Tax Payment Form Templates

Documents:

681

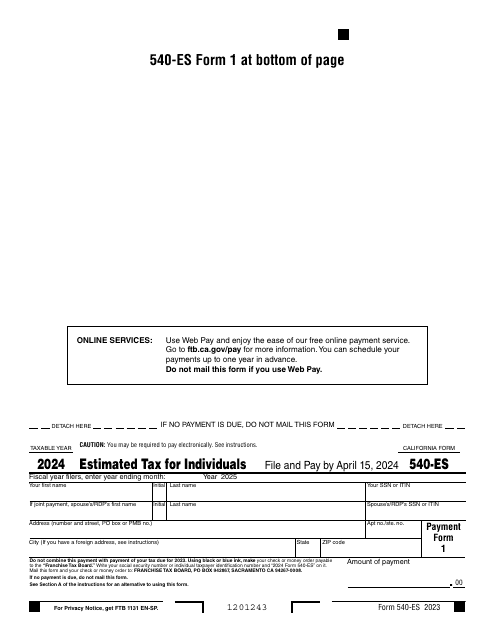

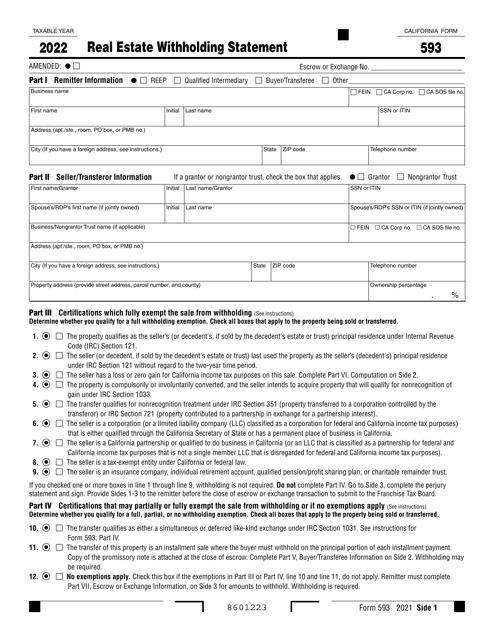

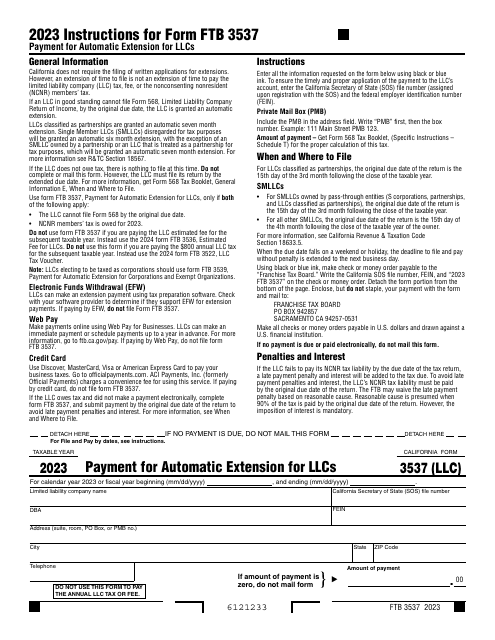

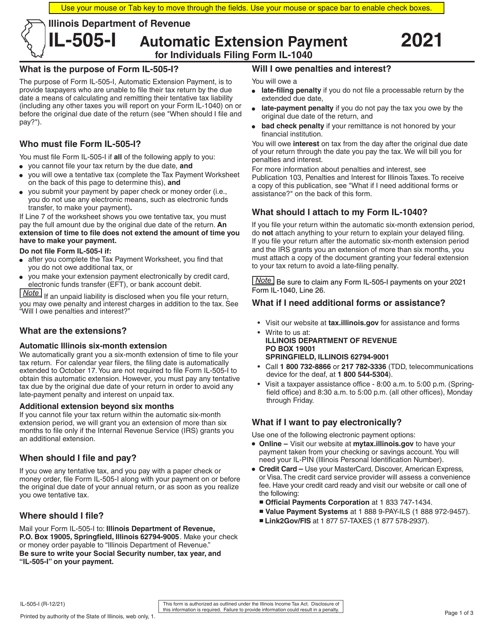

Fill out this form over the course of a year to pay your taxes in the state of California.

