Fill and Sign Wisconsin Legal Forms

Documents:

5190

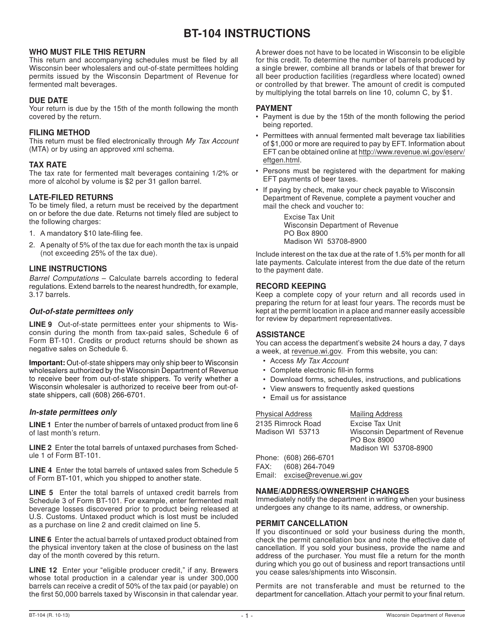

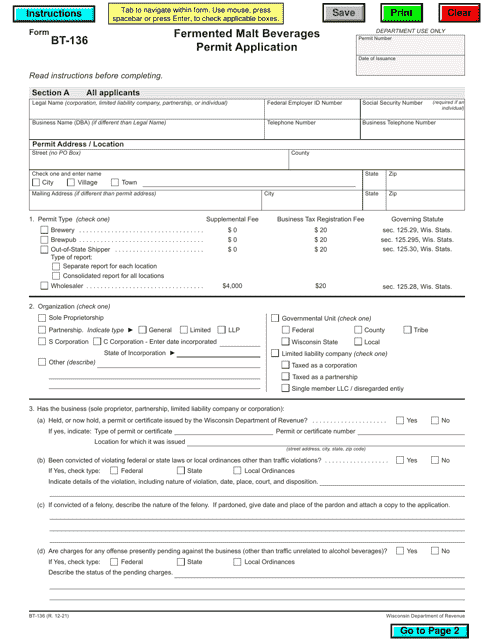

This form is used for reporting and paying taxes on fermented malt beverages in the state of Wisconsin.

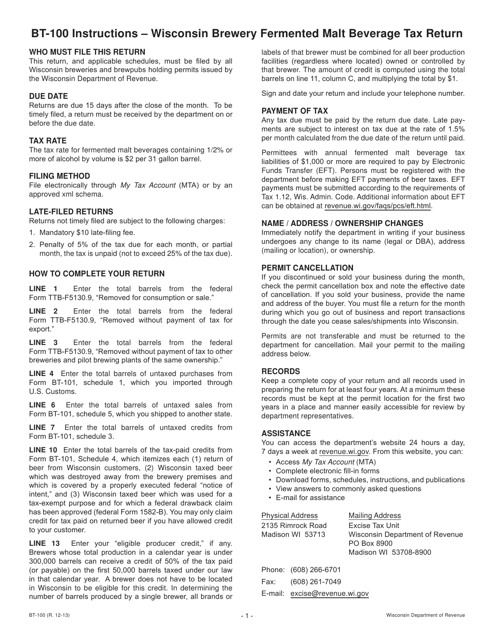

This document is a sample of the Form BT-100 Wisconsin Brewery Fermented Malt Beverage Tax Return used in Wisconsin. It is used by breweries to report and pay taxes on fermented malt beverages.

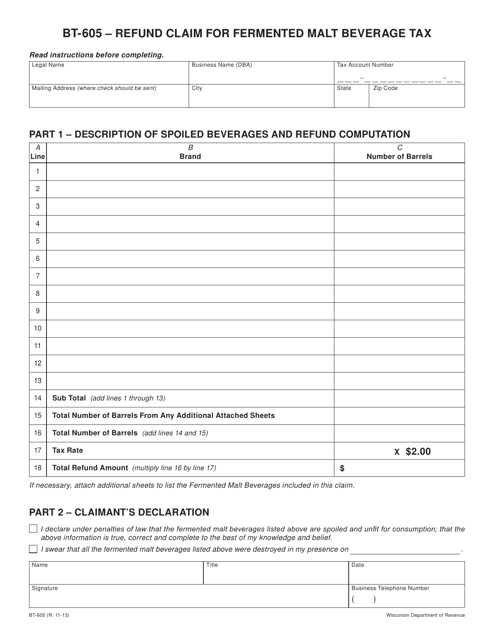

This form is used for claiming a refund for the fermented malt beverage tax in Wisconsin. It is for individuals or businesses who have paid this tax and are eligible for a refund.

