Alabama Department of Revenue Forms

Documents:

587

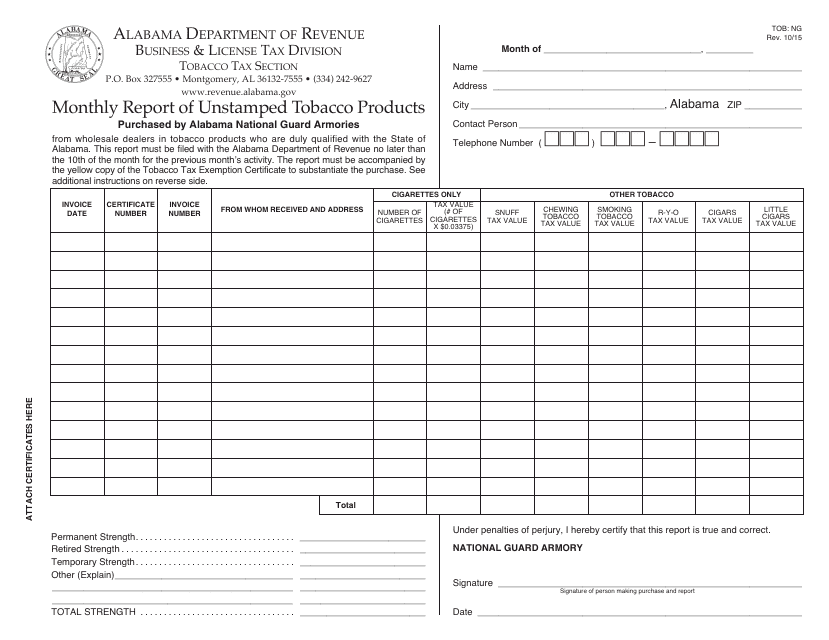

This document is used for reporting unstamped tobacco products on a monthly basis in Alabama.

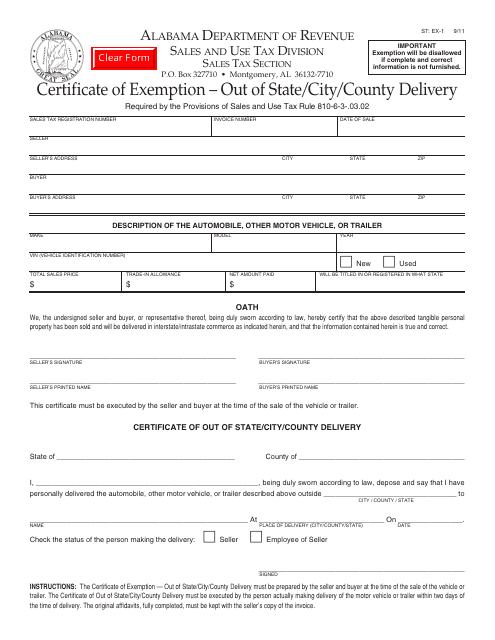

This form is used for obtaining a certificate of exemption for out-of-state or out-of-city/county delivery in Alabama.

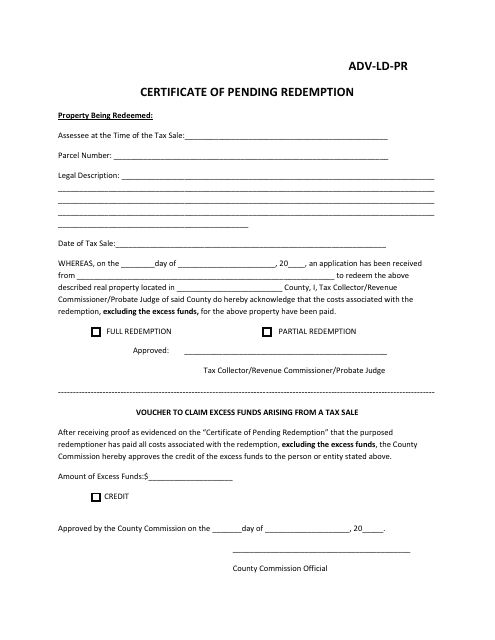

This type of document, the Form ADV-LD-PR Certificate of Pending Redemption, is used for redeeming securities in the state of Alabama. It certifies that a redemption of securities is pending and provides necessary information for the redemption process.

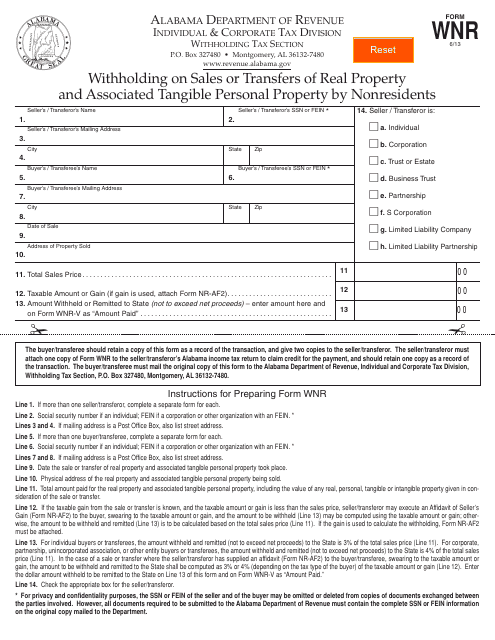

This form is used for reporting and withholding taxes on sales or transfers of real property and associated tangible personal property by nonresidents in the state of Alabama.