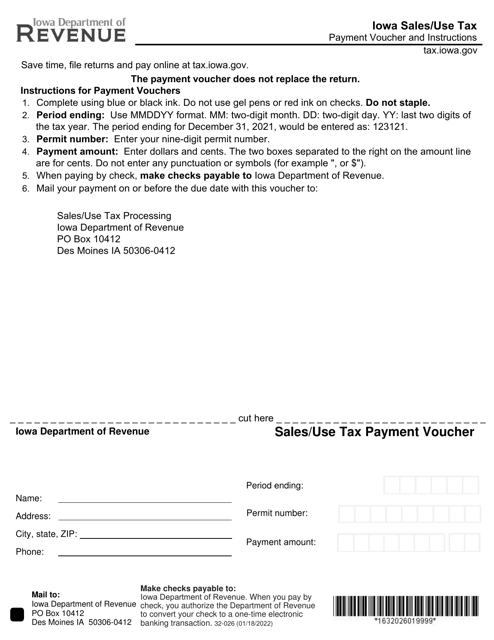

This form is used for making sales/use tax payments in the state of Iowa.

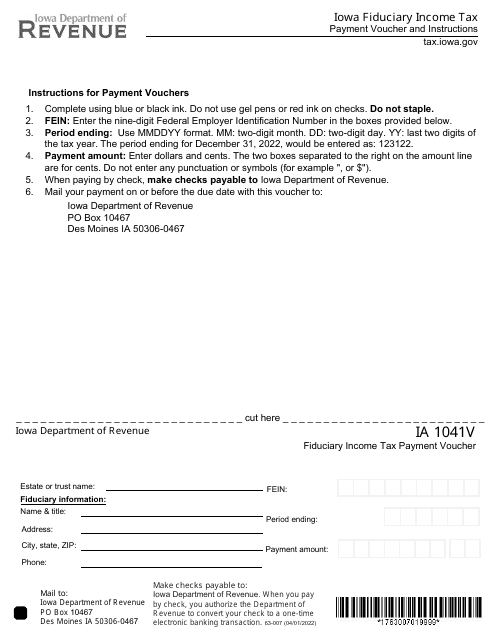

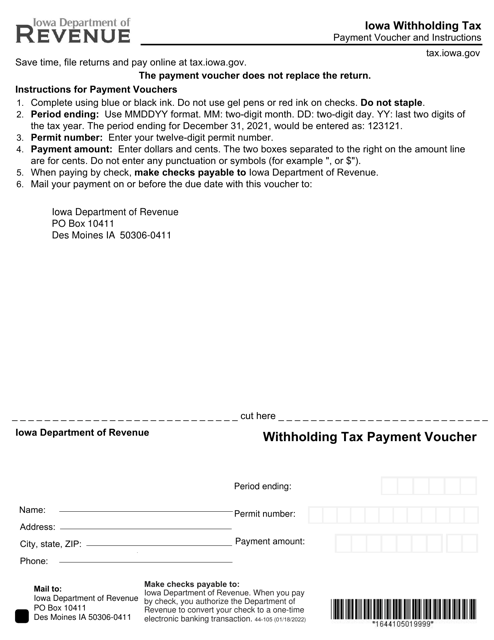

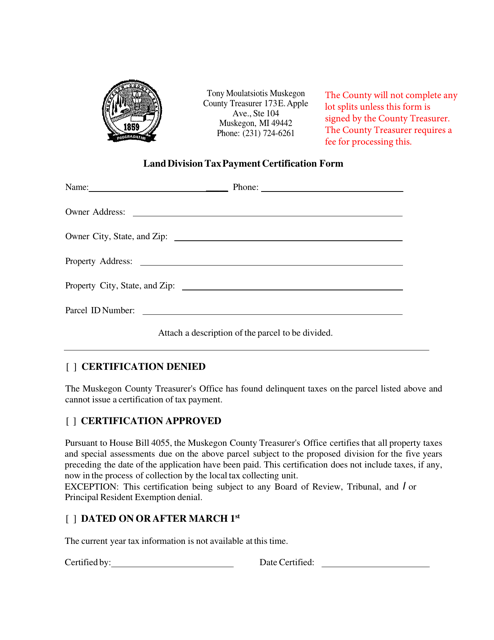

This form is used for making tax payments to the state of Iowa.

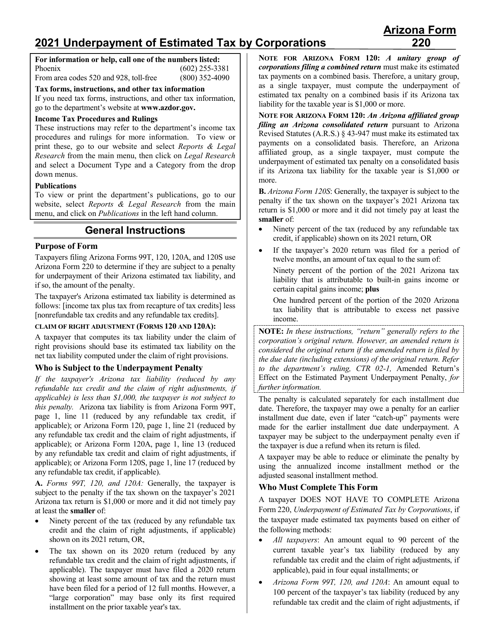

