Fill and Sign Maryland Legal Forms

Documents:

3176

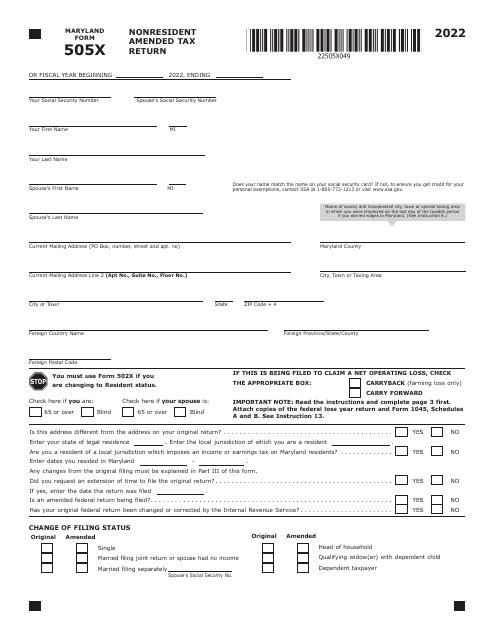

This Form is used for filing an amended tax return for nonresidents of Maryland.

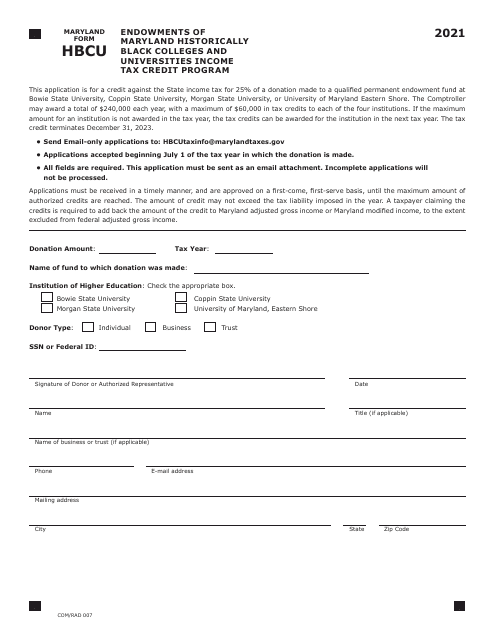

This document is used for the Endowments of Maryland Historically Black Colleges and Universities Income Tax Credit Program in Maryland. It is specifically for the HBCUs in the state and provides a tax credit for donations made to their endowments.

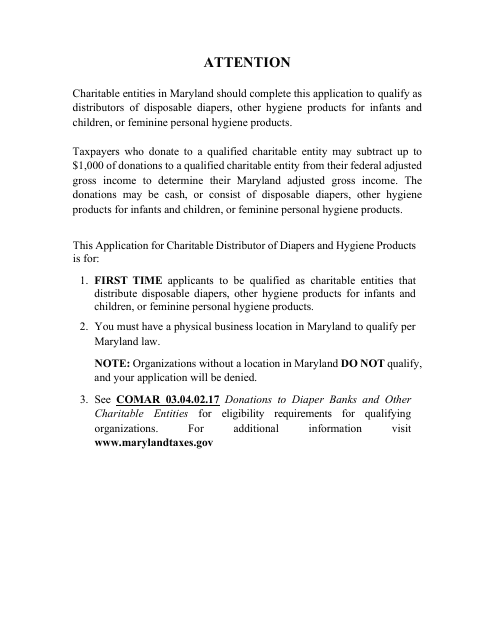

This form is used for applying to become a charitable distributor of diapers and hygiene products in Maryland.

