Free Promissory Note Templates

Documents:

141

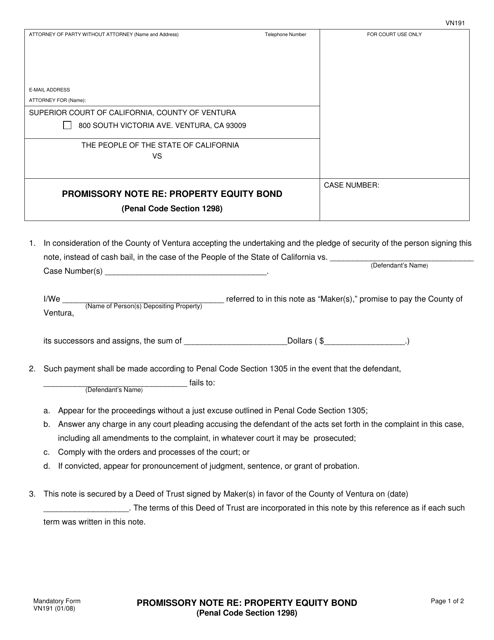

This form is used for creating a promissory note regarding a property equity bond in Ventura County, California.

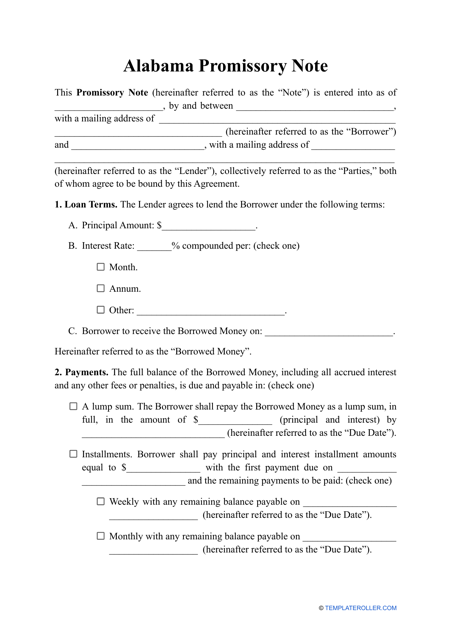

This document provides a template for a promissory note in the state of Alabama. A promissory note is a written agreement that outlines the terms and conditions of a loan or debt. It includes information such as the amount borrowed, repayment terms, and interest rate. The template can be customized to suit the specific needs of the borrower and lender.

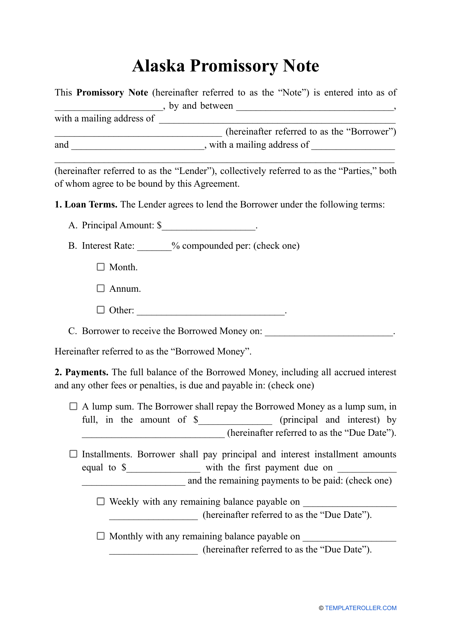

This type of document is used for creating a promissory note in the state of Alaska. It outlines the terms and conditions of a loan or debt agreement between a borrower and a lender.

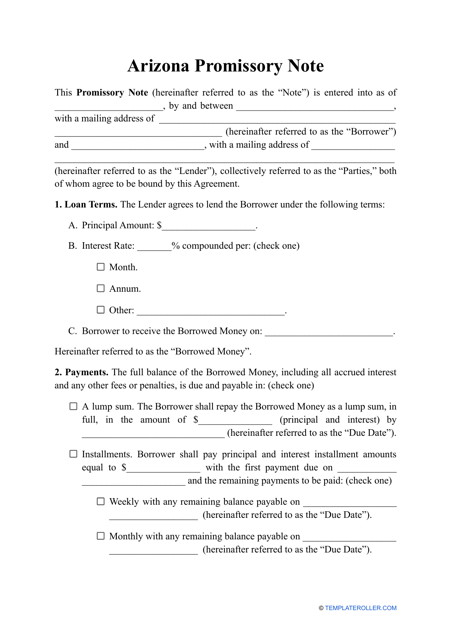

This document provides a template for a promissory note in Arizona. It establishes a legal agreement between a borrower and a lender regarding a loan.

