Arkansas Department of Finance & Administration Forms

Documents:

426

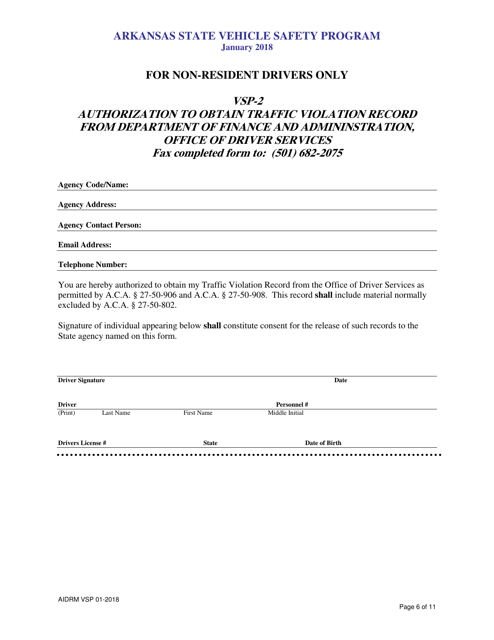

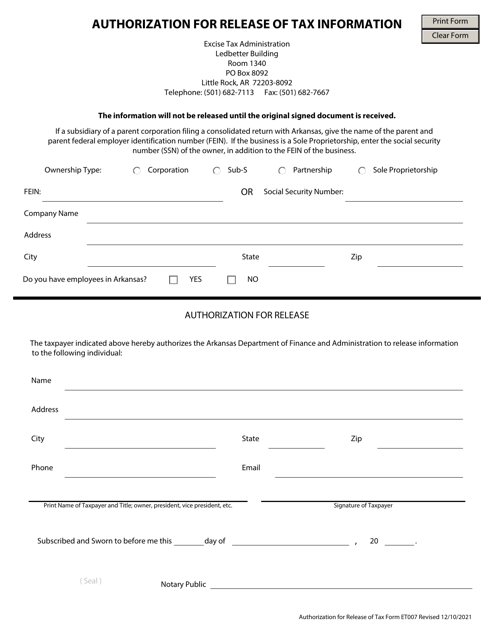

This form is used for authorizing the Department of Finance and Administration, Office of Driver Services in Arkansas to obtain a traffic violation record.

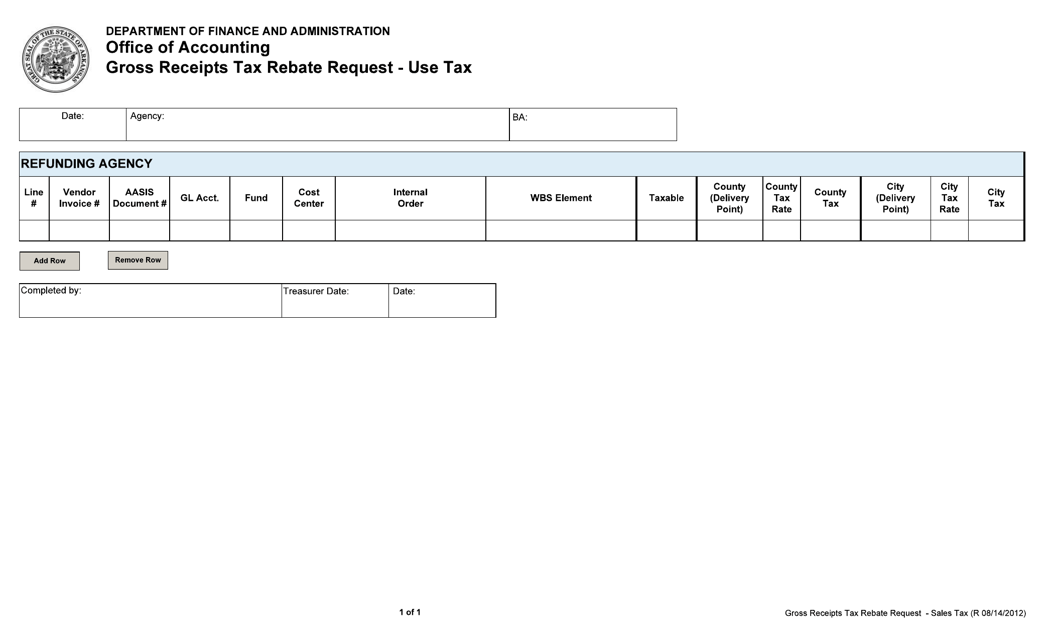

This document is used for requesting a rebate of the Gross Receipts Tax on Use Tax in Arkansas.

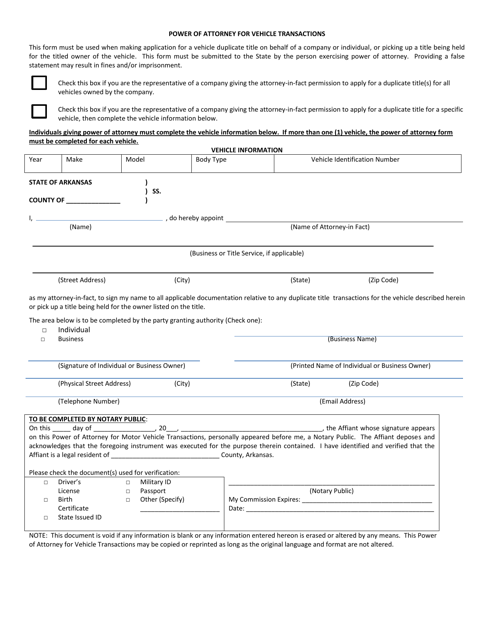

This type of document, known as Power of Attorney for Vehicle Transactions, is used in Arkansas to authorize someone else to handle vehicle-related transactions on your behalf.

