Free Promissory Note Templates

What Is a Promissory Note?

A Promissory Note is a legally binding document that outlines how much money the lender gave to the borrower and the structure of repayment. Whether you get a mortgage, take out a student loan, car loan, or a personal loan, you need to create a Promissory Note to have evidence of the loan and protect both parties who signed the note from any misunderstandings in the future. This document is not very complicated or long, yet it is enforceable and is usually prepared by family members and friends without the help of a professional lawyer since there is no need to have any legal knowledge to properly draft this legal instrument.

If you are looking for a Promissory Note template, you can download one through the links below. There are two main types of Promissory Notes:

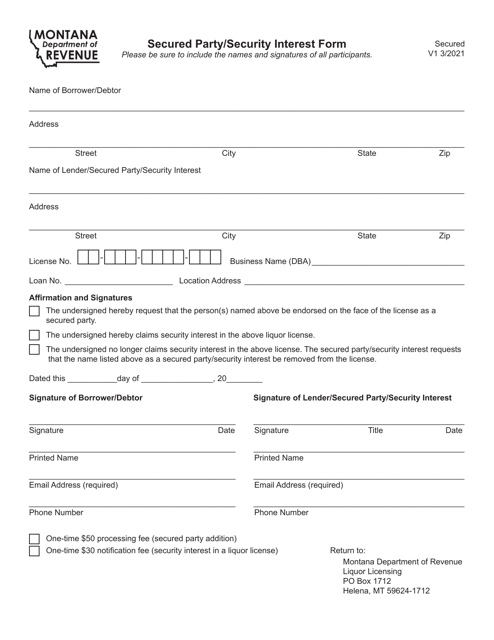

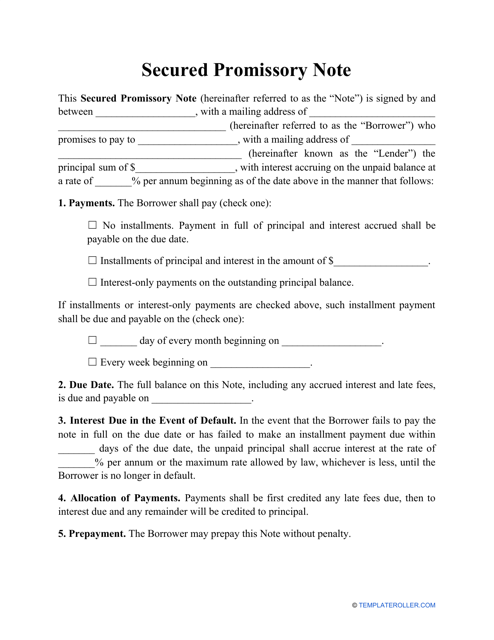

- A Secured Promissory Note is a document that secures the loan by a property – typically, a vehicle or real estate. Essentially, it means that if the borrower fails to pay the money back, the lender is within their rights to seize the property described in the Promissory Note as a reimbursement of the loan. This property has a significant value and this way the lender has a better guarantee of future payments. A Secure Promissory Note is the best choice for a lender and is often used when a large sum of money is being borrowed.

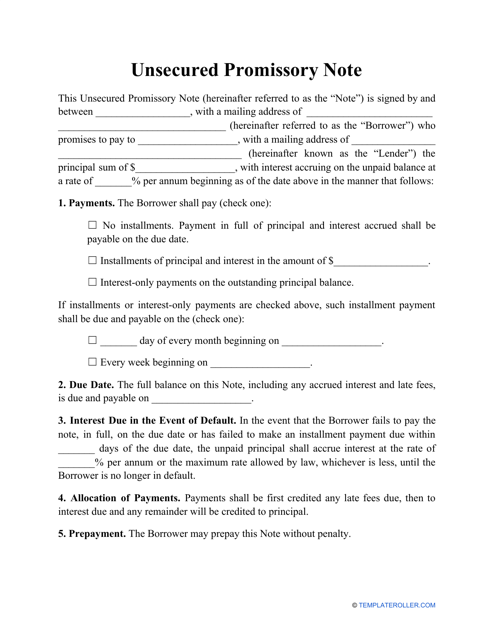

- An Unsecured Promissory Note is a document that does not list any property to secure the payment. In case of a non-payment, the lender can file a lawsuit to satisfy the loan, and if the borrower does not have enough assets or files for bankruptcy, the lender’s money may be lost. Only use this type of Promissory Note when lending a small amount of money to someone you know well.

