Alabama Department of Revenue Forms

Documents:

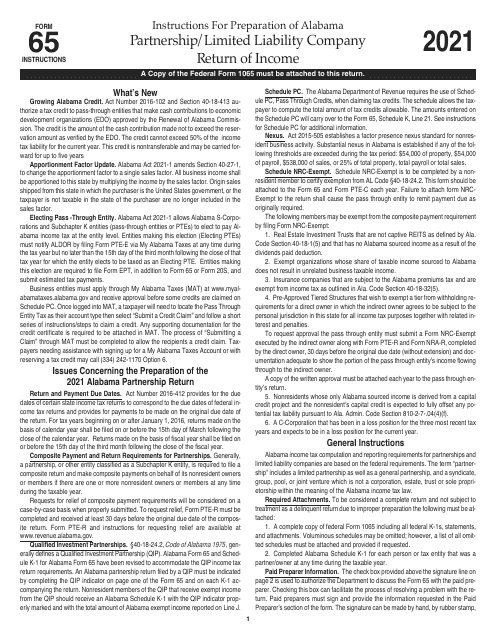

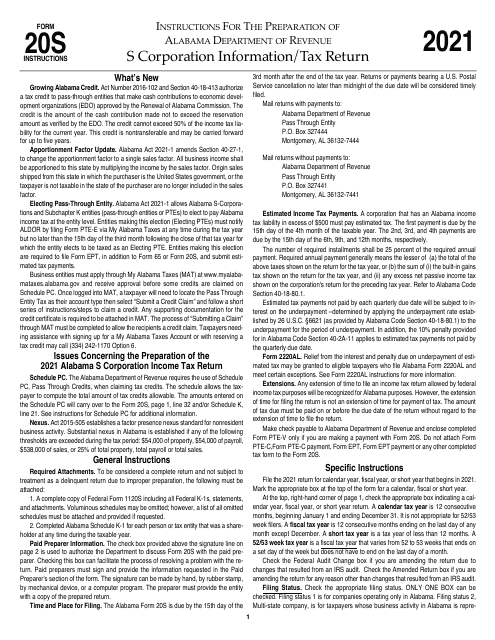

587

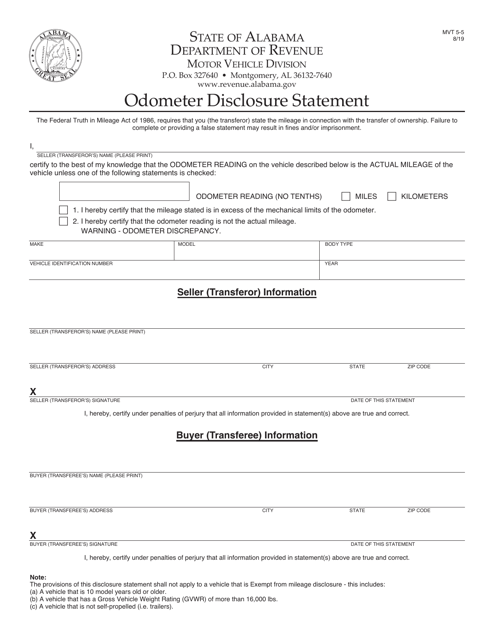

This form is used for disclosing the vehicle's odometer reading when buying or selling a vehicle in Alabama.

