Tax Refund Form Templates

Documents:

569

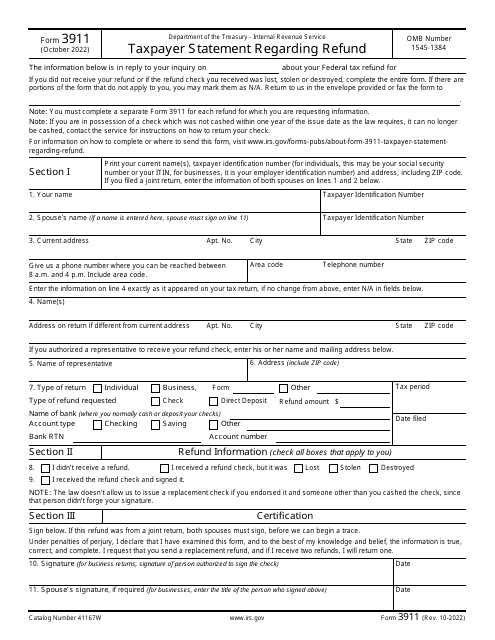

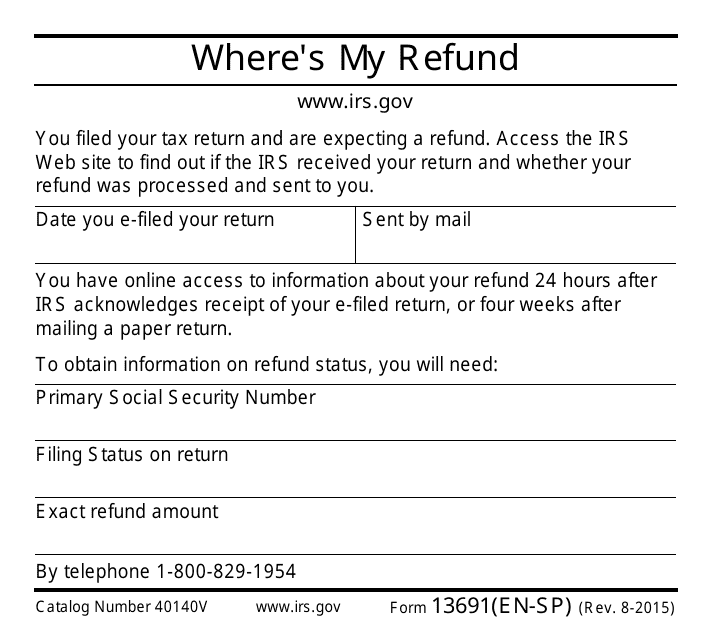

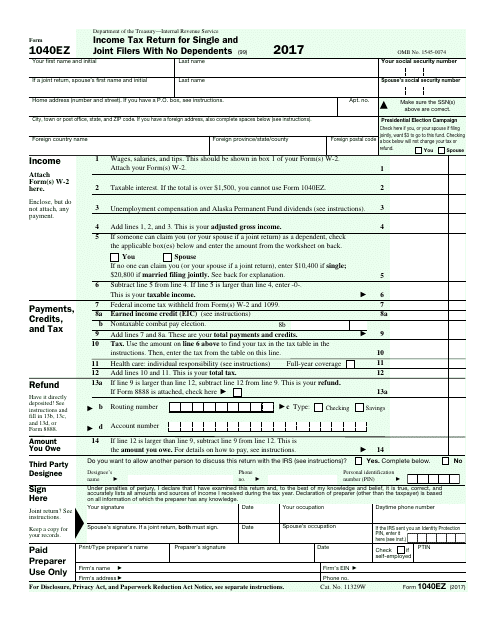

This is an IRS legal document completed by individuals who want to inquire about the status of an expected tax refund.

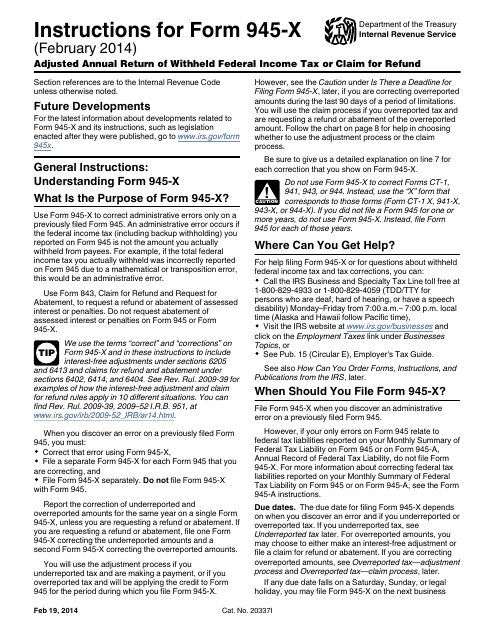

This Form is used for making adjustments to the annual return of withheld federal income tax or claiming a refund. It is specifically designed for the IRS Form 945-X.

