Loan Repayment Form Templates

Documents:

92

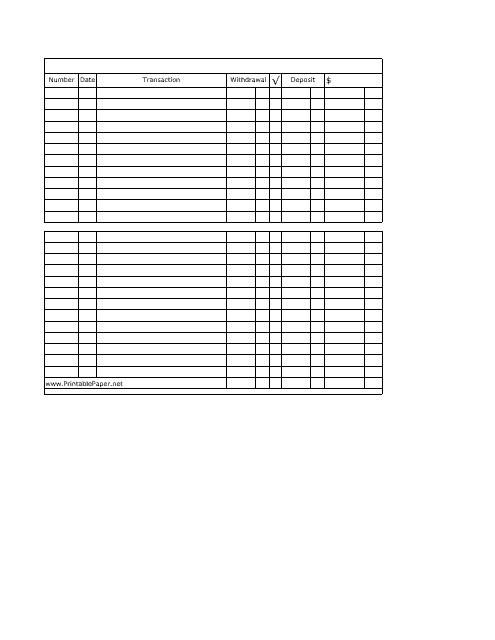

This document is a template for creating a payment schedule. It includes a small table for organizing payment details.

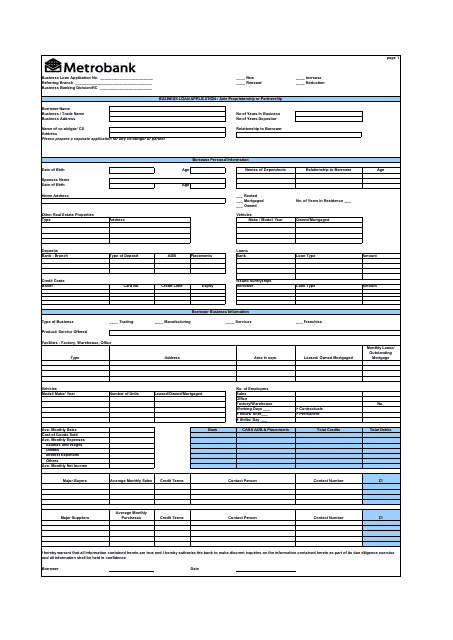

This document is used for applying for a business loan with Metrobank.

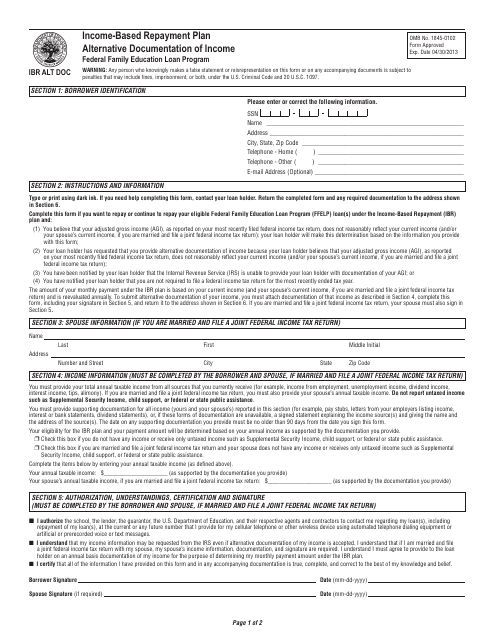

This document is used for providing alternative documentation of income for the Income-Based Repayment Plan.

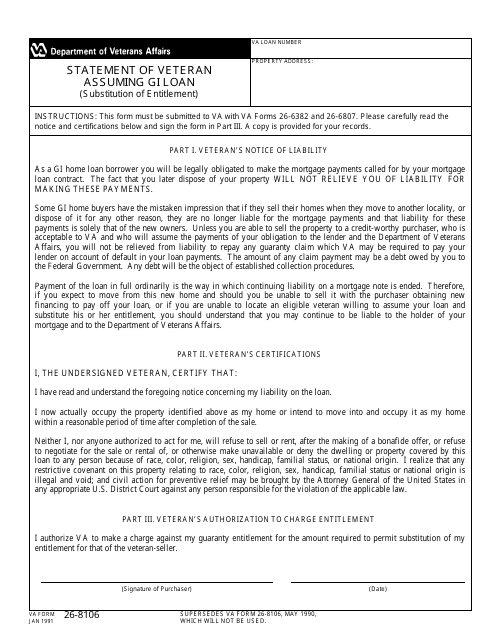

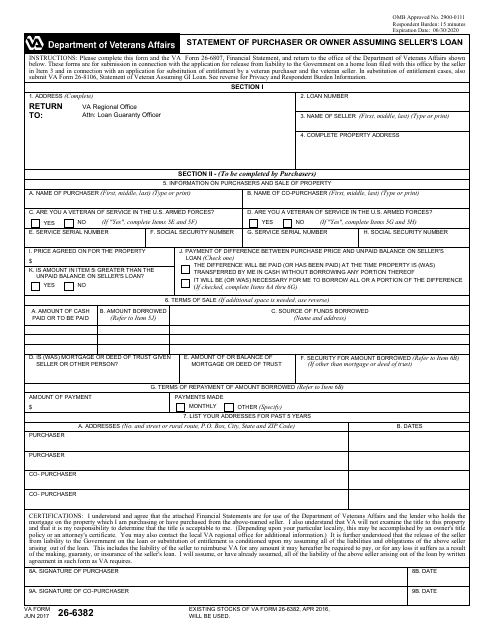

This Form is used for veterans assuming GI loans to provide a statement confirming their intention to assume the loan.