This form is used for addressing underpayment of estimated tax by corporations in Arizona. It provides instructions for filing Form 220, ADOR10342.

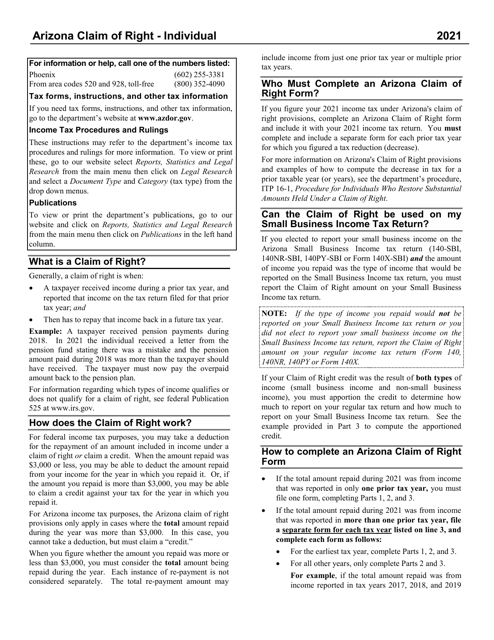

This Form is used for claiming the right to a refund on individual taxes paid in Arizona. It provides instructions for completing and filing Form ADOR11273.

