Property Valuation Form Templates

Documents:

114

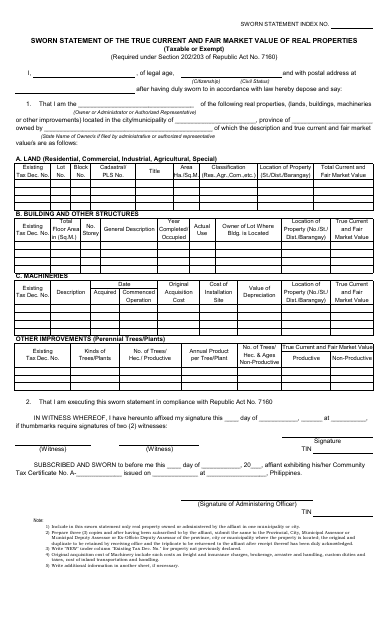

This document is used to declare the accurate and current market value of real properties in the Philippines.

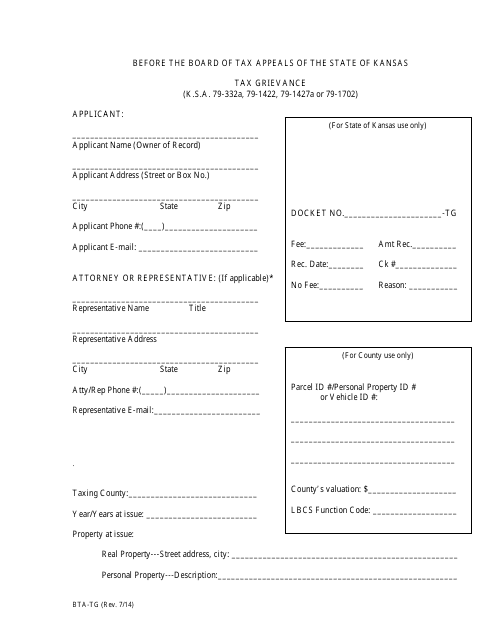

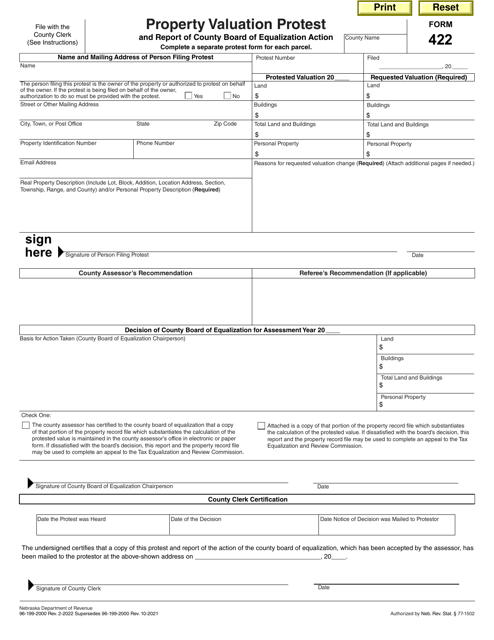

This document is used for filing a tax grievance in the state of Kansas.

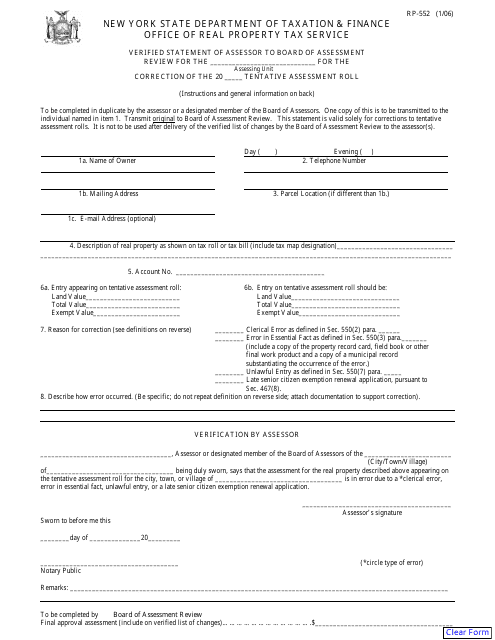

This form is used for the verified statement of the assessor to the Board of Assessment Review in New York. It is to provide accurate and verifiable information regarding assessments.

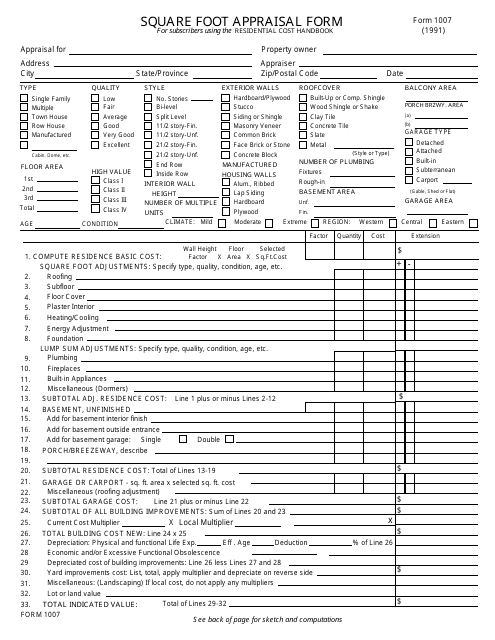

This form is used for assessing the value of a property based on its square footage.

