Tax Payment Form Templates

Documents:

681

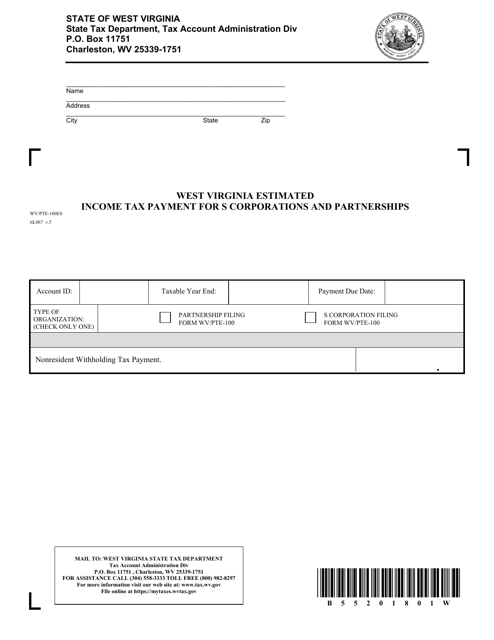

This Form is used for making estimated income tax payments for S Corporations and Partnerships in the state of West Virginia.

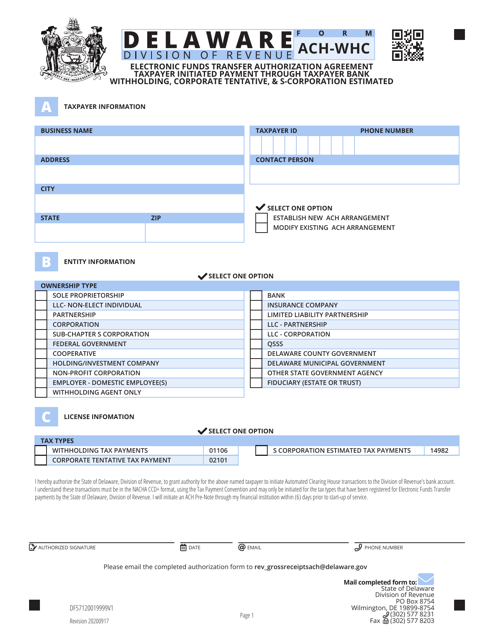

This Form is used for authorizing electronic funds transfer for taxpayer-initiated payments for withholding, corporate tentative, and S-corporation estimated taxes in Delaware.

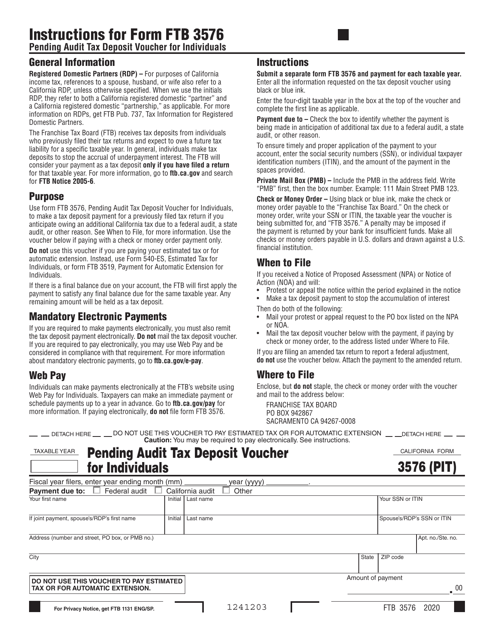

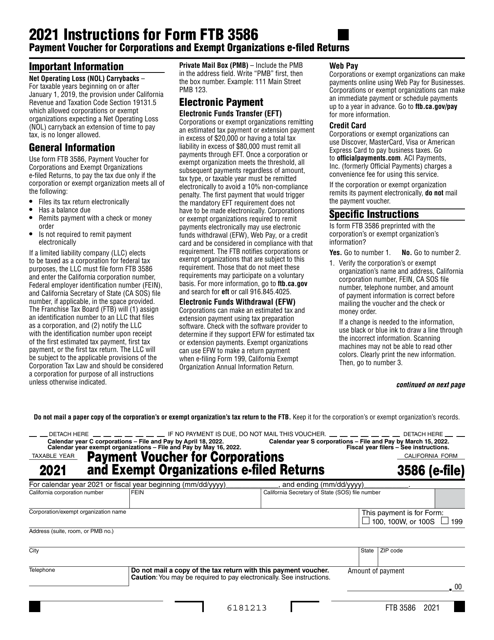

This form is used for making tax deposits for individuals who are undergoing a pending audit in California.

