Individual Tax Form Templates

Documents:

127

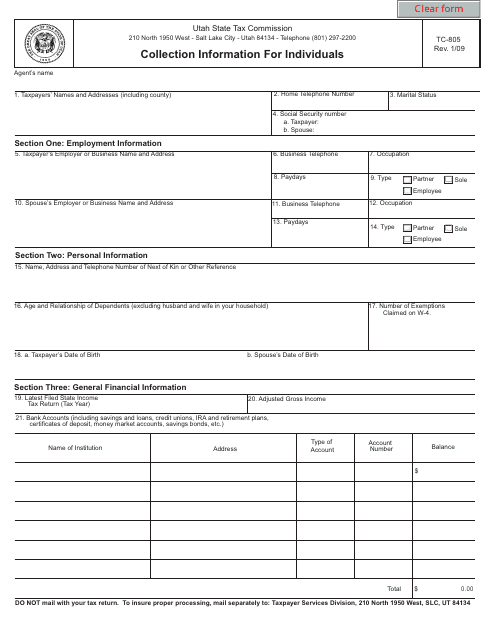

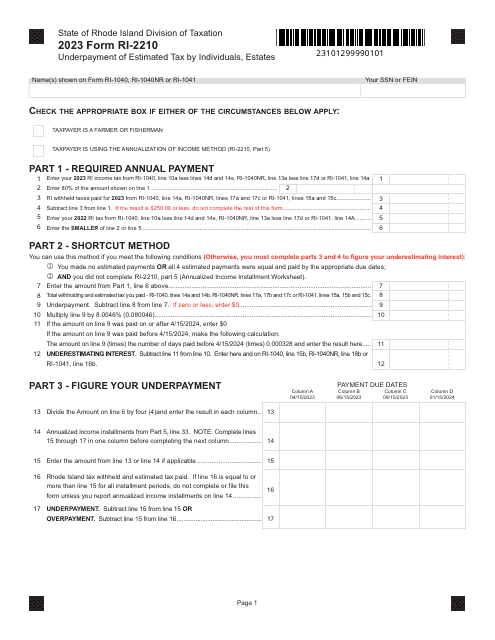

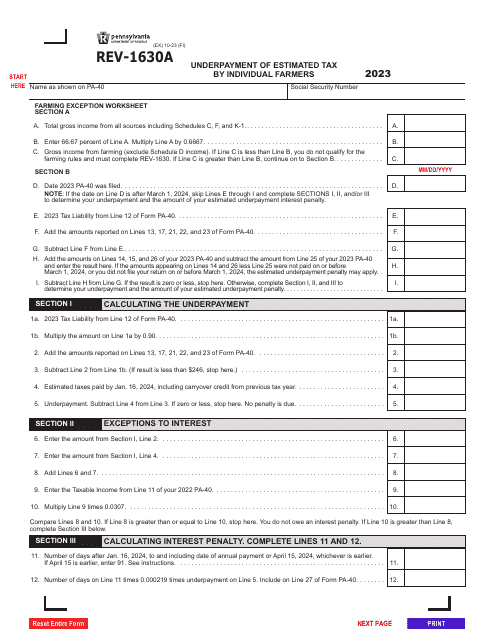

This form is used for collecting information from individuals in Utah for tax purposes. It helps the government determine an individual's ability to pay their taxes.

