Property Tax Exemption Form Templates

Documents:

173

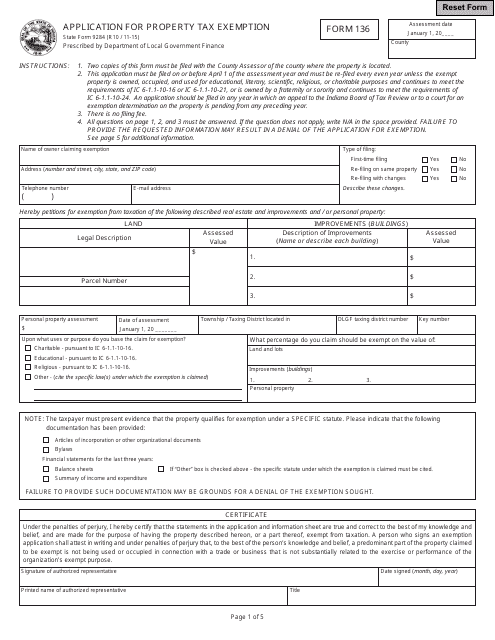

This form is used for applying for a property tax exemption in the state of Indiana. It is used to request an exemption from paying property taxes on certain types of properties.

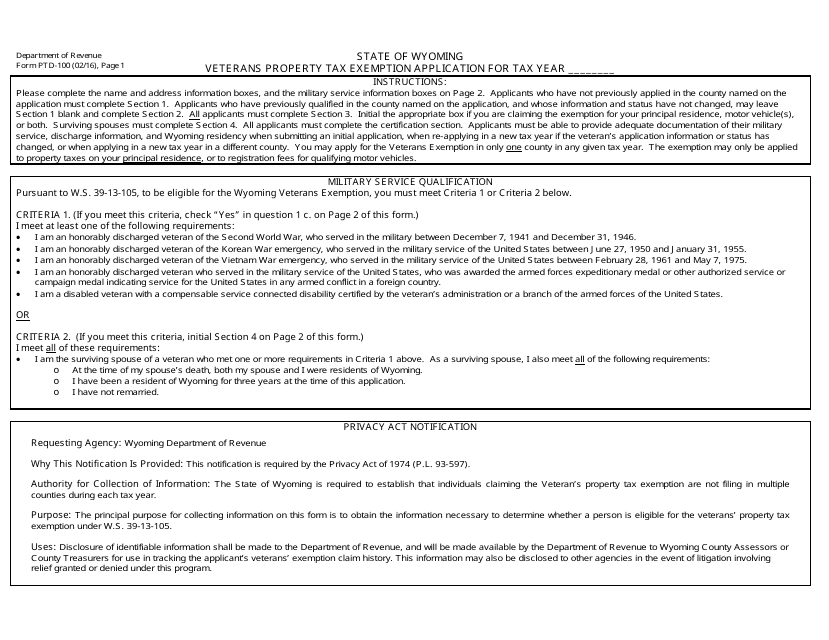

This Form is used for applying for the Veterans Property Tax Exemption in Wyoming.

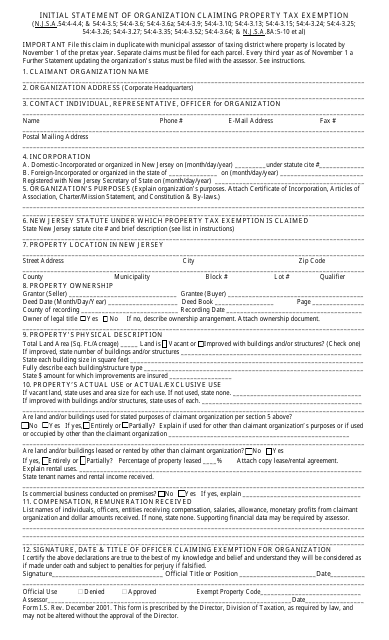

This document is used for claiming property tax exemption in New Jersey.

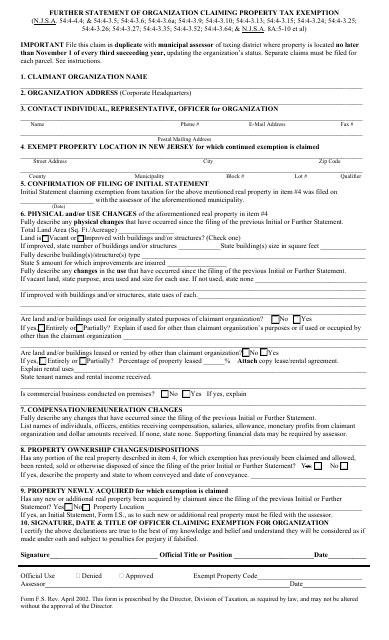

This form is used for organizations in New Jersey to provide further information when claiming a property tax exemption.