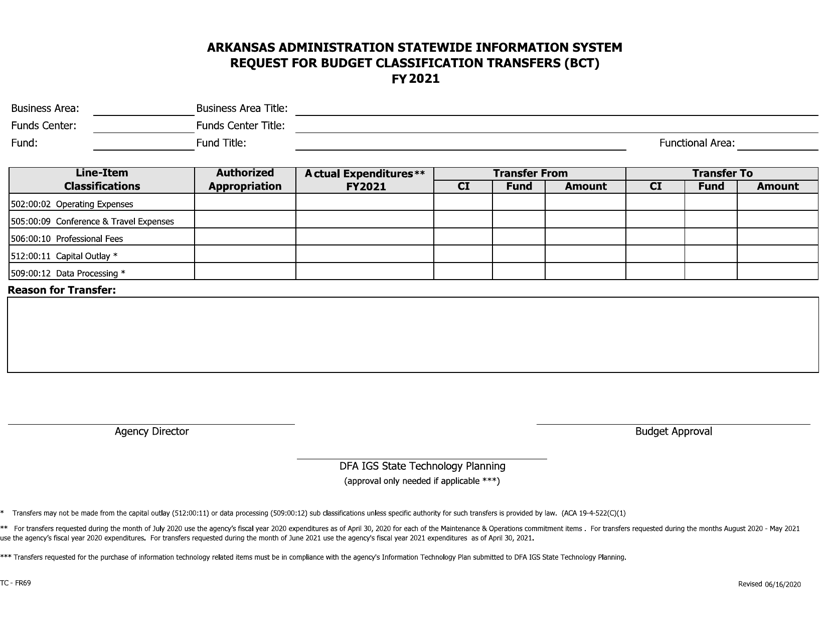

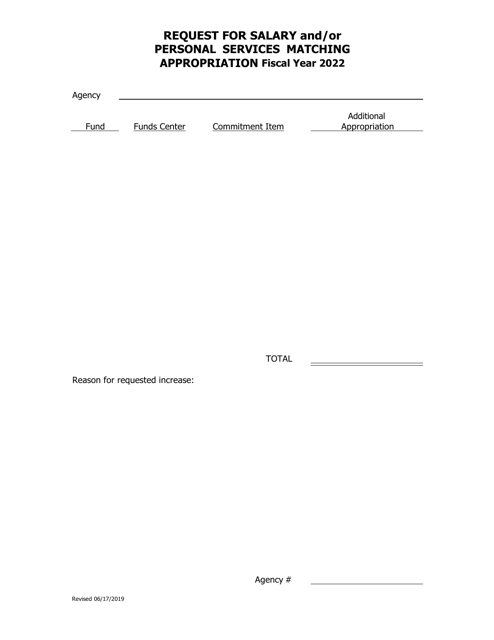

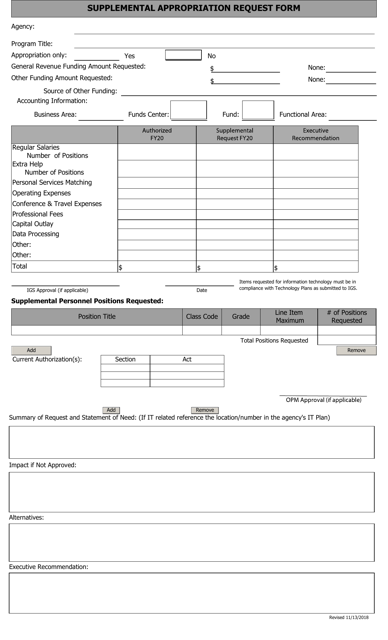

This Form is used for requesting additional funding beyond the original budget allocation in Arkansas.

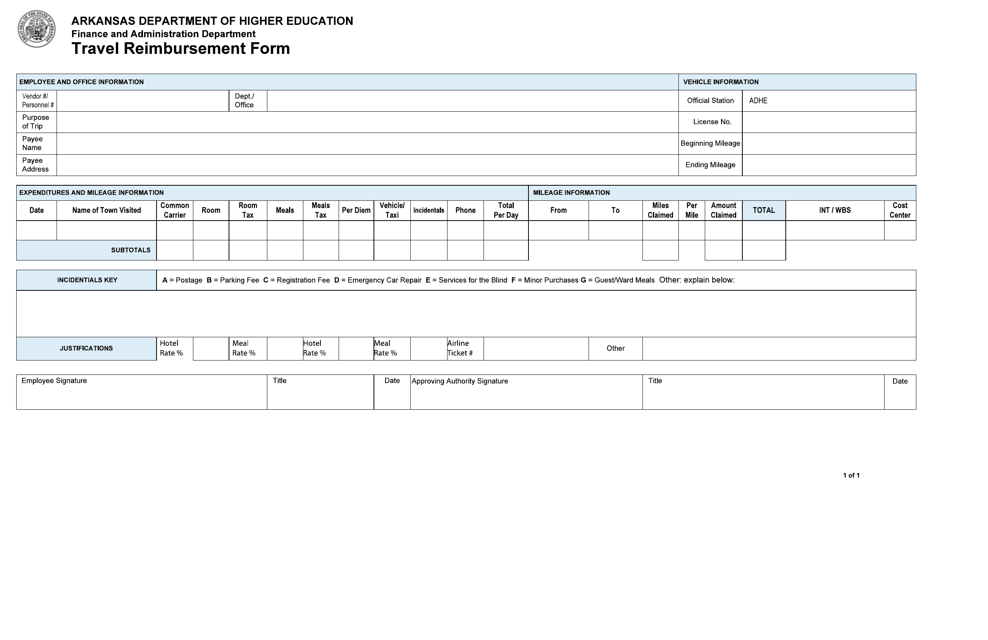

This Form is used for requesting reimbursement for travel expenses in Arkansas.