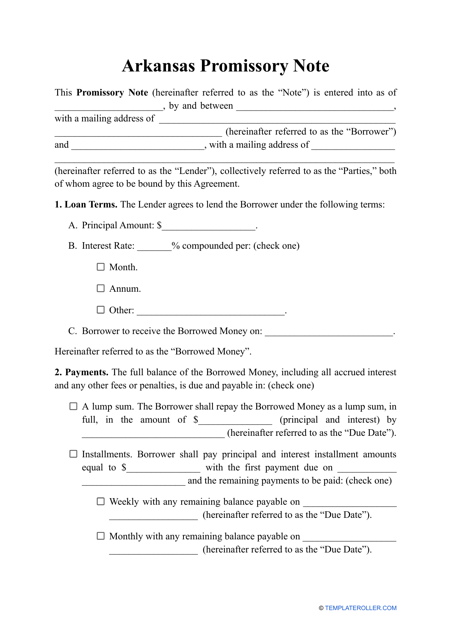

This type of document is a promissory note template specific to the state of Arkansas. It is used for creating a legally binding agreement between a borrower and a lender regarding the repayment of a loan.

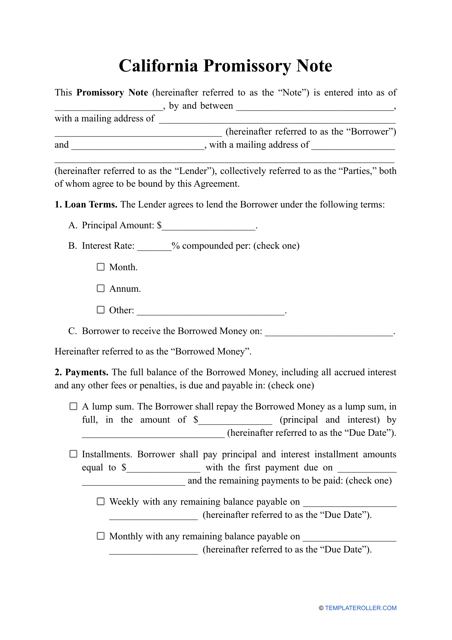

This document is a template for a promissory note in the state of California. It outlines the terms and conditions of a loan, including the repayment schedule and interest rate.

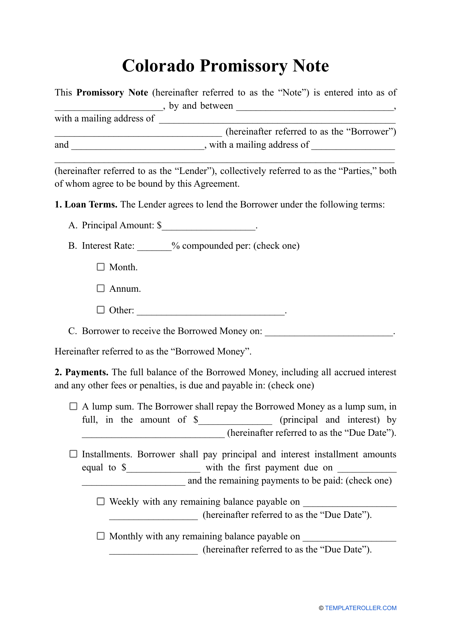

This form is used for creating a legally binding agreement in Colorado where one party agrees to pay a specified amount of money to another party by a specified date in the future.

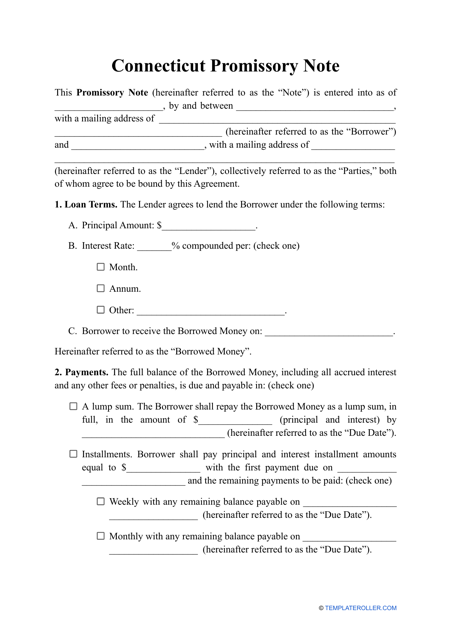

This document is a promissory note template specifically designed for use in Connecticut. It outlines the terms and conditions for repayment of a loan or debt.

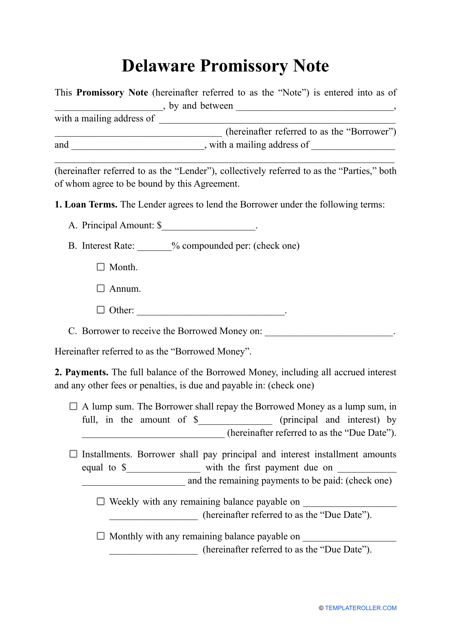

This document is a template for a promissory note, which is a written agreement outlining a borrower's promise to repay a loan to a lender. It is specifically designed for use in the state of Delaware.