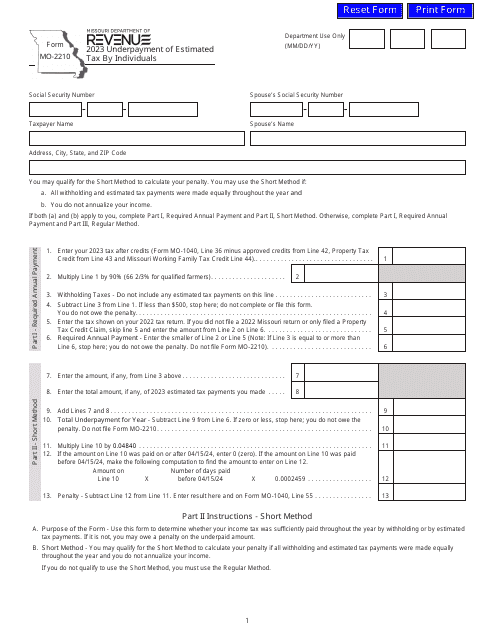

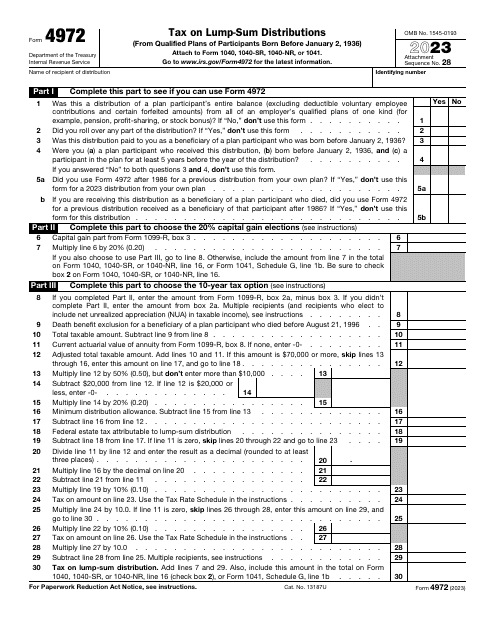

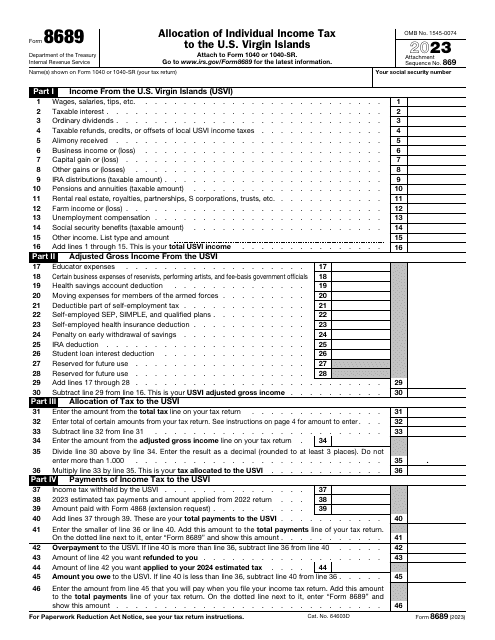

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

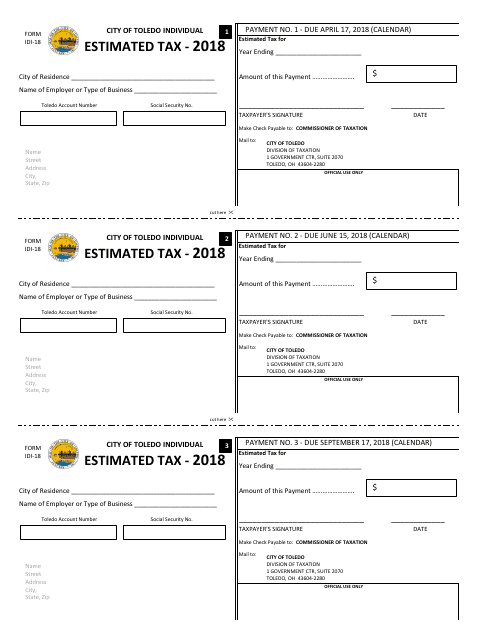

This form is used for individuals in Toledo, Ohio to submit their estimated taxes.

