Fill and Sign Maine Legal Forms

Documents:

2481

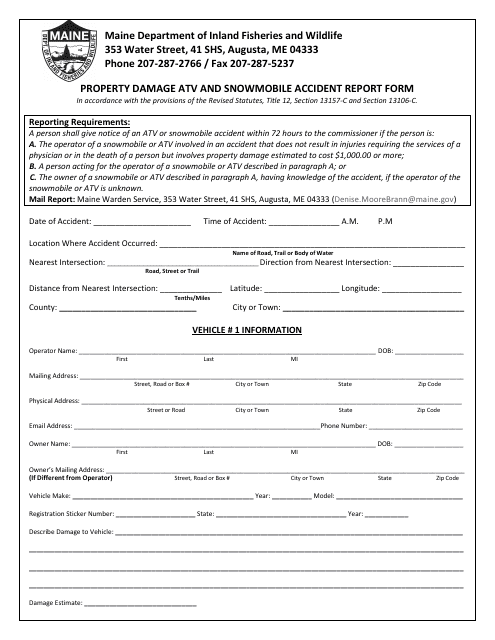

This form is used for reporting property damage caused by ATV and snowmobile accidents in the state of Maine.

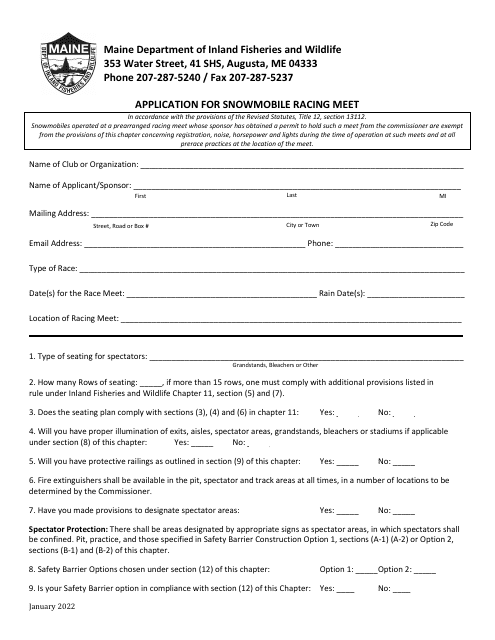

This form is used for applying to participate in a snowmobile racing meet in Maine.

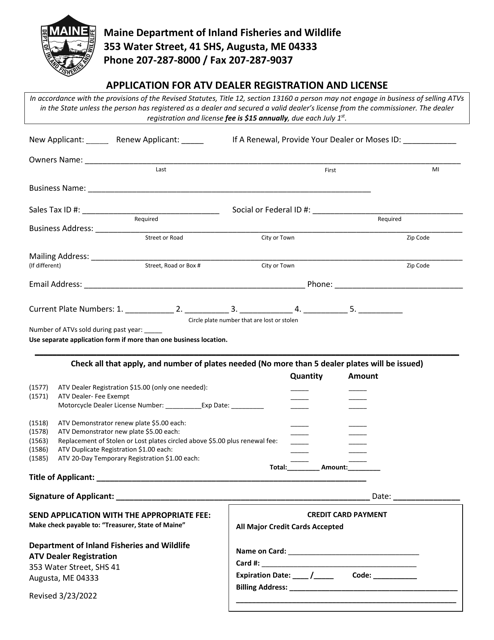

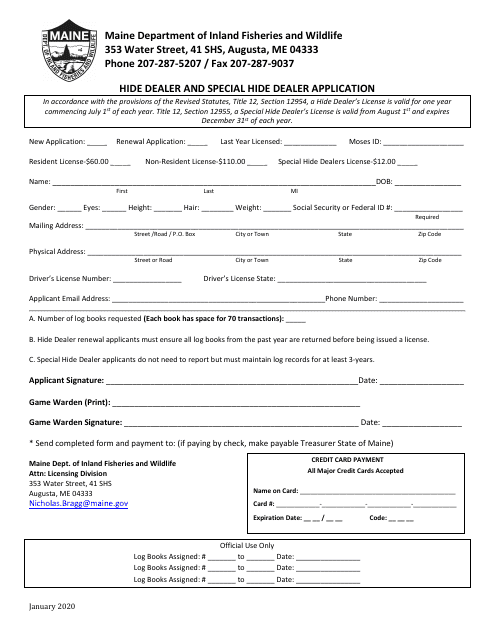

This form is used for applying to become a Hide Dealer in Maine, or for applying for special Hide Dealer status in Maine.

