Federal Tax Forms and Templates

Documents:

237

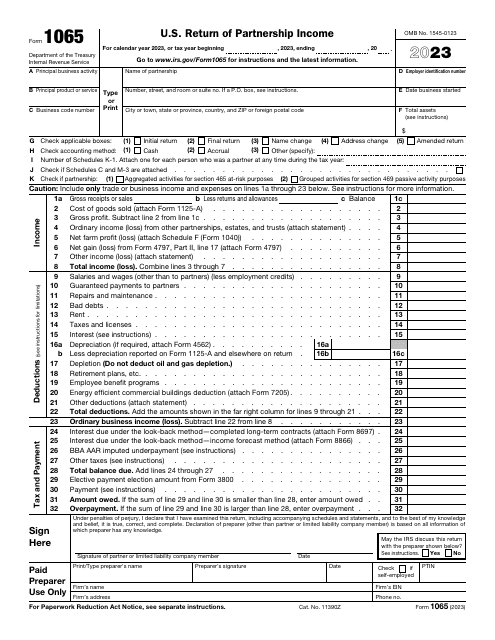

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

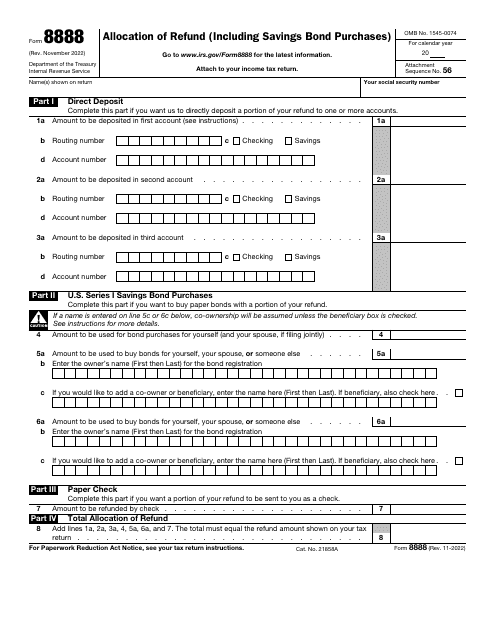

This is an IRS form filled out and submitted by a taxpayer that chooses to spread their tax refund across several accounts.