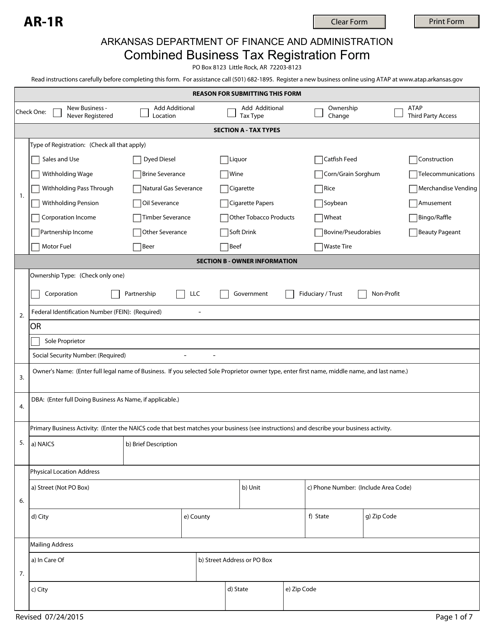

This Form is used for registering a business for tax purposes in Arkansas.

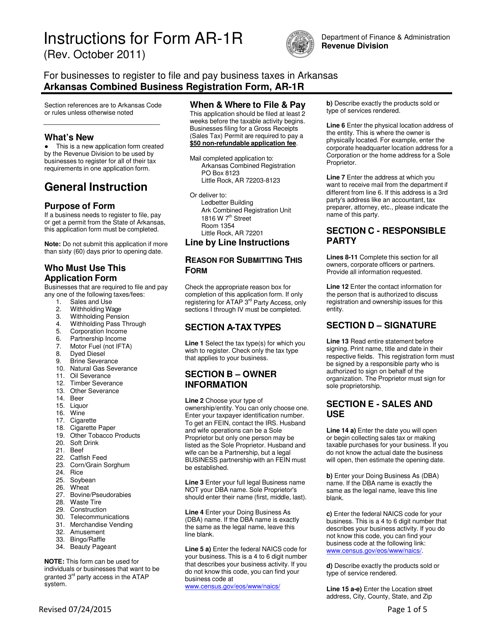

This Form is used for combined business tax registration in the state of Arkansas. It provides instructions on how to complete Form AR-1R to register your business for various taxes.

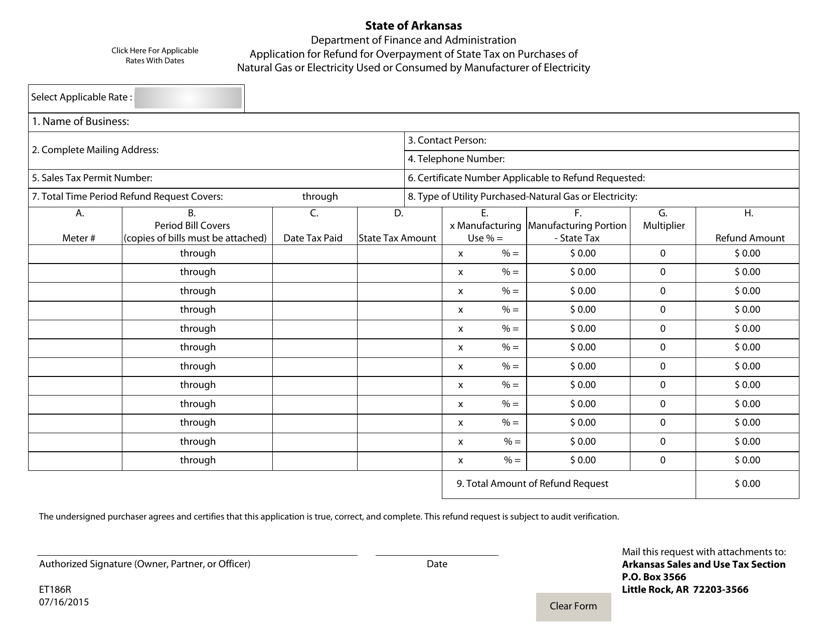

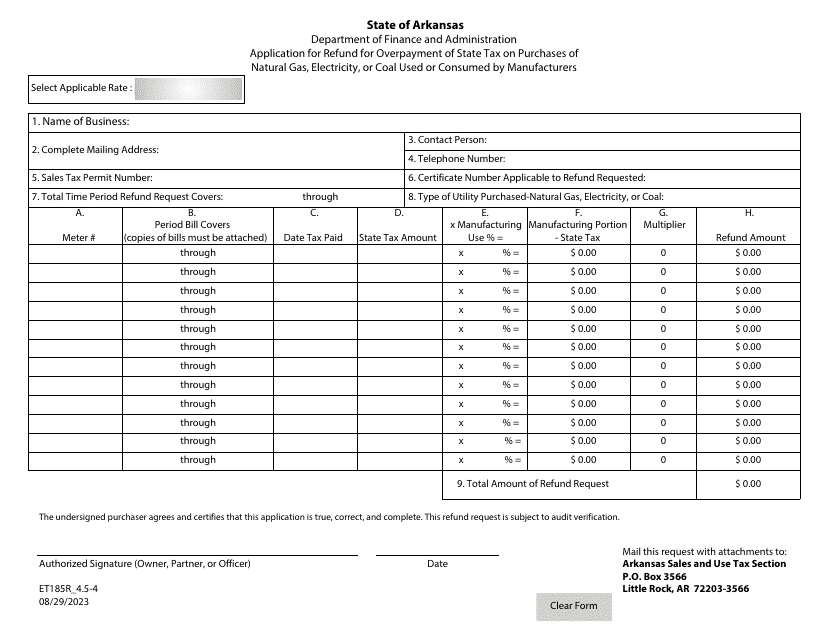

This form is used for applying for a refund for overpayment of state tax on purchases of natural gas or electricity used or consumed by a manufacturer of electricity in Arkansas.

