Fill and Sign Maryland Legal Forms

Documents:

3176

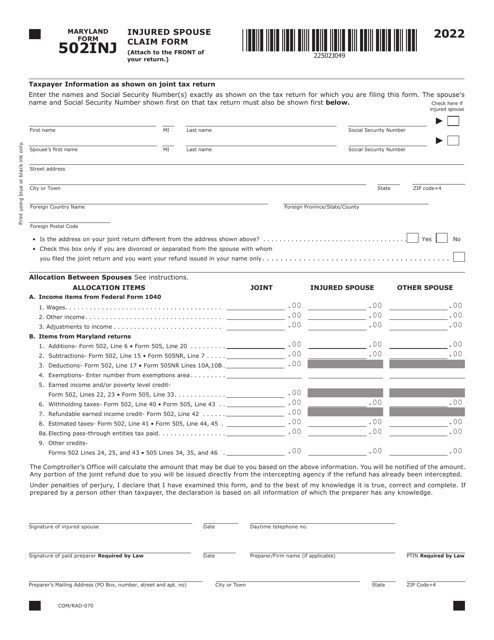

This form is used for filing an injured spouse claim in Maryland. It helps spouses who have separate tax liabilities protect their portion of a joint refund from being applied to the other spouse's debts.

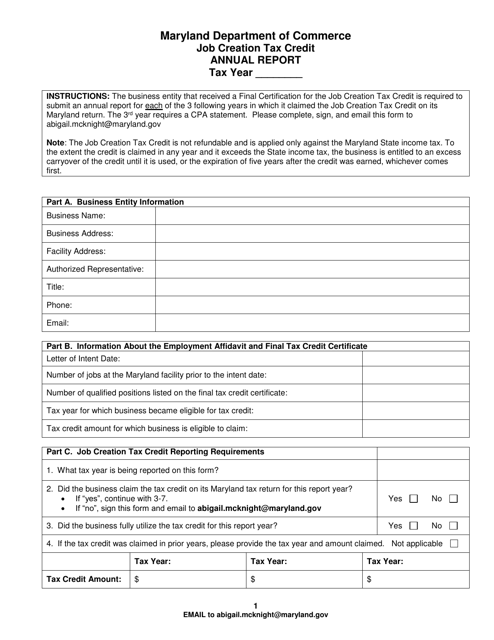

This document provides an annual report on the Job Creation Tax Credit in the state of Maryland. It highlights the progress and impact of the tax credit in promoting job creation and economic growth.

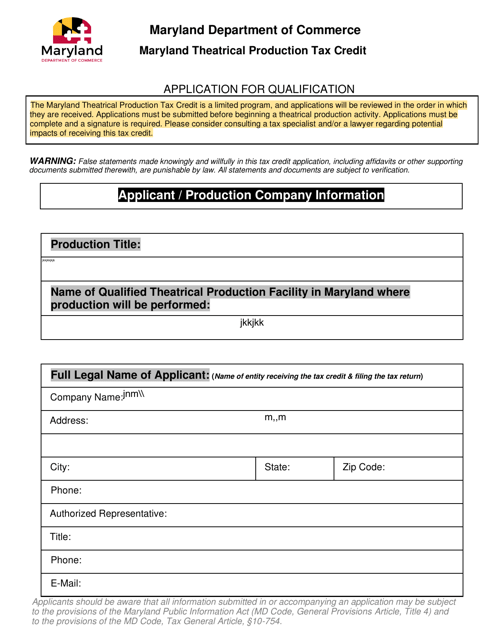

This document is an application for the Maryland Theatrical Production Tax Credit. It is used by theatrical production companies in Maryland to apply for a tax credit for their production expenses.