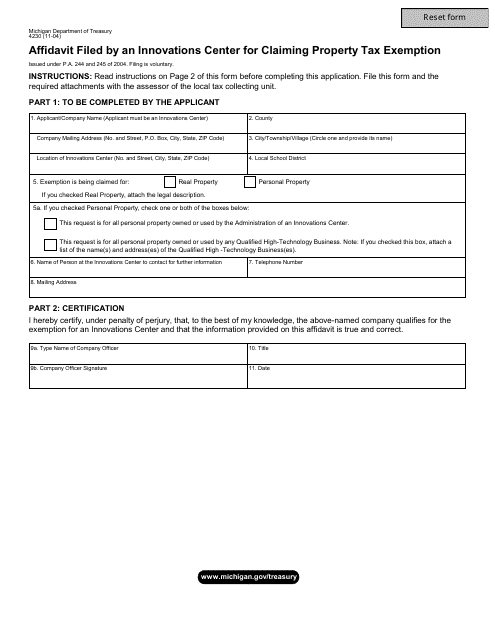

This document is used for filing an affidavit by an Innovations Center in Michigan to claim a property tax exemption.

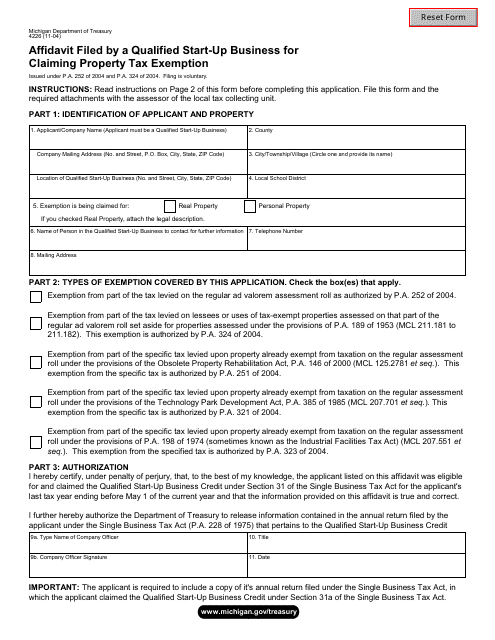

This form is used for filing an affidavit by a qualified start-up business in Michigan to claim a property tax exemption.

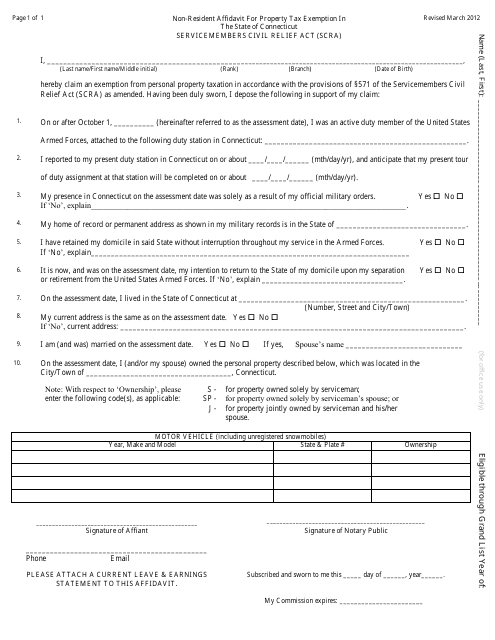

This document is a template for a non-resident affidavit that can be used to apply for property tax exemption in the state of Connecticut under the Service Members Civil Relief Act (SCRA).

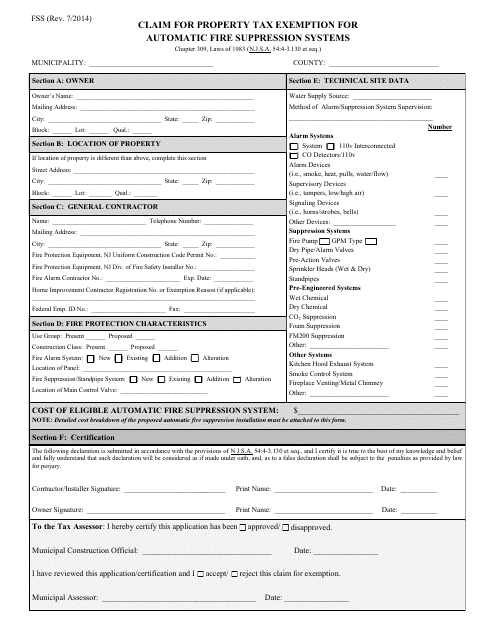

This form is used for claiming a property tax exemption for automatic fire suppression systems in New Jersey.