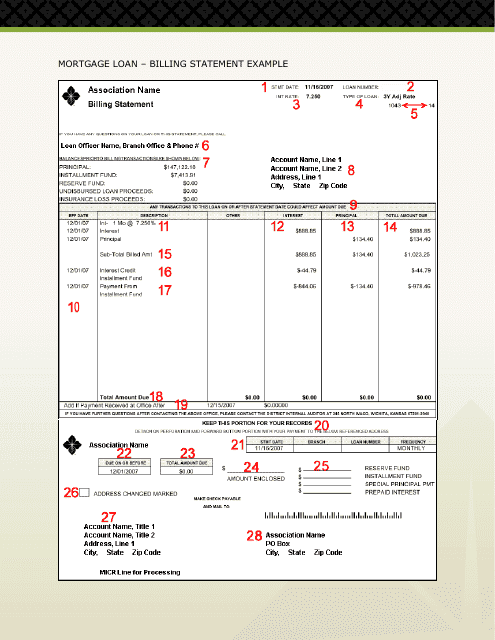

This document is a sample billing statement for a mortgage loan. It provides a breakdown of the amount due, including principal, interest, and any additional fees or charges.

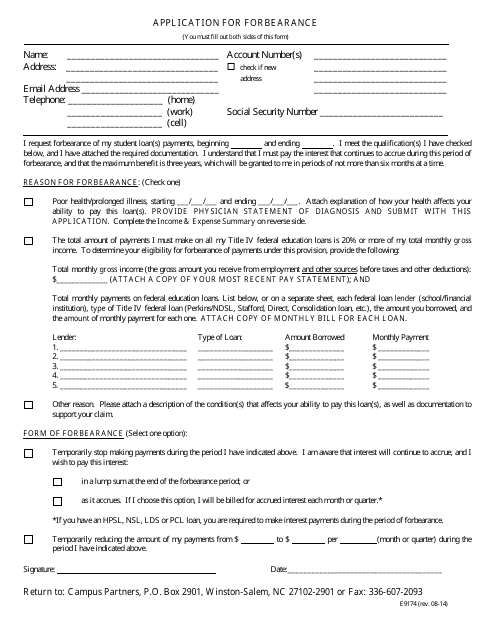

This Form is used for requesting forbearance on student loans with Campus Partners.

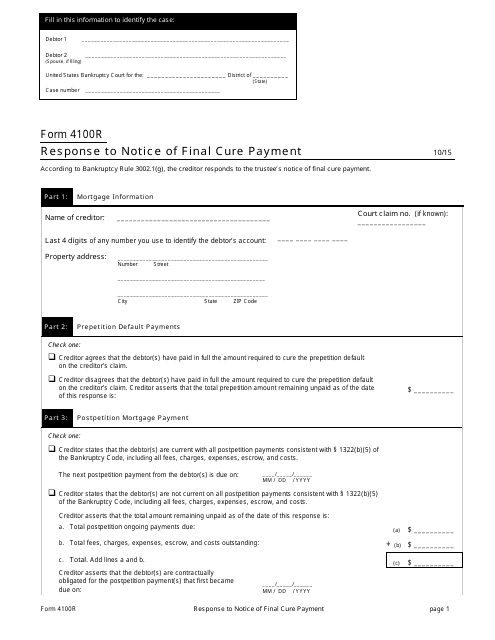

This Form is used for submitting a response to a Notice of Final Cure Payment. It is important to complete and submit this form to finalize the payment process.

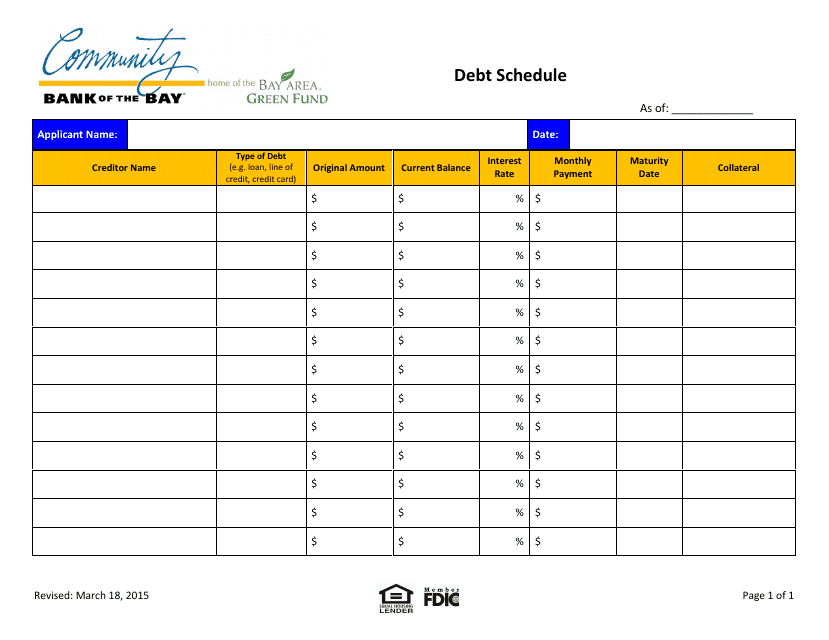

This document is a debt schedule template provided by Community Bank of the Bay. It helps individuals or businesses in organizing their debt repayment schedule.