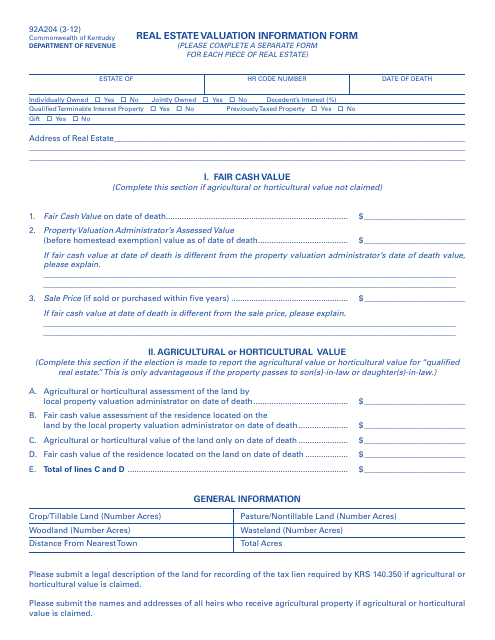

This form is used for providing real estate valuation information in the state of Kentucky.

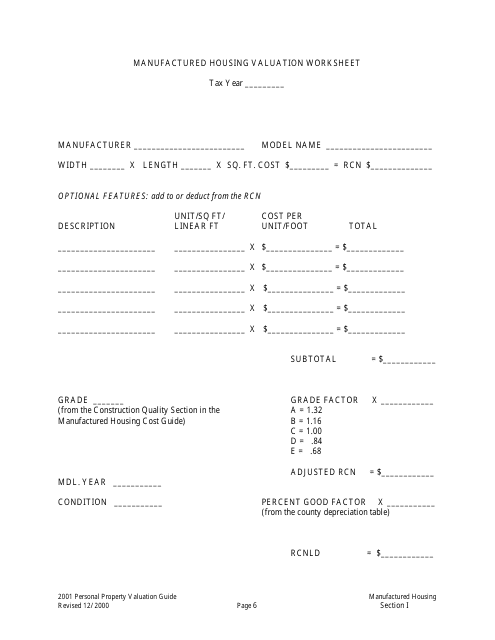

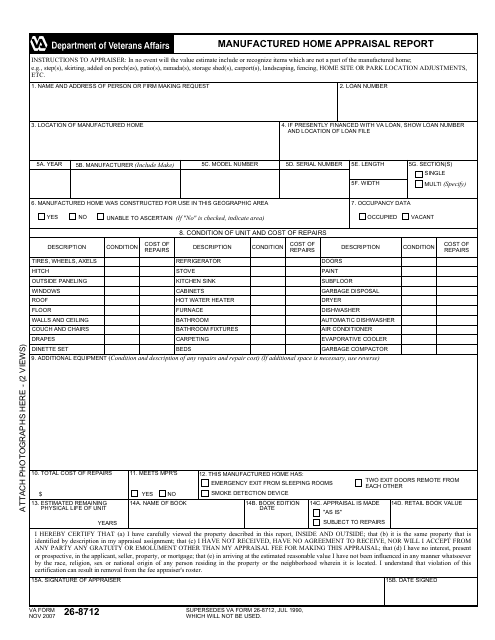

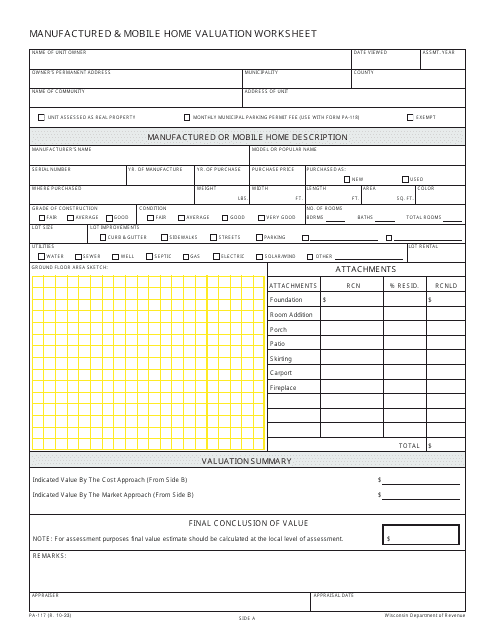

This document is used for evaluating the value of manufactured housing units. It helps in assessing the worth of mobile or prefabricated homes.

