Offer in Compromise Form Templates

Documents:

63

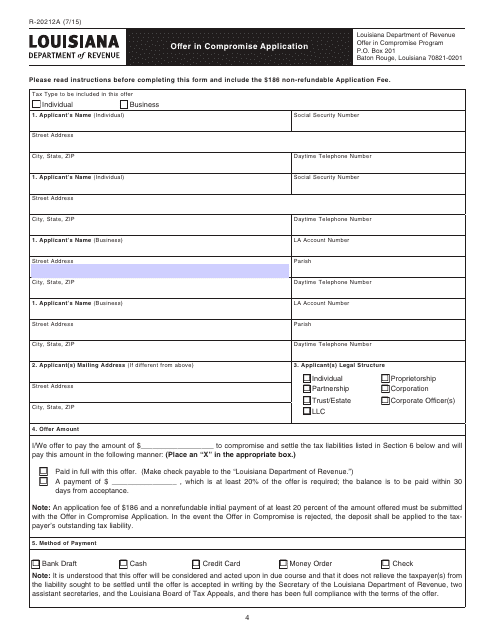

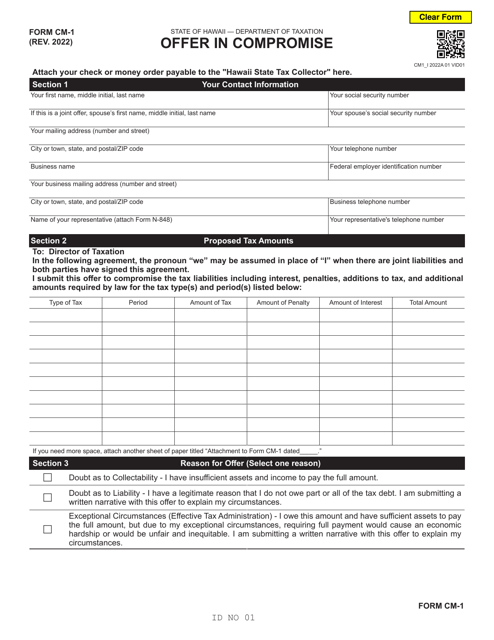

This Form is used for filing an Offer in Compromise Application in the state of Louisiana.

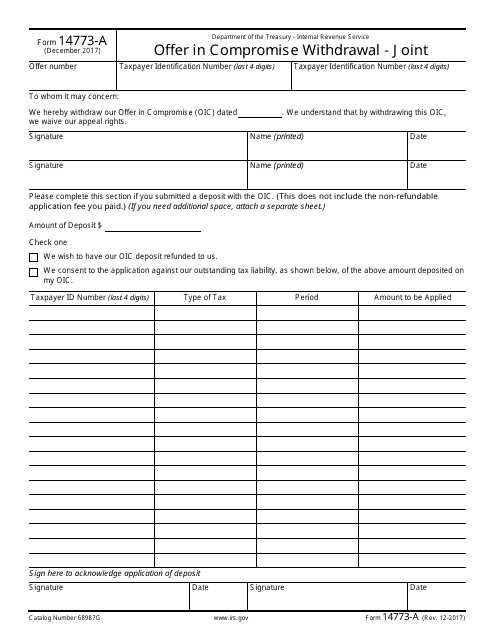

This form is used for withdrawing a joint offer in compromise submission to the IRS.

This document provides information and instructions for businesses in California who want to make an offer in compromise to settle their tax debt with the Franchise Tax Board (FTB).

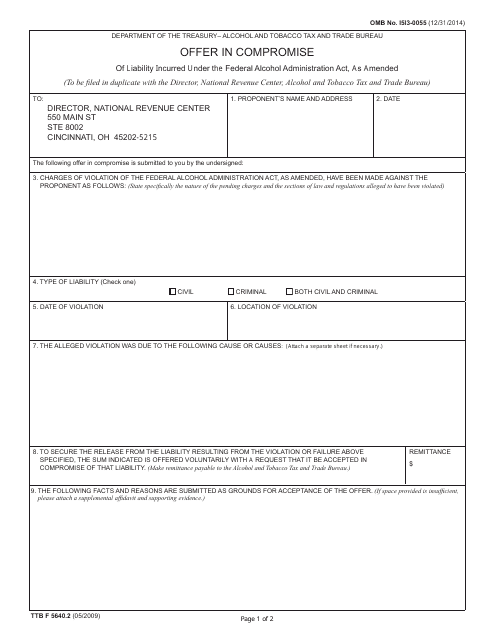

This Form is used for submitting an Offer in Compromise for violations of the Federal Alcohol Administration Act (FAA Act).