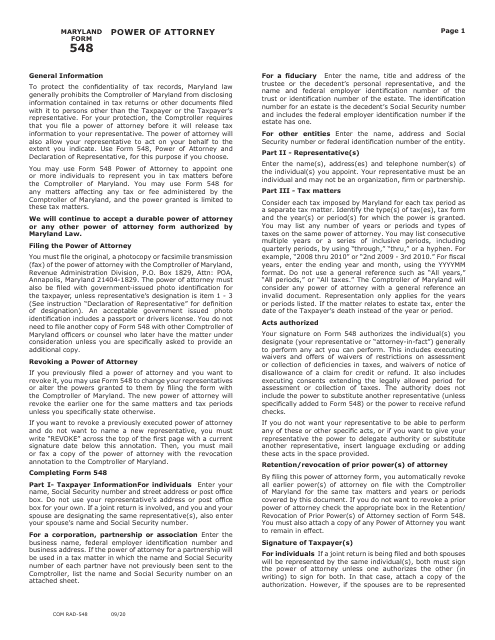

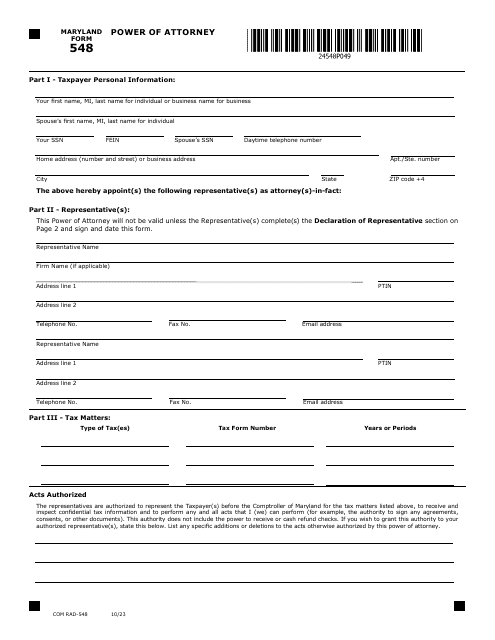

This document is used for granting power of attorney in the state of Maryland. It provides instructions for completing the Maryland Form 548, COM/RAD-548 Power of Attorney.

