Property Tax Exemption Form Templates

Documents:

173

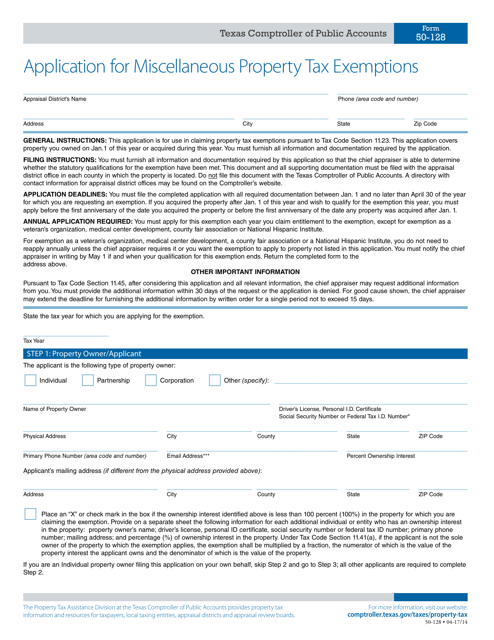

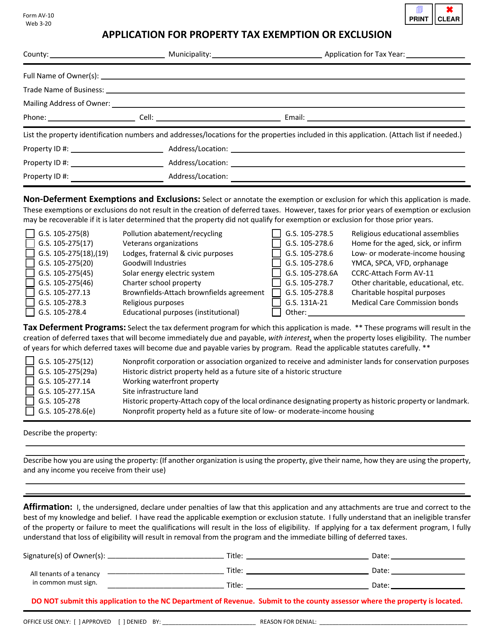

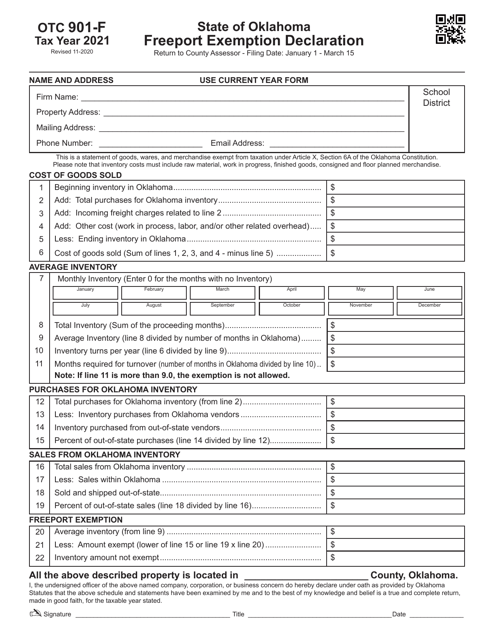

This form is used for applying for miscellaneous property tax exemptions in Texas.

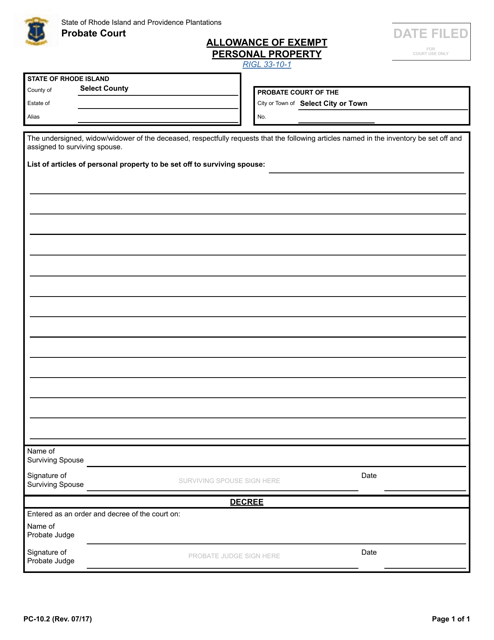

This Form is used for the allowance of exempt personal property in Rhode Island.