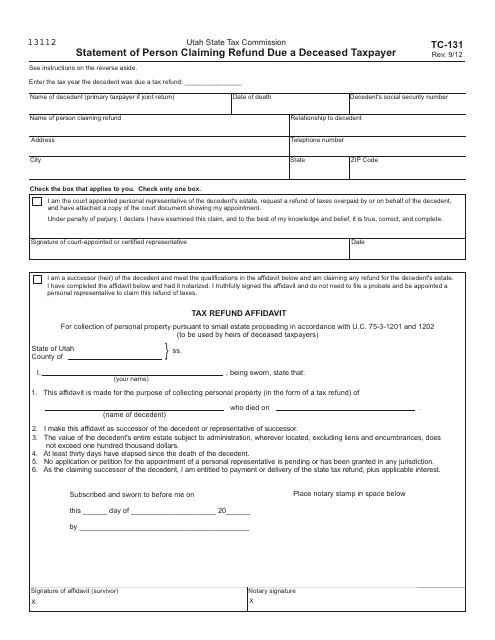

This form is used for individuals claiming a refund on behalf of a deceased taxpayer in the state of Utah.

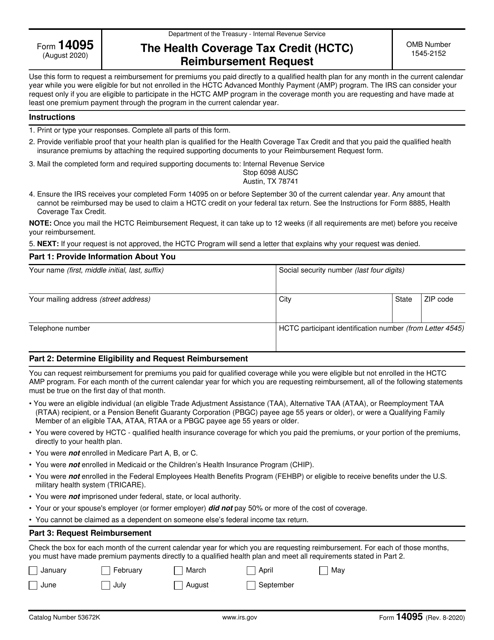

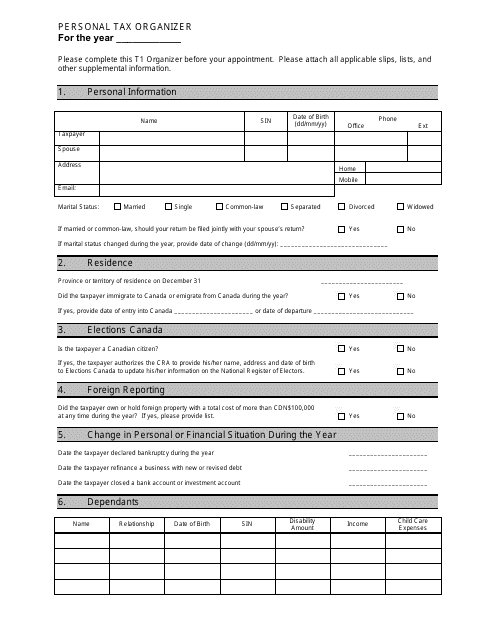

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

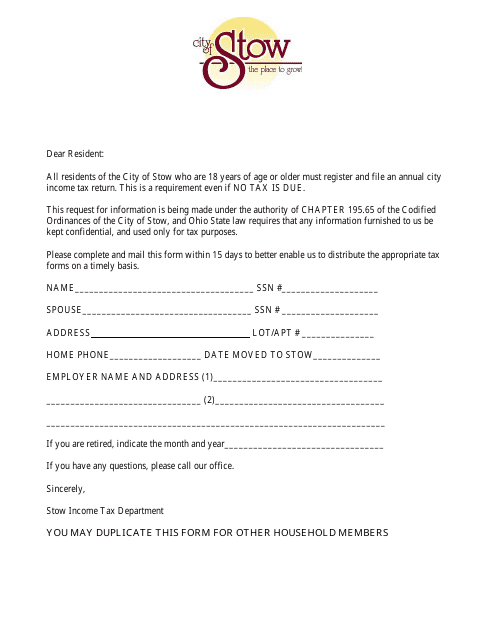

This Form is used for filing your income tax return in the City of Stow, Ohio.

