Small Business Documents Templates

Related Articles

Documents:

640

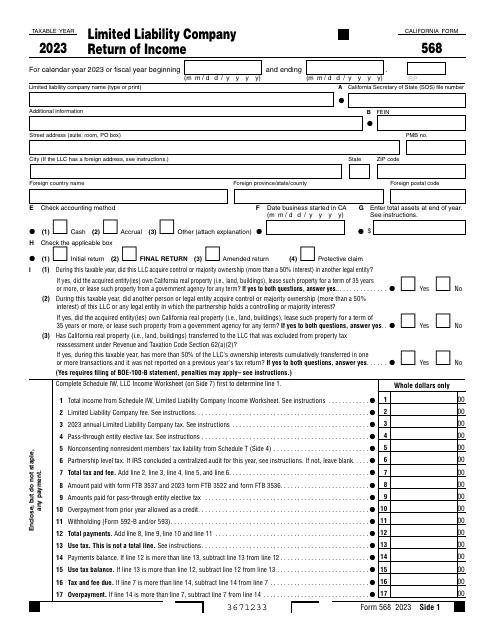

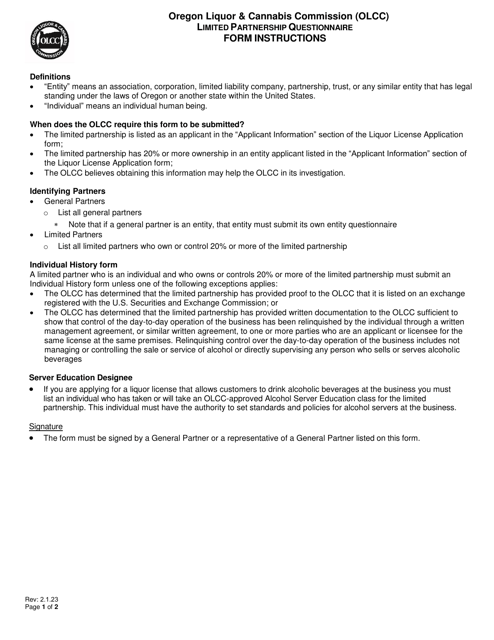

This document is supposed to be filled out only by a Limited Liability Company (LLC) classified as a Partnership. They should use this form as an income tax return that should be filed every year.

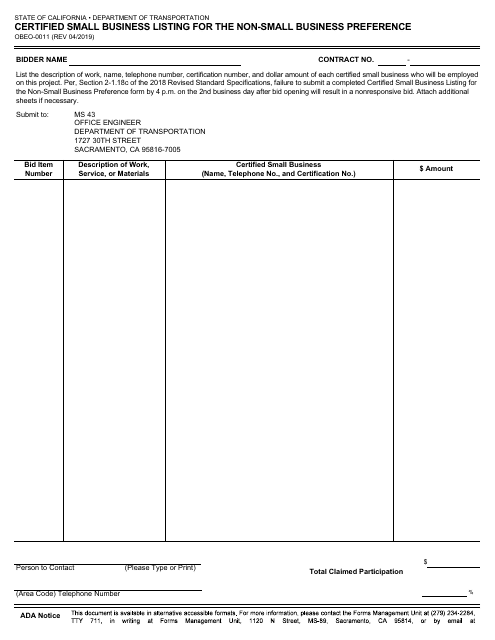

This form is used for listing certified small businesses for the non-small business preference in California.

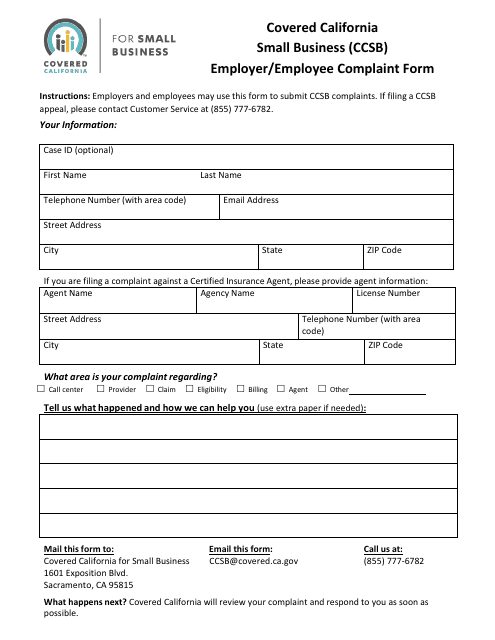

This document is used for filing complaints by employers or employees with Covered California Small Business (CCSB) in California. It provides a formal avenue for raising concerns or issues related to the CCSB program.