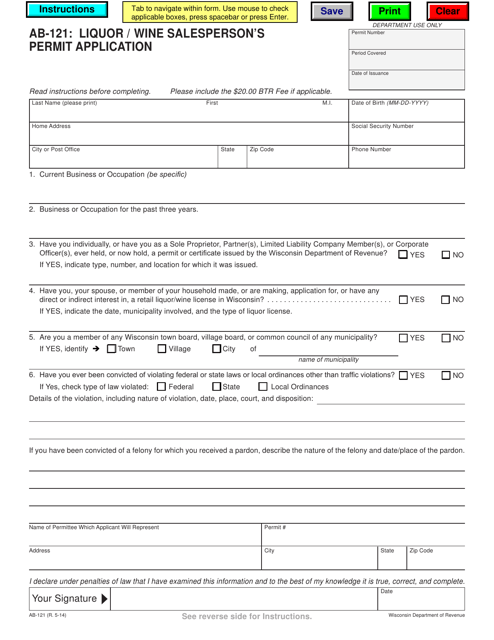

This form is used for applying for a liquor/wine salesperson's permit in Wisconsin.

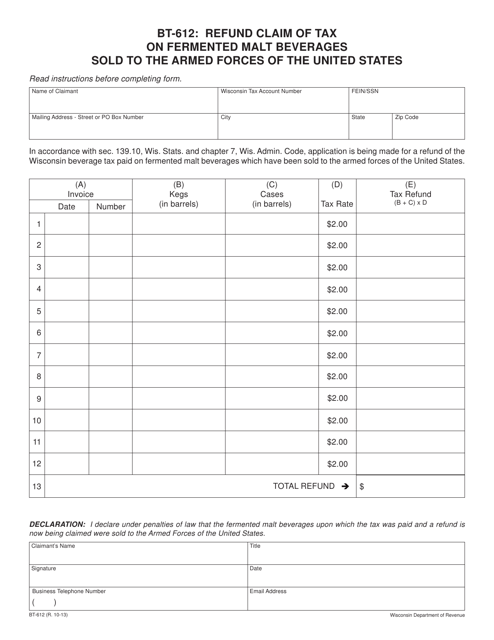

This Form is used for claiming a refund of tax on fermented malt beverages sold to the Armed Forces of the United States in Wisconsin.

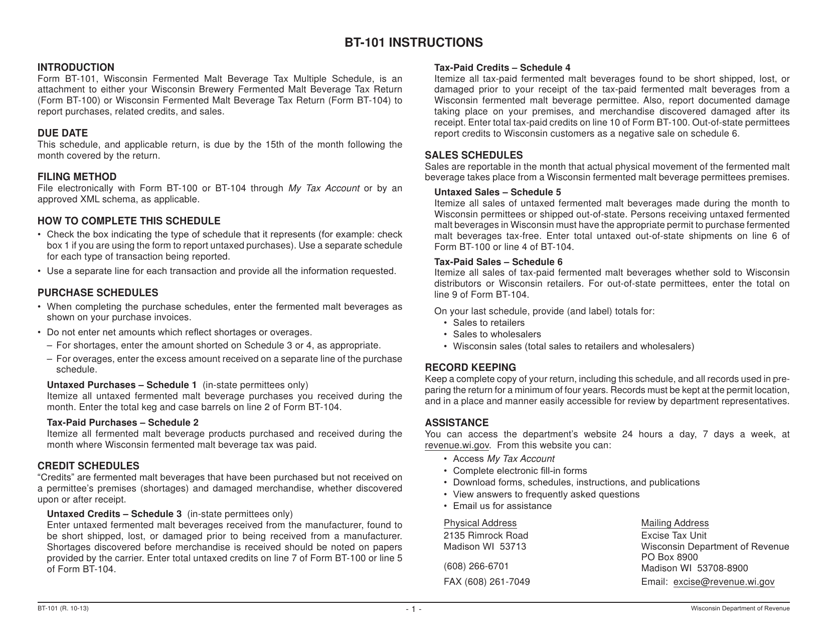

This document is a sample of the BT-101 Wisconsin Fermented Malt Beverage Tax Multiple Schedule form, which is used to report and pay taxes on fermented malt beverage sales in Wisconsin.