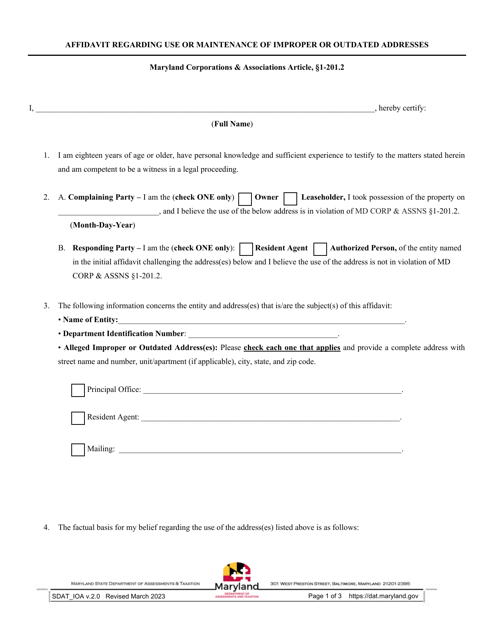

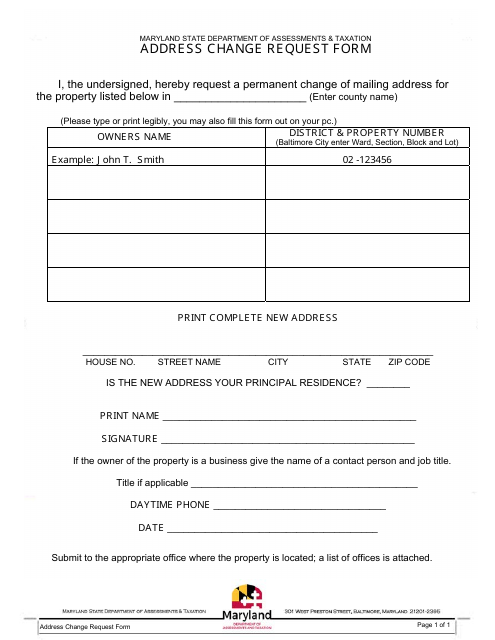

This document is used in Maryland to address any issues related to the use or maintenance of incorrect or outdated addresses.

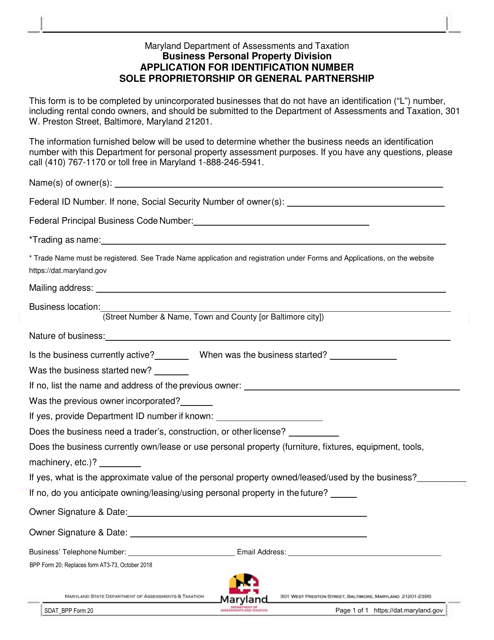

This form is used for applying for an identification number for a sole proprietorship or general partnership in the state of Maryland.

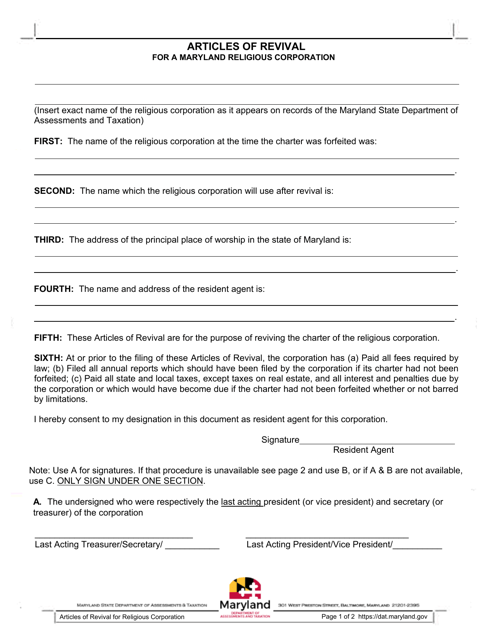

This document is used for reviving a religious corporation in the state of Maryland. It outlines the necessary steps and requirements to reinstate the corporation's legal status.

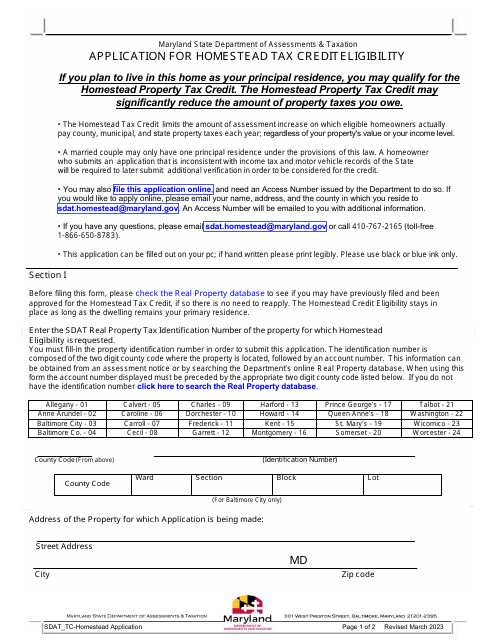

This document is an application for the Homestead Tax Credit eligibility in the state of Maryland. The Homestead Tax Credit is a program that provides property tax relief to eligible homeowners. To apply, you must meet certain criteria, such as owning the property as your primary residence.