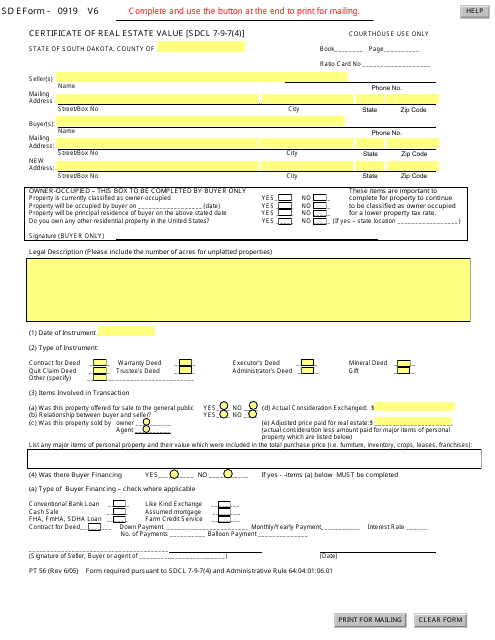

This form is used for reporting the value of real estate transactions in South Dakota. It is required for tax purposes and helps determine the assessment of property values.

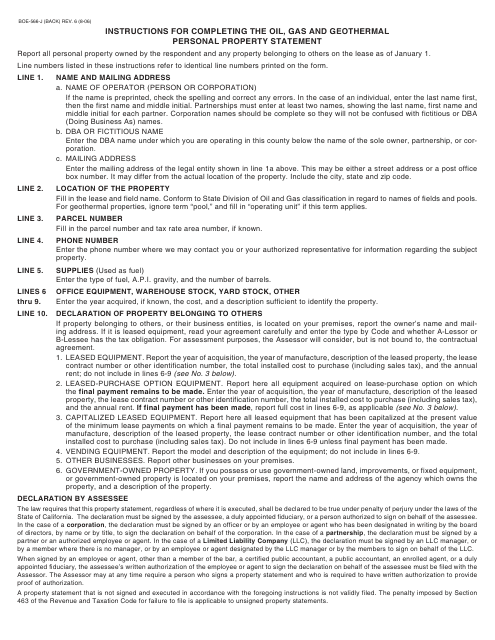

This Form is used for reporting oil, gas, and geothermal personal property in California. It provides instructions on how to fill out and submit the Form BOE-566-J.

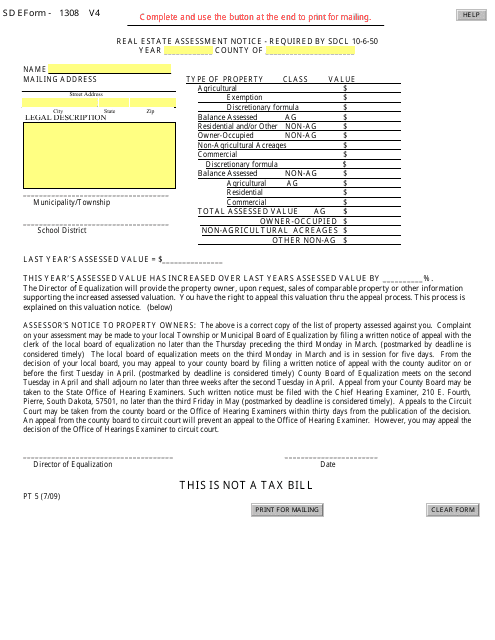

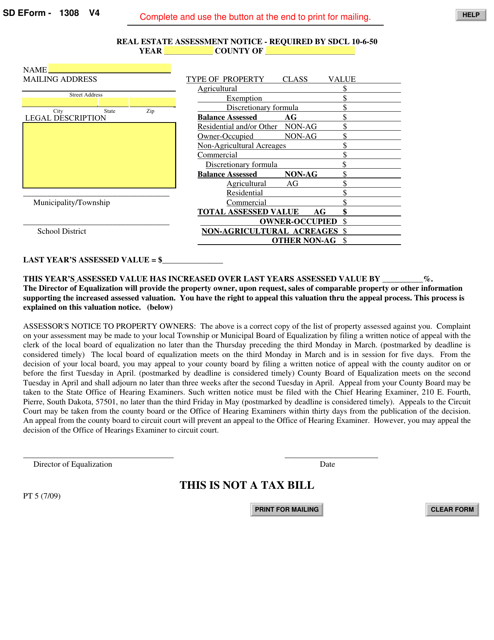

This Form is used for receiving a Real Estate Assessment Notice in South Dakota.

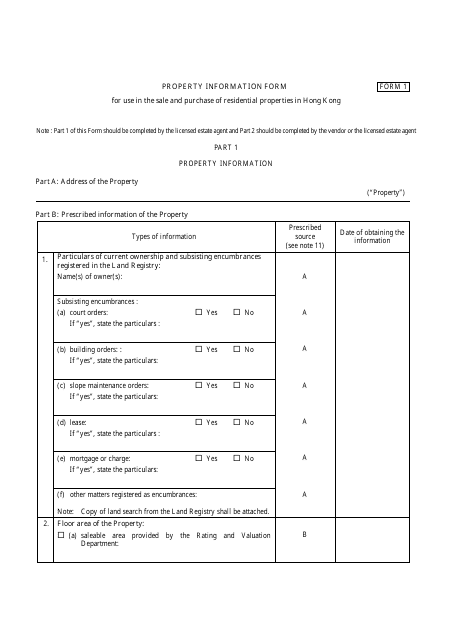

This Form is used for gathering information about properties in Hong Kong.