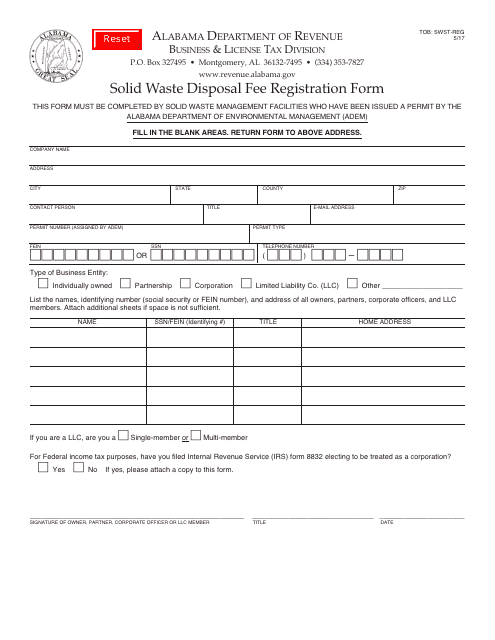

This form is used for registering for the Solid Waste Disposal Fee in Alabama.

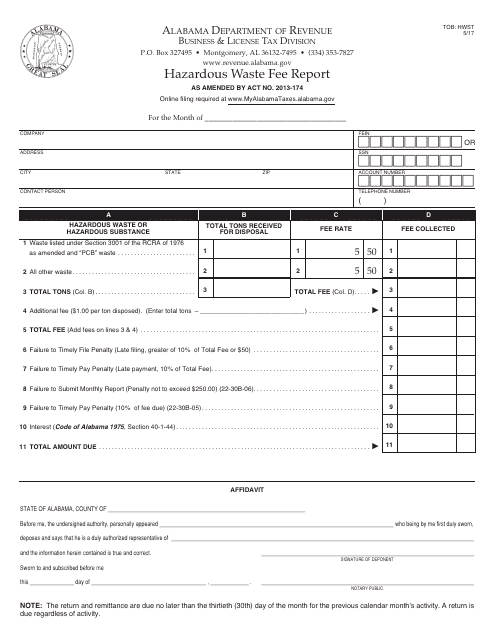

This Form is used for reporting the Hazardous Waste Fee in Alabama.

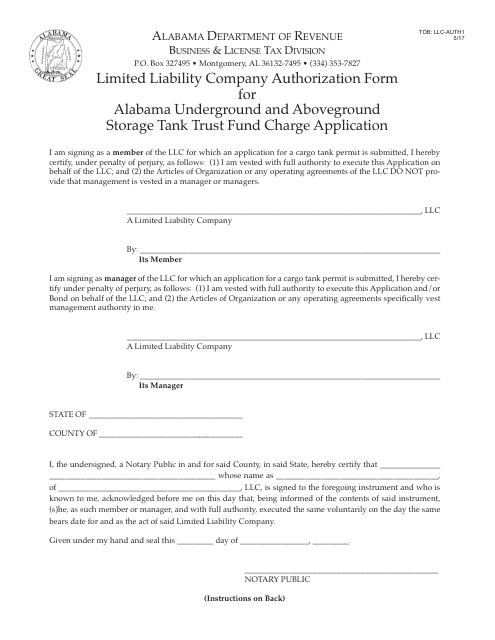

This form is used for LLCs to authorize the Alabama Underground and Aboveground Storage Tank Trust Fund charge application.

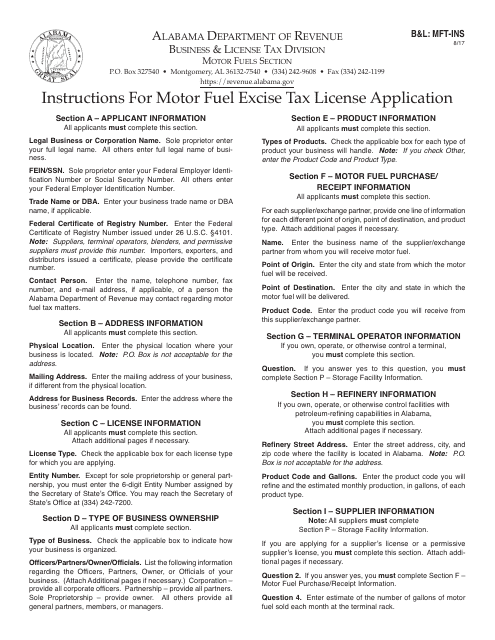

This Form is used for applying for a Motor Fuel Excise Tax License in Alabama. It is also referred to as Form B&L: MFT-INS or B&L:MFT-APP. Follow the instructions provided to complete the application accurately.