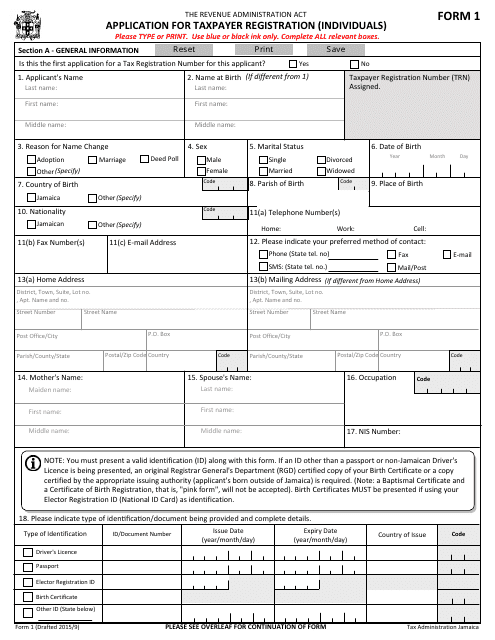

This Form is used for individuals in Jamaica to apply for taxpayer registration with the tax authorities.

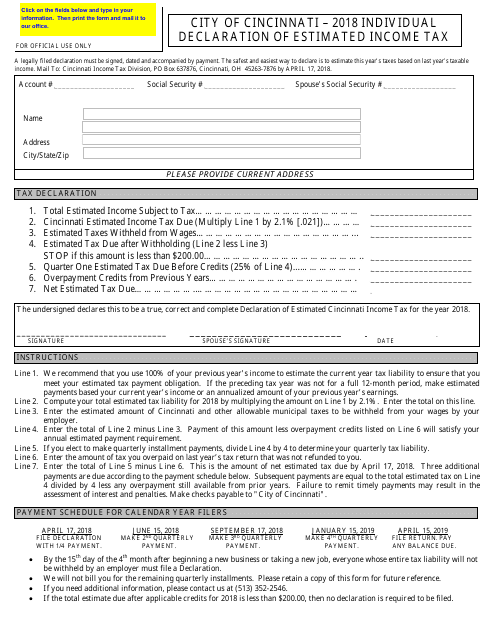

This document is used for individuals to declare their estimated income tax in the City of Cincinnati, Ohio. It is used to estimate and pay the amount of income tax owed to the city throughout the year.

