Tax Refund Form Templates

Documents:

569

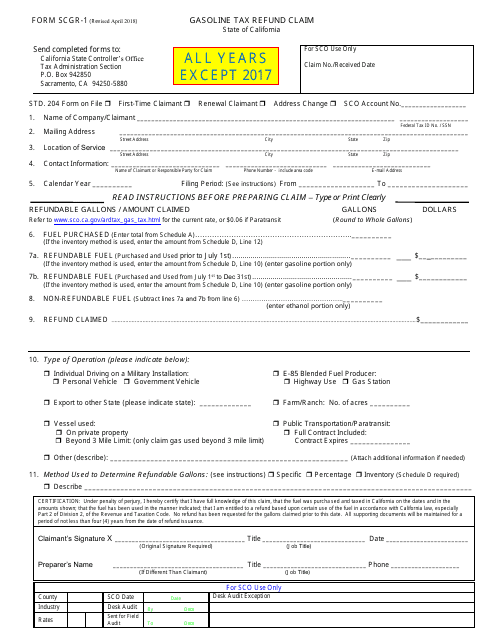

This Form is used for claiming a refund of gasoline tax in California.

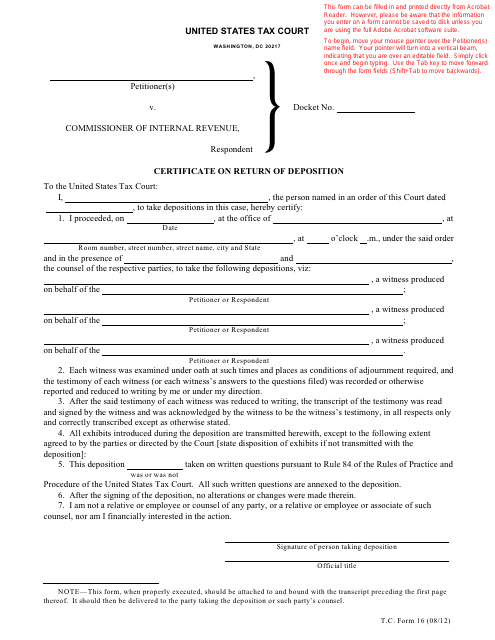

This Form is used for filing a certificate on the return of a deposition in a legal case.

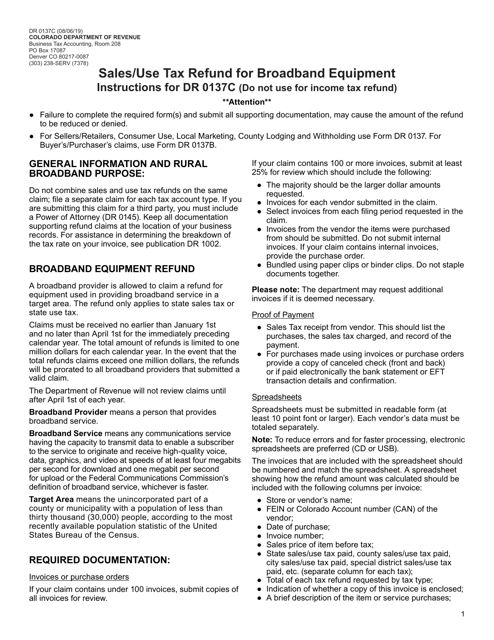

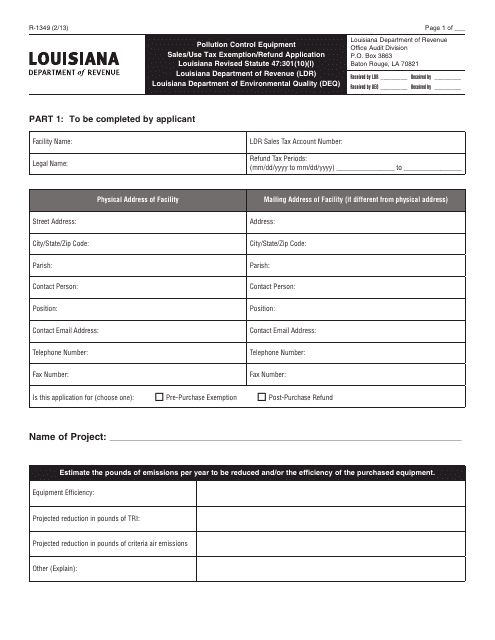

This type of document is an application form used in Louisiana to request an exemption or refund for sales or use tax related to pollution control equipment.

