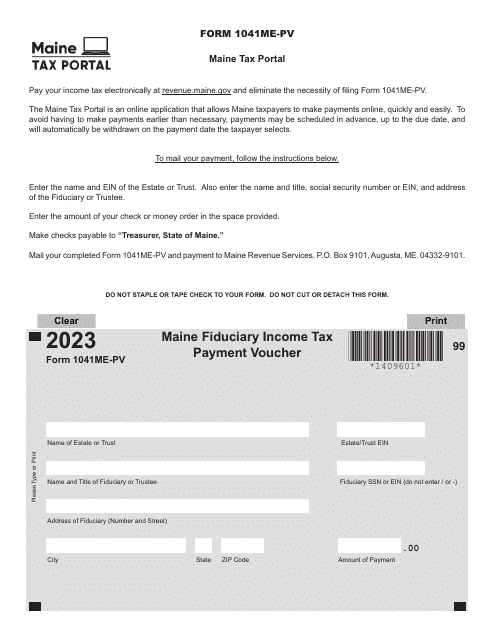

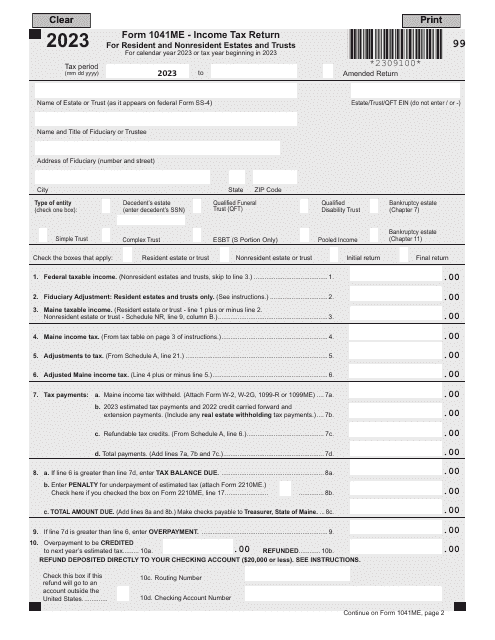

Income Tax Form Templates

Documents:

2505

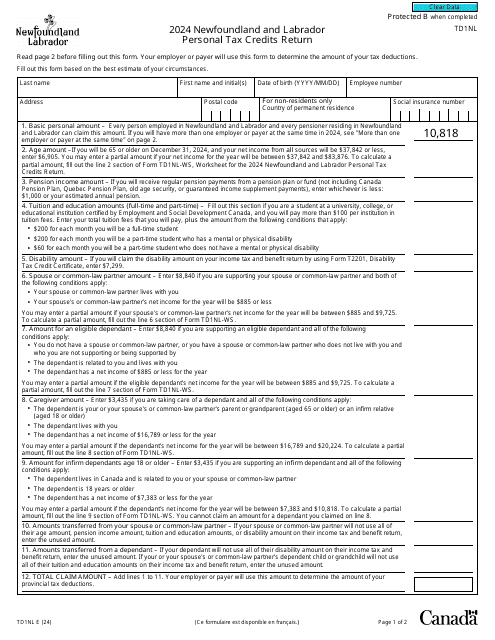

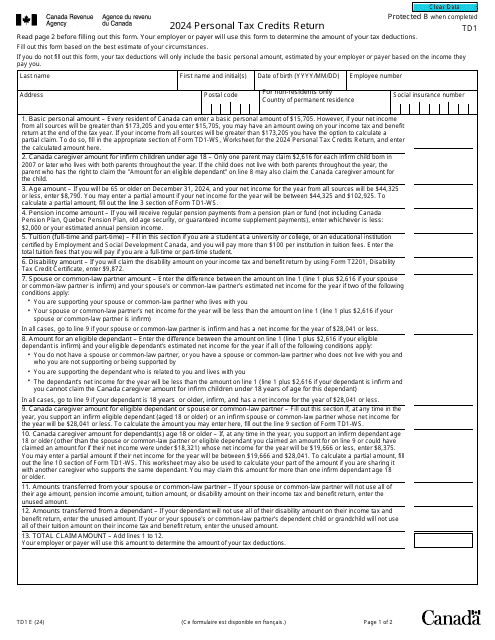

The purpose of this document is to provide a taxpayer's employer with all of the necessary information so that they will be able to determine the number of tax deductions for the Canadian taxpayer.