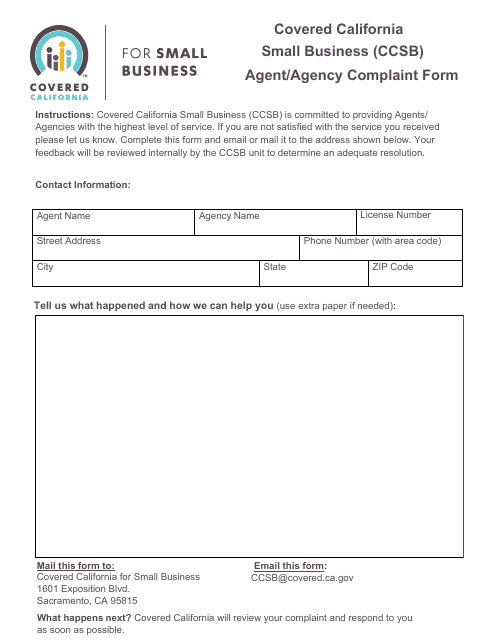

This form is used for filing a complaint against a Covered California Small Business (CCSB) agent or agency in California. It provides a way for individuals to report any issues or concerns they have regarding their interactions with an agent or agency.

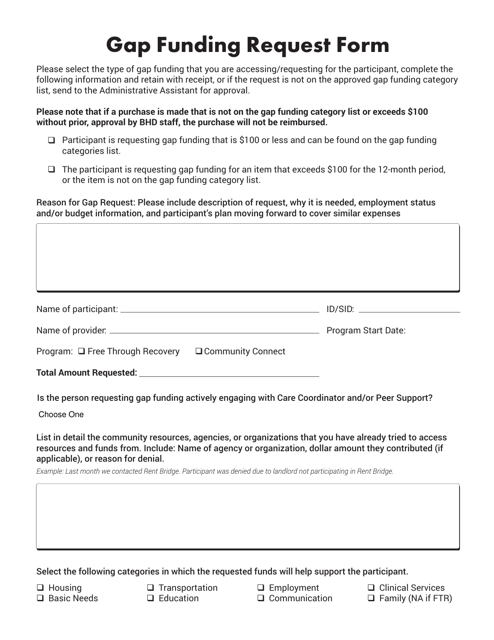

This Form is used for requesting gap funding in the state of North Dakota. Gap funding is financial assistance provided to bridge the gap between other sources of funding and the total cost of a project or initiative.

This document is used to apply for a pawnbroker branch office in the state of Ohio. It outlines the requirements and information needed to open a branch office for a pawnbroker business.