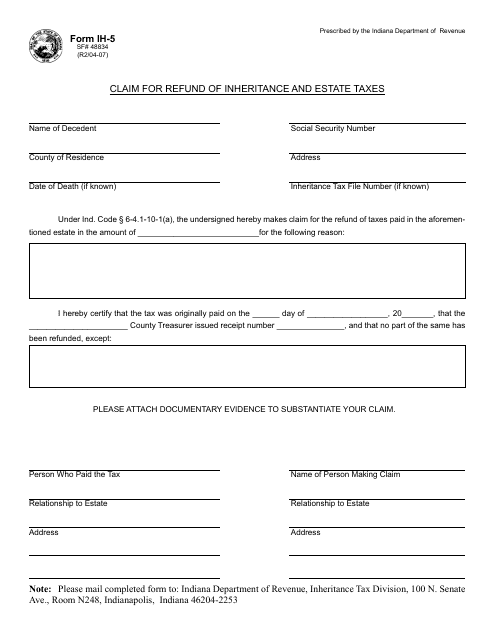

This form is used for claiming a refund of inheritance and estate taxes in the state of Indiana.

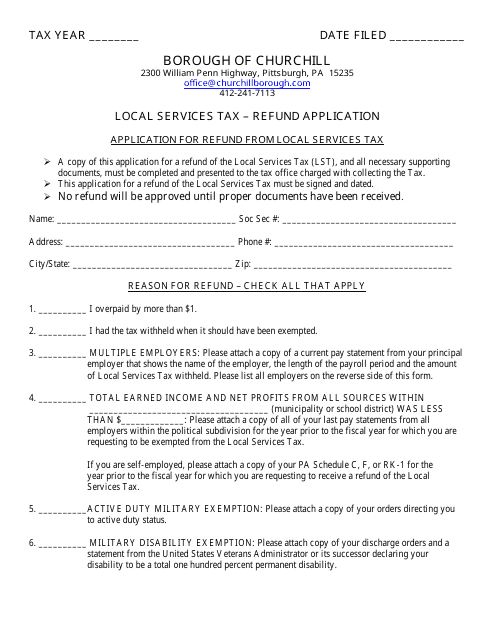

This Form is used for applying for a refund of local services tax paid to the Borough of Churchill, Pennsylvania.