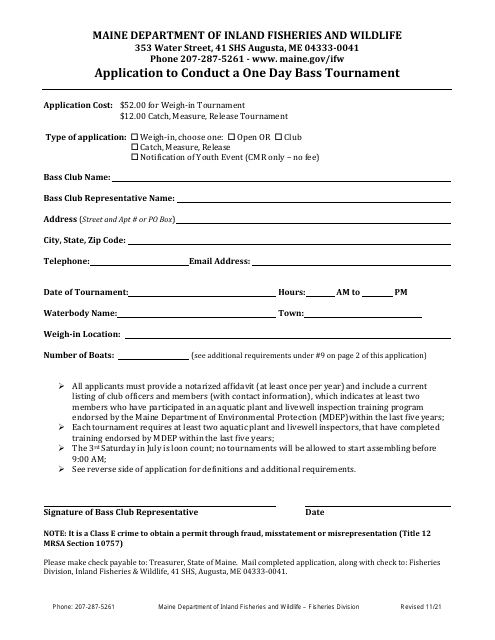

This document is a form used for applying to conduct a one-day bass tournament in Maine.

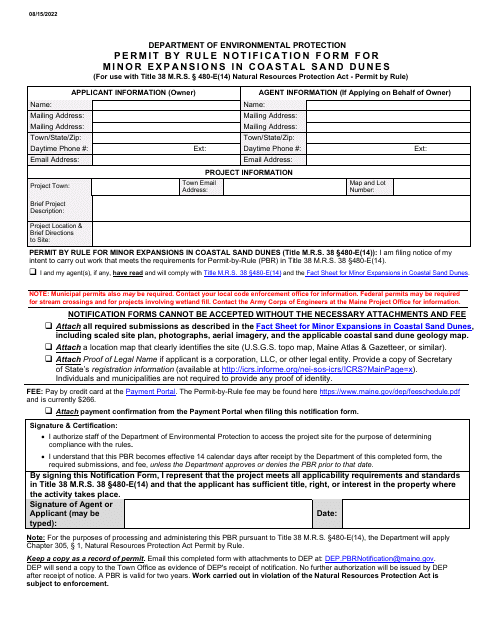

This Form is used for notifying the authorities about minor expansions in coastal sand dunes in Maine.

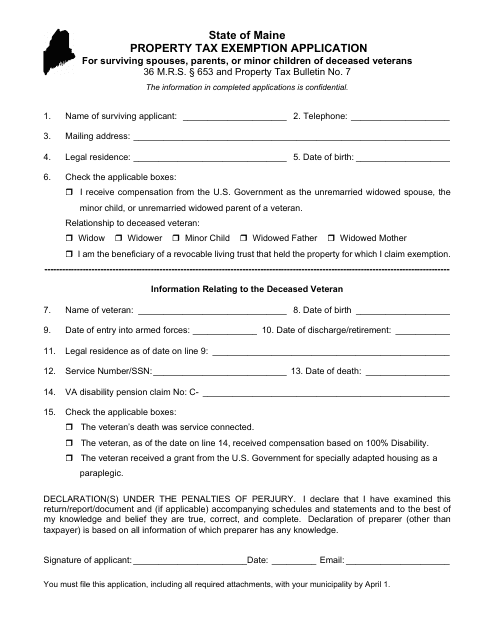

This form is used for applying for property tax exemption in Maine for surviving spouses, parents, or minor children of deceased veterans.

