Fill and Sign Wisconsin Legal Forms

Documents:

5190

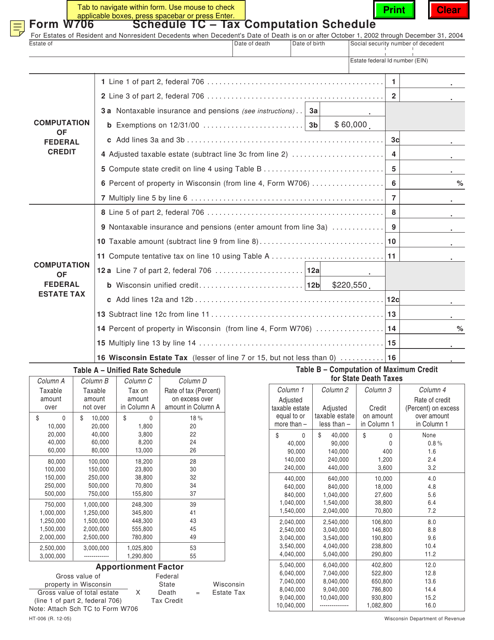

This form is used for tax computation for deaths in Wisconsin occurring between October 1, 2002 and December 31, 2004.

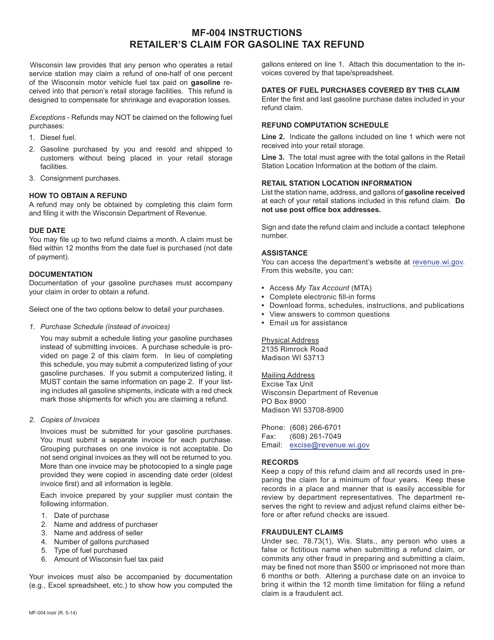

This form is used for retailers in Wisconsin to claim a refund on gasoline taxes paid. It provides instructions on how to fill out the form and submit the claim.

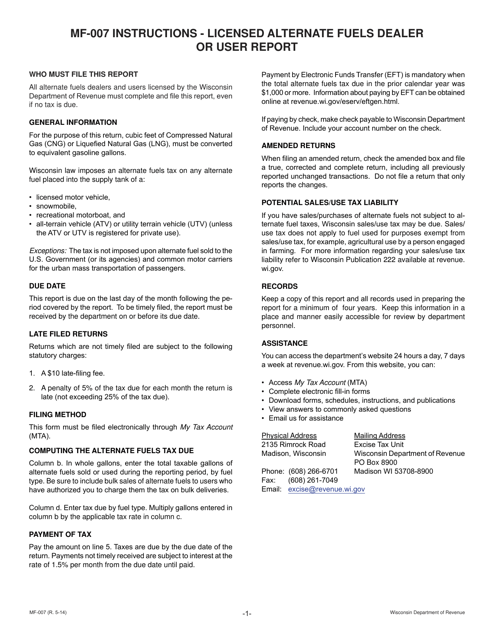

This form is used for reporting by licensed alternate fuels dealers or users in Wisconsin. It is used to provide information about fuel sales, storage, and usage.