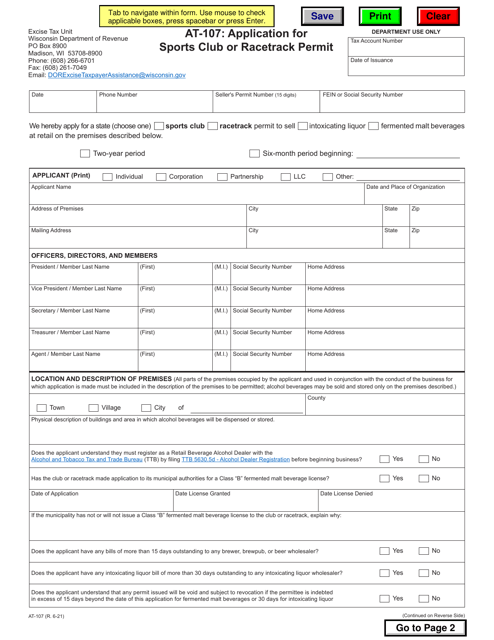

This Form is used for applying for a permit to operate a sports club or racetrack in Wisconsin.

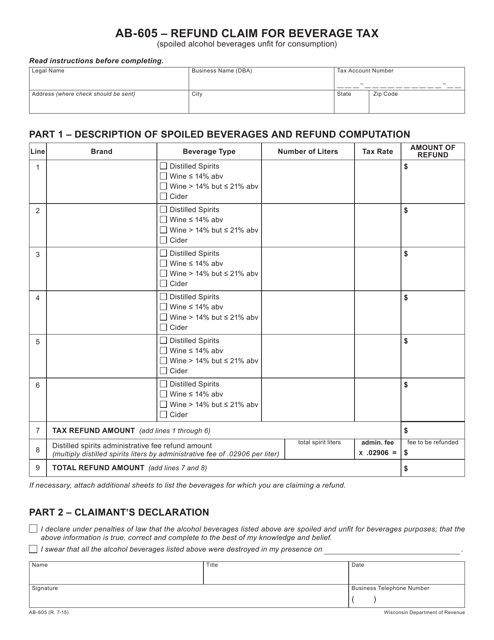

This form is used for claiming a refund of beverage tax in the state of Wisconsin.

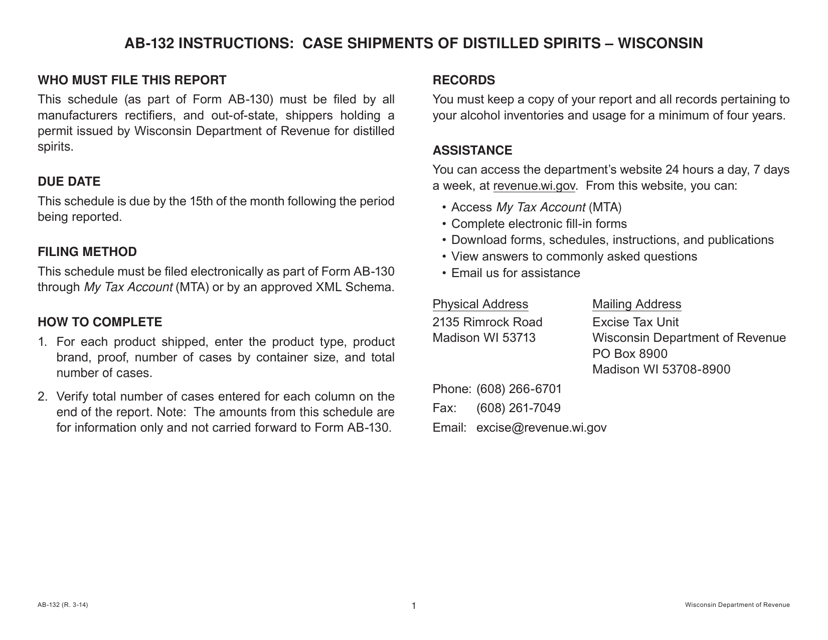

This document is used for reporting the shipment of distilled spirits in Wisconsin. It is a sample form that helps in tracking the transportation of alcoholic beverages within the state.