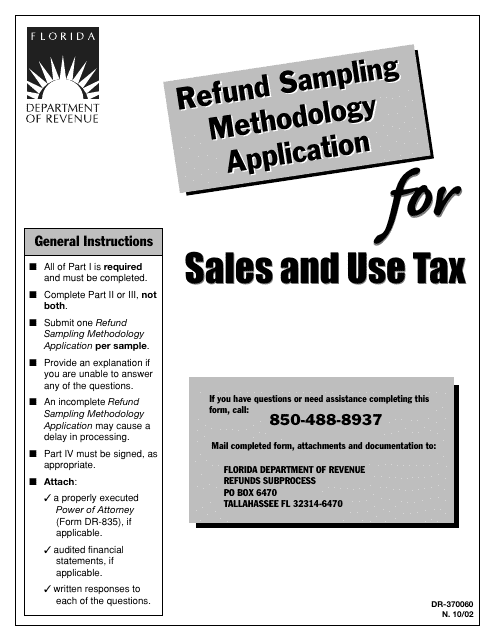

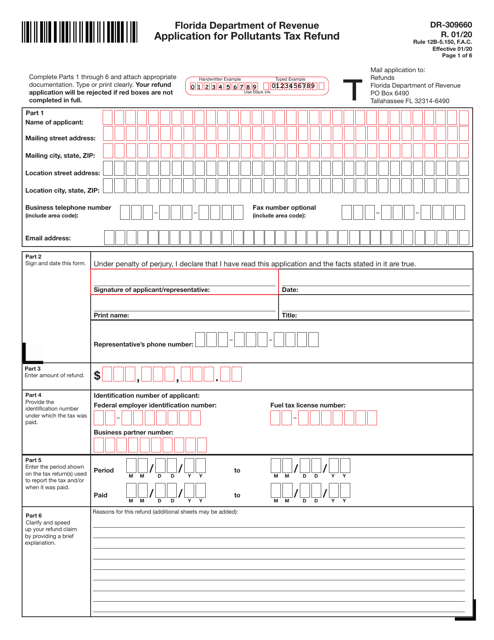

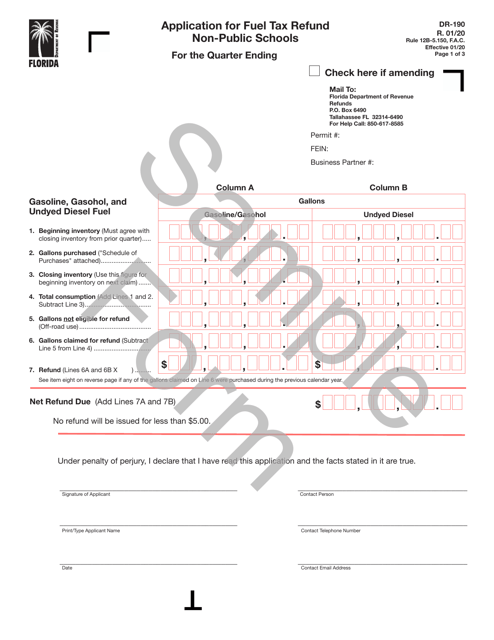

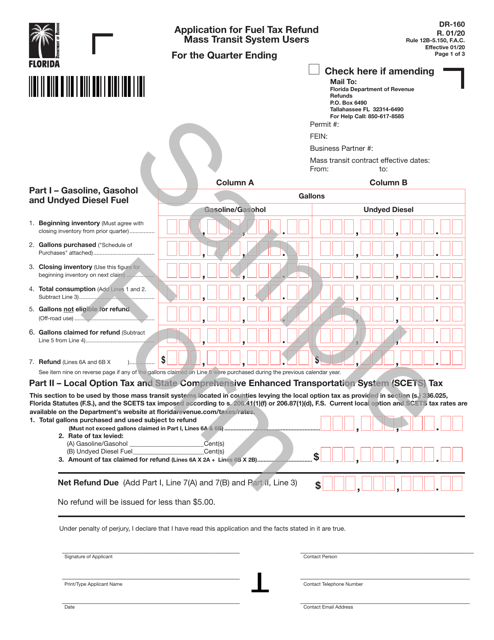

This Form is used for applying for a refund of sales and use tax in Florida. It specifically pertains to the sampling methodology that will be used to determine the amount of the refund.

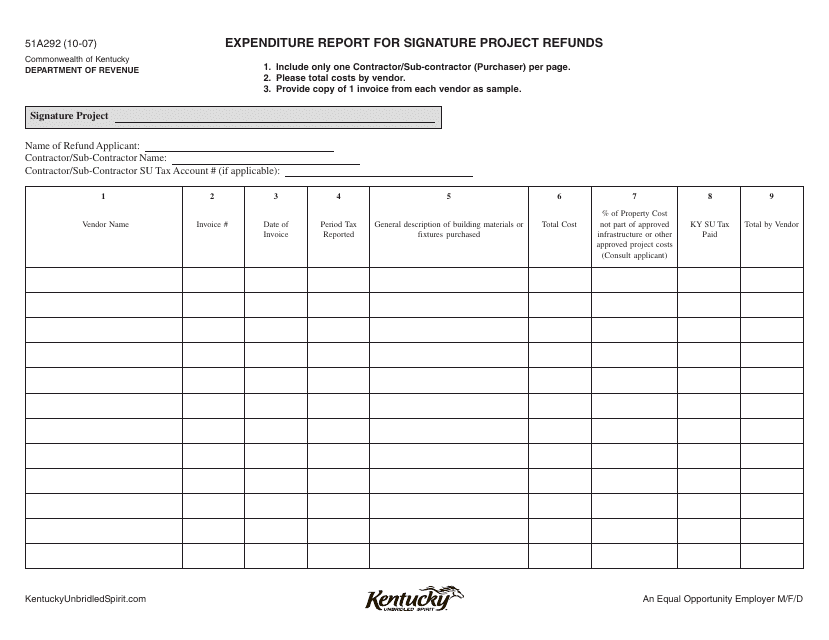

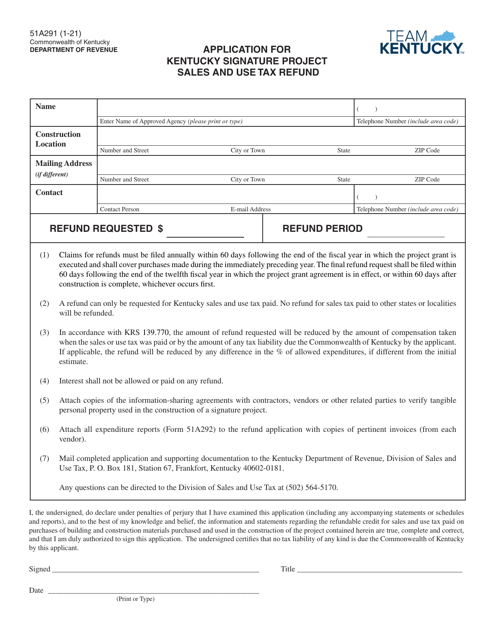

This form is used for reporting expenditures related to signature project refunds in the state of Kentucky.

