Fill and Sign Maine Legal Forms

Documents:

2481

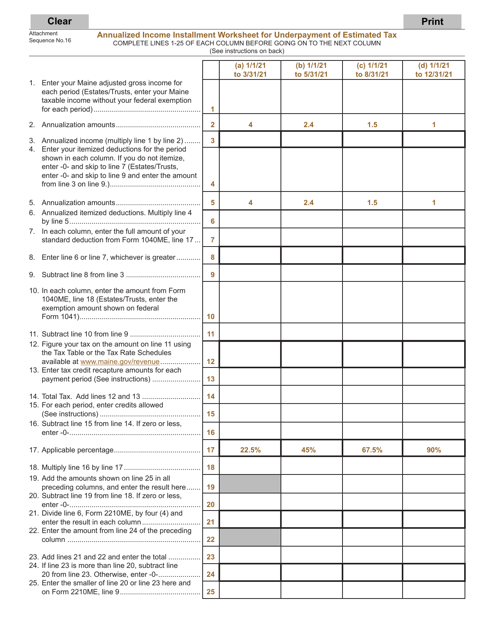

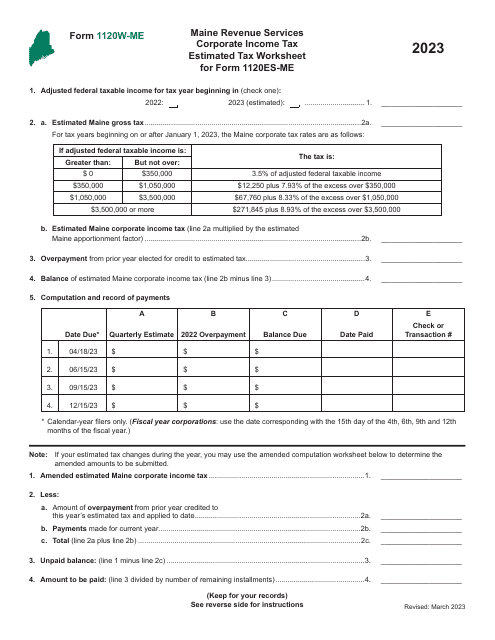

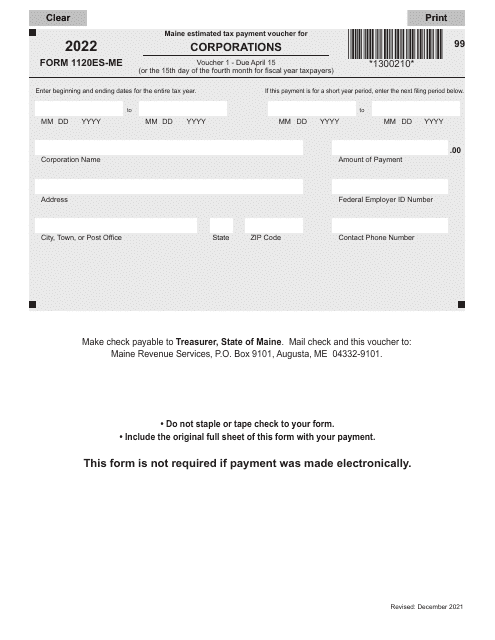

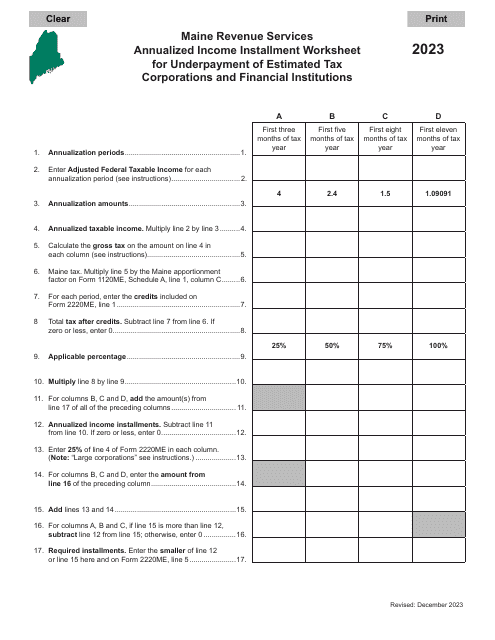

This Form is used for calculating and reporting any underpayment of estimated tax for residents of Maine. It helps taxpayers determine if they owe any additional tax due to not paying enough estimated tax throughout the year.