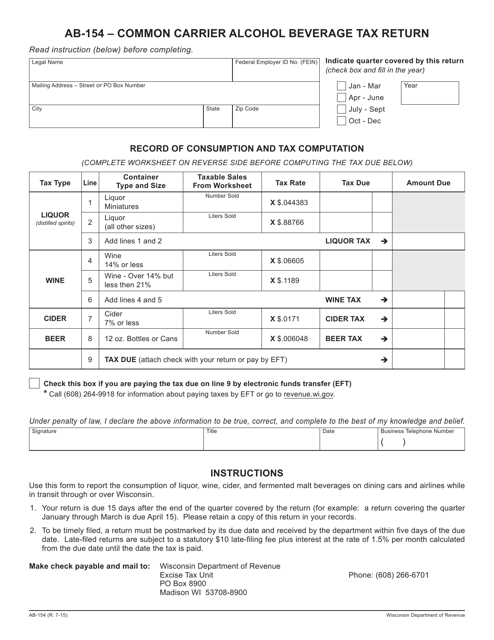

This form is used for reporting alcohol beverage tax for common carriers in the state of Wisconsin.

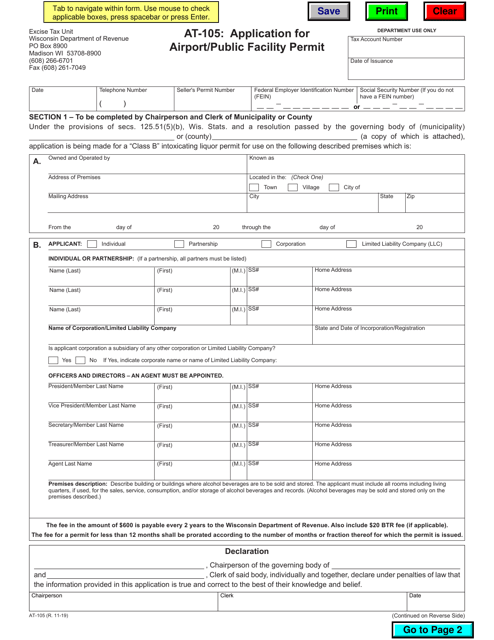

This Form is used for applying for an Airport/Public Facility Permit in Wisconsin.

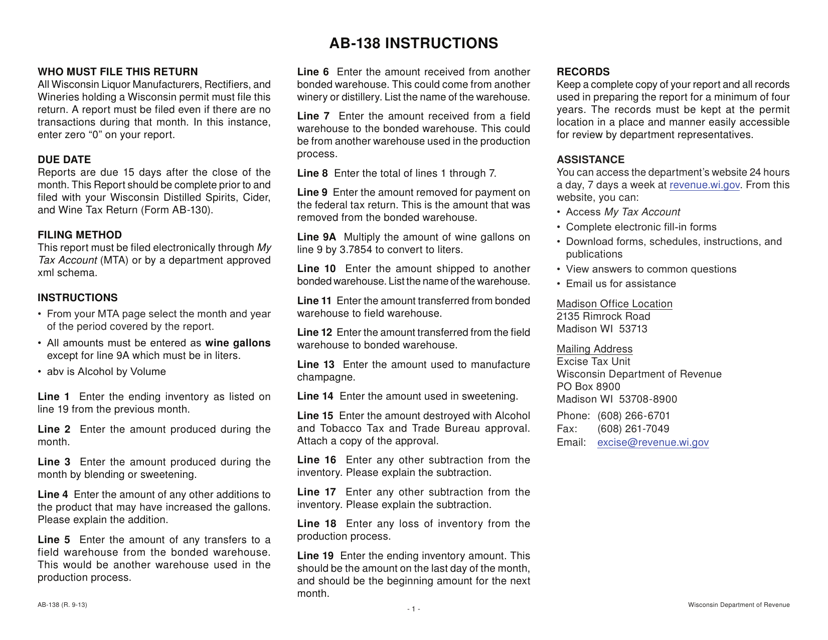

This form is used for reporting information about bonded warehouses in Wisconsin. It is a sample of the AB-138 Wisconsin Bonded Warehouse Report.