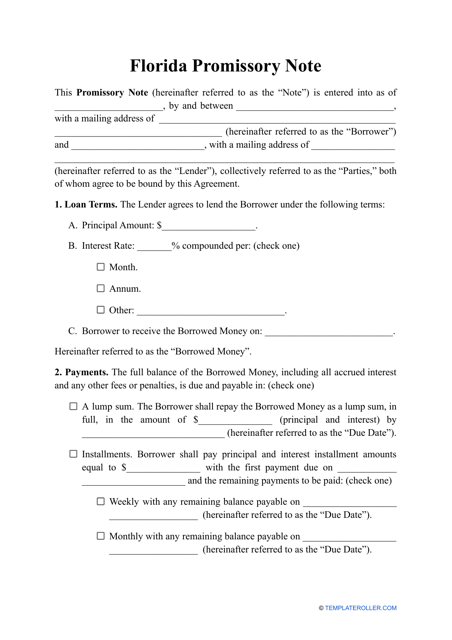

This document template is used for creating a promissory note in the state of Florida. A promissory note is a legal agreement where one party promises to pay a specific amount of money to another party at a designated time.

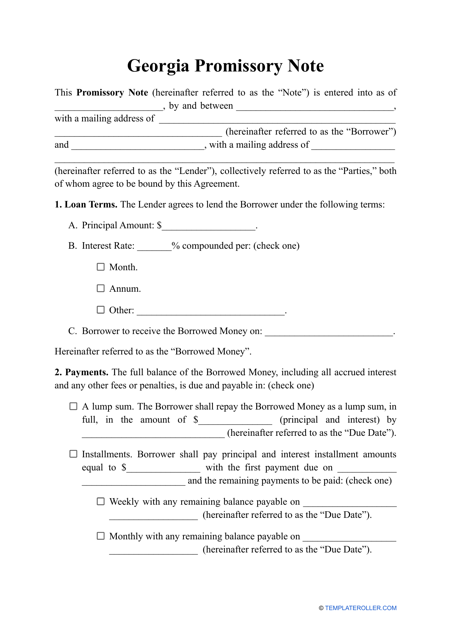

This document is a Promissory Note template specific to the state of Georgia in the United States. It is used to record a promise to repay a debt.

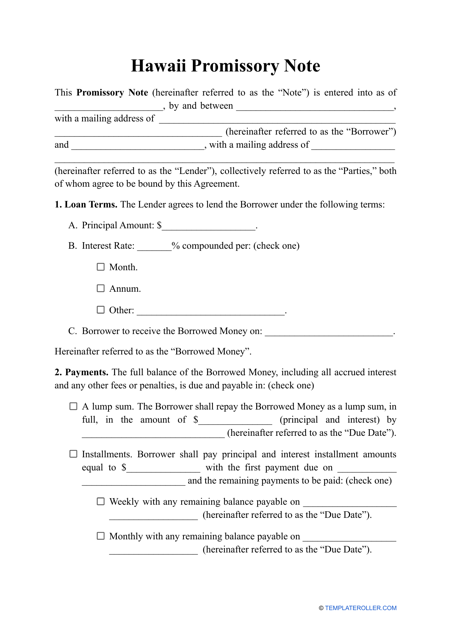

This type of document is a promissory note template specific to the state of Hawaii. It is used to record a promise to pay back a loan or debt.

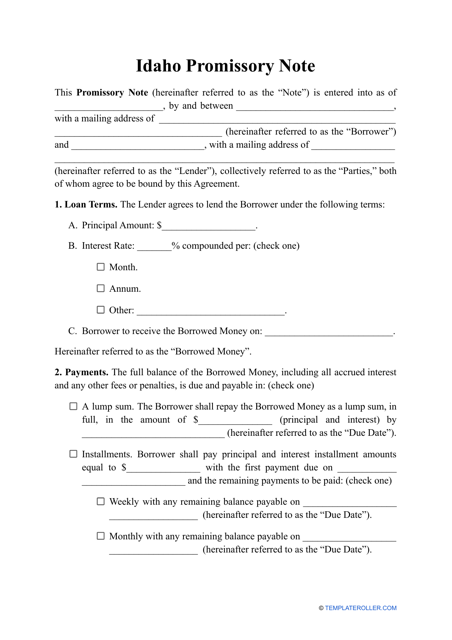

This document is a template for a promissory note in the state of Idaho. It outlines the terms and conditions of a loan agreement between a borrower and a lender.

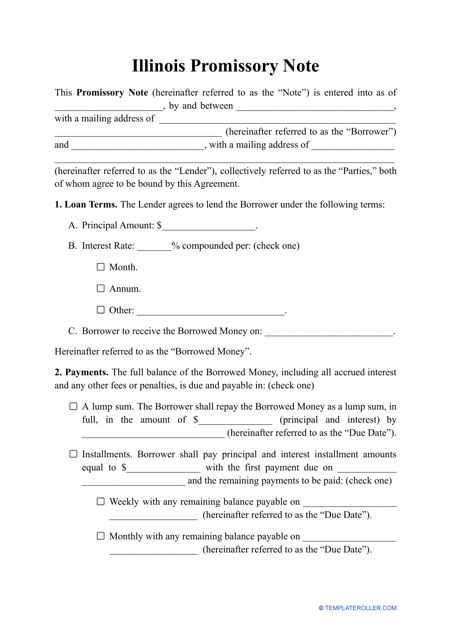

This document is a template for creating a promissory note in the state of Illinois. A promissory note is a legal document that outlines a promise to repay a loan or debt. It includes details such as the amount borrowed, interest rate, repayment terms, and any penalties for non-payment. Using a template can help ensure that all necessary information is included and the note is legally binding.