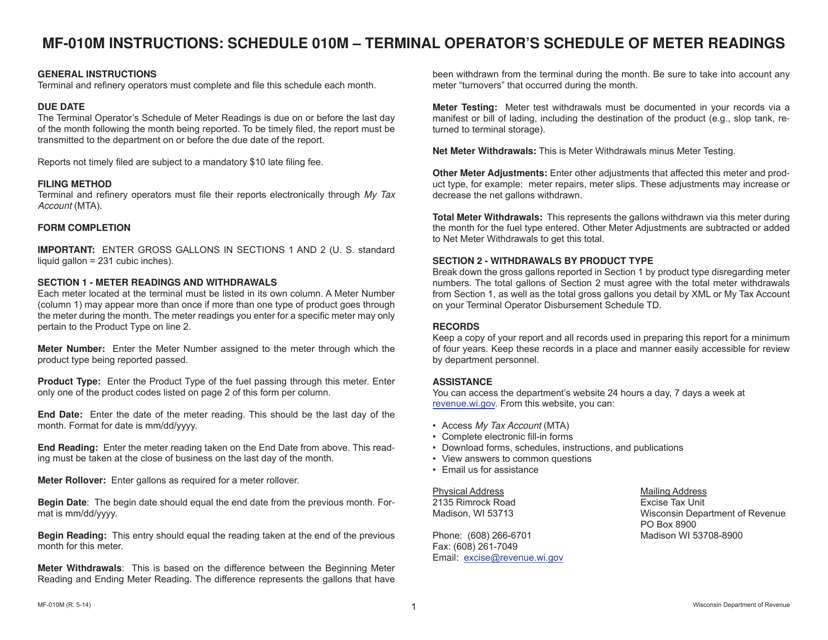

This document is used for recording and organizing meter readings for terminal operators in Wisconsin.

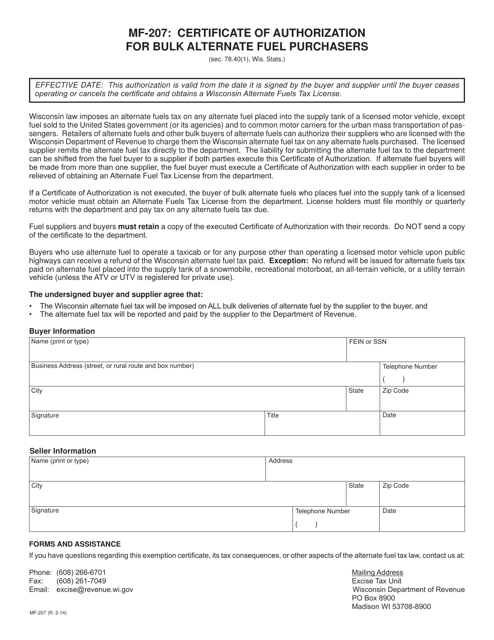

This Form is used for obtaining a Certificate of Authorization for bulk alternate fuel purchasers in the state of Wisconsin.

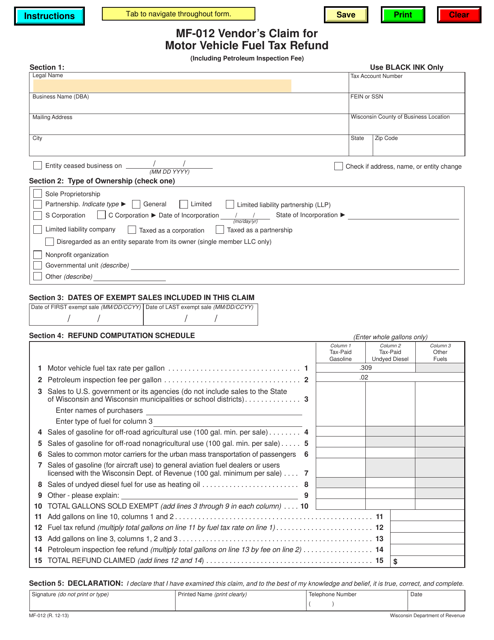

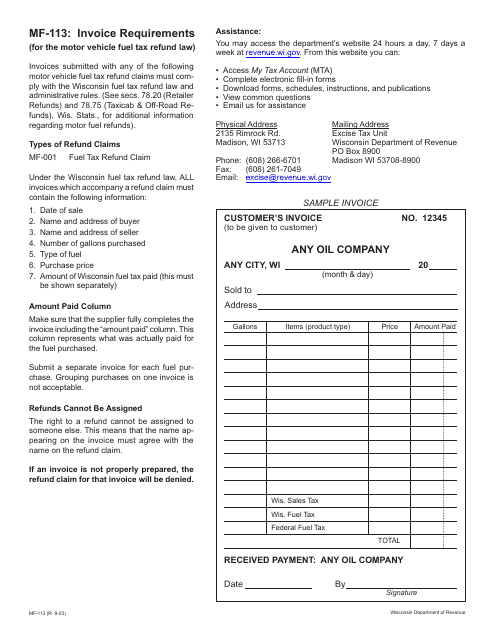

This Form is used for vendors in Wisconsin to claim a refund on motor vehicle fuel tax.