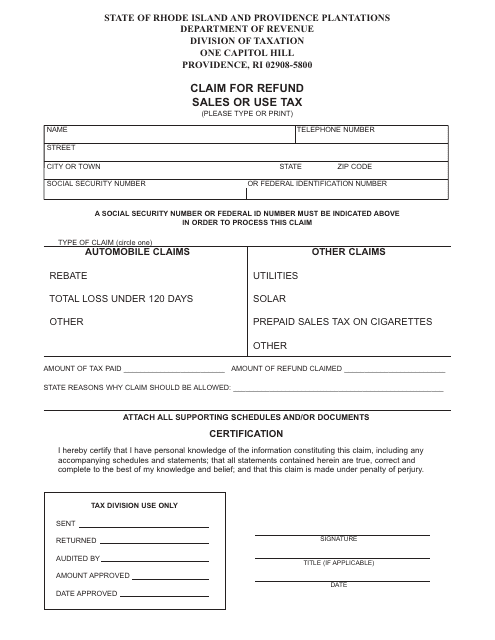

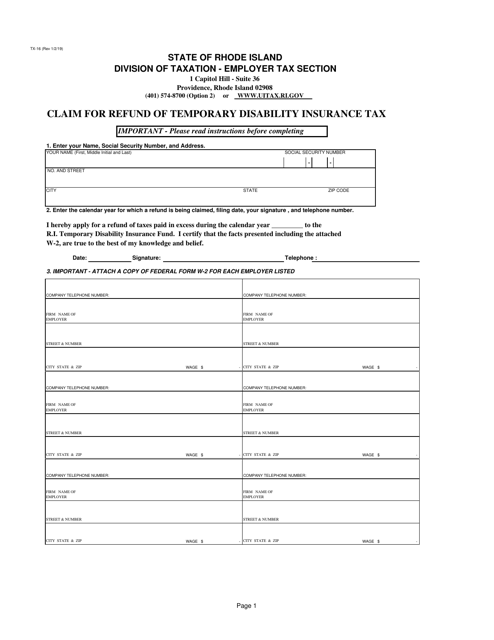

This document is for claiming a refund of sales or use tax paid in Rhode Island. You can use this form to request a refund if you believe you have overpaid or are eligible for a tax exemption.

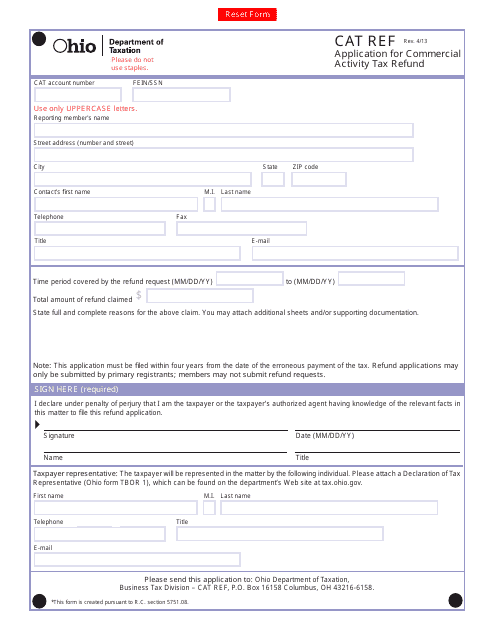

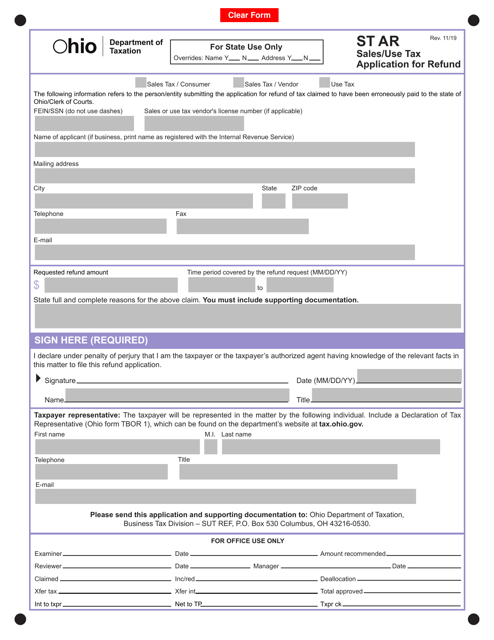

This Form is used for applying for a refund of Commercial Activity Tax in the state of Ohio.