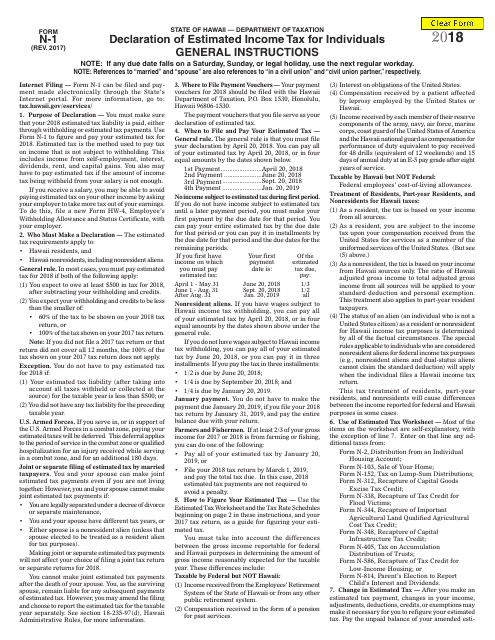

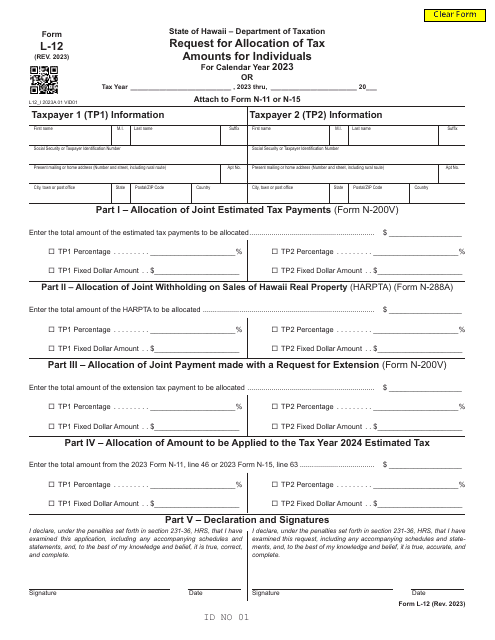

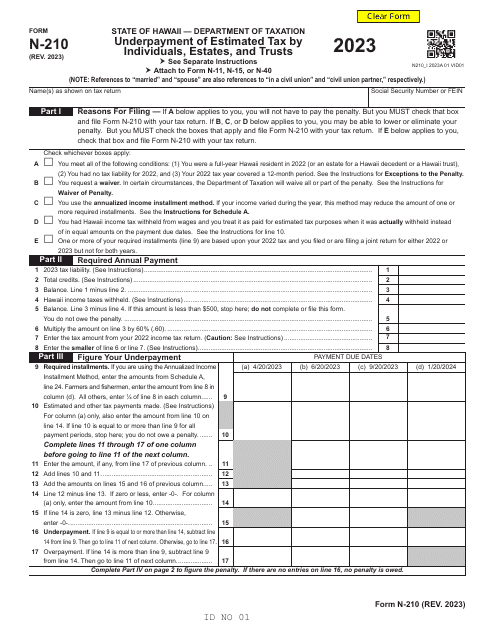

This form is used for individuals in Hawaii to declare their estimated income tax for the year. It is used to estimate and pay taxes throughout the year, rather than waiting until the tax return is due.

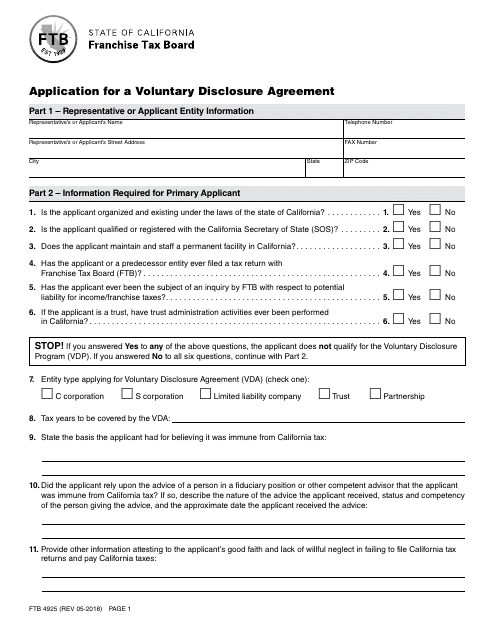

This Form is used for applying for a Voluntary Disclosure Agreement (VDA) in the state of California. A VDA allows taxpayers to voluntarily disclose and resolve past tax liabilities in exchange for potential penalty relief.

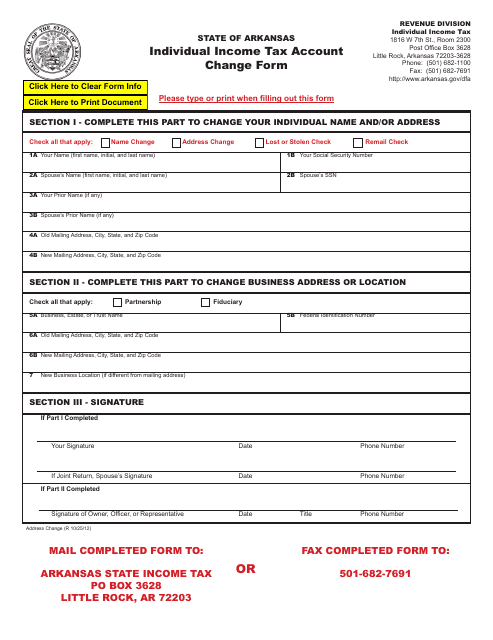

This Form is used for updating your name and address for individual income tax purposes in Arkansas.