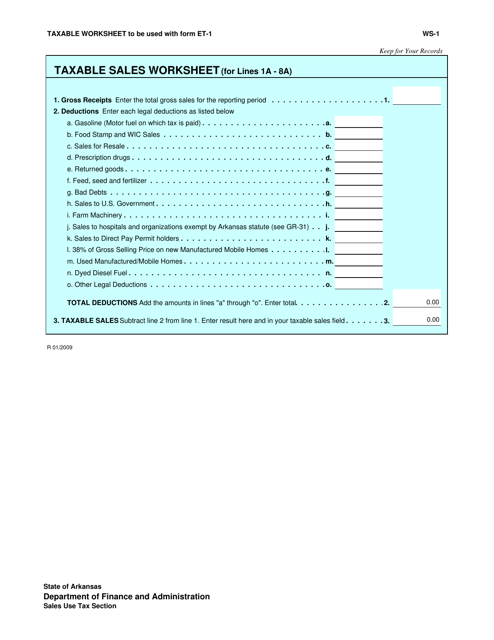

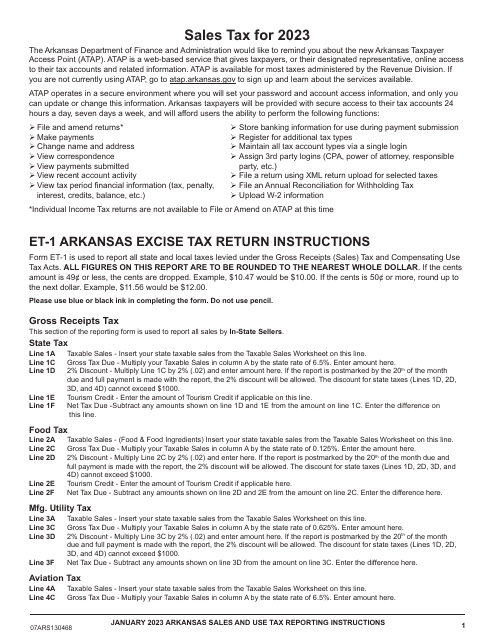

This document is used for calculating taxable sales in the state of Arkansas. It helps businesses determine the amount of sales that are subject to sales tax.

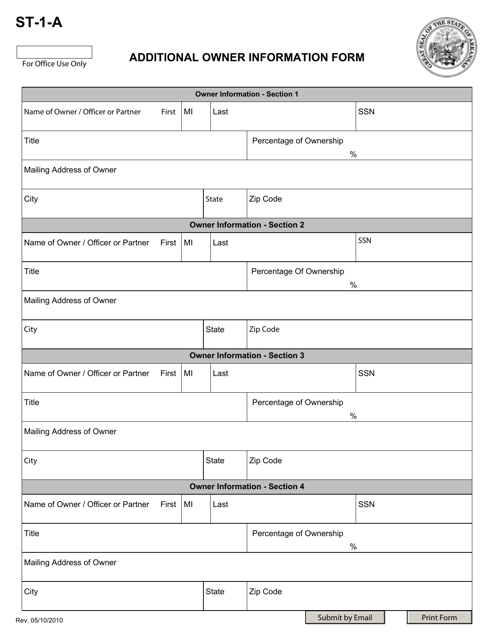

This form is used to provide additional information about the owner(s) of a business in the state of Arkansas.

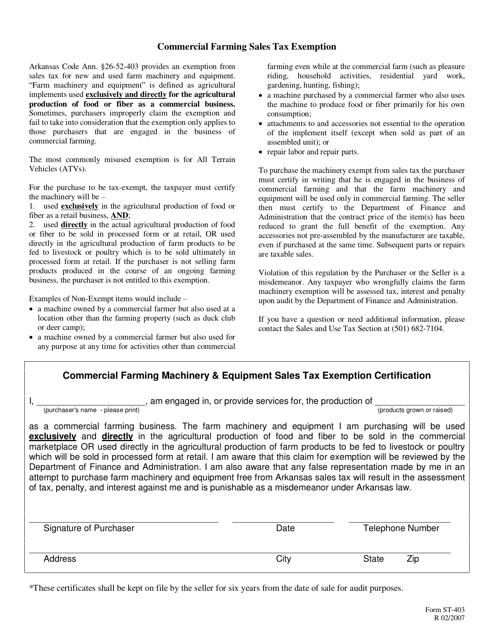

This form is used for applying for a commercial farm exemption certificate in Arkansas.