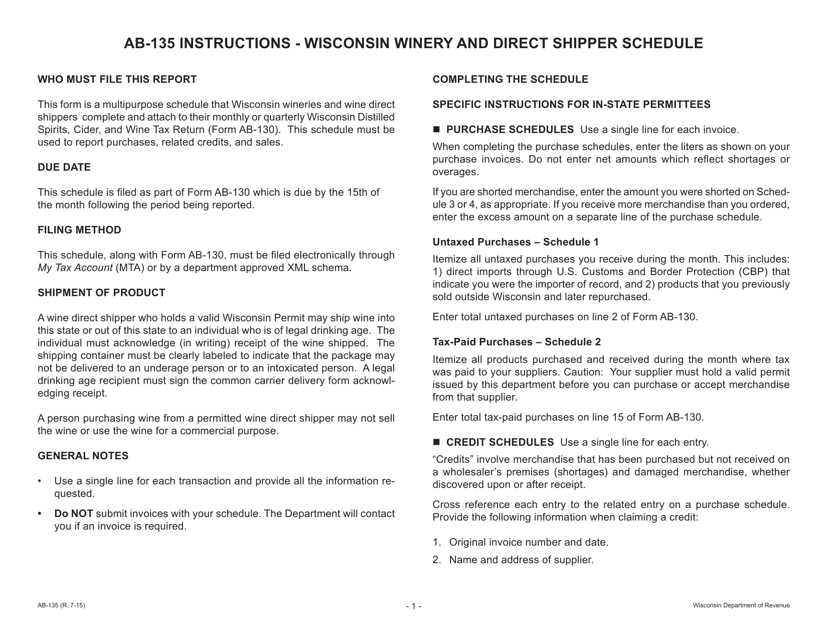

This form is used for wineries and direct shippers in Wisconsin to schedule their activities.

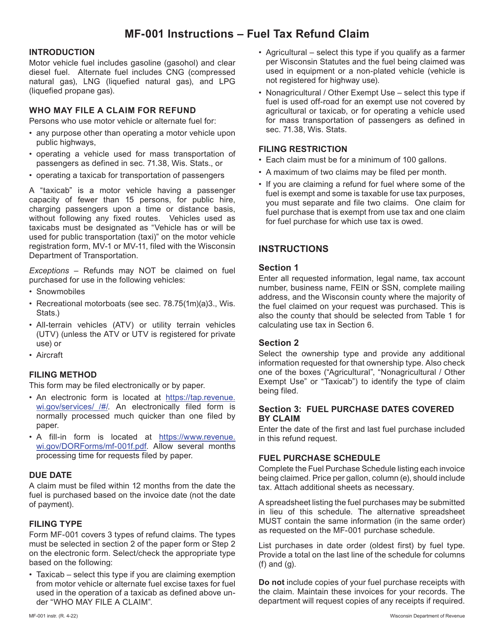

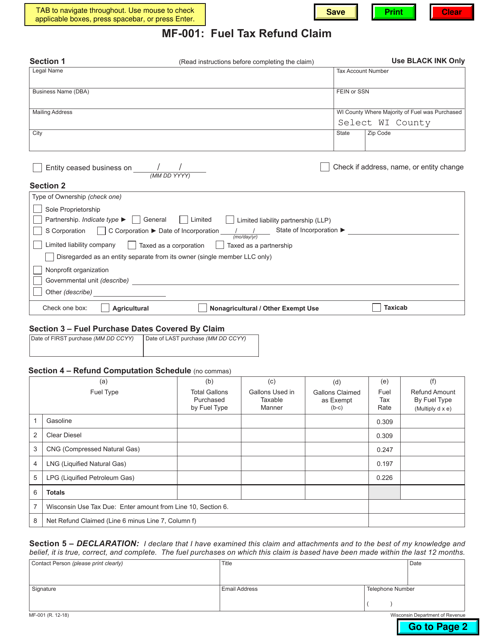

This form is used for claiming a refund on fuel taxes paid in the state of Wisconsin.