What Is a Master Promissory Note?

A Master Promissory Note is a document signed as a promise to repay the student loans and related fees and interest to the Department of Education. It must be completed before you can receive any Federal Direct Loan funds to pay for your education. This type of Promissory Note describes how much money you will owe, calculates the interest, and states when the interest is to be charged. It will also provide information about available repayment plans and options to cancel the loans.

Generally, a Master Promissory Note is signed once for various subsidized and unsubsidized loans, because it is valid for up to ten years of education. Unlike a regular Promissory Note, it can be used to borrow many loans over a period of several years.

How to Write a Promissory Note?

Follow these steps to compose a Promissory Note form:

- Identify the lender and borrower, write down their mailing addresses and other contact information.

- Indicate the principal loan amount in words and numbers.

- Calculate the interest rate - the fee for taking out the loan. Check the laws in your state - each state has a maximum amount of interest rate that can be charged.

- Decide on a payment schedule. Add the date when the full loan balance, including interest, is due. Determine whether the borrower has to pay the loan in installments or using a lump-sum payment. If you choose the first option, specify how often the borrower pays money - once a week, a month, a quarter, or a year.

- Record a late fee amount in case the borrower does not make the payments on time.

- Make your Promissory Note secured if you want to add extra security to the loan. Specify the property that will be transferred to the ownership of the lender if you do not pay back the loan.

- Obtain the consent of another person to pay back the loan if the original borrower is unable to do so - a co-signer must agree to the obligations and liabilities indicated in the note.

- Print your legal names, sign and date the document.

What Makes a Promissory Note Invalid?

Like any other legal instrument, a Promissory Note can be considered invalid and voided. To be legally enforceable, it must have all the essential terms and conditions – the exact loan amount, repayment schedule, signatures of the parties that verify the intent to enter into this transaction. The last part is especially important – the court will consider your Promissory Note invalid if the identity of the borrower is not explicitly verified. If you refer to outdated laws to calculate the interest rate, for instance, it will render your note invalid. Additionally, if you cannot find a note or its certified copy, you cannot prove your case as a lender and collect the money, since this is the only piece of paper that confirms the loan.

Not the form you were looking for? Check out these related templates:

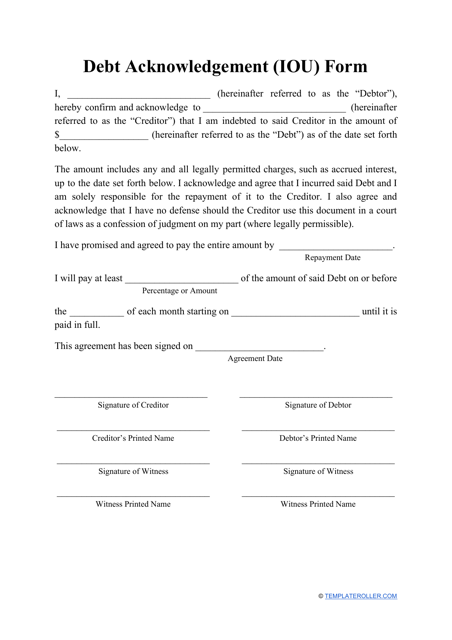

- IOU Template (Debt Acknowledgement Form);

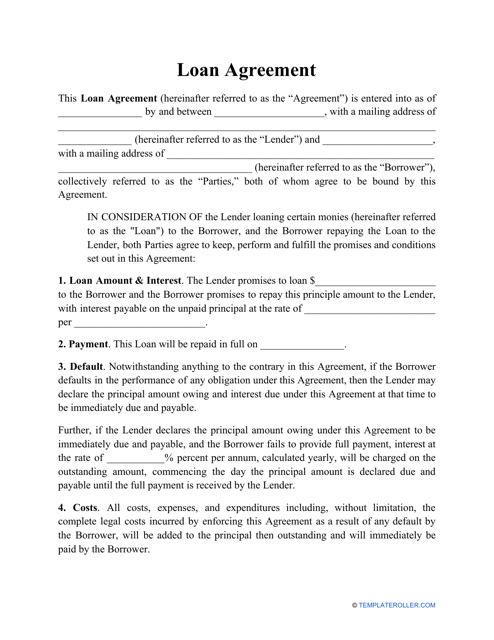

- Loan Agreement Template;

- Credit Dispute Letter;

- Credit Application Form;

- Credit Card Authorization Form.