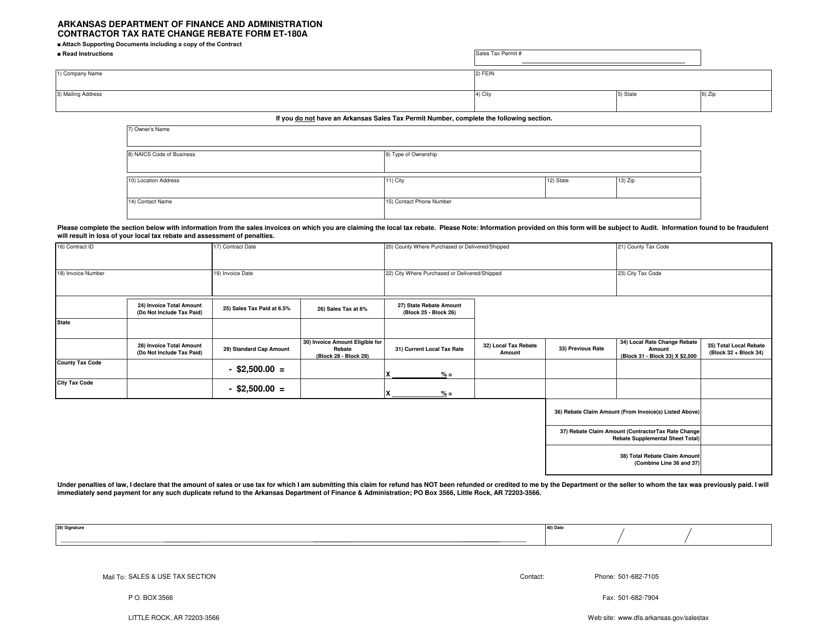

This form is used for contractors in Arkansas to apply for a rebate on tax rate changes.

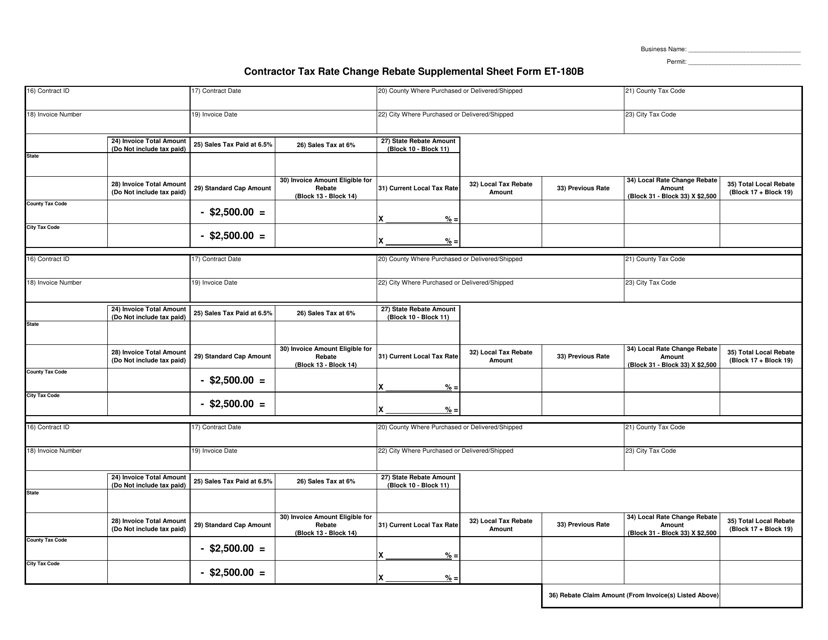

This document is a supplemental sheet for the ET-180B Contractor Tax Rate Change Rebate form in Arkansas. It provides additional information or instructions related to the tax rate change rebate for contractors.

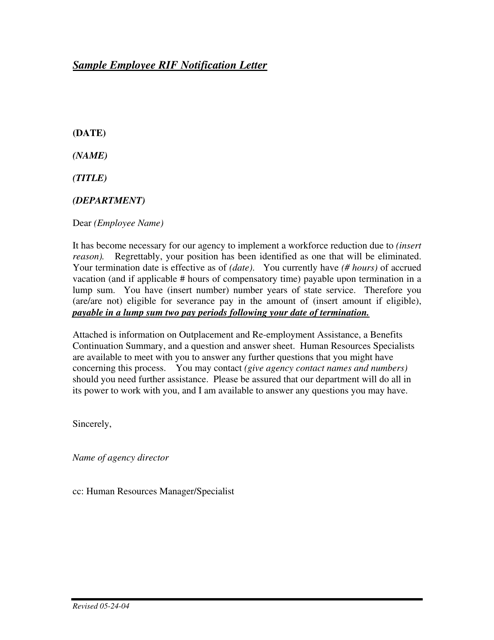

This document is a sample letter for notifying an employee about their reduction in force (RIF) in the state of Arkansas. It provides a template that employers can use to communicate this information to affected employees.

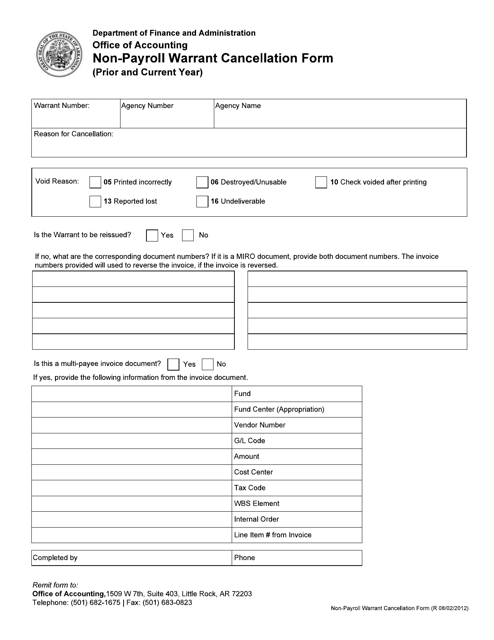

This document is used for canceling non-payroll warrants in Arkansas for both the current and prior years.

