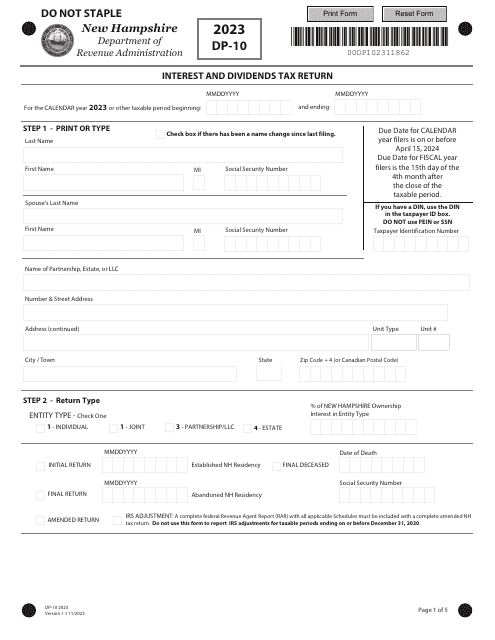

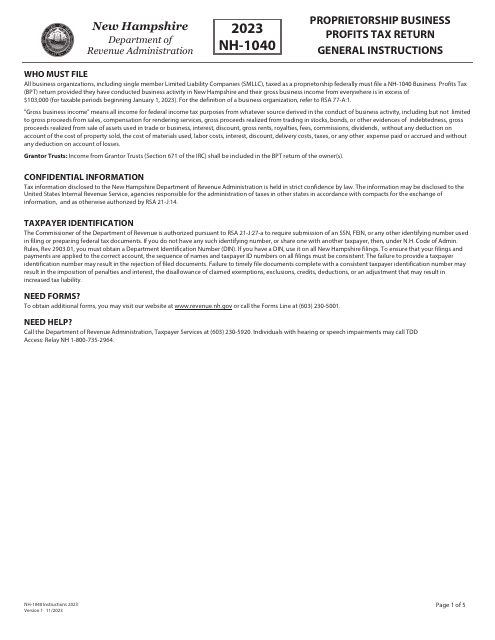

Income Tax Form Templates

Documents:

2505

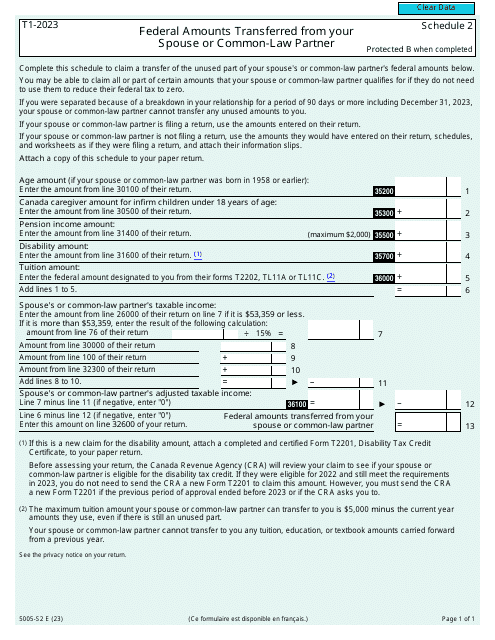

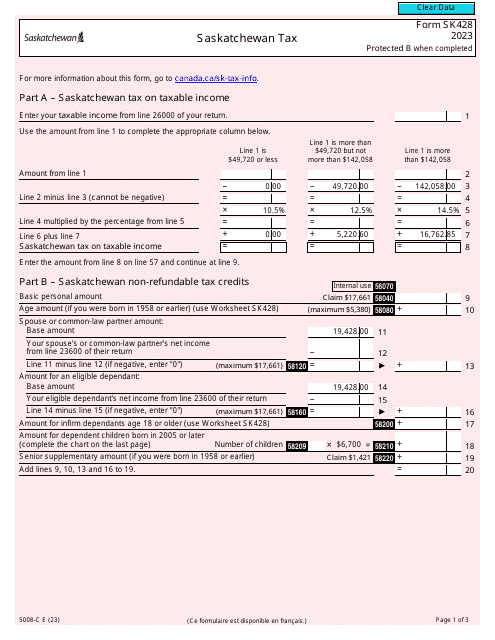

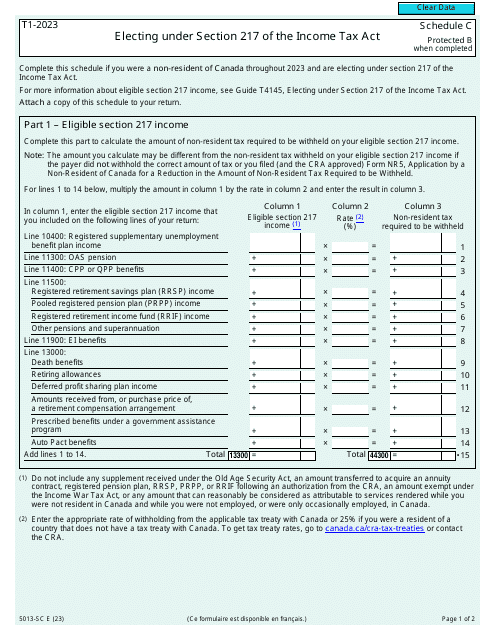

This form is used for filing income tax and benefit returns in Quebec, Canada. It is specifically designed for residents of Quebec.