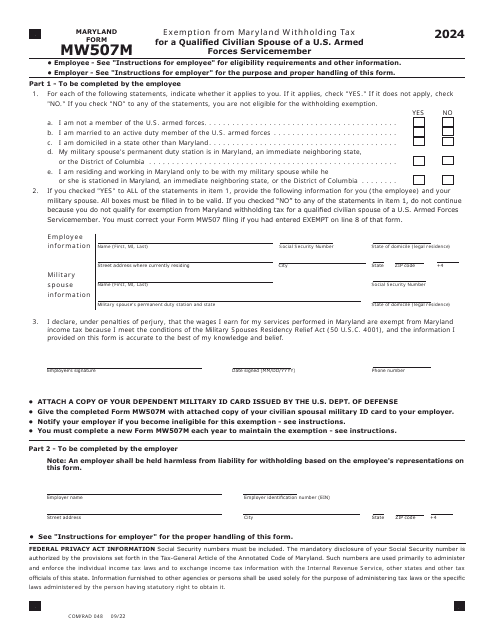

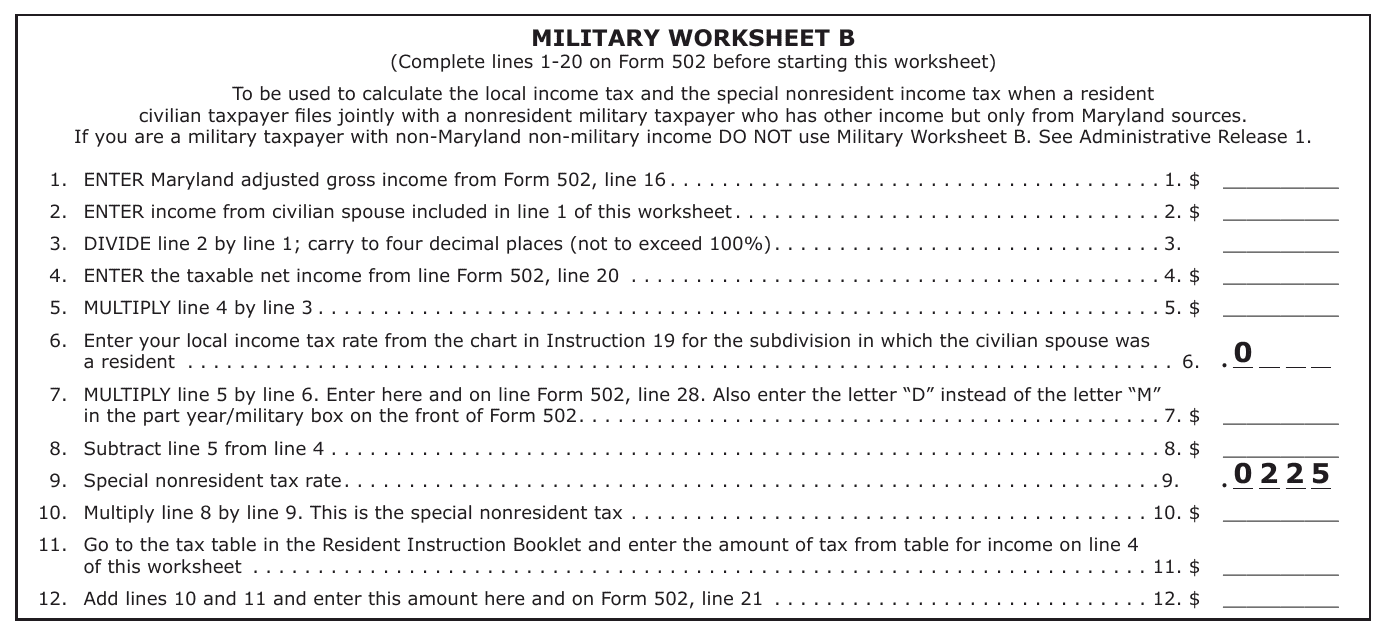

This document is a worksheet specifically designed for military personnel residing in Maryland. It likely includes relevant information and calculations for tax purposes or other official matters related to their military service in the state.

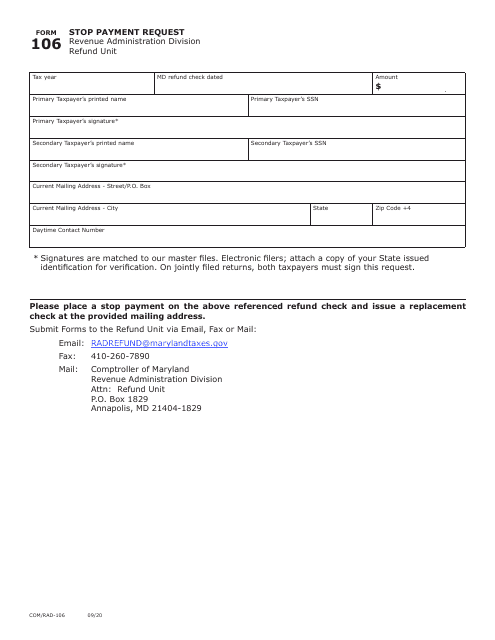

This Form is used for submitting a stop payment request in Maryland.

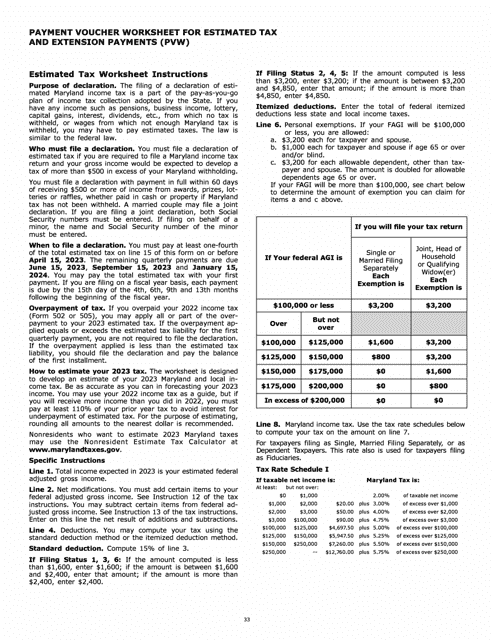

This form is used for making estimated tax and extension payments in the state of Maryland. It serves as a worksheet for recording payment details.