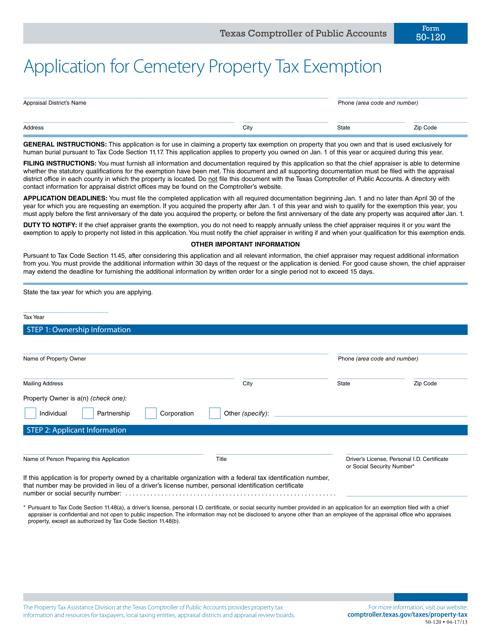

This form is used for applying for a property tax exemption for cemetery property in Texas.

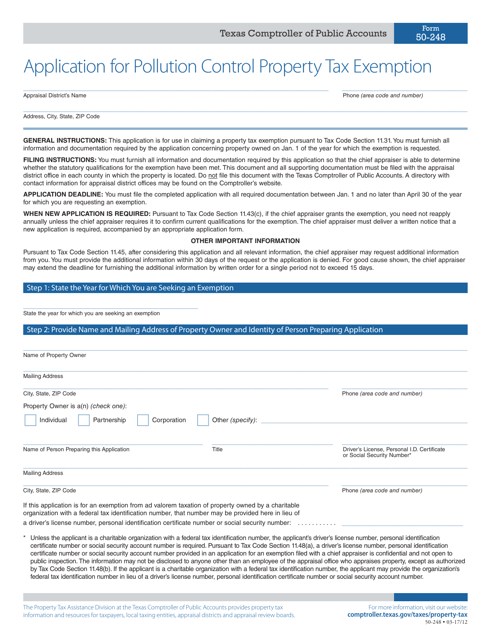

This form is used for applying for a tax exemption on pollution control property in the state of Texas.

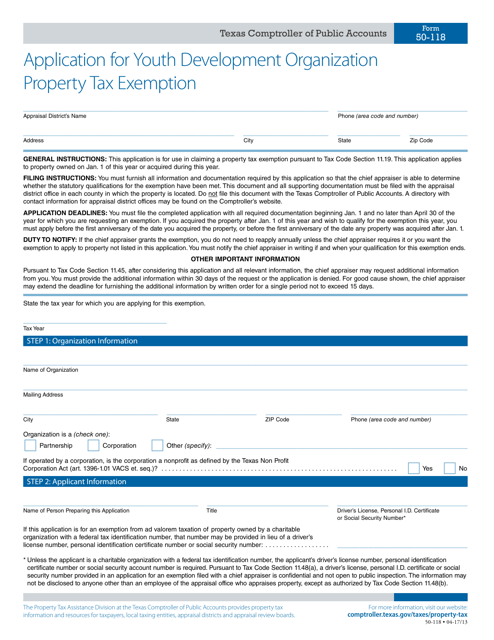

This form is used for applying for a property tax exemption for a youth development organization in Texas.

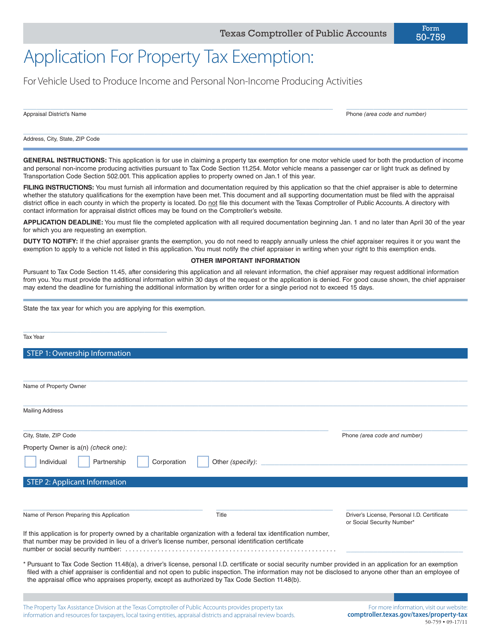

This form is used for applying for a property tax exemption in Texas for vehicles that are used to generate income and for personal activities that do not generate income.