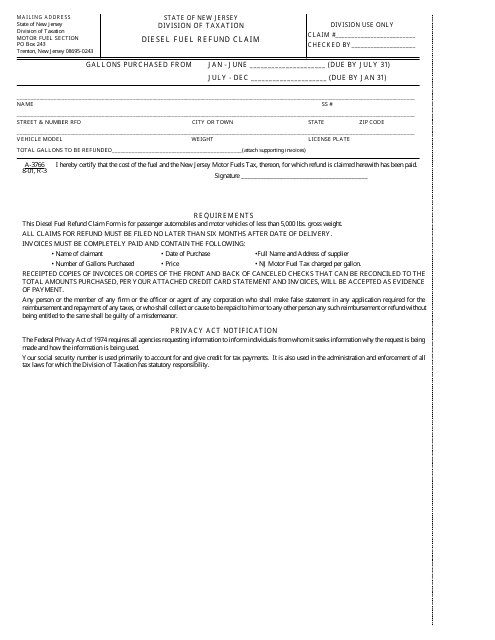

This form is used for claiming a refund on diesel fuel taxes paid in the state of New Jersey.

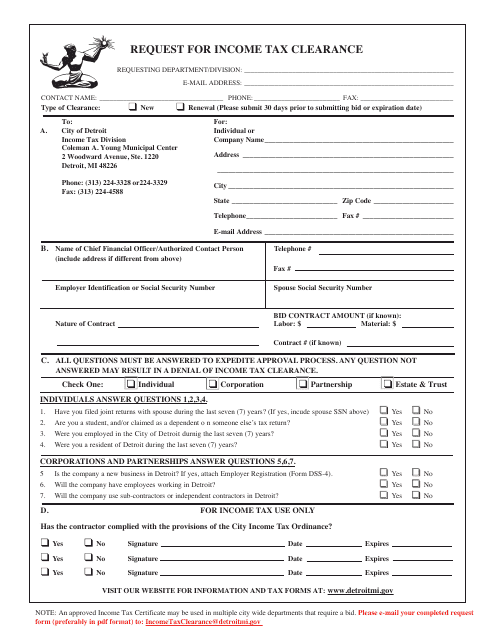

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

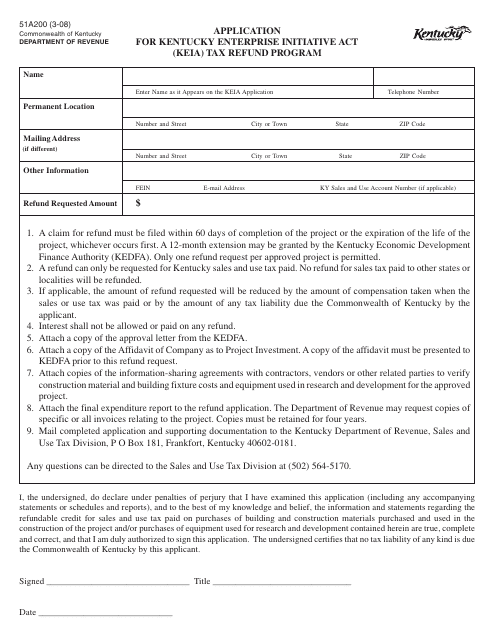

This form is used for applying for the Kentucky Enterprise Initiative Act (Keia) Tax Refund Program in Kentucky.

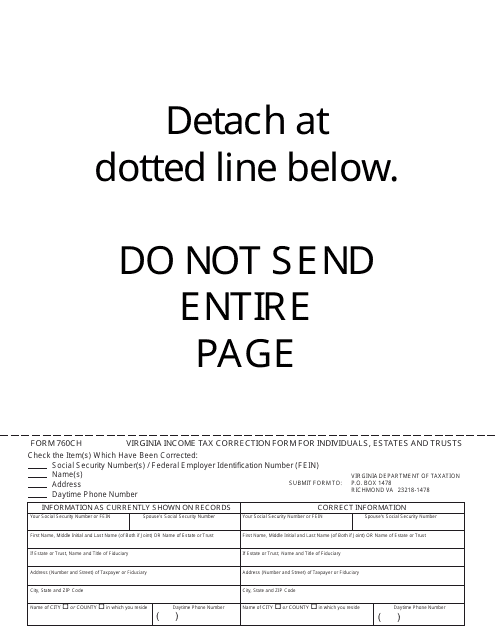

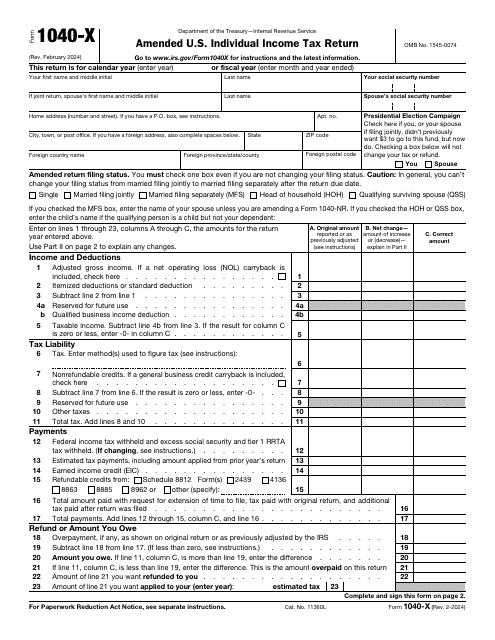

This form is used for correcting Virginia income tax filings for individuals, estates, and trusts in the state of Virginia. It is used to amend any errors or omissions made on previous tax returns.