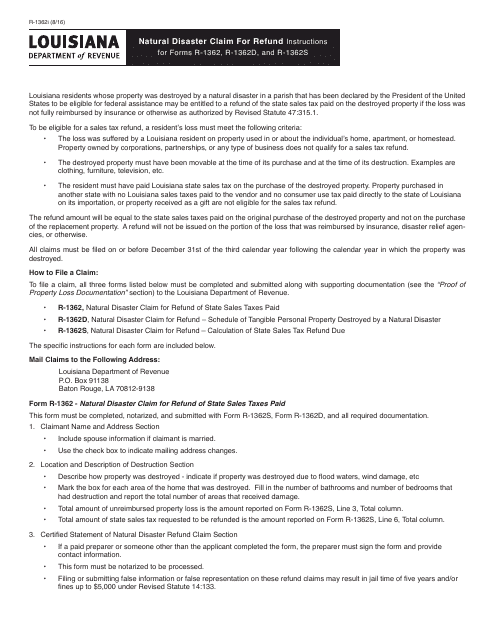

This form is used for filing a claim for a refund in case of natural disasters in Louisiana. It provides instructions for Form R-1362, R-1362D, and R-1362S.

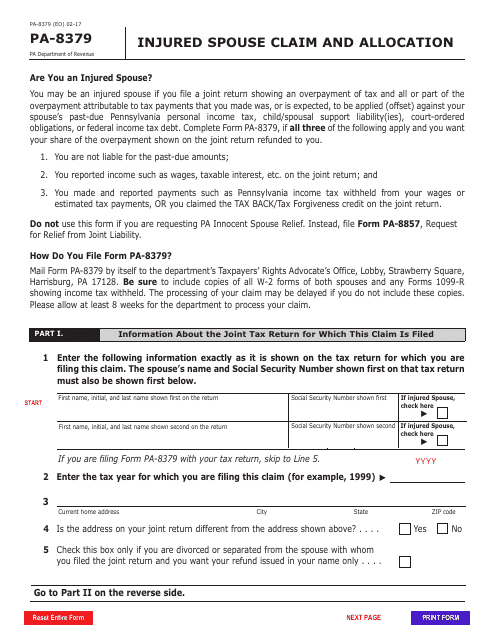

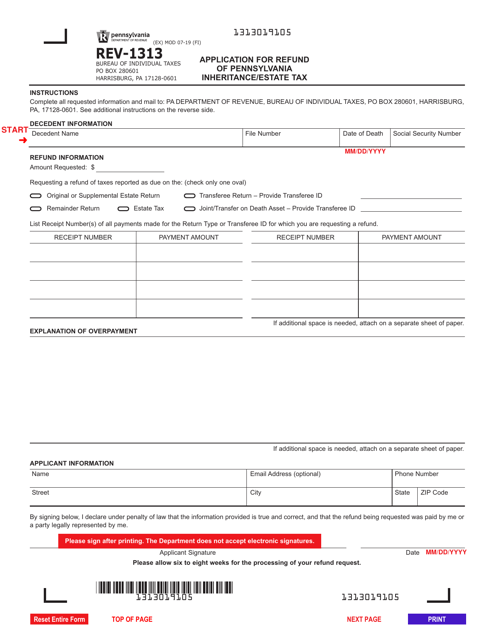

This form is used for spouses in Pennsylvania to file a claim and allocate any refunds due to them when their tax refund is being offset for their partner's debts.

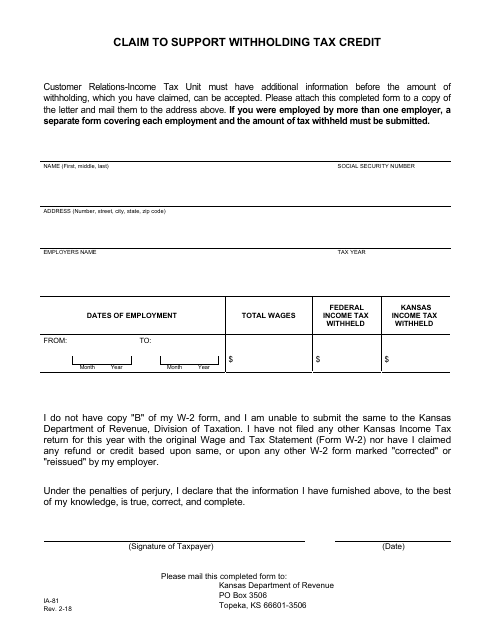

This Form is used for residents of Kansas to claim a withholding tax credit.

