Individual Tax Form Templates

Documents:

127

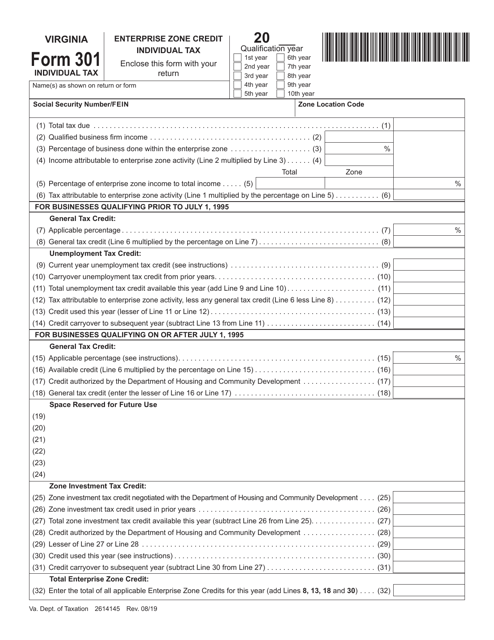

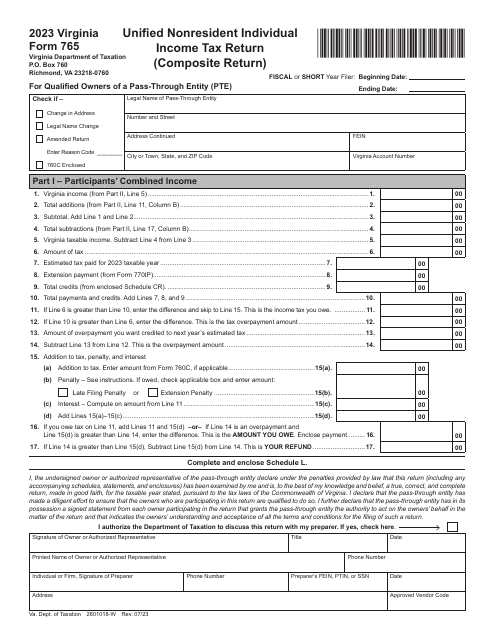

This Form is used for claiming the Enterprise Zone Credit on individual income tax returns in Virginia.

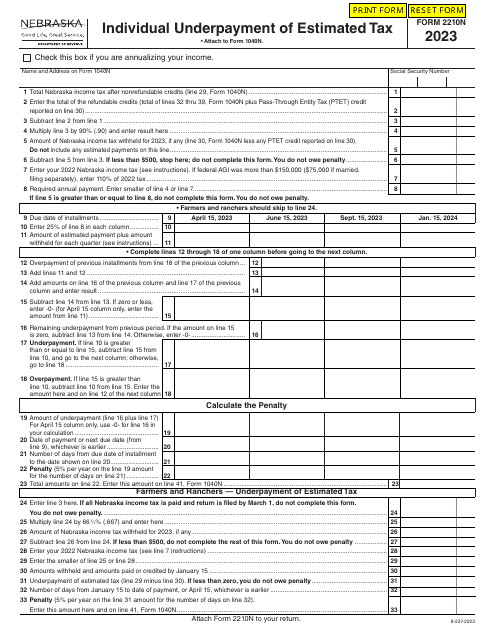

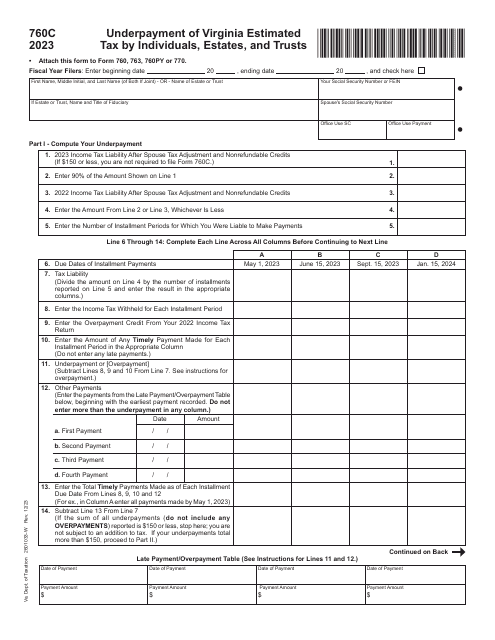

Form 760C Underpayment of Virginia Estimated Tax by Individuals, Estates and Trusts - Virginia, 2023

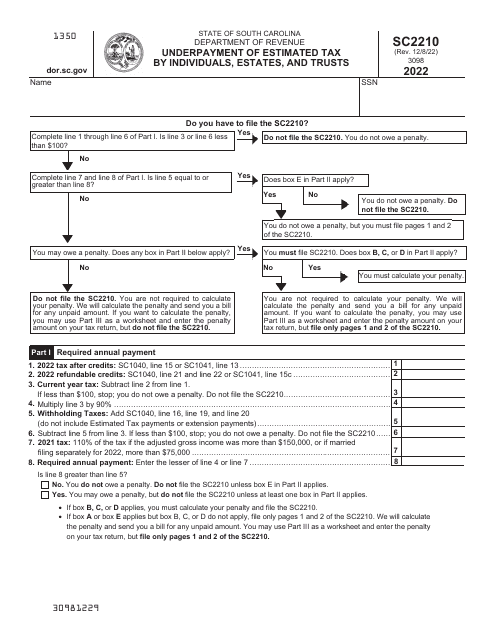

Form SC2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts - South Carolina, 2022

