Federal Tax Forms and Templates

Documents:

237

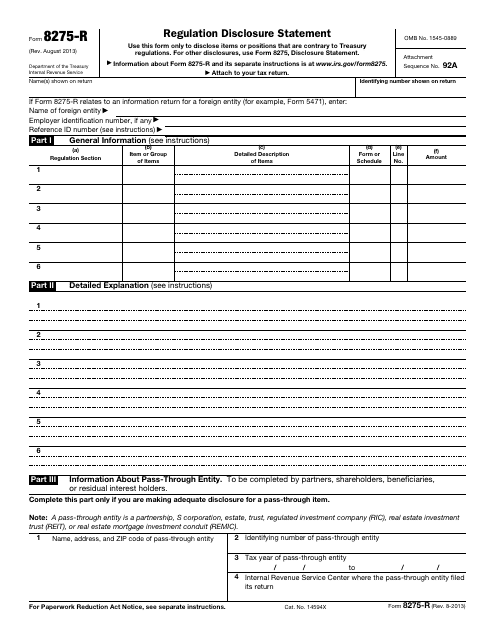

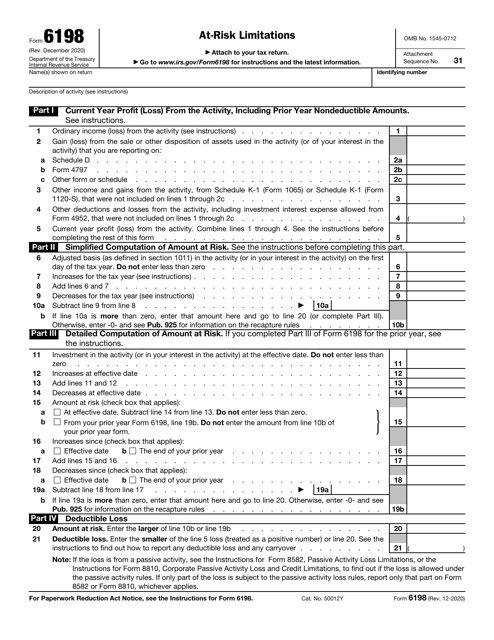

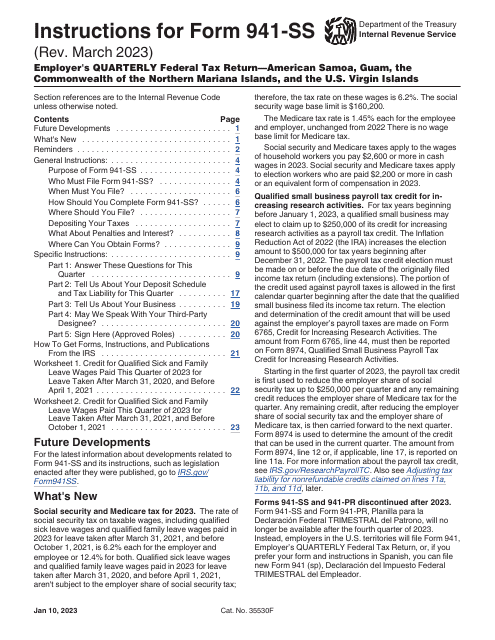

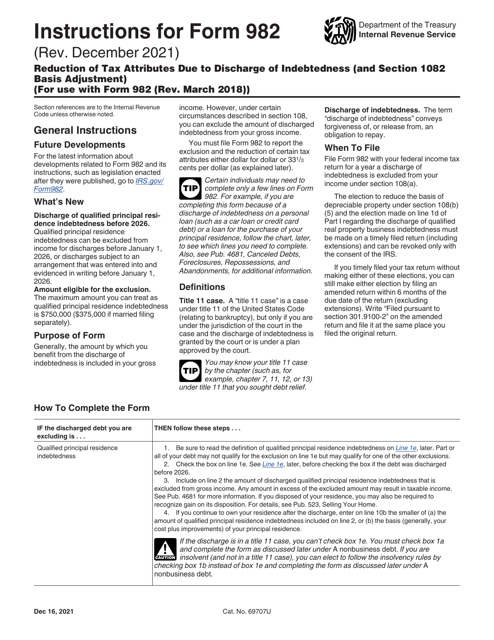