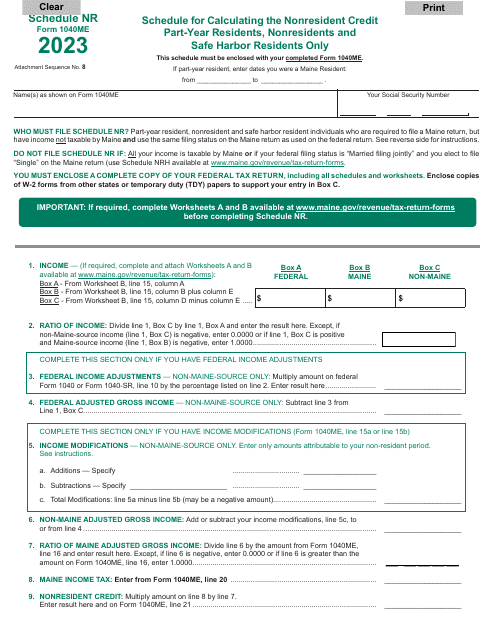

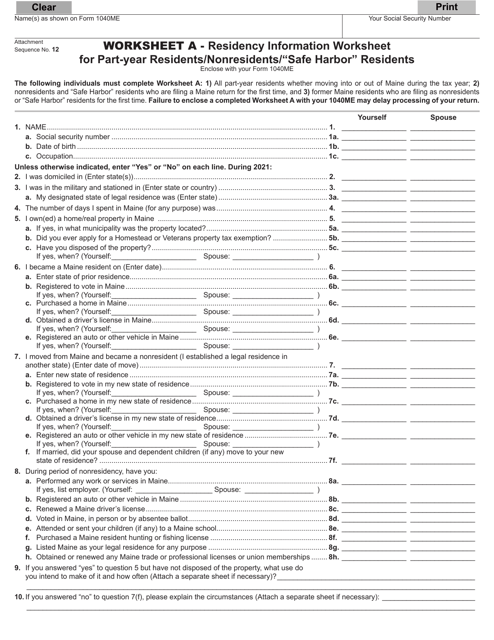

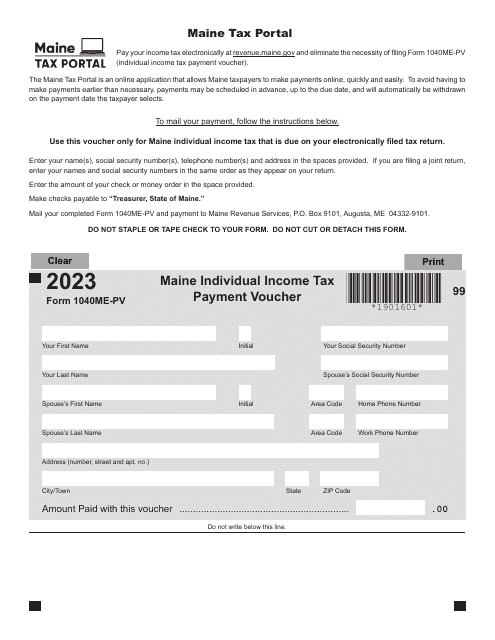

This form is used for determining residency information and income allocation for individuals who are part-year residents, nonresidents, or "safe harbor" residents in the state of Maine.