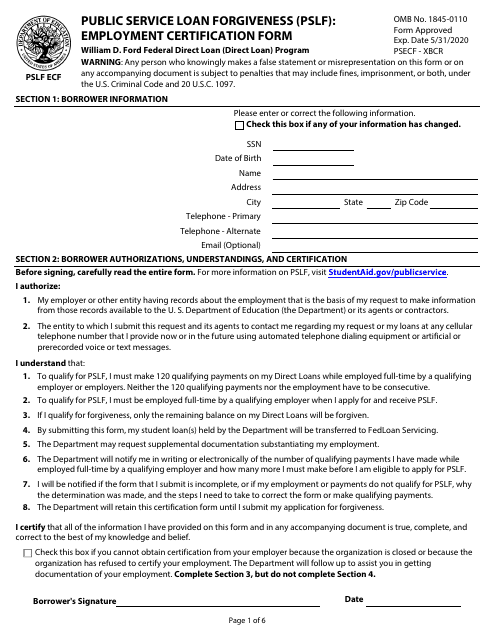

This form is used for verifying employment for the Public Service Loan Forgiveness (PSLF) program. It helps borrowers apply for loan forgiveness if they work in a qualifying public service job.

This Form is used for buyers or owners who are assuming the seller's loan.

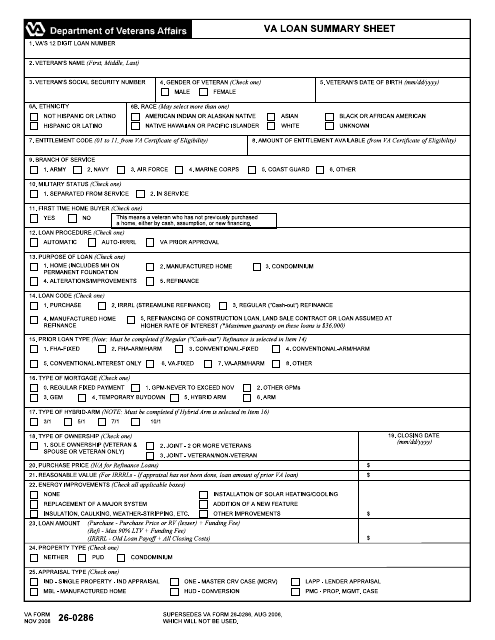

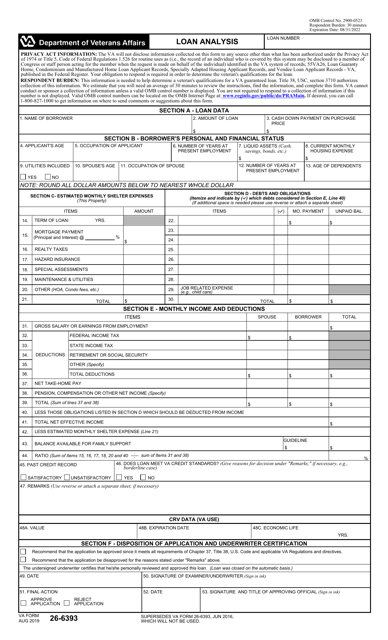

This document provides a summary of information related to a VA loan. It is used to summarize important details of a VA loan application.

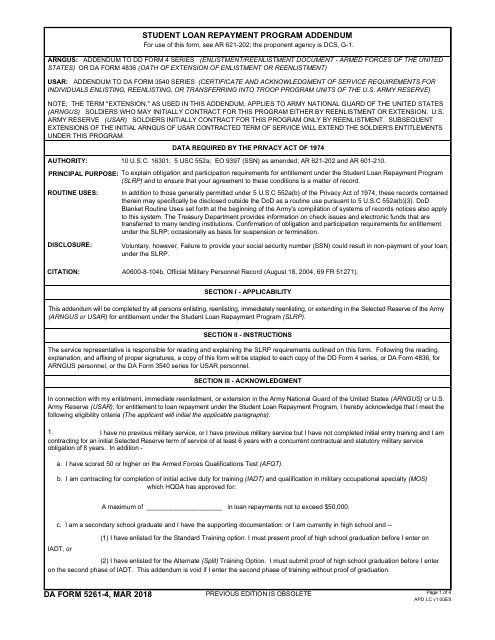

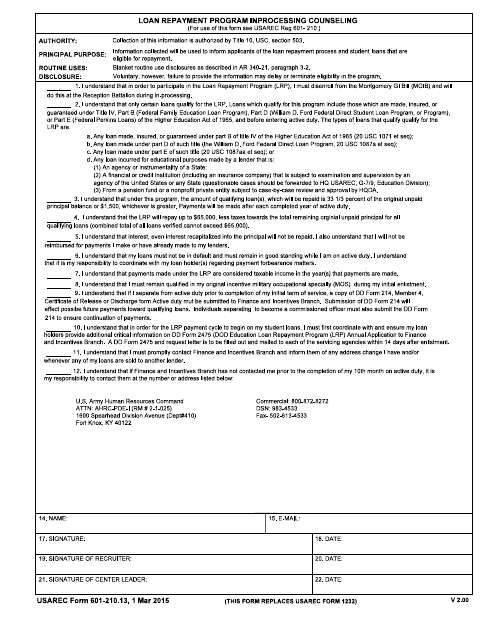

This document is used for in-processing counseling for the Loan Repayment Program.