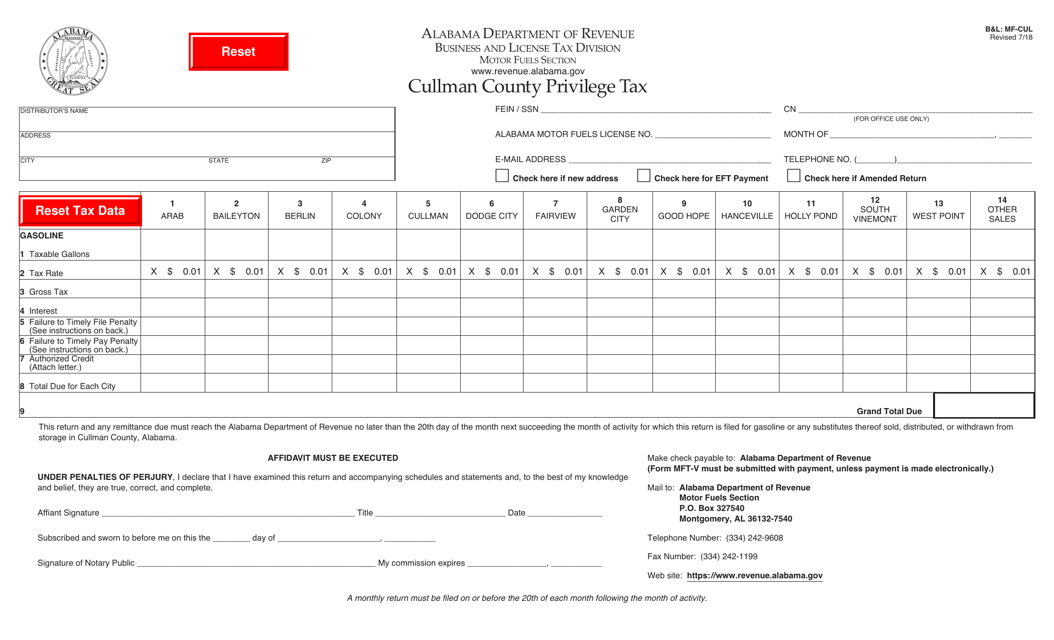

This form is used for paying the privilege tax in Cullman County, Alabama.

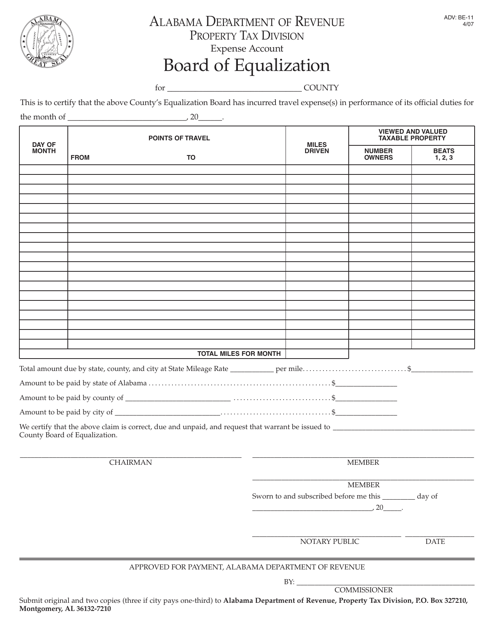

This document is used for reporting expenses related to the board of equalization in Alabama.

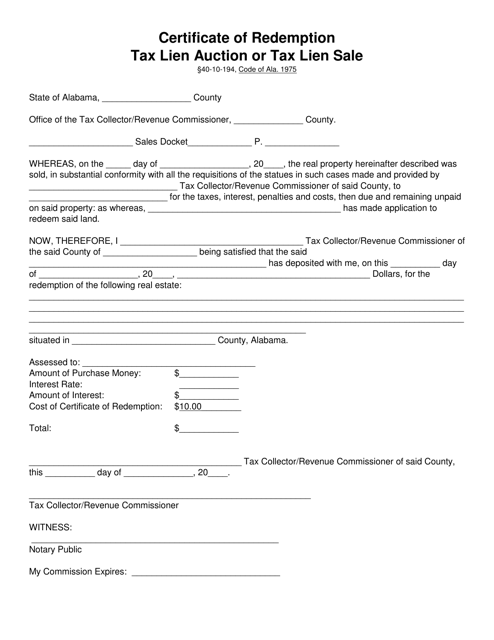

This type of document is used for certifying the redemption of a tax lien in Alabama after an auction or sale has taken place. It confirms that the property owner has paid the required amount to redeem the tax lien and regain ownership of the property.

