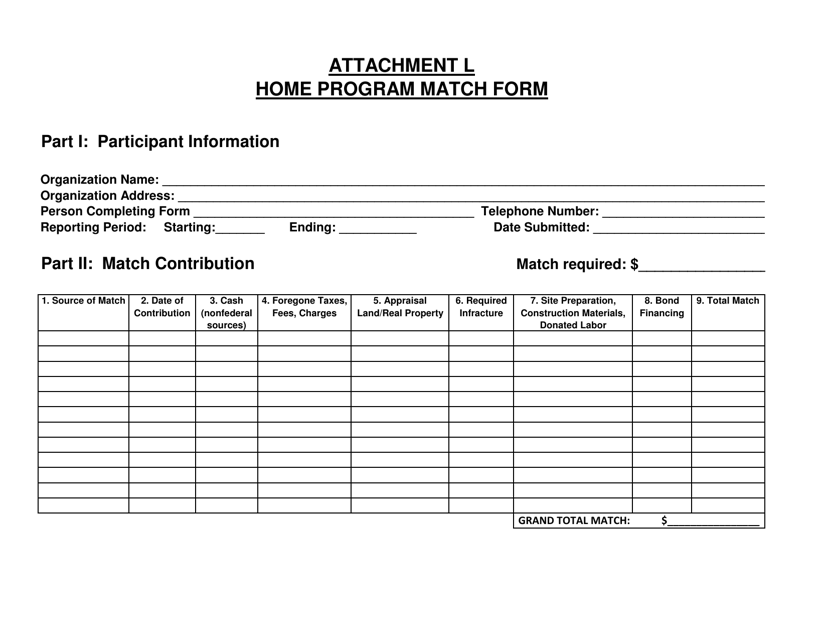

This Form is used for the Home Program in Arkansas to match funding for affordable housing projects.

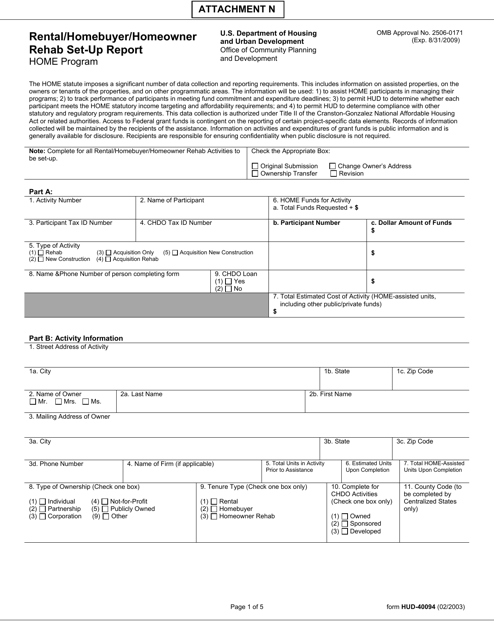

Form HUD-40094 Attachment N Rental/Homebuyer/Homeowner Rehab Set-Up Report - Home Program - Arkansas

This form is used for reporting the set-up of rental, homebuyer, or homeowner rehab projects under the Home Program in Arkansas.

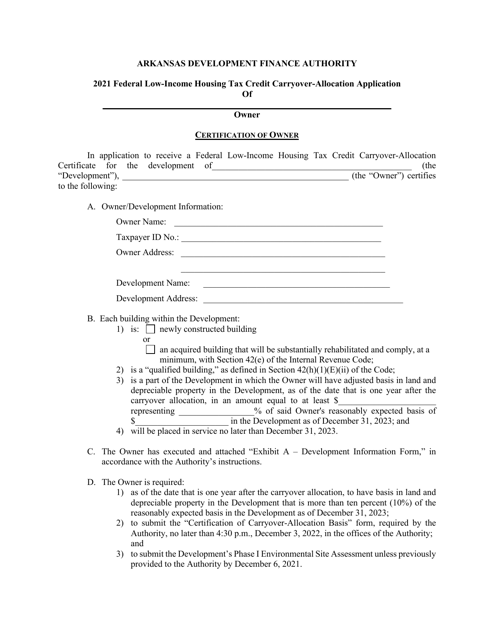

This document is used for applying for carryover-allocation of federal low-income housing tax credits in Arkansas.

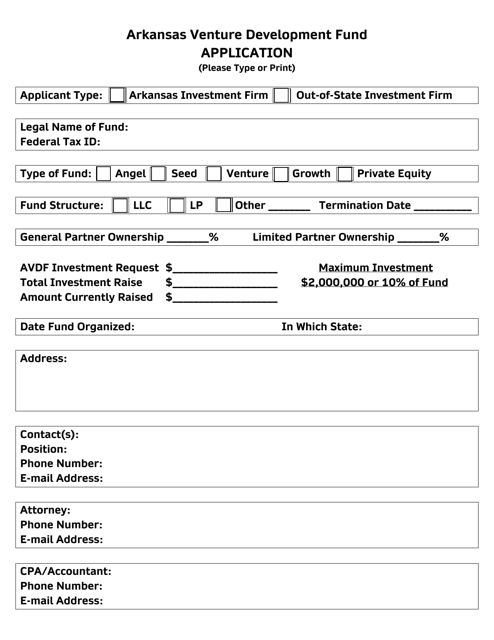

This document is an application for the Arkansas Venture Development Fund, which is a program in Arkansas that provides financial support to innovative businesses and entrepreneurs.