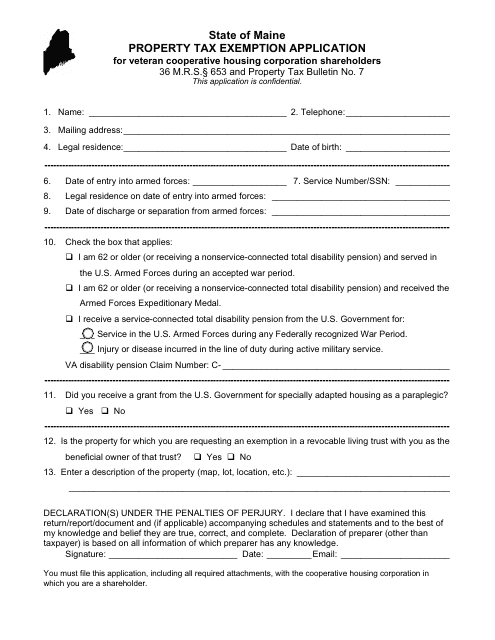

This Form is used for applying for property tax exemption for shareholders of veteran cooperative housing corporations in Maine.

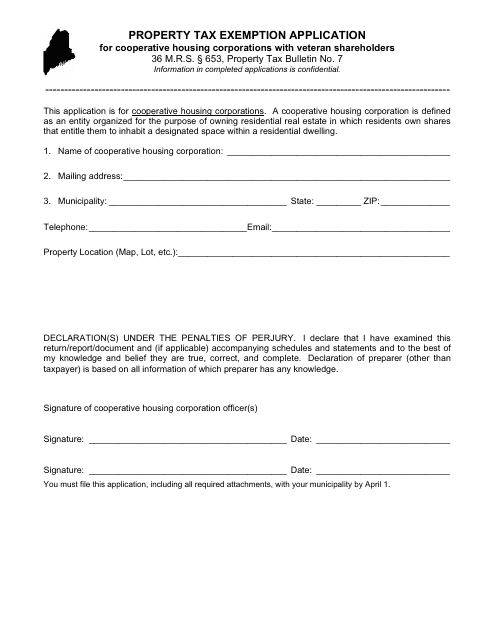

This form is used for Cooperative Housing Corporations in Maine to apply for property tax exemption if they have veteran shareholders.

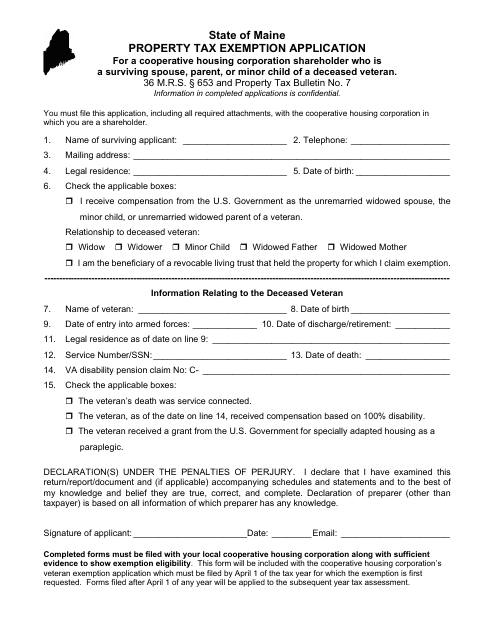

This form is used for applying for a property tax exemption in Maine if you are a surviving spouse, parent, or minor child of a deceased veteran and a shareholder in a cooperative housing corporation.

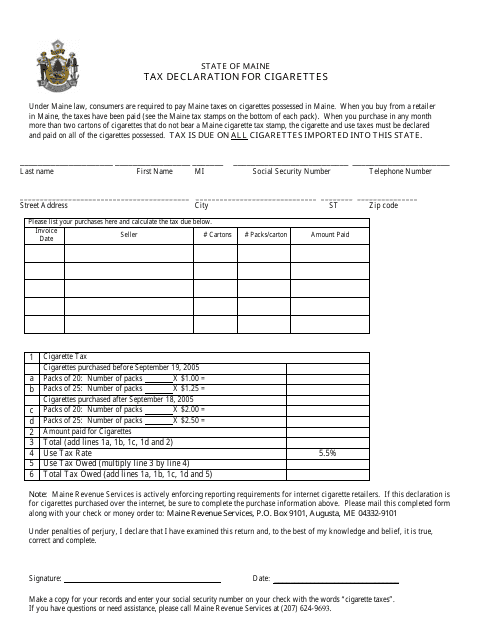

This form is used for declaring taxes on cigarettes in the state of Maine.