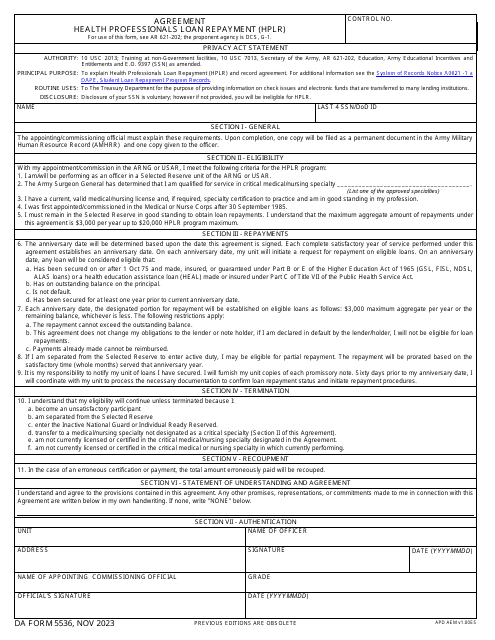

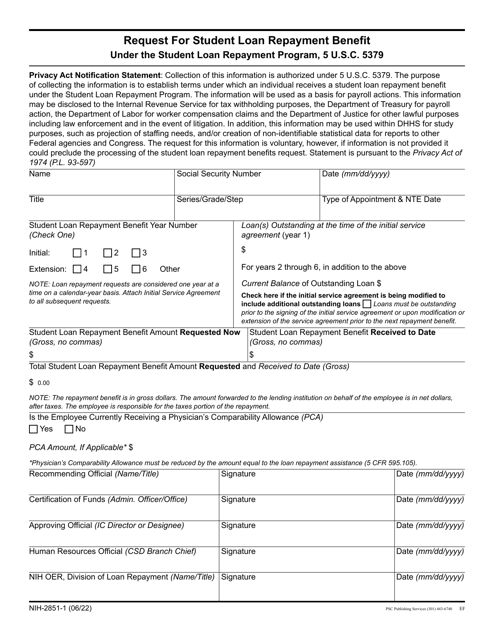

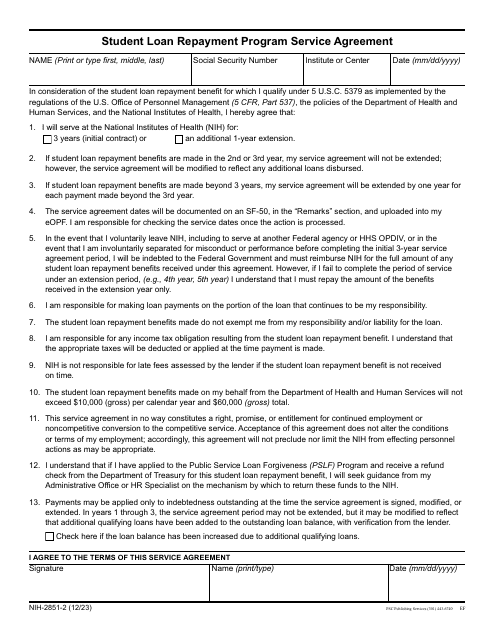

This document is a contract for the Loan Repayment Program of the National Institutes of Health (NIH). It is used to formalize the terms and conditions of the program between the applicant and NIH.

This form is used for providing applicant information for the NIH Loan Repayment Programs.

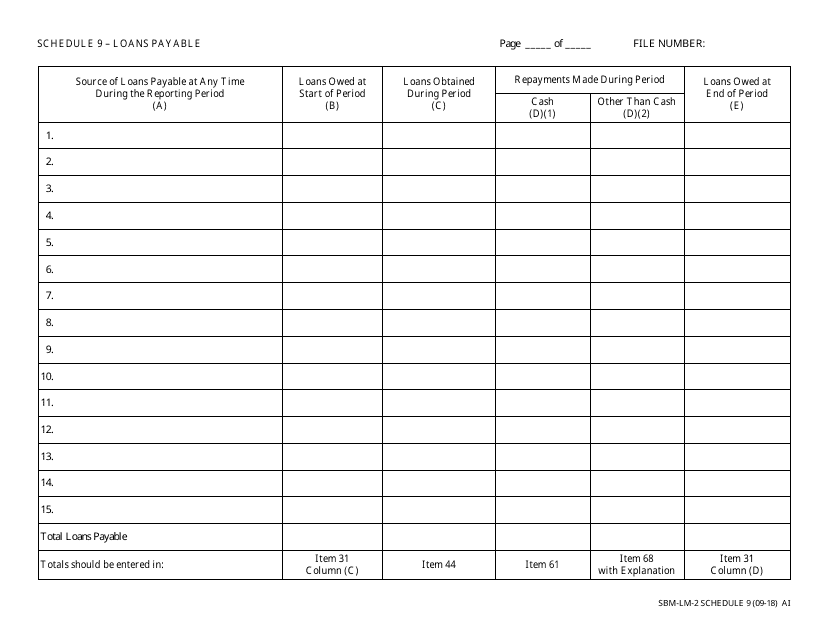

This Form is used for reporting loans payable specifically in the state of Missouri.