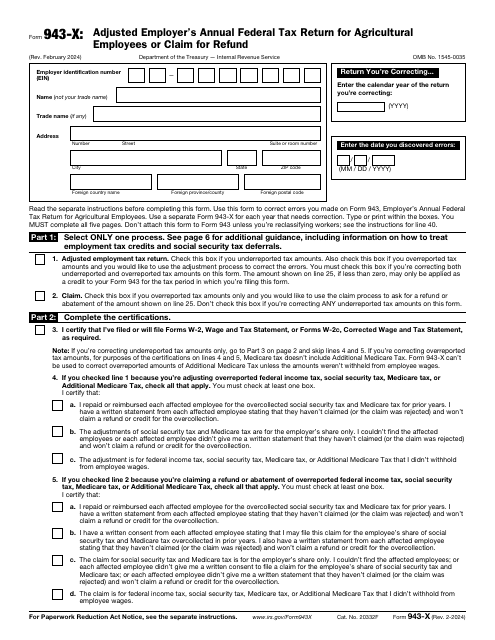

This is an IRS form designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages.

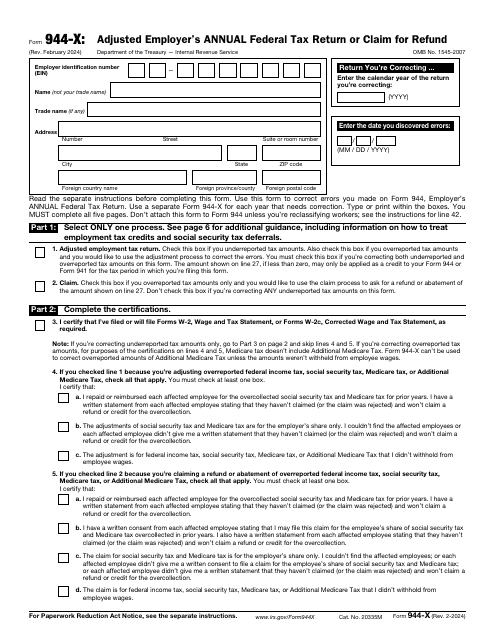

This is a fiscal form used by employers that learned about the need to correct a previously filed IRS Form 944, Employer's Annual Federal Tax Return.

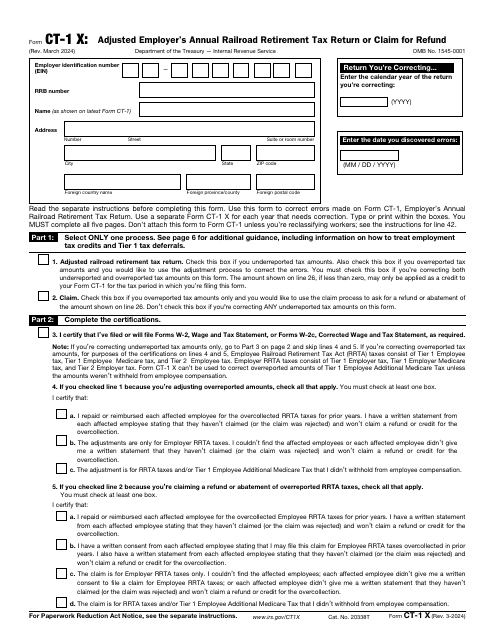

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.

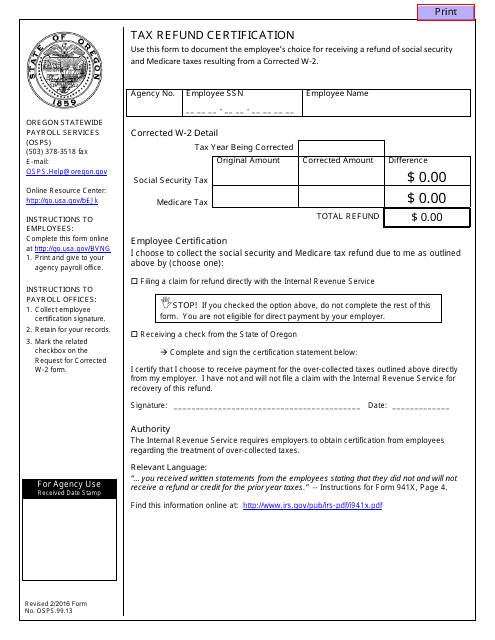

This form is used for certifying your tax refund in the state of Oregon.

