Property Valuation Form Templates

Documents:

114

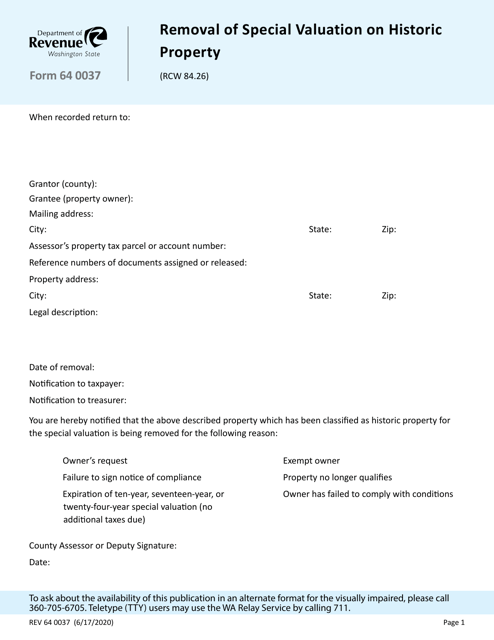

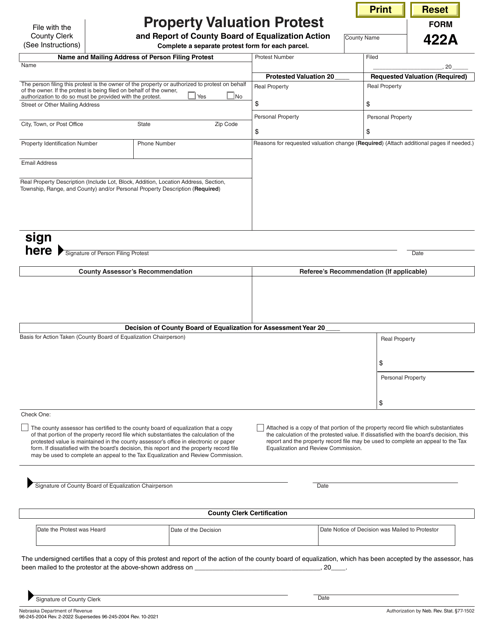

This Form is used for requesting the removal of special valuation on a historic property in Washington state.

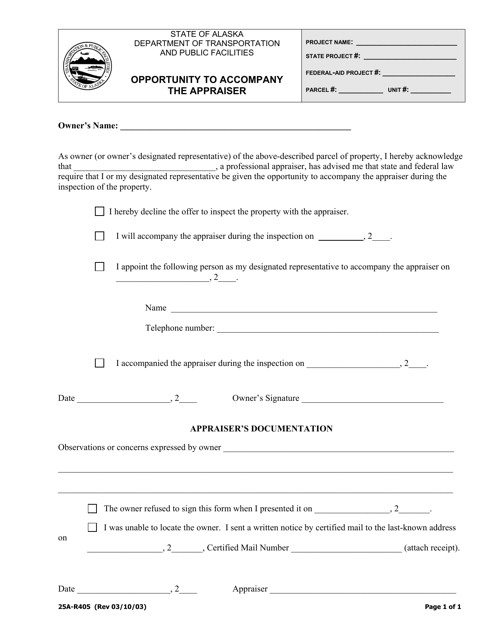

This form is used for requesting an opportunity to accompany the appraiser during property valuation in Alaska.

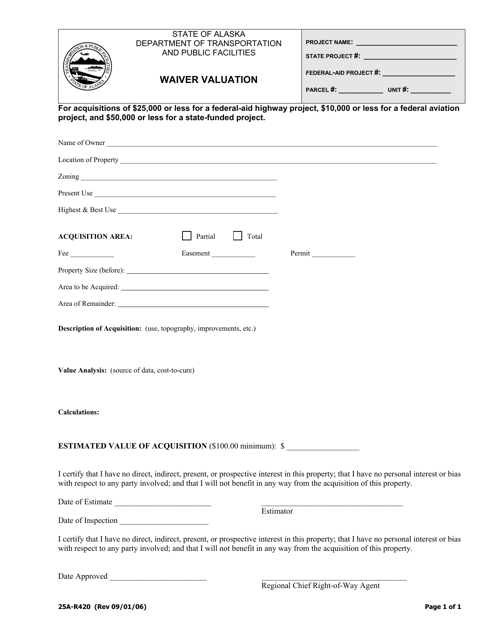

This form is used for requesting a waiver valuation in Alaska.