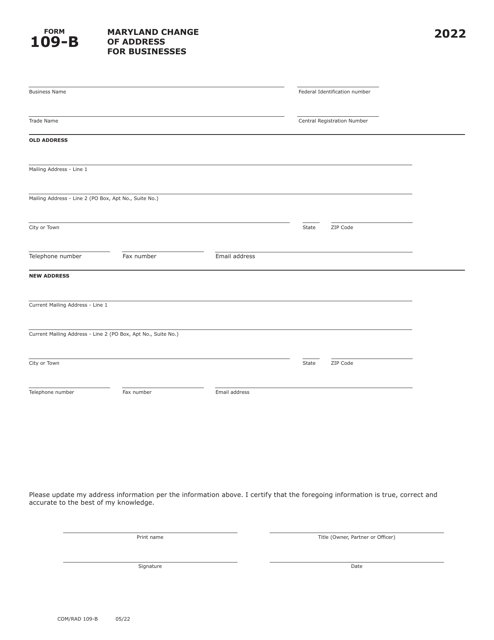

This form is used for businesses to notify the state of Maryland when they change their address.

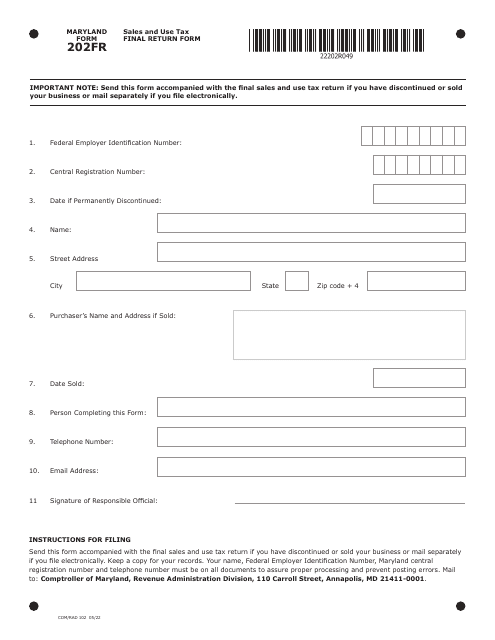

This Form is used for filing the final sales and use tax return in Maryland. It is used by businesses to report their sales and use tax liability for the last reporting period.

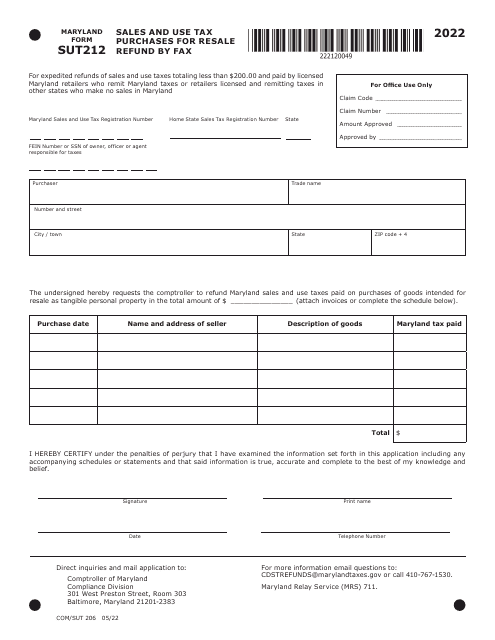

This Form is used for requesting a refund of sales and use tax for purchases made for resale in Maryland. The form can be submitted by fax.