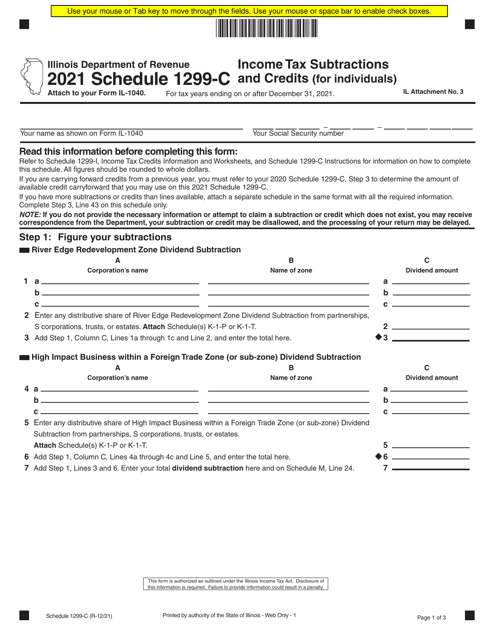

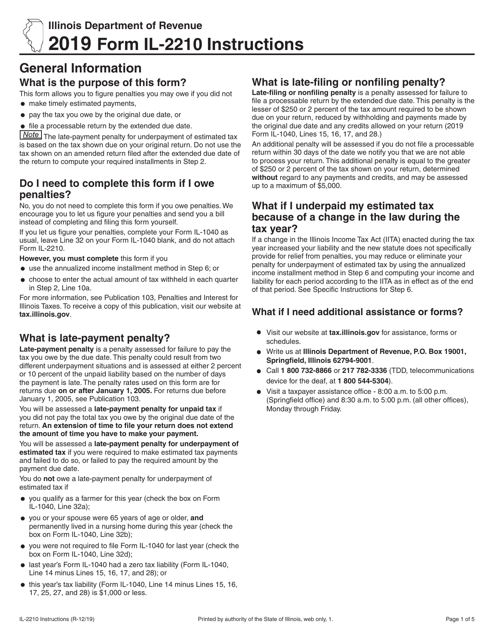

This form is used for calculating penalties for individuals in Illinois who have underpaid their taxes or failed to file their tax returns on time. It provides instructions on how to compute the penalties and includes the necessary calculations.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

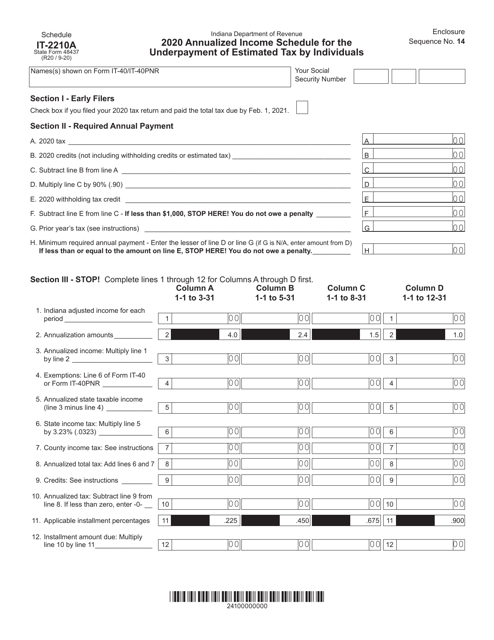

This form is used for calculating the underpayment of estimated tax by individuals in Indiana. It is an annualized income schedule that helps individuals determine if they owe any additional tax due to underestimating their income throughout the year.

This Form is used for filing Arkansas state income tax returns for foreign individuals and non-resident taxpayers. It provides instructions on how to accurately complete the AR1002F and AR1002NR forms.

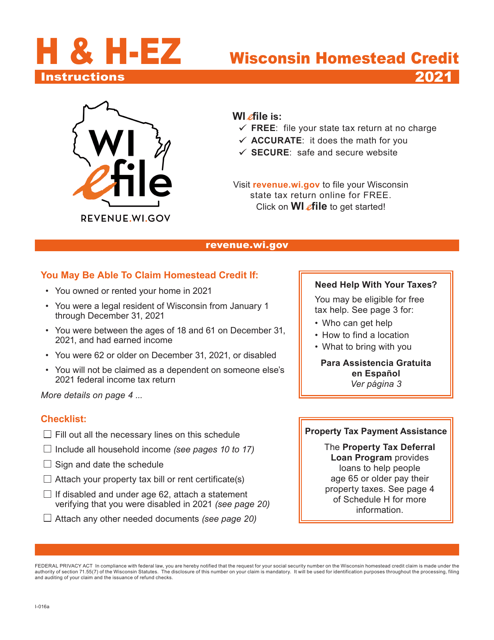

This Form is used for providing instructions on how to fill out Form I-015, I-016 Schedule H, H-EZ specific to individuals residing in Wisconsin.

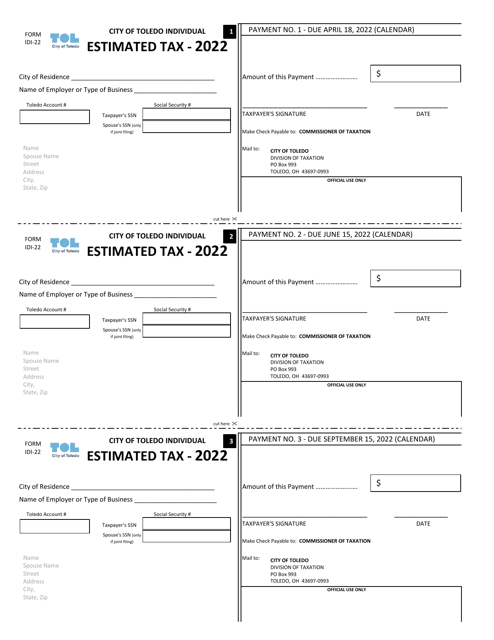

This form is used for individuals in Toledo, Ohio to estimate their city taxes.