This form is used for completing an appraisal report for a manufactured home. It helps evaluate the value and condition of the home.

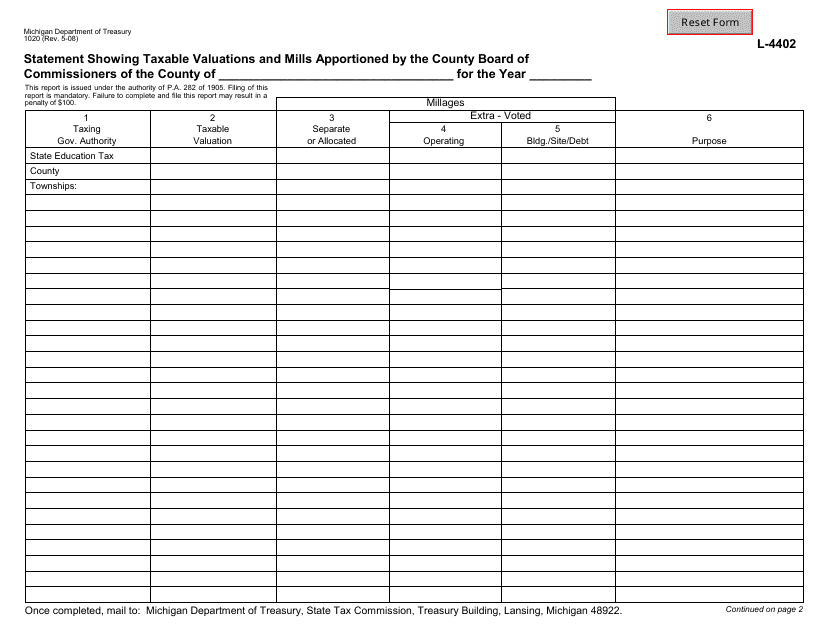

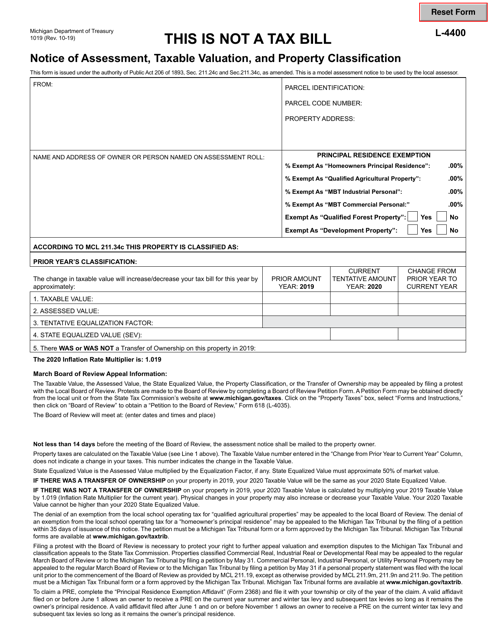

This form is used for showing the taxable valuations and mills apportioned by the County Board of Commissioners in Michigan.

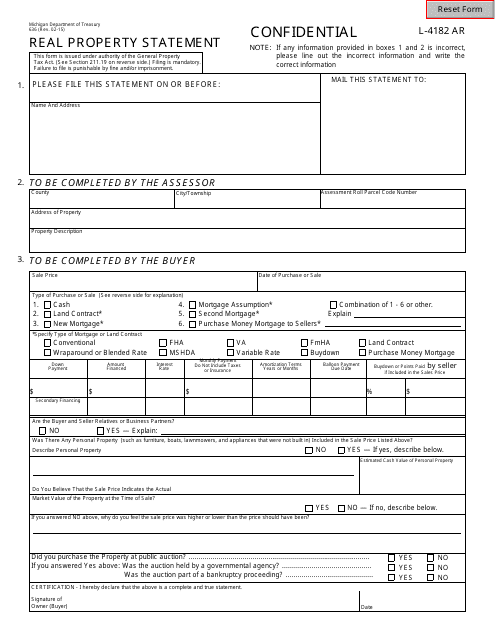

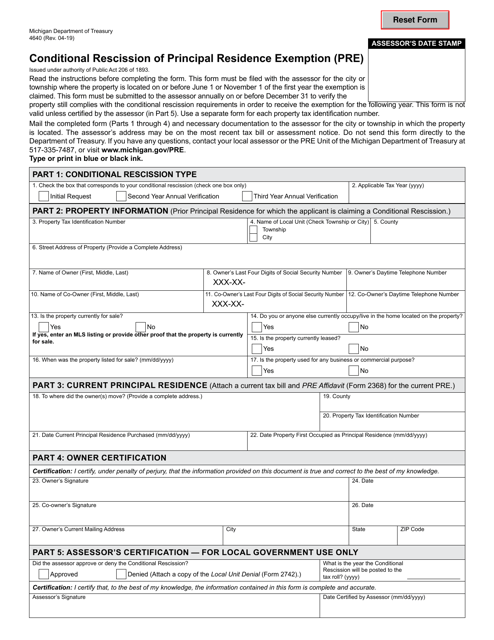

This Form is used for declaring real property in Michigan. It contains information about the property, its ownership, and its assessed value.