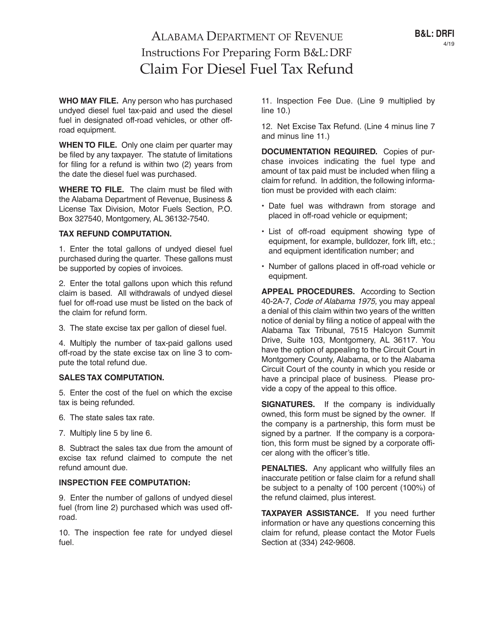

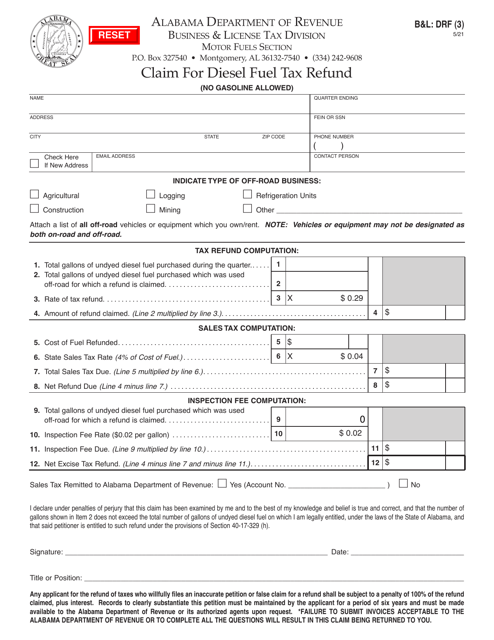

This type of document is used for claiming a refund on diesel fuel taxes in Alabama. It provides instructions on how to fill out Form B&L: DRF Claim for Diesel Fuel Tax Refund.

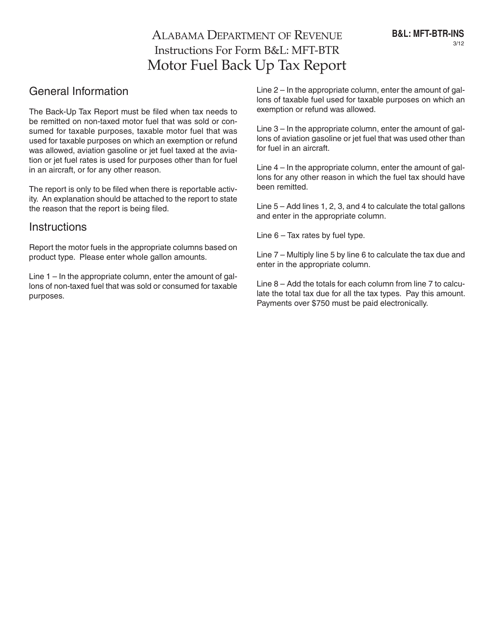

This form is used for reporting motor fuel back up tax in the state of Alabama. It provides instructions for filling out Form B&L: MFT-BTR.

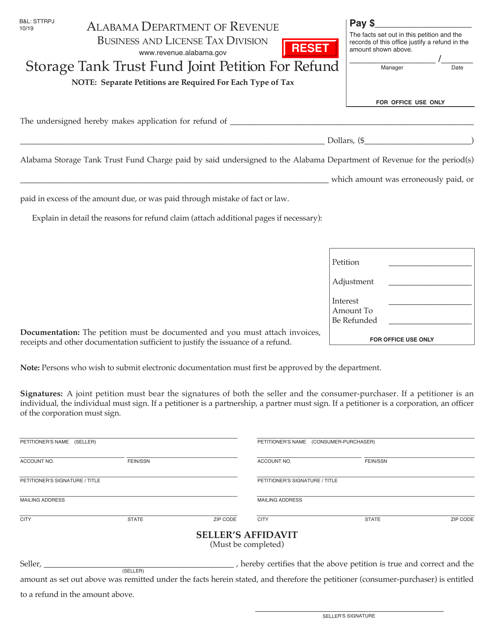

This document is used for filing a joint petition for a refund from the STTRPJ Storage Tank Trust Fund in the state of Alabama.