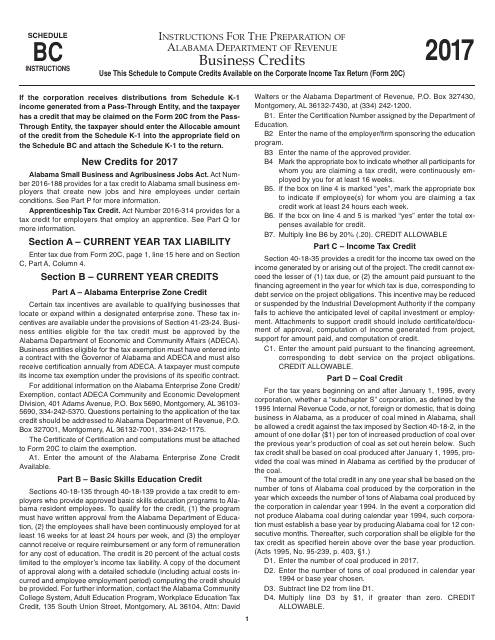

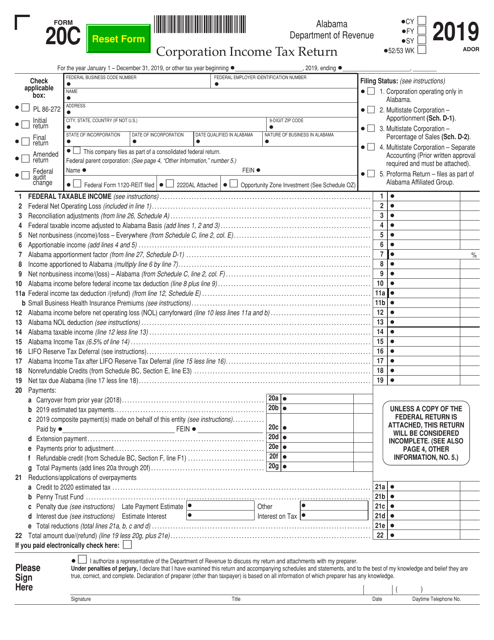

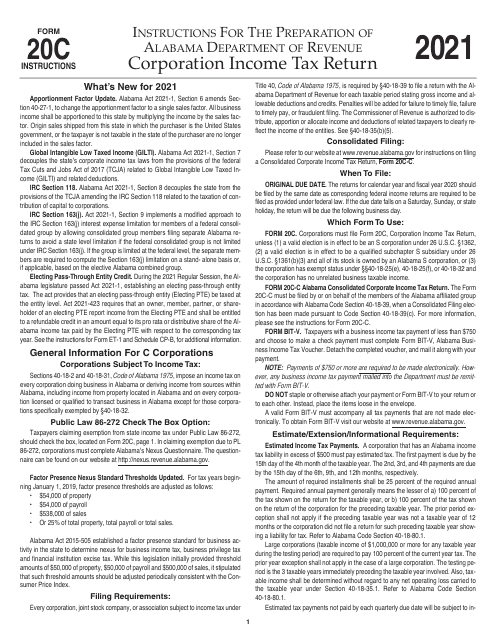

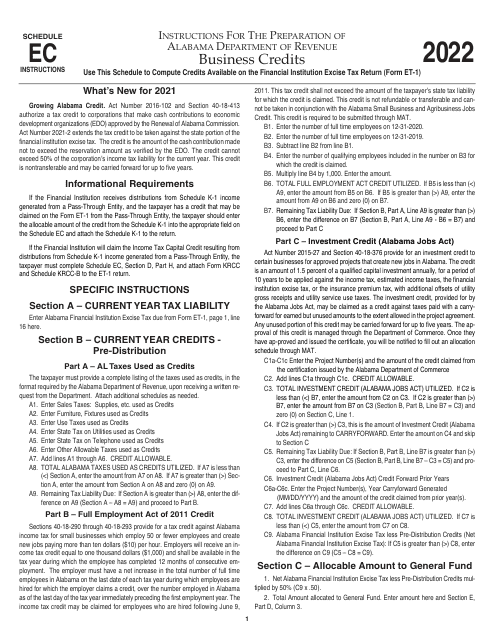

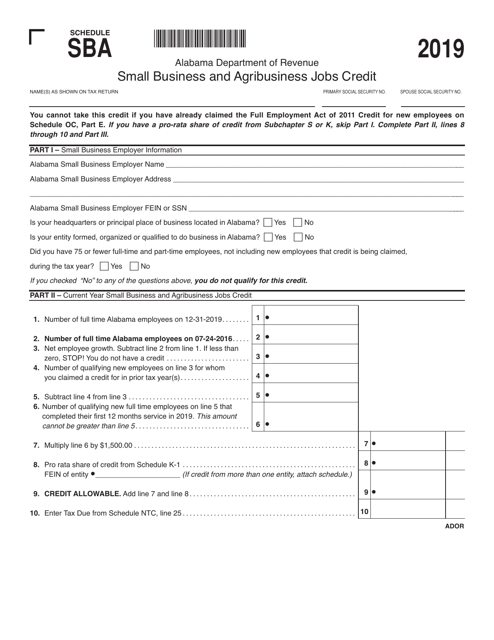

This Form is used for reporting business credits in Alabama. It provides instructions on how to fill out Schedule BC for Form 20C.