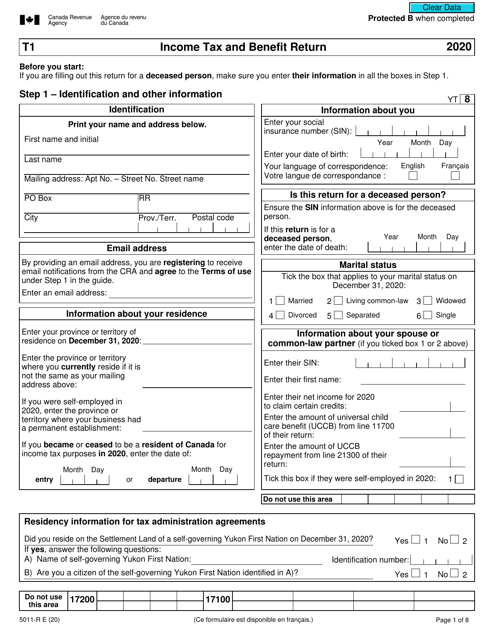

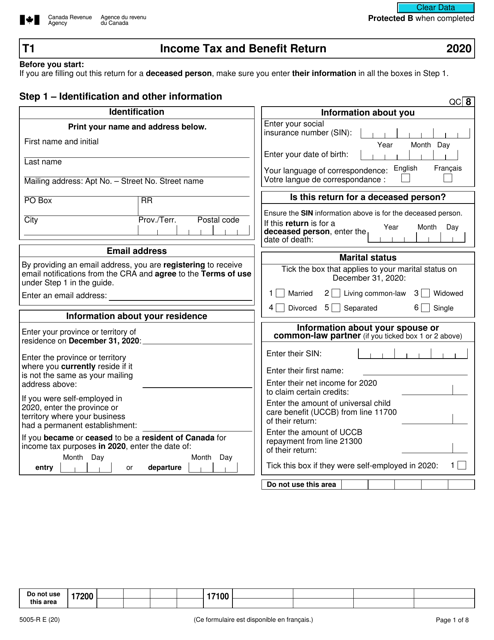

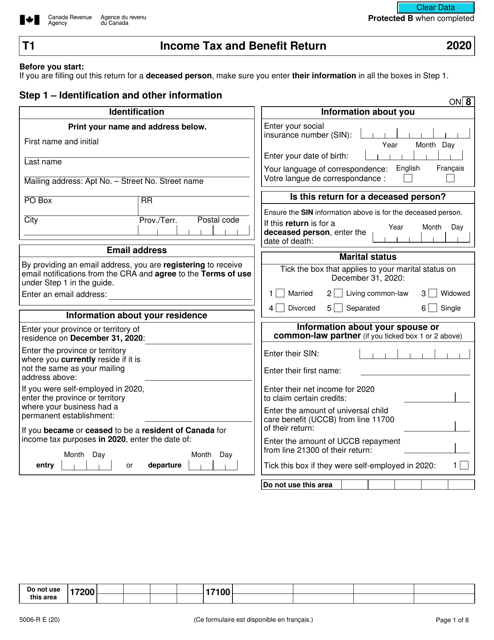

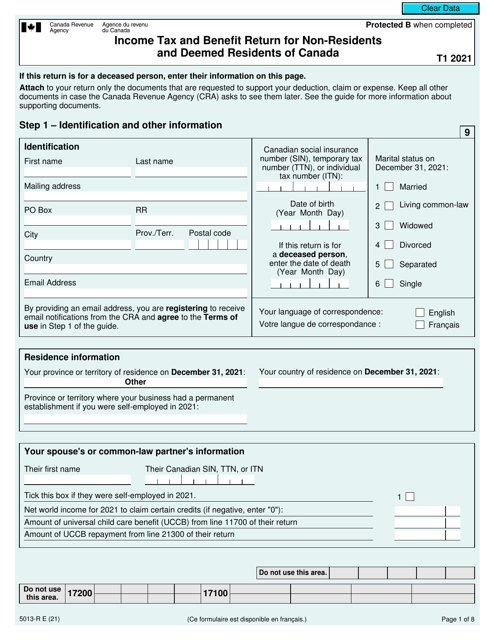

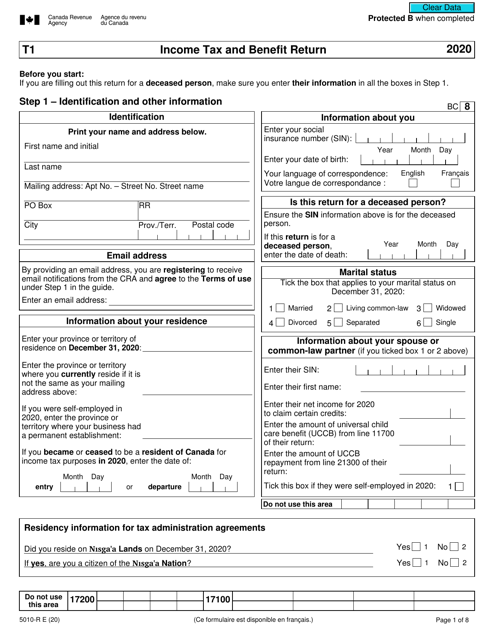

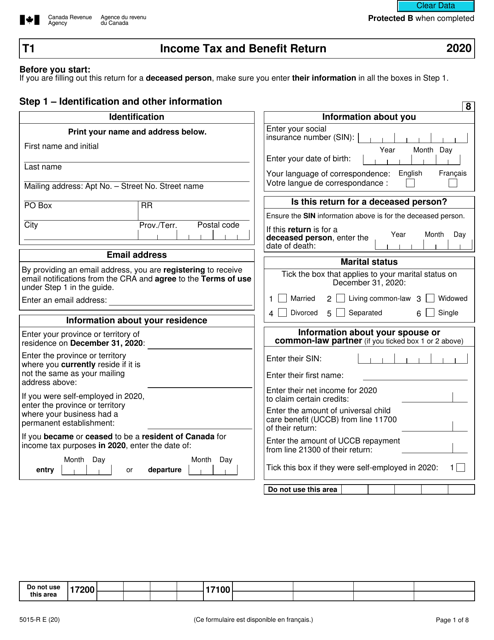

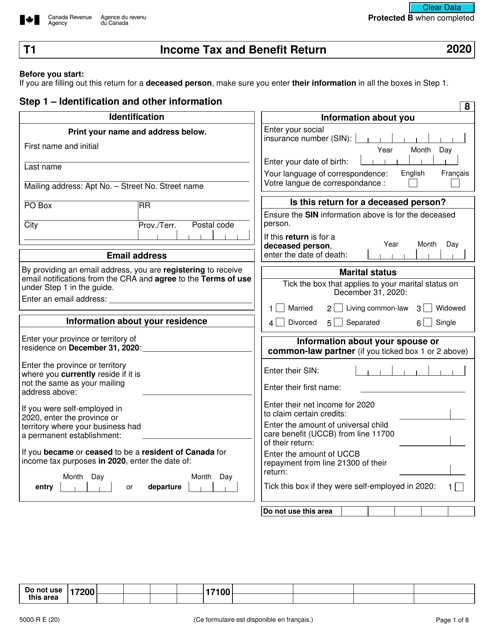

This Form is used for filing your income taxes and reporting your benefits in Canada.