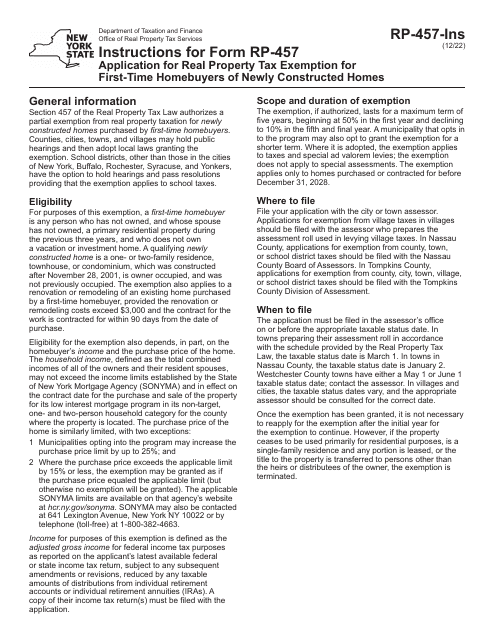

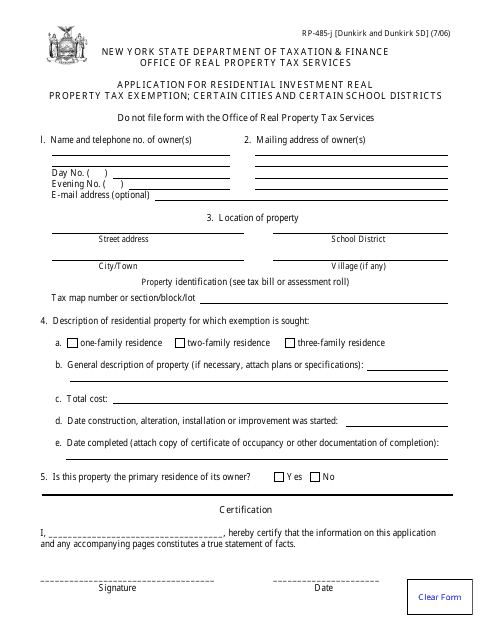

This form is used for applying for a residential investment real property tax exemption in the City of Dunkirk, New York.

This document is used for applying for a residential investment real property tax exemption in the City of Amsterdam, New York.

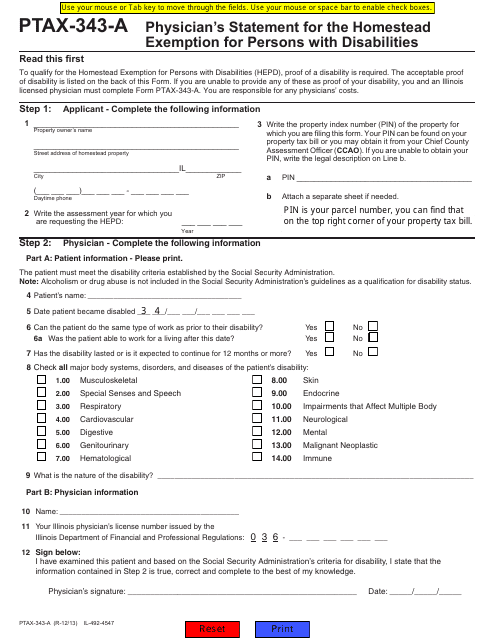

This form is used for individuals with disabilities in St. Clair County, Michigan, to apply for a homestead exemption. It requires a physician's statement to verify the disability.

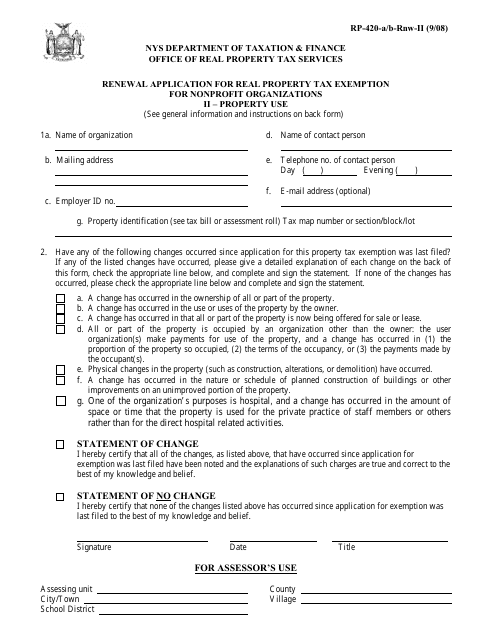

This form is used for renewing the real property tax exemption for nonprofit organizations in New York.

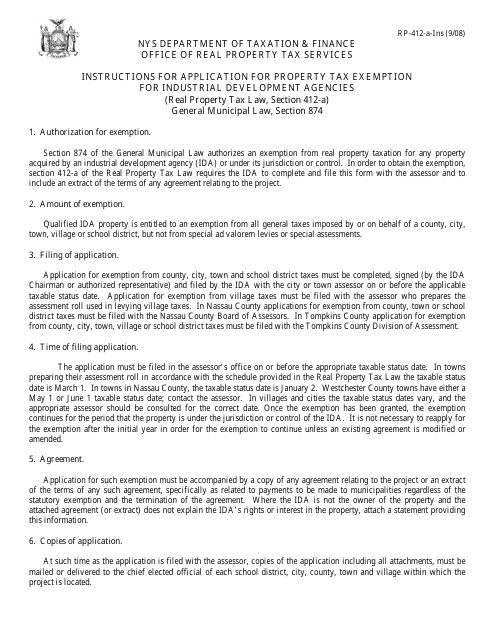

This Form is used for applying for a property tax exemption for Industrial Development Agencies in New York. It provides instructions on how to fill out the application.