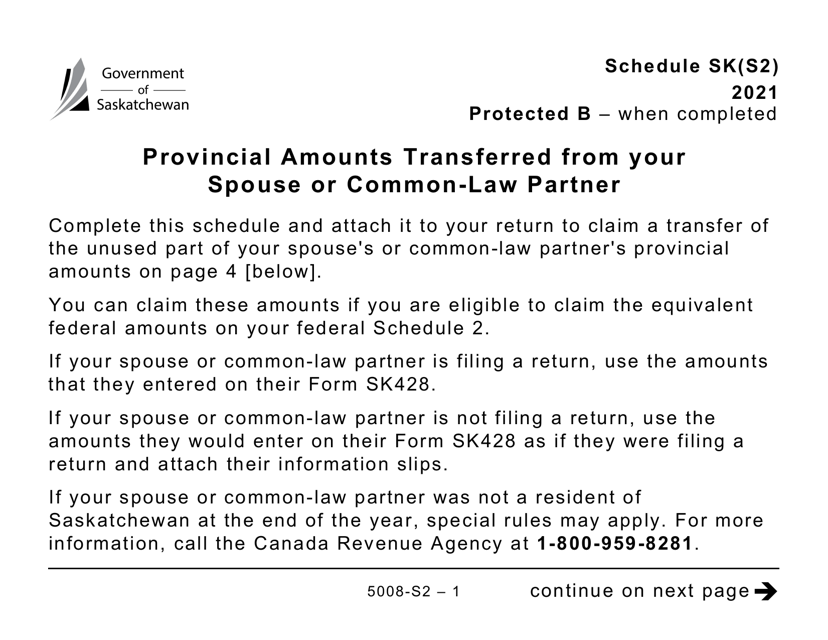

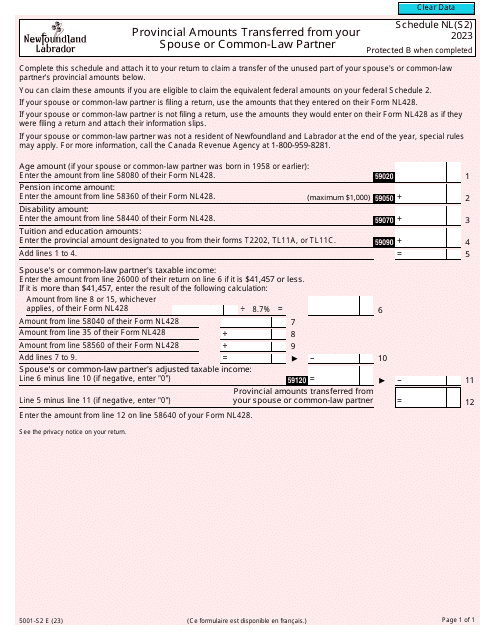

This form is used for reporting the provincial amounts transferred from your spouse or common-law partner on Schedule SK(S2) in a large print format.

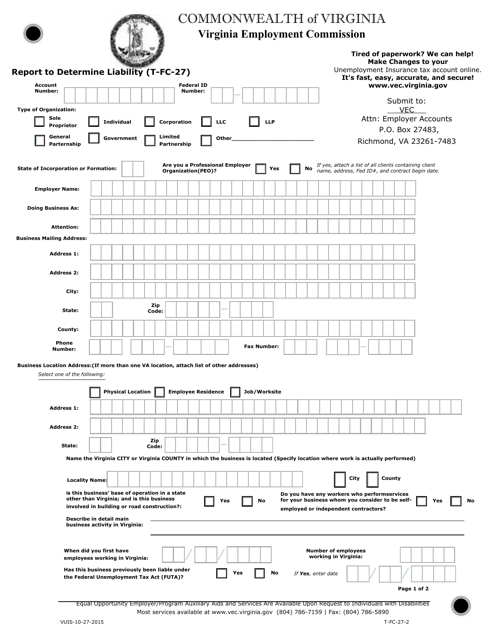

This form is used for reporting and determining liability in the state of Virginia. It is specifically for tax purposes and helps individuals or businesses report their financial obligations accurately.