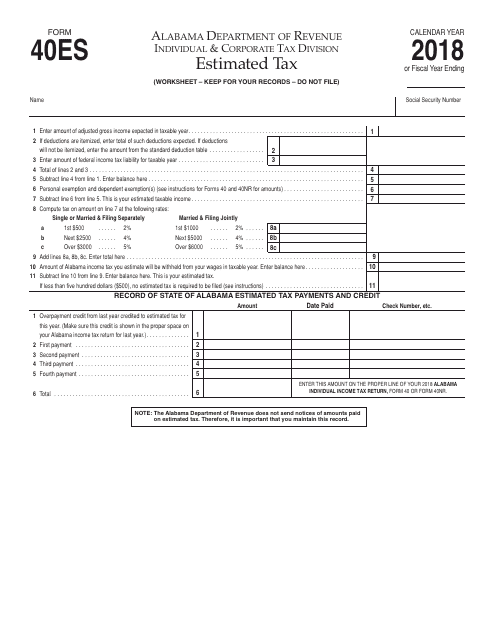

This form is used for individuals in Alabama to report and pay estimated taxes.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

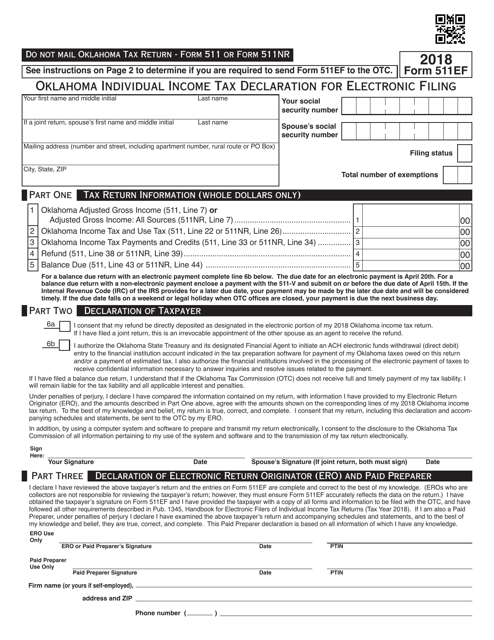

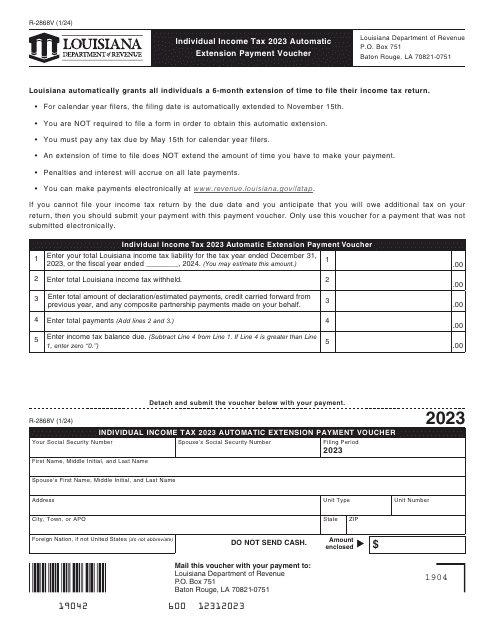

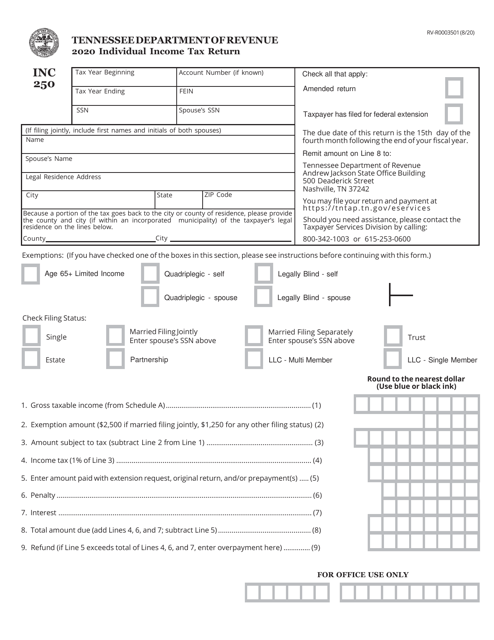

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

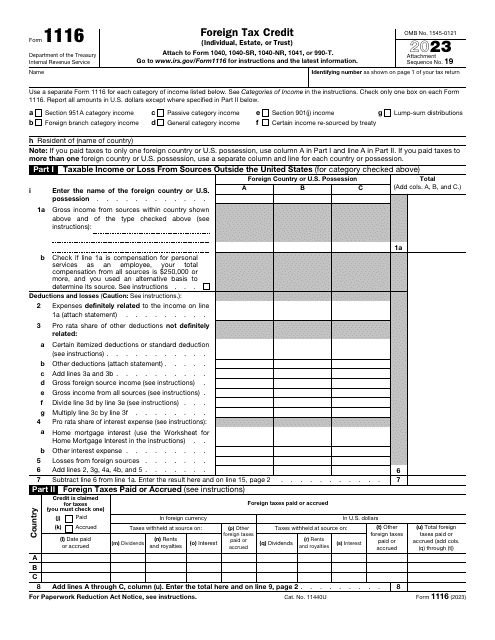

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

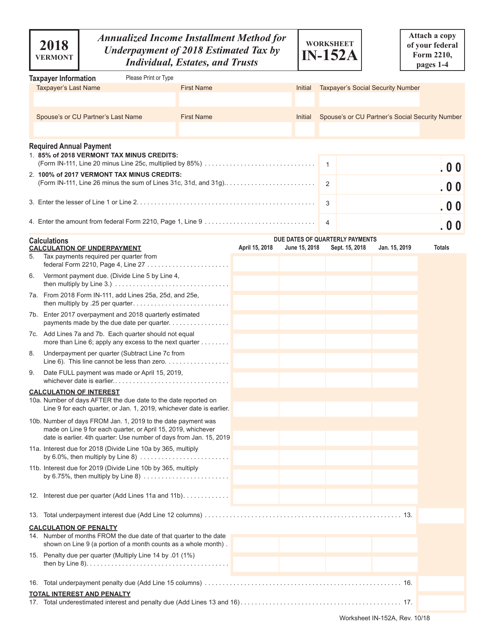

This document is a worksheet that individuals, estates, and trusts in Vermont can use to calculate their annualized income installment for the underpayment of estimated tax for the year 2018. It helps determine if any additional tax needs to be paid to avoid penalties.