This form is used to report income, deductions, and tax credits for individuals in Canada filing their income tax and benefit return.

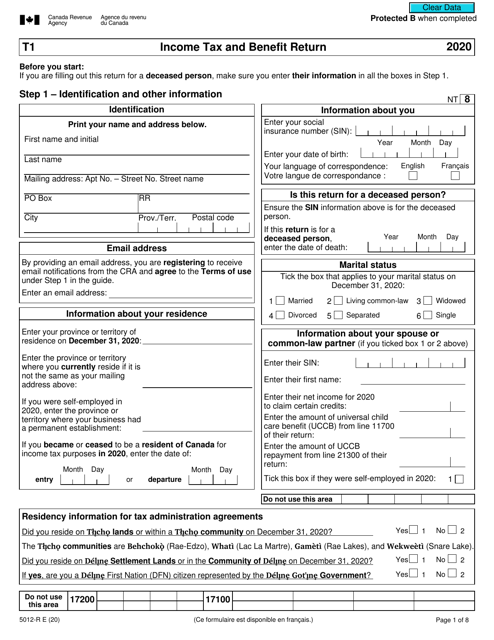

This type of document is used for filing income tax and benefit returns for residents of New Brunswick, Nova Scotia, Nunavut, and Prince Edward Island in Canada.