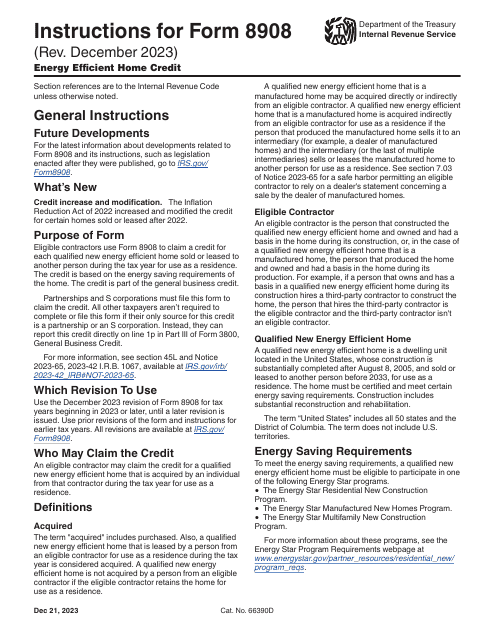

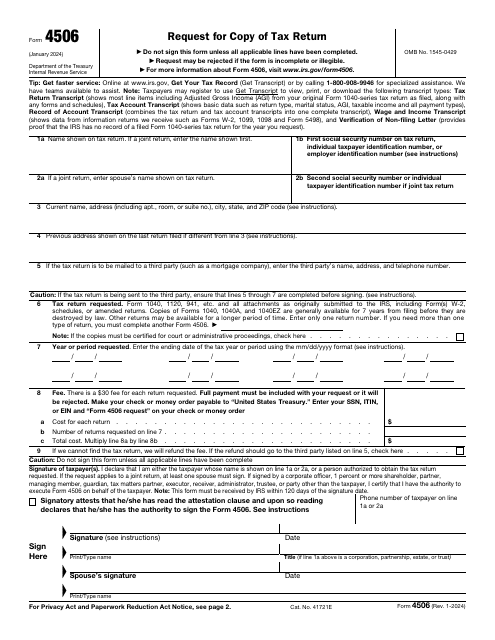

This document is used to disclose information about the regulations that apply to a tax return.