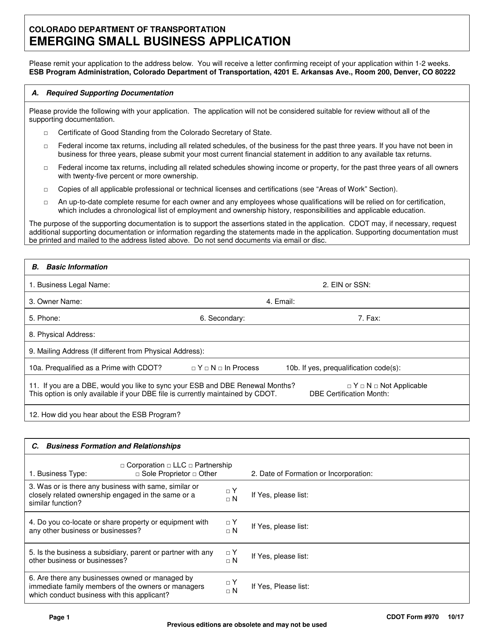

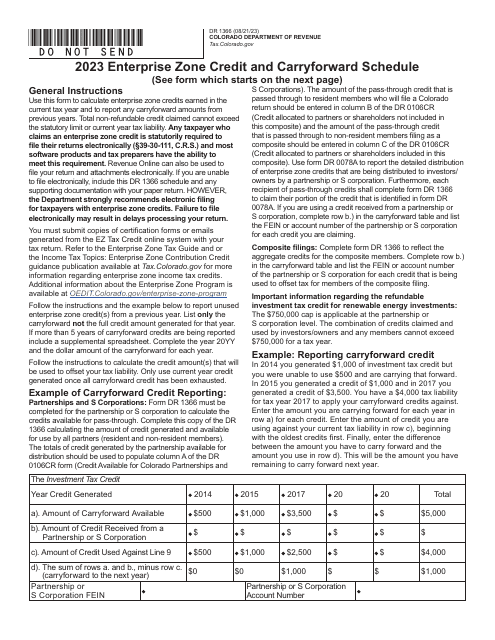

This Form is used for applying to be recognized as an emerging small business in Colorado.

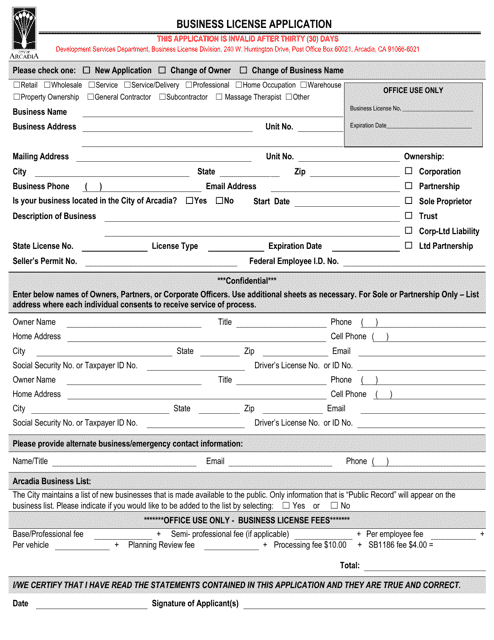

This document is used for applying for a business license in the City of Arcadia, California.

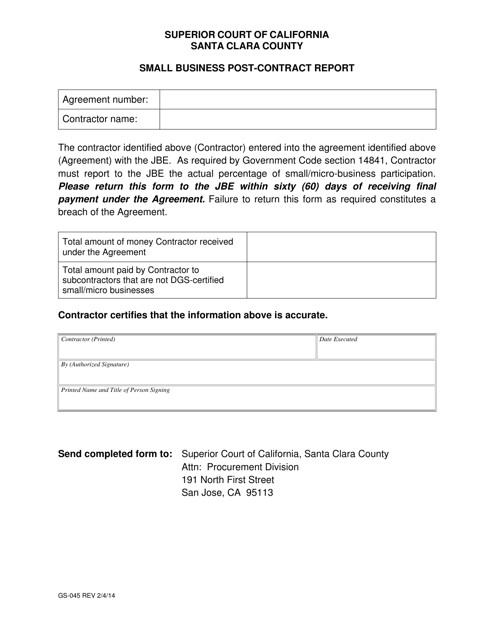

This form is used for the Small Business Post-contract Report in the County of Santa Clara, California. It is used to gather information on small businesses that have completed a contract with the county.

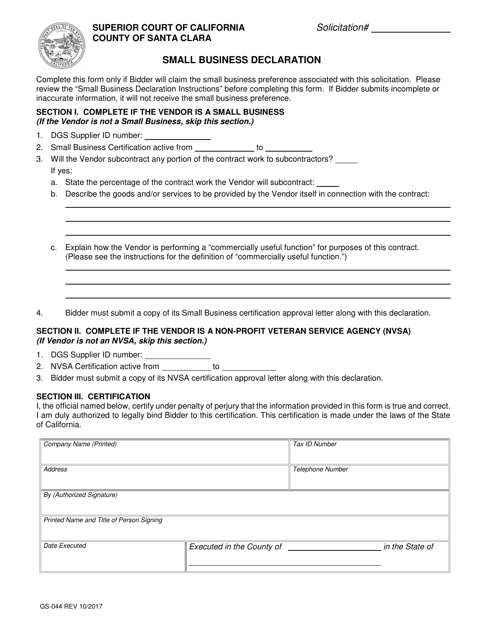

This form is used for small businesses in Santa Clara County, California to declare their status as a small business.