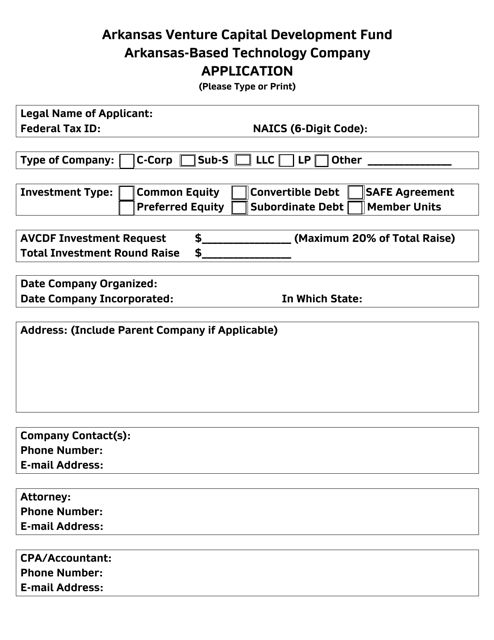

This type of document is used for applying to an Arkansas-based technology company.

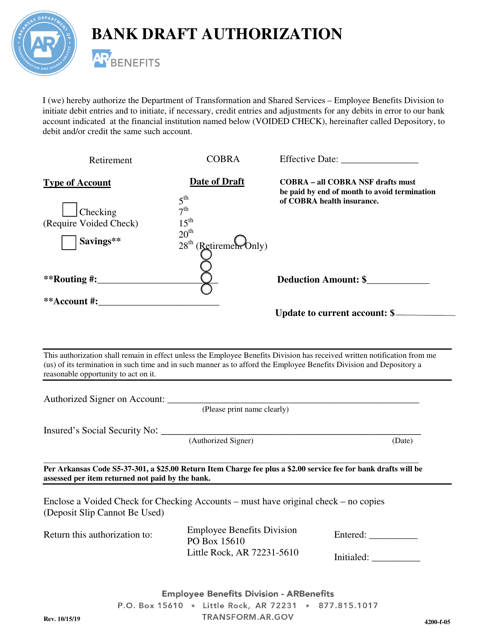

This form is used for authorizing a bank draft in Arkansas.

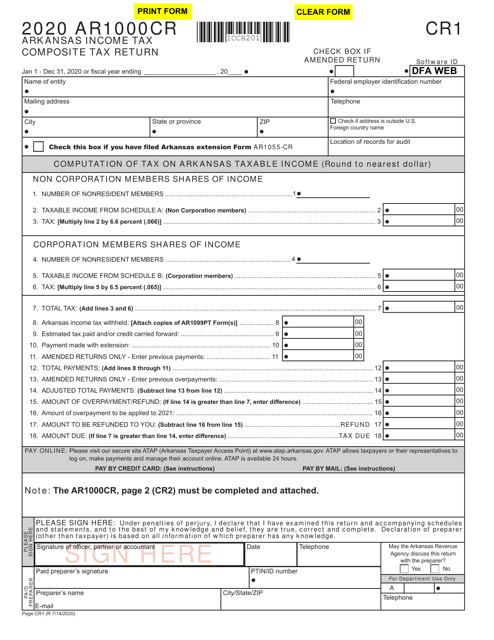

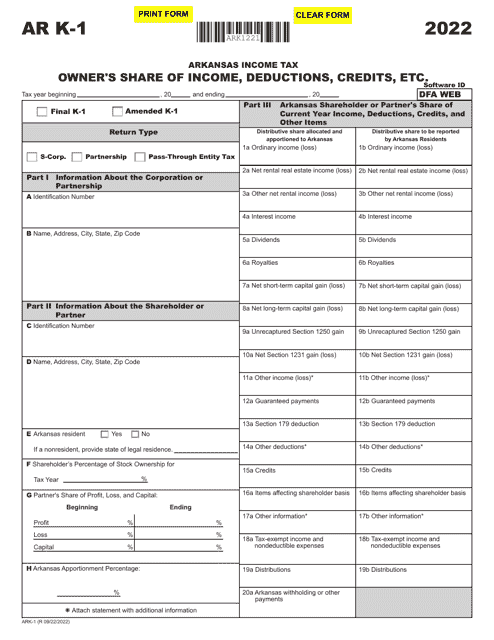

This document is used for filing a composite tax return for Arkansas income tax.

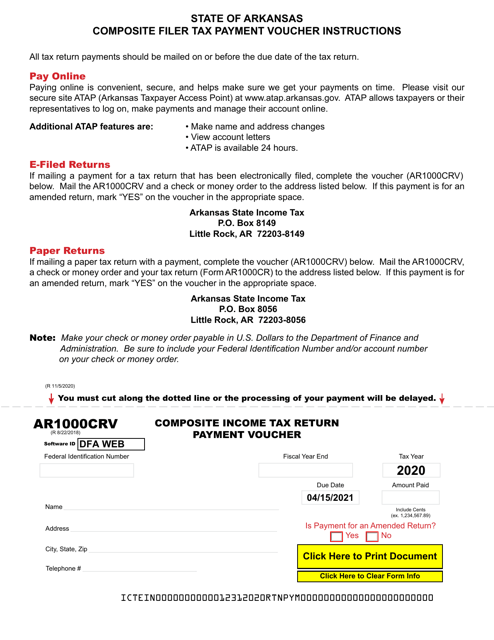

This Form is used for making payment for the Arkansas Composite Income Tax Return.

This Form is used for filing the Arkansas Income Tax Composite Tax Return for individuals or entities participating in a composite filing. This form is specific to Arkansas state income taxes.