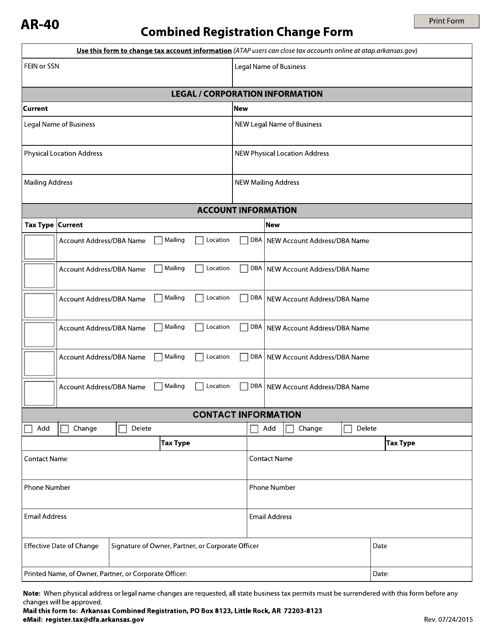

This form is used for making changes to your registration information in Arkansas.

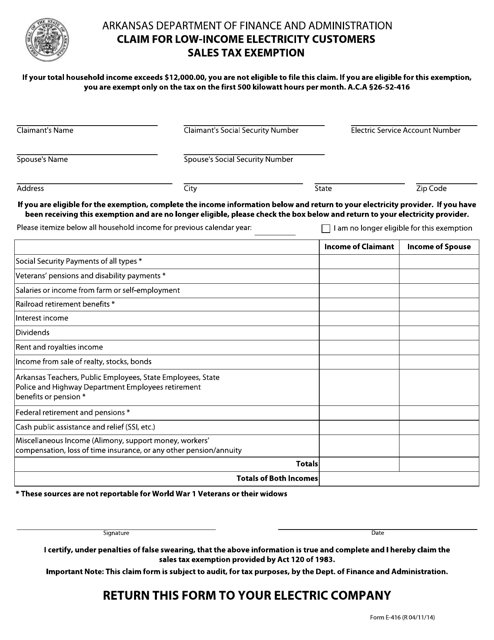

This form is used for claiming a sales tax exemption on electricity for low-income customers in Arkansas.

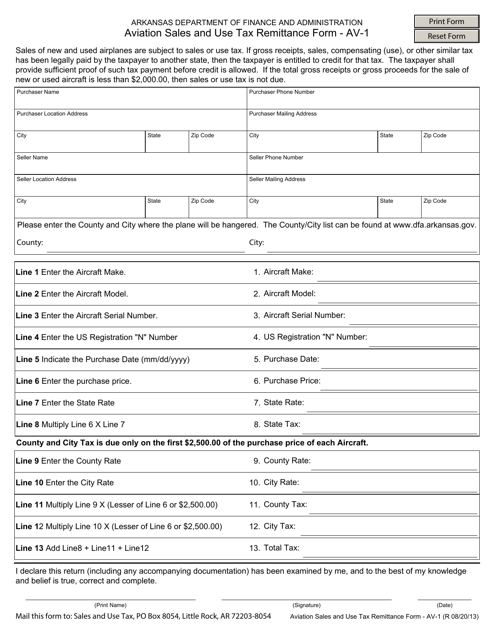

This form is used for remitting aviation sales and use tax in the state of Arkansas.

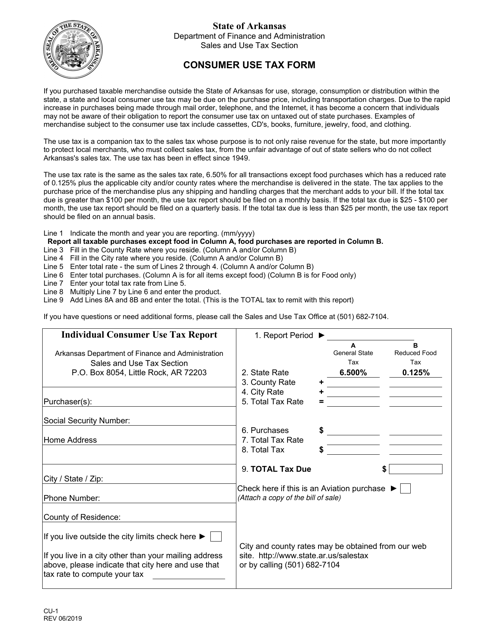

This Form is used for reporting and paying consumer use tax in Arkansas.

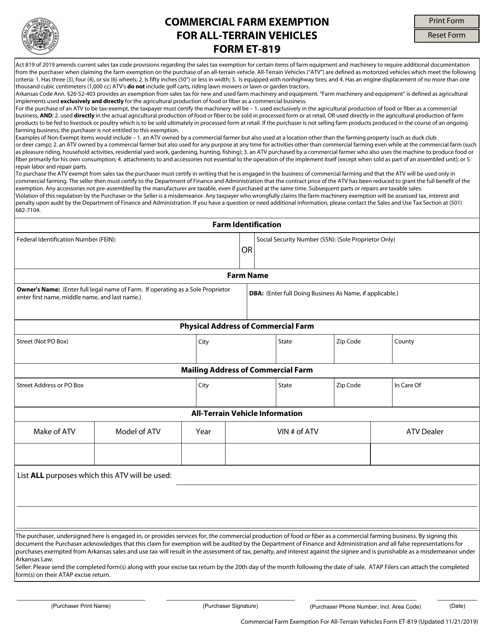

This form is used for applying for a commercial farm exemption for all-terrain vehicles in Arkansas.