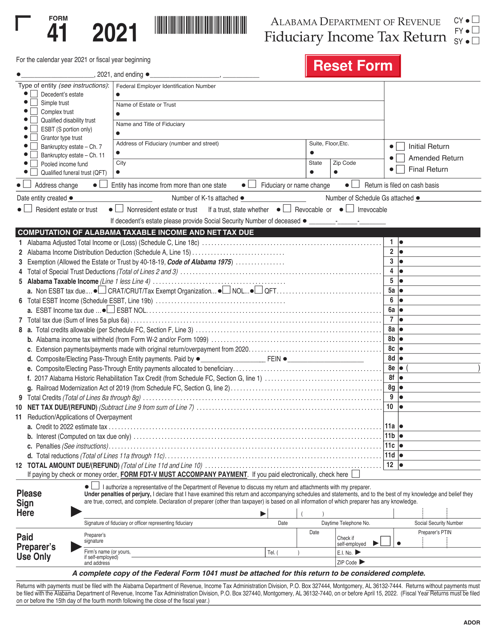

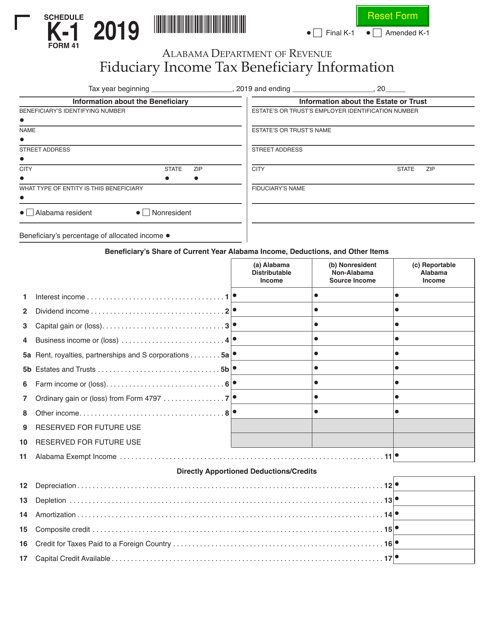

This Form is used for providing beneficiary information for fiduciary income tax in Alabama.

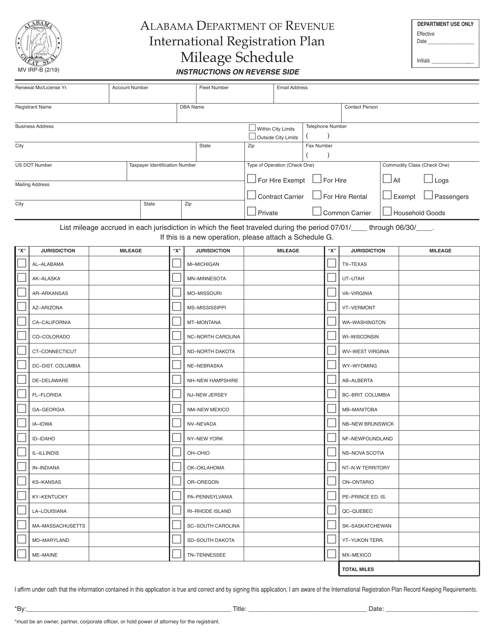

This document is used for the International Registration Plan (IRP) Mileage Schedule for commercial vehicles registered in Alabama. It provides a schedule for calculating the mileage and fees for vehicles operating under the IRP.

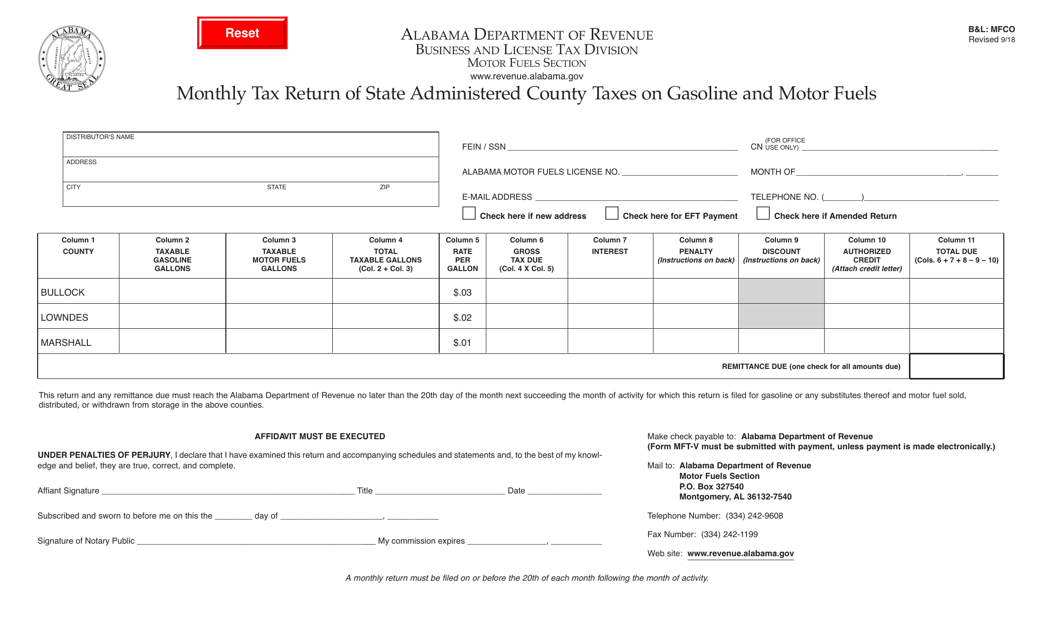

This form is used for filing the monthly tax return for state-administered county taxes on gasoline and motor fuels in Alabama.