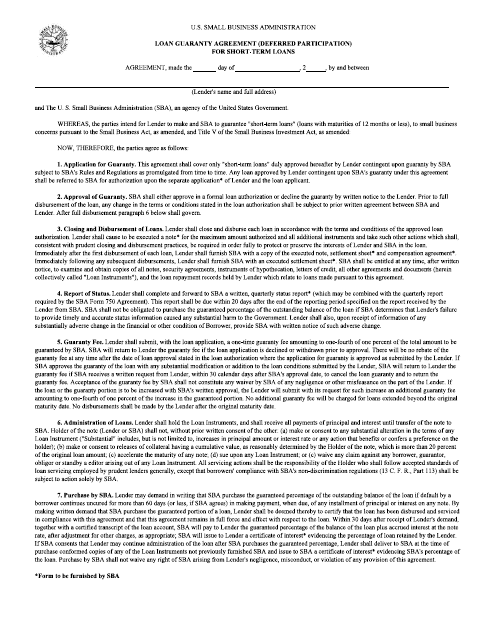

This document is used for the Loan Guaranty Agreement (Deferred Participation) for Short-Term Loans under the Small Business Administration (SBA) program.

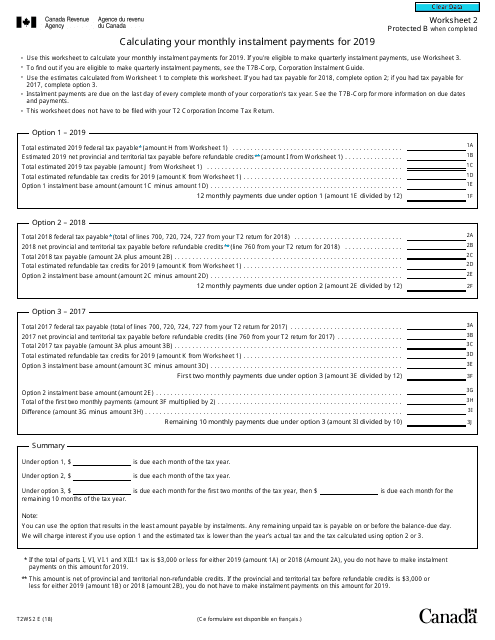

This form is used for calculating your monthly installment payments in Canada. It helps you determine how much you need to pay each month for various types of loans or financing arrangements.

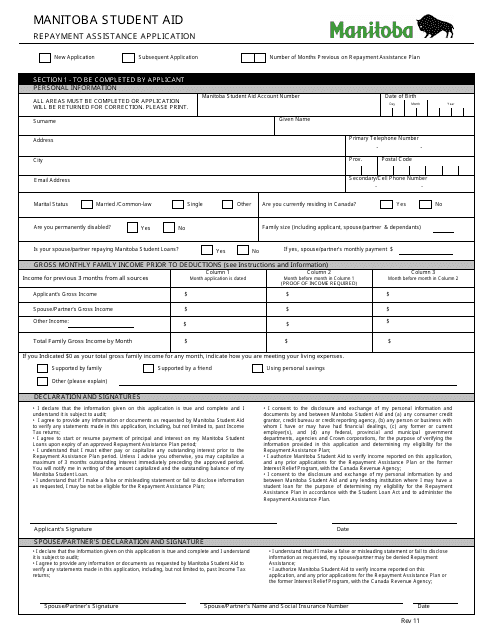

This document is used for applying for repayment assistance in Manitoba, Canada. It helps individuals who are struggling to make loan repayments to get the necessary assistance they need.

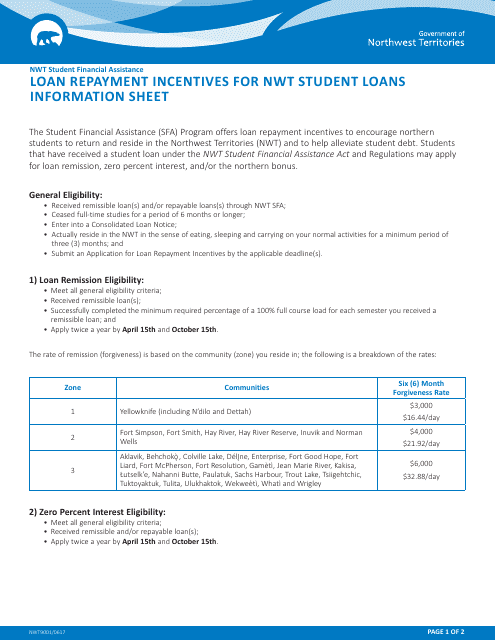

This form is used for applying for loan repayment incentives in the Northwest Territories, Canada.