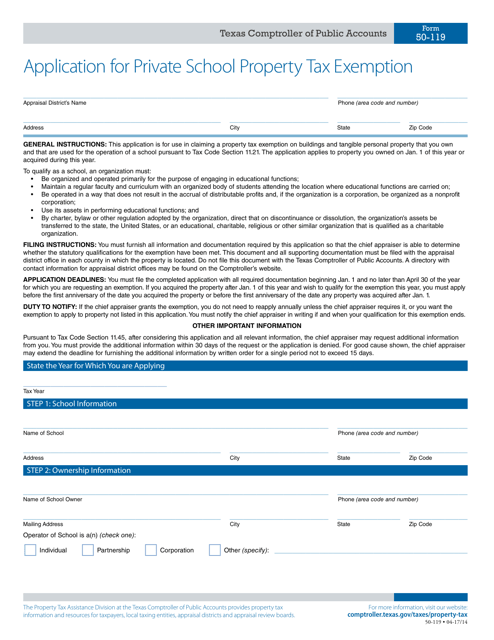

This form is used for applying for a property tax exemption for private schools in Texas.

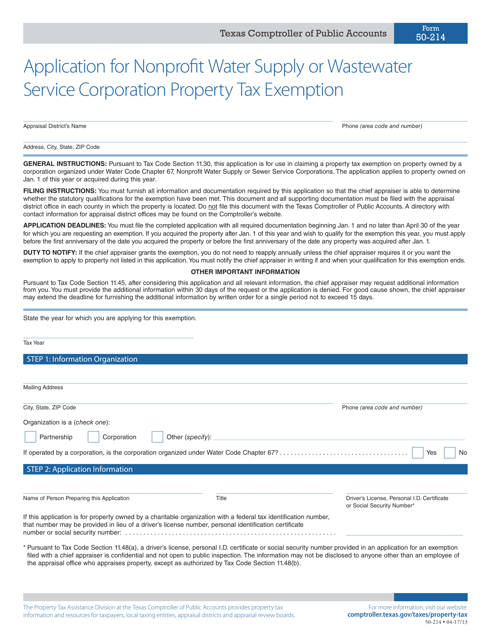

This Form is used for applying for a property tax exemption for nonprofit water supply or wastewater service corporations in Texas.

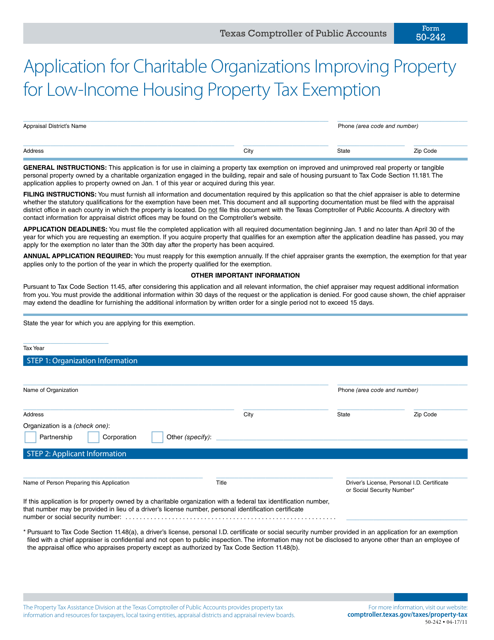

This Form is used for applying for a property tax exemption in Texas for charitable organizations that improve property for low-income housing.