Documents:

141

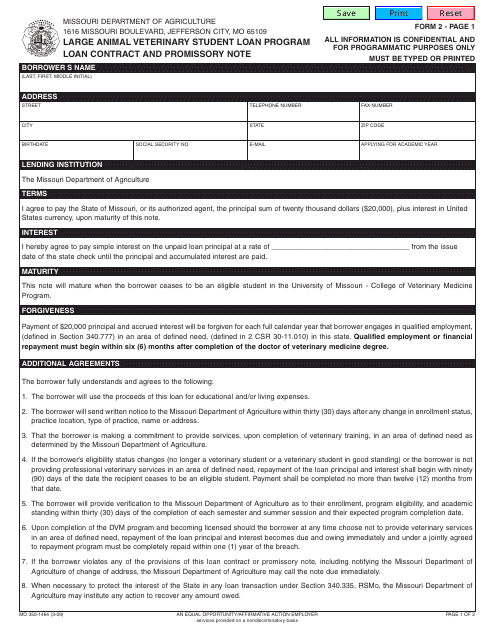

This form is used for facilitating student loans for large animal veterinary students in Missouri.

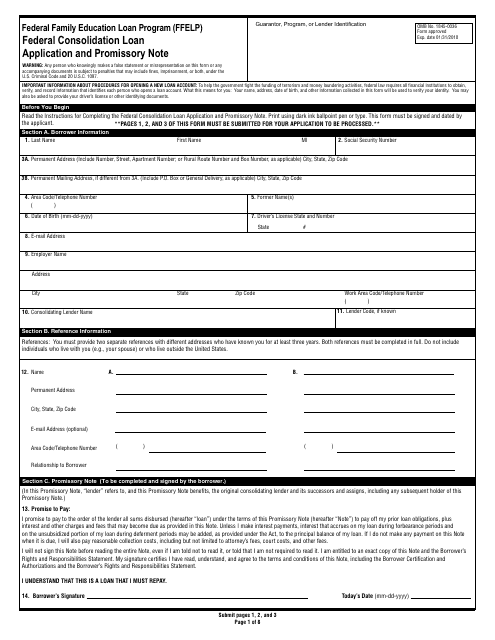

This type of document is used for applying for a Federal Consolidation Loan under the Federal Family Education Loan Program.

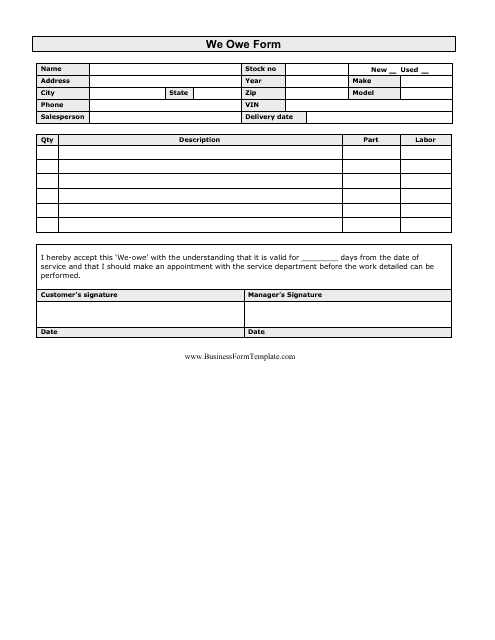

This type of document is a blank "We Owe" form. It is used when purchasing a car or real estate to document any additional promises or agreements made by the seller to the buyer. The form outlines specific items or services that the seller will provide or complete before or after the sale.