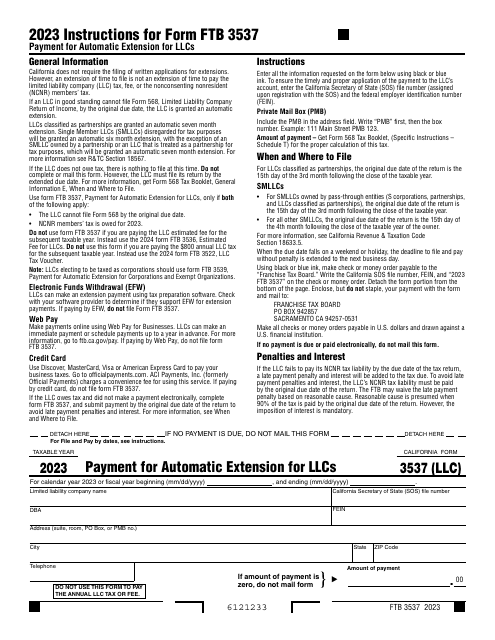

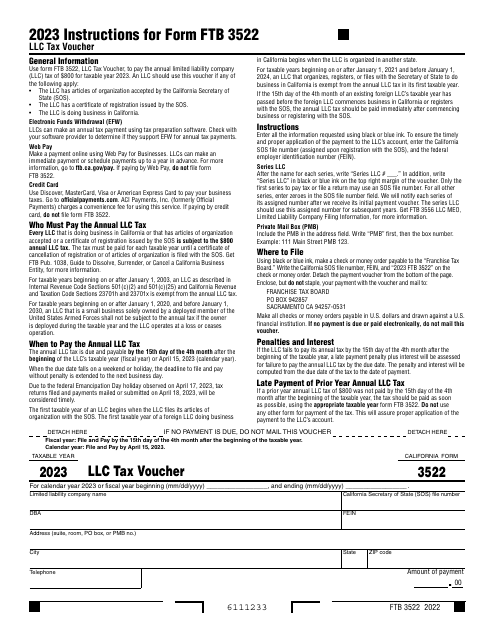

This is a legal document every California-based limited liability company (LLC) needs to submit to pay the annual LLC tax of $800. This form is a tax voucher - it details payment information you need to provide with your check or money order.

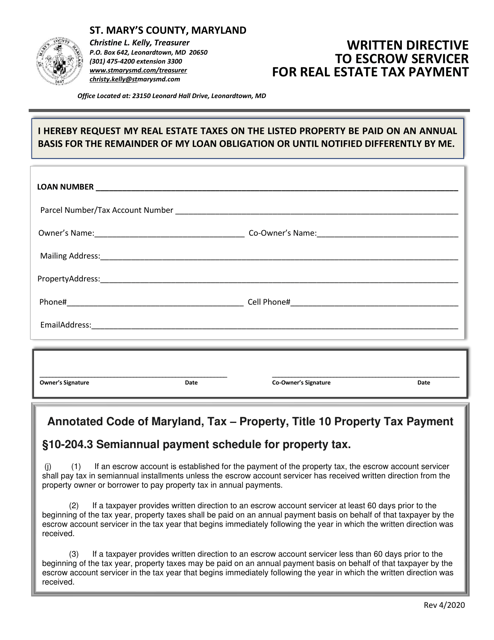

This document is a written directive used to instruct an escrow servicer on how to handle the payment of real estate taxes in St. Mary's County, Maryland.