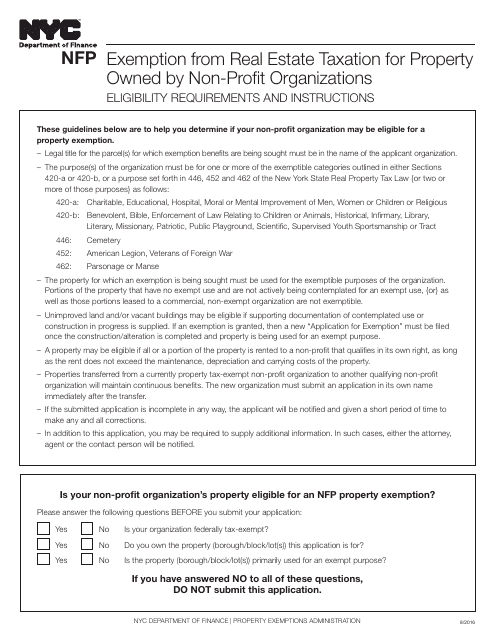

This Form is used for non-profit organizations in New York City to apply for exemption from real estate taxation for their properties.

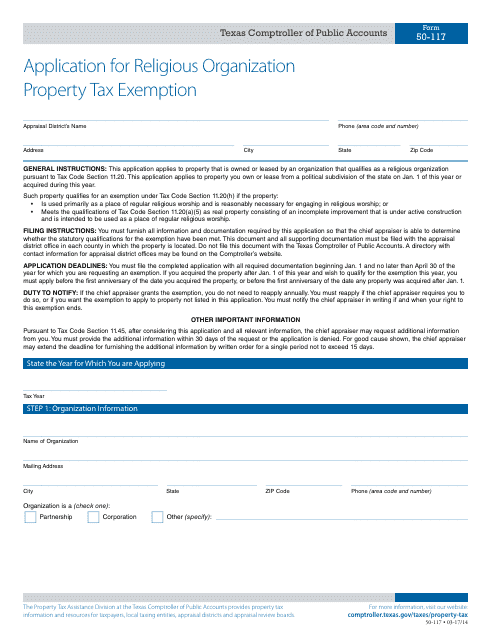

This form is used for applying for a property tax exemption for religious organizations in Texas.

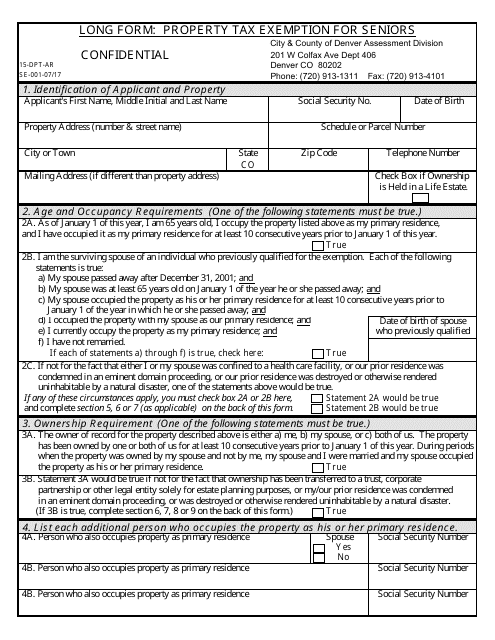

This form is used for applying for property tax exemption for seniors in Colorado. It is the long form version of Form 15-DPT-AR. This document is important for seniors who want to qualify for a property tax exemption in Colorado.

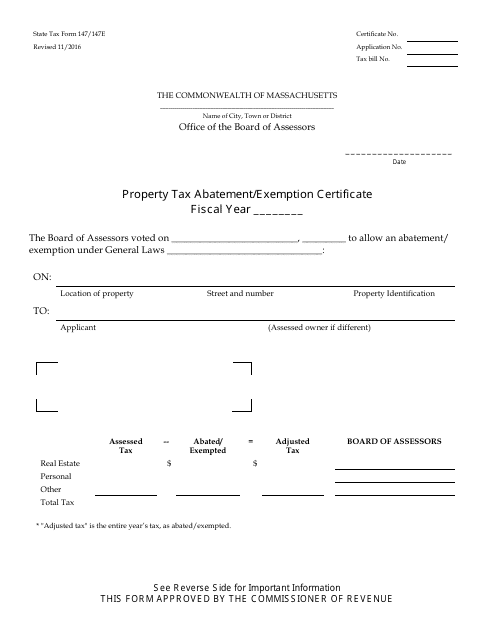

This form is used for requesting property tax abatement or exemption in Massachusetts. It is used to provide information about the property and the reason for seeking the abatement or exemption.