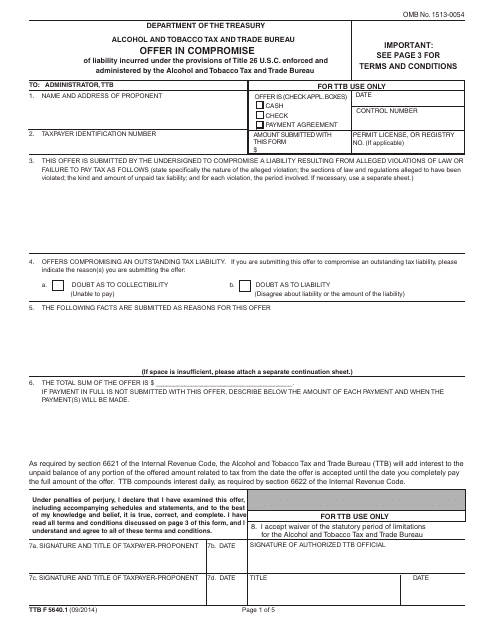

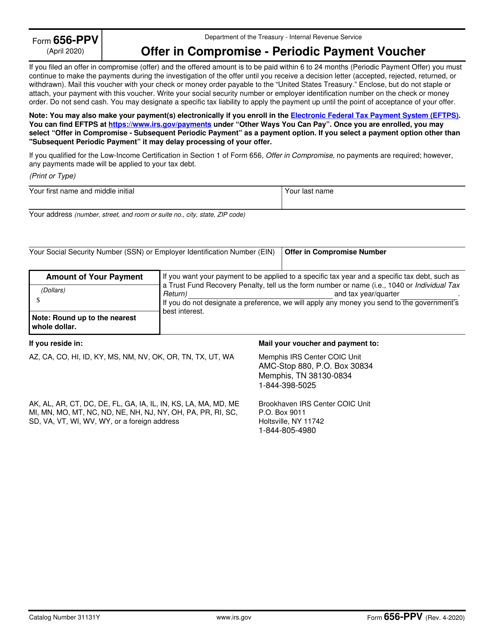

This document is used for making an offer in compromise to the Internal Revenue Service (IRS) for violations of the Internal Revenue Code (IRC).

This Form is used for submitting an offer in compromise application for the California Personal Income Tax (PIT).

This form is used for submitting an offer-in-compromise to the Arizona Department of Revenue. It allows taxpayers to propose a settlement for their outstanding tax liabilities with the state of Arizona.

This form is used for submitting an offer in compromise application to the California Department of Tax and Fee Administration.

This form is used for submitting an offer in compromise to multiple agencies in California.

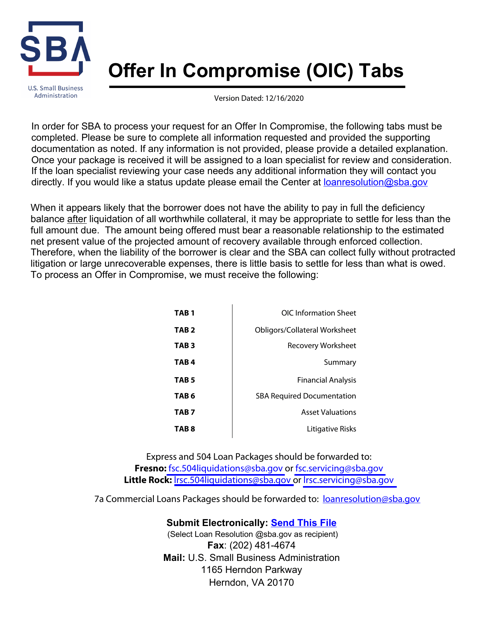

Download this form if you are a borrower who is unable to repay a loan after liquidation and agree to settle with a lender for less than the full amount due.