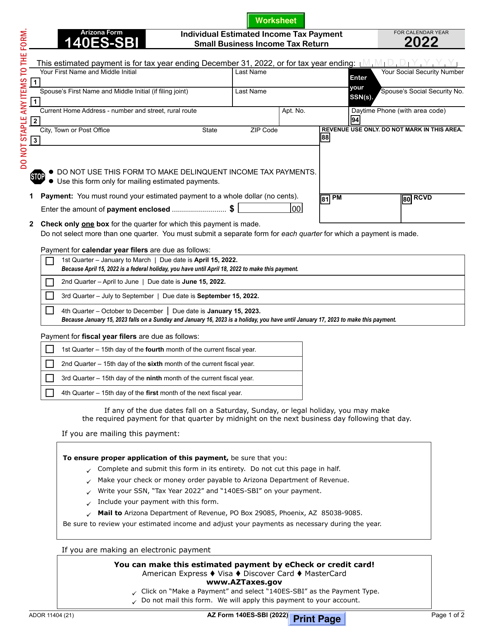

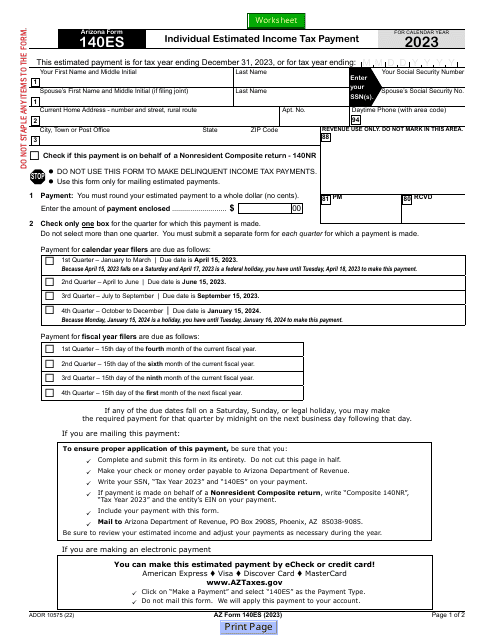

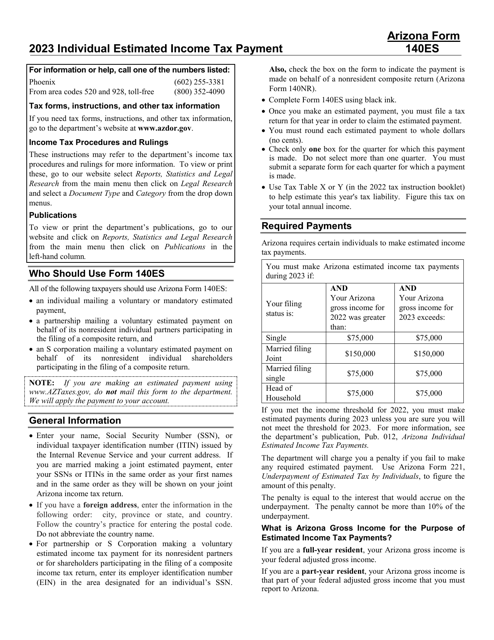

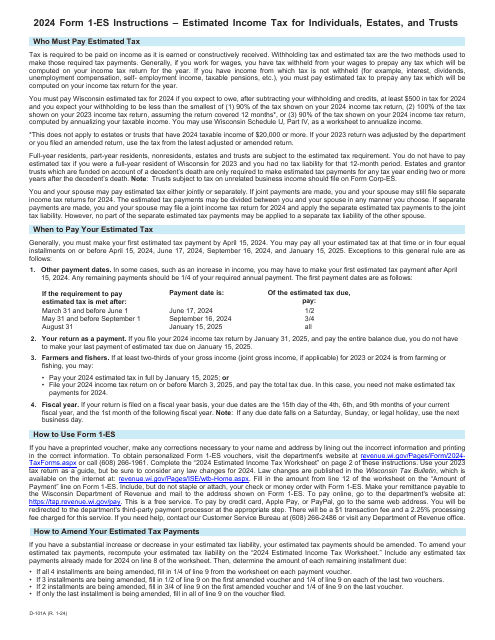

This Form is used for making estimated income tax payments for individuals who own a small business in Arizona.