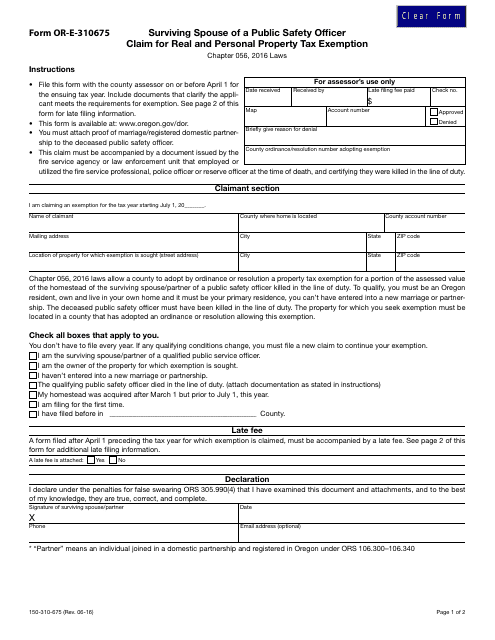

This form is used for a surviving spouse of a public safety officer to claim a real and personal property tax exemption in the state of Oregon.

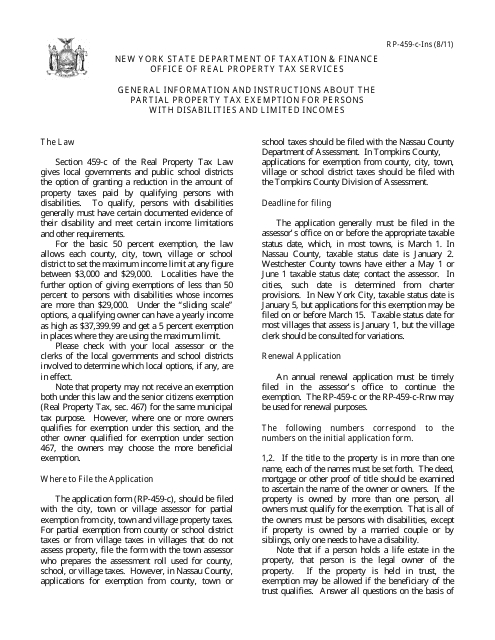

This Form is used for claiming a partial property tax exemption in New York for individuals with disabilities and limited incomes. It provides instructions on how to apply for the exemption and the documentation required.

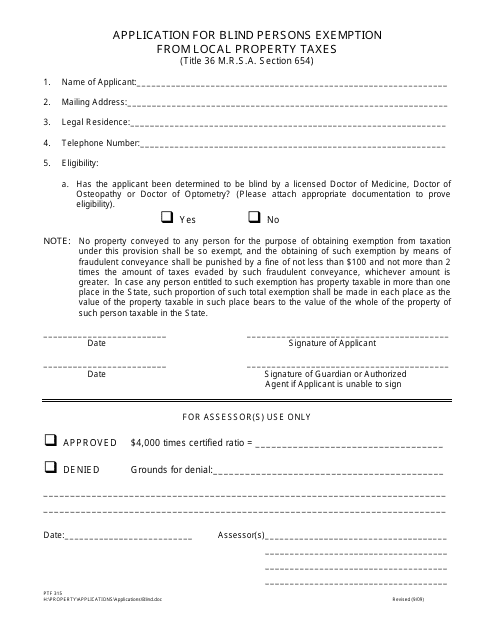

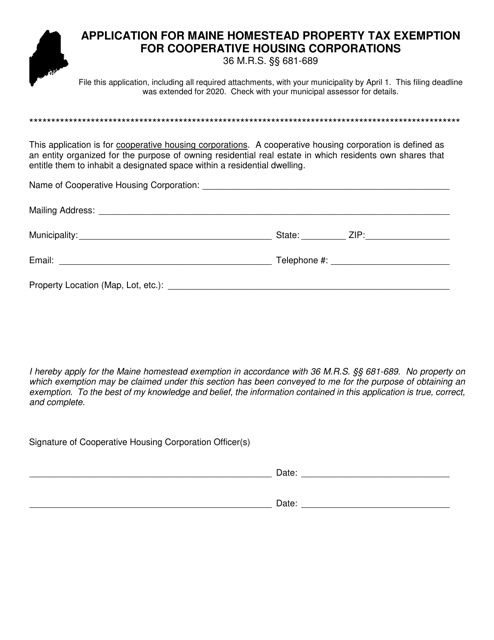

This form is used for applying for an exemption from local property taxes in Maine for blind persons.

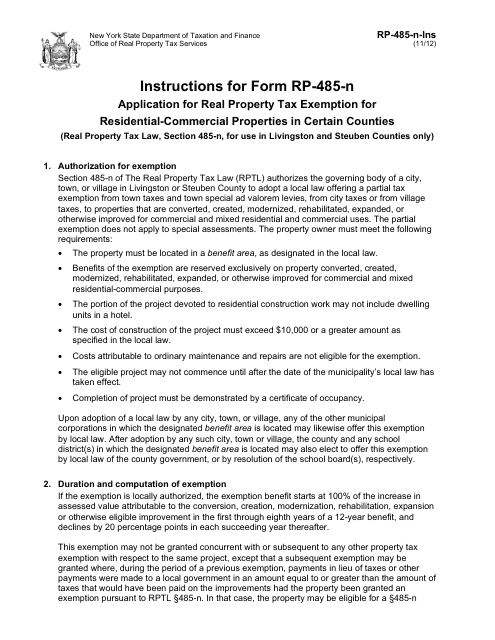

This Form is used for applying for a tax exemption on residential-commercial properties in certain counties in New York. It provides instructions for completing the application process.