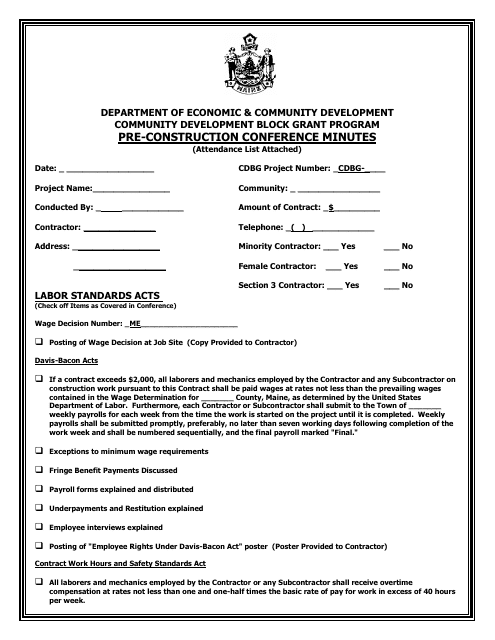

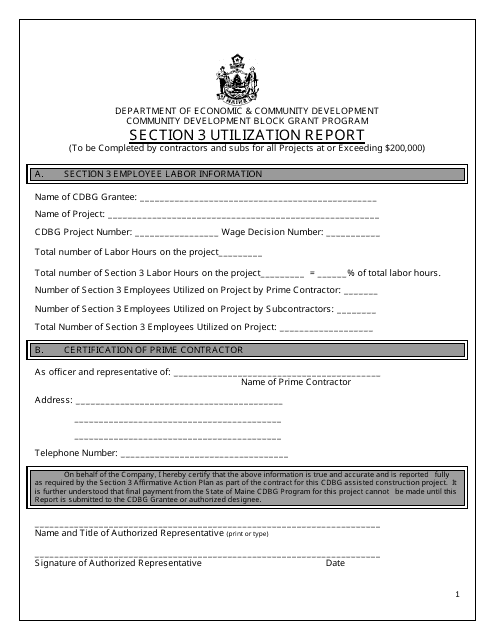

This document provides the minutes of a pre-construction conference for a project funded by the Community Development Block Grant Program in Maine. It includes details and discussions related to the project planning and execution.

This document is a Utilization Report for the Community Development Block Grant Program in Maine. It provides information on how the grant money has been utilized by the community.

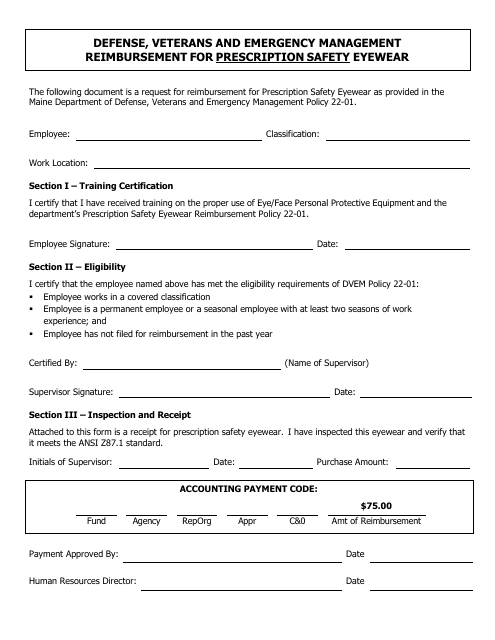

This document is for individuals in Maine who need to seek reimbursement for prescription safety eyewear. It provides guidelines and instructions on how to submit a reimbursement request.