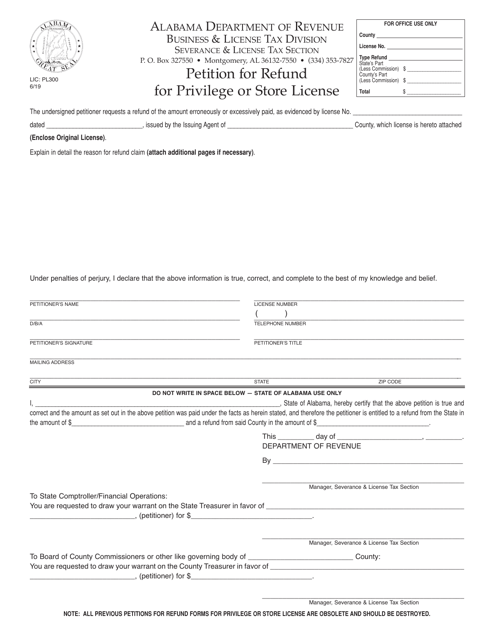

This form is used for petitioning a refund for privilege or store license fees in the state of Alabama.

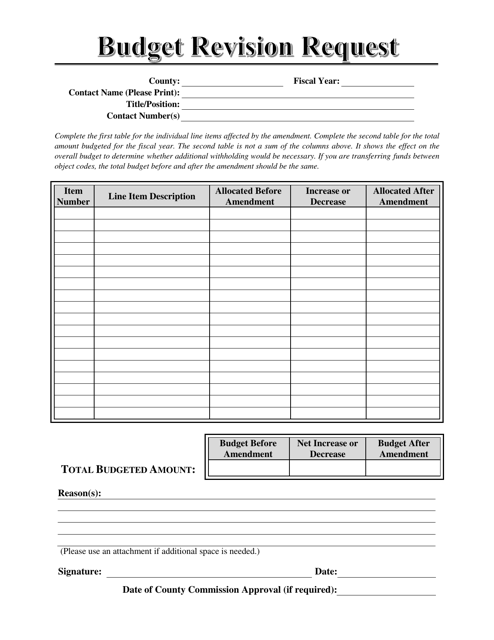

This form is used for requesting a revision to the budget in the state of Alabama. It allows individuals or organizations to propose changes to the initial budget allocation.

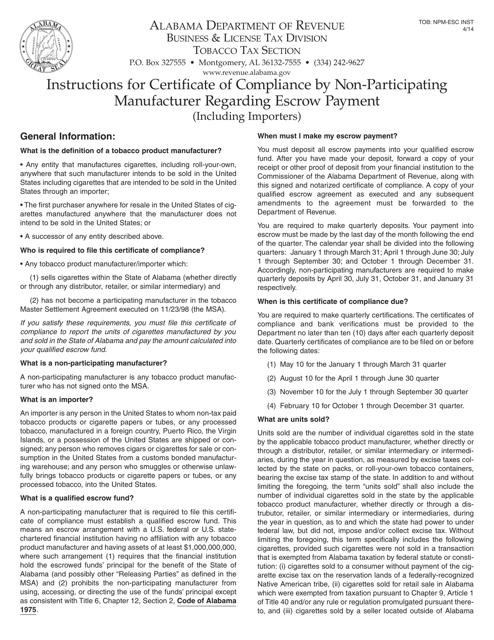

This Form is used for manufacturers and importers in Alabama to certify their compliance with escrow payment regulations.