This type of document, IRS Form 13691(EN-SP) Where Is My Refund (English/Spanish), is used for tracking the status of your tax refund with the IRS. It is available in both English and Spanish.

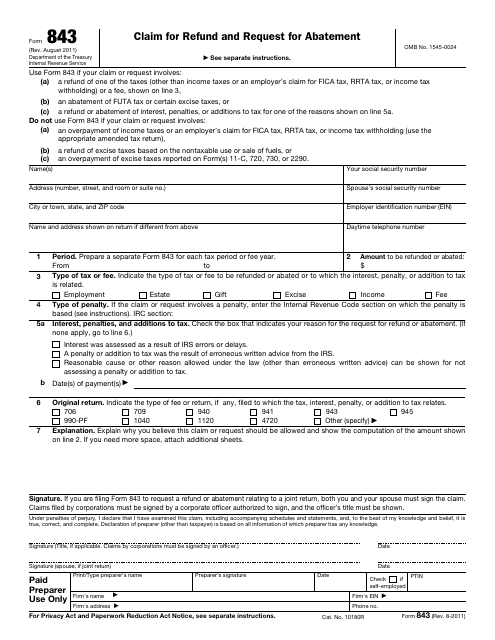

This form is used for claiming a refund and requesting a reduction in penalties or interest from the Internal Revenue Service (IRS).