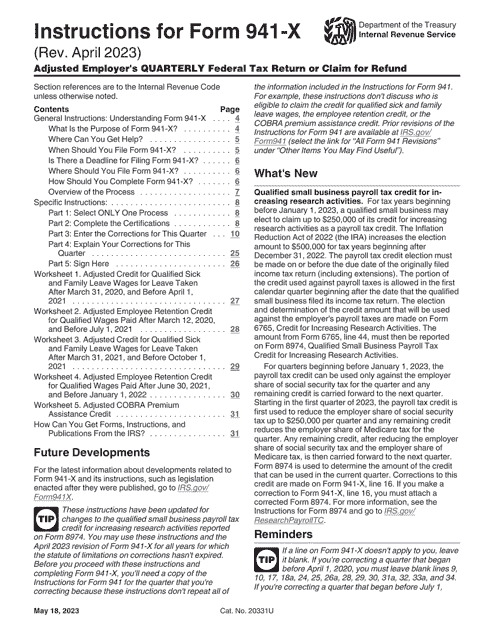

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

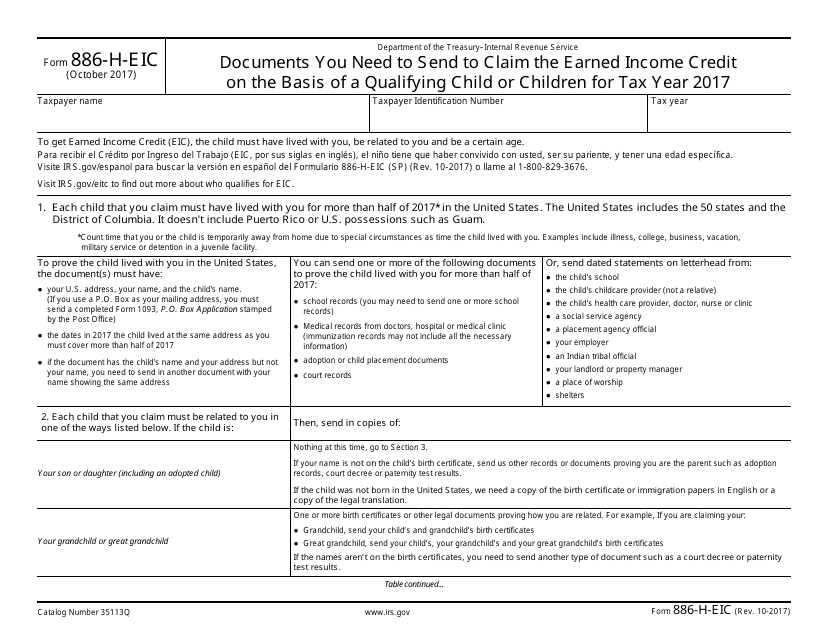

This form is used to provide the necessary documentation required to claim the Earned Income Credit (EIC) based on having a qualifying child or children. It outlines the specific documents that need to be submitted to the IRS in order to support your claim.

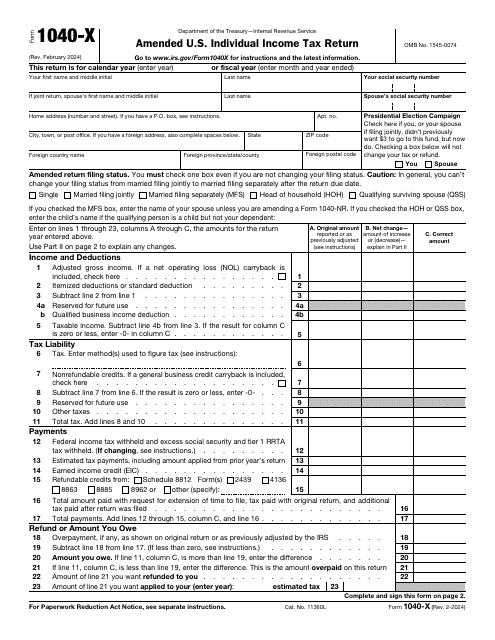

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

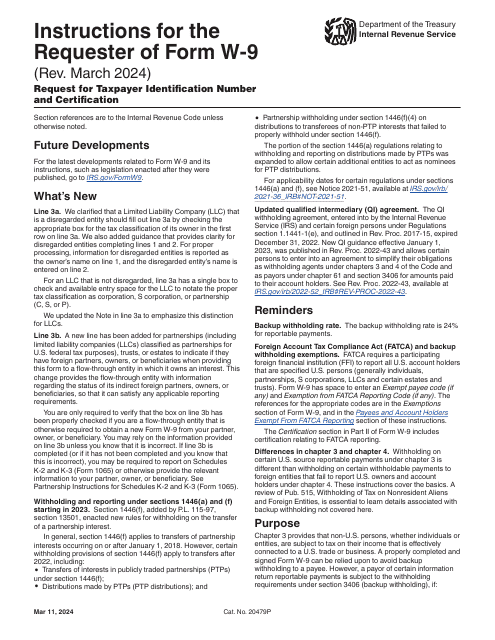

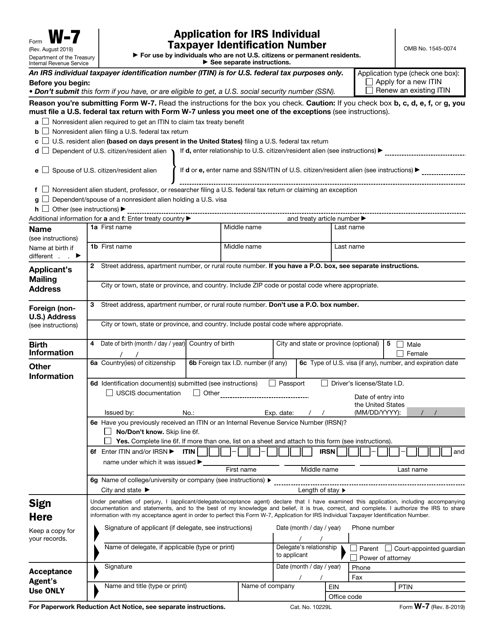

This is a formal statement filled out by individuals that want to obtain an identification number that will confirm their identity to fiscal organizations and let them communicate with the government as taxpayers. Additionally, it may be completed to renew a number they received before.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