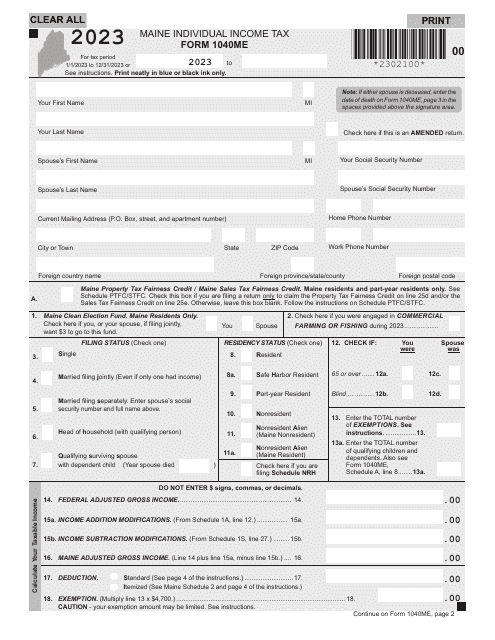

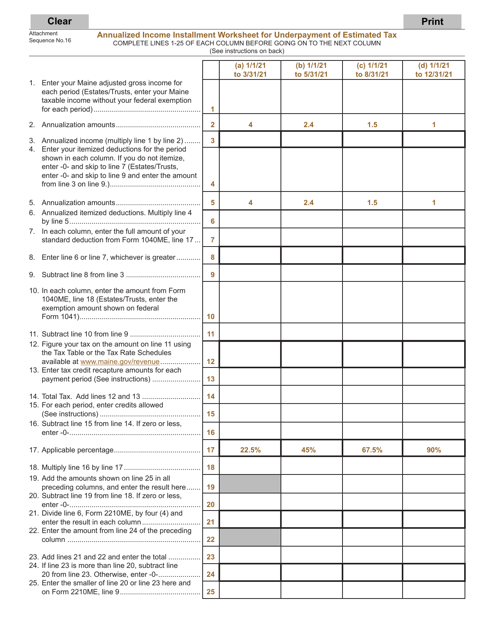

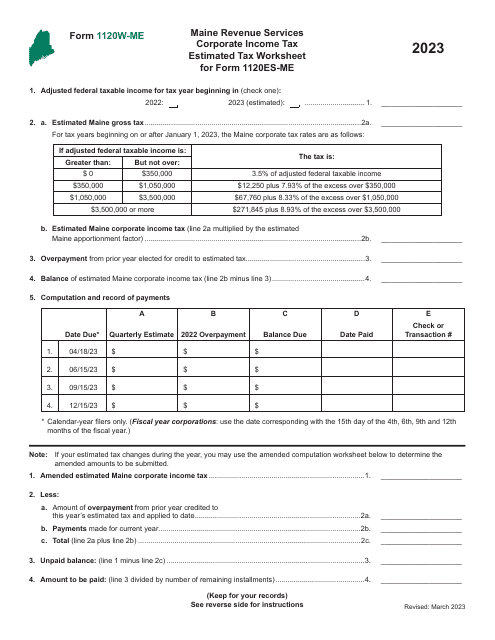

This Form is used for calculating and reporting any underpayment of estimated tax for residents of Maine. It helps taxpayers determine if they owe any additional tax due to not paying enough estimated tax throughout the year.

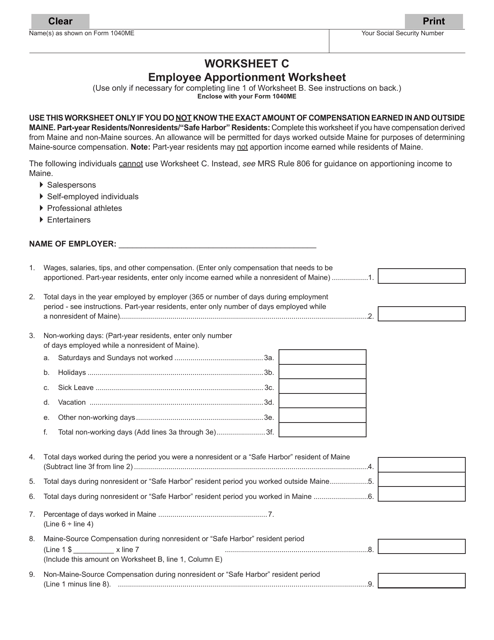

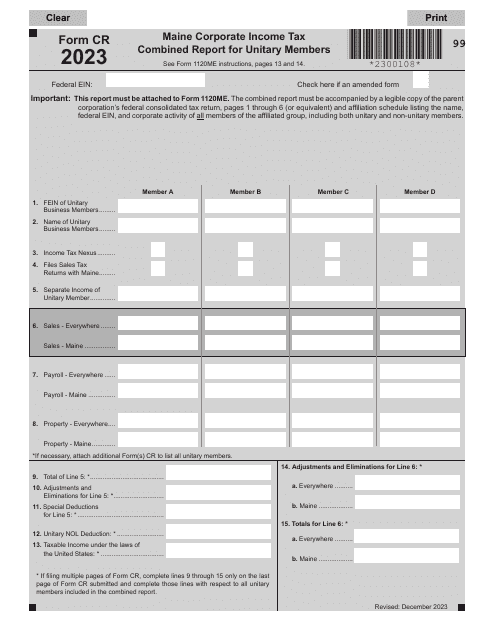

This document is a worksheet used to calculate employee apportionment for state income tax in Maine.