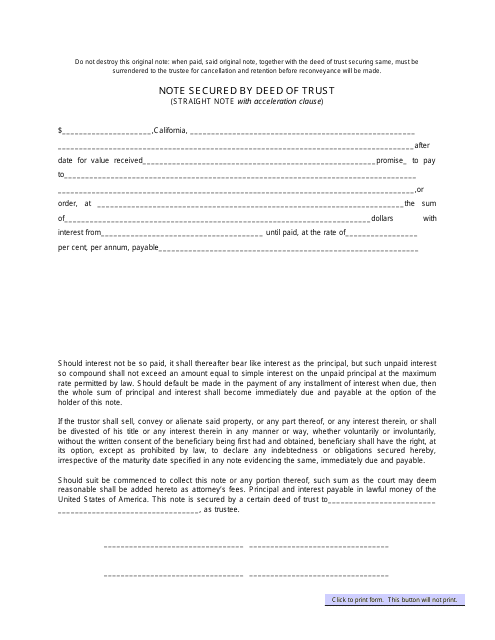

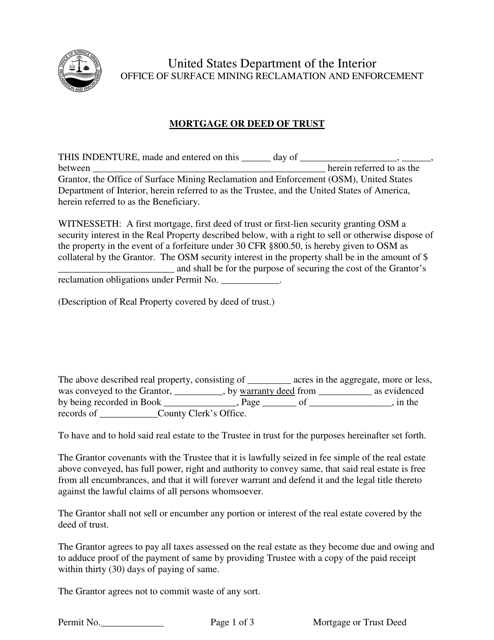

This Form is used for securing a loan with a property through a Deed of Trust.

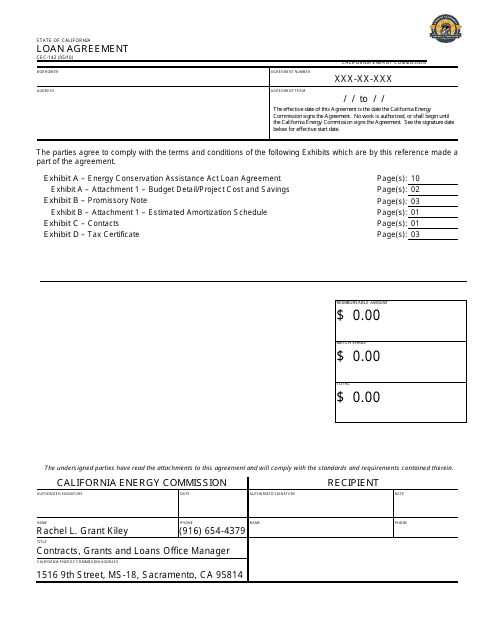

This form is used for creating a loan agreement in the state of California. It outlines the terms and conditions of the loan, including the amount borrowed, interest rates, and repayment terms.

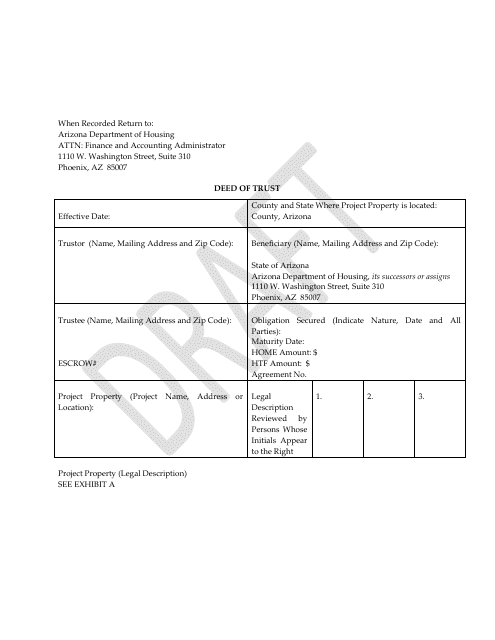

This type of document is a draft version of a Deed of Trust specific to the state of Arizona. It is used to specify the terms and conditions of a trust agreement relating to real estate property.