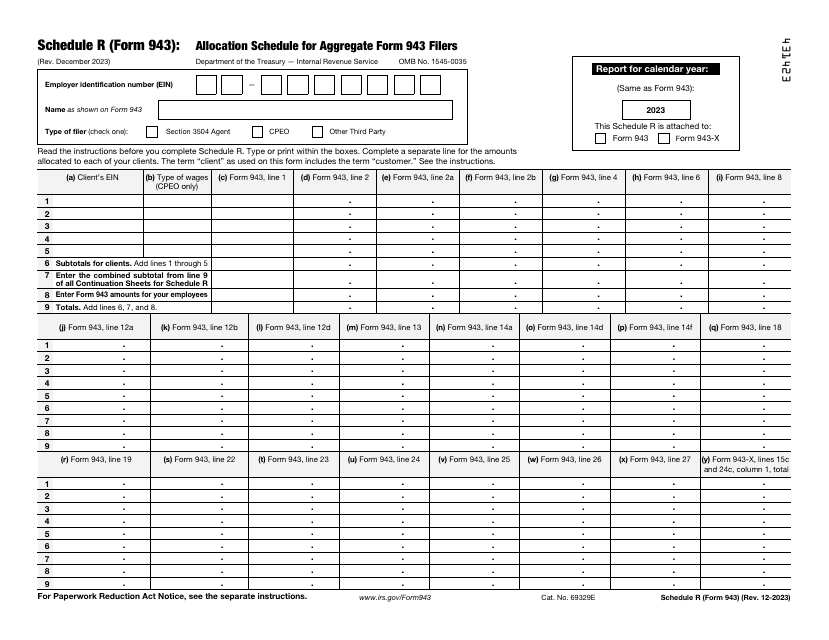

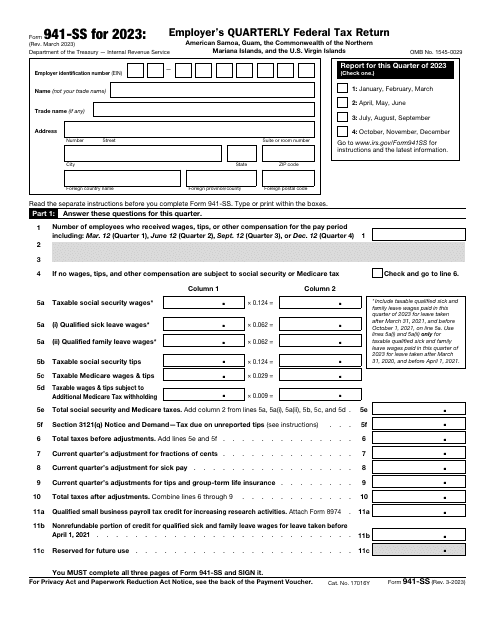

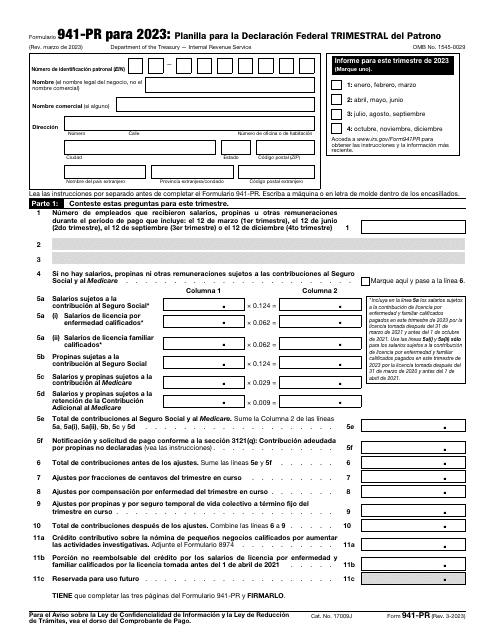

This document, otherwise known as the Employer's Quarterly Federal Tax Return, is a form downloaded to report about your social security and Medicare taxes. This form is used only if the official place of business is located within the specified territories.