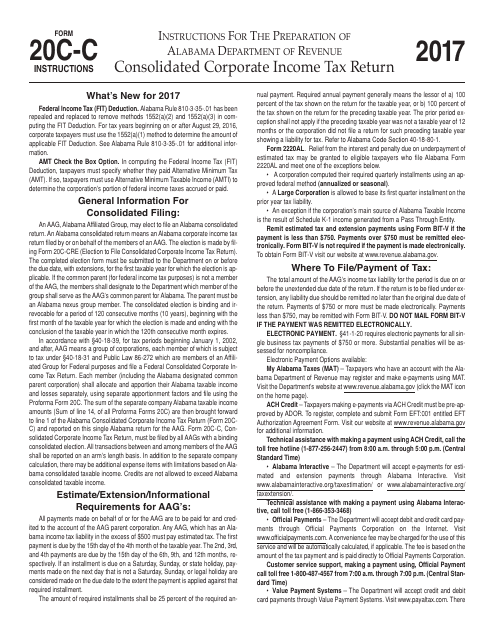

This Form is used for filing consolidated corporate income tax returns in the state of Alabama. It provides instructions for completing and submitting Form 20C-C.

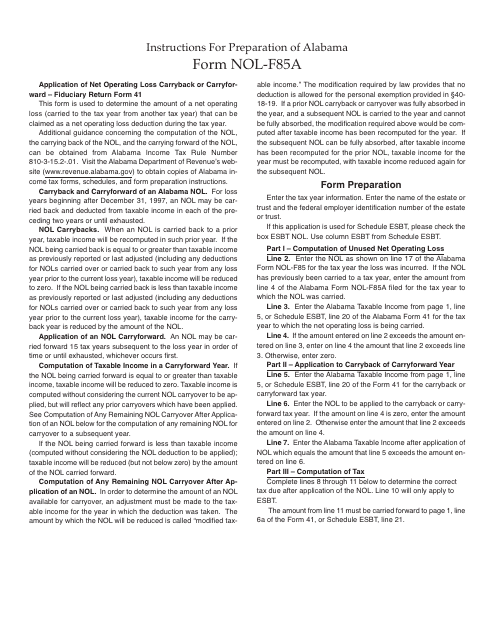

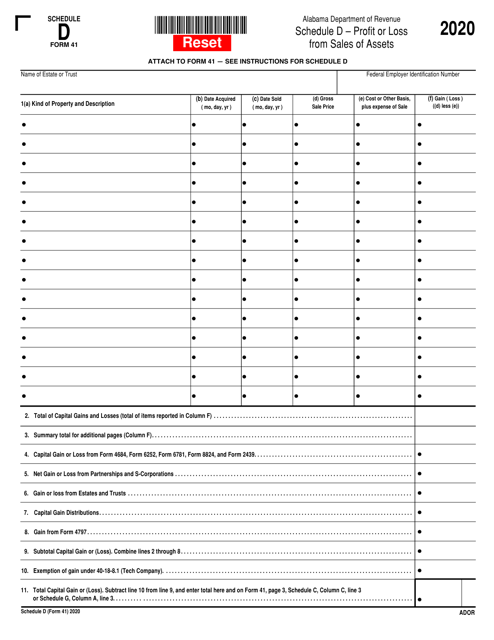

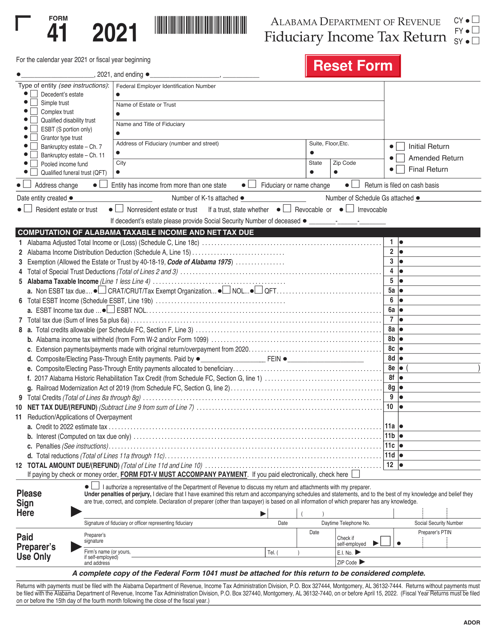

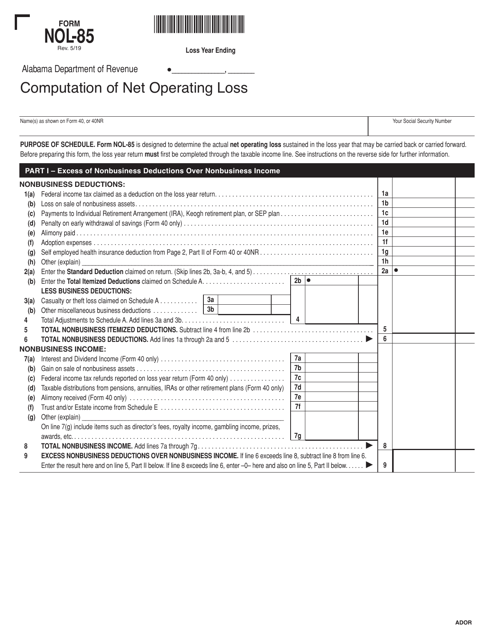

This document provides instructions for completing Form NOL-F85A, which is used to apply for a net operating loss carryback or carryforward on a Fiduciary Return Form 41 in the state of Alabama.