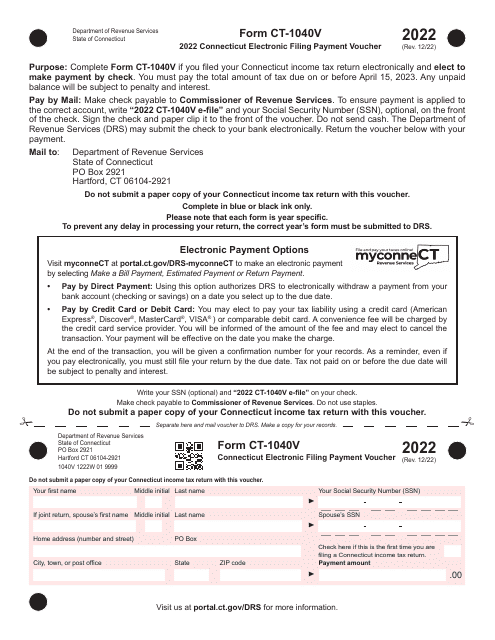

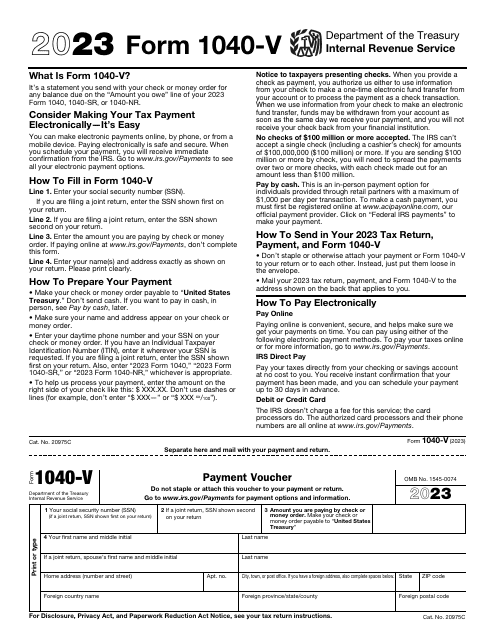

This is a supplementary document completed by taxpayers that chose to fulfill their financial obligations to fiscal organizations with the help of a check or money order.