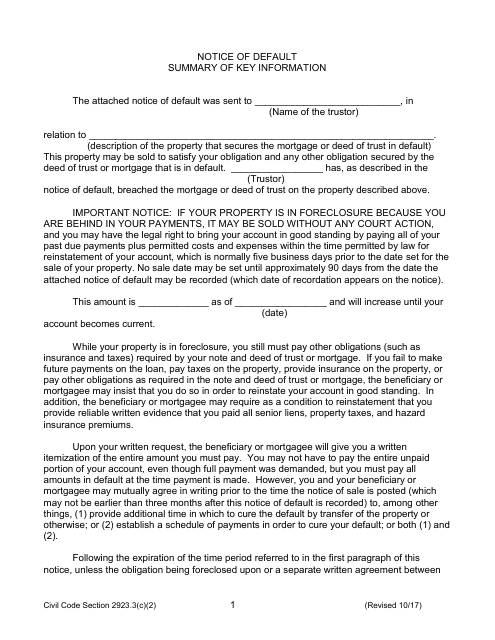

This document is used to notify a borrower in California that they have defaulted on their loan or mortgage payments.

This document is used to petition and seek legal remedies related to a promissory note in the state of Kansas.

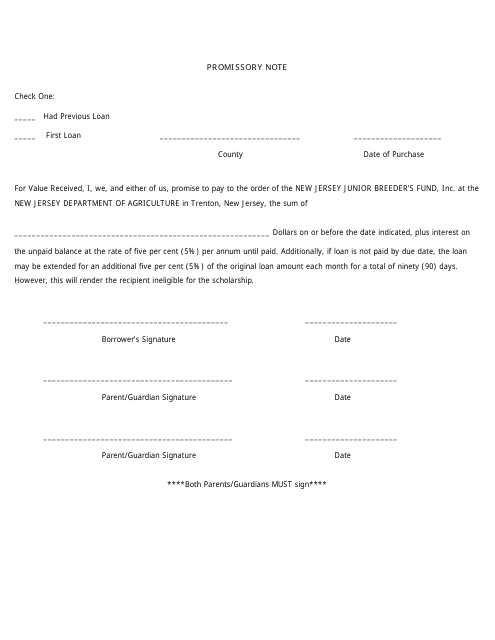

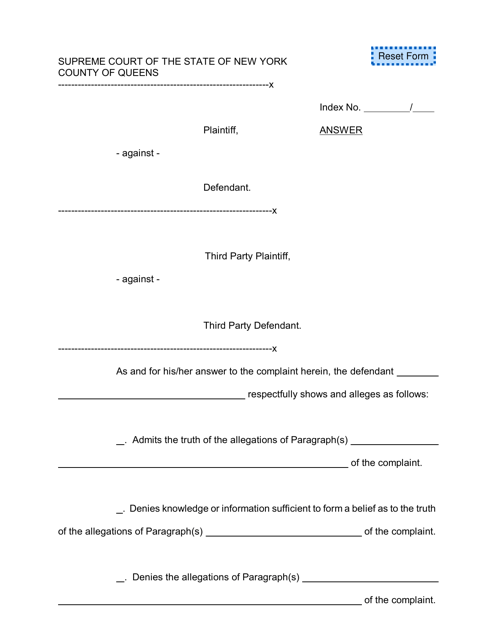

This type of document, known as a Promissory Note, is commonly used in New Jersey. It is a legal agreement that outlines the terms and conditions of a loan or debt. The note contains information such as the amount borrowed, the repayment schedule, and any interest involved. It serves as a written promise to repay the borrowed amount according to the agreed terms.

This type of document is used to secure a loan for a property. It gives the lender the right to take ownership of the property if the borrower fails to repay the loan.

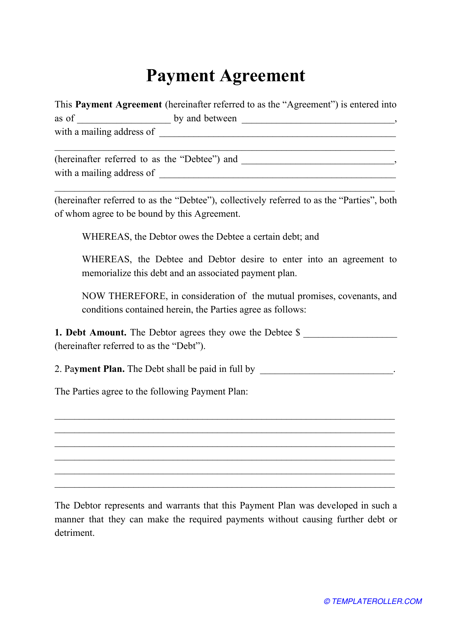

This legal contract is signed by a lender and a borrower and specifies the conditions of the payment, the details of the loan, interest rates, and payment periods.