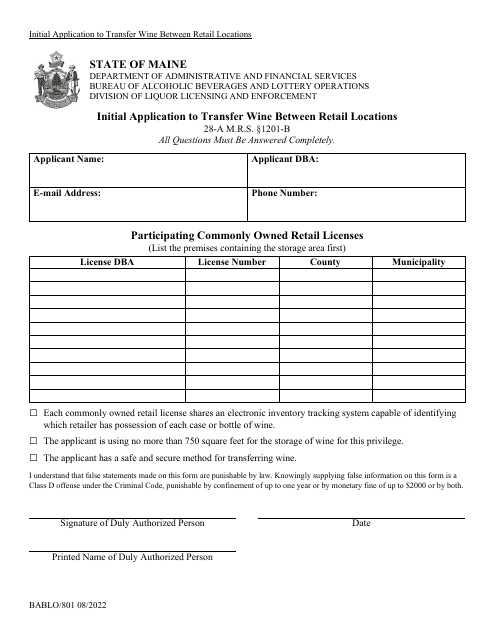

This Form is used for applying to transfer wine between retail locations in the state of Maine. It is the initial application for this process.

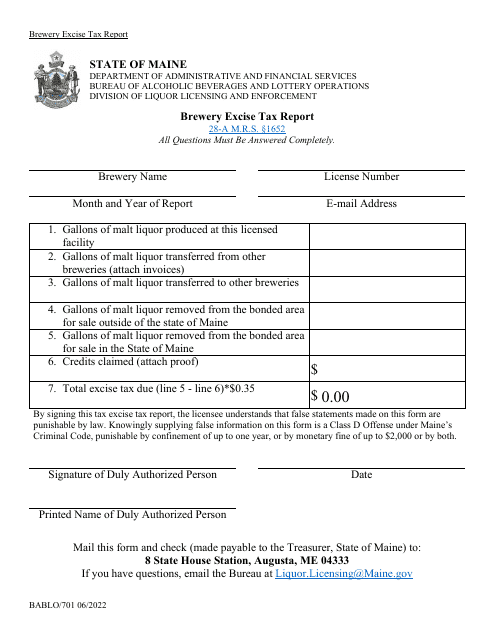

This Form is used for reporting brewery excise taxes in the state of Maine. It is required for breweries to accurately report and pay their excise tax obligations.

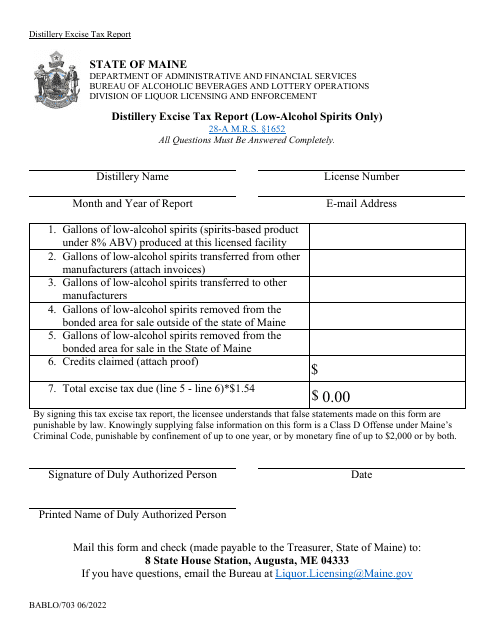

This Form is used for reporting distillery excise tax for low-alcohol spirits in Maine.

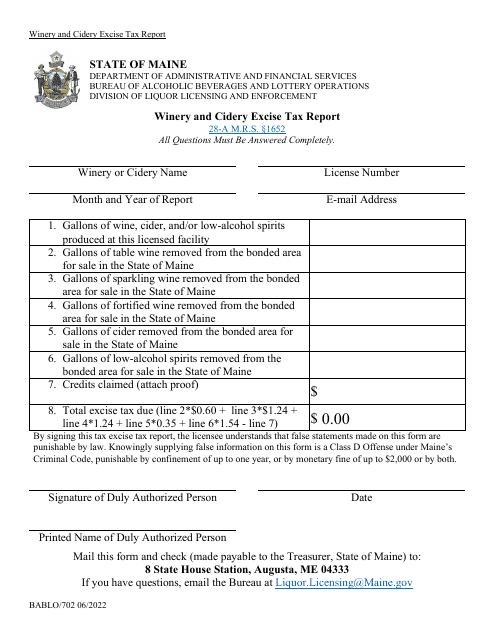

This document is used for reporting and calculating excise tax for wineries and cideries in the state of Maine.