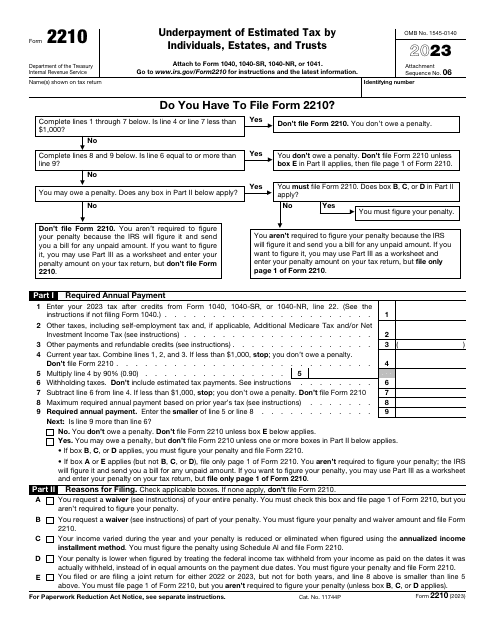

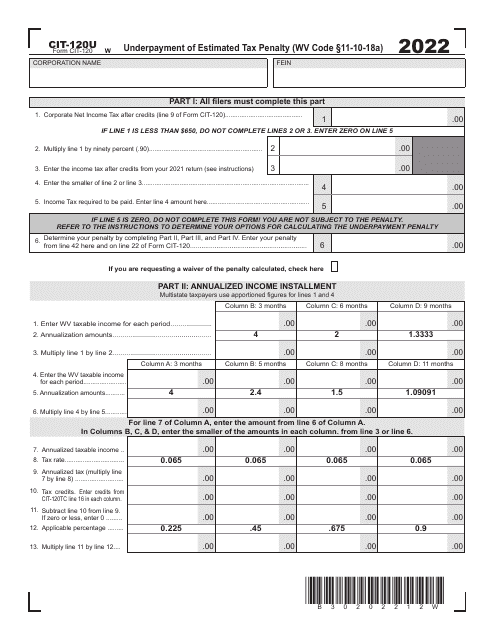

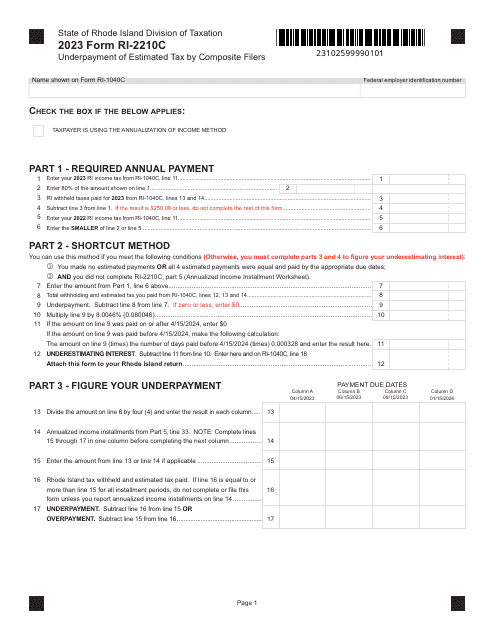

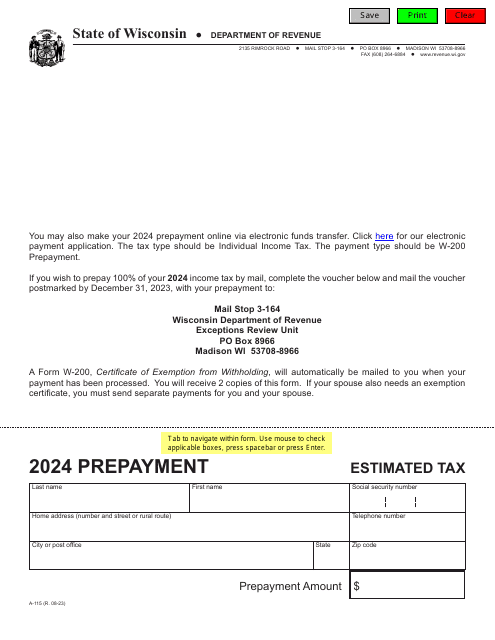

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

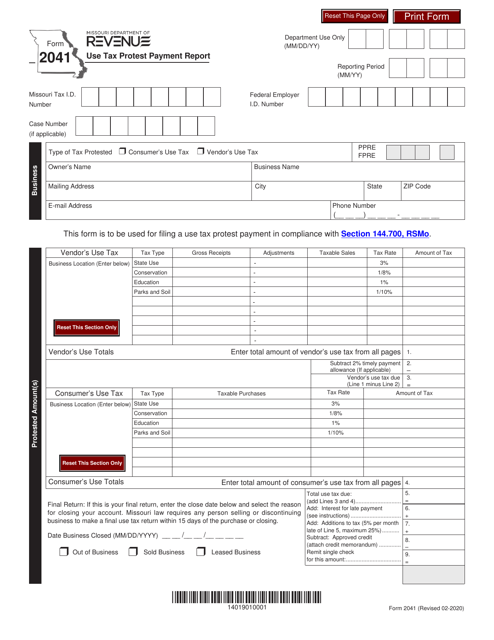

This form is used for reporting and protesting use tax payments in the state of Missouri. It allows individuals and businesses to dispute any taxes they believe were incorrectly imposed on their purchases.

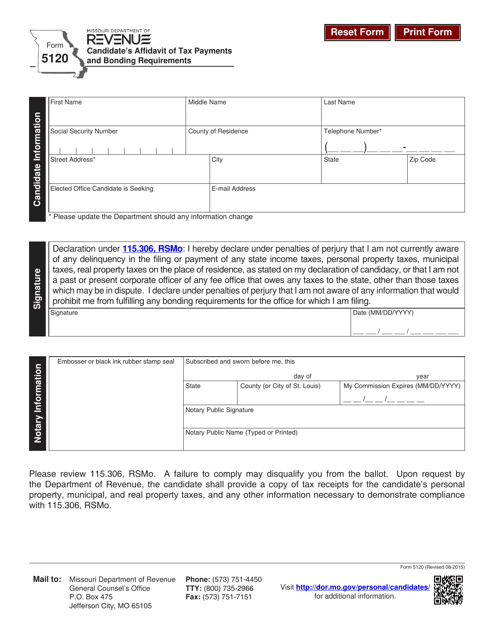

This form is used for candidates in Missouri to declare their tax payments and bonding requirements.