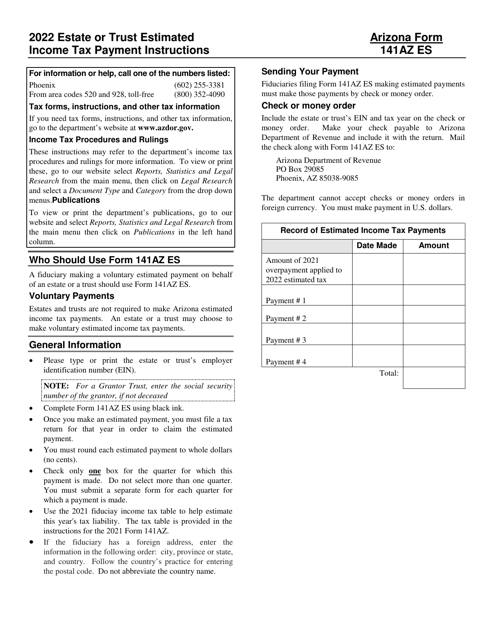

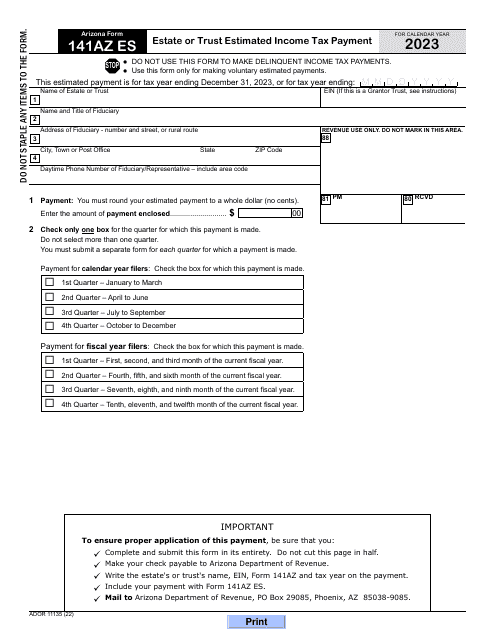

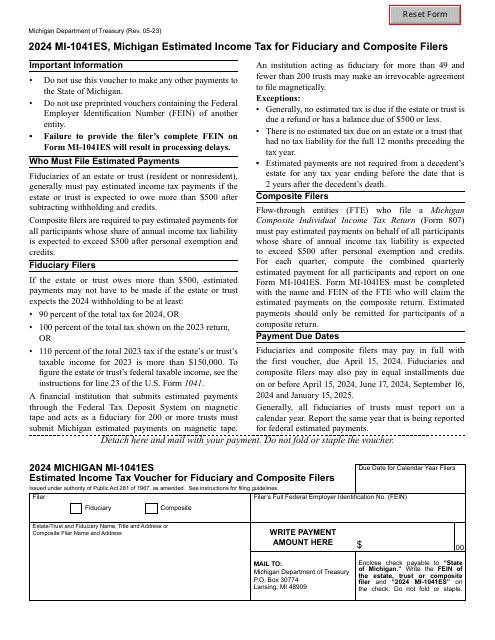

This Form is used for making estimated income tax payments for estates or trusts in Arizona.