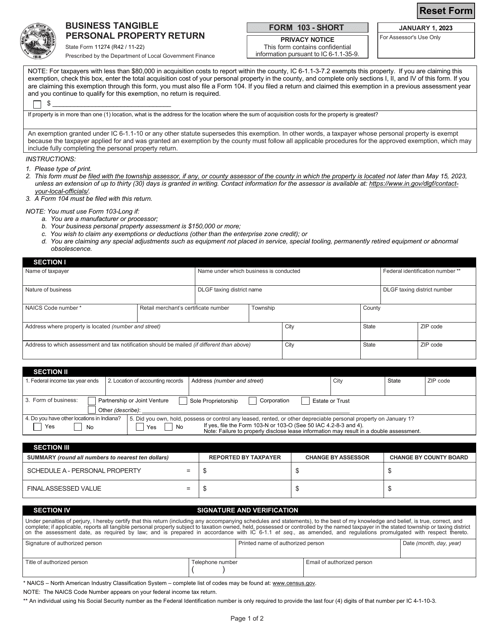

This Form is used for reporting business tangible personal property in Indiana. It is used to calculate and report the value of tangible assets owned by a business for taxation purposes.

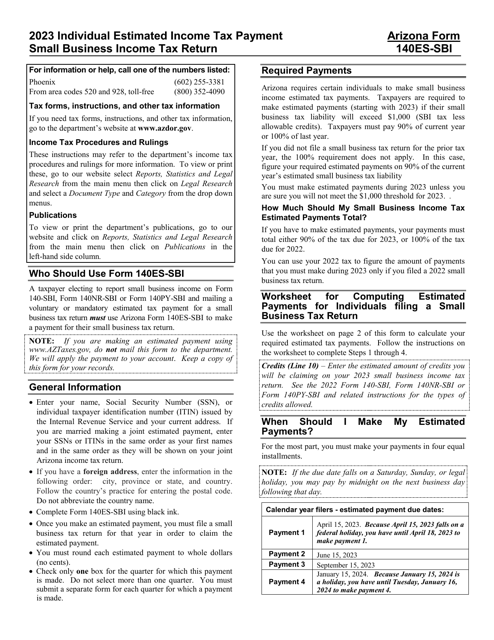

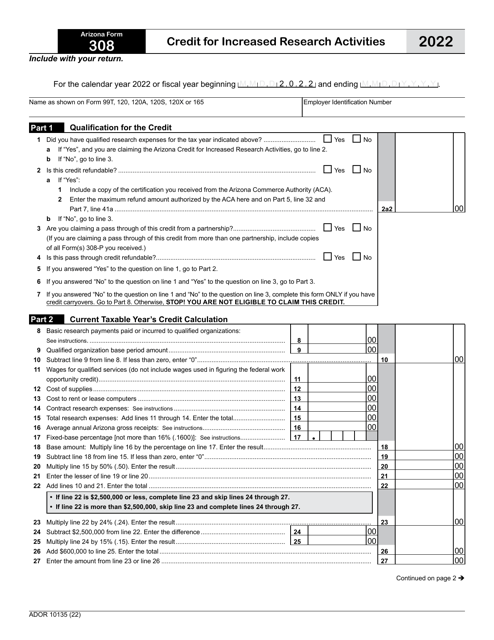

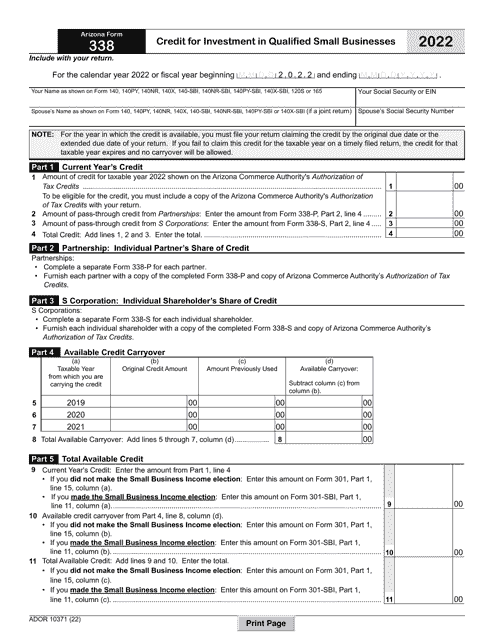

This Form is used for claiming the Credit for Increased Research Activities in the state of Arizona.