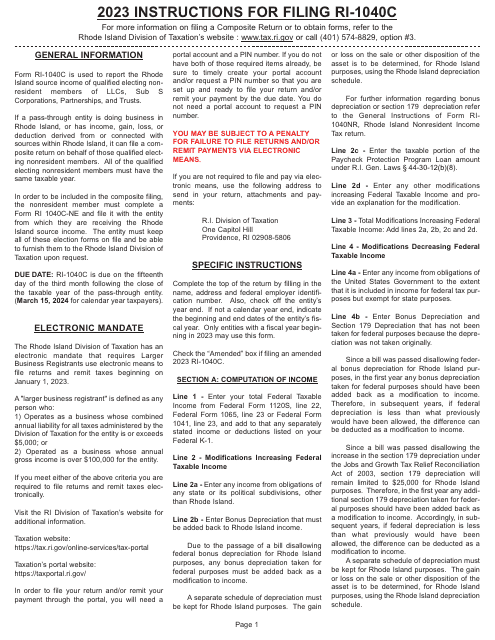

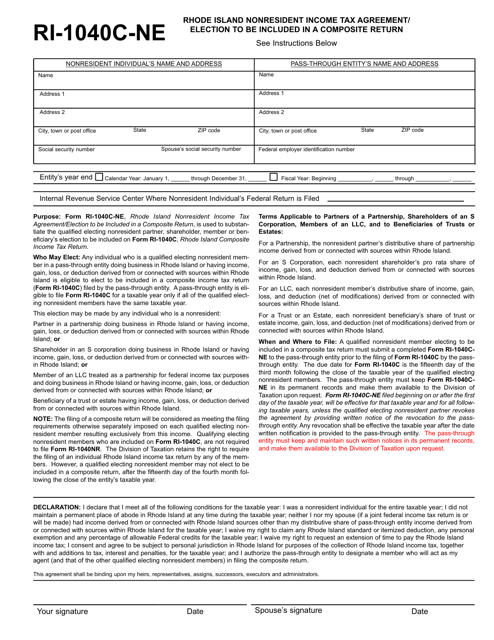

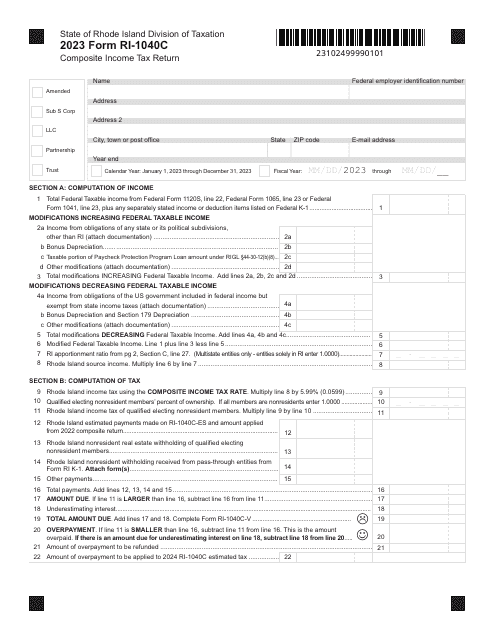

This Form is used for Rhode Island nonresident taxpayers who want to be included in a composite tax return.