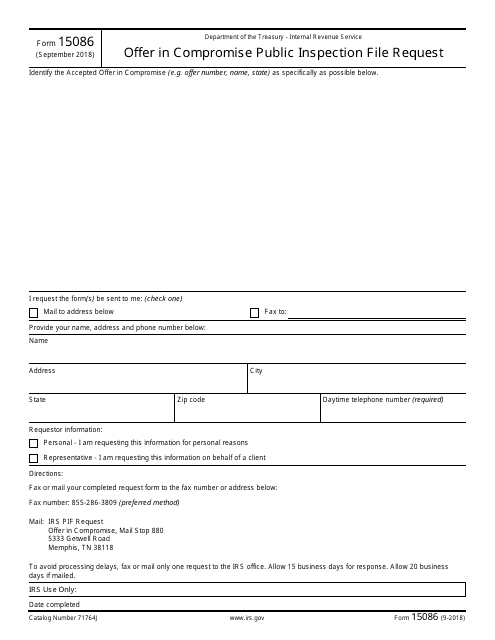

This form is used for requesting access to the public inspection file for Offer in Compromise records with the IRS.

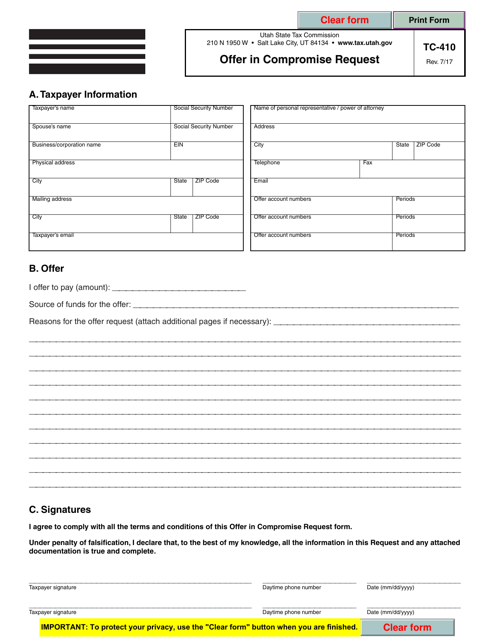

This form is used for requesting an offer in compromise with the state of Utah. It allows individuals or businesses who have outstanding tax liabilities to propose a smaller payment to settle their debts.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

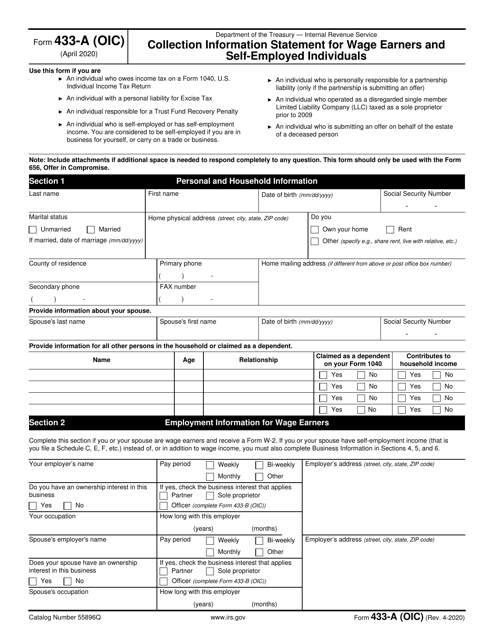

This Form is used for individuals who owe taxes to provide detailed financial information to the IRS in order to request an offer in compromise (OIC) and settle their tax debt.

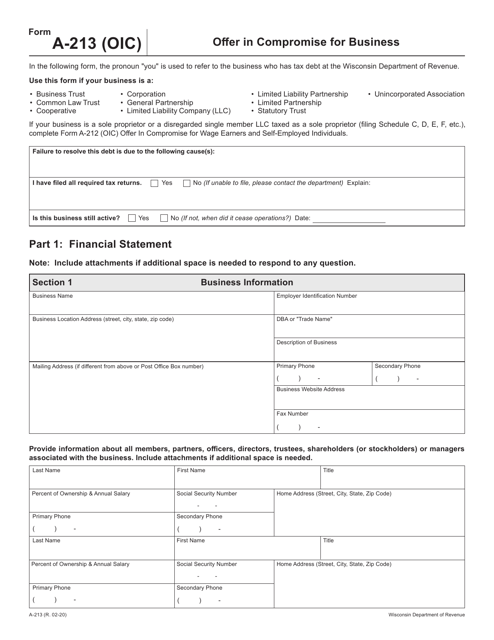

This form is used for making an offer in compromise for a business located in Wisconsin.