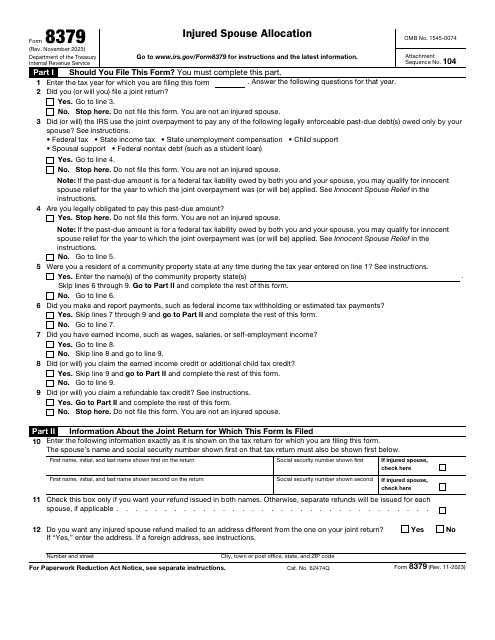

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

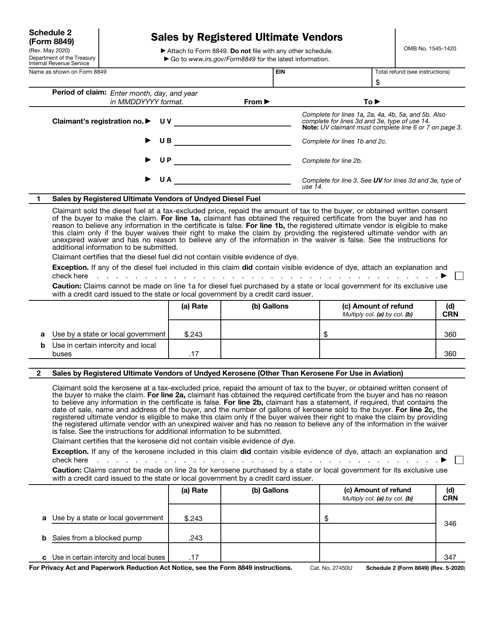

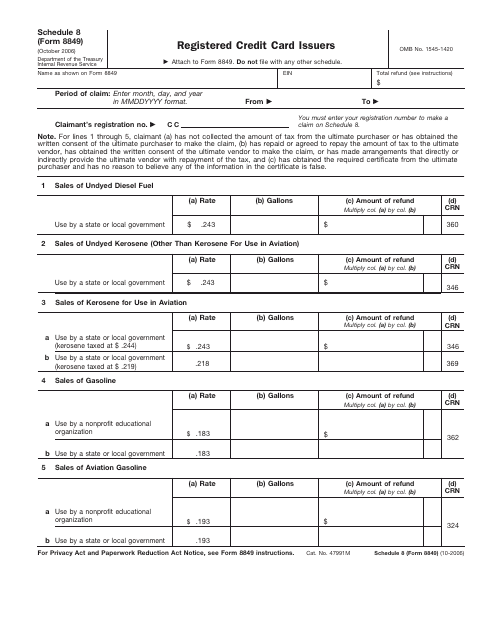

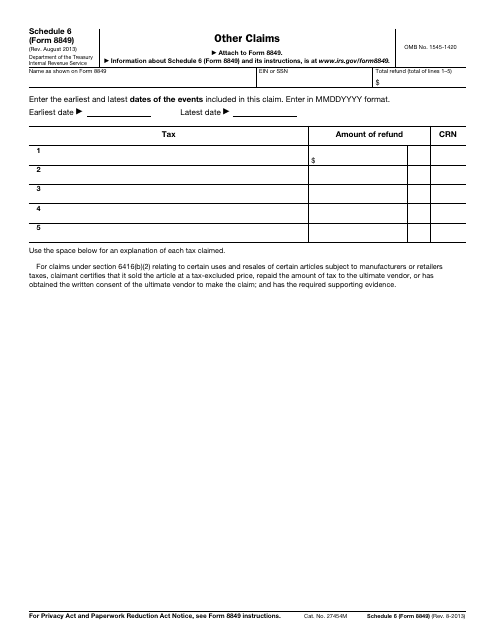

This Form is used for making other claims such as refunds for certain fuel-related taxes paid in error or excessive amounts.

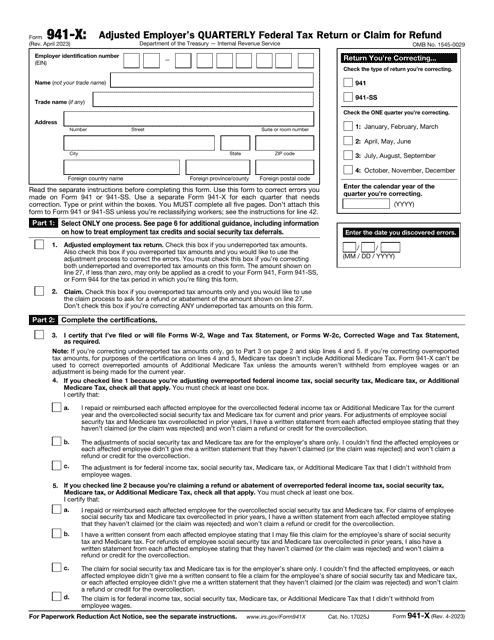

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

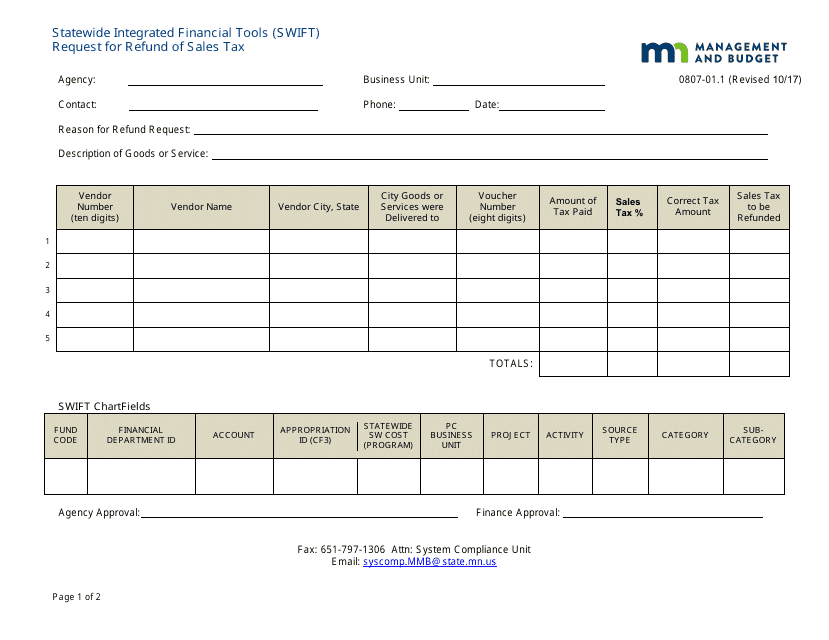

This form is used for Minnesota residents to request a refund of sales tax through the Statewide Integrated Financial Tools (Swift) system.

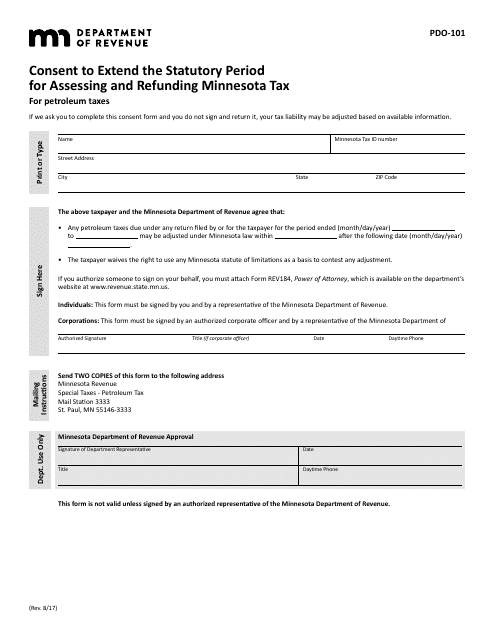

This form is used for requesting to extend the statutory period for assessing and refunding Minnesota tax for petroleum taxes in the state of Minnesota.