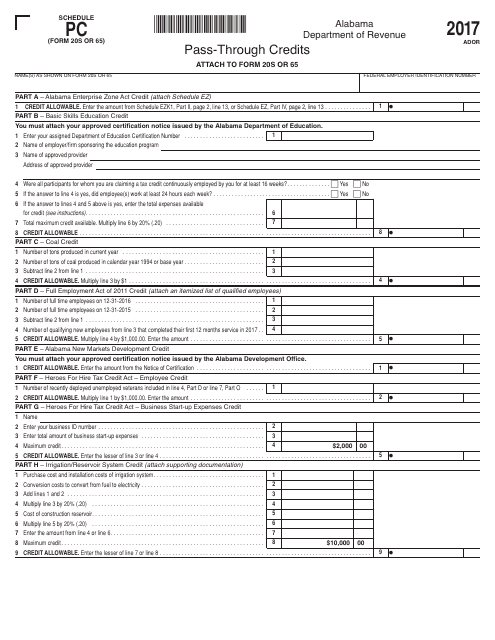

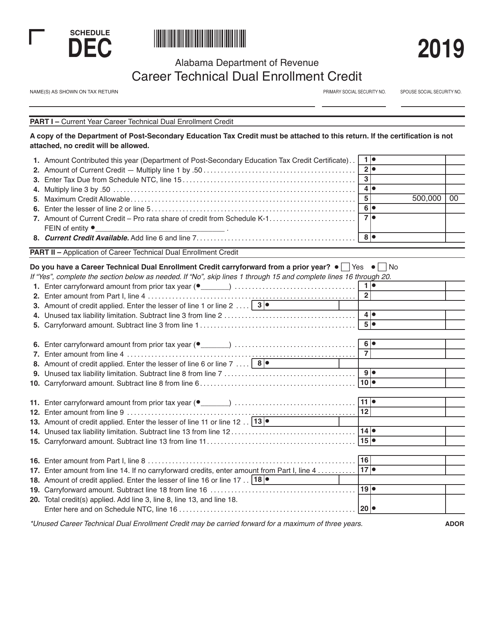

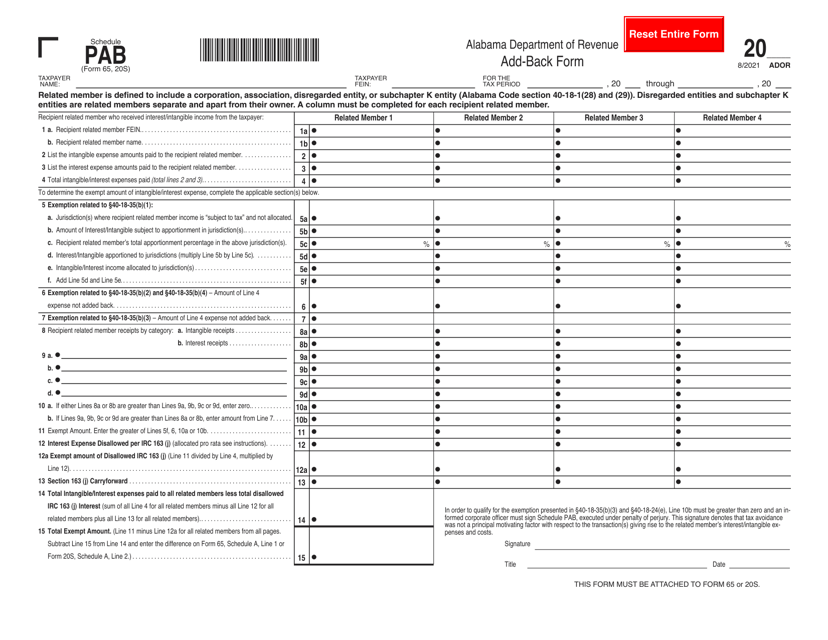

This form is used for reporting pass-through credits on Alabama Schedule PC for partnerships and S corporations.