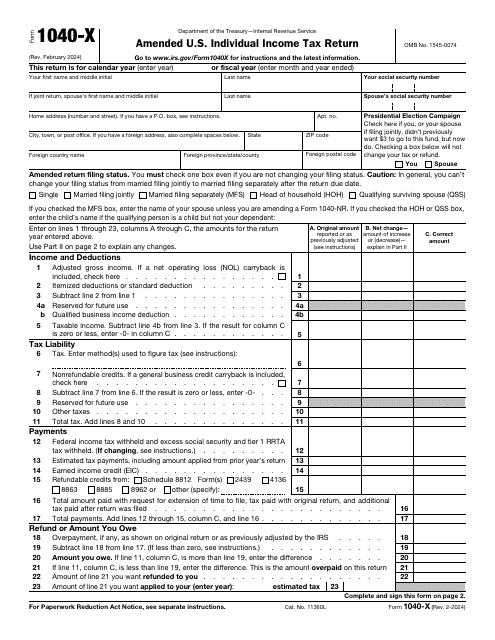

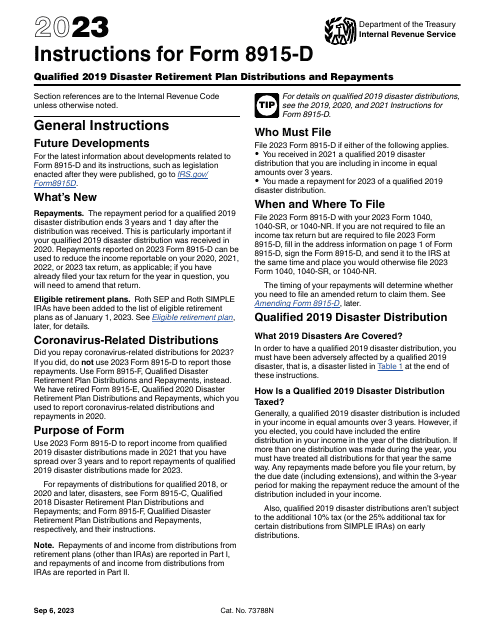

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

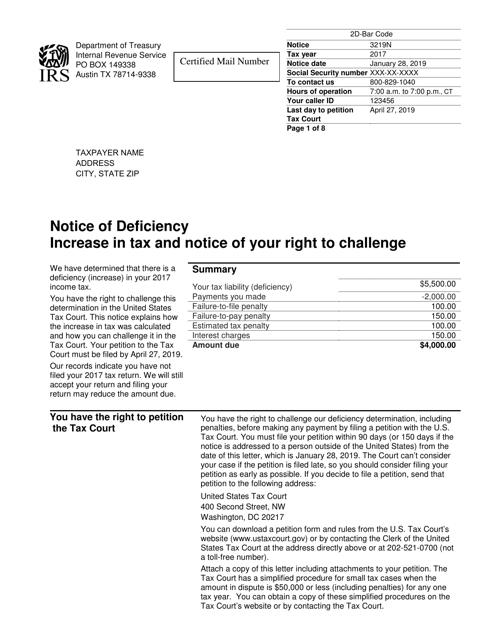

This document is a Notice of Deficiency from the Internal Revenue Service (IRS). It is sent to taxpayers who have underreported their income or have other tax liabilities. The notice provides information about the proposed changes to the tax return and the options available to the taxpayer to respond.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

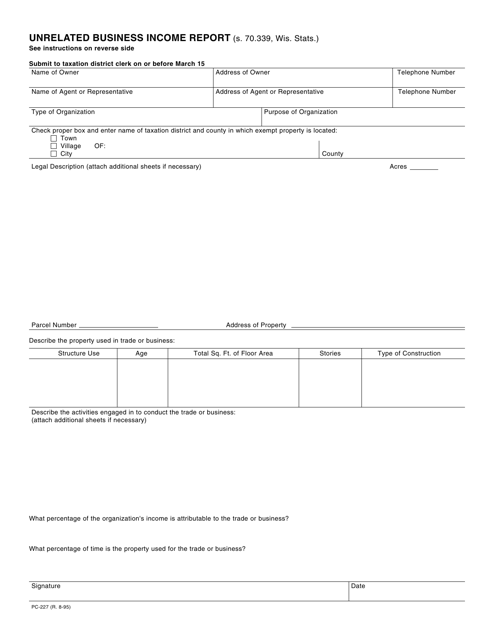

This Form is used for reporting unrelated business income in the state of Wisconsin.

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

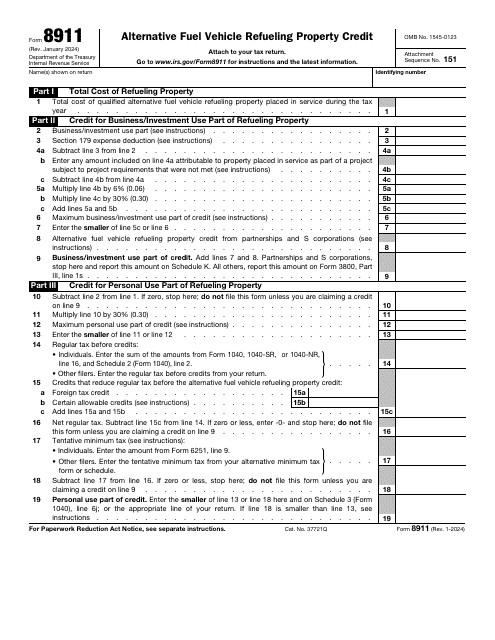

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

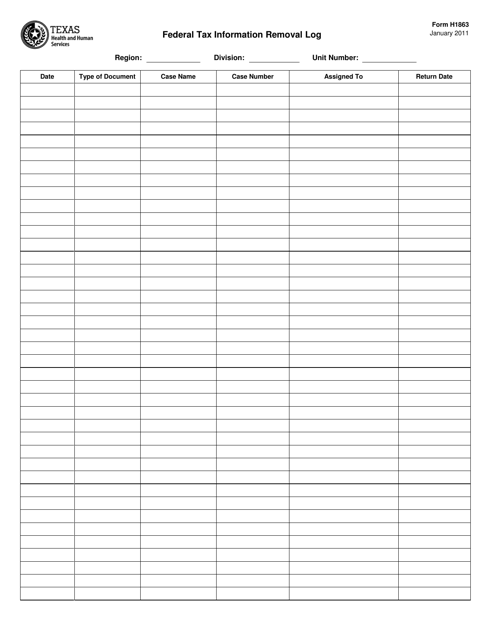

This form is used for keeping track of the removal of federal tax information in Texas.