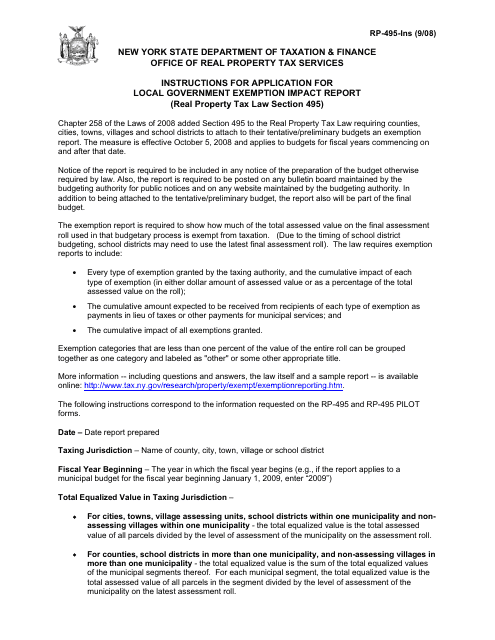

This document is used for applying for a local government exemption impact report in New York. It provides instructions on how to complete the Form RP-495.

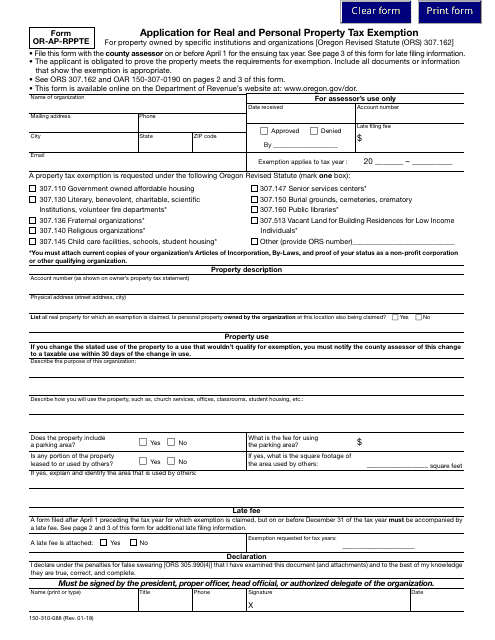

This Form is used for applying for a real and personal property tax exemption in Oregon.

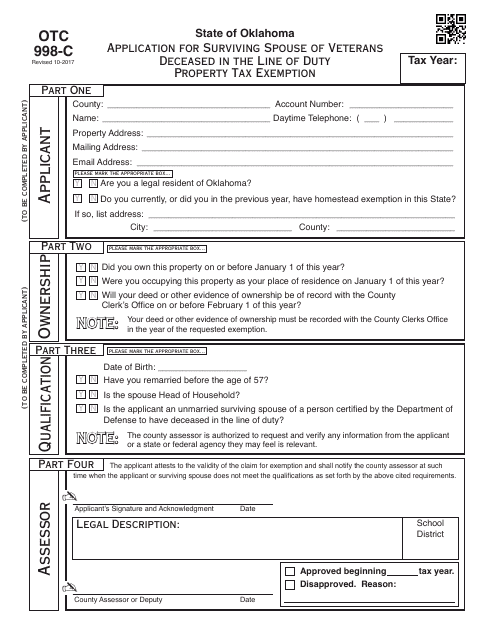

This form is used for applying for a property tax exemption in Oklahoma for surviving spouses of veterans who died in the line of duty.

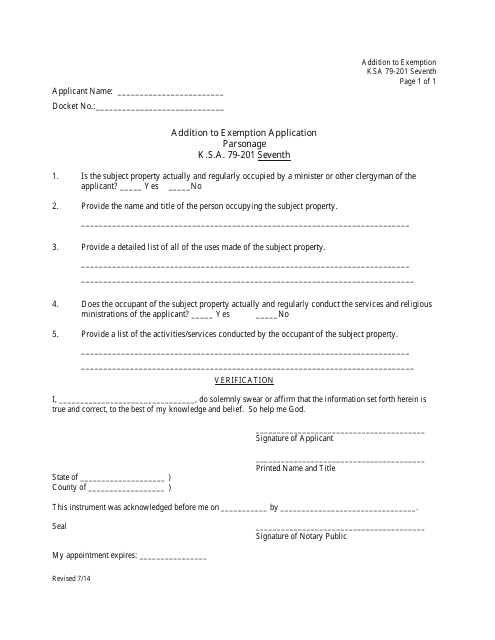

This document is an addition to the exemption application for parsonage in the state of Kansas. It is used to provide additional information or updates to an existing application.