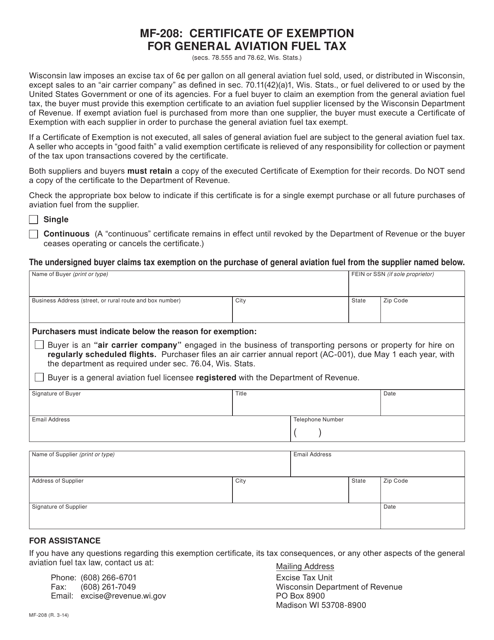

This Form is used for applying for a certificate of exemption from the general aviation fuel tax in Wisconsin. It is used by individuals or organizations involved in general aviation operations to claim a tax exemption on fuel purchases.

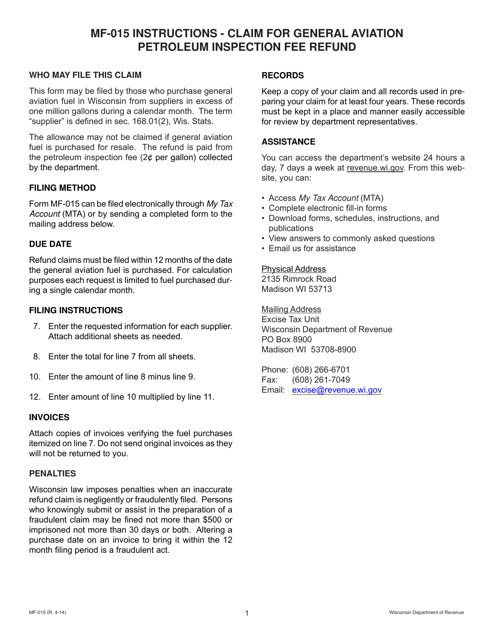

This form is used for claiming a refund on the general aviation petroleum inspection fee in Wisconsin.

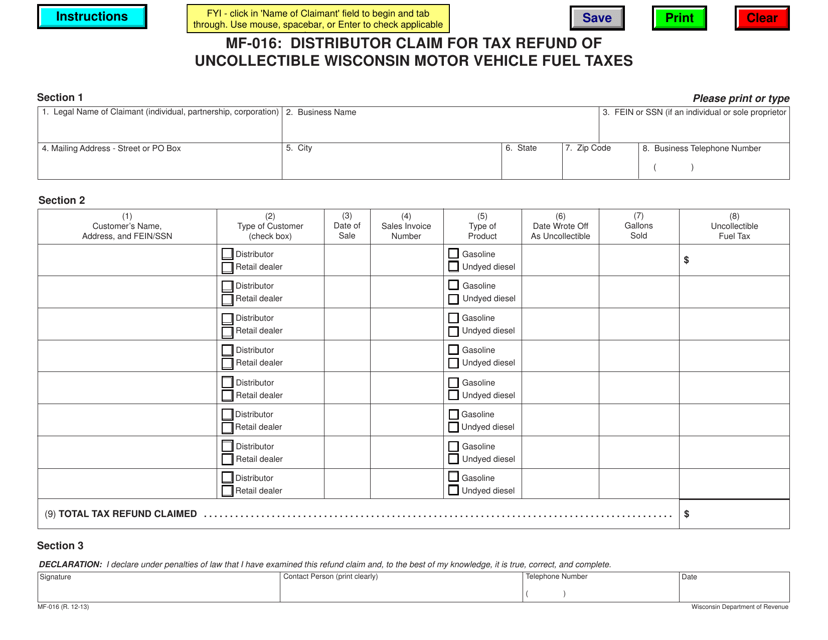

This form is used for distributors in Wisconsin to claim a tax refund for uncollectible motor vehicle fuel taxes.