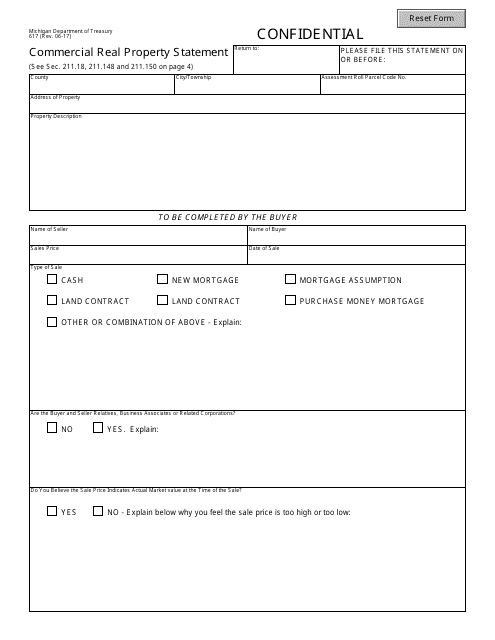

This Form is used for providing a statement of commercial real property in the state of Michigan. It is required for assessment and taxation purposes.

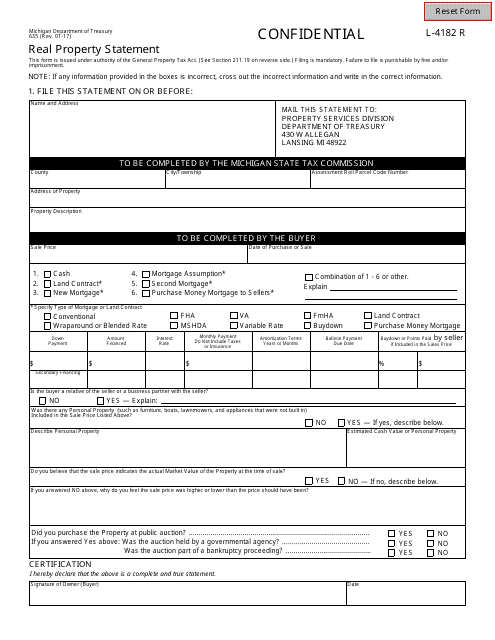

This document is used for providing a statement of real property in the state of Michigan. It is used to report the value of real property for tax assessment purposes.

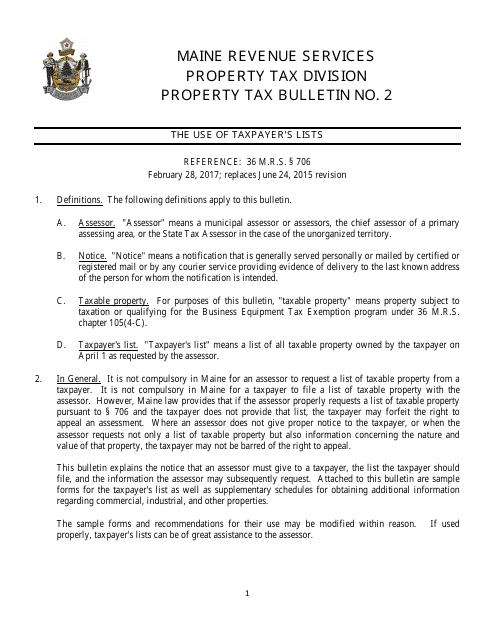

This document is a request for a list of taxable property in the state of Maine. It is used to gather information on properties that are subject to taxation.

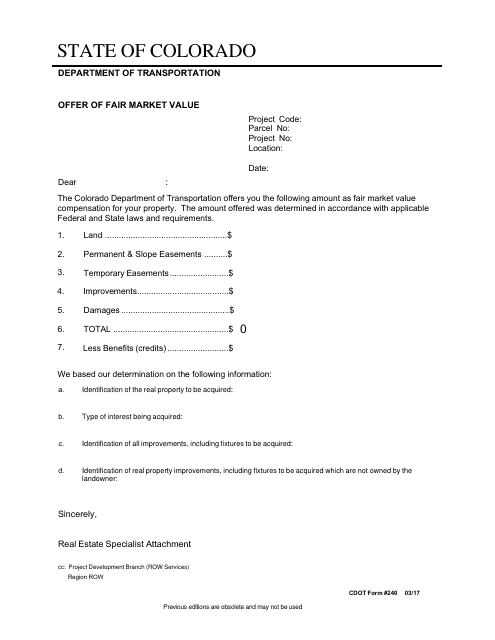

This form is used for submitting an offer of fair market value for a property in Colorado.