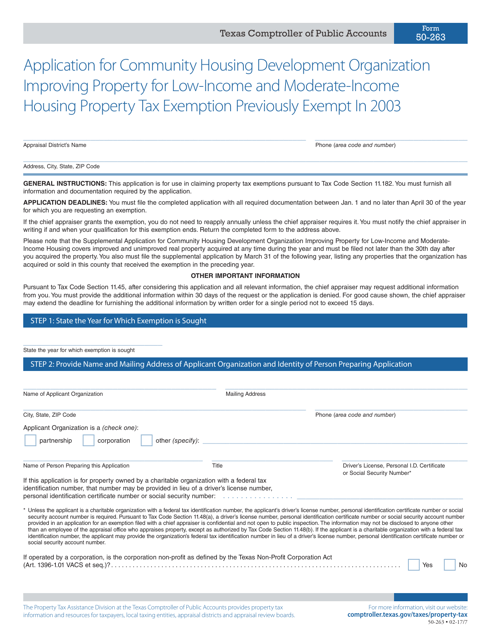

This form is used for applying for a property tax exemption for a Community Housing Development Organization (CHDO) that is improving property for low-income and moderate-income housing in Texas.

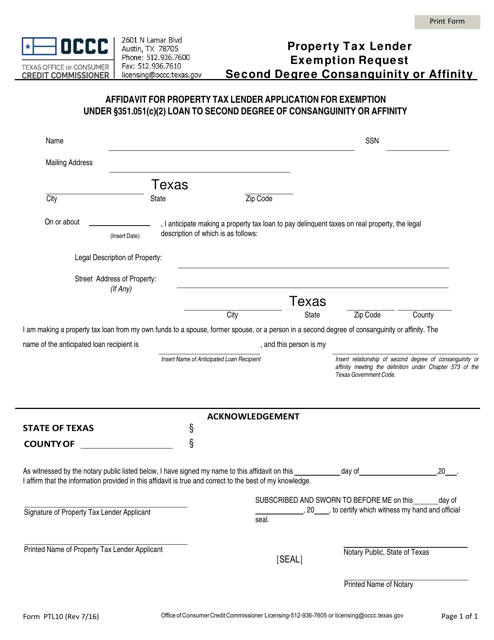

This form is used for requesting an exemption from property tax for property held by a lender who is related to the property owner by second-degree consanguinity or affinity in Texas.