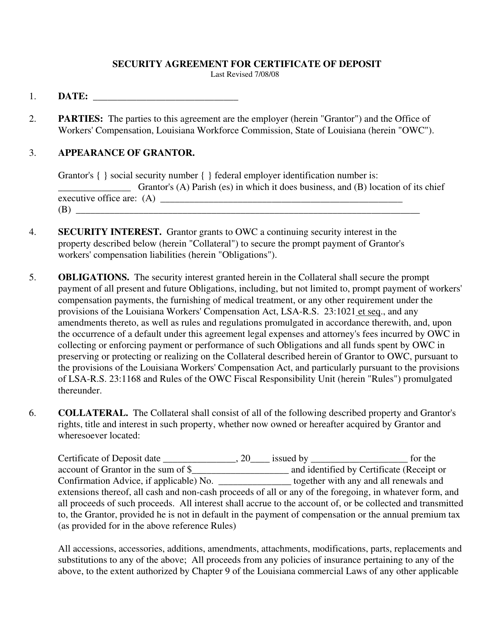

This document is used for securing a certificate of deposit in the state of Louisiana. It outlines the terms and conditions of the agreement between the depositor and the financial institution.

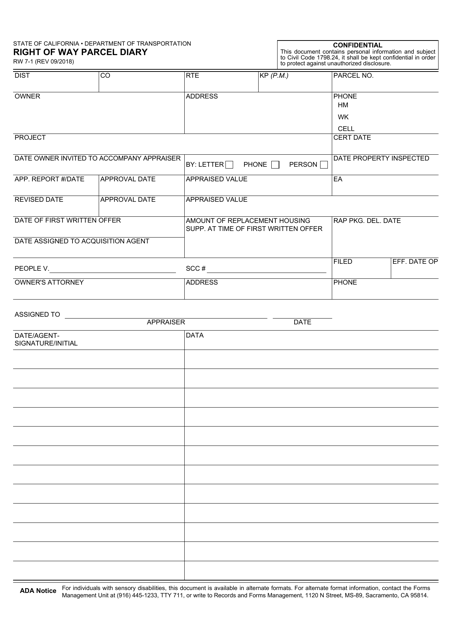

This Form is used for documenting the right of way parcels in the state of California. It serves as a diary to keep track of the parcels and their corresponding information.

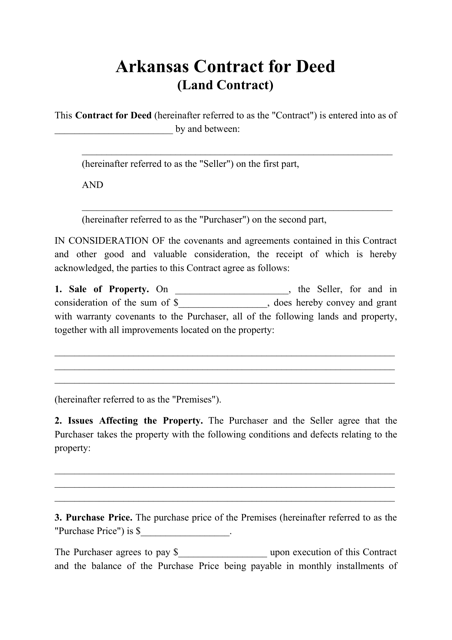

This document is used for a Contract for Deed (Land Contract) in the state of Arkansas. It outlines the terms and conditions for the sale of a property, where the buyer makes payments directly to the seller over a specified period of time until the purchase price is fully paid.

This type of document is used for purchasing real estate in Delaware through a contract for deed, also known as a land contract. It outlines the terms and conditions of the sale and the buyer's agreement to make installment payments to the seller until the property is fully paid off.

This document is used in Louisiana for a contract called "Contract for Deed" or "Land Contract". It outlines the terms and conditions for buying or selling land, where the seller retains ownership until the buyer completes payment.