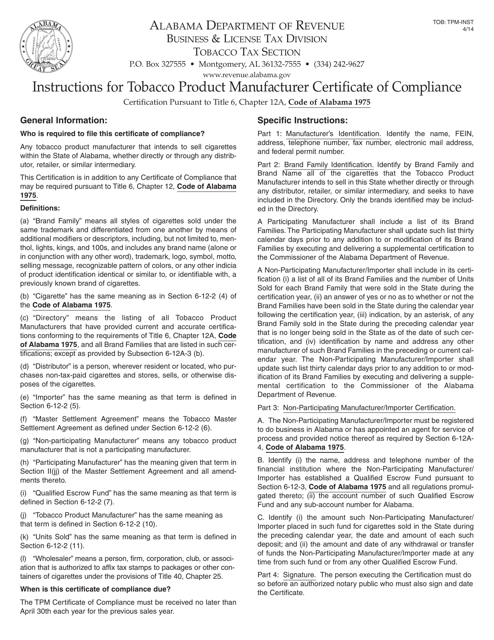

Instructions for Form TOB: TPM CERT Tobacco Product Manufacturer Certificate of Compliance - Alabama

This document is used for obtaining a certificate of compliance for tobacco product manufacturers in the state of Alabama. It provides instructions on how to fill out Form TOB to certify that the manufacturer meets all the necessary requirements.

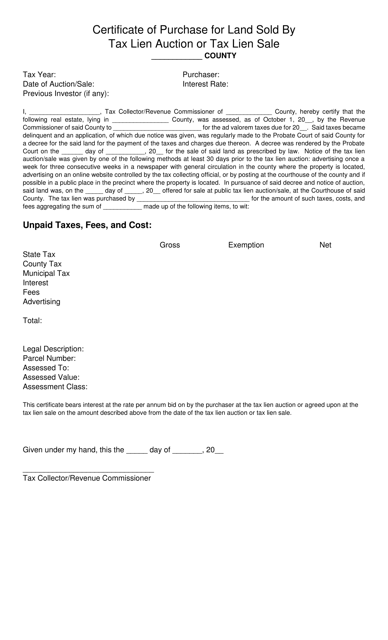

This document is used for certifying the purchase of land sold through a tax lien auction or tax lien sale in the state of Alabama.

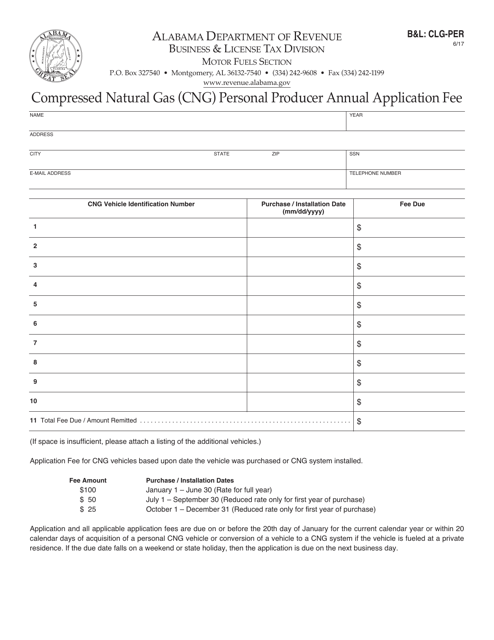

This Form is used for paying the annual application fee for individuals who produce compressed natural gas (CNG) in Alabama.

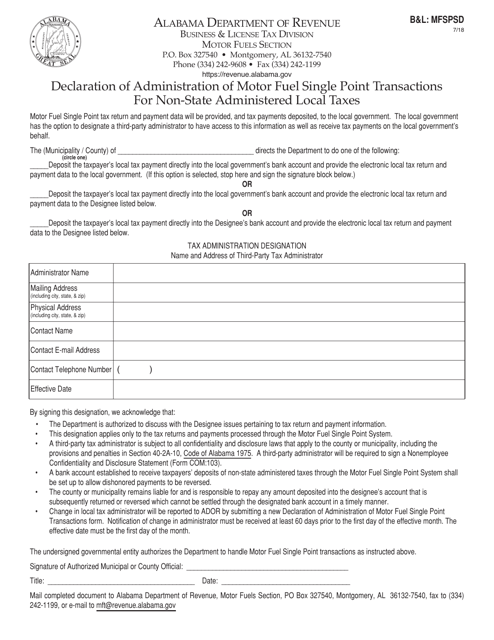

This Form is used for declaring the administration of motor fuel single point transactions for non-state administered local taxes in Alabama.

