Small Business Documents Templates

Related Articles

Documents:

640

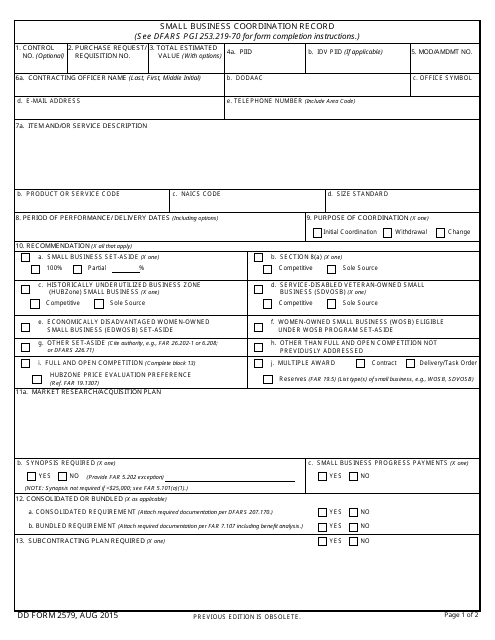

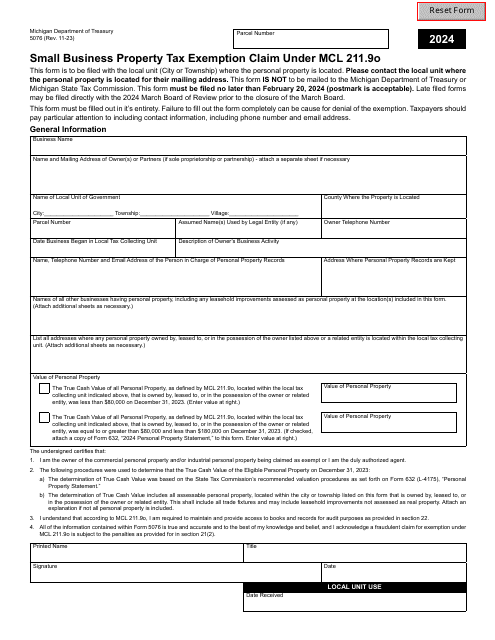

This document is used for keeping track of small business coordination efforts.

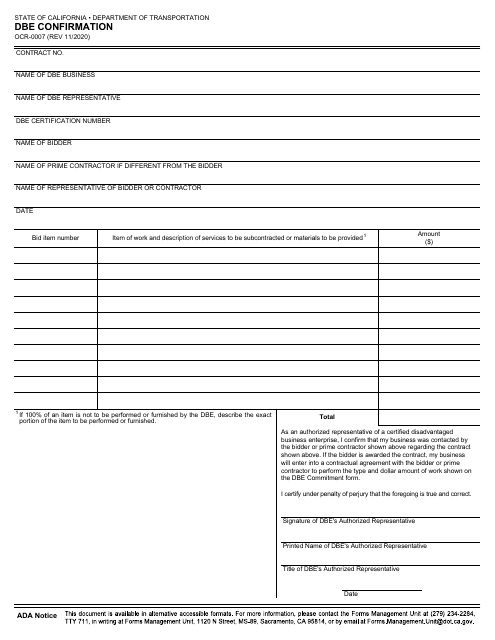

This Form is used for confirming the Disadvantaged Business Enterprise (DBE) status in California. It is required for companies seeking contracting opportunities with certain government agencies or projects.

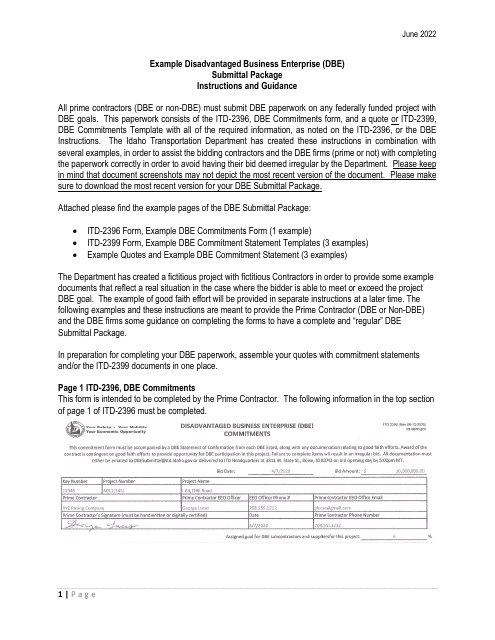

This Form is used for submitting DBE commitments in Idaho. It provides instructions on how to complete the form and submit it to the appropriate authorities.