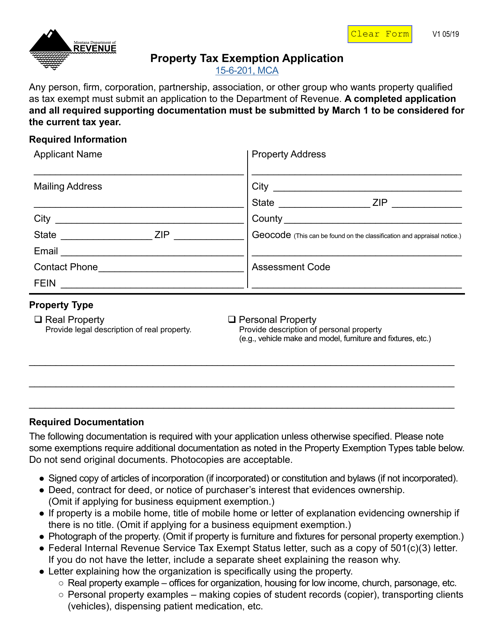

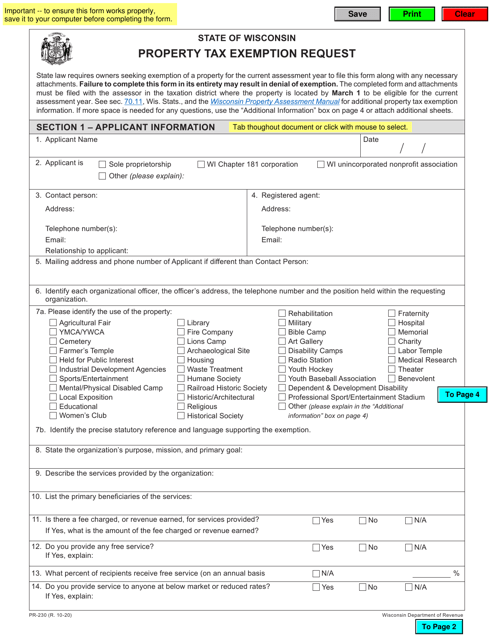

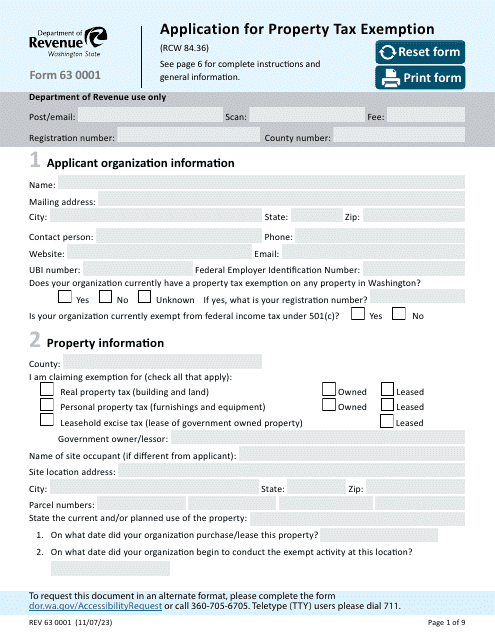

This document is used for applying for a property tax exemption in Montana. It helps eligible individuals or organizations apply for a reduction or exemption from their property taxes.

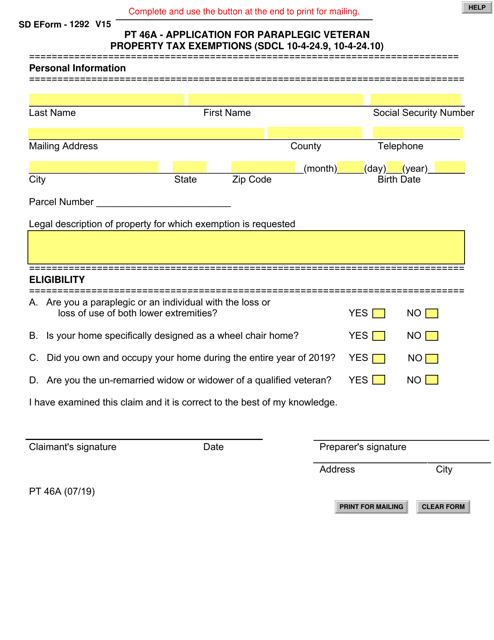

This form is used for applying for property tax exemptions for paraplegic veterans in South Dakota.

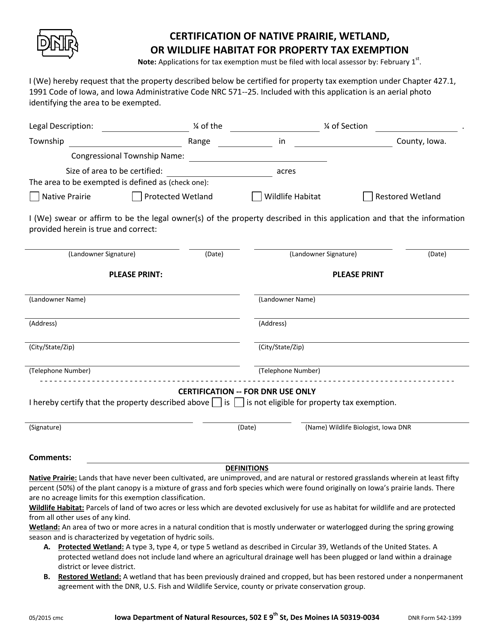

This form is used for certifying native prairie, wetland, or wildlife habitat on a property in Iowa in order to claim a property tax exemption.