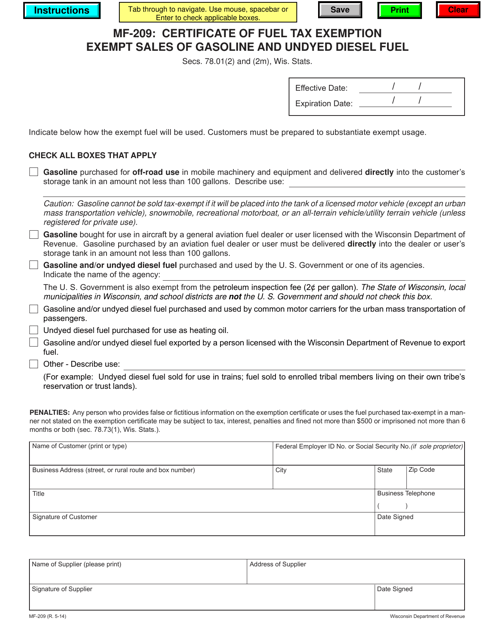

This form is used for claiming a fuel tax exemption on sales of gasoline and undyed diesel fuel in Wisconsin.

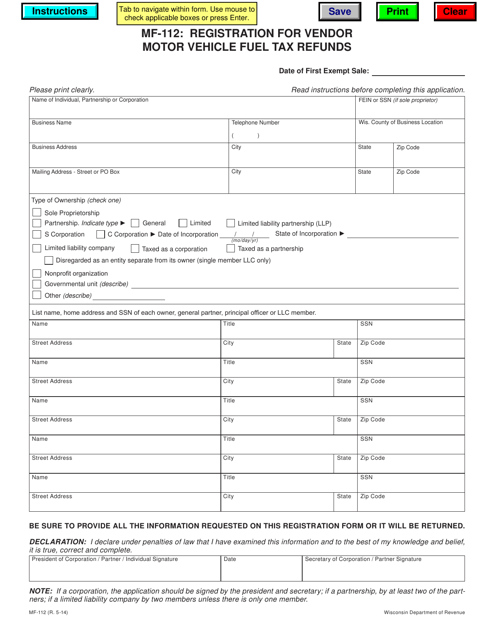

This form is used for registering vendors to claim refunds for motor vehicle fuel tax in Wisconsin.

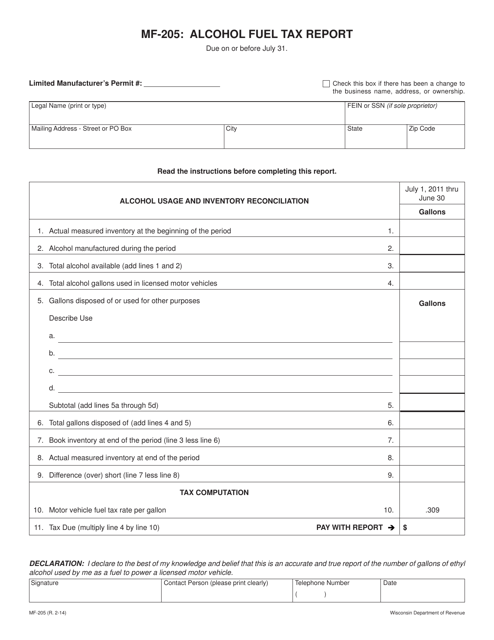

This Form is used for reporting alcohol fuel tax in Wisconsin.

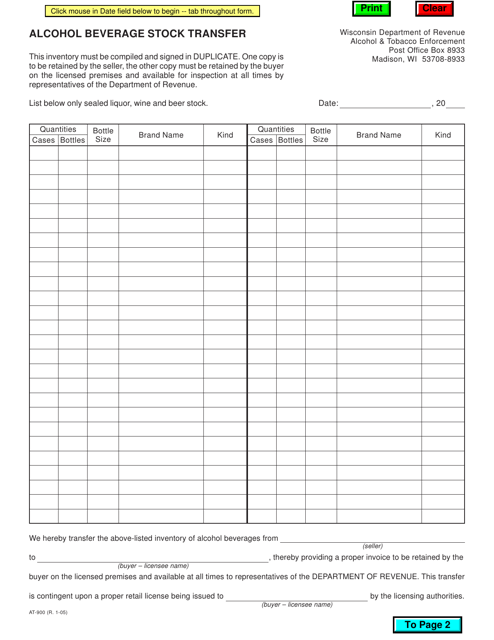

This form is used for transferring stock of alcohol beverages in the state of Wisconsin. It is required by the Wisconsin Department of Revenue for recordkeeping and regulatory purposes.