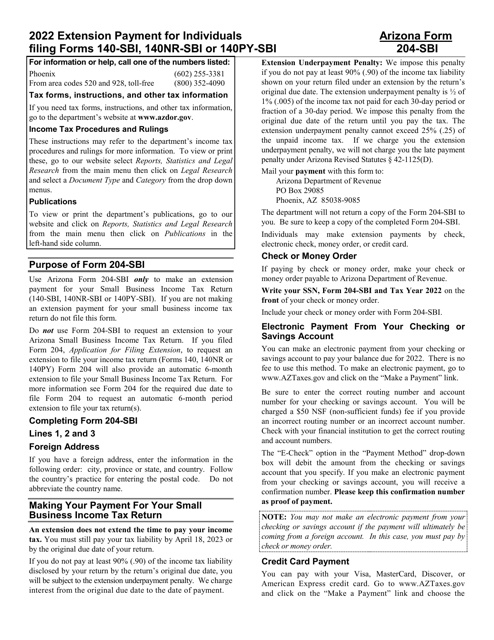

This form is used for making extension payments for small business income tax returns in Arizona. It provides instructions on how to properly complete and submit Form 204-SBI, ADOR11402.

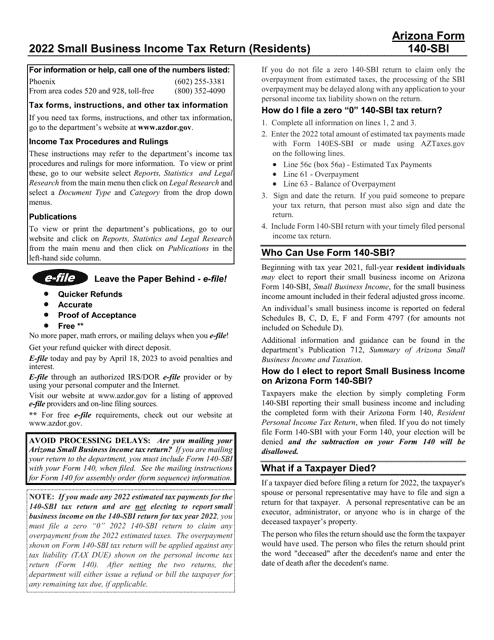

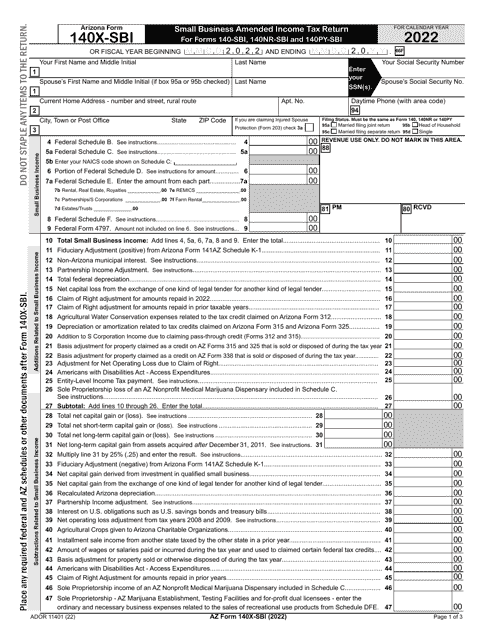

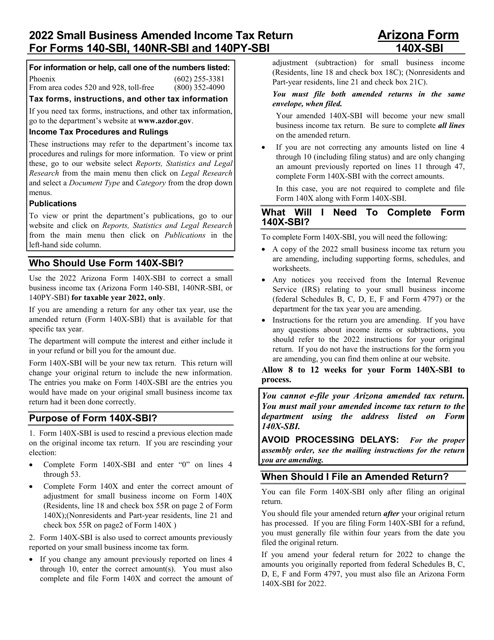