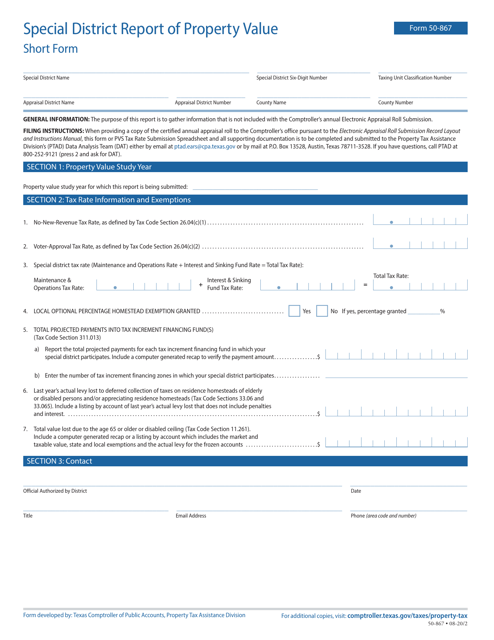

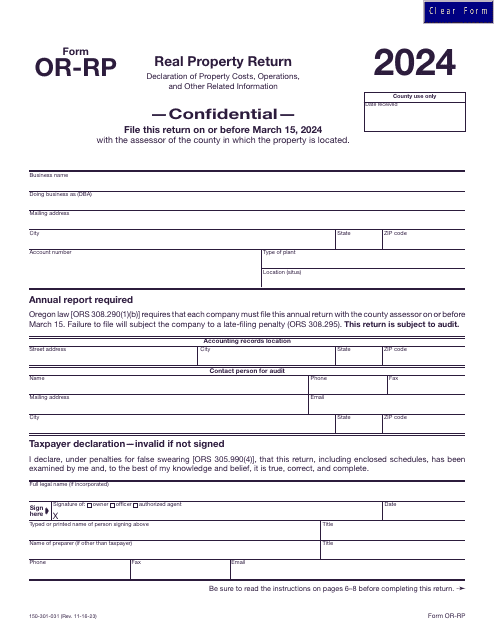

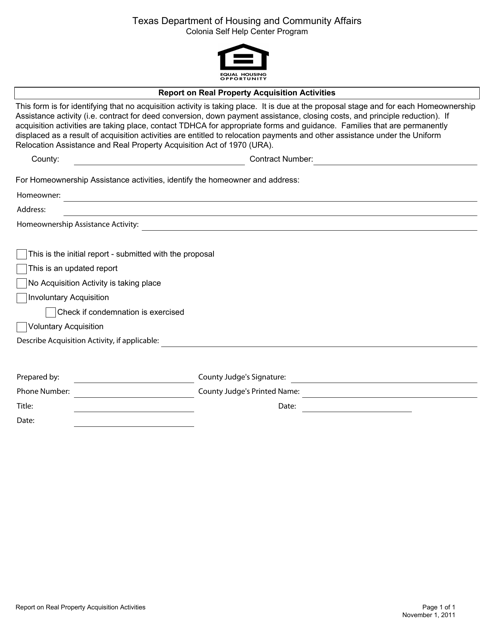

This document provides a report on real property acquisition activities in the state of Texas. It includes information on the acquisition process, properties acquired, and any relevant updates or changes.

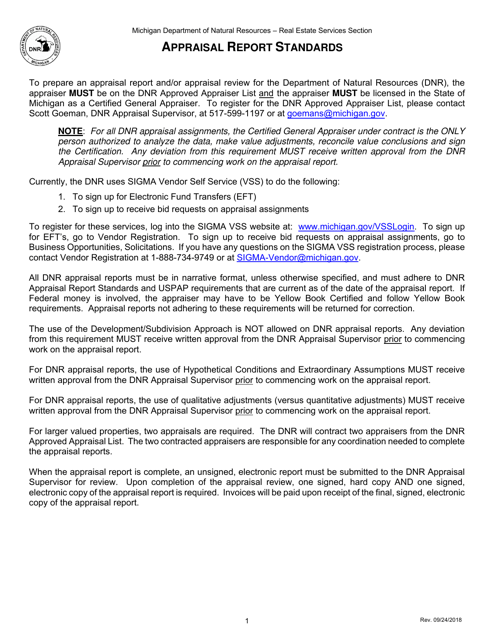

This document sets the standards for appraisal reports in Michigan. It provides guidelines and requirements for the content and format of appraisal reports.