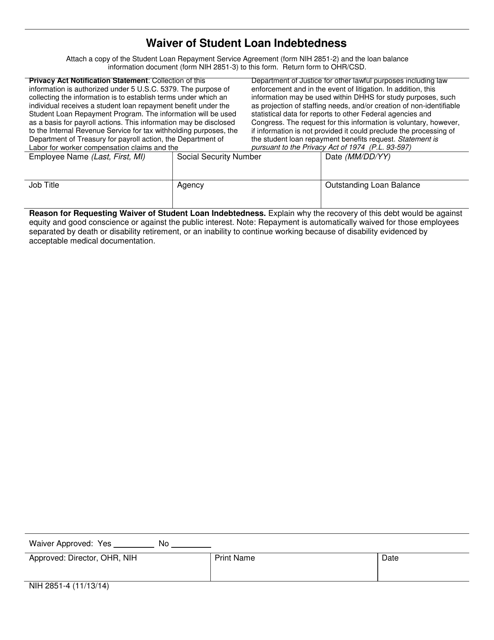

This Form is used for applying for a waiver of student loan indebtedness. It allows individuals to request forgiveness of their student loans based on certain eligibility criteria.

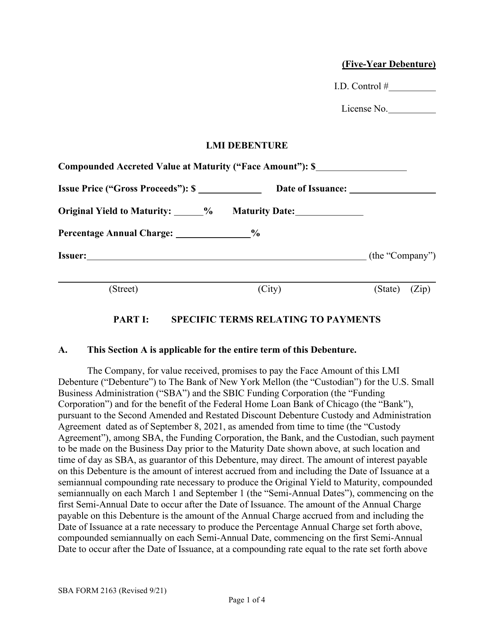

This form is used for notifying new borrowers about the Small Business Administration (SBA) requirements and terms for their loan.

This form is used for making borrower payments in relation to a Small Business Administration (SBA) loan.

This form is used for borrowers in the state of Washington to enter into an agreement.

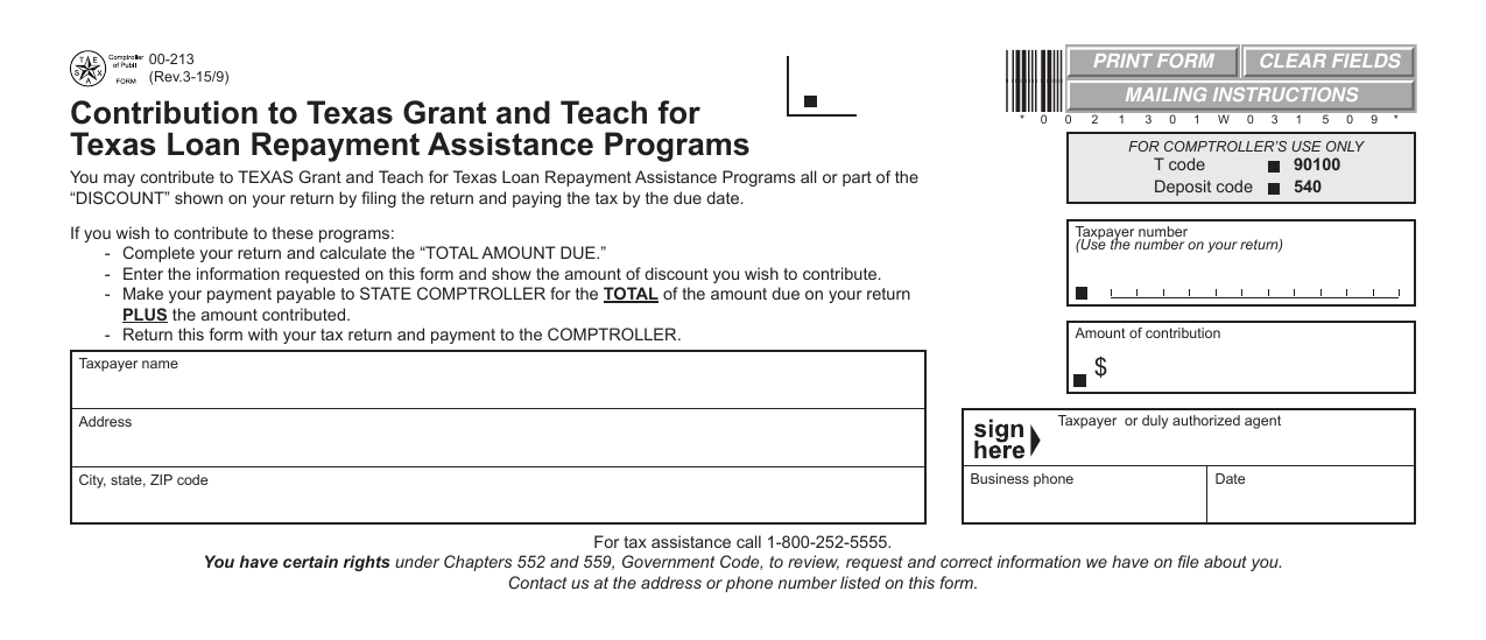

This form is used for making contributions to the Texas Grant and Teach for Texas Loan Repayment Assistance Programs in Texas.