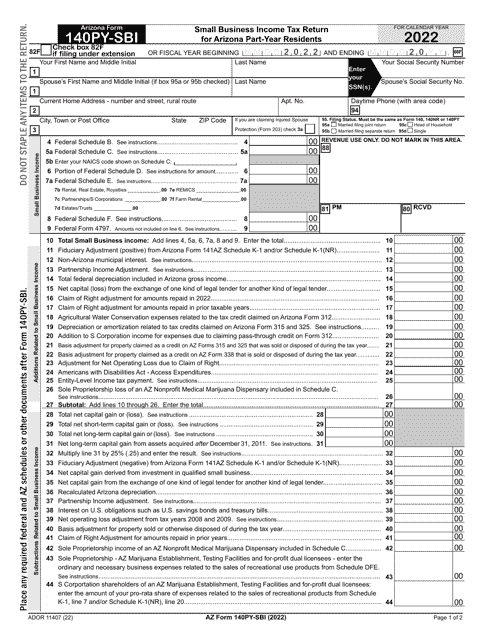

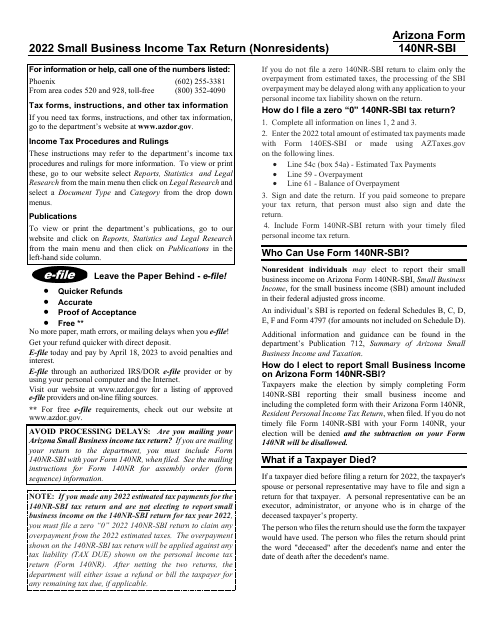

This Form is used for filing the small business income tax return in Arizona for part-year residents.

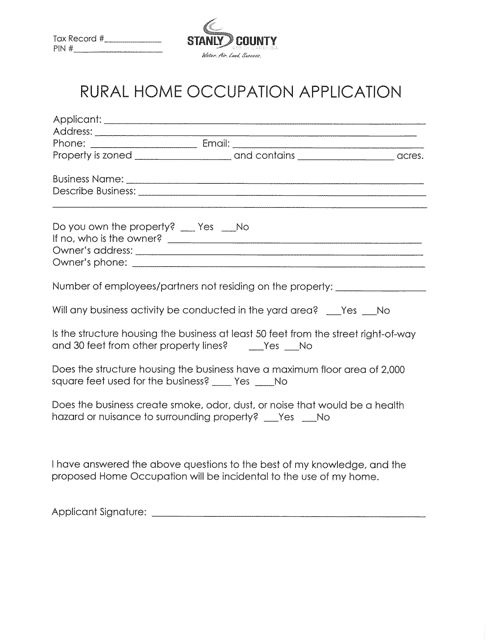

This form is used for applying for a home occupation permit in Stanly County, North Carolina. It is specifically for rural areas.