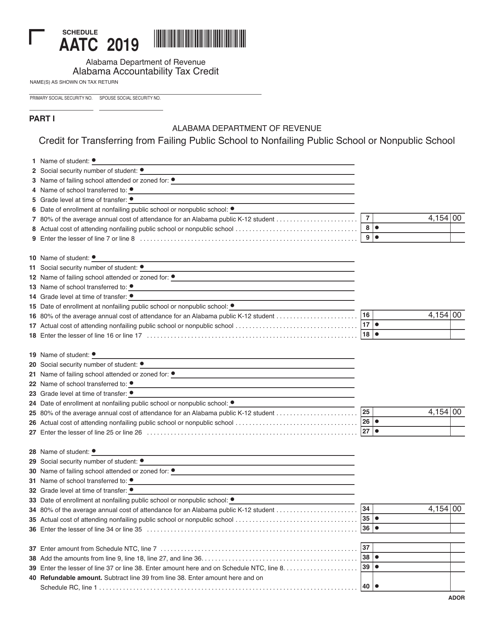

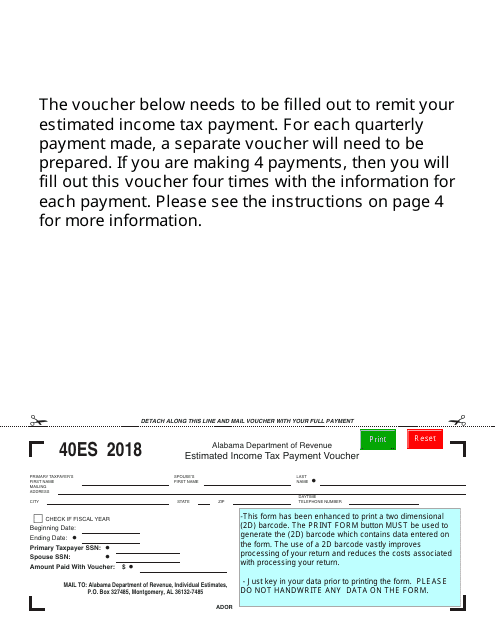

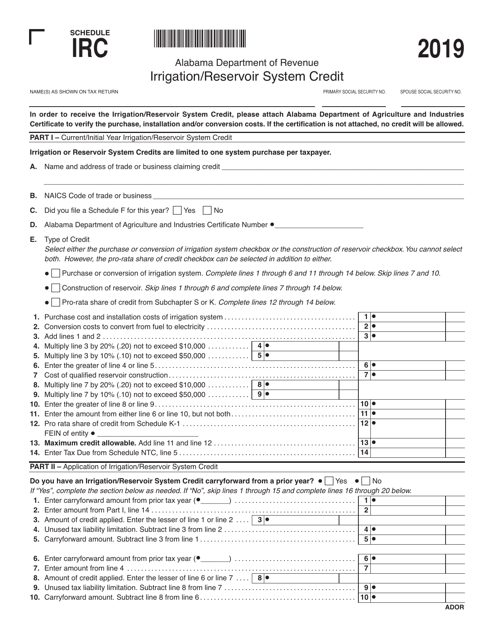

This form is used for making estimated income tax payments in Alabama.

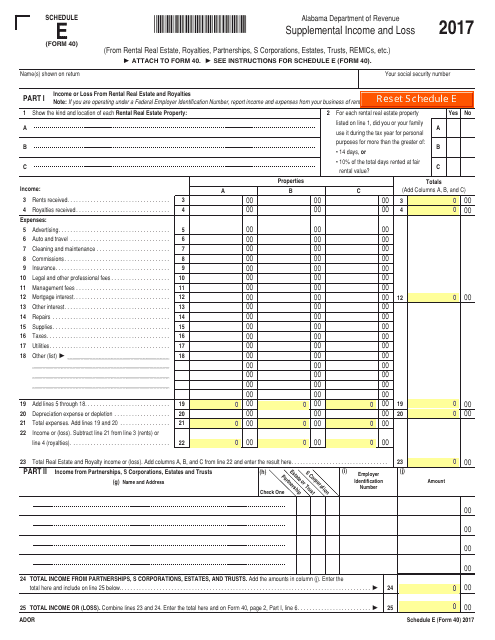

This Form is used for reporting supplemental income and loss in the state of Alabama.

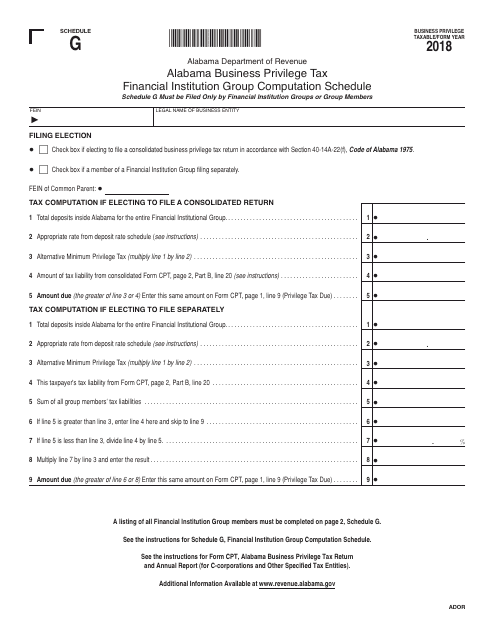

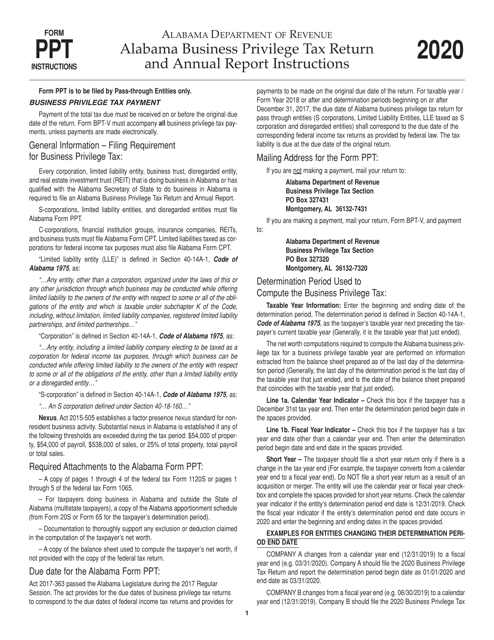

This document is used for calculating the Alabama Business Privilege Tax for financial institutions. It is a schedule specifically for the computation of the tax for the Financial Institution Group in Alabama.