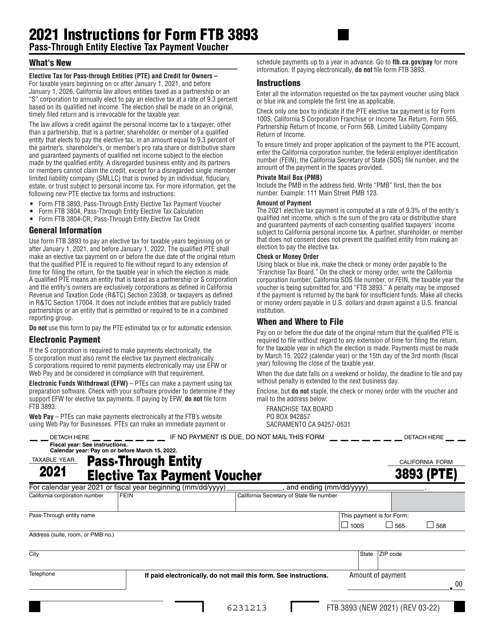

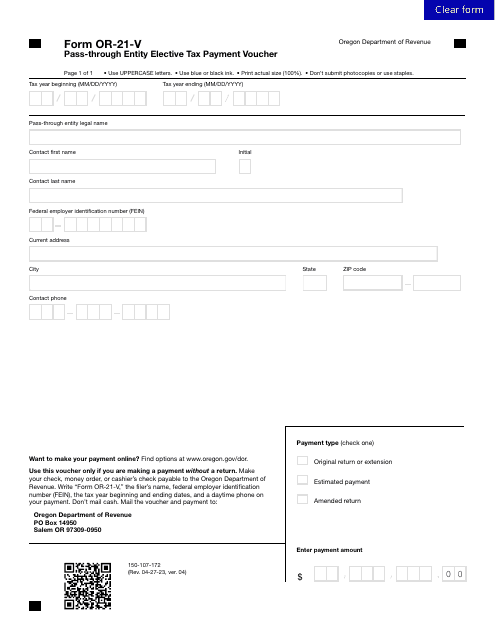

This form is used for making tax payments for pass-through entities in California.

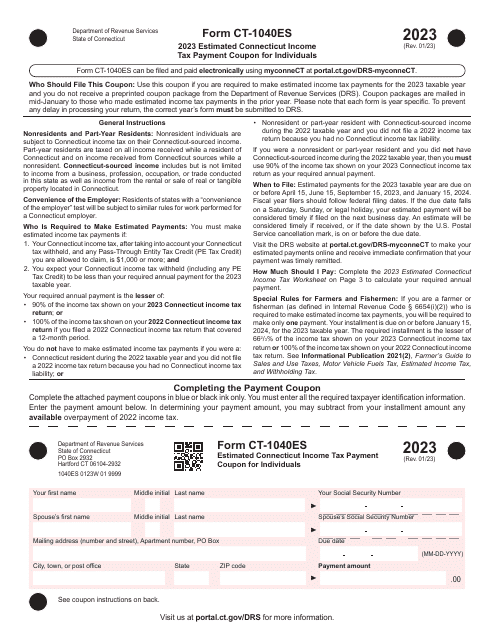

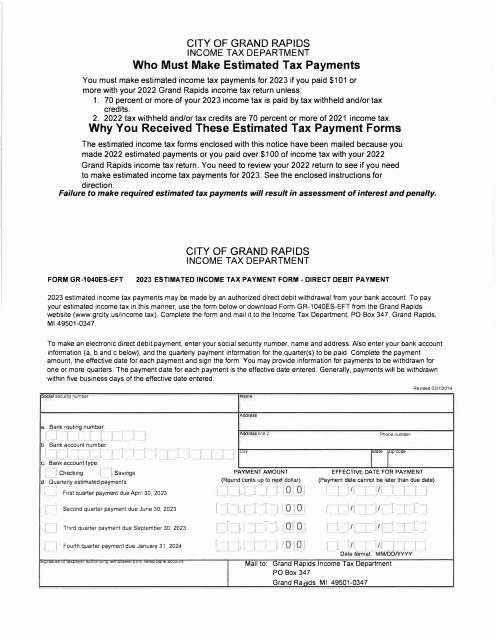

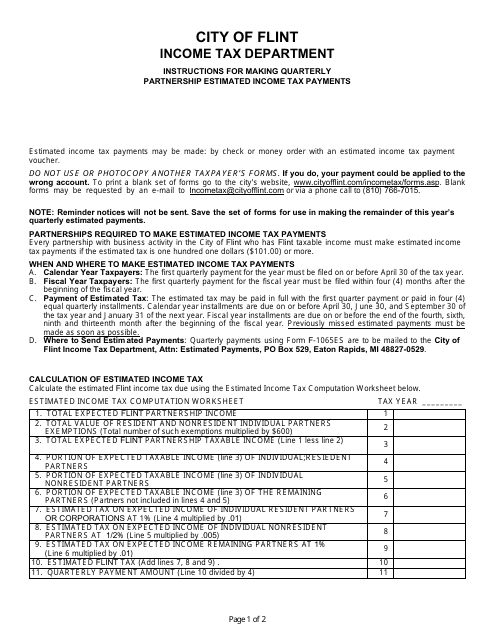

This Form is used for certifying tax payments related to land division in the City of Muskegon, Michigan.