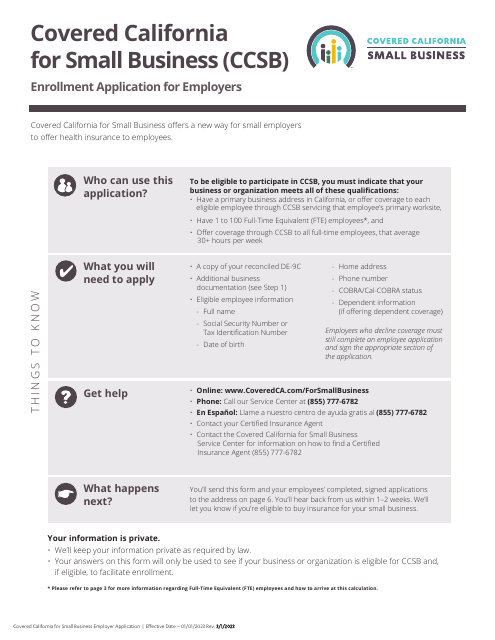

This document is an application form used by employers in California to enroll their small business in Covered California for Small Business (CCSB), which offers health insurance options for employees.

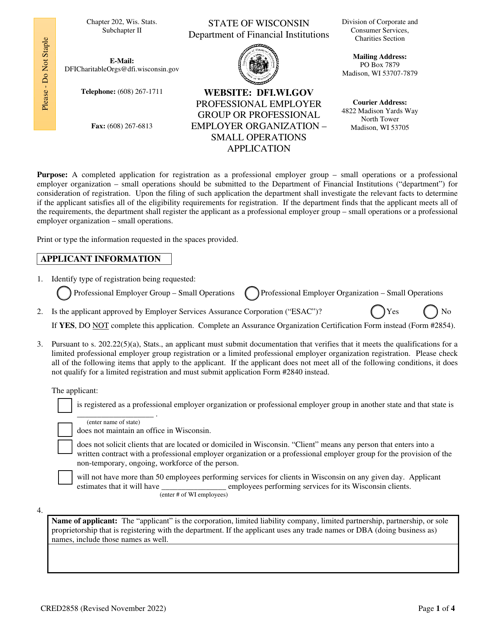

This form is used for applying to become a professional employer group or professional employer organization with small operations in the state of Wisconsin.

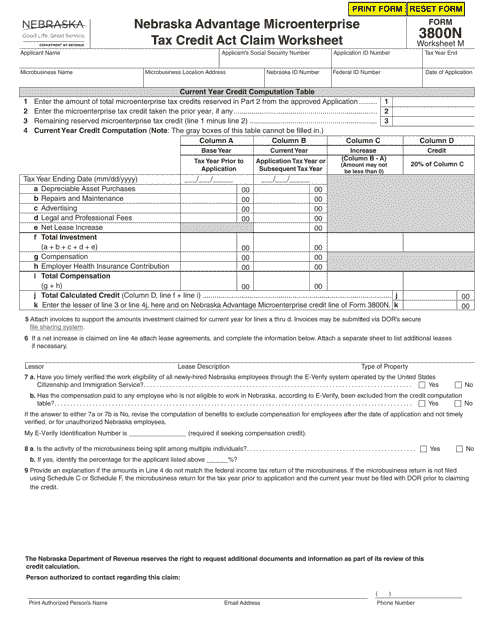

This form is used for claiming the Microenterprise Tax Credit under the Nebraska Advantage program. It is a worksheet specifically designed for small businesses participating in the program.

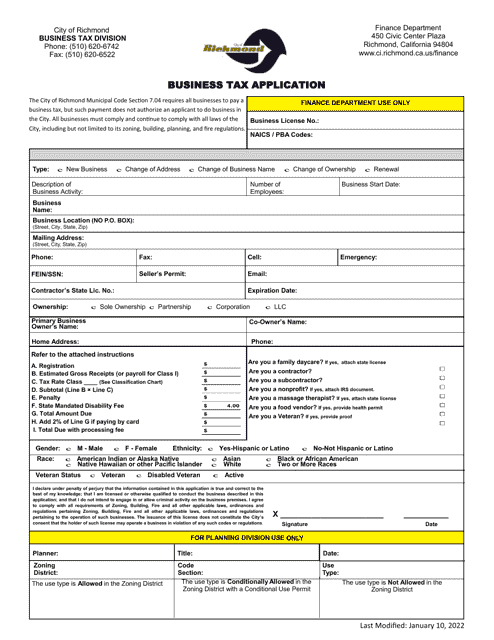

This form is used for applying for business tax in Richmond City, California.