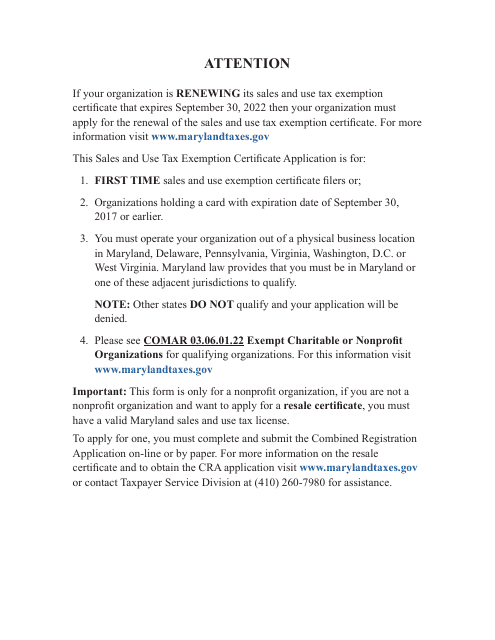

This Form is used for applying for a Sales and Use Tax Exemption Certificate in Maryland.

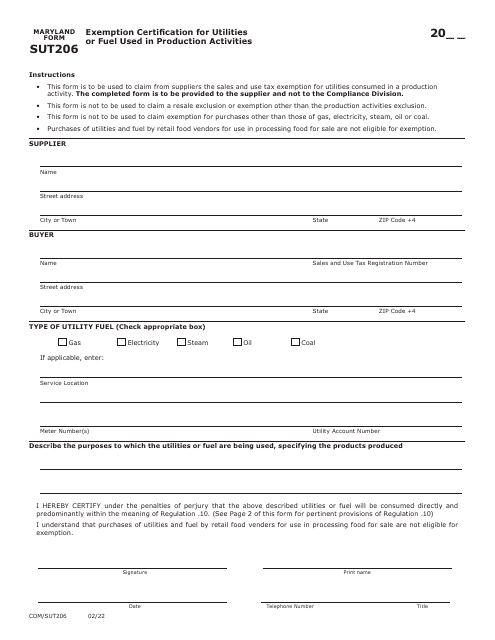

This form is used for obtaining an exemption certification for utilities or fuel used in production activities in Maryland.

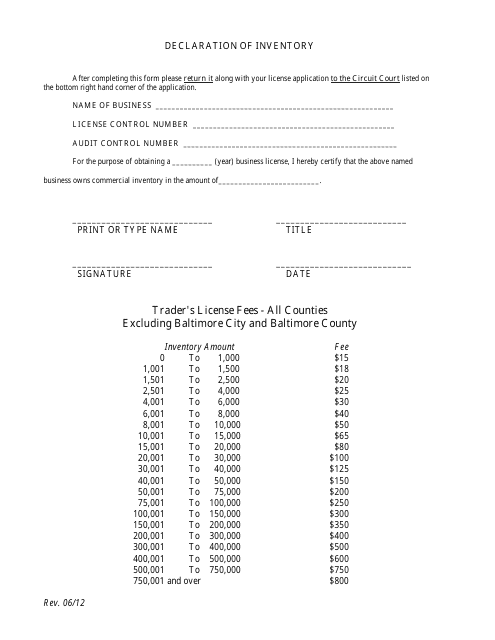

This document is used to declare the inventory of goods in the state of Maryland. It is used to provide an inventory list and details of the goods that are being held or stored in a particular location. The declaration is typically required for regulatory purposes or during certain legal proceedings.