This document is a legally binding agreement used in Montana for the sale of a property where the seller finances the purchase and retains the title until the buyer fulfills the payment.

This document is a Contract for Deed, also known as a land contract, which is used in the state of Wyoming. It outlines the terms and conditions for the sale of a property where the buyer takes possession but makes payments to the seller over time, rather than obtaining financing from a traditional lender.

An IOU is a typed or handwritten document that outlines the details about the debt owed by one party (borrower, or debtor) to another (creditor, or lender).

This is a contract used to document and formalize all obligations that regulate receiving the loan and paying it back.

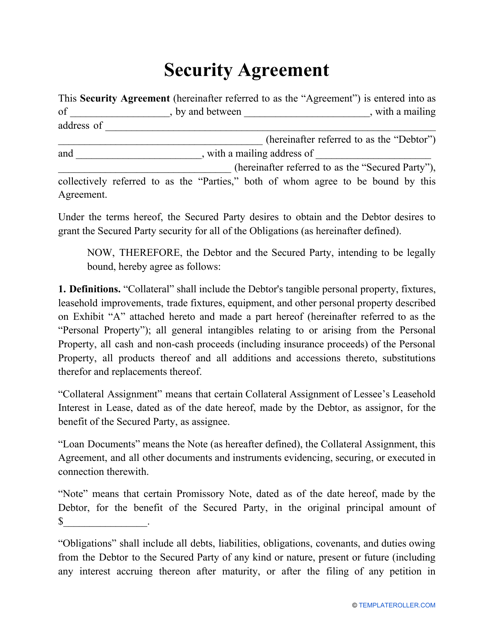

This is a formal document signed by a lender and a borrower in which the borrower provides their property or interest in an asset as collateral for a loan.

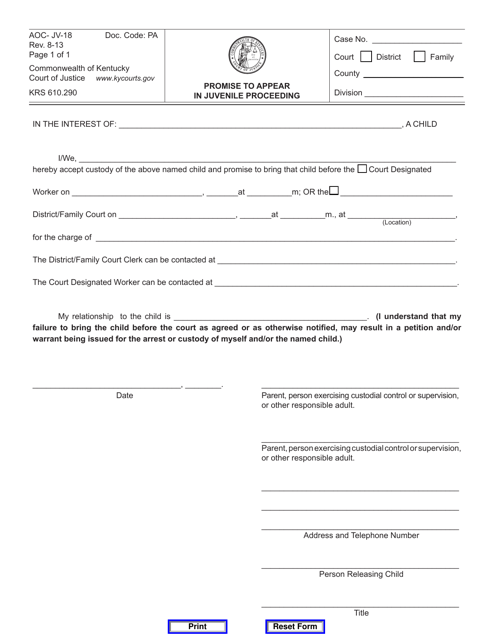

This Form is used for promising to appear in a juvenile proceeding in Kentucky.

Individuals may use this template when they would like to secure a financial obligation to legally bind a borrower to pay their loan back to a lender.

This template establishes the basic terms of the agreement between a lender and a borrower regarding the money the former has provided the latter with.

This document is a Credit Agreement and Promissory Note used in Kentucky. It outlines the terms and conditions of a credit agreement and includes a promissory note for repayment.

Use this printable template when making your own Deed of Trust in the state of Alabama.

Transferring property in the state of Alaska? This printable Deed of Trust makes it possible to temporarily give a property to a neutral third party to serve as a trustee.

Are you looking to transfer your property using a Deed of Trust? Complete this printable template when drafting your own Deed in the state of Arkansas.

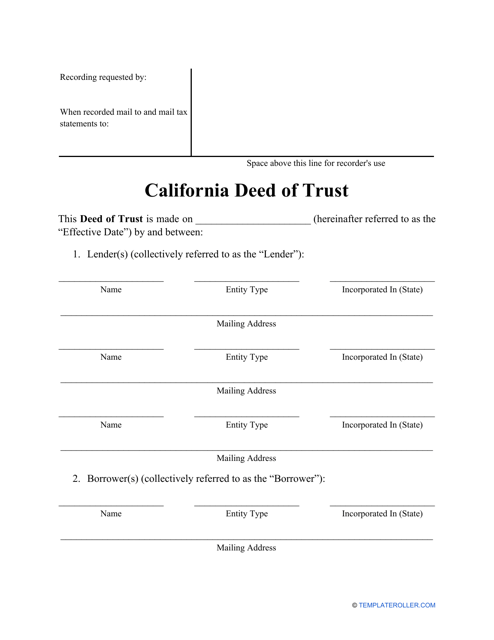

Complete this printable Deed of Trust template when making your own Deed in the state of California.