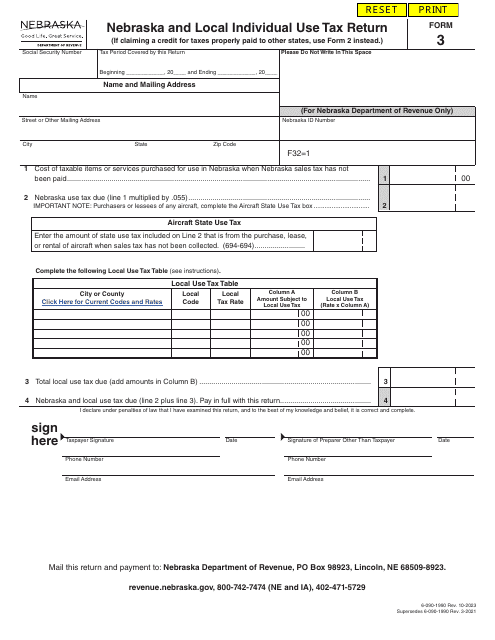

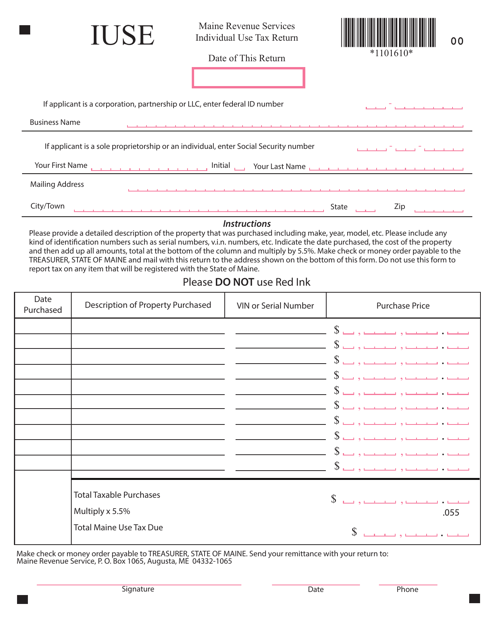

This form is used for reporting and paying individual use tax in the state of Maine. Individual use tax is owed on items purchased outside of Maine that would have been subject to sales tax if purchased in the state.

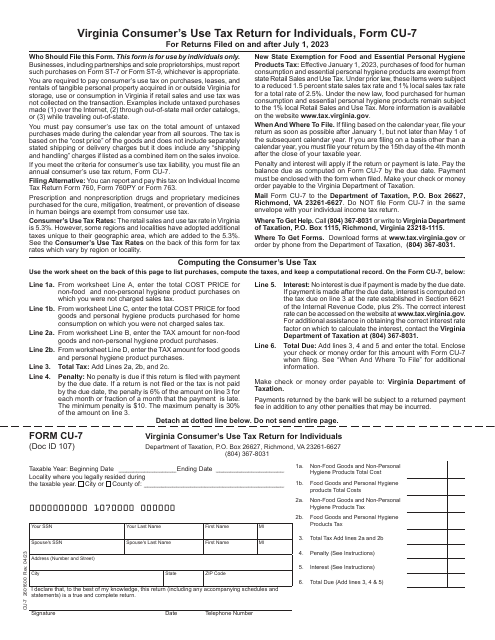

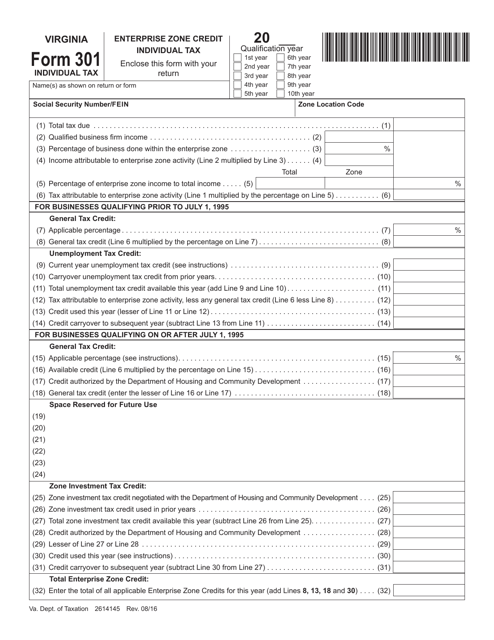

This form is used for claiming the Enterprise Zone Credit on individual taxes in the state of Virginia.

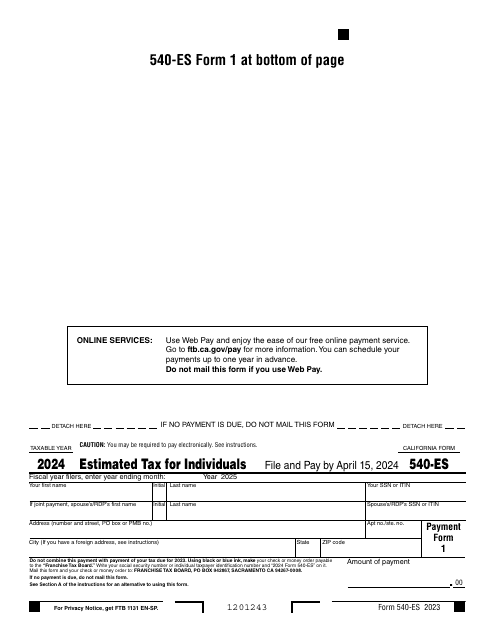

Fill out this form over the course of a year to pay your taxes in the state of California.