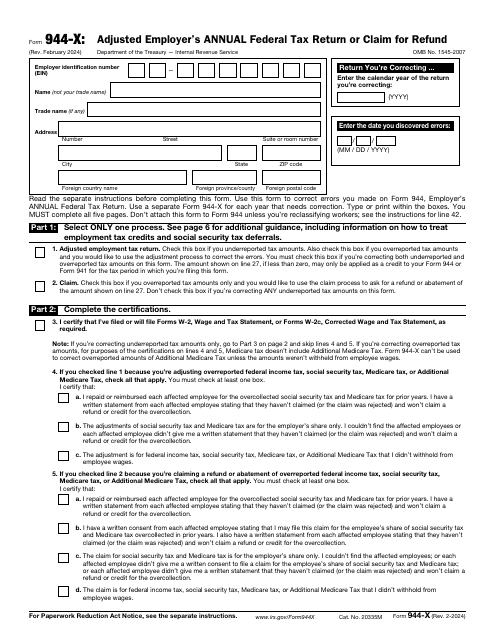

This is a fiscal form used by employers that learned about the need to correct a previously filed IRS Form 944, Employer's Annual Federal Tax Return.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

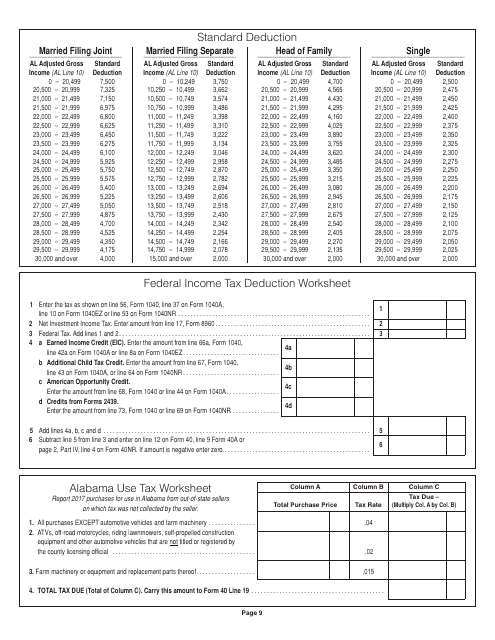

This document provides a worksheet for Alabama residents to calculate their federal income tax deductions.

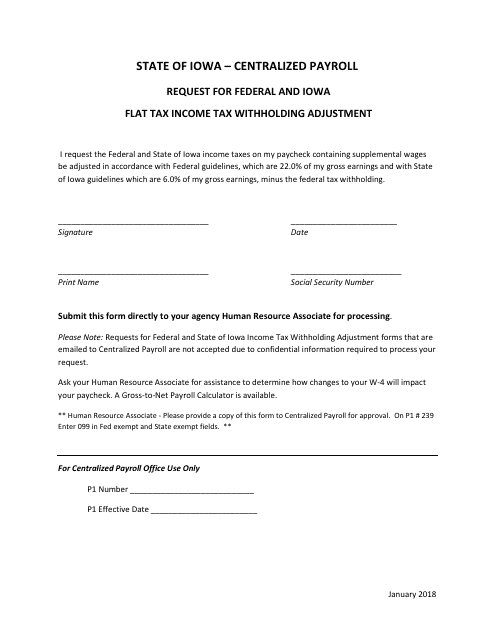

This Form is used for requesting adjustments to federal and Iowa flat tax income tax withholding in the state of Iowa.