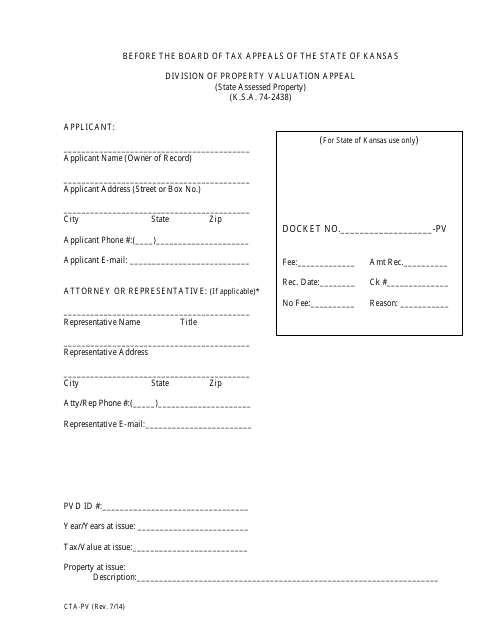

This Form is used for filing an appeal regarding property valuation in Kansas. It is specifically for the Division of Property Valuation.

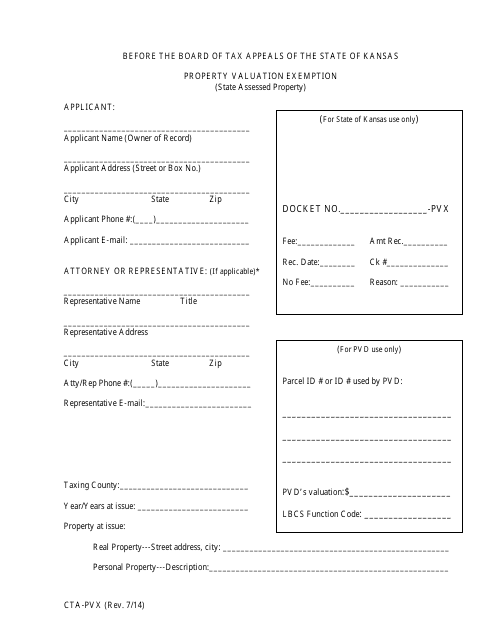

This form is used for applying for a property valuation exemption in Kansas. It is known as the CTA-PVX Form.

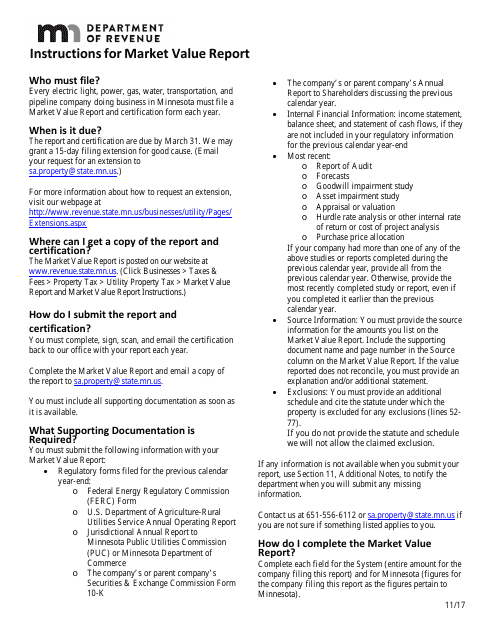

This form is used for reporting the market value of a property in Minnesota. It provides instructions on how to properly fill out the report and submit it to the relevant authorities.

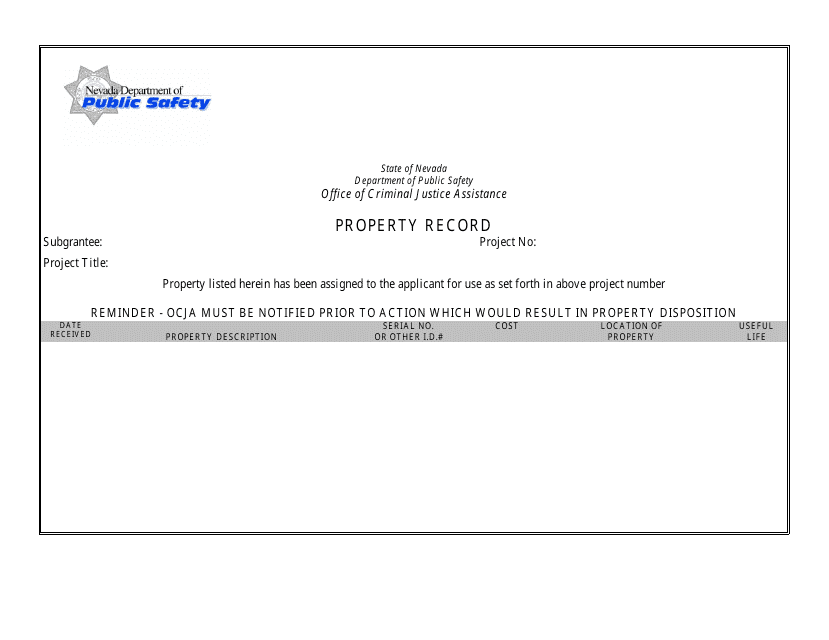

This type of document is used for recording property information in the state of Nevada. It includes details such as the property owner's name, address, and legal description.