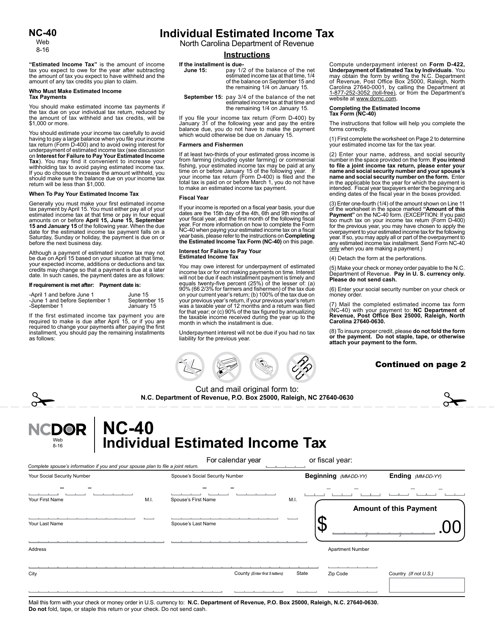

This Form is used for filing individual estimated income tax payments in the state of North Carolina.

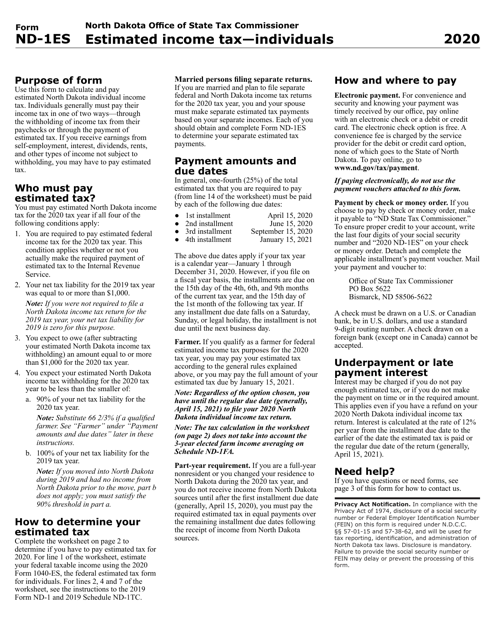

This Form is used for individuals in North Dakota to calculate and pay their estimated state income taxes.

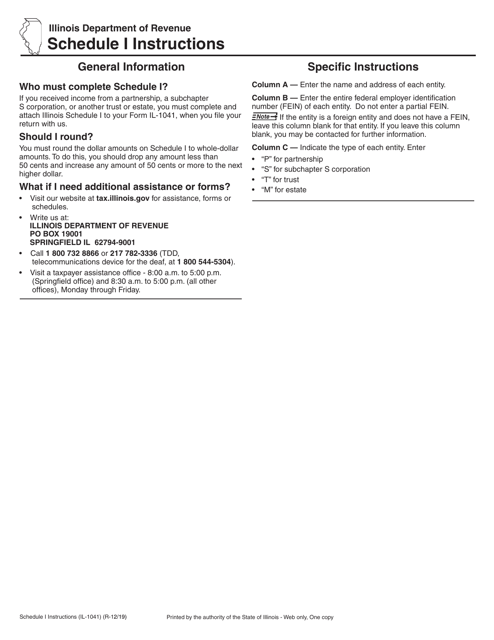

This Form is used for reporting income received in the state of Illinois when filing Form IL-1041. It provides instructions for filling out Schedule I, which is used to report various types of income.