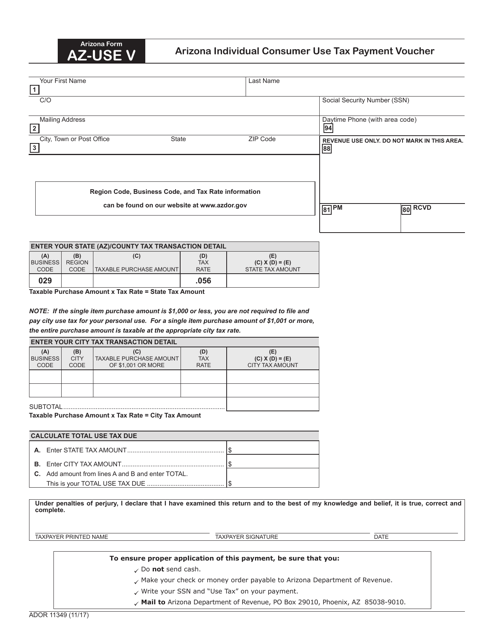

This Form is used for making individual consumer use tax payment in Arizona.

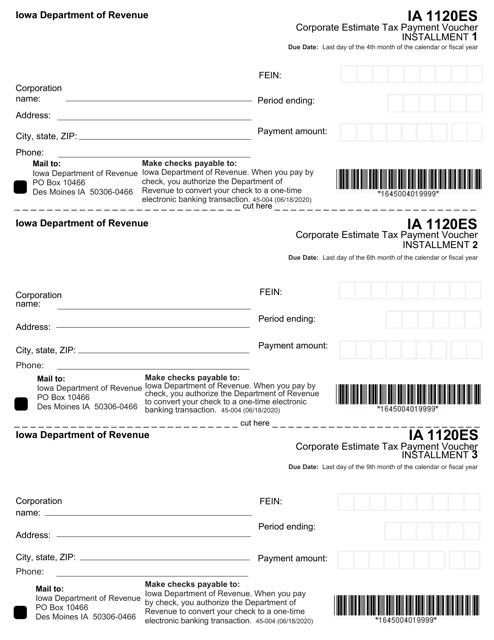

This form is used for making estimated tax payments for corporations in the state of Iowa.

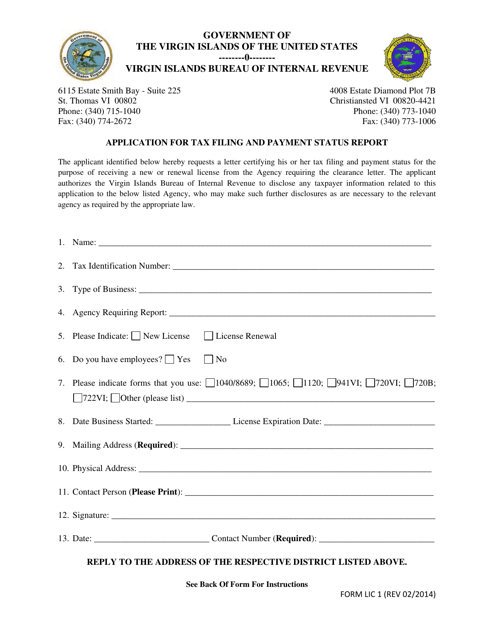

This form is used for applying for tax filing and payment status report in the Virgin Islands. It helps individuals and businesses to track their tax filing and payment history.