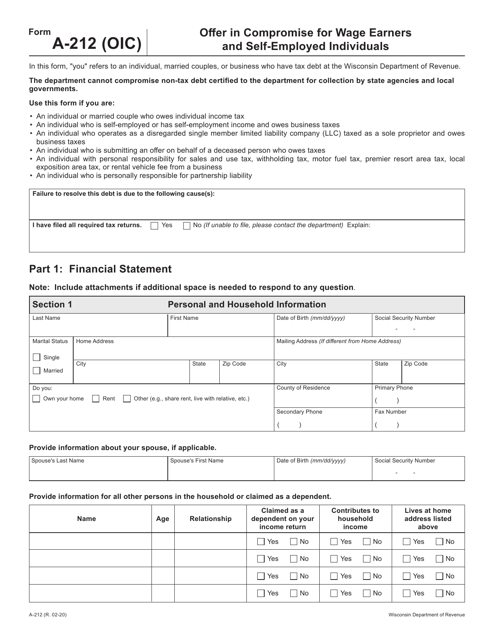

This Form is used for individuals in Wisconsin who want to make an offer in compromise for their unpaid taxes as wage earners or self-employed individuals.

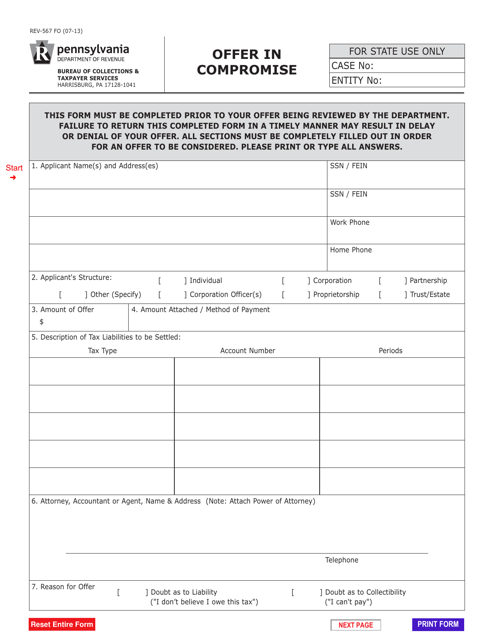

This Form is used for making an offer in compromise with the state of Pennsylvania to settle your tax debt for less than the full amount owed.