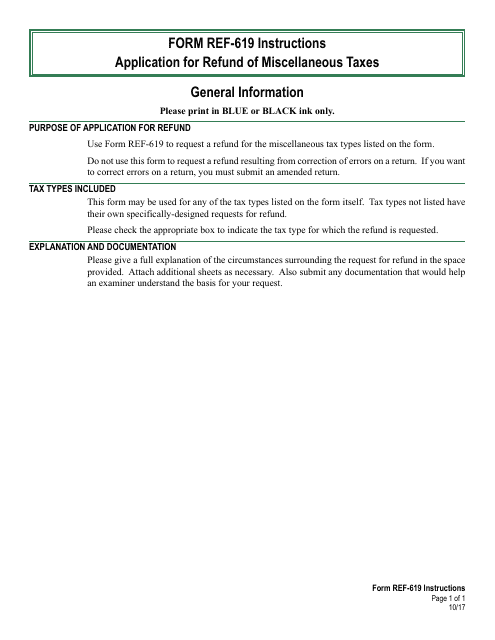

This Form is used for applying for a refund of miscellaneous taxes paid in the state of Vermont.

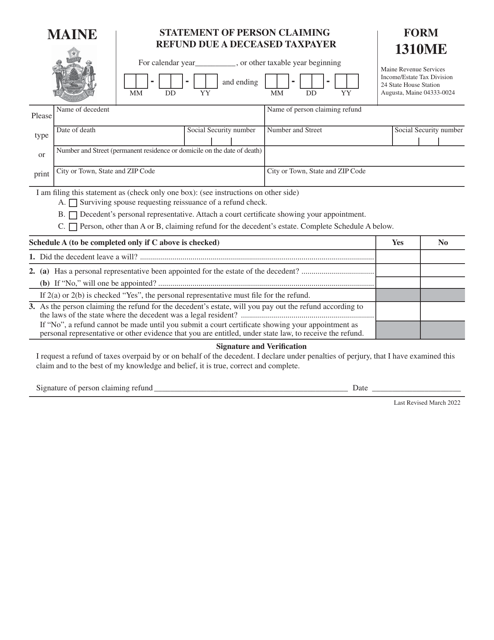

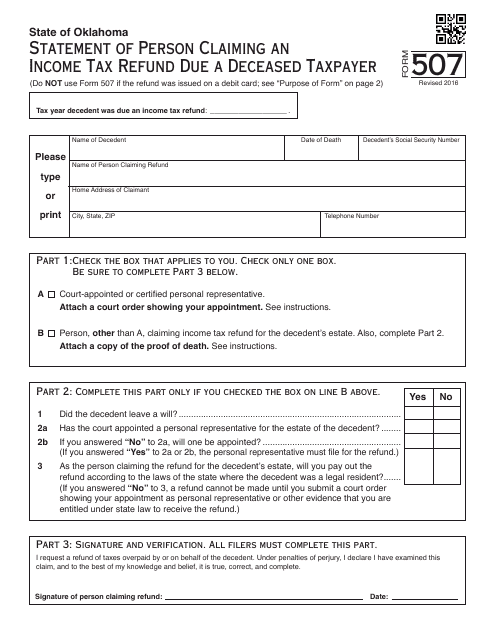

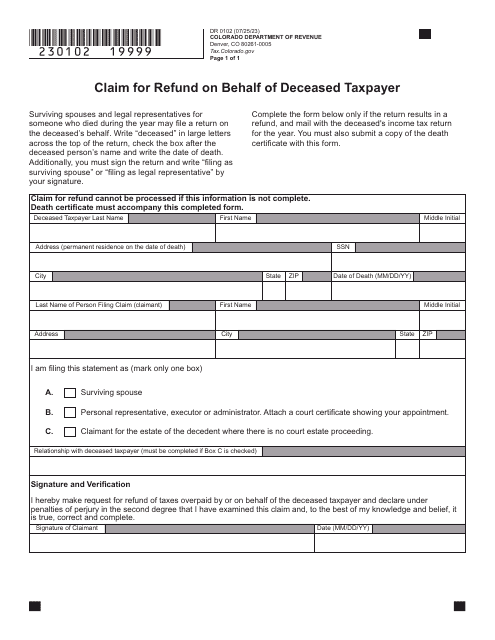

This form is used for claiming a refund on behalf of a deceased taxpayer in the state of Oklahoma.