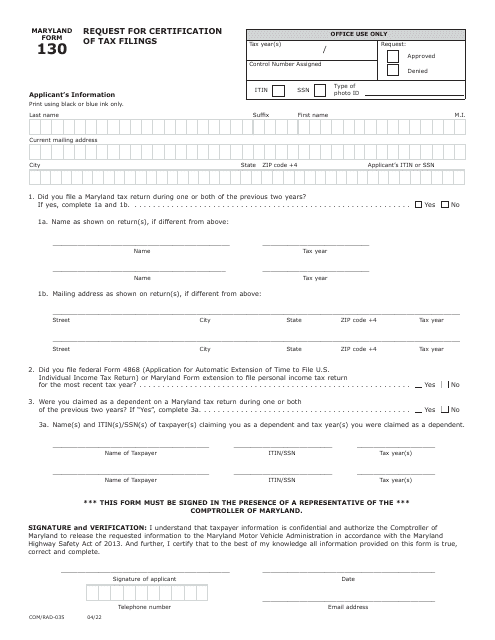

This form is used for requesting certification of tax filings in the state of Maryland.

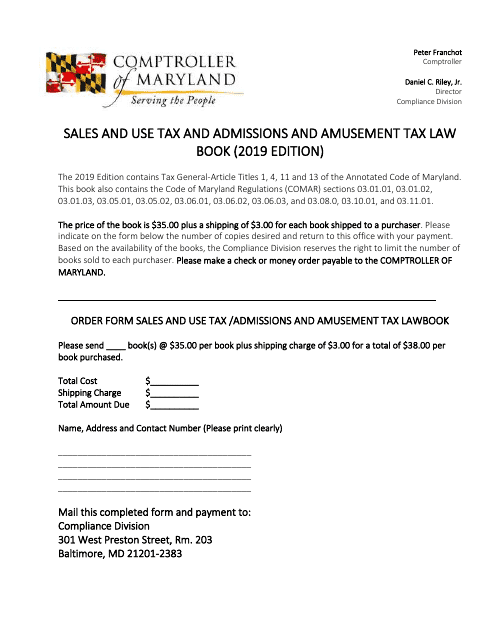

This document is a sales and use tax and admissions and amusement tax law book specific to Maryland for the year 2019. It provides information and regulations regarding these types of taxes in the state.

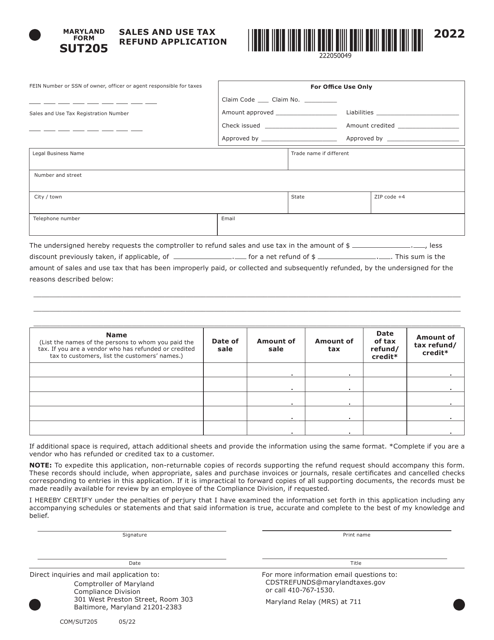

This form is used for applying for a sales and use tax refund in the state of Maryland. It is called the Maryland Form SUT205 (COM/SUT205) Sales and Use Tax Refund Application.

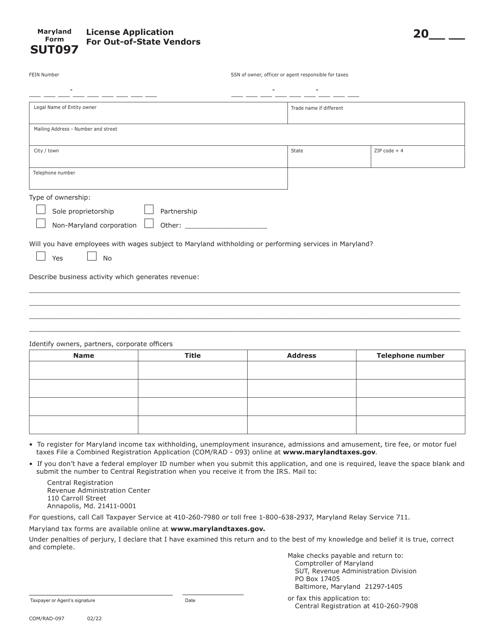

This form is used for vendors located outside of Maryland who want to apply for a license to sell goods/services within the state.