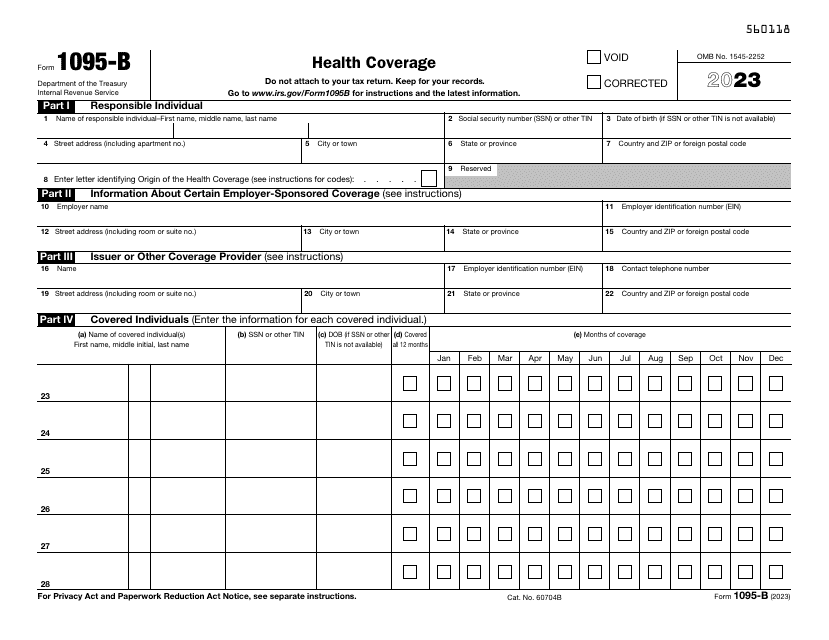

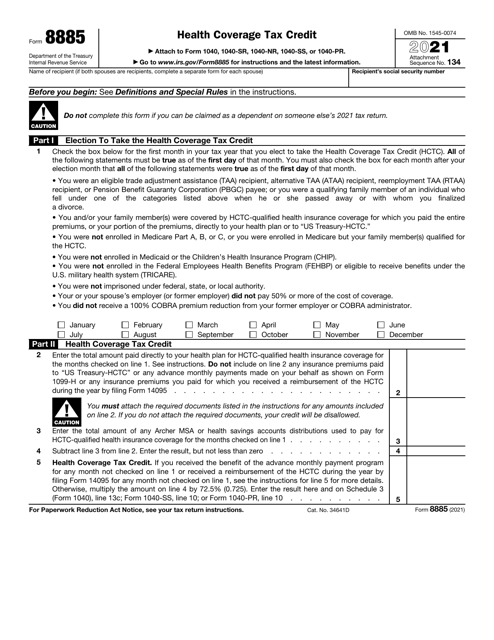

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

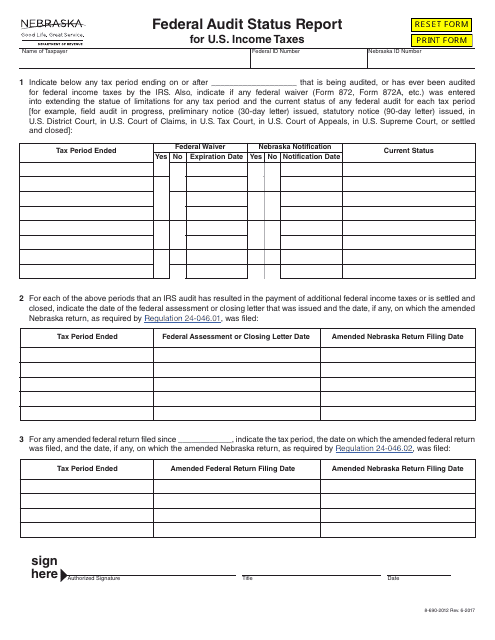

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.