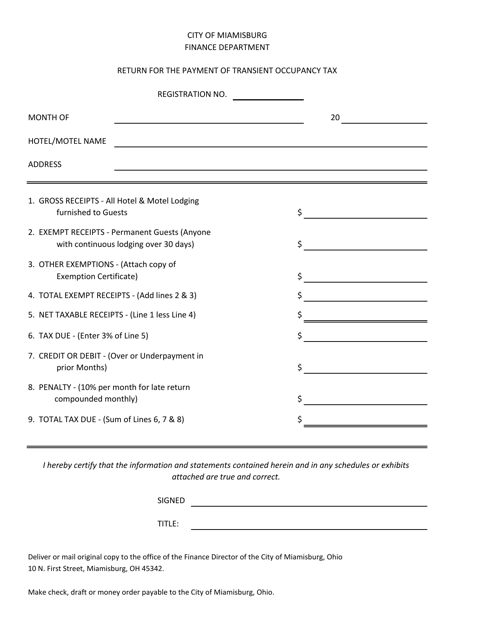

This form is used for reporting and submitting payment for the transient occupancy tax in the City of Miamisburg, Ohio.

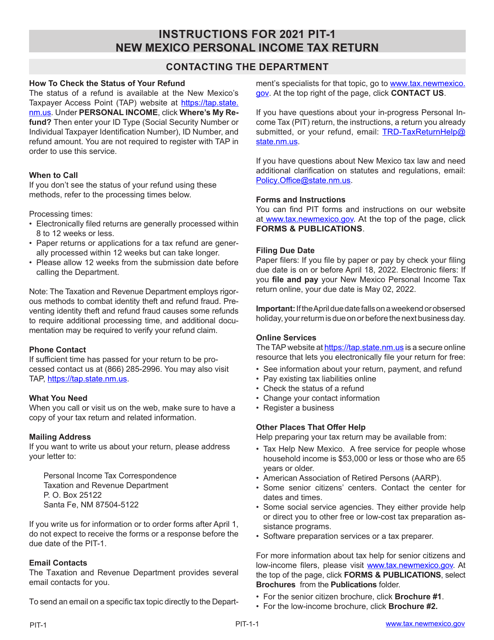

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.

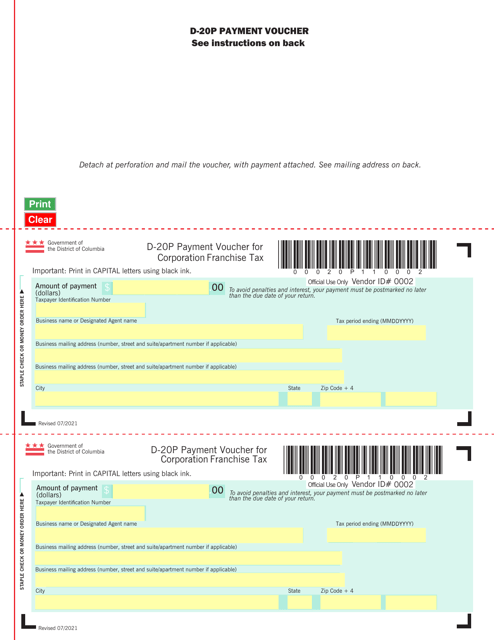

This form is used for making payment for Corporation Franchise Tax in Washington, D.C.