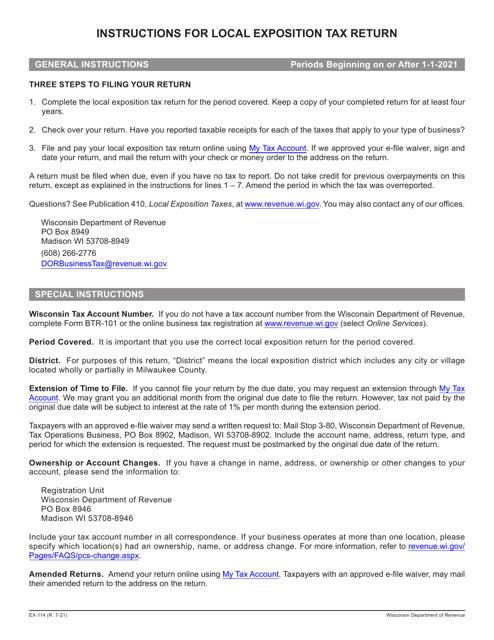

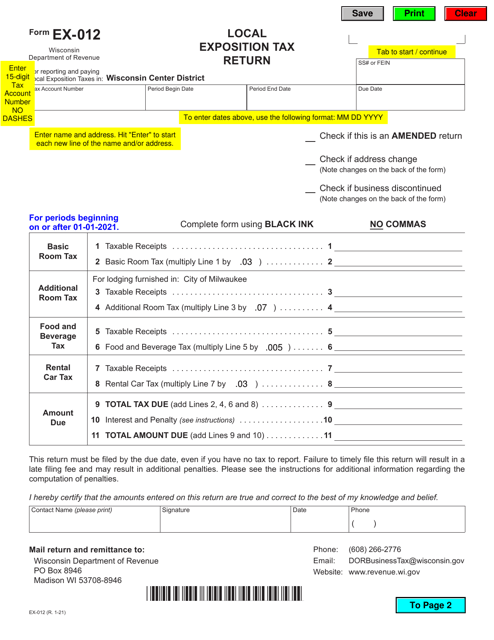

This document is for filing the Local Exposition Tax Return in Wisconsin. It provides instructions on how to complete and submit Form EX-012.

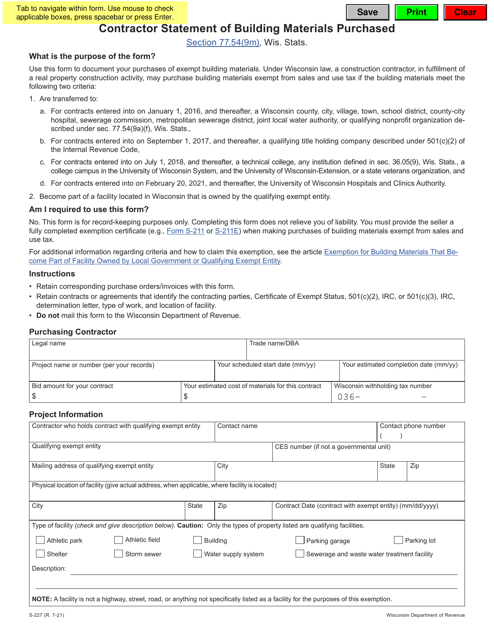

This form is used for contractors in Wisconsin to provide a statement of building materials purchased.