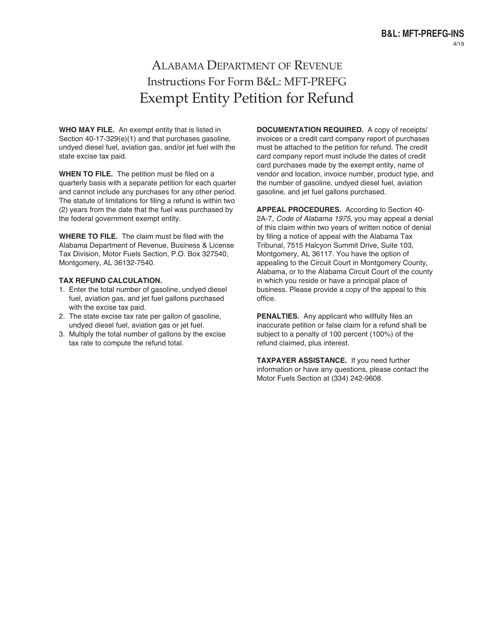

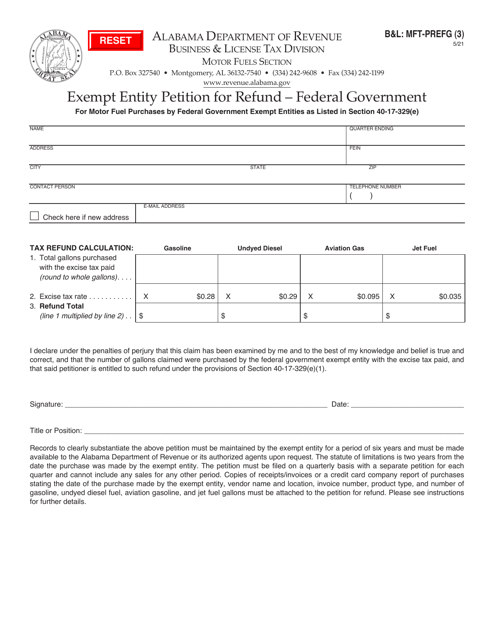

This Form is used for filing a petition for refund for exempt entities of the federal government in Alabama. It provides instructions on how to fill out and submit the Form B&L: MFT-PREFG.

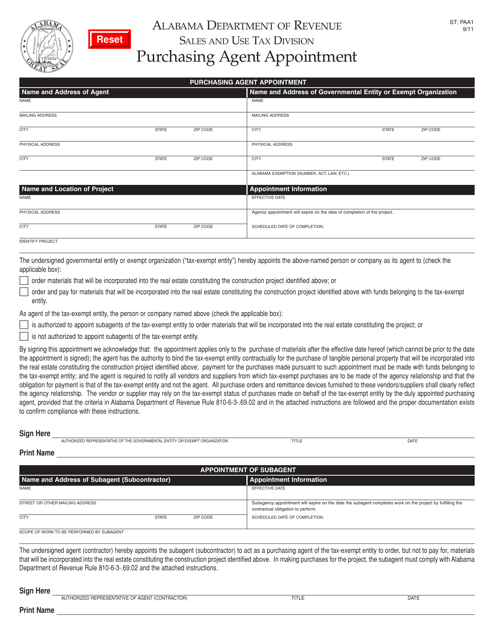

This form is used for appointing a purchasing agent in the state of Alabama.

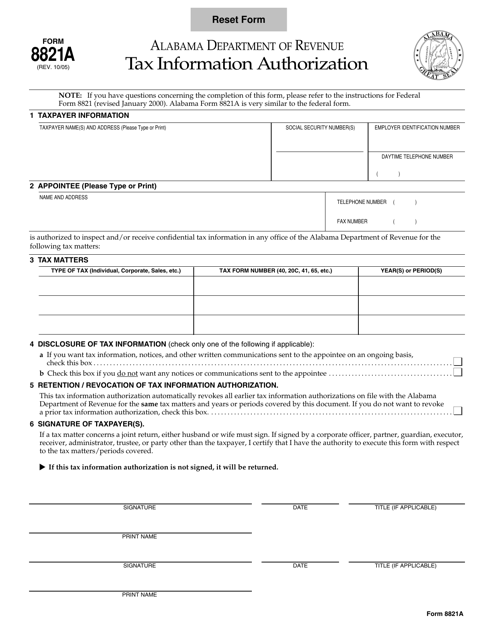

This Form is used for authorizing someone to receive or inspect your tax information in Alabama.