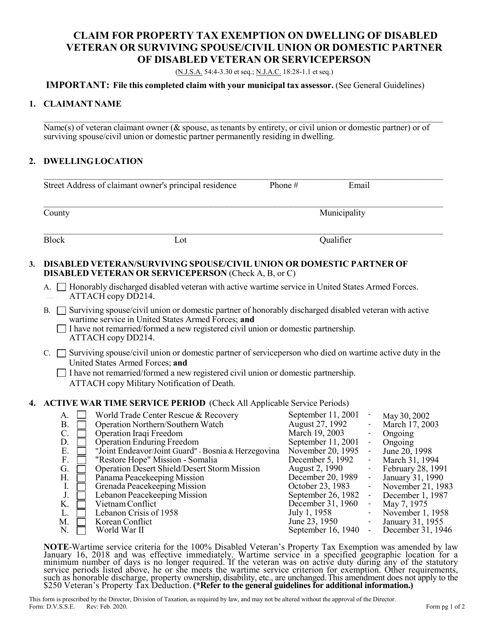

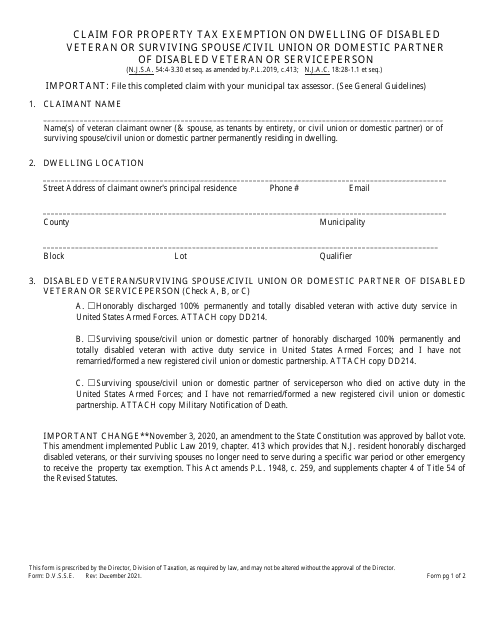

This form is used for claiming property tax exemption on the dwelling of a disabled veteran or surviving spouse or civil union or domestic partner of a disabled veteran or serviceperson in New Jersey.

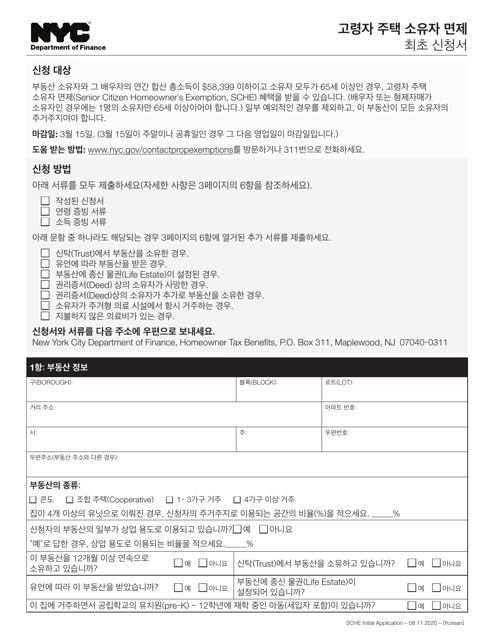

This document is for senior citizens in New York City who want to apply for the initial homeowners' exemption. It is available in Korean.

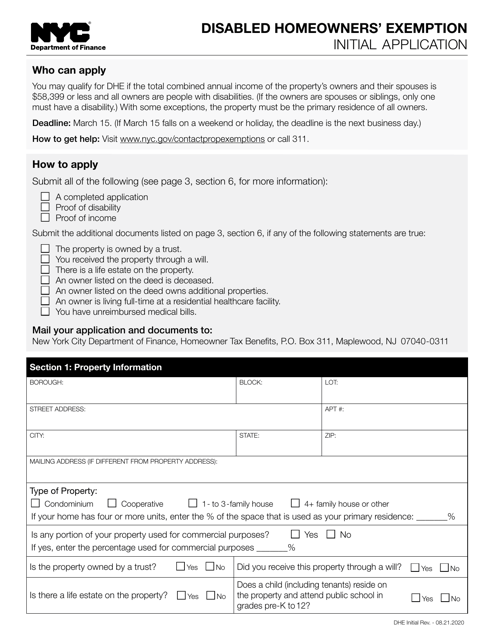

This document is for disabled homeowners in New York City who are applying for the initial exemption.

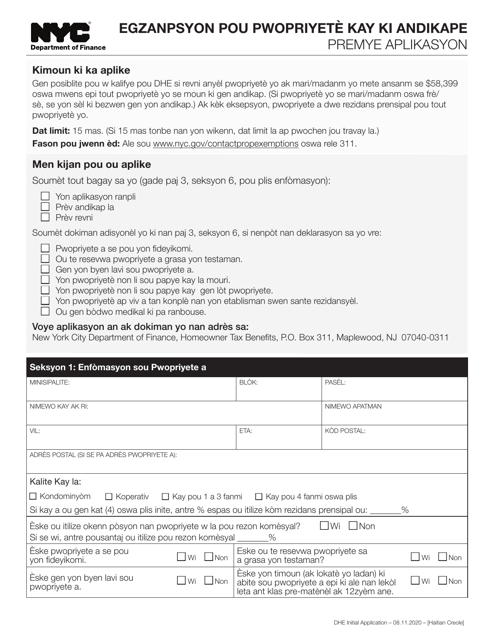

This type of document is used for disabled homeowners in New York City who are applying for the initial exemption. It is available in Haitian Creole language.