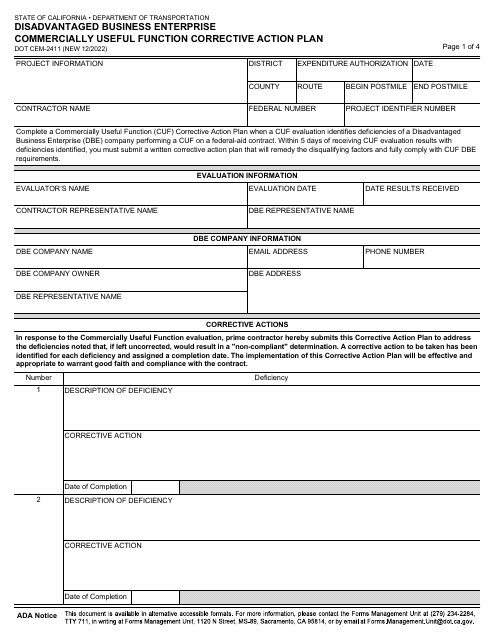

This form is used for correcting the commercially useful function deficiencies of disadvantaged business enterprises in California.

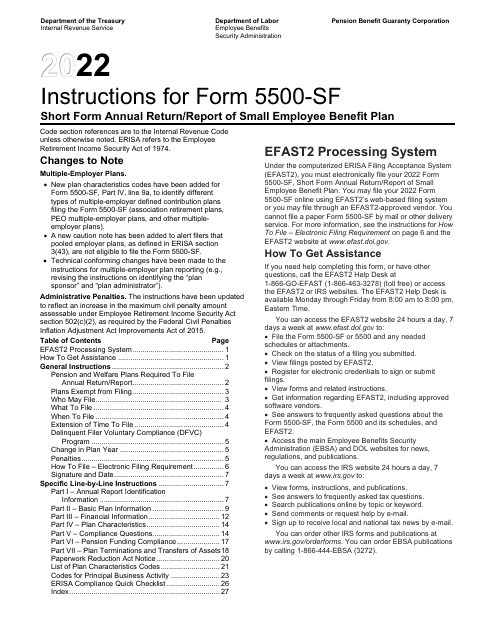

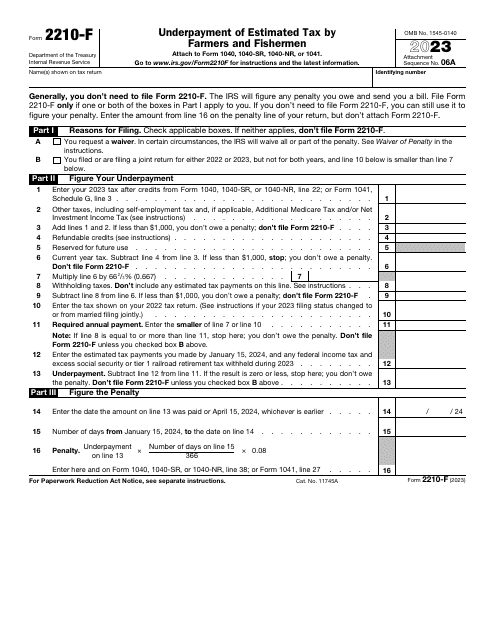

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

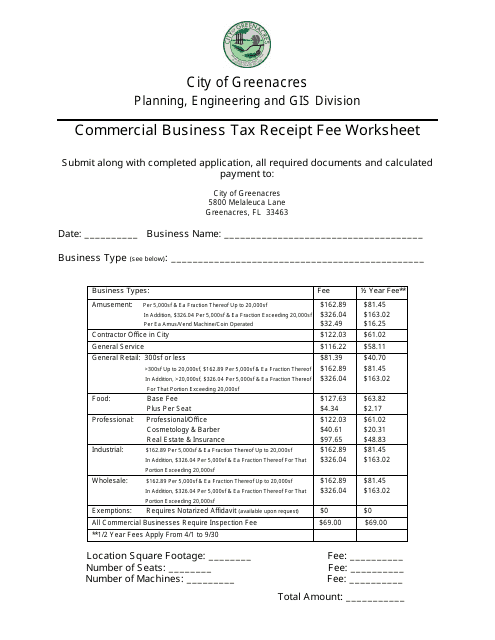

This document is used for calculating the fee for a commercial business tax receipt in the City of Greenacres, Florida.

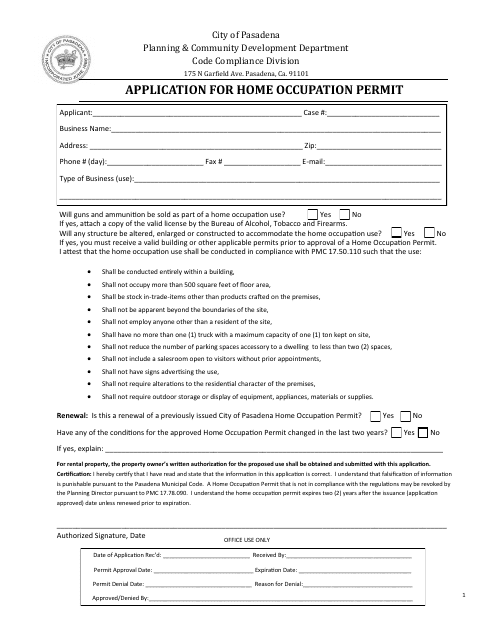

This document is used for applying for a Home Occupation Permit in the City of Pasadena, California. A Home Occupation Permit is required for individuals operating a business out of their home within the city limits of Pasadena.