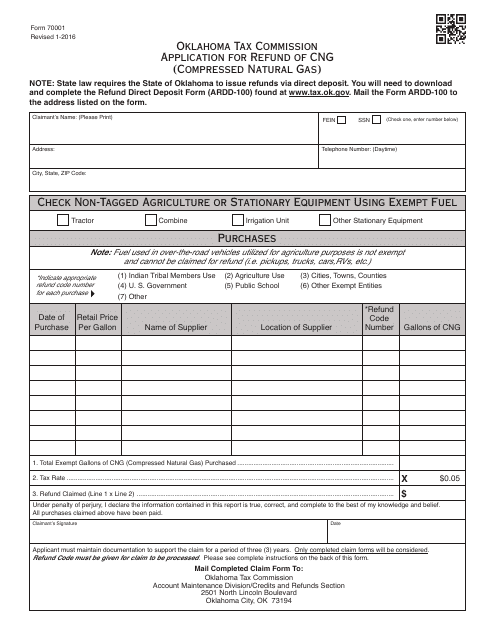

This Form is used for applying for a refund of Compressed Natural Gas (CNG) in Oklahoma.

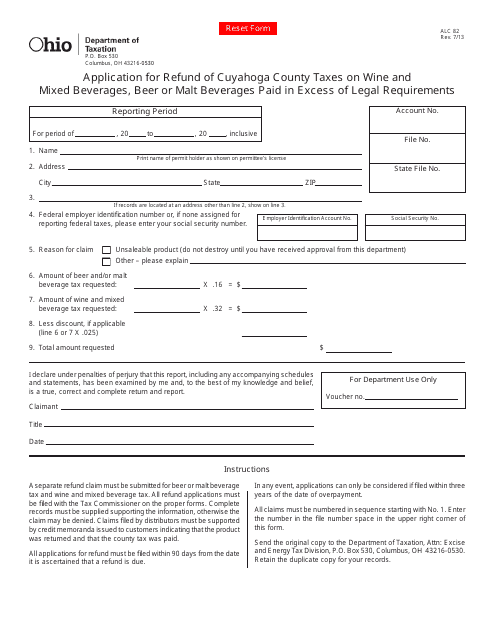

This form is used for applying for a refund of Cuyahoga County taxes on wine and mixed beverages, beer or malt beverages in Ohio.

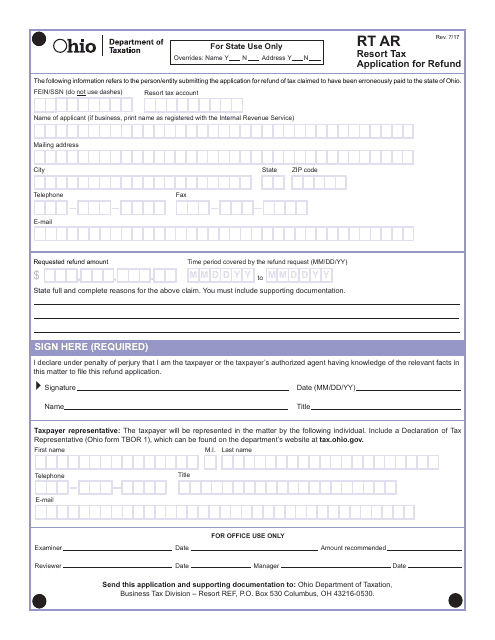

This Form is used for applying for a resort tax refund in Ohio. If you have paid resort taxes in Ohio and want to request a refund, you can use this form to submit your application.