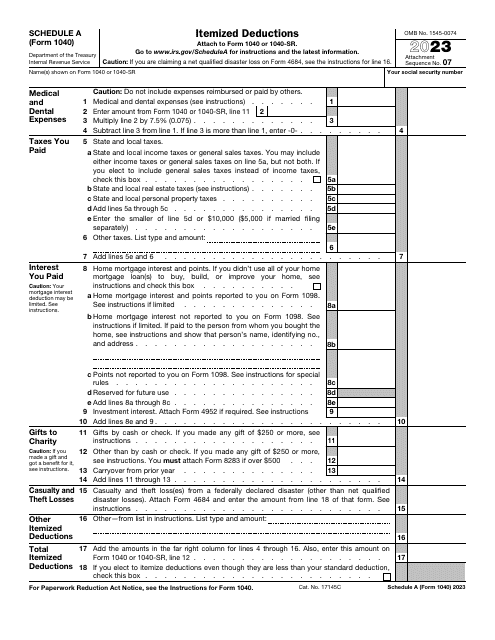

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

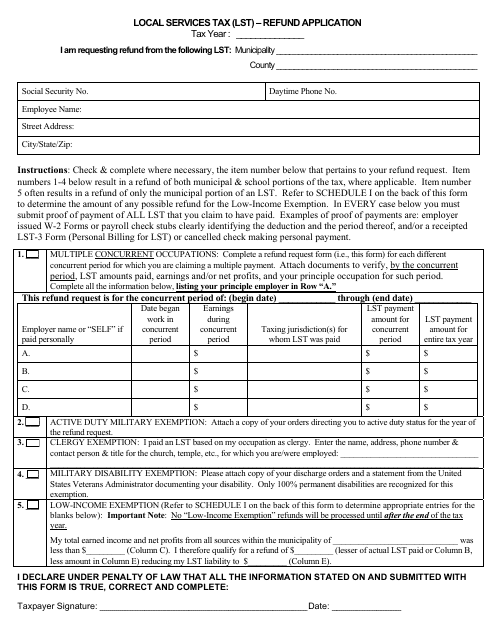

This Form is used for applying for a refund of the Local Services Tax (LST).

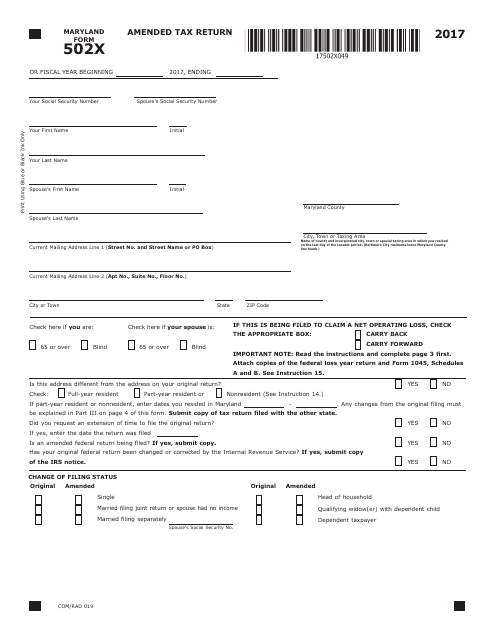

This form is used for filing an amended tax return in the state of Maryland.

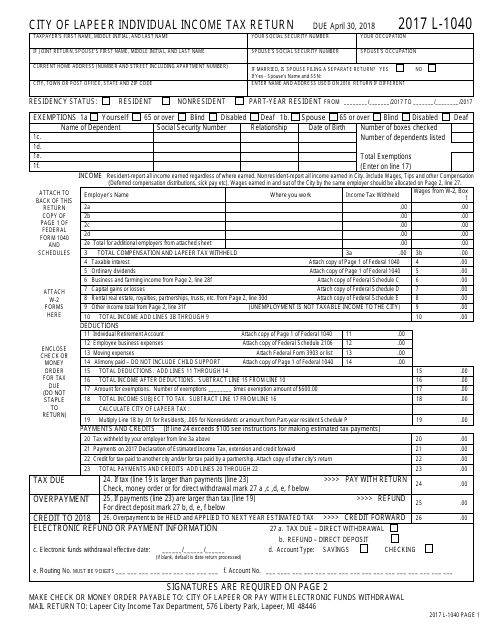

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.