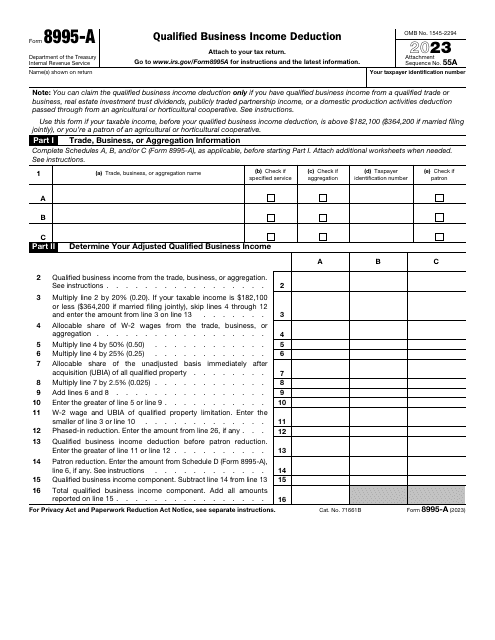

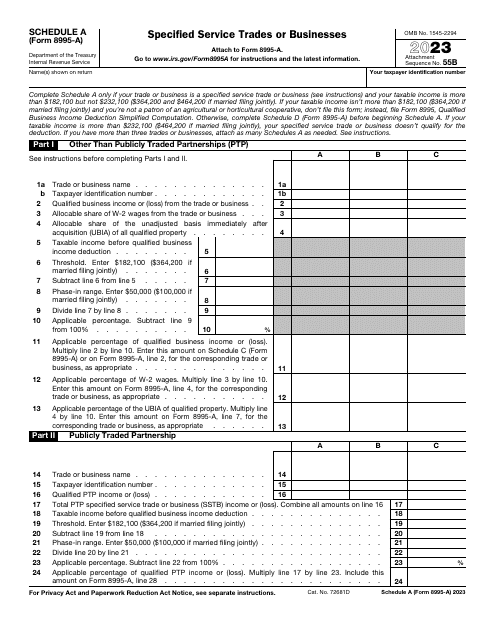

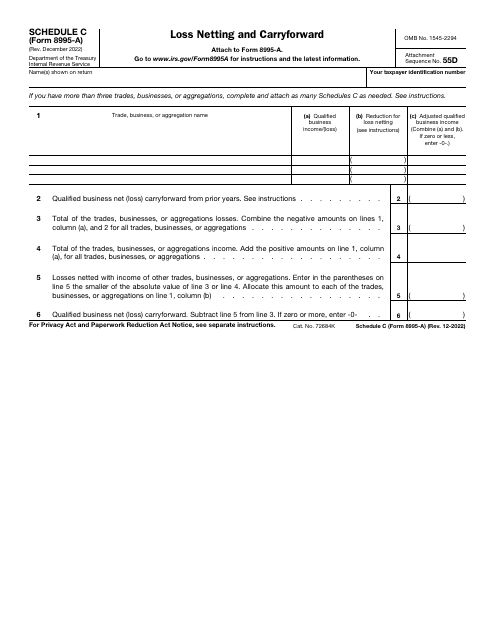

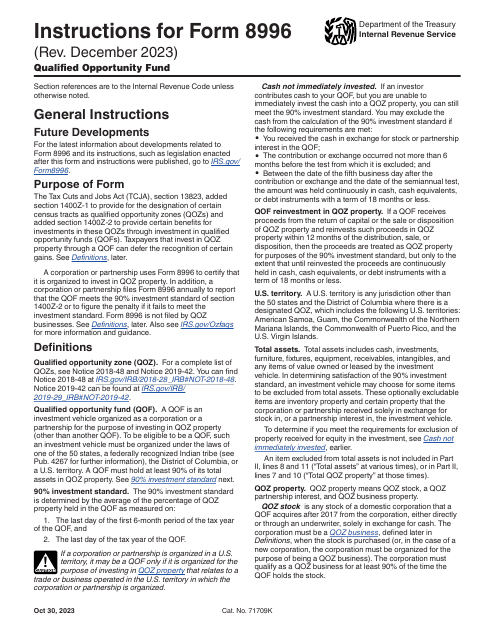

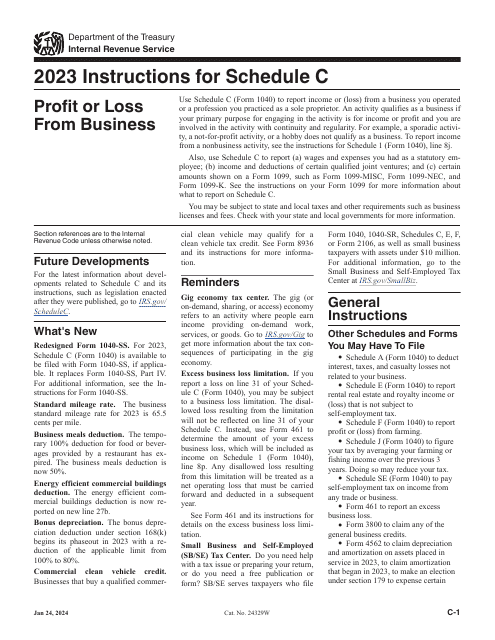

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

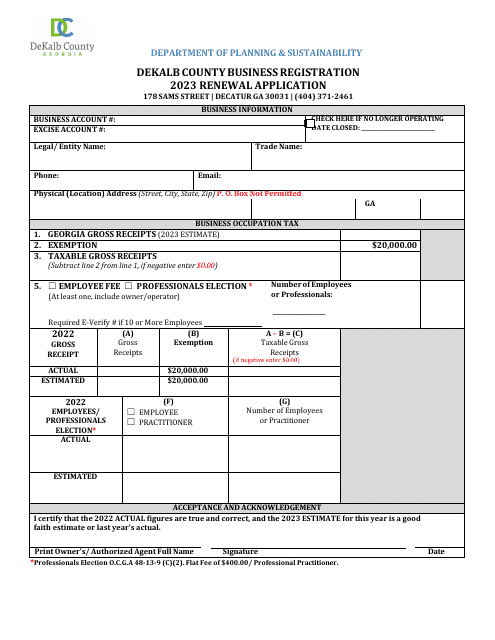

This document is for renewing the registration of a business located in DeKalb