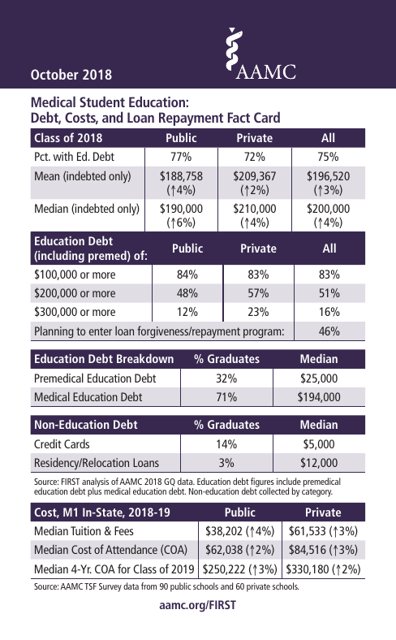

This document provides information about the costs of medical education, student debt, and loan repayment options for medical students in the United States. It aims to help students make informed decisions regarding their education and finances.

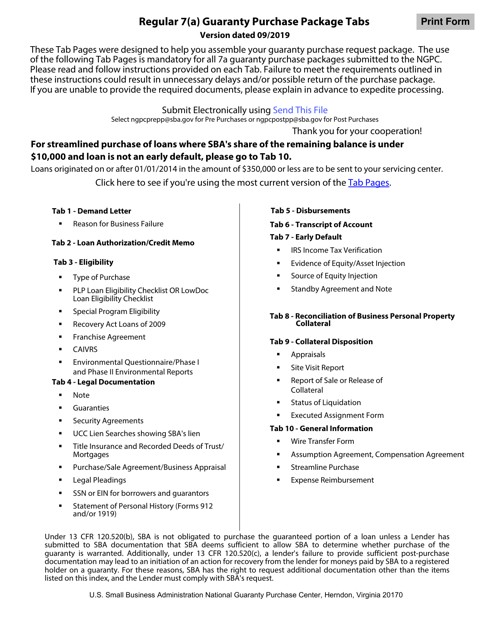

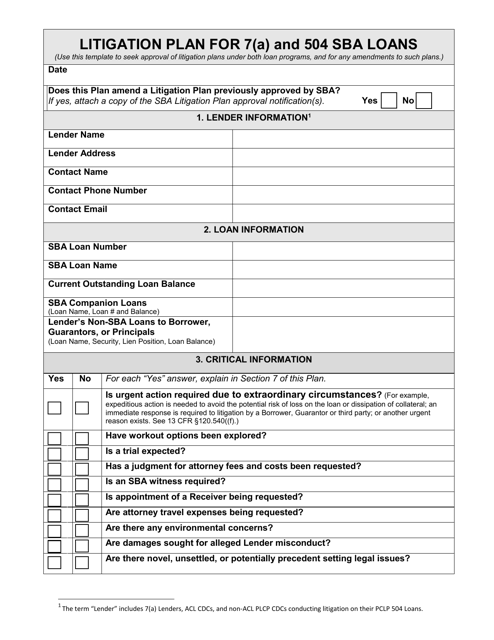

This document outlines the plan for handling legal disputes related to 7(A) and 504 SBA loans. It covers strategies and steps to take in litigation proceedings.

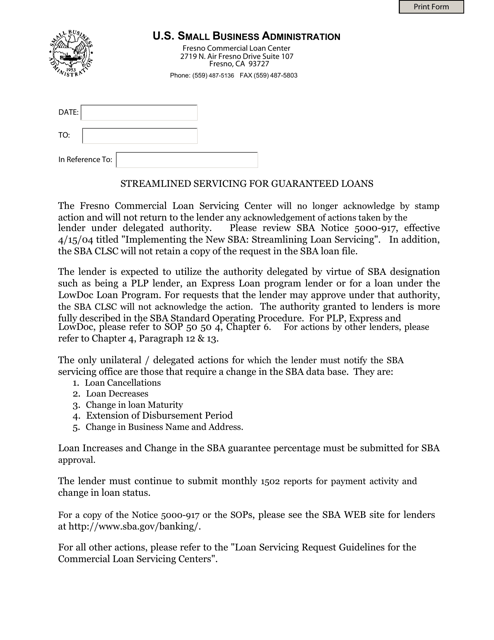

This document provides information and guidelines for a simplified process of managing and servicing loans that are guaranteed by a certain entity. It outlines the steps and requirements for efficient loan administration.