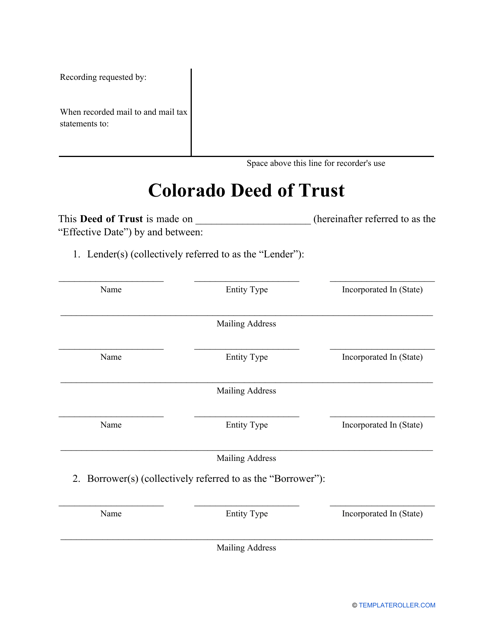

Are you looking to transfer property using a Deed of Trust? Complete this printable template when drafting your own Deed in the state of Colorado.

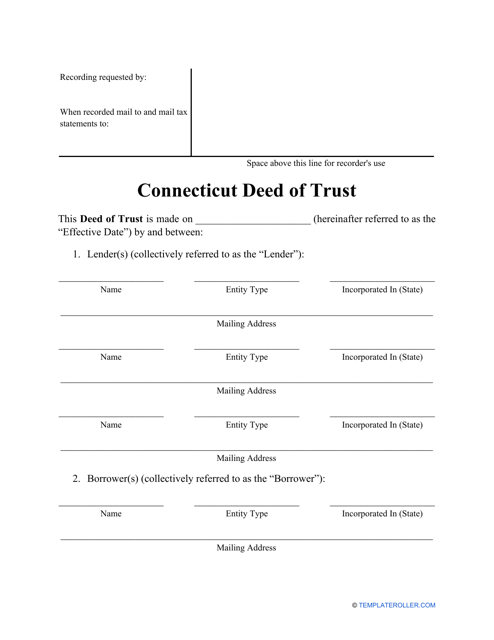

This is a legal document that can be used to protect a real estate transaction when a loan is involved in the state of Connecticut.

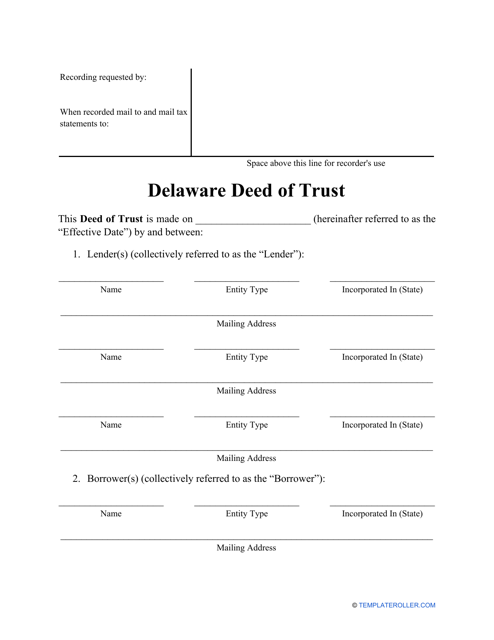

Use this printable template when making your own Deed of Trust in the state of Delaware.

Complete this printable Deed of Trust template when making your own Deed in the state of Georgia.

Are you looking to transfer property using a Deed of Trust? Complete this printable template when drafting your own Deed in the state of Hawaii.

This type of deed is used to transfer property between a trustor (a borrower), a trustee, and a beneficiary in the state of Idaho.

Transferring property in the state of Indiana? This printable Deed of Trust makes it easy to protect a real estate transaction when a loan is involved.