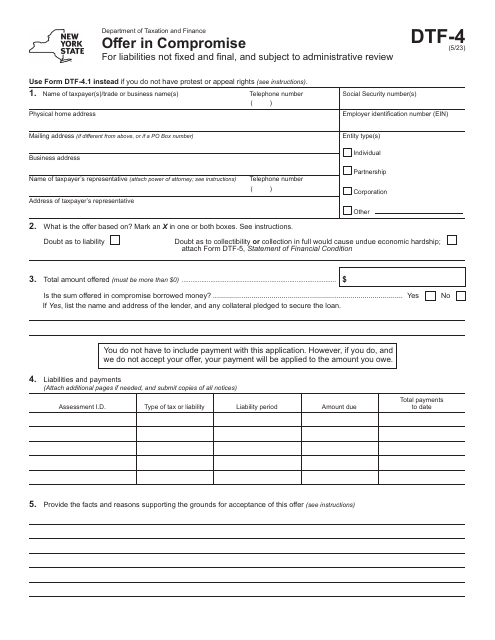

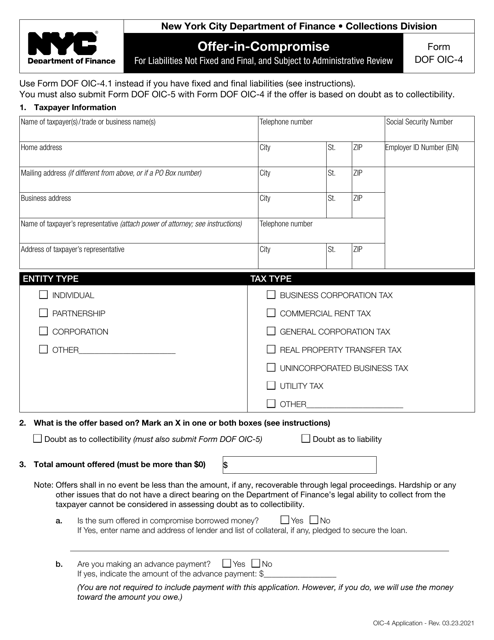

This Form is used for submitting an offer-in-compromise to the New York City Department of Finance for liabilities that are not fixed and final, and are subject to administrative review.

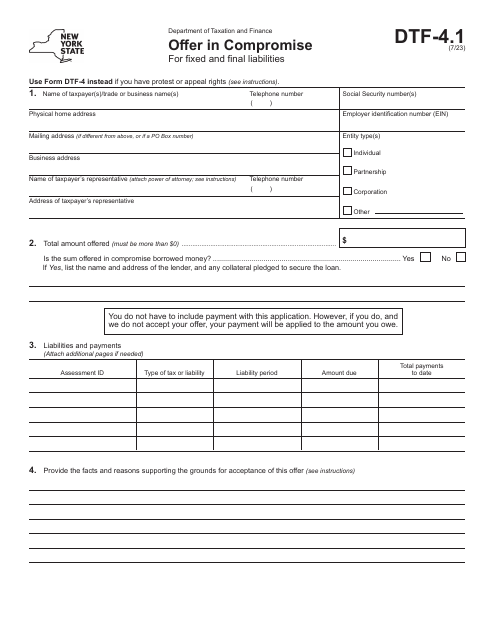

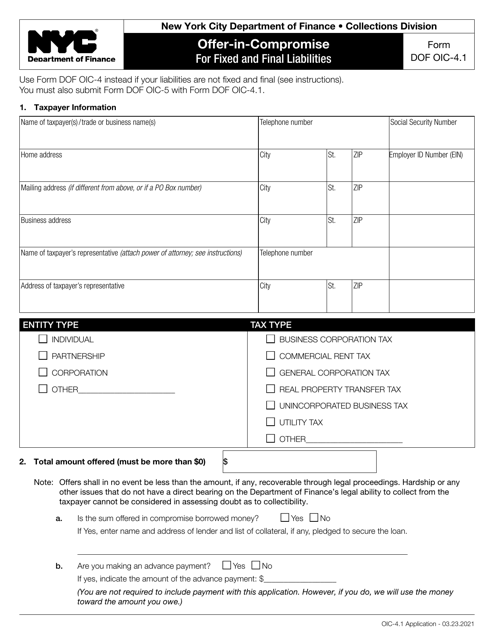

This Form is used for making an offer-in-compromise for fixed and final liabilities in New York City.

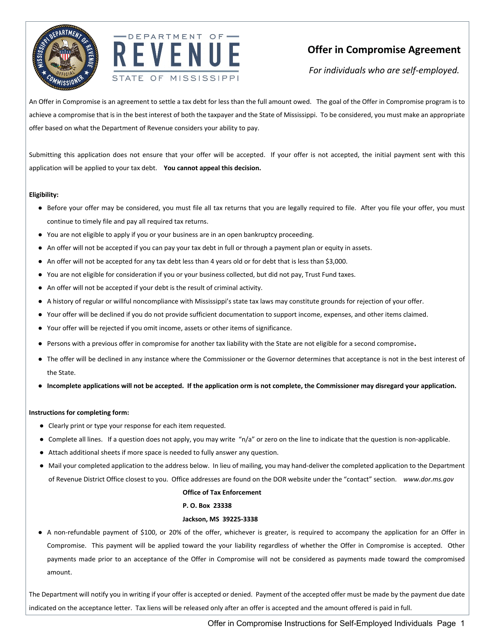

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.