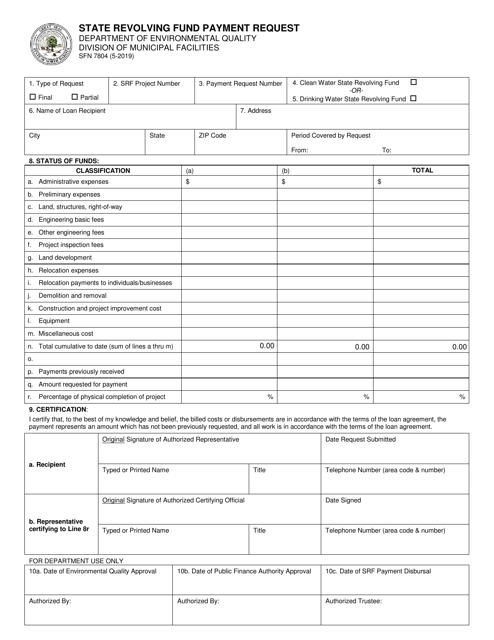

This Form is used for requesting payment from the State Revolving Fund in North Dakota.

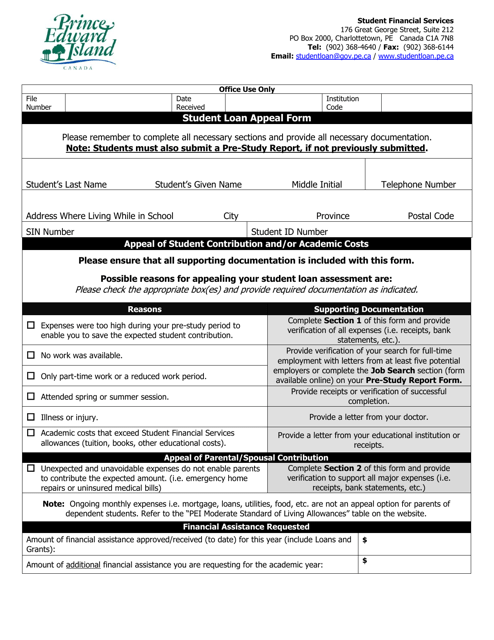

This document is used for appealing a student loan decision in Prince Edward Island, Canada.

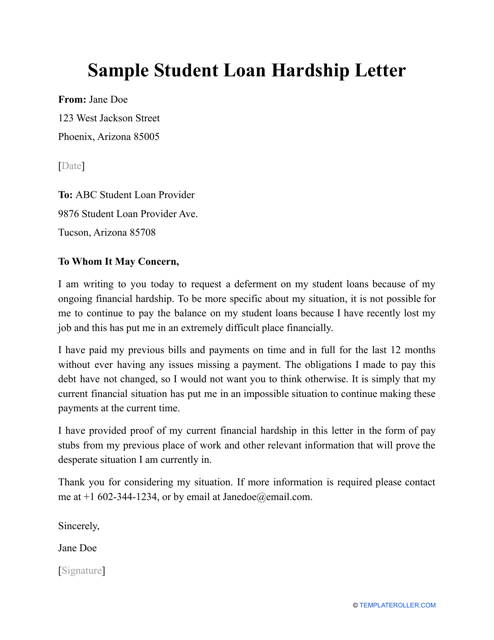

This form is used when an applicant needs to defer payments on their student loan (or decrease, modify, etc.) due to a financial hardship situation.

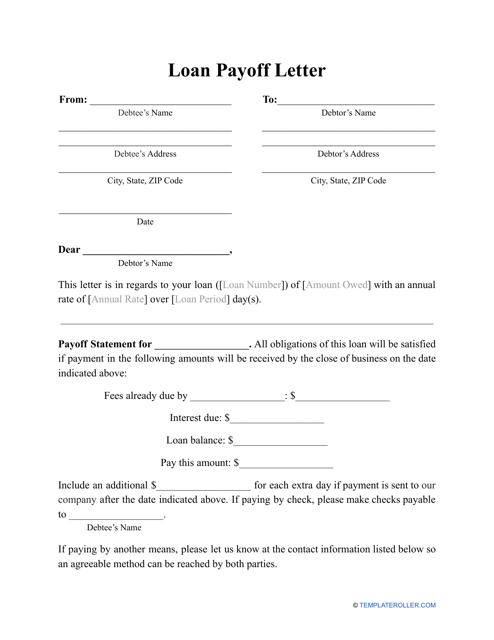

This letter provides detailed instructions on how to pay off a loan.

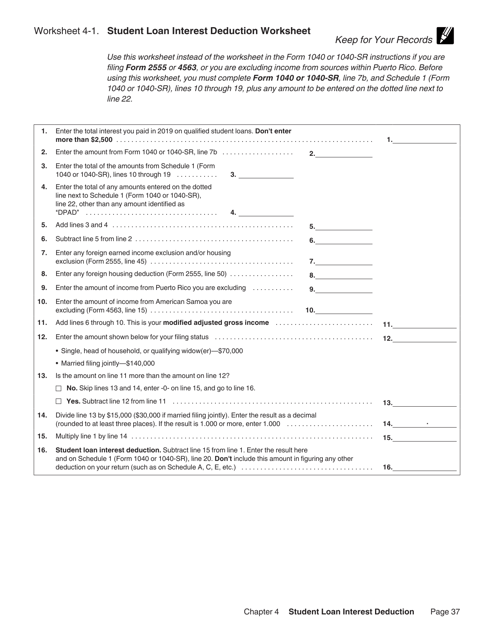

This document is a worksheet that helps you calculate the amount of student loan interest you can deduct from your taxes. It is explained in Publication 970, which provides information on tax benefits for education expenses.