Offer in Compromise Form Templates

Documents:

63

This document provides instructions for individuals in Mississippi who want to submit an Offer in Compromise application to settle their tax debt with the government. The instructions cover the application process and required forms.

This document provides instructions for submitting an Offer in Compromise application for entities in the state of Mississippi. It outlines the steps and requirements for individuals looking to settle their tax debt with the Mississippi Department of Revenue through the Offer in Compromise program.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

This document is for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to resolve their tax debt.

This Form is used for applying for an Offer in Compromise for individuals and businesses who owe taxes in Missouri.

This form is used for individuals in Missouri to apply for an Offer in Compromise for their income tax. It allows taxpayers to settle their tax debts for a lesser amount if they meet certain criteria.

This document is a sample agreement for an offer-in-compromise in the state of Ohio. It outlines the terms and conditions for settling a tax debt with the Ohio Department of Taxation.

This form is used for making an offer in compromise to the Internal Revenue Service (IRS) in Washington, D.C. It allows taxpayers to settle their tax debt for less than the full amount owed.

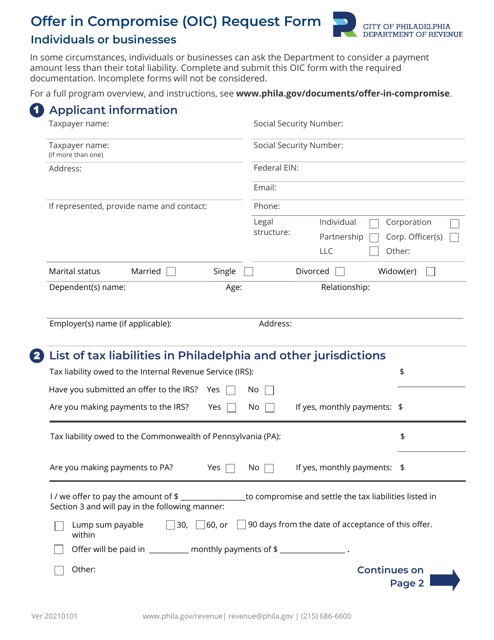

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.

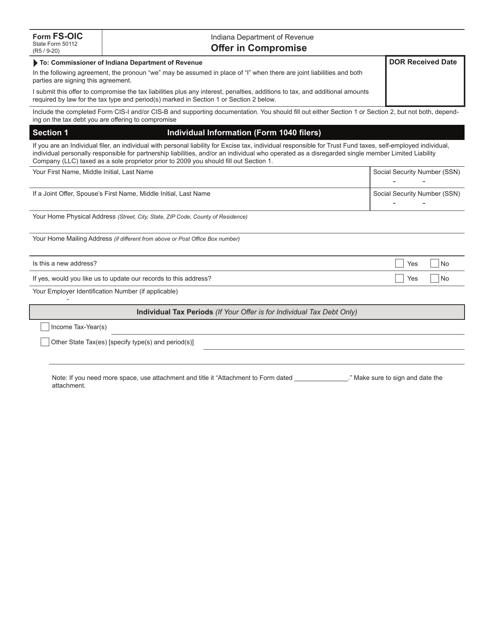

This form is used for submitting an Offer in Compromise to the state of Indiana. It allows individuals or businesses to propose a settlement to resolve their tax liabilities for a reduced amount.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

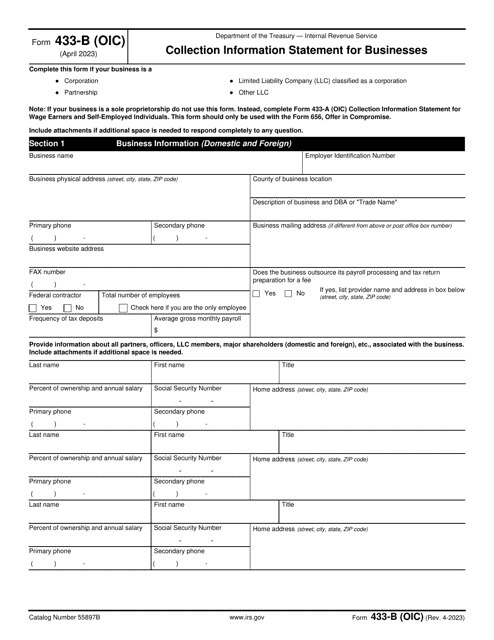

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

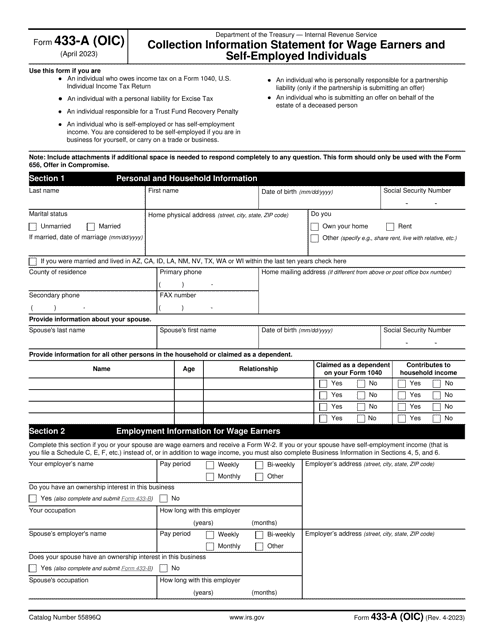

IRS Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-employed Individuals

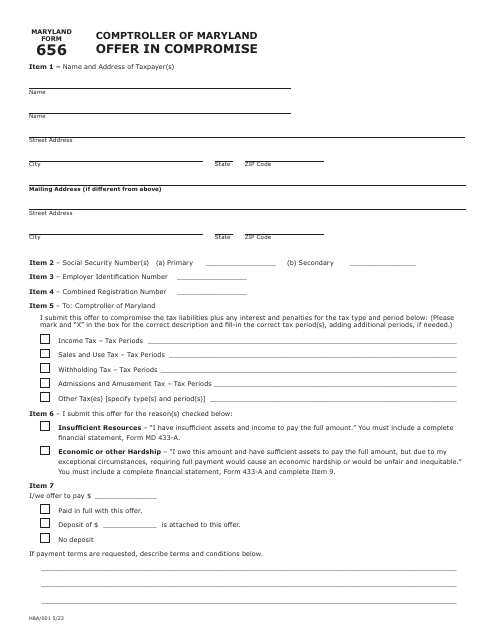

This Form is used for applying for an Offer in Compromise in the state of Maryland. It is a method for taxpayers to settle their tax debt for less than the full amount owed.