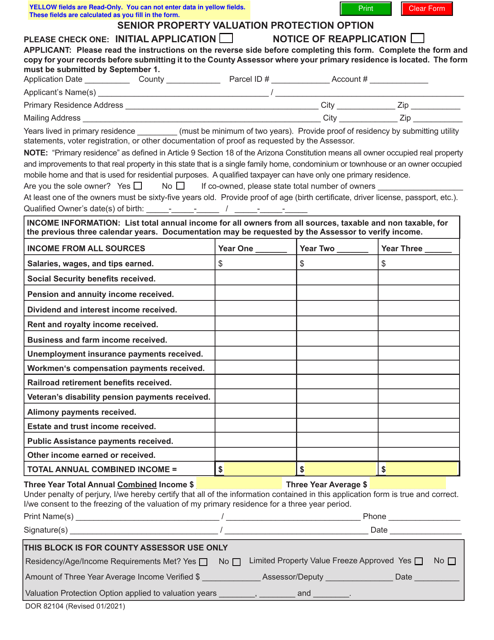

This Form is used for seniors in Arizona to apply for the Property Valuation Protection Option which can help to reduce property taxes.

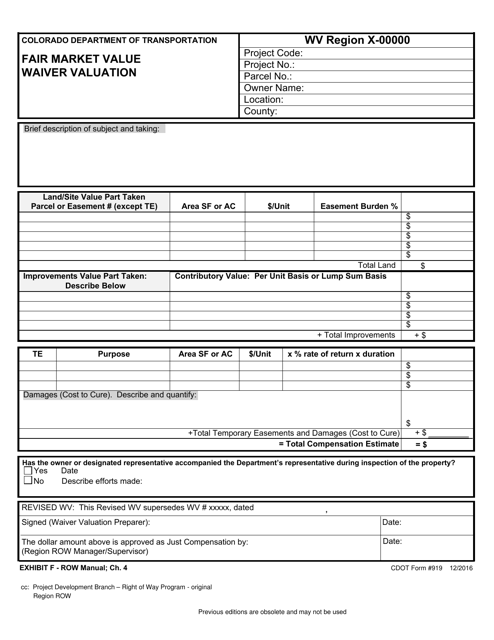

This form is used to request a waiver of the fair market value for property in Colorado.

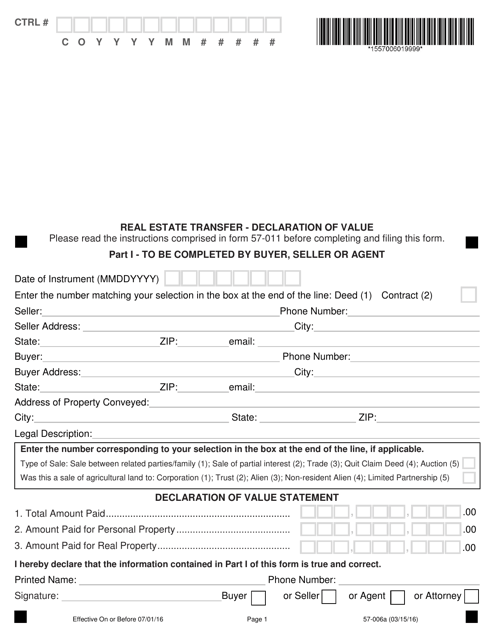

This Form is used for declaring the value of a real estate transfer in the state of Iowa. It is used to provide accurate information for taxation purposes.