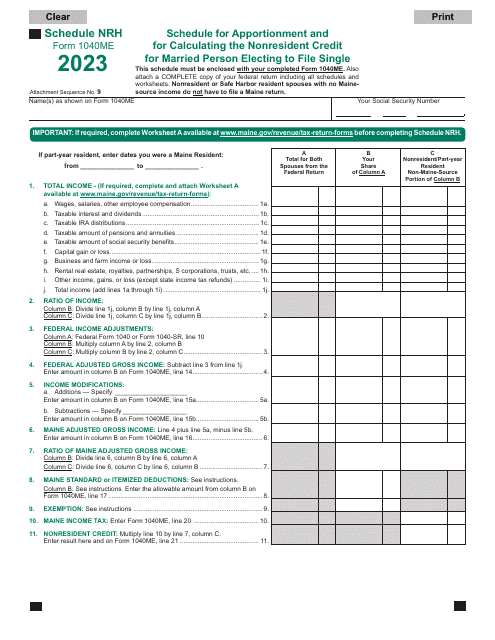

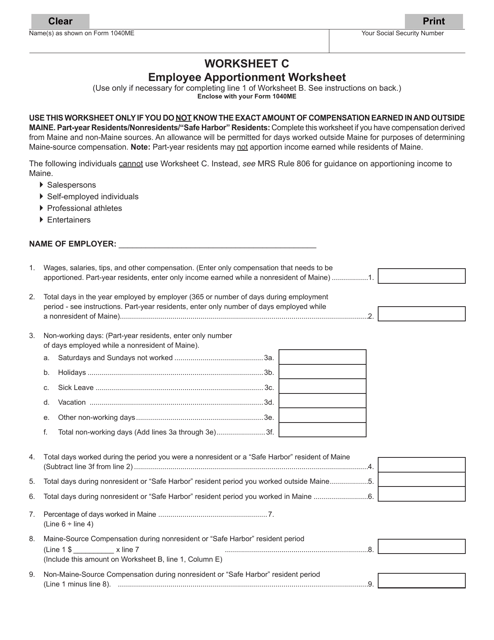

This document is a worksheet used to calculate employee apportionment for state income tax in Maine.

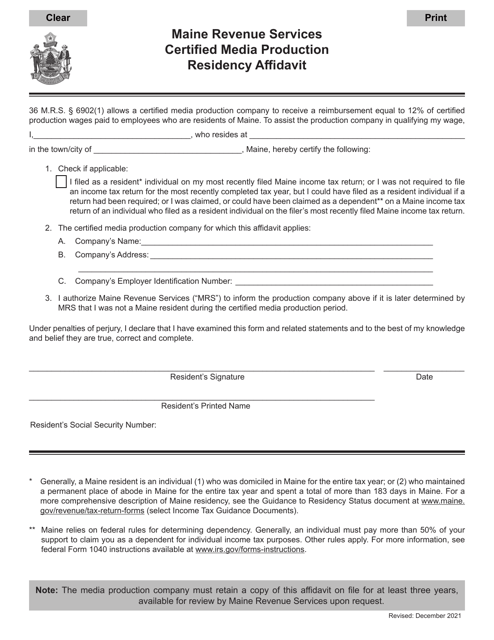

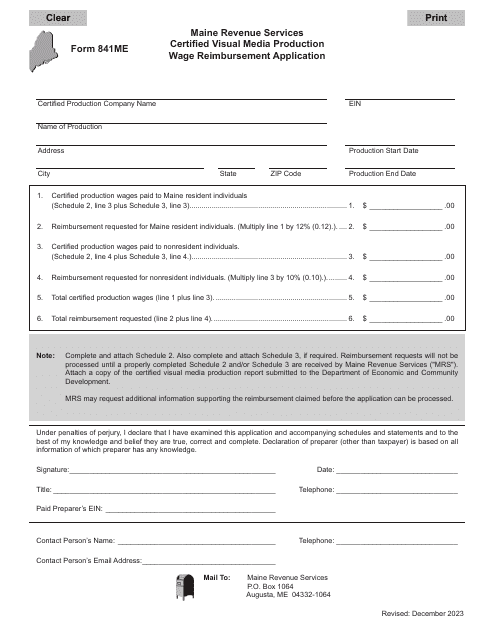

This document is used for certifying residency in Maine for media production purposes.