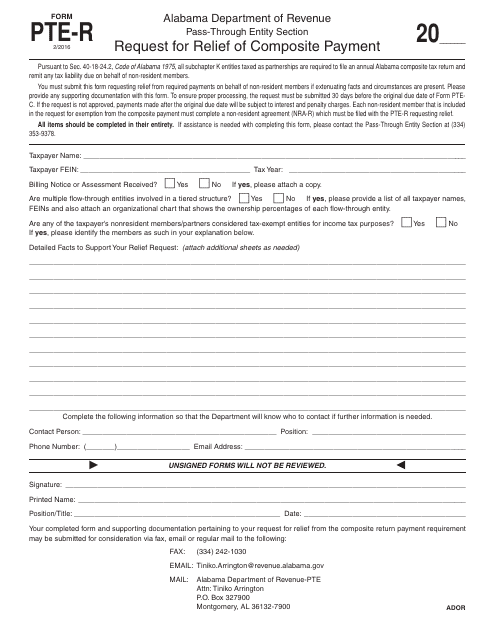

This form is used for requesting relief from composite payment in the state of Alabama.

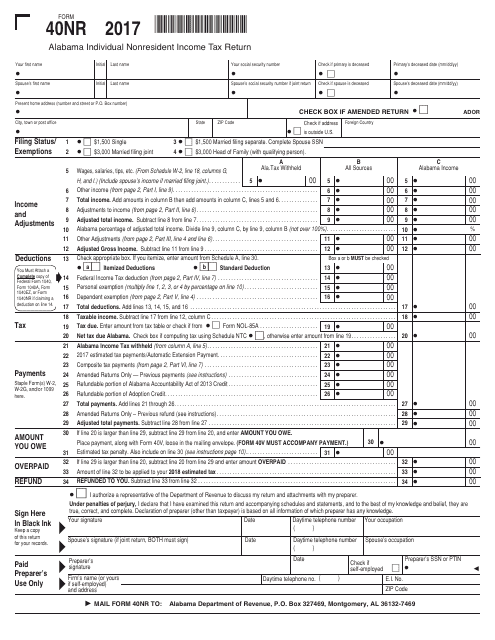

This Form is used for filing Alabama individual nonresident income tax return for taxpayers who earned income in Alabama but are not residents of the state.

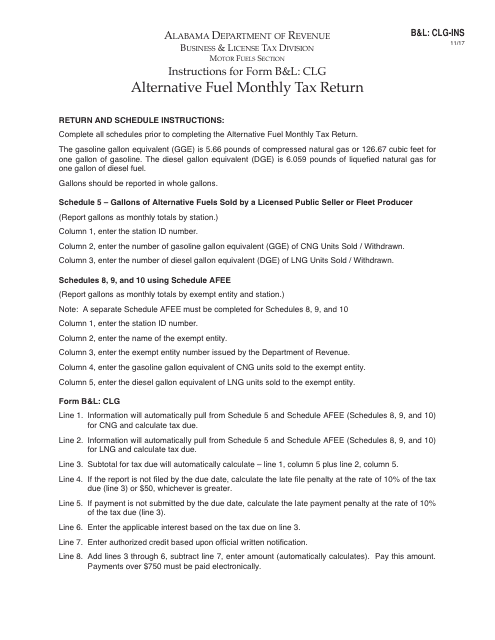

This Form is used for reporting and paying monthly taxes on alternative fuel usage in Alabama.

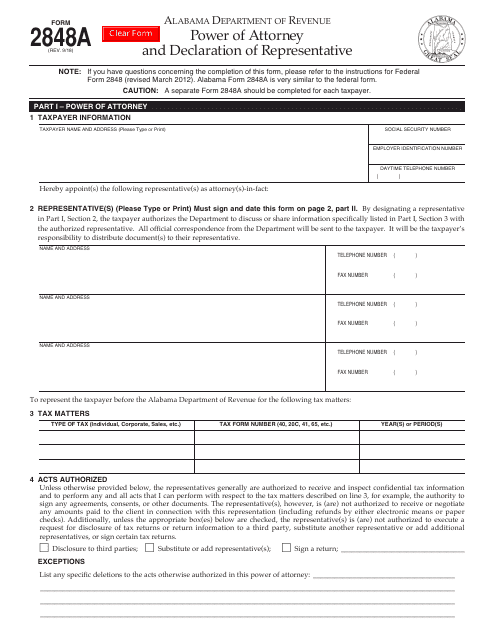

This form is used for granting power of attorney and designating a representative in Alabama.