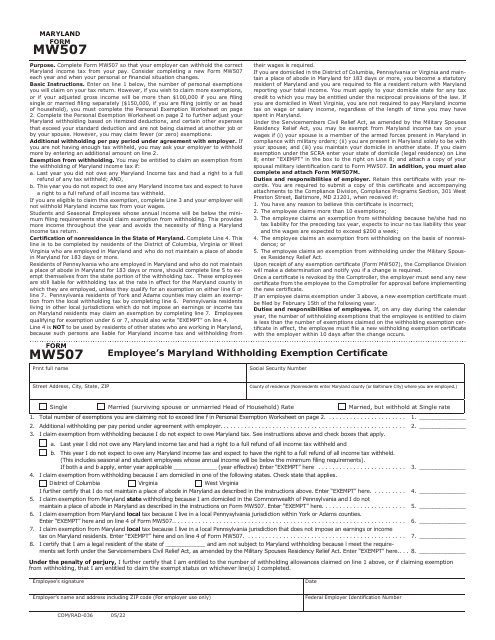

This form is used for employees in Maryland to declare their withholding exemption status for state taxes.

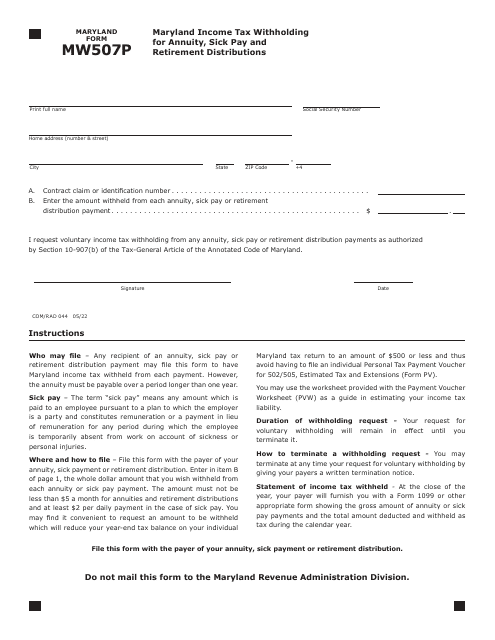

This Form is used for Maryland residents to specify their income tax withholding for annuity, sick pay, and retirement distributions.

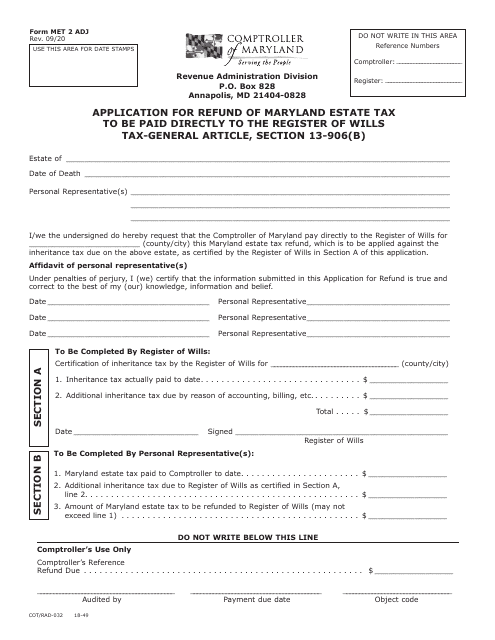

This Form is used for applying for a refund of Maryland Estate Tax to be paid directly to the Register of Wills.