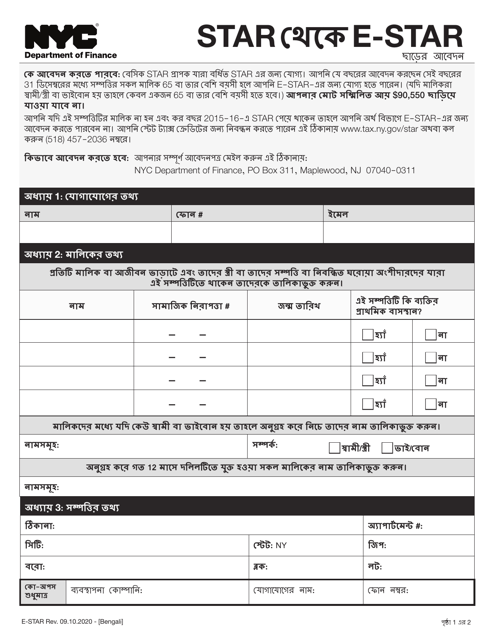

This document is for applying for the Star to E-Star Exemption in New York City. It is available in Bengali.

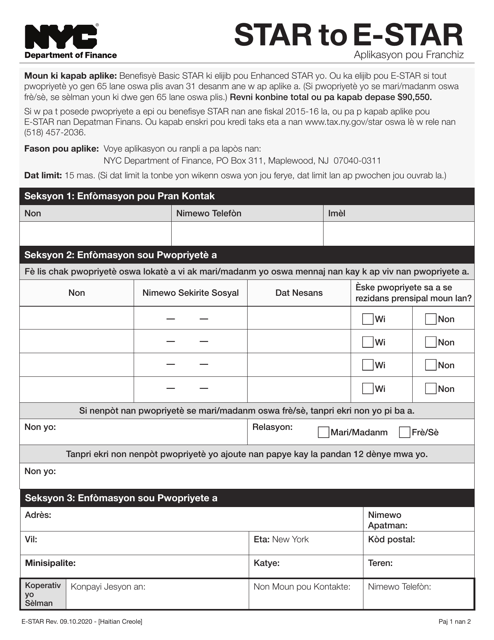

This document is used for applying for the Star to E-Star exemption in New York City. It is available in Haitian Creole language.

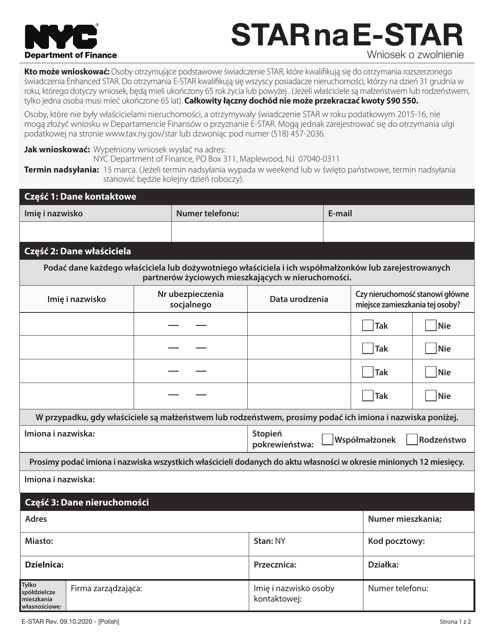

This Form is used for applying for the Star to E-Star Exemption in New York City for Polish-speaking residents.