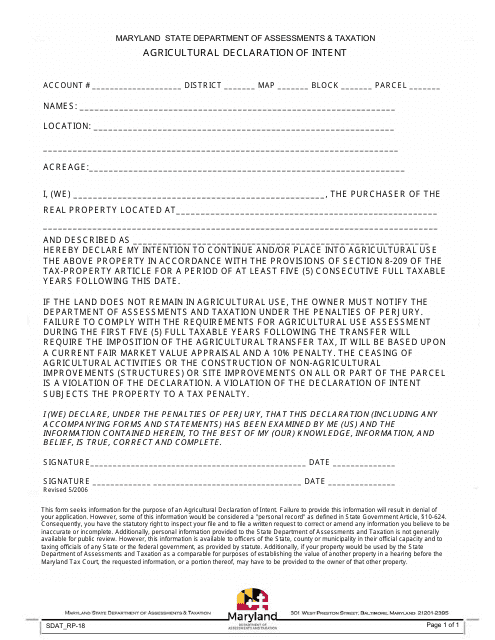

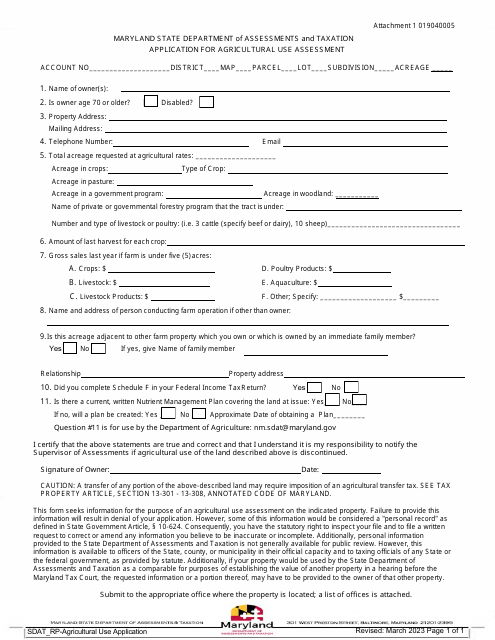

This form is used by landowners in Maryland, who intend to use their property for agricultural purposes. It helps in declaring the user's intention to commence or continue agriculture and qualifies them for certain tax advantages.

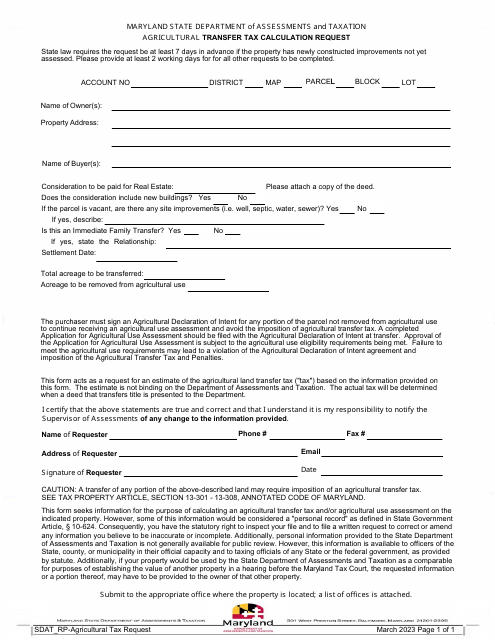

This document is used for applying for agricultural use assessment in the state of Maryland.

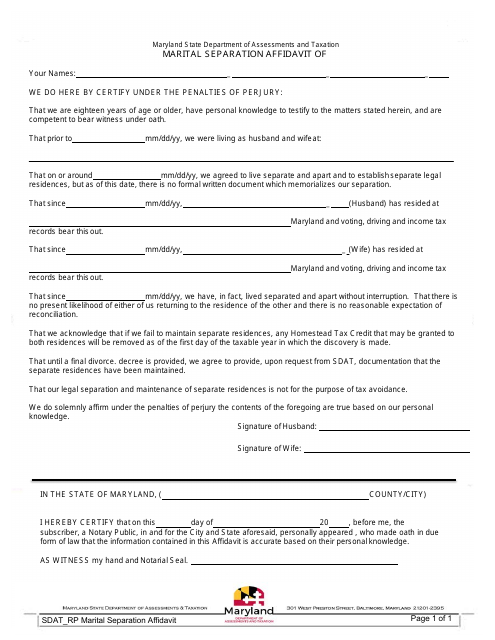

This document is used for legally declaring marital separation in the state of Maryland.

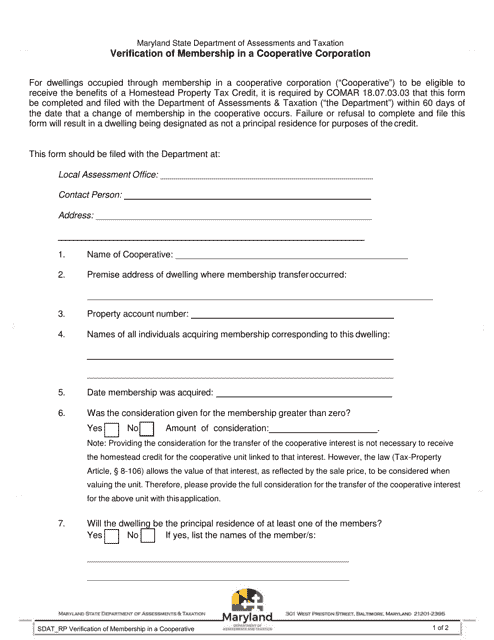

This form is used for verifying membership in a cooperative corporation in the state of Maryland.