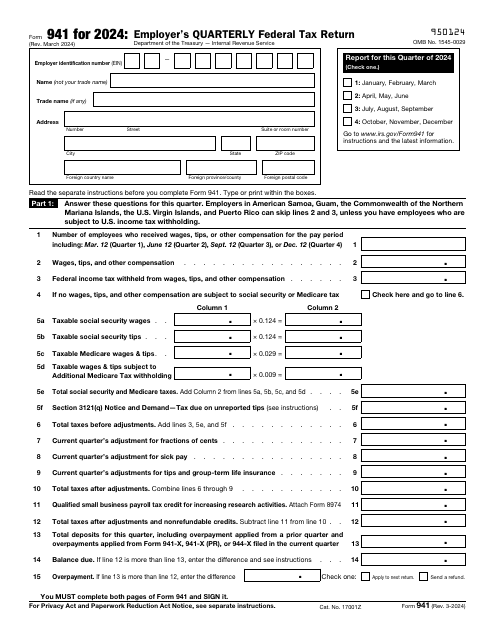

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

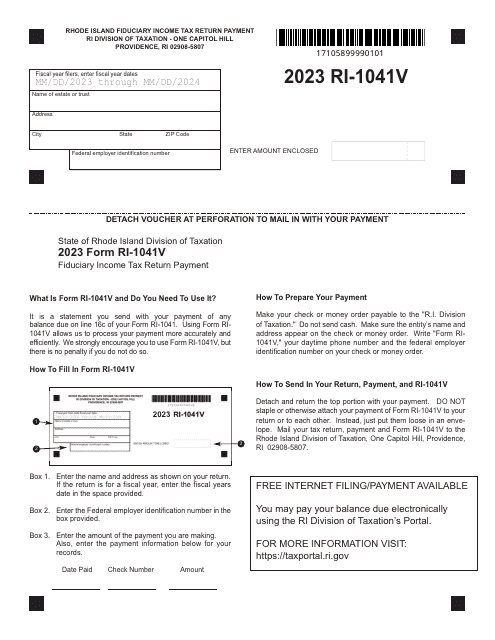

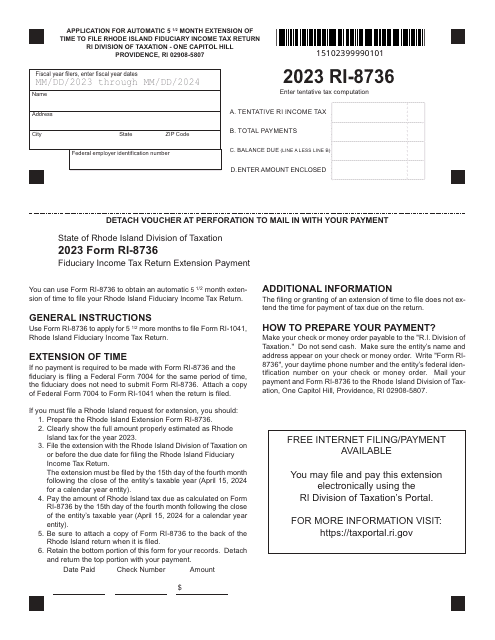

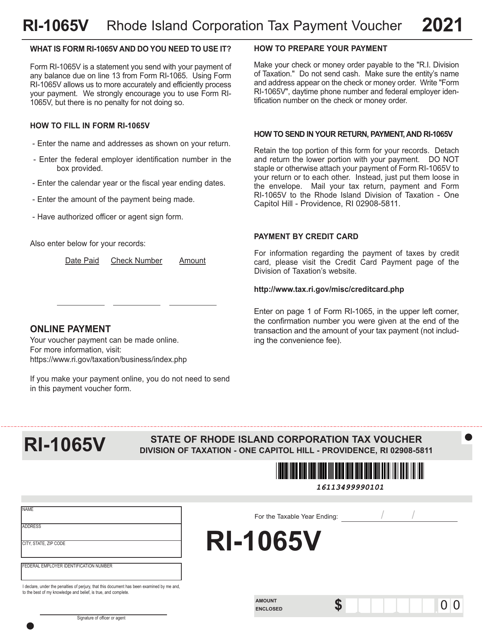

This Form is used for making tax payments for corporations in Rhode Island.