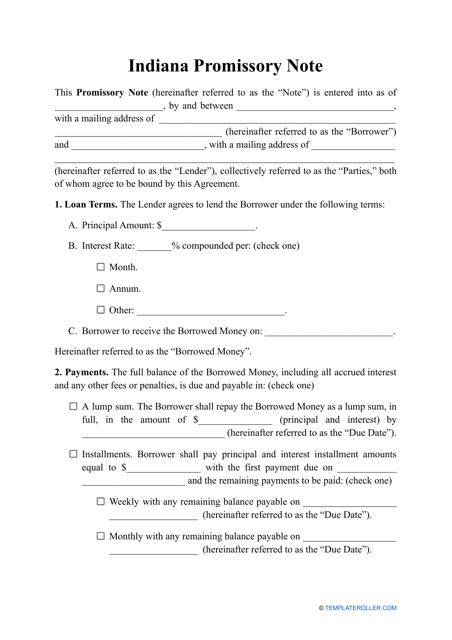

This document is a template for creating a promissory note in Indiana. A promissory note is a legal document that outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. This template can be customized to meet the specific needs of the borrower and lender in Indiana. Use this template to ensure a clear and legally binding agreement for a loan in Indiana.

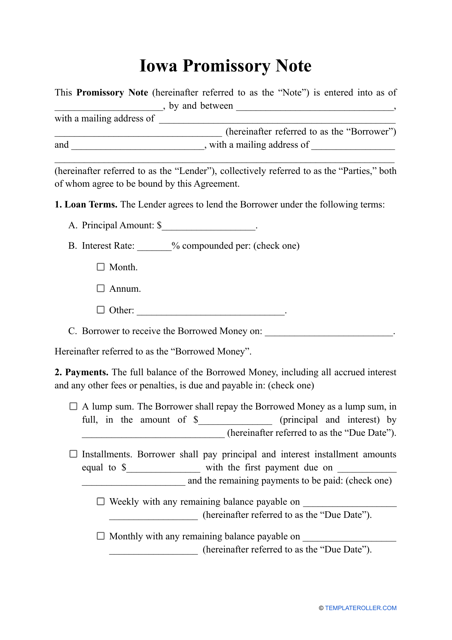

This document template is used in Iowa to create a legally binding agreement between a borrower and a lender, outlining the repayment terms and conditions of a loan.

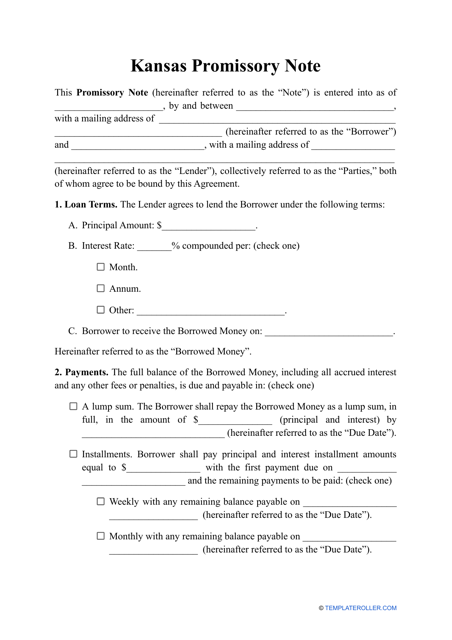

This document is a Promissory Note template specific to the state of Kansas. It is used to outline the terms and conditions of a loan or debt agreement between two parties.

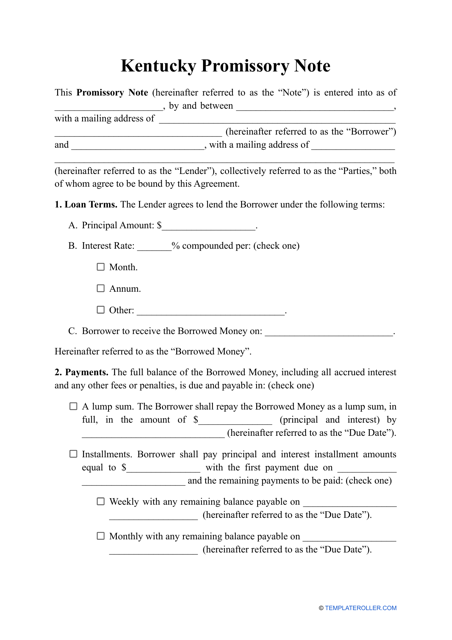

This document is a legally binding agreement between a borrower and a lender in the state of Kentucky. It outlines the terms and conditions of a loan, including the amount borrowed, interest rate, repayment schedule, and consequences of defaulting on the loan. This template can be used to create a promissory note specific to Kentucky.