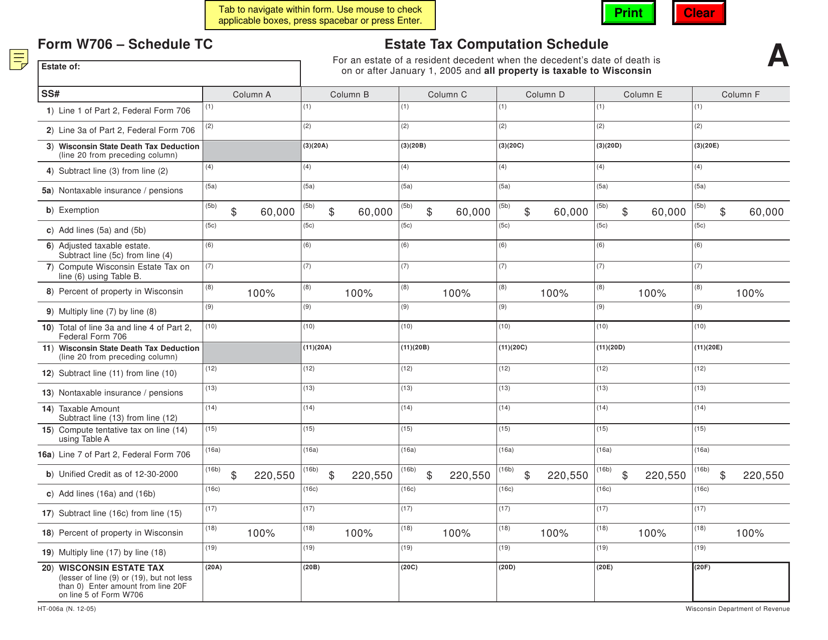

This document is a tax computation schedule used for deaths that occurred on or after January 1, 2005 in Wisconsin. It applies to situations where all property is taxable in Wisconsin.

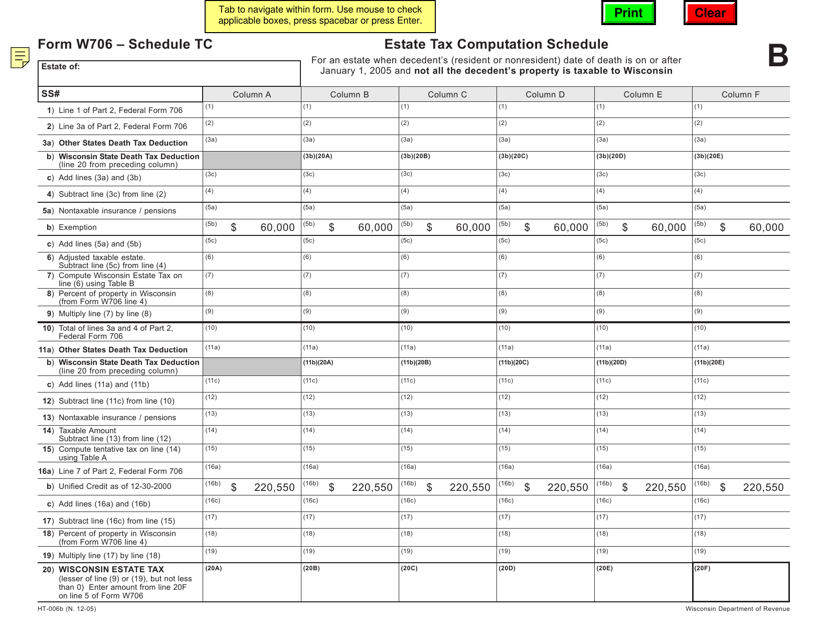

This form is used for calculating the tax for deaths that occurred on or after January 1, 2005, in cases where not all of the deceased person's property is taxable to the state of Wisconsin.