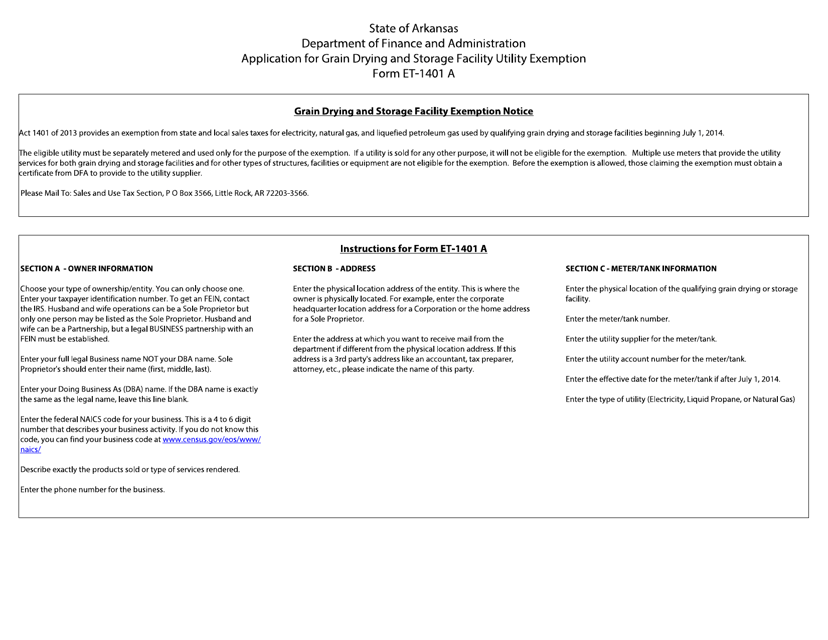

This form is used for applying for a utility exemption for grain drying and storage facilities in Arkansas.

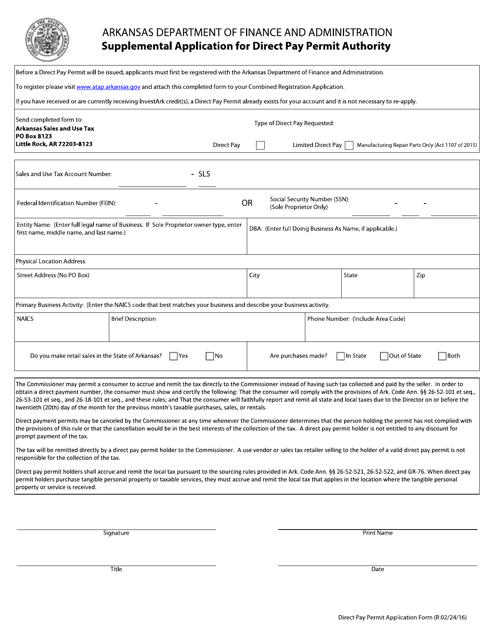

This document is used for applying for direct pay permit authority in the state of Arkansas. A direct pay permit allows a business to pay sales tax directly to the state instead of collecting it from customers.

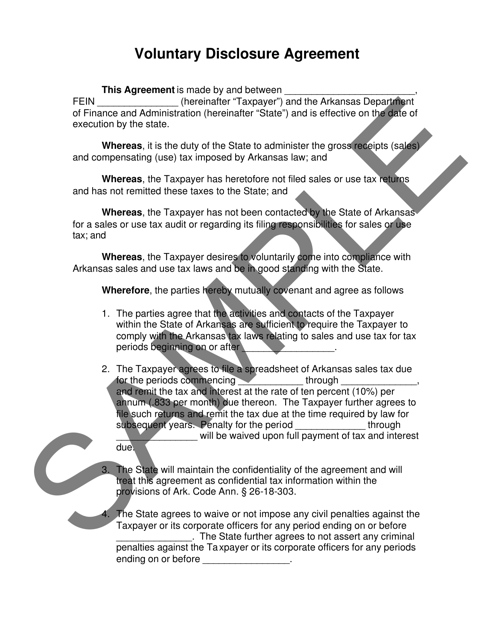

This Form is used for disclosing and resolving any past sales tax liabilities in Arkansas on a voluntary basis.