County, Georgia. It is used to ensure that the business remains compliant with local regulations and is able to continue operating legally.

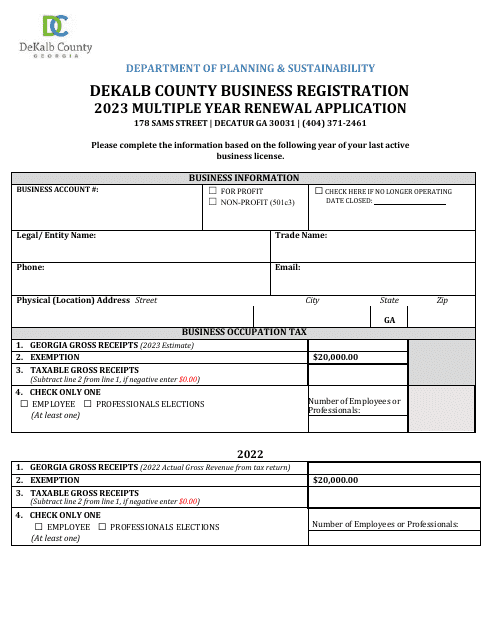

This document is for businesses in DeKalb County, Georgia who need to renew their registration for multiple years. It allows businesses to conveniently renew their registration in advance for several years at once.