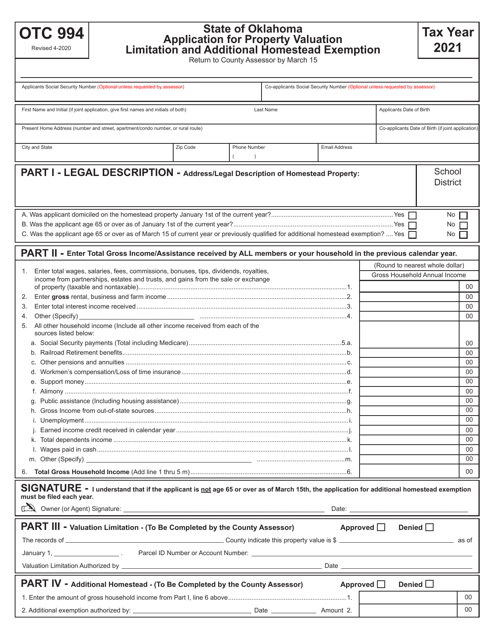

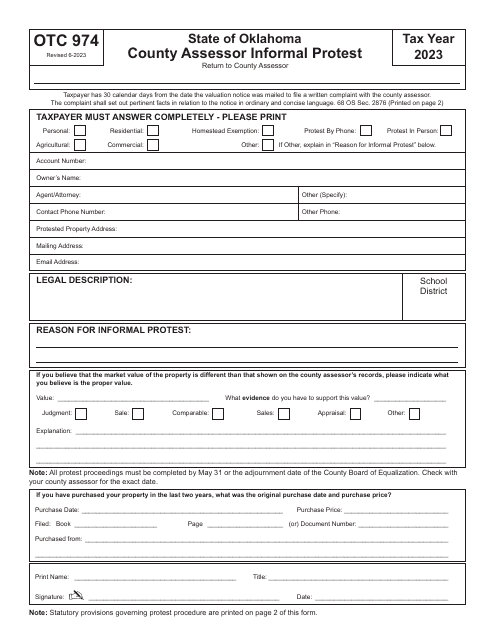

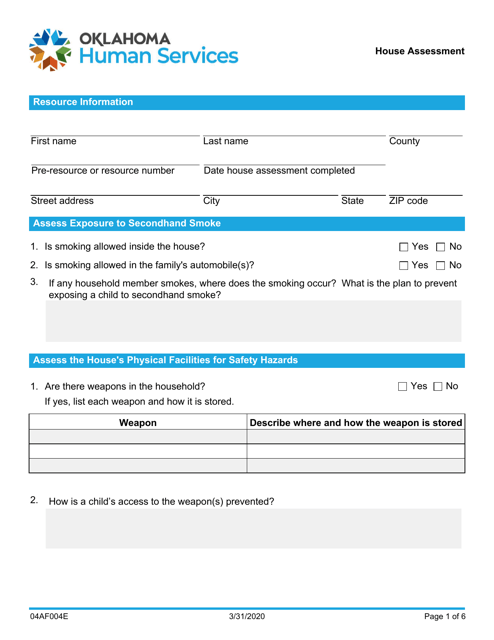

This Form is used for assessing houses in Oklahoma. It helps determine the value and tax assessment of residential properties in the state.

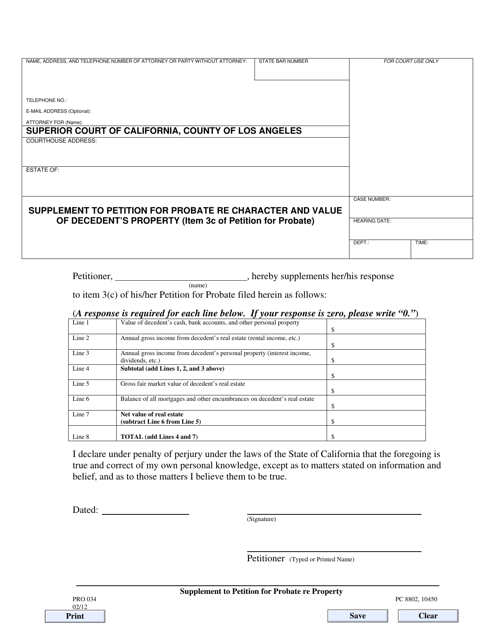

This form is used to supplement a petition for probate in Los Angeles County, California. It specifically addresses the character and value of the deceased person's property, specifically item 3c of the original petition.

This Form is used for applying for a tax abatement on real property in Washington, D.C.

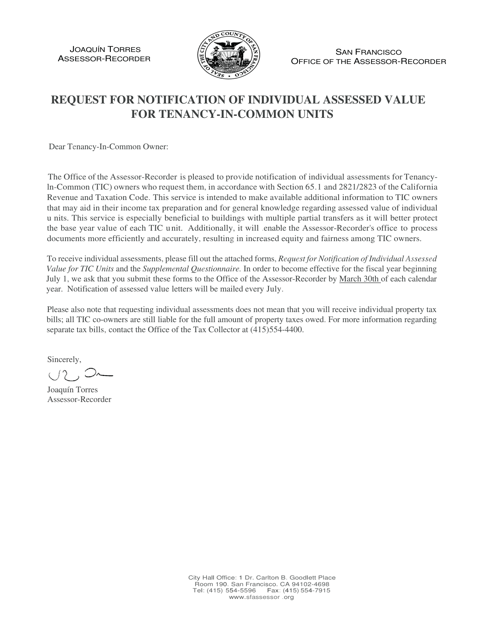

This document is a request for notification of the assessed value of individual Tic (Tenants in Common) Units in the City and County of San Francisco, California.