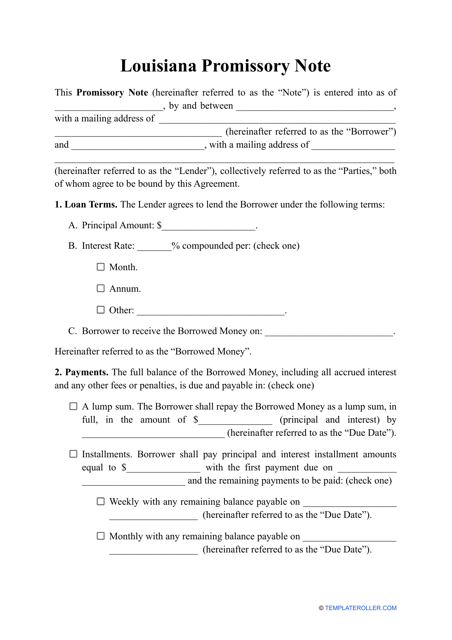

This document is a template for creating a promissory note in the state of Louisiana. A promissory note is a legal agreement in which one party promises to repay a specified amount of money to another party at a future date. Use this template to outline the terms of the loan, including the repayment schedule and any interest charges.

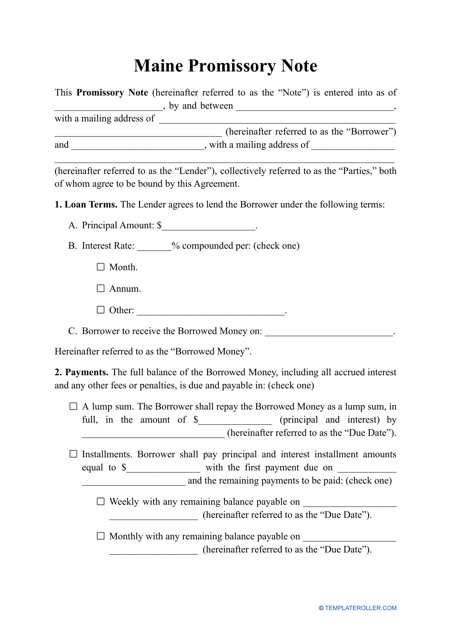

This document is a template for a promissory note in the state of Maine. It outlines the terms and conditions of a loan agreement between a lender and a borrower. Use this template to create a legally binding promissory note in Maine.

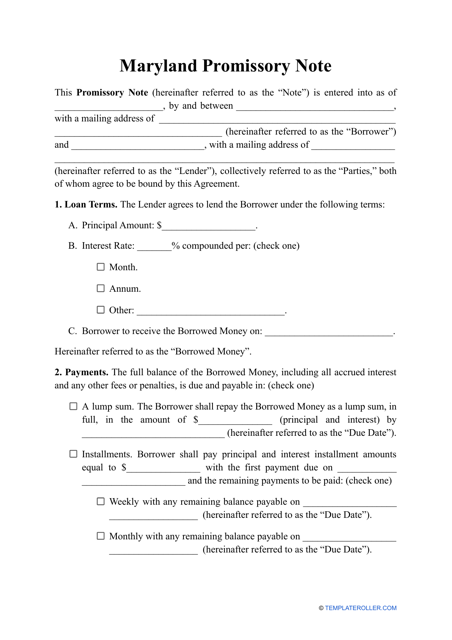

This document provides a template for creating a promissory note in the state of Maryland. It includes sections for the borrower's and lender's information, loan terms, and repayment details. Use this form to legally document a loan agreement in Maryland.

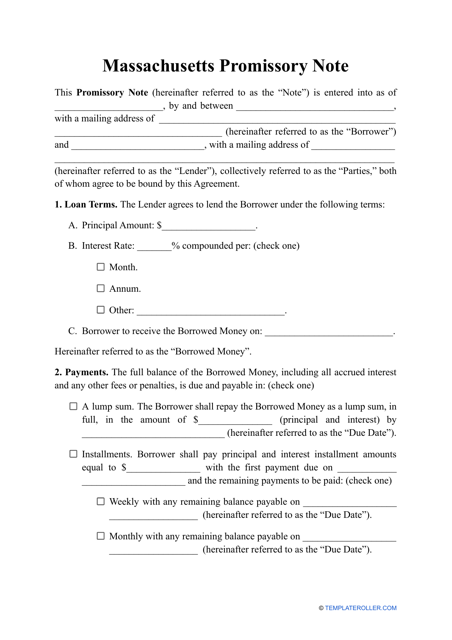

This document for creating a promissory note in Massachusetts for legally documenting a loan agreement.

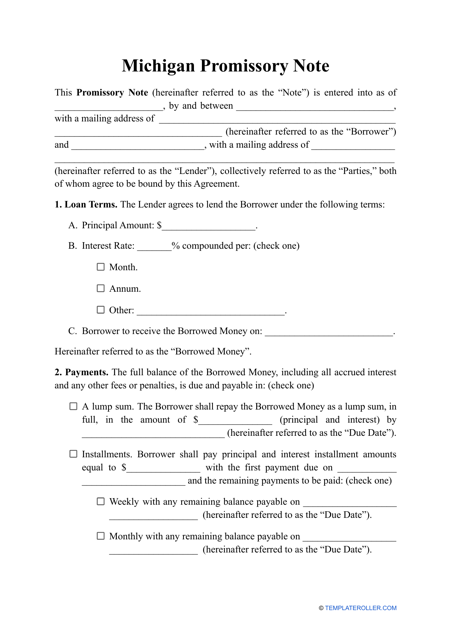

This document provides a template for a promissory note in the state of Michigan. It outlines the terms and conditions of a loan agreement between a borrower and a lender.