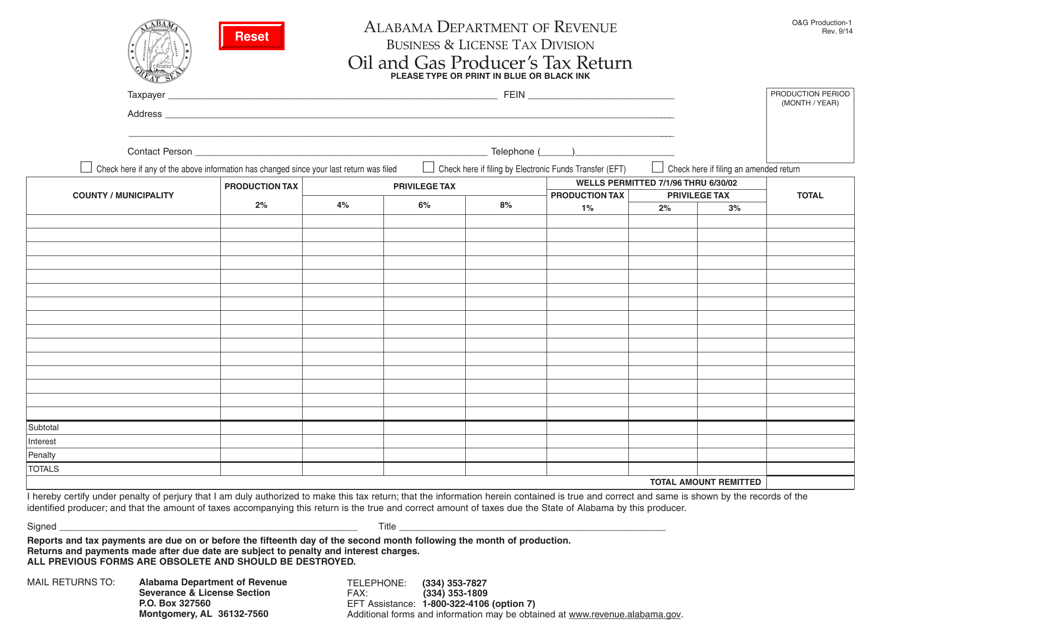

This Form is used for filing the Oil and Gas Producer's Tax Return in Alabama. It is for producers in the oil and gas industry to report their production and calculate the taxes owed to the state.

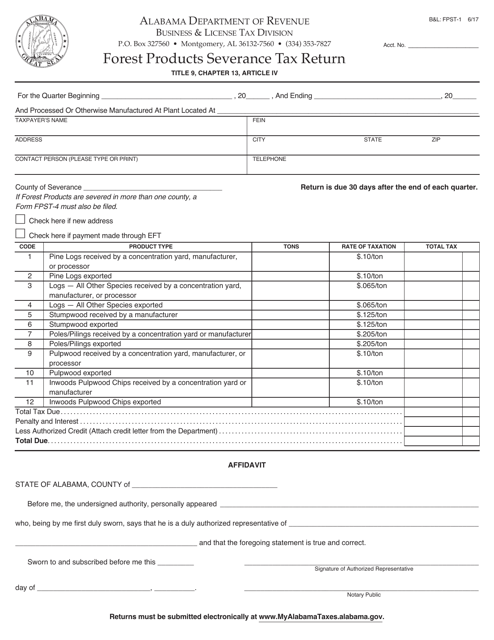

This form is used for filing the Forest Products Manufacturers Tax Return in Alabama. It is specifically designed for businesses in the forest products industry to report and pay their taxes.

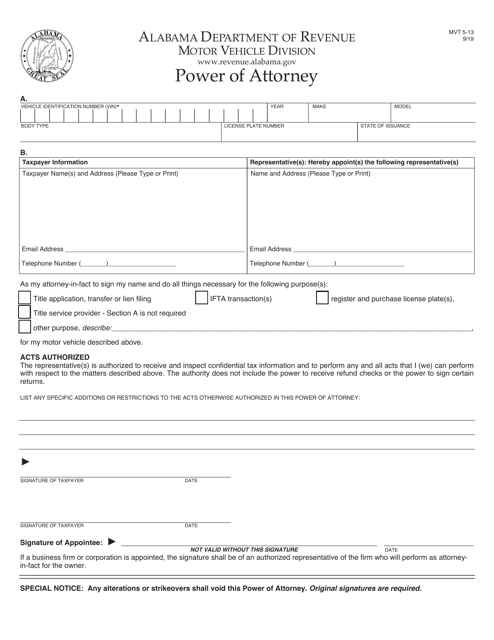

This form is used for appointing someone as a power of attorney in the state of Alabama.