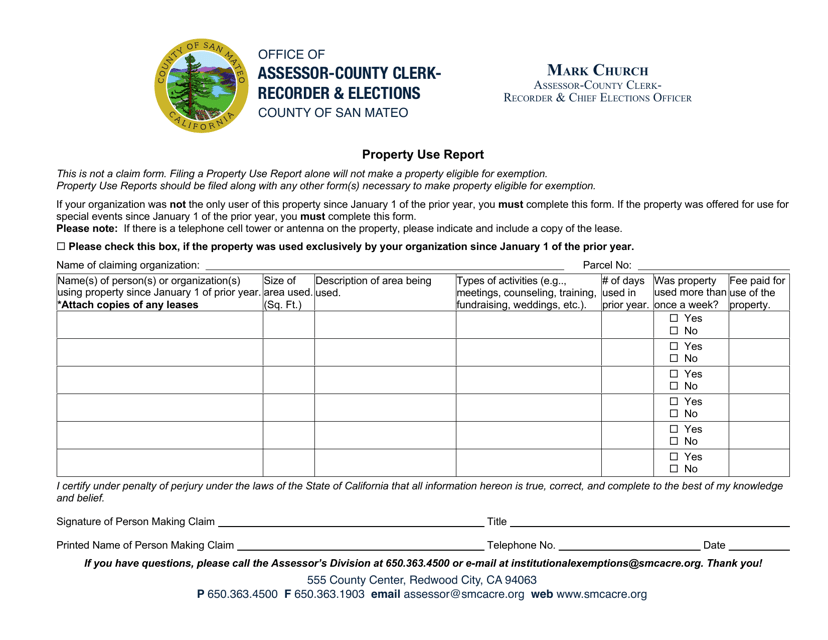

This document provides a report on the use of properties in San Mateo County, California. It gives information about how the properties are being used and can be useful for research or planning purposes.

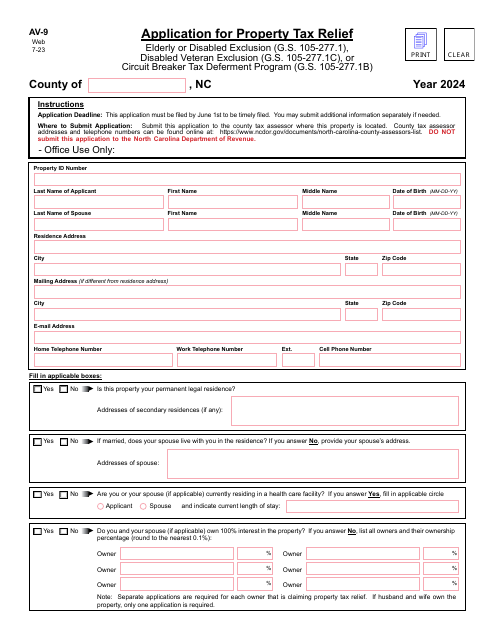

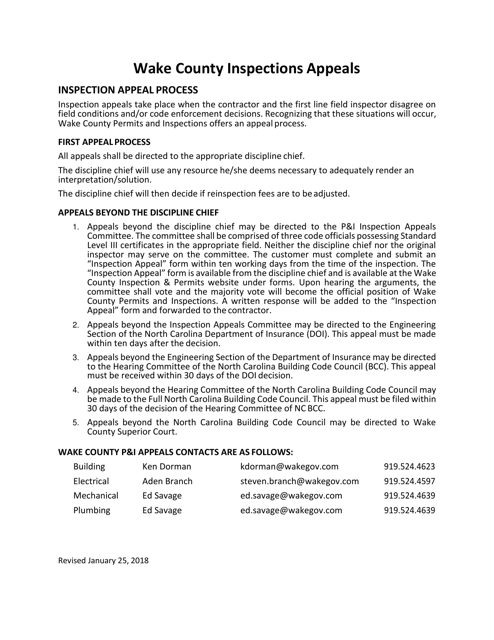

This document is used for appealing the results of an inspection in Wake County, North Carolina.