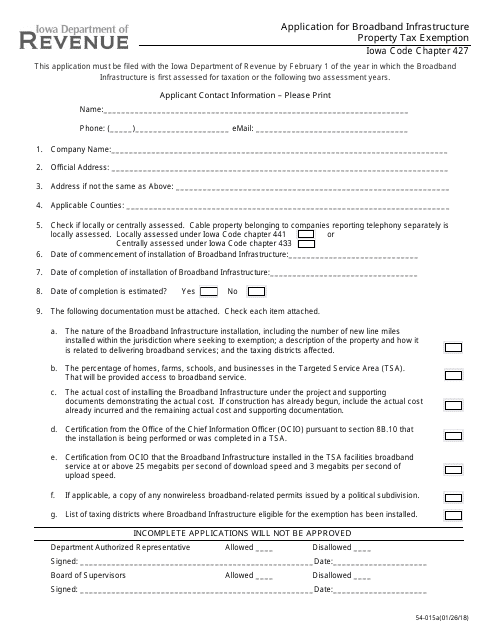

This Form is used for applying for a property tax exemption for broadband infrastructure in Iowa.

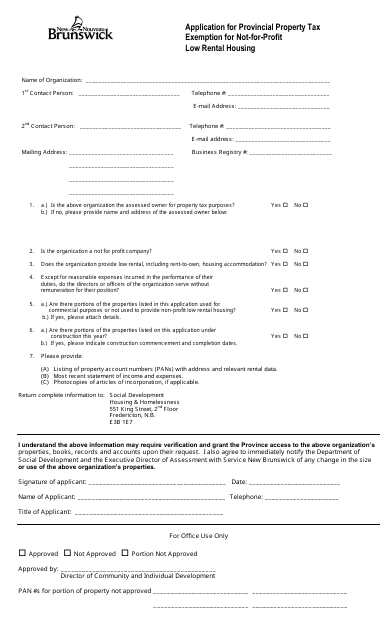

This application form is used for provincial property tax exemption in New Brunswick, Canada for not-for-profit low rental housing.

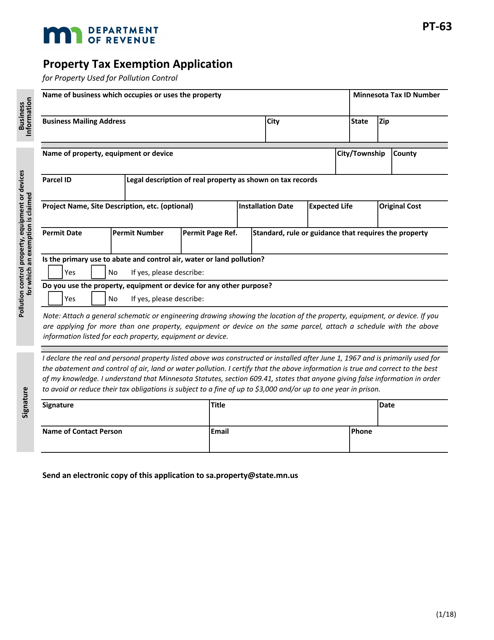

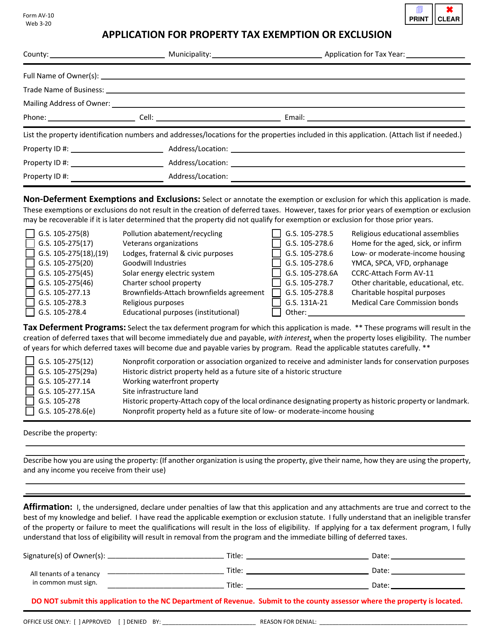

This document is used for applying for a property tax exemption in Minnesota.

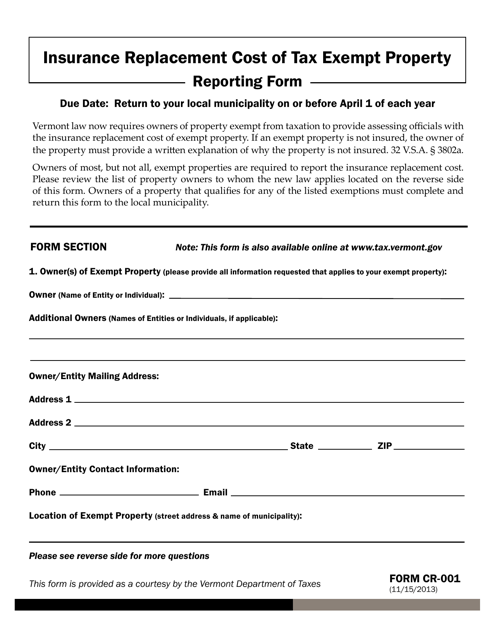

This form is used for reporting the replacement cost of tax exempt property for insurance purposes in Vermont.