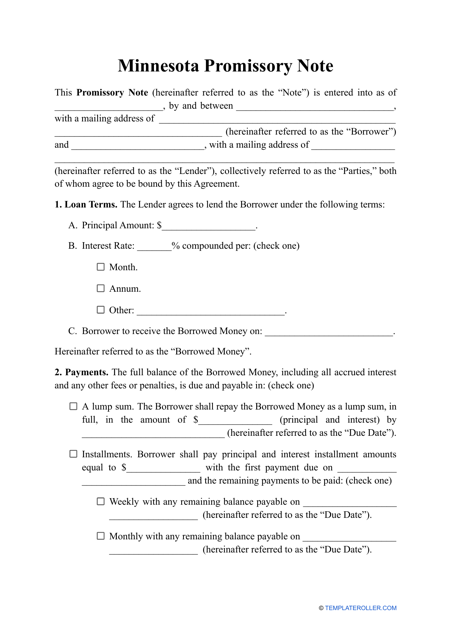

This document is a template for a promissory note in the state of Minnesota. It outlines the terms and conditions of a loan, including the repayment schedule and interest rate.

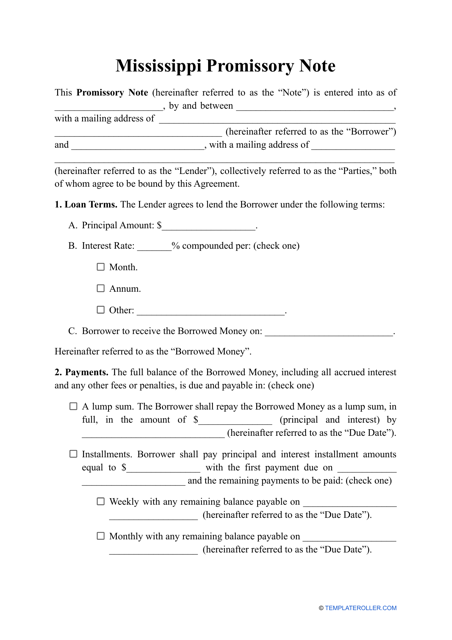

This document is a promissory note template specific to the state of Mississippi. It outlines the details and terms of a loan agreement.

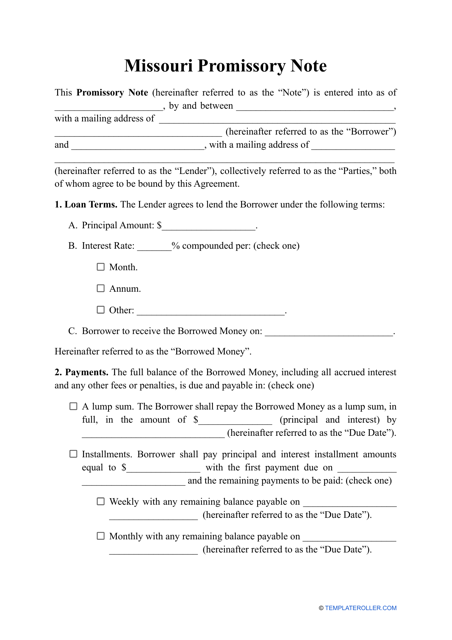

This document template is a promissory note for the state of Missouri, used for establishing a legally binding agreement to repay a loan. It outlines the terms, conditions, and consequences of non-payment.

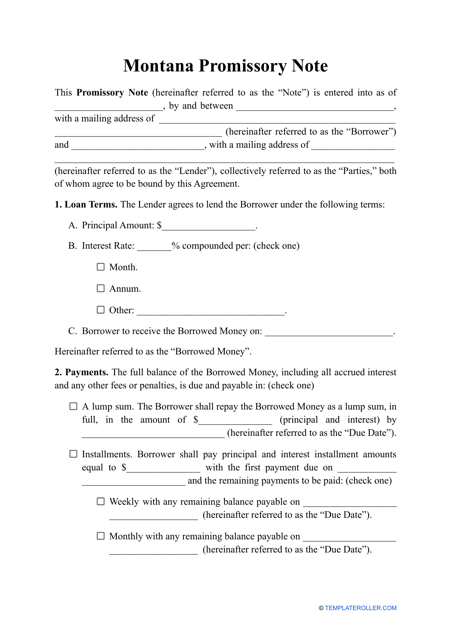

This document provides a template for a promissory note in the state of Montana. A promissory note is a legal document that outlines the terms of a loan, including the amount borrowed, repayment schedule, and any applicable interest.