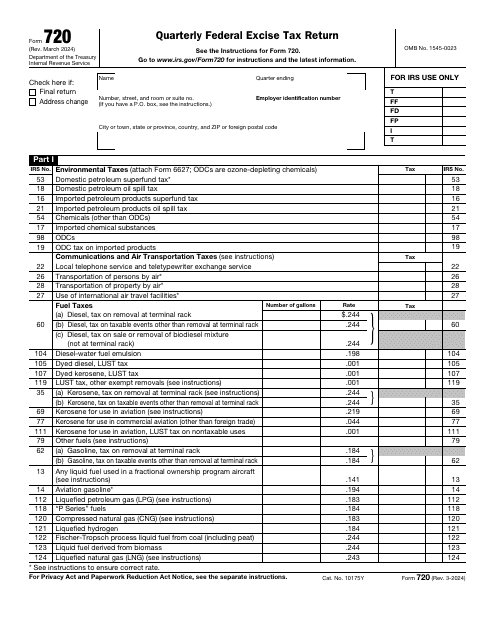

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

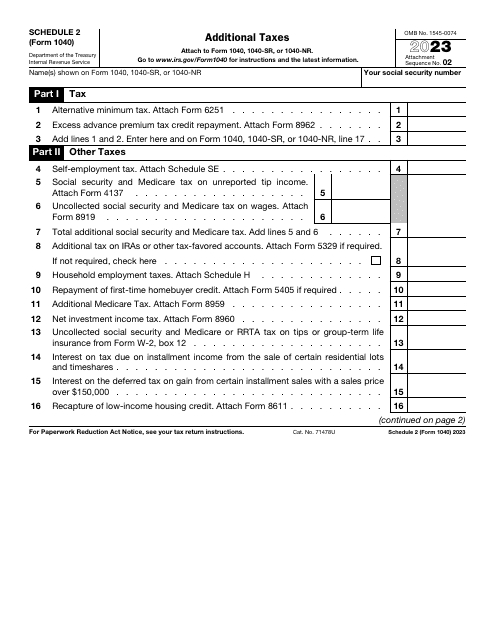

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

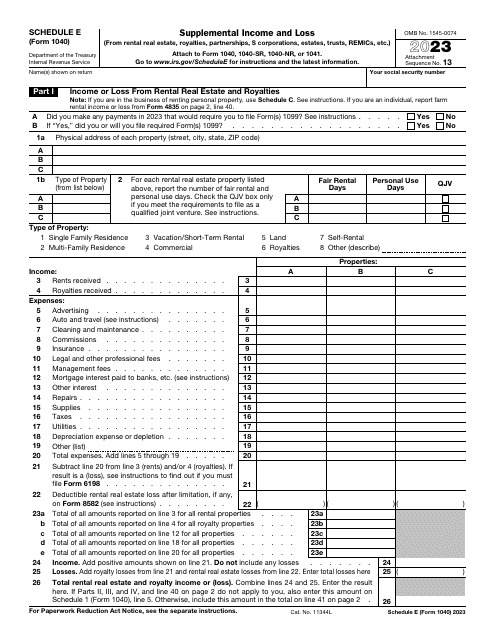

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

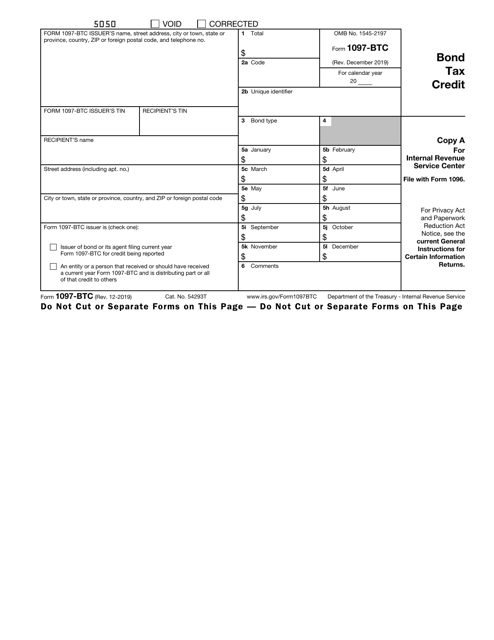

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

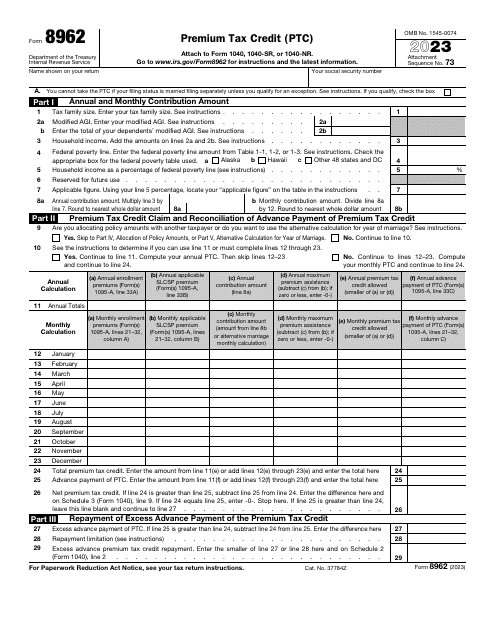

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.