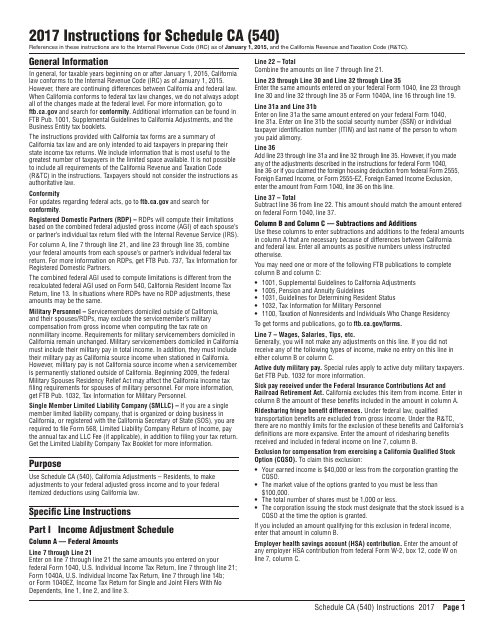

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

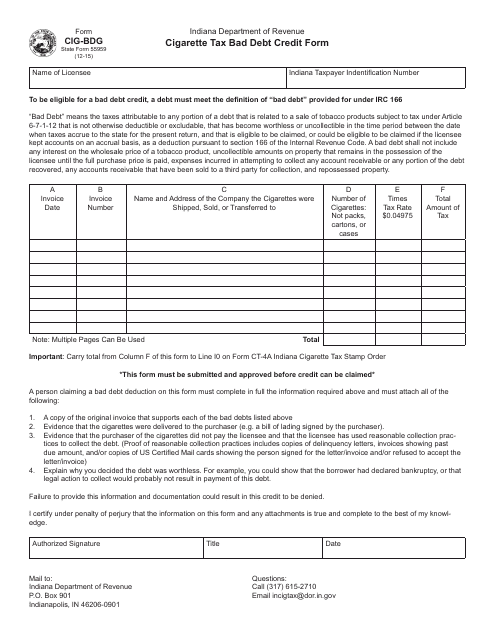

This form is used for claiming a bad debt credit related to cigarette taxes in Indiana.

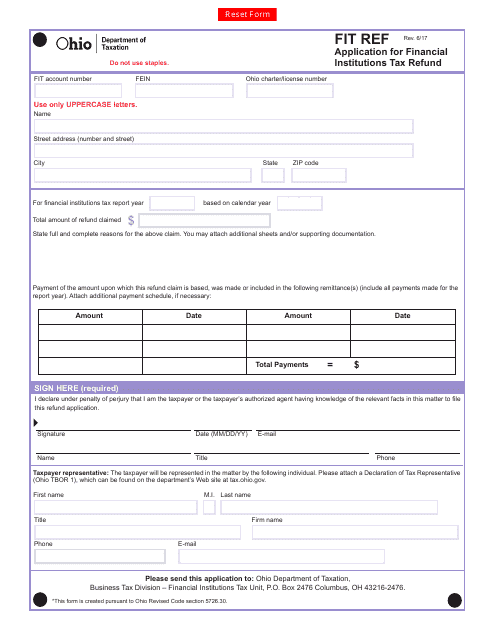

This form is used for financial institutions in Ohio to apply for a tax refund.

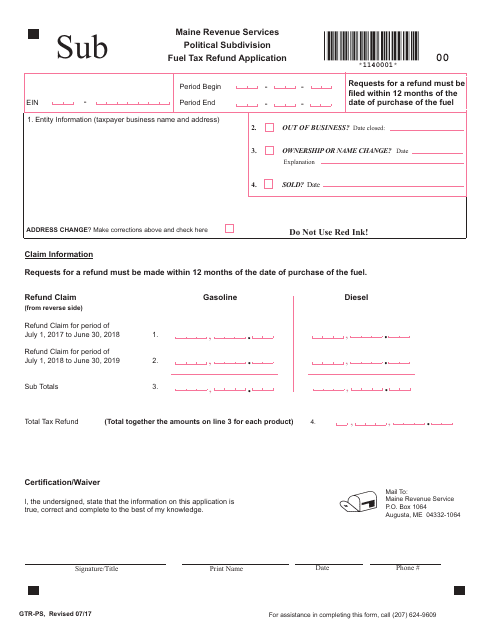

This form is used for applying for a fuel tax refund for political subdivisions in the state of Maine.