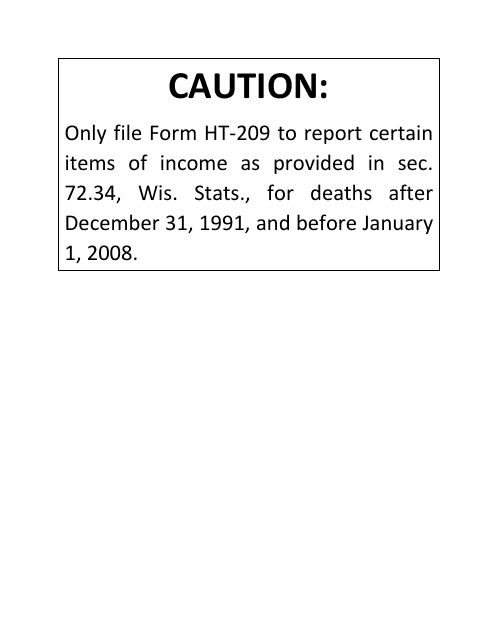

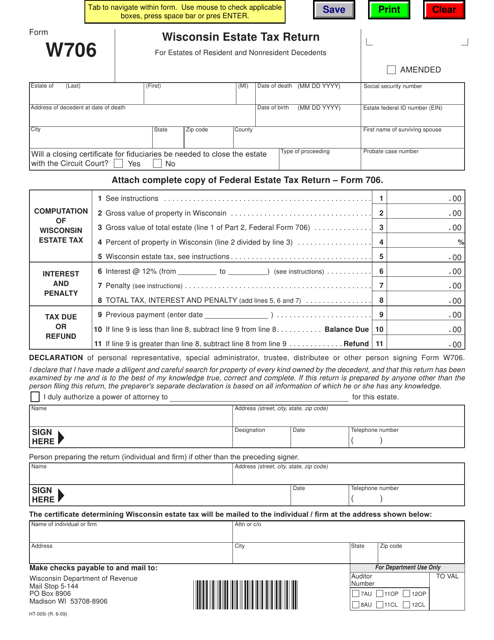

This document is used for filing the Wisconsin Estate Tax Return for estates of resident and nonresident decedents in the state of Wisconsin.

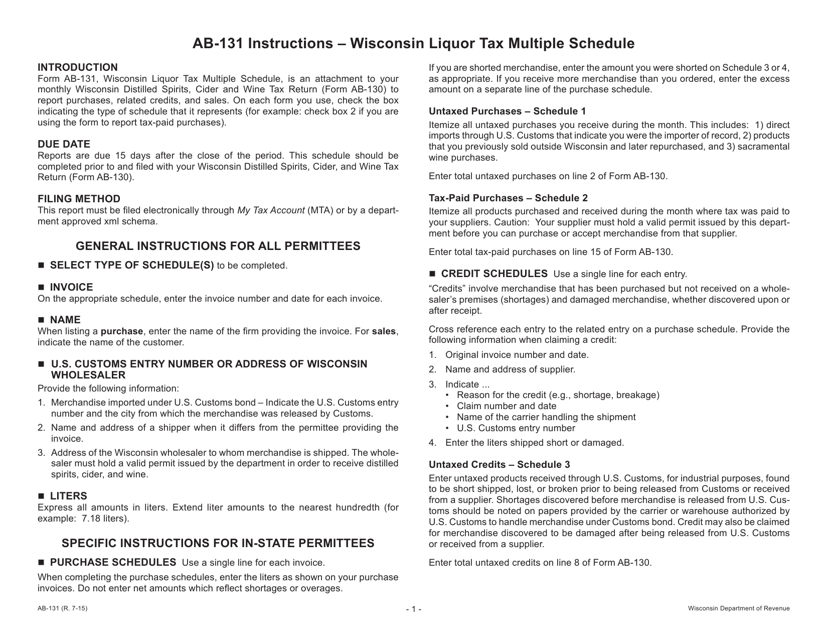

This Form is used for reporting liquor taxes in Wisconsin. It includes multiple schedule options for different types of liquor.

This Form is used for reporting a subtraction modification for dividends in Wisconsin.

Instructions for Form IC-074 Schedule ED Wisconsin Economic Development Tax Credit - Wisconsin, 2023

Instructions for Form IC-034 Schedule HR Wisconsin Historic Rehabilitation Credits - Wisconsin, 2023