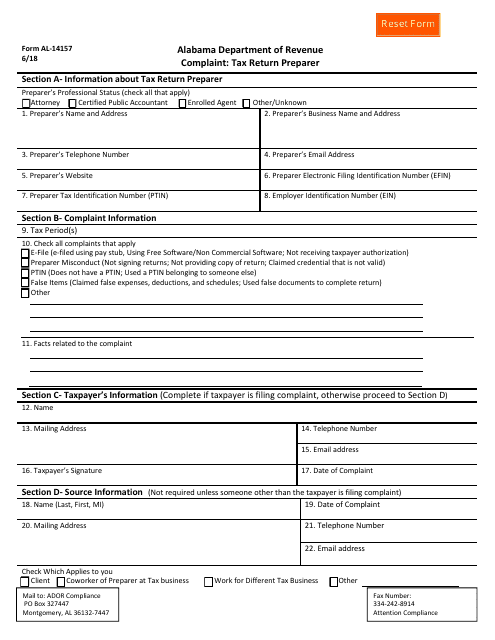

This form is used for filing a complaint against a tax return preparer in the state of Alabama.

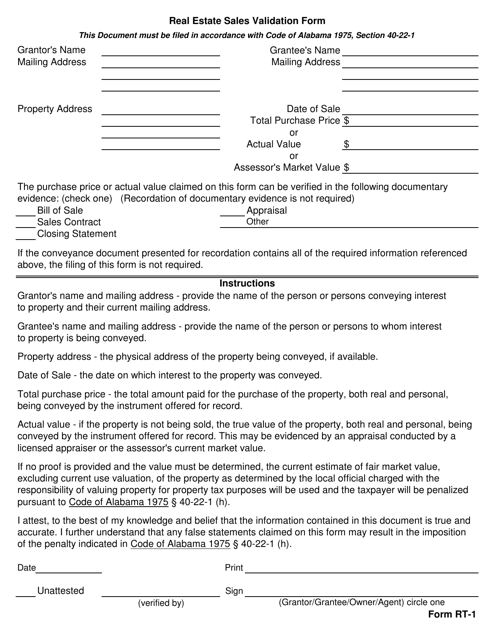

This form is used for validating real estate sales in Alabama. It is known as the RT-1 Real Estate Sales Validation Form.

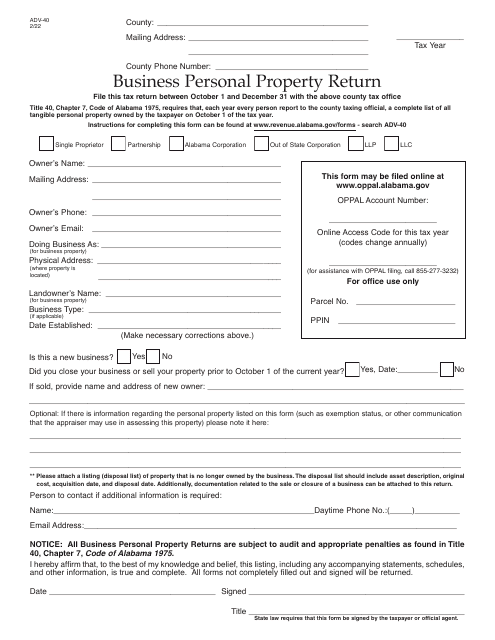

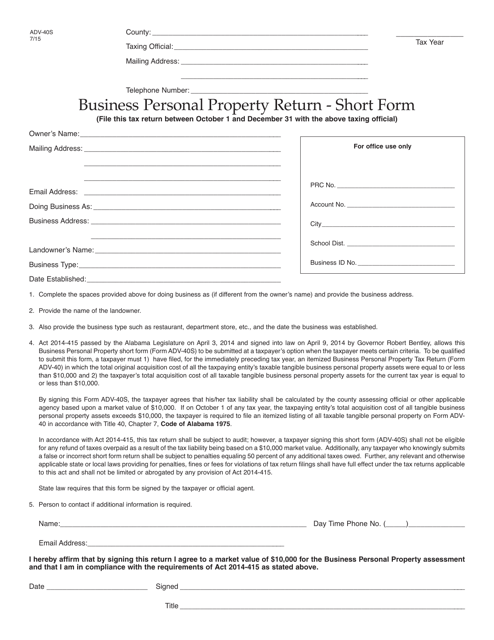

This Form is used for reporting business personal property in Alabama. It is a shorter version of the regular Form ADV-40 for easier filing.

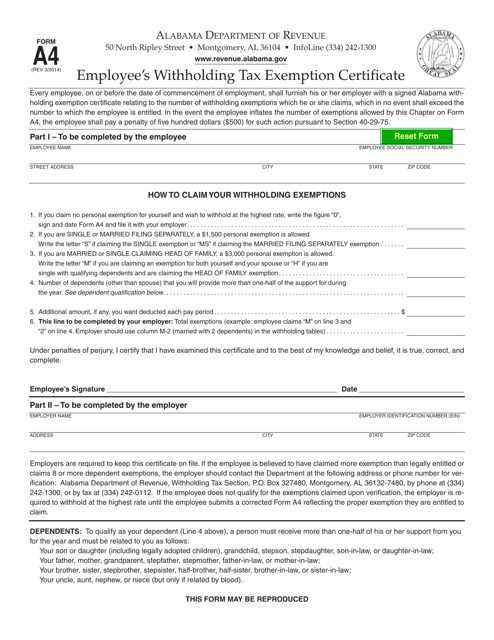

This form is used for employees in Alabama to claim exemption from withholding tax.