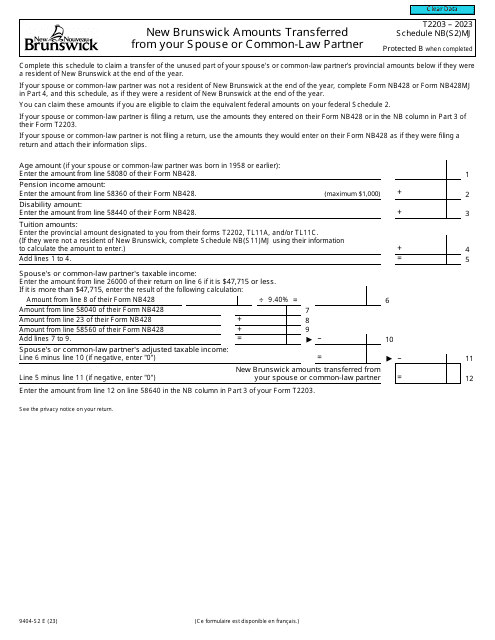

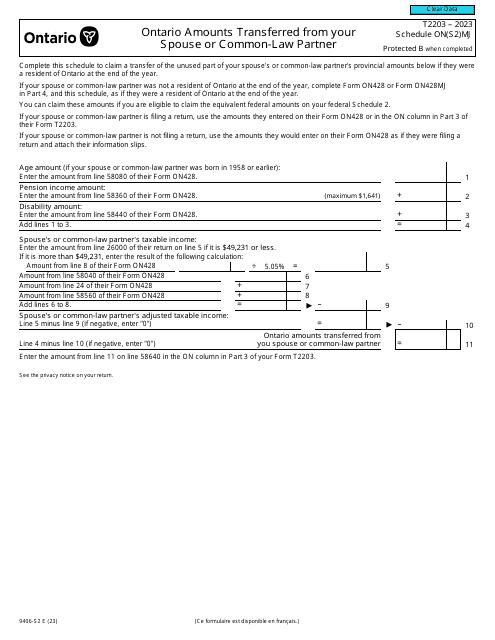

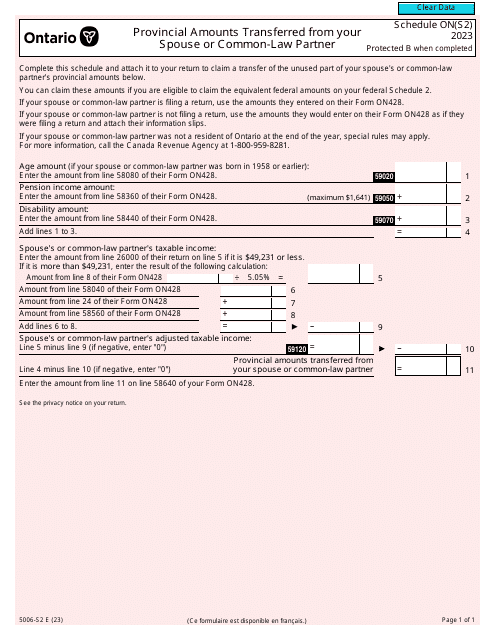

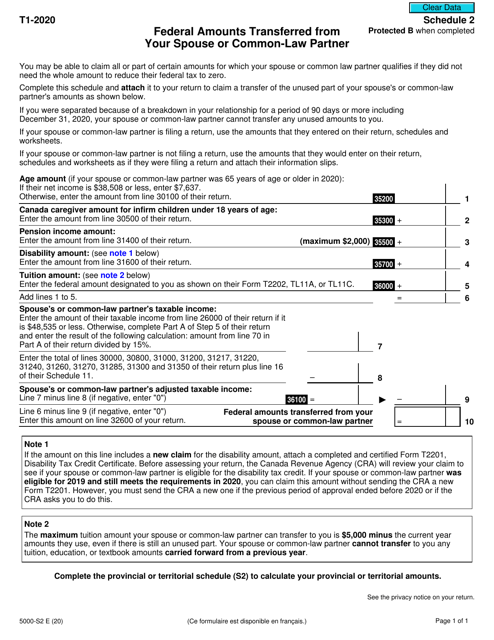

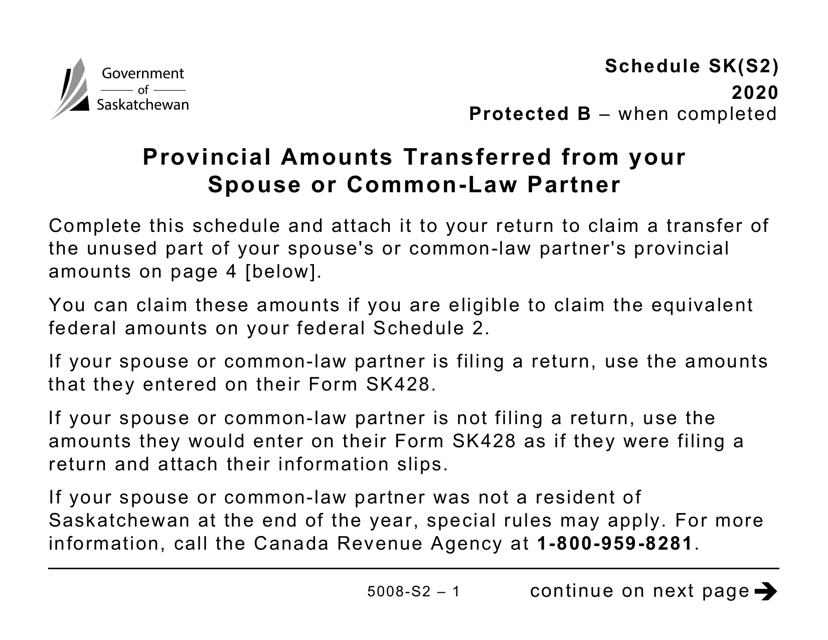

This form is used for reporting provincial amounts transferred from your spouse or common-law partner. It is designed in large print for individuals in Canada.