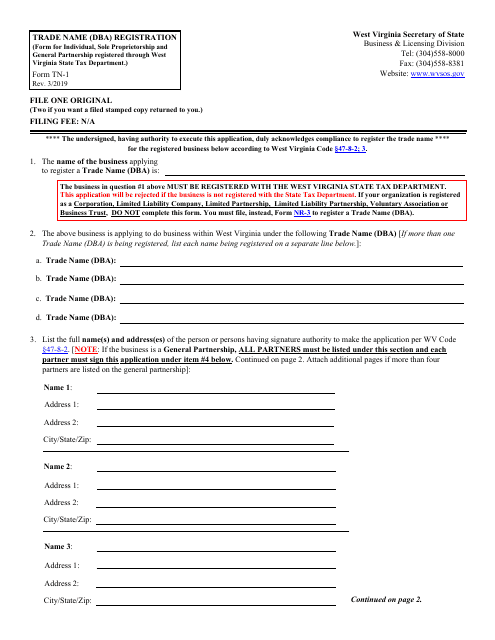

This Form is used for registering a trade name (DBA) in the state of West Virginia.

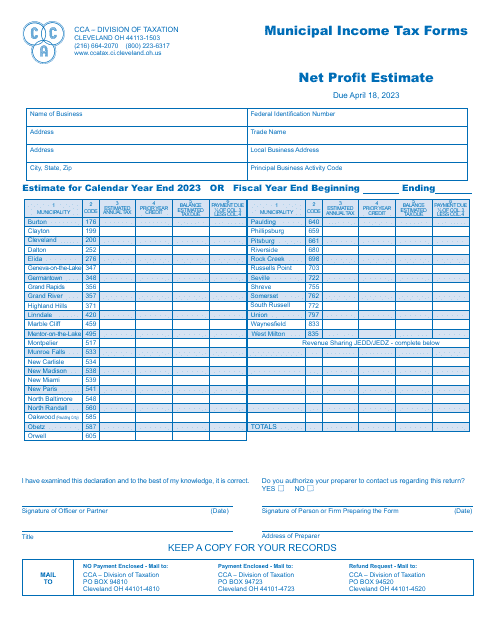

This document provides an estimate of the net profit for the City of Cleveland, Ohio. It helps in analyzing the financial performance of the city and determining the amount of profit generated after expenses.