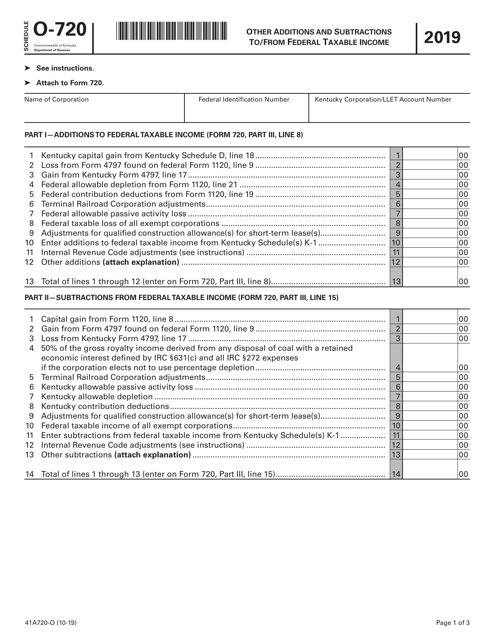

This form is used for reporting other additions and subtractions to or from federal taxable income for residents of Kentucky on their state tax return.

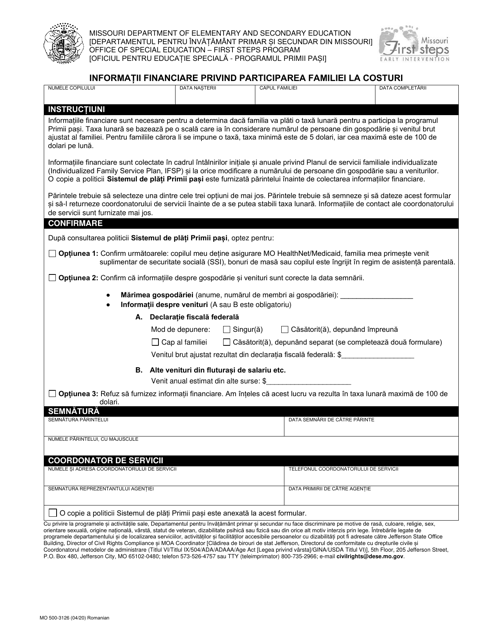

This form is used to gather financial information for Romani families in Missouri who are participating in cost-sharing programs. It helps determine the family's eligibility for financial assistance.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