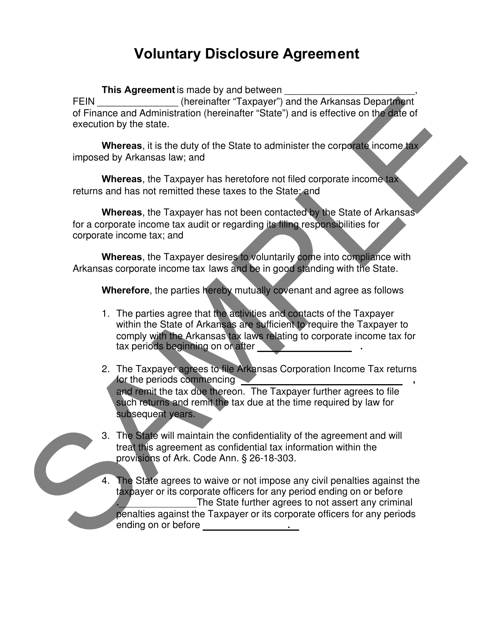

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

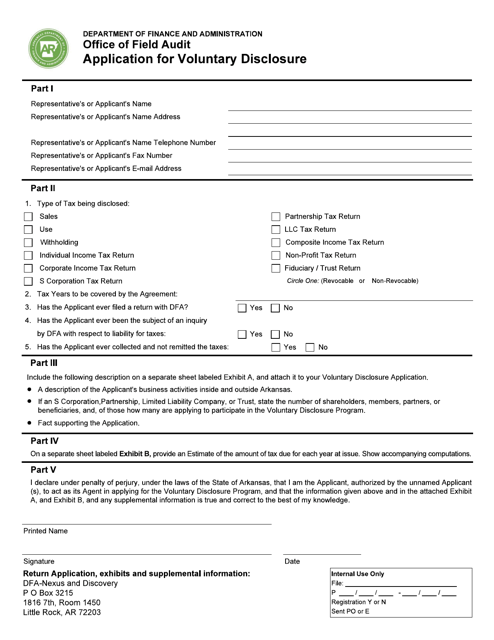

This document is an application for voluntary disclosure in the state of Arkansas. It is used for individuals or businesses to voluntarily disclose any past tax liabilities and come into compliance with state tax laws.

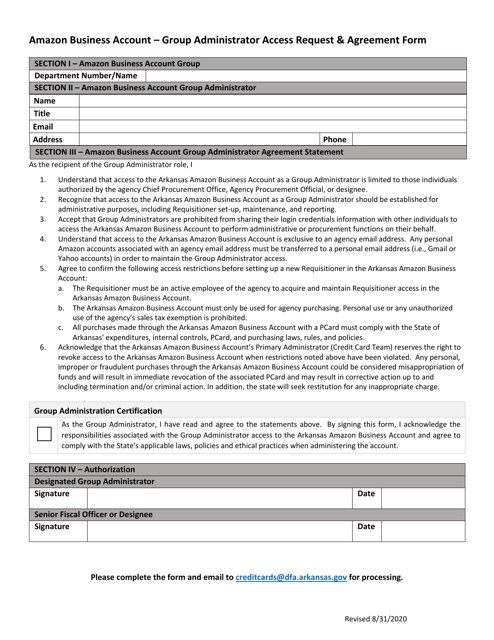

This form is used for requesting and gaining group administrator access to an Amazon Business account in the state of Arkansas.

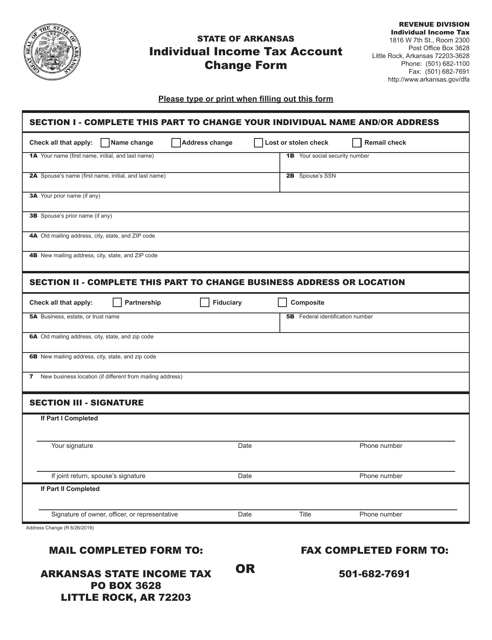

This form is used for making changes to an individual's income tax account in the state of Arkansas.

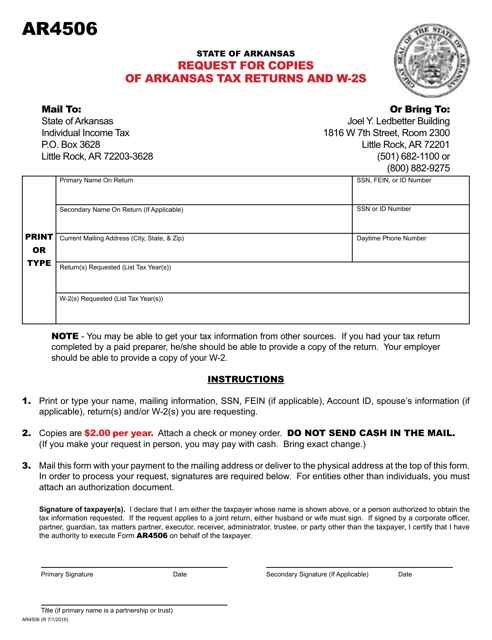

This form is used for requesting copies of Arkansas tax returns.

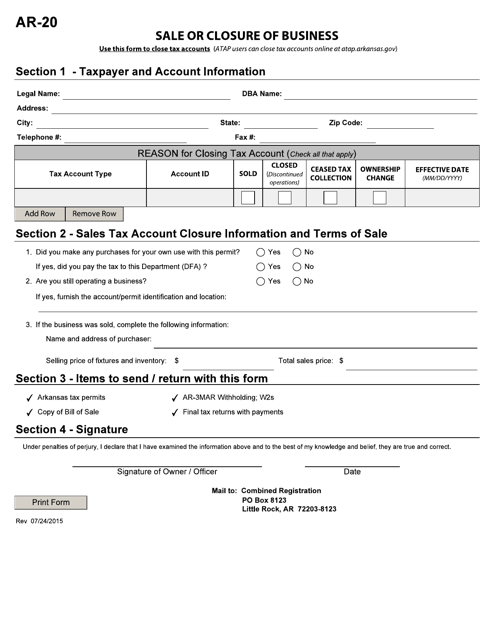

This form is used for reporting the sale or closure of a business in Arkansas. It is required by the state for tax and record-keeping purposes.