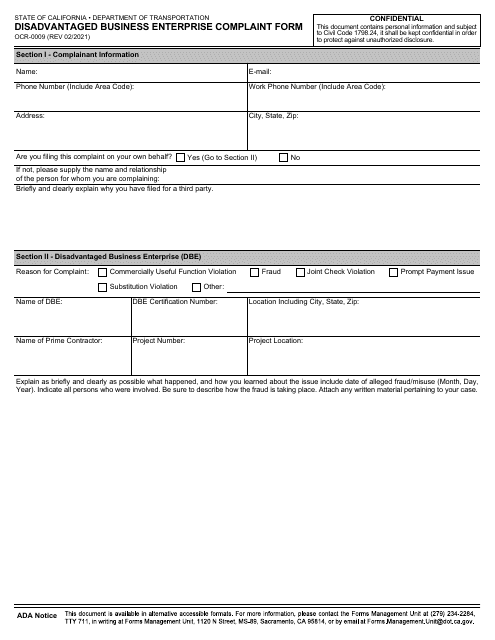

This form is used for filing a complaint related to the Disadvantaged Business Enterprise program in California.

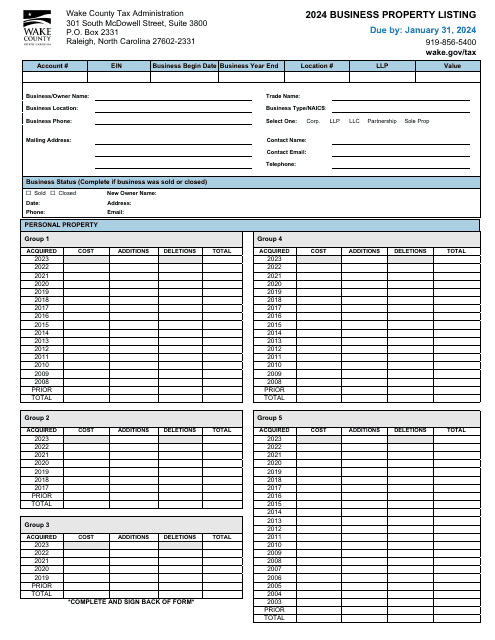

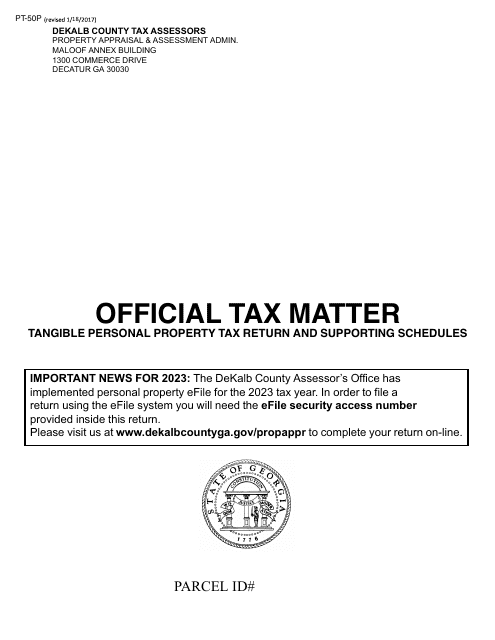

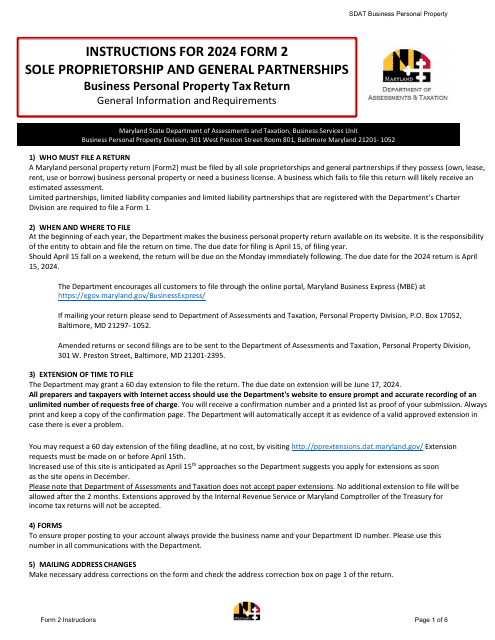

This document is used for filing personal property taxes on business assets in DeKalb County, Georgia.