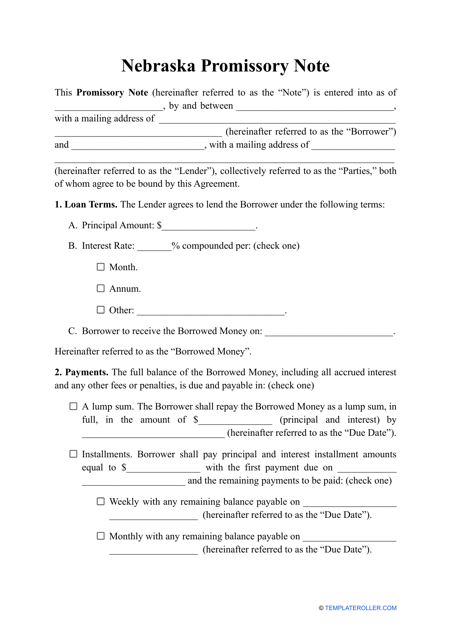

This type of document is used for creating a promissory note in the state of Nebraska. It helps in legally documenting a promise to repay a loan or debt.

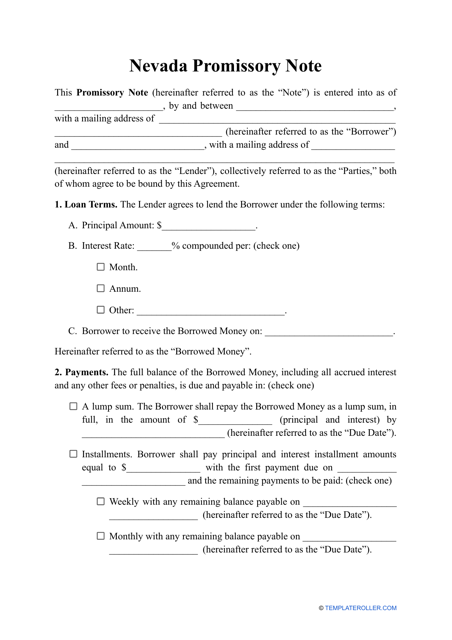

This document is a template for a promissory note, which is a legal agreement in the state of Nevada that sets out the terms of a loan or debt. It outlines the amount borrowed, the interest rate, and the repayment schedule. Use this template to create a promissory note in Nevada.

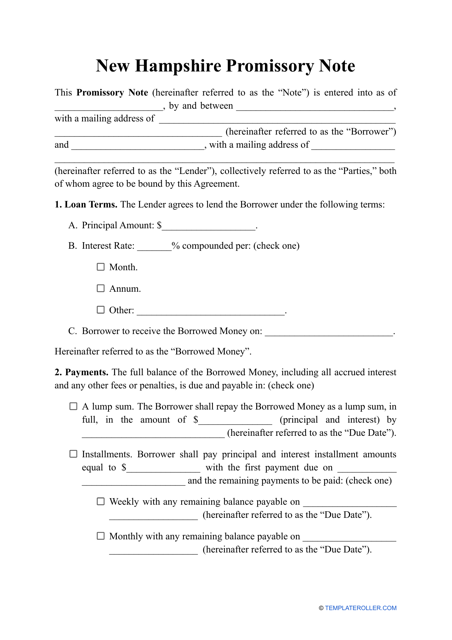

This document provides a template for creating a promissory note, which is a legal agreement in New Hampshire to outline the terms of a loan or debt repayment.

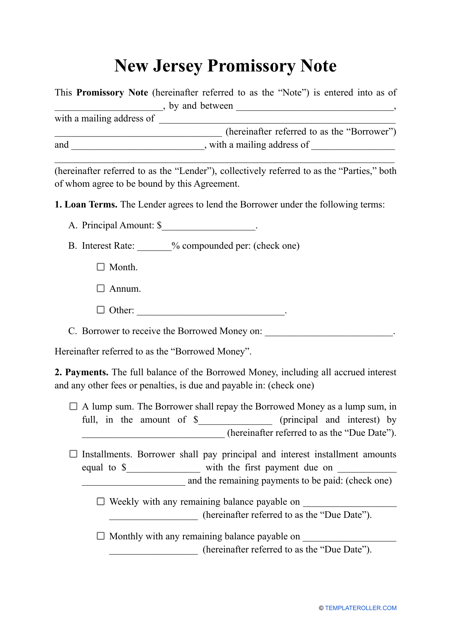

This Form is used for creating a promissory note agreement in the state of New Jersey.

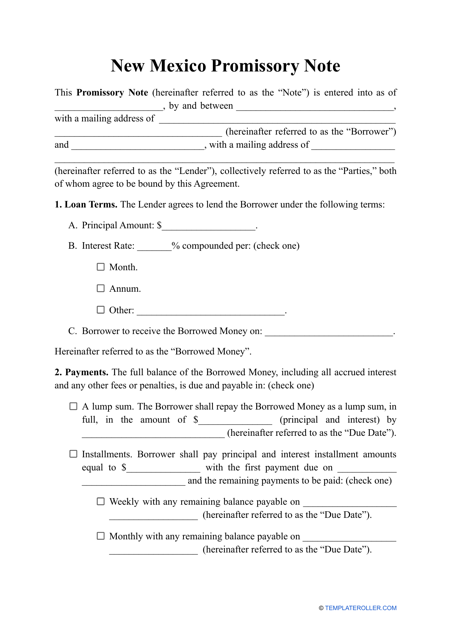

This document is a template for creating a promissory note in New Mexico. A promissory note is a legal agreement that outlines the terms of a loan, including the amount borrowed, interest rate, repayment schedule, and consequences for non-payment. This template can be used to create a promissory note specifically tailored to New Mexico's laws and regulations.