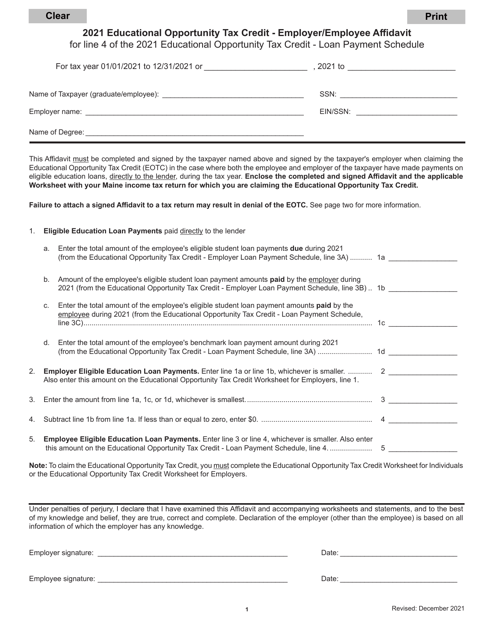

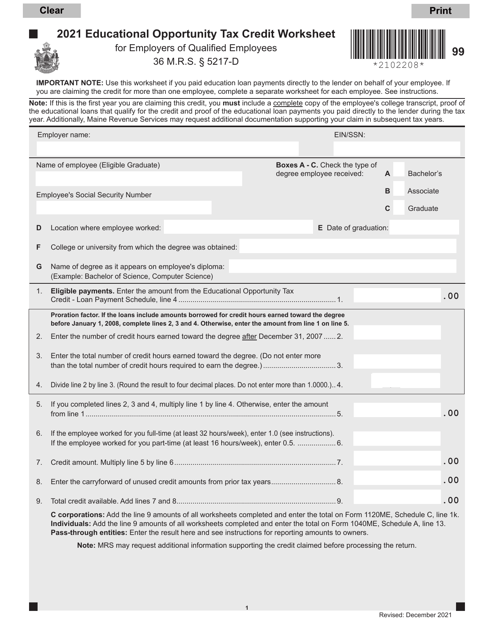

This document is for employers and employees in Maine to complete an affidavit for Line 4 of the Educational Opportunity Tax Credit. It also includes a loan payment schedule.

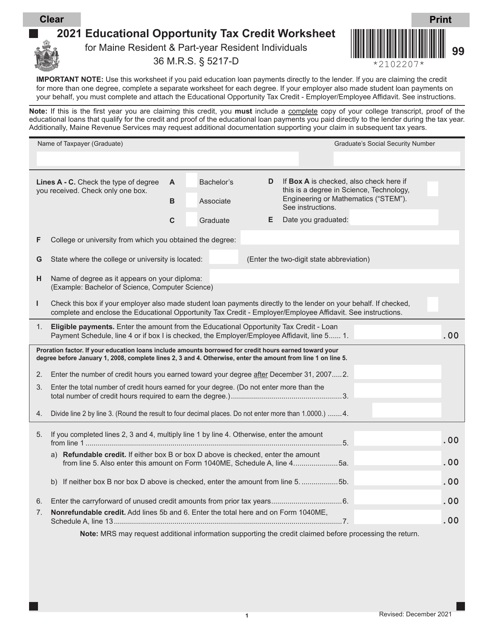

This type of document is used for calculating the Educational Opportunity Tax Credit for Maine residents and part-year residents. It provides a worksheet to help individuals determine their eligibility and correctly calculate the credit amount.