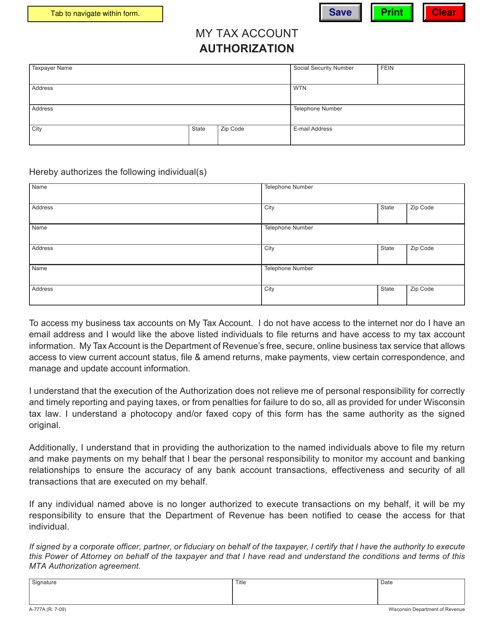

This form is used for authorizing someone to access and manage your tax account in the state of Wisconsin.

This form is used for filing the local exposition tax return in the state of Wisconsin. It is necessary for businesses and individuals who have participated or earned income from local expositions within the state.

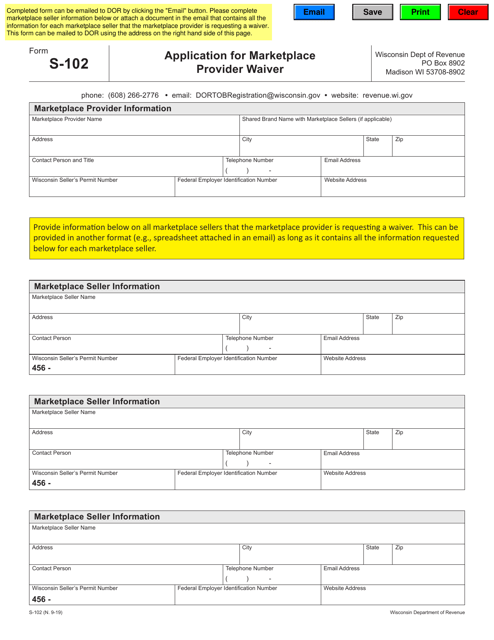

This form is used for applying for a waiver as a marketplace provider in the state of Wisconsin.

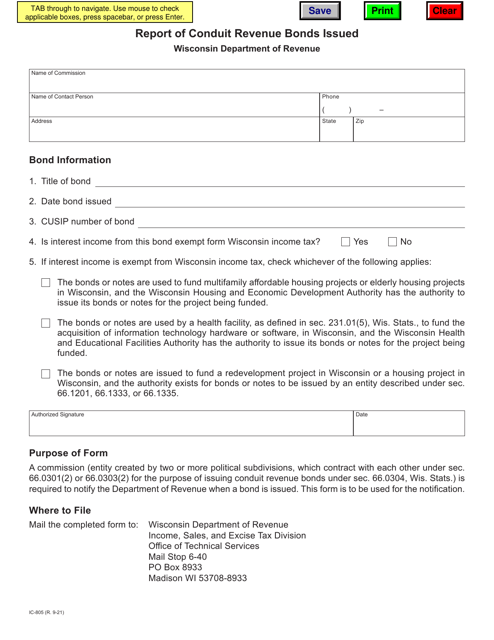

This Form is used for reporting conduit revenue bonds issued in Wisconsin.

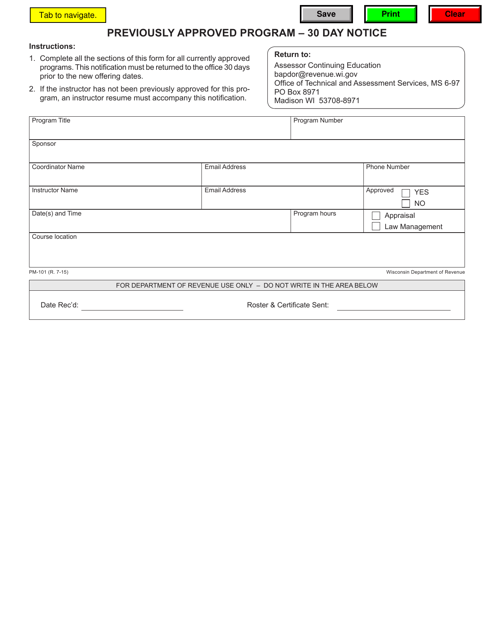

This form is used for providing a 30-day notice for a previously approved program in Wisconsin.