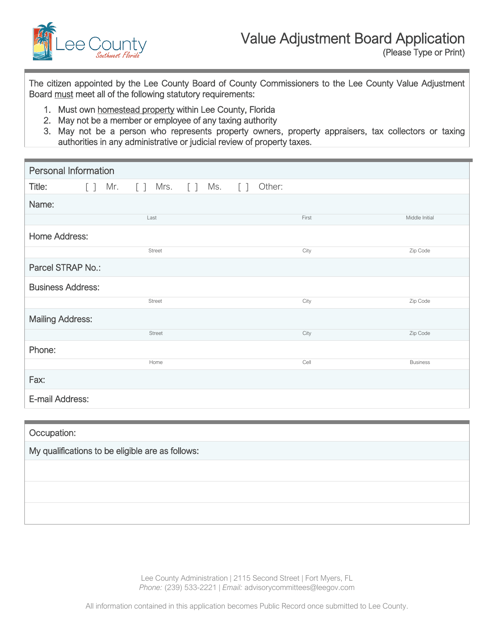

This document is for applying to the Value Adjustment Board in Lee County, Florida.

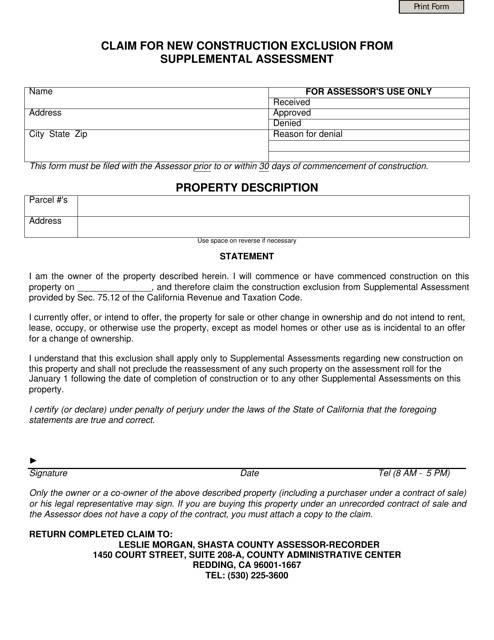

This form is used for claiming a new construction exclusion from supplemental assessment in Shasta County, California

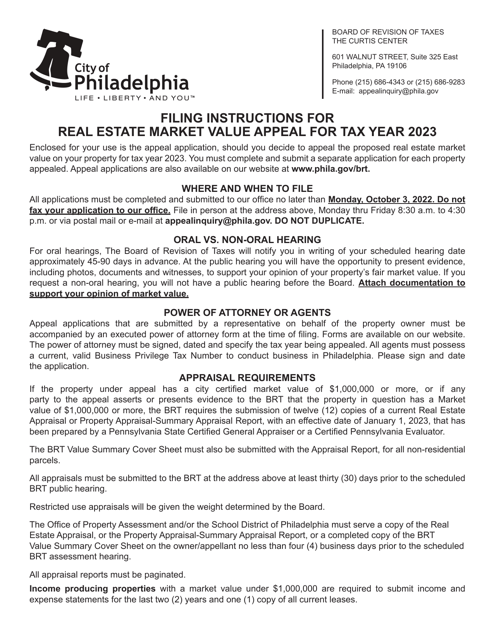

This document is for appealing the market value of real estate in Philadelphia, Pennsylvania. It provides a process for challenging the assessed value of a property in order to potentially lower property taxes.

This Form is used for applying for a Greenbelt Assessment in the state of Tennessee. Greenbelt Assessment allows eligible agricultural, forest, or open land to be appraised at its current use value rather than its market value for property tax purposes.

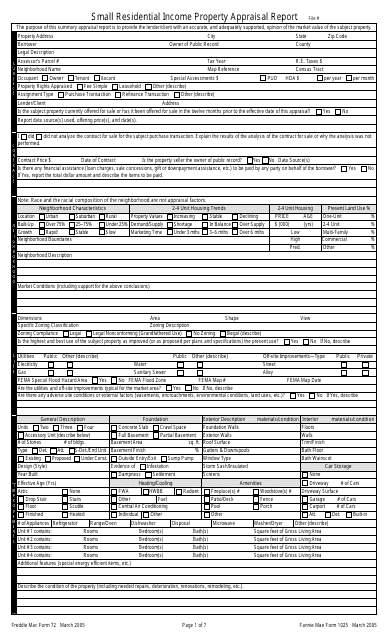

This document is used to assess the value of a small residential income property. It is typically used by lenders to make informed decisions about loans related to such properties.