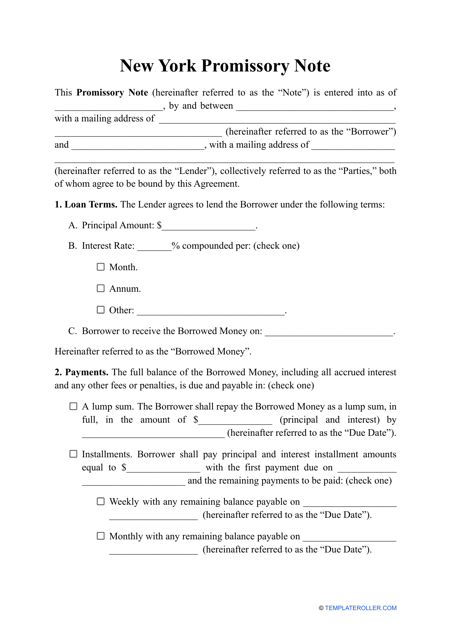

This document template is used to create a legally binding promissory note in the state of New York.

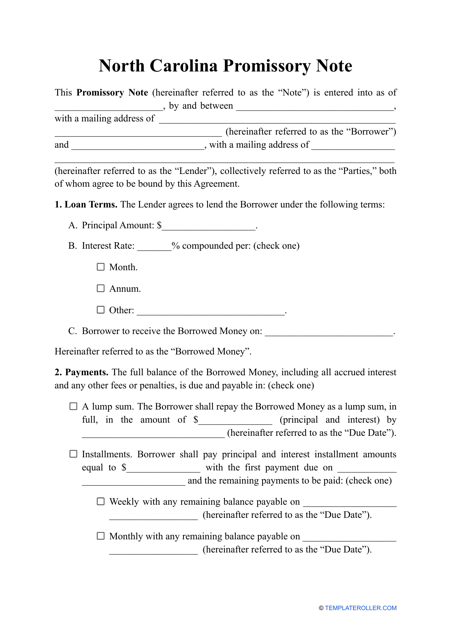

This document is a template for a promissory note in North Carolina. A promissory note is a legal agreement where one party promises to repay a loan to another party within a specific timeframe. The template can be used to create a promissory note that complies with North Carolina law.

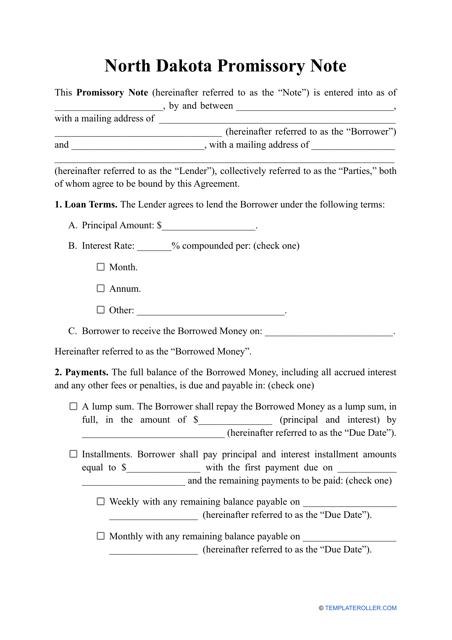

This document template contains the legally binding terms and conditions for a promissory note in the state of North Dakota. Use this template to create a promissory note for any financial transaction in North Dakota.

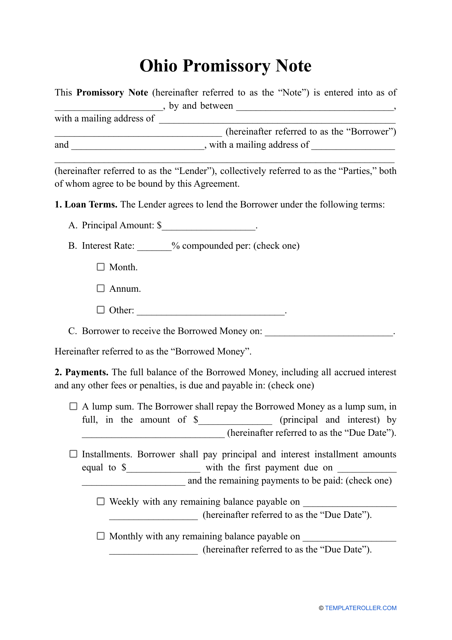

This document for creating a written promise to pay back a loan or debt in Ohio. It contains essential details such as the amount borrowed, terms of repayment, and consequences for non-payment.

This document for Oklahoma is a template for a Promissory Note, a legal agreement between a borrower and a lender that specifies the terms of a loan.

This document is used for creating a legally binding agreement between a borrower and a lender in the state of Oregon. It outlines the terms and conditions of a loan, including the repayment schedule and interest rate.

This document provides a template for a promissory note in Pennsylvania, which is a legal agreement where one party promises to repay a loan to another party.

This document is a template for a promissory note in Rhode Island. It is used to outline the terms of a loan agreement between a lender and a borrower.