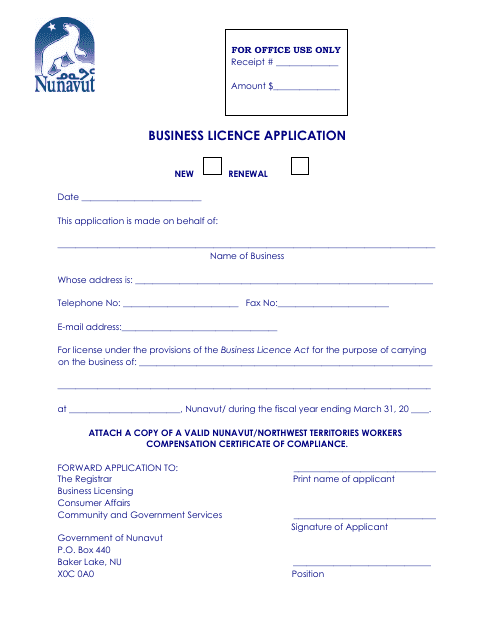

This document is used for applying for a business license in the Canadian territory of Nunavut.

This document is for applying for a small business support grant in Allegany County, New York.

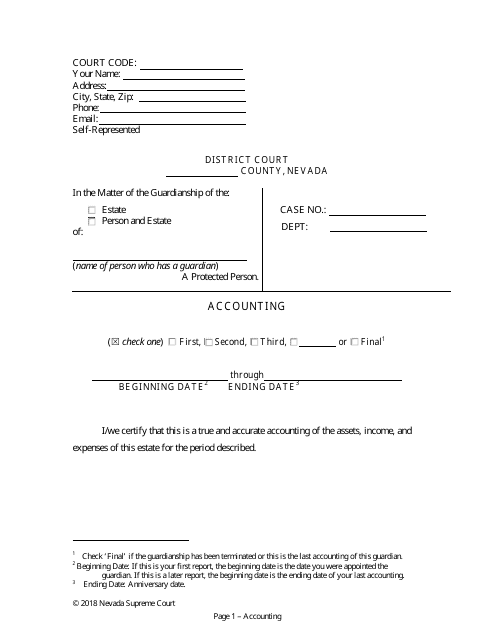

This type of document provides information about accounting practices and regulations specific to the state of Nevada. It may cover topics such as tax laws, financial reporting requirements, and auditing standards applicable in Nevada.

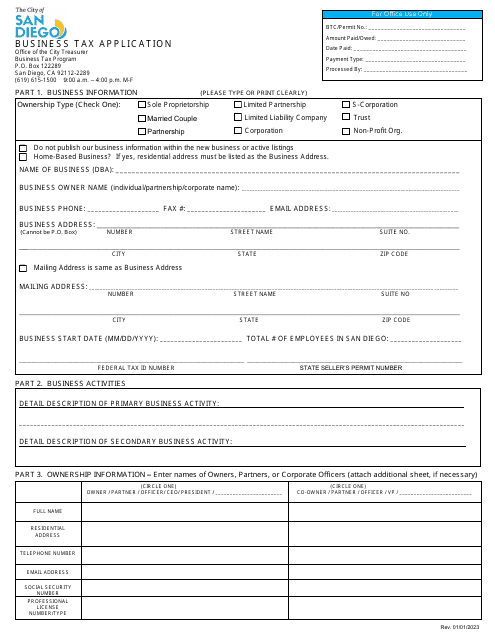

This form is used for applying for business tax in the City of San Diego, California.