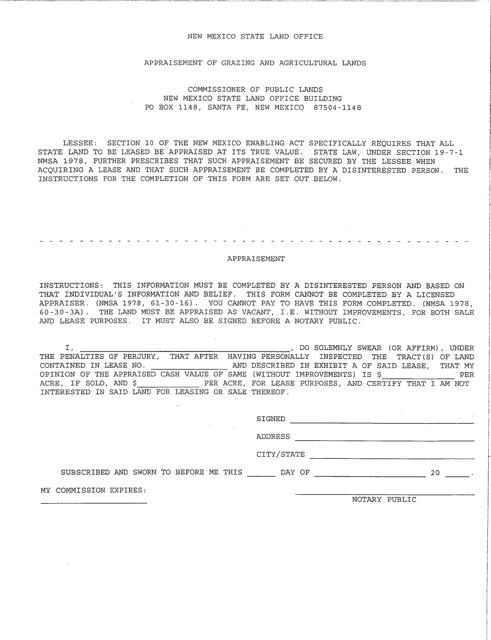

This document is used for appraising grazing and agricultural lands in the state of New Mexico. It provides a valuation of these types of properties for assessment and taxation purposes.

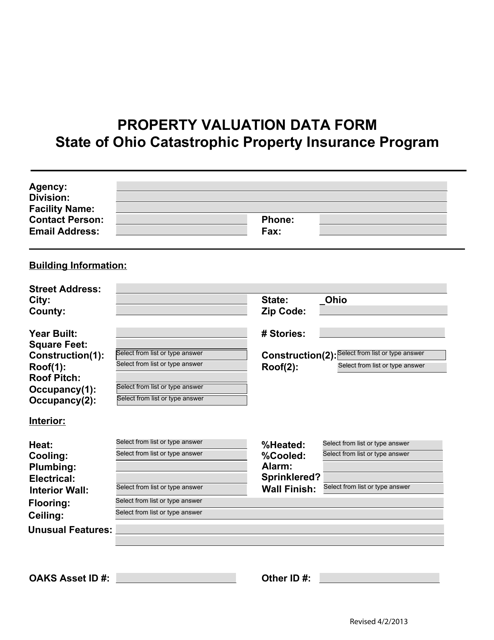

This Form is used for obtaining property valuation data in the state of Ohio.

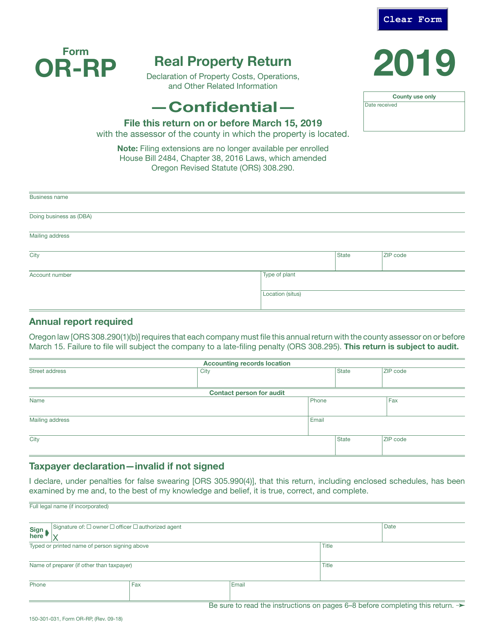

This form is used for filing a real property return in the state of Oregon. It is required by the Oregon Department of Revenue and must be completed by property owners to report their real estate holdings.

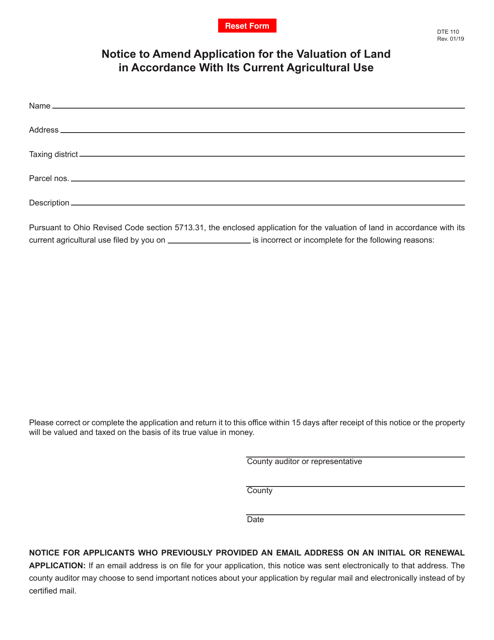

This form is used for notifying the Ohio Department of Taxation about changes in the application for the valuation of agricultural land.