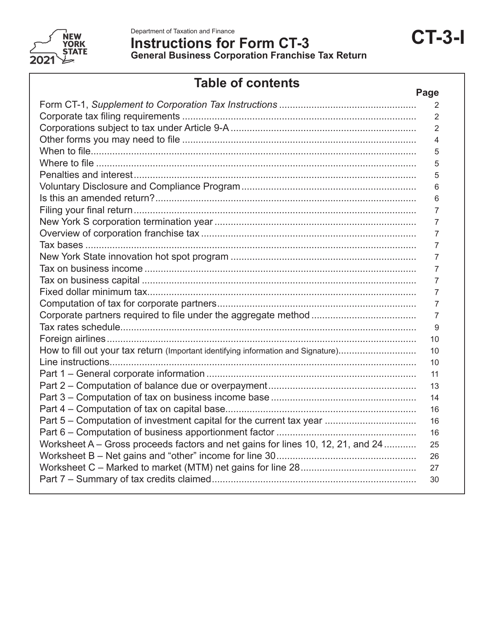

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

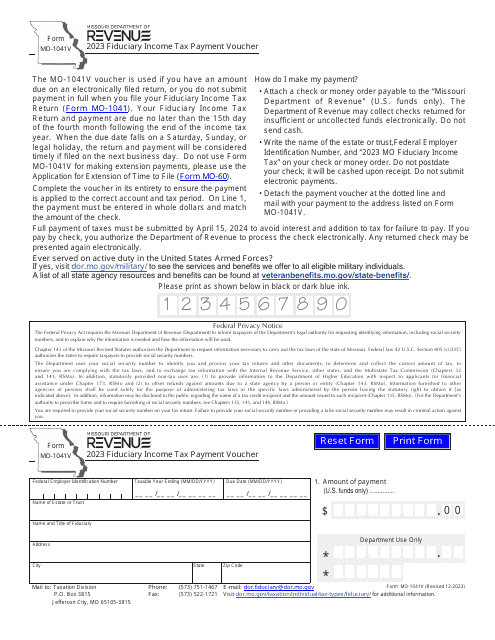

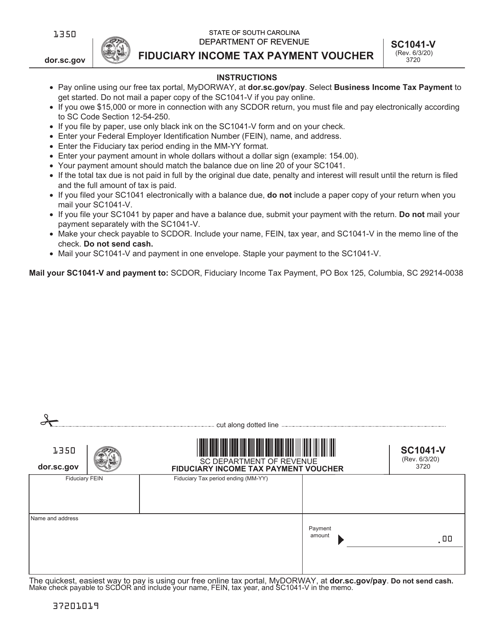

This form is used for making income tax payments as a fiduciary in South Carolina.

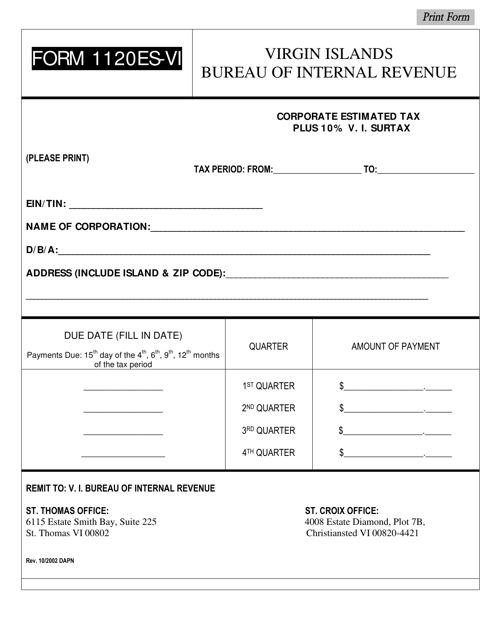

This Form is used for corporate estimated tax payments for businesses located in the Virgin Islands.

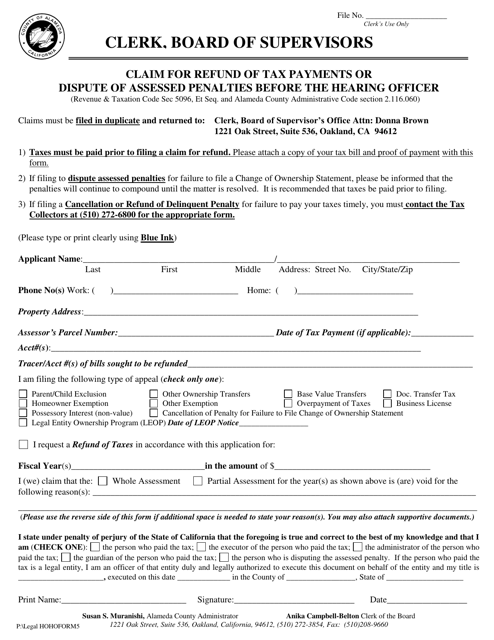

This document is used for filing a claim to request a refund of tax payments or dispute assessed penalties in the County of Alameda, California.