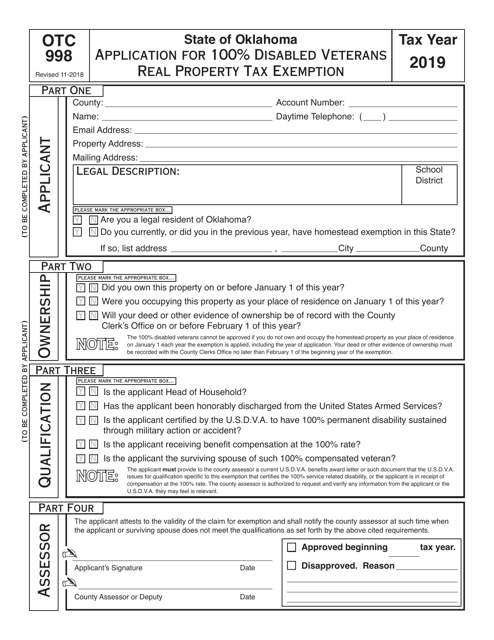

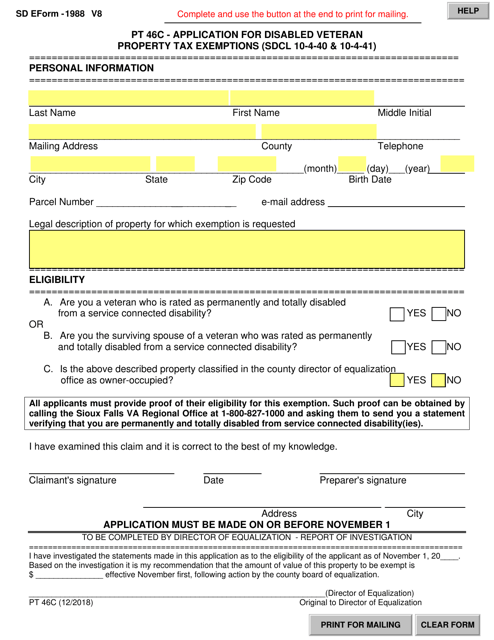

This Form is used for applying for property tax exemptions for disabled veterans in South Dakota.

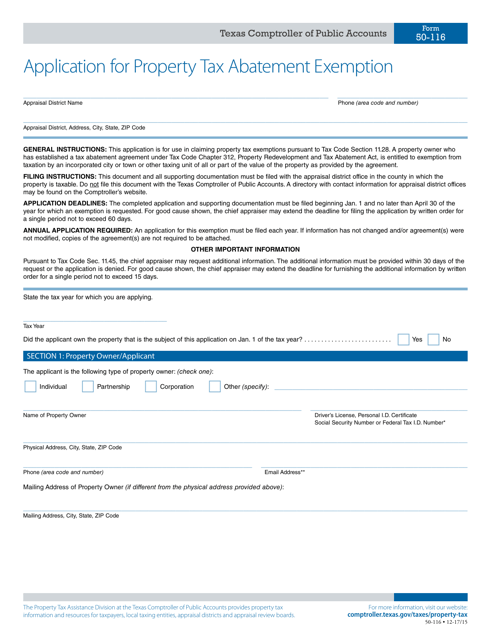

This form is used for applying for a property tax abatement exemption in Texas.

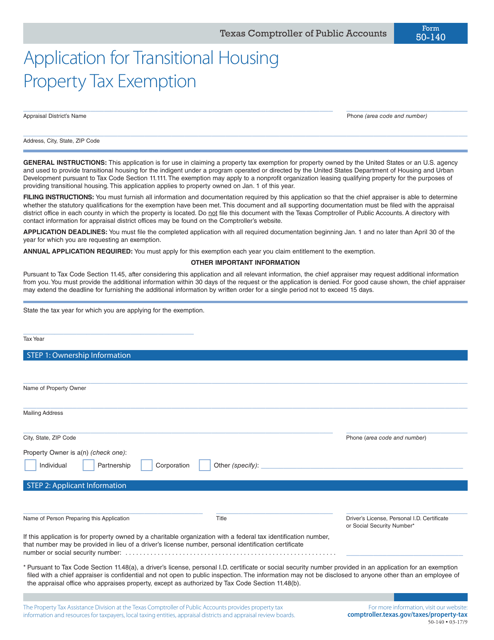

This Form is used for applying for the Transitional Housing Property Tax Exemption in Texas.

![Form RP-485-J [AMSTERDAM] Application for Residential Investment Real Property Tax Exemption - City of Amsterdam, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578657/form-rp-485-j-amsterdam-application-for-residential-investment-real-property-tax-exemption-city-of-amsterdam-new-york_big.png)