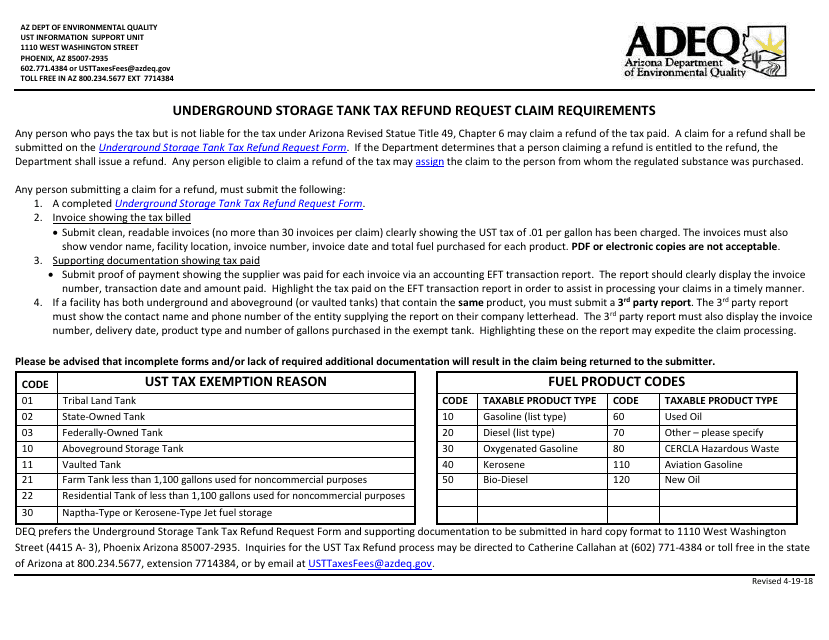

This form is used for requesting a refund of the tax paid on underground storage tanks in Arizona.

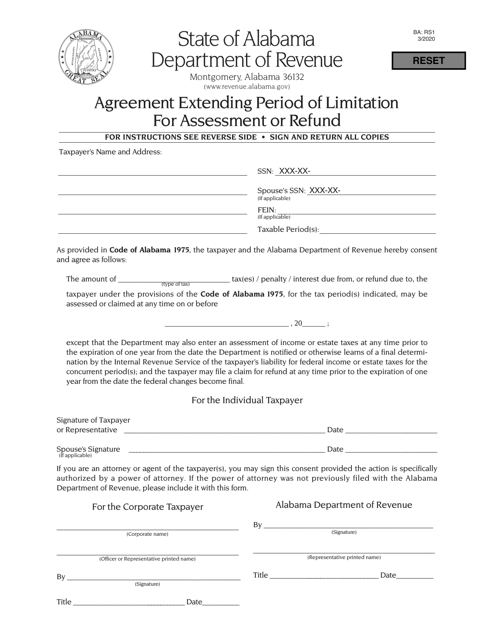

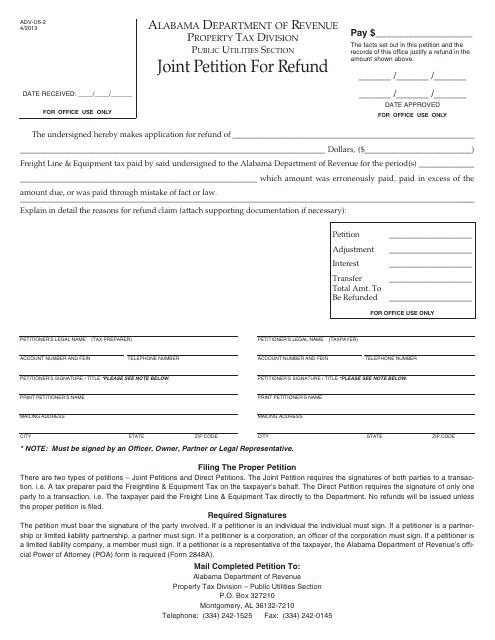

This Form is used for filing a joint petition for refund in Alabama.

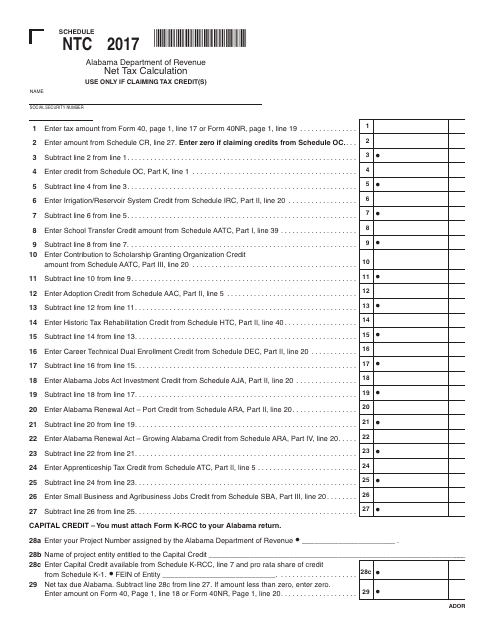

This document is used for calculating the net tax in Alabama using Schedule NTC.