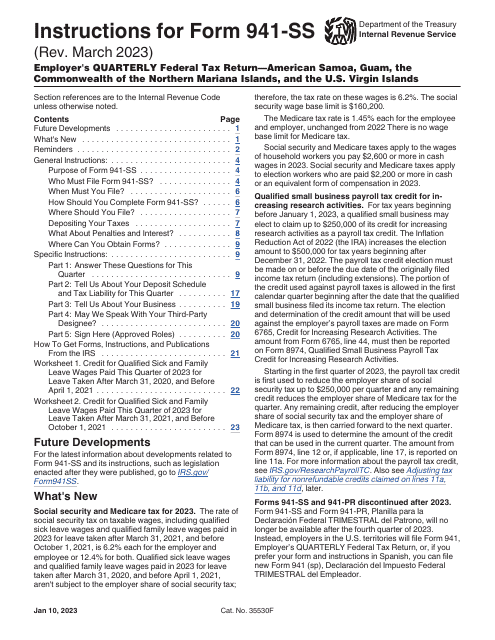

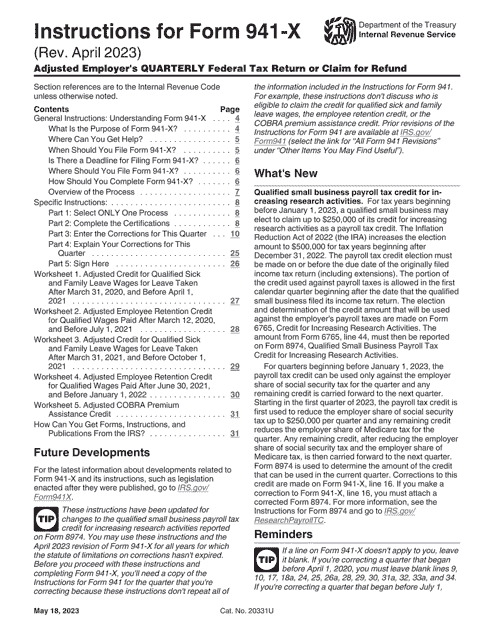

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

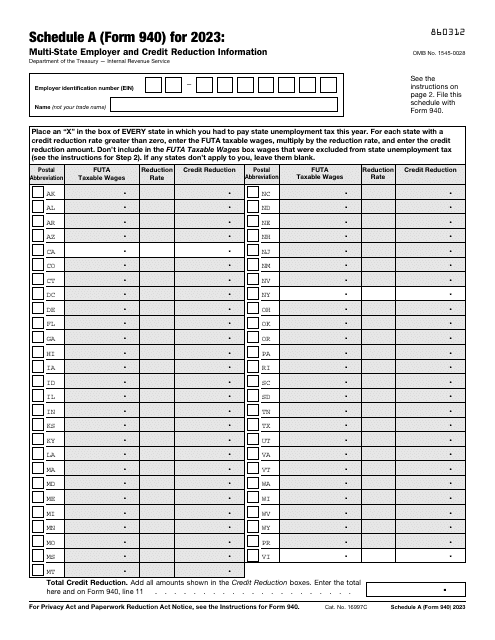

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

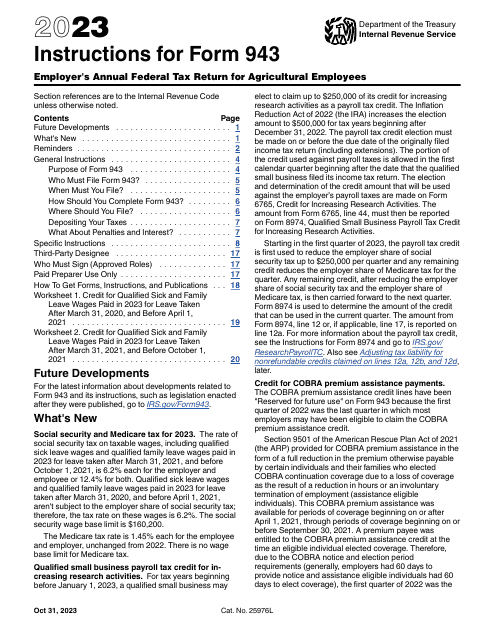

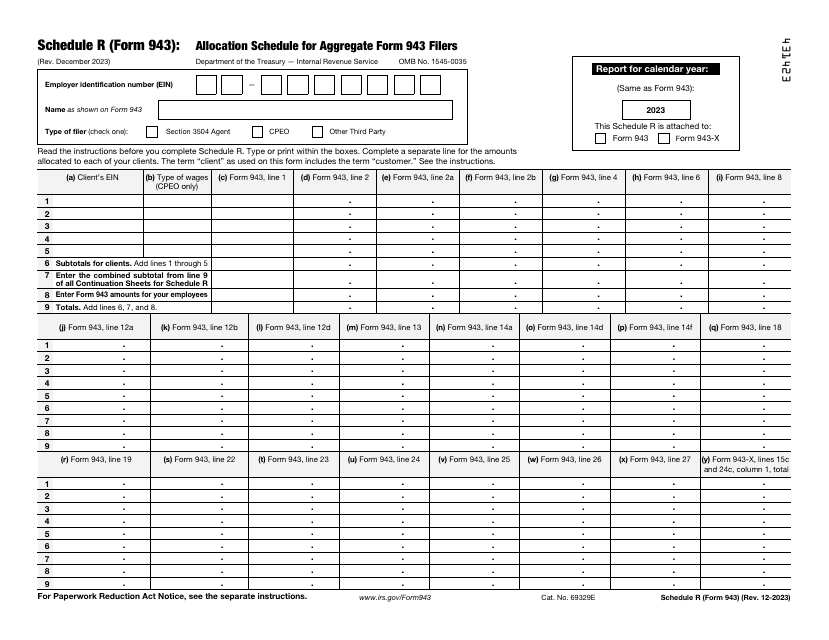

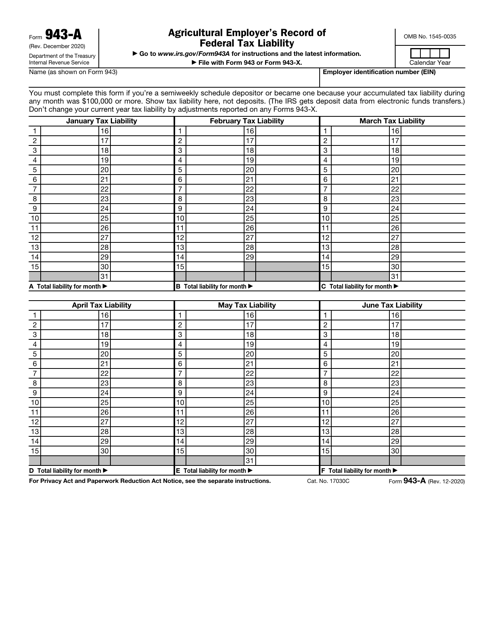

This is an IRS form used by agricultural employers that deposit schedules every two weeks or whose tax liability equals or exceeds $100,000 during any month of the year.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.