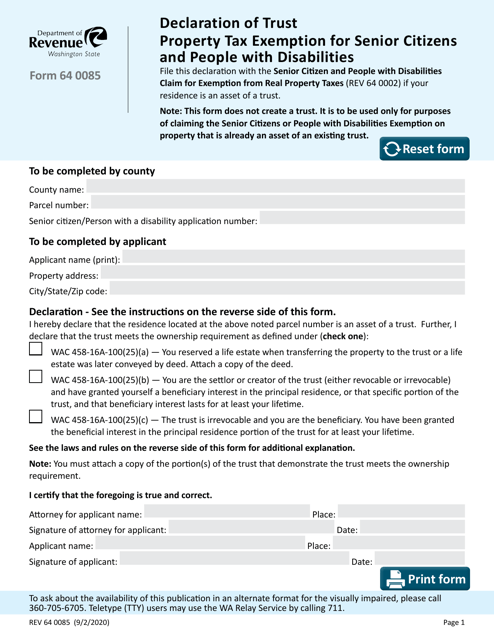

This form is used for declaring a trust for property tax exemption in Washington for senior citizens and people with disabilities. It allows eligible individuals to apply for tax relief on their property taxes.

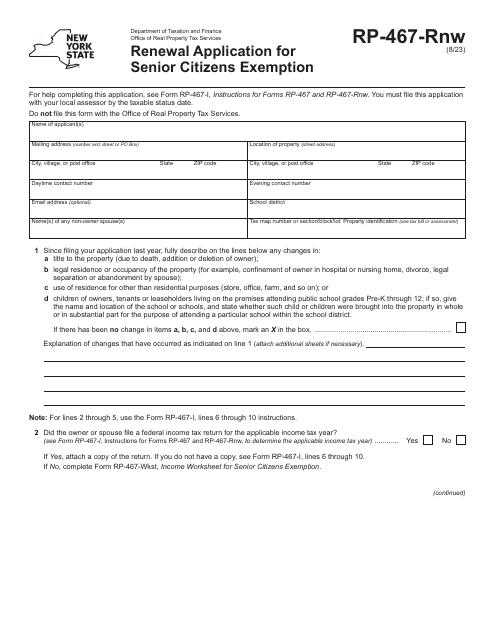

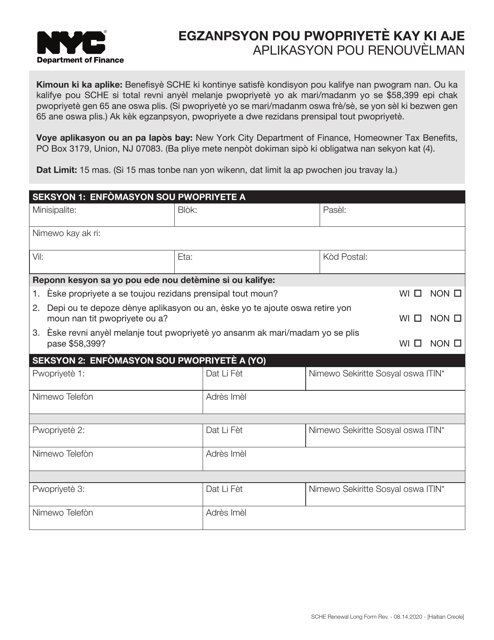

This Form is used for renewing the Senior Citizen Homeowners' Exemption in New York City. It is available in Haitian Creole language.

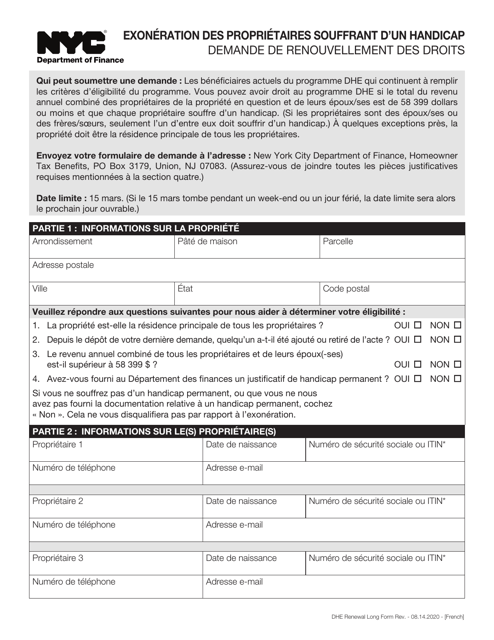

This Form is used for renewing the Disabled Homeowners' Exemption in New York City.