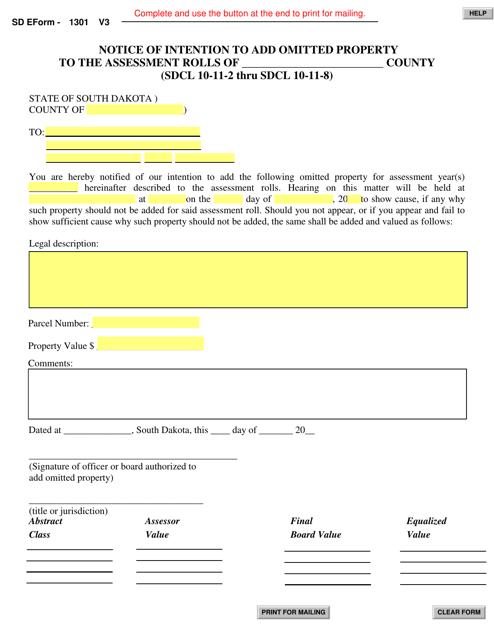

This document is used for notifying the assessor's office in South Dakota of any intention to add omitted property or valuation to the assessment rolls. It is important for property owners to make sure their property is correctly assessed for tax purposes.

This document is a real estate assessment notice specific to South Dakota. It is used to inform property owners about the assessed value of their property for tax purposes.

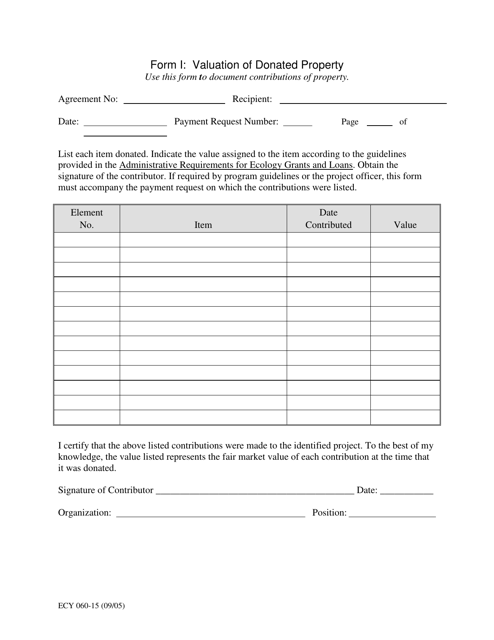

This form is used for the valuation of donated property in the state of Washington. It is required to accurately determine the value of the property for tax purposes.

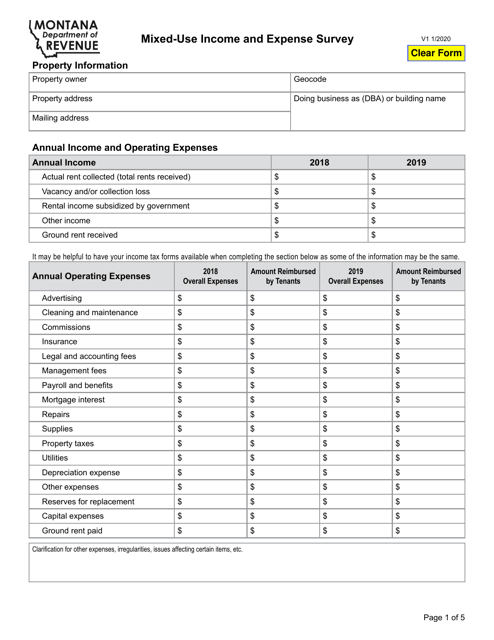

This form is used for conducting a survey to gather information on income and expenses related to mixed-use properties in the state of Montana.

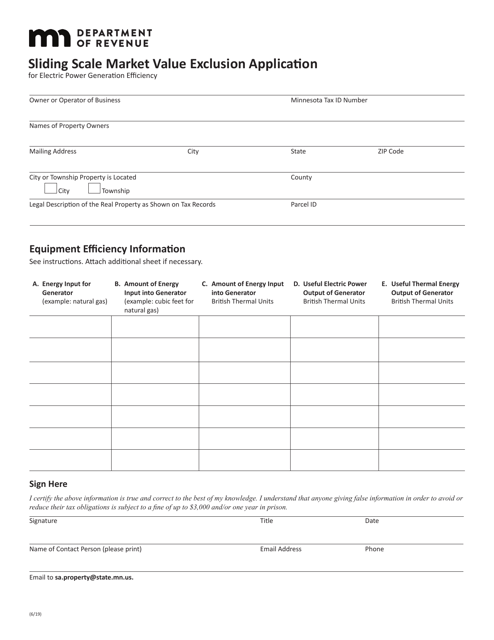

This form is used to apply for the sliding scale market value exclusion in Minnesota.